Key Insights

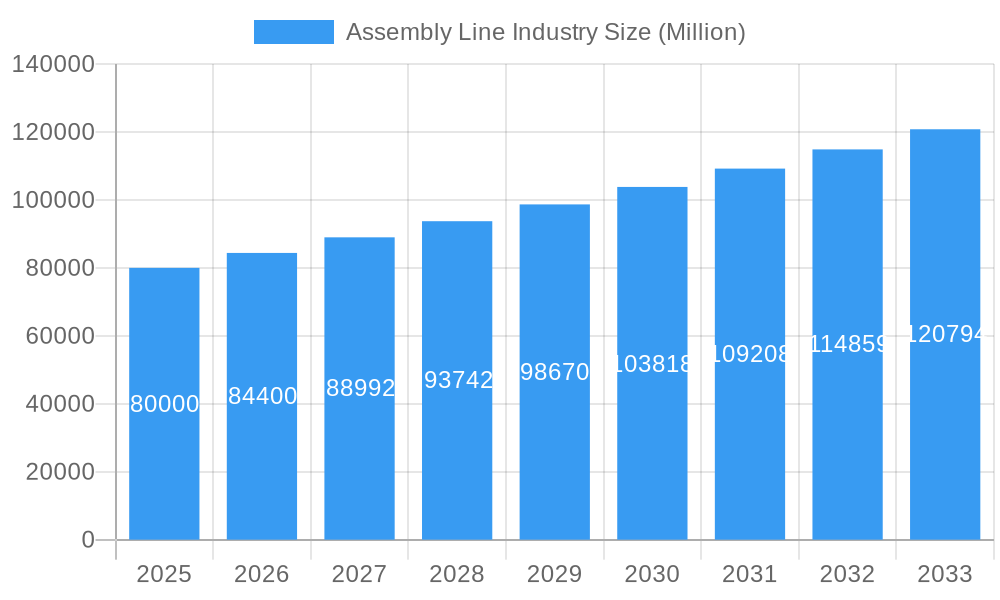

The global Assembly Line Industry is poised for significant growth, projected to reach a market size of $307.15 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.85% through 2033. This expansion is driven by the increasing demand for manufacturing efficiency, precision, and cost reduction. Key growth factors include the widespread adoption of automation for enhanced productivity and to mitigate labor shortages, ongoing advancements in robotics and AI for sophisticated assembly, and the need for adaptable production lines to meet evolving market needs. Industries are investing in advanced assembly solutions to elevate product quality and consistency, securing a competitive advantage.

Assembly Line Industry Market Size (In Billion)

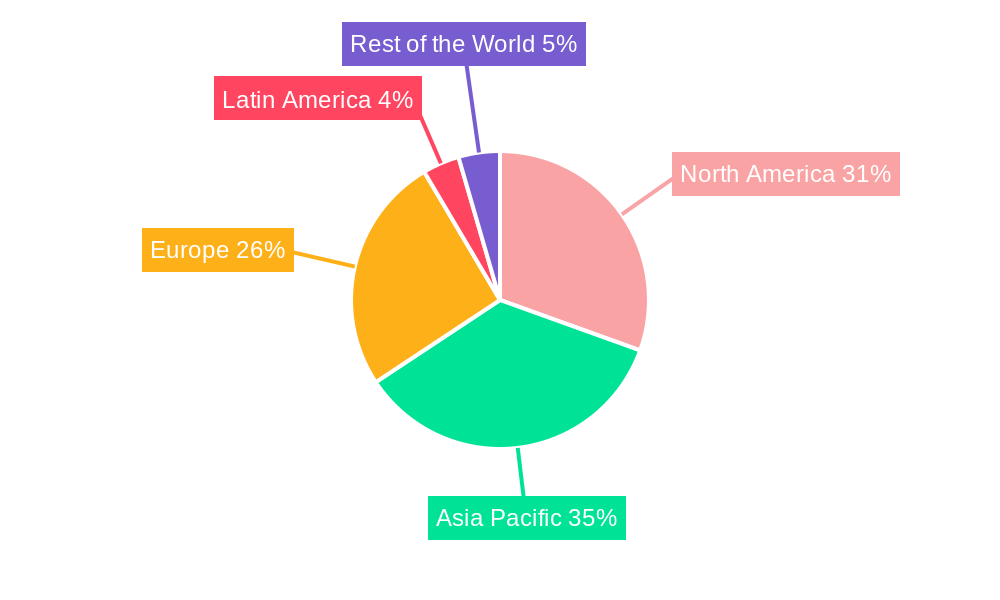

The market is segmented by type into Manual, Semi-automated, and Fully Automated Assembly Lines, with a pronounced shift towards greater automation. Leading end-user sectors include Automotive, Industrial Manufacturing, and Electronics & Semiconductors, due to their high-volume production requirements. The Medical & Pharmaceutical sector is also emerging as a key growth area, driven by stringent quality mandates and the demand for specialized automated solutions. Geographically, North America and Asia Pacific are expected to lead market share, supported by robust industrial infrastructure, substantial investments in advanced manufacturing, and supportive government policies. Europe also represents a significant market, influenced by its established industrial base and the adoption of Industry 4.0 principles. The competitive environment comprises established leaders and innovative newcomers, all focused on developing advanced solutions within this dynamic industry.

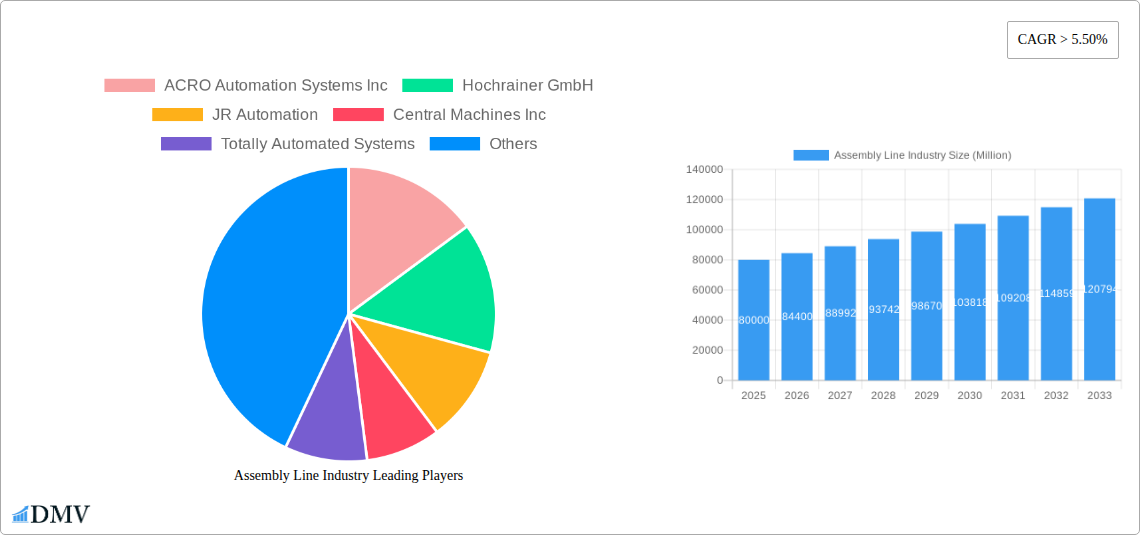

Assembly Line Industry Company Market Share

Assembly Line Industry Report: Market Insights & Future Trajectory (2019-2033)

Unlock the future of industrial automation with this comprehensive Assembly Line Industry report. Dive deep into market dynamics, technological advancements, and strategic growth opportunities shaping the global landscape. This analysis covers Manual, Semi-automated, and Fully Automated Assembly Lines across key sectors like Automotive, Industrial Manufacturing, Electronics & Semiconductors, and Medical & Pharmaceutical. With a study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report provides actionable intelligence for stakeholders seeking to capitalize on the burgeoning assembly line solutions market.

Assembly Line Industry Market Composition & Trends

The global Assembly Line Industry is characterized by a moderately consolidated market, driven by significant investments in automation technologies and an increasing demand for efficiency across various manufacturing sectors. Innovation catalysts, such as the integration of AI, robotics, and the Industrial Internet of Things (IIoT), are profoundly reshaping production processes. The regulatory landscape, while varying by region, generally favors advancements that enhance worker safety and environmental sustainability. Substitute products, primarily comprising less integrated manual labor or bespoke solutions, are gradually being overshadowed by the scalable and cost-effective nature of modern assembly lines. End-user profiles are diverse, with the Automotive sector leading in adoption due to its high-volume production needs, followed closely by Industrial Manufacturing and the rapidly growing Electronics and Semiconductors industry. M&A activities are a significant trend, with numerous strategic acquisitions aimed at expanding product portfolios and market reach. For instance, recent deal values in the industrial automation space have reached several hundred Million, signifying a robust M&A environment.

- Market Share Distribution: Dominated by a few key players, with the top 5 companies holding an estimated XX% market share.

- M&A Deal Values: Estimated to exceed XXX Million annually, indicating strategic consolidation.

- Innovation Focus: Emphasis on Industry 4.0 integration, predictive maintenance, and collaborative robotics.

- Key End-Users: Automotive (XX% of market), Industrial Manufacturing (XX%), Electronics & Semiconductors (XX%), Medical & Pharmaceutical (XX%).

Assembly Line Industry Industry Evolution

The Assembly Line Industry has undergone a transformative evolution, moving from rudimentary mechanical processes to highly sophisticated, digitally integrated systems. This trajectory is marked by a consistent upward market growth trajectory, projected to reach several Billion by 2033. Technological advancements have been the primary engine of this evolution. The introduction of robotics, particularly collaborative robots (cobots), has revolutionized flexibility and efficiency in Manual and Semi-automated Assembly Lines, enabling them to handle complex tasks with precision. Fully Automated Assembly Lines are increasingly incorporating AI-powered vision systems for quality control and machine learning algorithms for process optimization, leading to unprecedented levels of output and reduced error rates. The adoption of IIoT sensors and data analytics allows for real-time monitoring, predictive maintenance, and seamless integration with enterprise resource planning (ERP) systems, driving operational excellence. Shifting consumer demands for personalized products and faster delivery cycles have further accelerated the need for agile and adaptable assembly line solutions. This has spurred innovations in modular assembly line designs and flexible manufacturing systems. The historical period (2019-2024) witnessed a surge in smart factory initiatives, with an average annual growth rate of XX% in automated solutions. The base year (2025) sets a strong foundation, with an estimated market value of XXX Billion, and the forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of XX%, driven by continued technological integration and expansion into emerging markets. Adoption metrics for advanced automation technologies have seen a significant uptick, with XX% of new automotive production lines now incorporating advanced robotics and AI.

Leading Regions, Countries, or Segments in Assembly Line Industry

The Assembly Line Industry is experiencing robust growth across several key regions and segments, with Fully Automated Assembly Lines emerging as the dominant segment. This dominance is fueled by the relentless pursuit of efficiency, precision, and cost reduction in high-volume manufacturing environments. The Automotive industry stands out as the leading end-user, accounting for an estimated XX% of the total market revenue. This leadership is attributed to the sector's inherent need for mass production, stringent quality control, and continuous innovation in vehicle design and manufacturing processes.

Key drivers for the dominance of Fully Automated Assembly Lines and the Automotive sector include:

- High Investment Trends: Significant capital expenditure by automotive manufacturers in advanced robotics, AI, and automation technologies to remain competitive.

- Regulatory Support: Government incentives and regulations promoting manufacturing efficiency, safety, and technological adoption.

- Technological Advancements: Breakthroughs in AI, machine learning, robotics, and IoT are making fully automated lines more versatile and intelligent.

- Global Competition: Intense global competition necessitates the highest levels of productivity and quality, achievable through full automation.

Beyond automotive, the Industrial Manufacturing sector is a significant contributor, driven by the need to modernize legacy systems and enhance operational flexibility. The Electronics and Semiconductors industry is also a rapidly growing area, demanding highly precise and defect-free assembly processes, making fully automated lines indispensable. While Manual Assembly Lines and Semi-automated Assembly Lines continue to serve niche applications or specific stages of production, the overarching trend points towards greater automation for enhanced output and reduced human error. The Asia-Pacific region, particularly countries like China, Japan, and South Korea, represents a leading geographical market due to its substantial manufacturing base and proactive adoption of cutting-edge technologies. North America and Europe also maintain strong positions, driven by advanced manufacturing initiatives and a focus on Industry 4.0 integration.

Assembly Line Industry Product Innovations

Product innovations in the Assembly Line Industry are centered on enhancing efficiency, flexibility, and intelligence. Advanced robotics, including collaborative robots (cobots) capable of working alongside human operators, are becoming increasingly sophisticated, offering greater dexterity and precision for complex tasks. AI-powered vision systems are revolutionizing quality control, enabling real-time defect detection with unparalleled accuracy. Furthermore, the integration of IIoT platforms allows for seamless data exchange, predictive maintenance, and optimized workflow management, creating truly smart factories. Modular assembly line designs offer greater adaptability to changing production demands and product variations, minimizing downtime and maximizing throughput. These innovations are driving significant improvements in performance metrics, such as reduced cycle times, increased yield rates, and enhanced worker safety. The unique selling proposition of these advanced solutions lies in their ability to deliver customized, high-efficiency production capabilities.

Propelling Factors for Assembly Line Industry Growth

Several key factors are propelling the growth of the Assembly Line Industry. Technological Advancements are at the forefront, with the continuous development of robotics, AI, machine learning, and IIoT technologies making automated assembly more accessible, efficient, and versatile. Economic Influences, such as the drive for cost reduction and productivity enhancement in manufacturing, are creating a strong demand for automated solutions. Government initiatives and incentives promoting Industry 4.0 adoption and advanced manufacturing further bolster growth. For example, tax credits for automation investments in certain regions are encouraging widespread adoption. The increasing complexity of product designs across sectors like automotive and electronics also necessitates sophisticated assembly capabilities that only advanced automation can provide.

Obstacles in the Assembly Line Industry Market

Despite robust growth, the Assembly Line Industry faces several obstacles. High initial investment costs can be a significant barrier, particularly for small and medium-sized enterprises (SMEs), requiring substantial capital outlay for advanced systems. Integration complexities with existing legacy systems can also pose challenges, demanding specialized expertise and time-consuming implementation processes. Shortage of skilled labor to operate and maintain sophisticated automated systems is another critical concern, necessitating significant investment in training and workforce development. Supply chain disruptions, as evidenced in recent years, can impact the availability of critical components for assembly line manufacturing. Regulatory hurdles related to safety standards and data privacy can also introduce complexities.

Future Opportunities in Assembly Line Industry

Emerging opportunities in the Assembly Line Industry are vast and varied. The expansion into new markets, particularly in developing economies undergoing industrialization, presents significant growth potential. The increasing demand for personalized and customized products is driving the need for more flexible and agile assembly line solutions, including modular and reconfigurable systems. Advances in AI and machine learning will enable even more sophisticated autonomous operations and predictive capabilities. The growing adoption of sustainable manufacturing practices offers opportunities for developing energy-efficient and environmentally friendly assembly line solutions. Furthermore, the integration of digital twins for simulation and optimization of assembly processes represents a significant future opportunity.

Major Players in the Assembly Line Industry Ecosystem

- ACRO Automation Systems Inc

- Hochrainer GmbH

- JR Automation

- Central Machines Inc

- Totally Automated Systems

- Fusion Systems Group

- Adescor Inc

- Gemtec GmbH

- Markone Control Systems

- Eriez Manufacturing Co

- NEVMAT Australia PTY LTD

- RNA Automation

- UMD Automated Systems

- Mondragon Assembly

- Hitachi Power Solutions Co Ltd

- MechTech Automation Group

- RG-Luma Automation

- BBS Automation

- SITEC Industrietechnologie GmbH

Key Developments in Assembly Line Industry Industry

- May 2021: Mondragon Assembly is expanding into the USA market. The opening of a new subsidiary in Chicago will enable Mondragon Assembly to provide a closer and personalized service to the customers in the country.

- Aug 2021: JR Automation, a leading global systems integrator and a wholly-owned subsidiary of Hitachi, Ltd. (TSE: 6501), is pleased to announce that it is uniting its five divisional brands - JR Automation, Esys Automation, Setpoint, FSA Technologies and PSB Technologies - under the singular corporate identity of JR Automation.

Strategic Assembly Line Industry Market Forecast

The Assembly Line Industry is poised for substantial growth, driven by ongoing technological innovation and increasing global demand for efficient manufacturing solutions. The strategic forecast highlights a continued shift towards advanced automation, particularly in fully automated assembly lines, fueled by AI, robotics, and IIoT integration. Emerging markets and the increasing need for product customization represent significant growth catalysts. Key opportunities lie in developing flexible, modular, and intelligent assembly systems that can adapt to evolving industry requirements. The market potential is substantial, with projected growth rates indicating a robust expansion of the assembly line solutions sector over the forecast period.

Assembly Line Industry Segmentation

-

1. Type

- 1.1. Manual Assembly Lines

- 1.2. Semi-automated Assembly Lines

- 1.3. Fully Automated Assembly Lines

-

2. End-user

- 2.1. Automotive

- 2.2. Industrial Manufacturing

- 2.3. Electronics and Semiconductors

- 2.4. Medical & Pharmaceutical

- 2.5. Others

Assembly Line Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Rest of the World

Assembly Line Industry Regional Market Share

Geographic Coverage of Assembly Line Industry

Assembly Line Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Electric Vehicle Companies Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Manual Assembly Lines

- 5.1.2. Semi-automated Assembly Lines

- 5.1.3. Fully Automated Assembly Lines

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Industrial Manufacturing

- 5.2.3. Electronics and Semiconductors

- 5.2.4. Medical & Pharmaceutical

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Manual Assembly Lines

- 6.1.2. Semi-automated Assembly Lines

- 6.1.3. Fully Automated Assembly Lines

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Industrial Manufacturing

- 6.2.3. Electronics and Semiconductors

- 6.2.4. Medical & Pharmaceutical

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Manual Assembly Lines

- 7.1.2. Semi-automated Assembly Lines

- 7.1.3. Fully Automated Assembly Lines

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Industrial Manufacturing

- 7.2.3. Electronics and Semiconductors

- 7.2.4. Medical & Pharmaceutical

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Manual Assembly Lines

- 8.1.2. Semi-automated Assembly Lines

- 8.1.3. Fully Automated Assembly Lines

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Industrial Manufacturing

- 8.2.3. Electronics and Semiconductors

- 8.2.4. Medical & Pharmaceutical

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Manual Assembly Lines

- 9.1.2. Semi-automated Assembly Lines

- 9.1.3. Fully Automated Assembly Lines

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Industrial Manufacturing

- 9.2.3. Electronics and Semiconductors

- 9.2.4. Medical & Pharmaceutical

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the World Assembly Line Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Manual Assembly Lines

- 10.1.2. Semi-automated Assembly Lines

- 10.1.3. Fully Automated Assembly Lines

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Industrial Manufacturing

- 10.2.3. Electronics and Semiconductors

- 10.2.4. Medical & Pharmaceutical

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ACRO Automation Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hochrainer GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JR Automation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Central Machines Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Totally Automated Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fusion Systems Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adescor Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gemtec GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Markone Control Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eriez Manufacturing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEVMAT Australia PTY LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RNA Automation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 UMD Automated Systems

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mondragon Assembly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hitachi Power Solutions Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 MechTech Automation Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RG-Luma Automation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BBS Automation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SITEC Industrietechnologie GmbH**List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 ACRO Automation Systems Inc

List of Figures

- Figure 1: Global Assembly Line Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Asia Pacific Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Asia Pacific Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Assembly Line Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Assembly Line Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Assembly Line Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Rest of the World Assembly Line Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Rest of the World Assembly Line Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of the World Assembly Line Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Assembly Line Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 9: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 15: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Assembly Line Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Assembly Line Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Assembly Line Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Assembly Line Industry?

The projected CAGR is approximately 7.85%.

2. Which companies are prominent players in the Assembly Line Industry?

Key companies in the market include ACRO Automation Systems Inc, Hochrainer GmbH, JR Automation, Central Machines Inc, Totally Automated Systems, Fusion Systems Group, Adescor Inc, Gemtec GmbH, Markone Control Systems, Eriez Manufacturing Co, NEVMAT Australia PTY LTD, RNA Automation, UMD Automated Systems, Mondragon Assembly, Hitachi Power Solutions Co Ltd, MechTech Automation Group, RG-Luma Automation, BBS Automation, SITEC Industrietechnologie GmbH**List Not Exhaustive.

3. What are the main segments of the Assembly Line Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Electric Vehicle Companies Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2021: Mondragon Assembly is expanding into the USA market. The opening of a new subsidiary in Chicago will enable Mondragon Assembly to provide a closer and personalized service to the customers in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Assembly Line Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Assembly Line Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Assembly Line Industry?

To stay informed about further developments, trends, and reports in the Assembly Line Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence