Key Insights

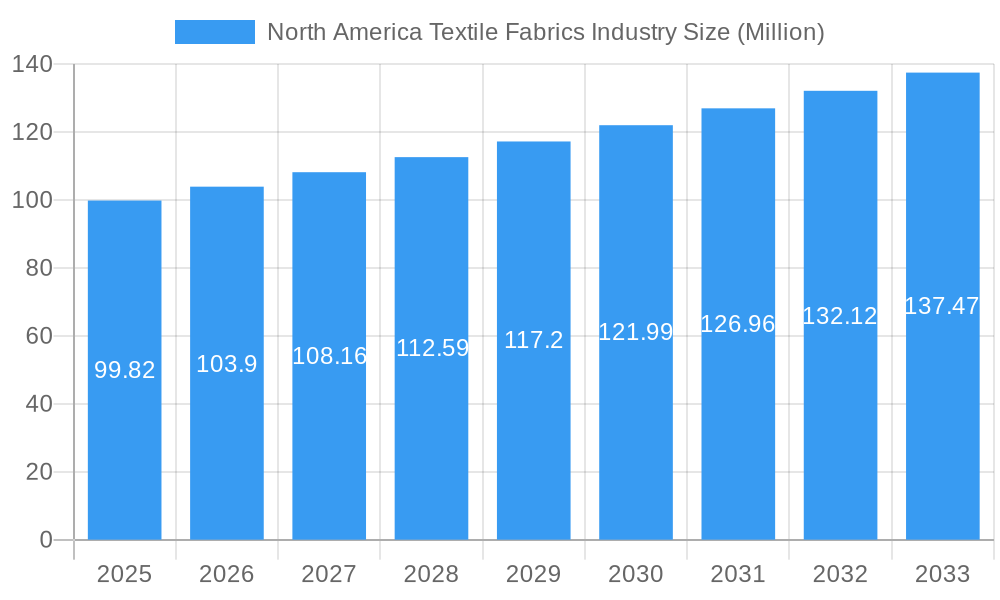

The North America textile fabrics industry, valued at $99.82 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for comfortable and sustainable apparel and home furnishings fuels this expansion. Consumer preferences are shifting towards eco-friendly materials, pushing manufacturers to innovate with recycled and organic fibers. Furthermore, technological advancements in fabric production, including improved dyeing techniques and enhanced functionality (e.g., moisture-wicking, antimicrobial properties), are contributing to market growth. The industry is also witnessing a rise in personalized and customized textile products, catering to individual preferences and boosting demand. Major players like Nike, Levi Strauss & Co., and American Eagle Outfitters are leveraging these trends to expand their market share, investing in research and development and exploring new retail strategies.

North America Textile Fabrics Industry Market Size (In Million)

However, the industry faces challenges. Fluctuations in raw material prices, particularly cotton and synthetic fibers, can impact profitability. The increasing competition from low-cost manufacturers in Asia presents another hurdle. Moreover, stricter environmental regulations regarding textile waste and water consumption necessitate increased investment in sustainable production processes. Despite these restraints, the industry’s long-term outlook remains positive, with projected growth driven by continuous innovation, a focus on sustainability, and the rising demand for high-quality, functional textiles in the North American market. The forecast period of 2025-2033 anticipates a continued expansion, albeit at a moderate pace, reflecting the balance between growth drivers and existing industry challenges.

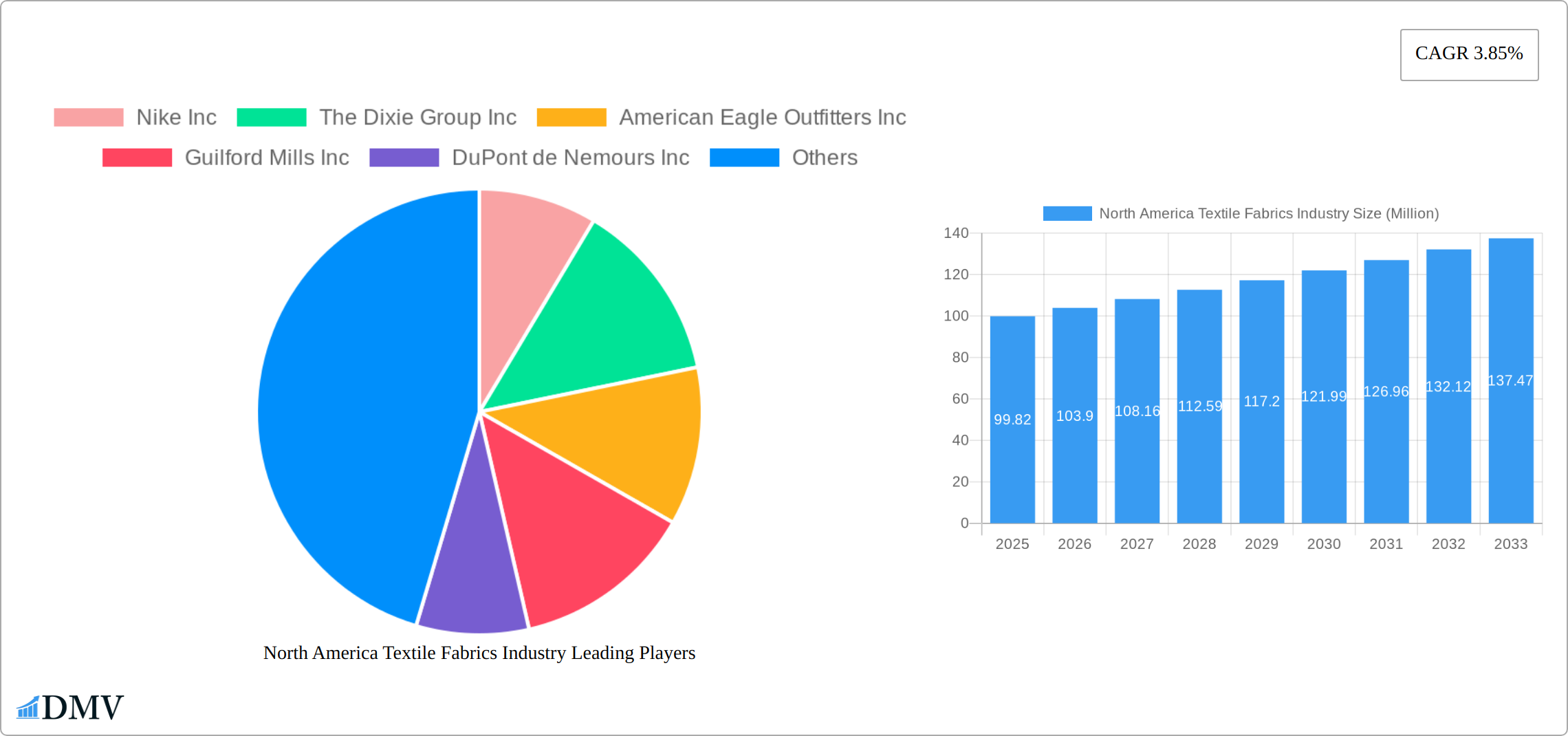

North America Textile Fabrics Industry Company Market Share

North America Textile Fabrics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America textile fabrics industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report's findings are based on rigorous market research and analysis, providing actionable insights for strategic decision-making. The market size is projected to reach xx Million by 2033.

North America Textile Fabrics Industry Market Composition & Trends

This section provides a comprehensive evaluation of the competitive landscape, key innovation drivers, the prevailing regulatory environment, the impact of substitute products, end-user dynamics, and merger & acquisition (M&A) activities within the North American textile fabrics market. The detailed study period, spanning from 2019 to 2033, highlights a dynamic interplay of factors that are actively shaping the market's evolution.

-

Market Concentration: The North American textile fabrics market is characterized by a moderately concentrated structure, where a number of established large players hold substantial market shares. In 2025, the top five companies collectively accounted for approximately 65-70% of the total market share, with numerous smaller, agile niche players adeptly serving specialized market segments and offering unique value propositions.

-

Innovation Catalysts: A trifecta of significant drivers is propelling innovation within the sector: a strong and growing emphasis on sustainability and circular economy principles, rapid technological advancements in fiber production (including the widespread adoption of recycled materials, bio-based fibers, and innovative dyeing techniques), and an escalating demand for high-performance fabrics engineered for specific functionalities and enhanced durability.

-

Regulatory Landscape: Stringent and evolving regulations are a pivotal influence on market dynamics. These encompass comprehensive worker safety standards, robust environmental protection mandates (particularly concerning textile waste reduction, water usage, and chemical discharge), and transparent product labeling requirements. Navigating compliance costs and adapting to these evolving standards directly impacts the profitability and strategic direction of various market segments.

-

Substitute Products: The industry faces ongoing competition from alternative materials. These include advanced synthetic fabrics that often offer superior durability or specific performance characteristics, and innovative leather alternatives that are gaining traction due to ethical and environmental considerations. These substitutes exert pressure on demand for certain traditional textile types, prompting a need for differentiation and innovation.

-

End-User Profiles: The market is driven by diverse end-user segments. The apparel sector remains a dominant force, with key brands such as Nike Inc., American Eagle Outfitters Inc., Levi Strauss & Co., and Hennes & Mauritz AB representing significant demand. The home furnishings sector, including players like The Dixie Group Inc. and WestPoint Home Inc., also contributes substantially. Furthermore, industrial applications for technical textiles continue to expand. Shifts in consumer preferences, such as the enduring popularity of athleisure and the sustained demand for ethically sourced and sustainable fashion, are continuously shaping demand patterns.

-

M&A Activities: The North American textile fabrics industry has experienced a notable surge in M&A activity. A prime example is the strategic acquisition of Huntsman Corporation's Textile Effects division by Archroma in February 2023 for USD 593 million, a deal that significantly reshaped competitive dynamics and bolstered Archroma's specialty chemical portfolio. These strategic consolidations are instrumental in enhancing technological capabilities, expanding product portfolios, and achieving economies of scale. Annual deal values are projected to reach approximately USD 1.5 - 2.0 Billion, with a considerable portion driven by acquisitions aimed at technological integration and market penetration.

North America Textile Fabrics Industry Industry Evolution

This section analyzes the market's growth trajectory, technological advancements, and evolving consumer preferences from 2019 to 2033. The industry has experienced fluctuating growth rates driven by economic cycles, technological disruptions, and shifting consumer demands. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is expected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the rise of sustainable and smart textiles, have significantly impacted industry operations and products. Increased consumer focus on eco-friendly and ethically sourced materials presents both opportunities and challenges. The shift towards online retail and the impact of fast fashion are also contributing factors to the market evolution. The integration of advanced technologies such as 3D printing, automation and smart manufacturing is transforming production methods and supply chains.

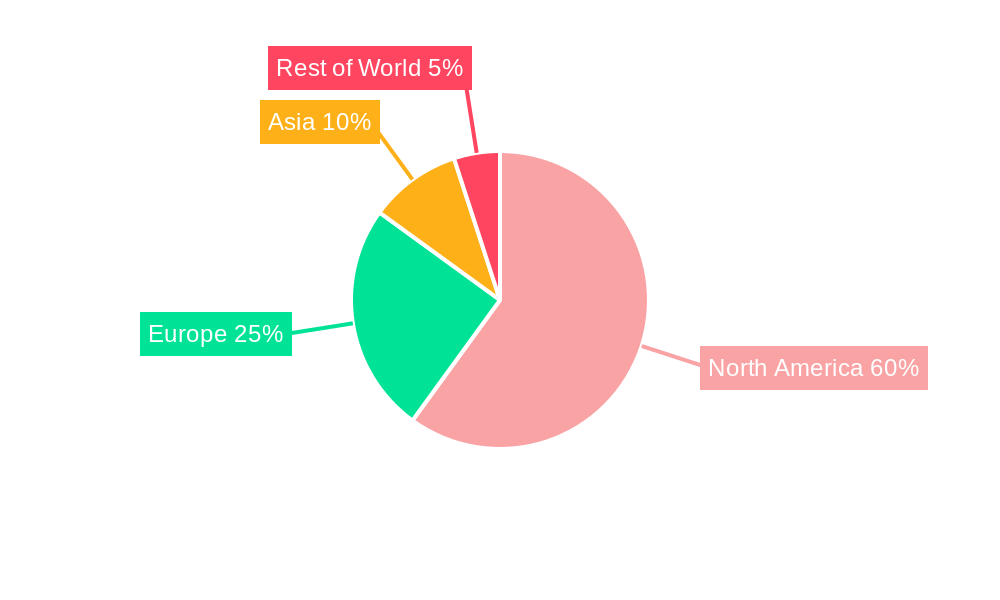

Leading Regions, Countries, or Segments in North America Textile Fabrics Industry

The United States currently dominates the North American textile fabrics market, driven by strong domestic demand, established manufacturing infrastructure, and a large pool of skilled labor.

- Key Drivers for US Dominance:

- High Domestic Consumption: Significant demand from apparel, home furnishings, and industrial sectors.

- Established Manufacturing Base: Existing infrastructure and expertise provide a competitive advantage.

- Technological Advancements: US companies are at the forefront of innovation in textile technologies.

- Government Support: Industry-specific policies and initiatives contribute to growth.

The report further dissects the performance of other regions (e.g., Canada, Mexico) and explores the dynamics of various segments like cotton, synthetic, and blended fabrics. Detailed analysis of regional growth trajectories, market size, and key players is included in this section.

North America Textile Fabrics Industry Product Innovations

The landscape of product innovation within the North American textile fabrics industry is being profoundly shaped by a focus on advanced functionalities and environmental responsibility. High-performance fabrics are a significant area of development, with notable advancements in moisture-wicking materials crucial for the rapidly growing sportswear sector, and the creation of exceptionally durable, water-resistant fabrics vital for the expanding outdoor apparel and equipment markets. Concurrently, sustainable and recycled fabrics are experiencing a substantial rise in market acceptance and demand, directly responding to growing consumer awareness and concern regarding the environmental impact of textile production. Looking ahead, smart textiles, which ingeniously integrate technological capabilities for features such as real-time temperature regulation, advanced health monitoring, and enhanced connectivity, represent a frontier of innovation. This burgeoning segment is particularly instrumental in driving growth within the premium and specialized corners of the market, offering higher value and novel applications.

Propelling Factors for North America Textile Fabrics Industry Growth

Technological advancements driving efficiency and sustainability are key growth drivers. Increased disposable incomes and rising consumer spending are also vital factors. Favorable government policies supporting textile manufacturing and promoting sustainable practices further contribute to the industry's expansion. The growing demand for high-performance and functional textiles, particularly in sectors like sportswear and outdoor apparel, is fueling growth.

Obstacles in the North America Textile Fabrics Industry Market

The North American textile fabrics industry is currently navigating a series of significant obstacles that are impacting its operational efficiency and profitability. Foremost among these are persistent supply chain disruptions, a challenge that has been acutely exacerbated by recent global events, leading to increased lead times and material shortages. The intensified competition from low-cost producers in international markets continues to exert considerable pressure on profit margins for domestic manufacturers. Furthermore, the increasing stringency of environmental regulations necessitates substantial capital investment in advanced compliance measures and sustainable manufacturing processes, adding to operational costs. The inherent volatility in the prices of key raw materials, such as cotton, polyester, and other synthetic inputs, also presents considerable unpredictability and risk for industry players, making long-term financial planning more complex.

Future Opportunities in North America Textile Fabrics Industry

The North American textile fabrics industry is poised to capitalize on a range of compelling future opportunities. A primary growth avenue lies in the escalating consumer demand for sustainable and recycled materials, driven by a heightened environmental consciousness and a desire for ethical consumption. The burgeoning market for smart textiles, which integrate sophisticated technologies for enhanced functionality and user experience, presents another significant area for expansion. The trend towards personalization and customization in consumer goods also extends to textiles, creating opportunities for businesses that can offer tailored solutions. Beyond product innovation, strategic expansion into underserved or emerging geographic markets within North America and leveraging cutting-edge technological advancements, such as advancements in digital textile printing and additive manufacturing (3D printing) for textiles, offer substantial potential for competitive advantage and revenue growth. Ultimately, meeting the increasing consumer demand for products that are both eco-friendly and ethically produced will reward businesses that prioritize transparency and sustainability in their operations.

Major Players in the North America Textile Fabrics Industry Ecosystem

- Nike Inc

- The Dixie Group Inc

- American Eagle Outfitters Inc

- Guilford Mills Inc

- DuPont de Nemours Inc

- Levi Strauss & Co

- Hennes & Mauritz AB

- WestPoint Home Inc

- Welspun India Ltd

- Standard Textile Co Inc

- Mohawk Industries Inc

- Elevate Textiles Inc

List Not Exhaustive

Key Developments in North America Textile Fabrics Industry Industry

February 2023: Huntsman Corporation (NYSE: HUN) completes the sale of its Textile Effects division to Archroma for USD 593 Million, significantly impacting market consolidation.

December 2022: India and Canada negotiate a free trade agreement (FTA), with potential implications for bilateral trade in textiles and apparel. The outcome could significantly affect export dynamics for the Indian textile industry.

August 2022: Huntsman Corporation announces Archroma's acquisition of its Textile Effects business. This deal reflects a strategic shift in market dynamics, with implications for industry competition.

Strategic North America Textile Fabrics Industry Market Forecast

The North American textile fabrics industry is on a trajectory for sustained and robust growth in the coming years. This expansion will be significantly fueled by continuous technological advancements in material science and manufacturing processes, a persistent rise in consumer demand for high-performance textiles with enhanced properties, and an unwavering global focus on sustainability and circular economy principles. The future of this dynamic market will undoubtedly be shaped by the agility and innovative capacity of companies that can effectively anticipate and respond to the evolving needs of both consumers and the broader global economic and environmental landscape. Promising opportunities in the development and adoption of smart textiles, the production of environmentally conscious and sustainable textile solutions, and the strategic targeting of specialized niche market segments are expected to yield significant returns for forward-thinking and strategically positioned players within the industry.

North America Textile Fabrics Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

North America Textile Fabrics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Textile Fabrics Industry Regional Market Share

Geographic Coverage of North America Textile Fabrics Industry

North America Textile Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.3. Market Restrains

- 3.3.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.4. Market Trends

- 3.4.1. Increasing demand for North America's apparels driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Textile Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nike Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dixie Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 American Eagle Outfitters Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guilford Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont de Nemours Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Levi Strauss & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hennes & Mauritz AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WestPoint Home Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Welspun India Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Textile Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mohawk Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Elevate Textiles Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nike Inc

List of Figures

- Figure 1: North America Textile Fabrics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Textile Fabrics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: North America Textile Fabrics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Textile Fabrics Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: North America Textile Fabrics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Textile Fabrics Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Textile Fabrics Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the North America Textile Fabrics Industry?

Key companies in the market include Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, Elevate Textiles Inc **List Not Exhaustive.

3. What are the main segments of the North America Textile Fabrics Industry?

The market segments include Application, Material Type, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

6. What are the notable trends driving market growth?

Increasing demand for North America's apparels driving the market.

7. Are there any restraints impacting market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

8. Can you provide examples of recent developments in the market?

February 2023: Huntsman Corporation (NYSE: HUN) announced that it has completed the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The agreed purchase price was USD 593 million in cash plus assumed pension liabilities. Huntsman expects the net after-tax cash proceeds to be approximately USD 540 million before customary post-closing adjustments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Textile Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Textile Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Textile Fabrics Industry?

To stay informed about further developments, trends, and reports in the North America Textile Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence