Key Insights

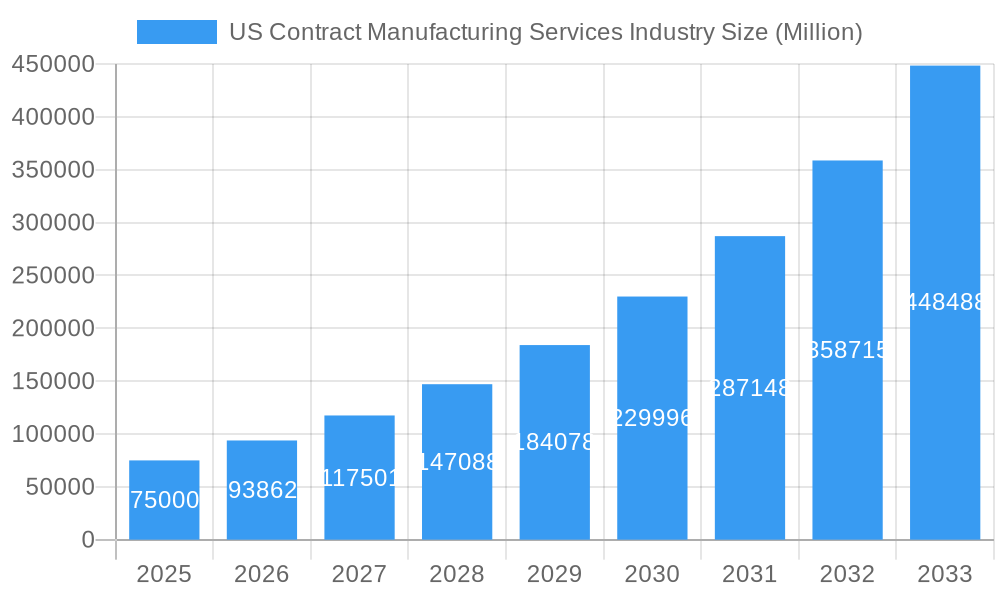

The US Contract Manufacturing Services industry is poised for significant expansion, projected to reach a substantial market size of approximately $75,000 million by 2025, driven by a remarkable Compound Annual Growth Rate (CAGR) of 25.10%. This robust growth is fueled by a confluence of factors including increasing outsourcing by pharmaceutical companies seeking to streamline operations and accelerate drug development, the rising demand for specialized manufacturing capabilities such as High Potency API (HPAPI) production, and the burgeoning market for finished dosage forms across various therapeutic areas. The food processing and manufacturing sector also contributes significantly, with growing demand for convenience foods, R&D services, and sophisticated food packaging solutions. Furthermore, the personal care segment, encompassing skincare, haircare, and cosmetics, is witnessing a surge in contract manufacturing as brands focus on innovation and market penetration.

US Contract Manufacturing Services Industry Market Size (In Billion)

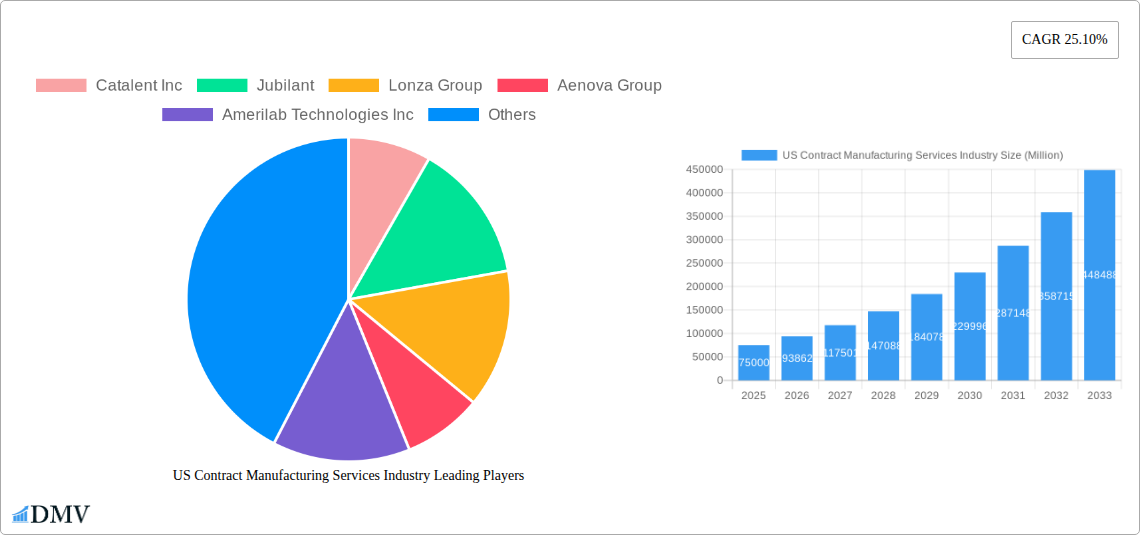

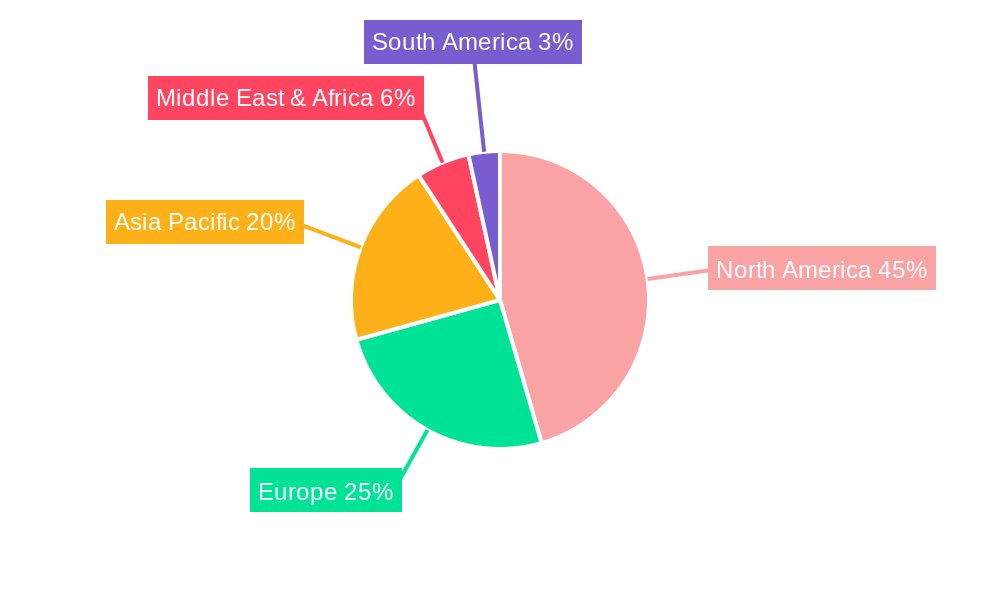

The market's dynamism is further underscored by evolving industry trends, such as the increasing adoption of advanced manufacturing technologies, a greater emphasis on sustainable and eco-friendly production processes, and the growing need for regulatory compliance in highly specialized segments like pharmaceuticals. While the industry benefits from substantial drivers, potential restraints include escalating raw material costs, stringent regulatory landscapes, and the need for specialized expertise in certain niche manufacturing areas. Key players like Catalent Inc., Lonza Group, and Jubilant are strategically positioned to capitalize on these opportunities, offering a comprehensive suite of services across pharmaceuticals, food processing, beverage production, and personal care manufacturing. The extensive regional breakdown indicates North America as a dominant market, with significant contributions from the United States, followed by robust growth in Asia Pacific, particularly China and India, and a steady presence in Europe.

US Contract Manufacturing Services Industry Company Market Share

Here is an SEO-optimized, insightful report description for the US Contract Manufacturing Services Industry, incorporating your specific details and adhering to your formatting and content requirements.

US Contract Manufacturing Services Industry Market Composition & Trends

The US contract manufacturing services industry is characterized by a dynamic market composition driven by innovation and evolving end-user demands across pharmaceutical, food processing & manufacturing, beverage, and personal care sectors. Market concentration is influenced by key players like Catalent Inc, Lonza Group, and KIK Custom Products, whose strategic M&A activities and investments significantly shape market share distribution. For instance, recent mergers and acquisitions, with deal values reaching into the Millions, underscore a trend towards consolidation and expanded capabilities. Regulatory landscapes, particularly within the pharmaceutical segment, impose stringent quality and compliance standards, acting as both a barrier to entry and a catalyst for specialized service providers. The report delves into an in-depth analysis of these forces, examining the interplay between market share, innovation, and regulatory frameworks. It meticulously assesses the influence of substitute products and the distinct profiles of end-users, providing a comprehensive overview of the industry’s current structure.

US Contract Manufacturing Services Industry Industry Evolution

The US contract manufacturing services industry has witnessed a remarkable evolution, driven by a confluence of technological advancements, shifting consumer preferences, and strategic industry collaborations. From its historical roots, the market has transformed into a sophisticated ecosystem supporting diverse sectors including pharmaceuticals, food, beverages, and personal care. The study period from 2019 to 2024 has seen robust growth, with the base year 2025 projecting a significant market expansion. This evolution is underpinned by substantial investments in advanced manufacturing technologies, such as AI-driven process optimization and automation, which have demonstrably increased efficiency and reduced lead times. For example, Catalent Inc's launch of GPEx lightning in July 2021, a next-generation cell line technology, has the potential to shorten drug development timelines by approximately three months, illustrating the impact of innovation on accelerating market progress. Furthermore, increasing outsourcing by major corporations seeking specialized expertise and economies of scale has fueled market growth trajectories. Consumer demand for personalized products, sustainable packaging, and healthier food options has also compelled contract manufacturers to adapt their service offerings, leading to a diversification of capabilities. The industry's resilience is further evidenced by its ability to navigate economic fluctuations and global supply chain disruptions, consistently demonstrating an upward trend in market growth rates. The forecast period, 2025–2033, anticipates continued innovation and specialization as key drivers of sustained expansion.

Leading Regions, Countries, or Segments in US Contract Manufacturing Services Industry

The US contract manufacturing services industry exhibits significant dominance across its key segments, with the pharmaceutical sector standing out as a major growth engine. Within pharmaceuticals, Active Pharmaceutical Ingredient (API) manufacturing, encompassing small molecules, large molecules, and high potency APIs (HPAPIs), commands substantial market share due to the complexity and high value of these products. The Finished dosage form segment, including solid dose formulation, liquid dose formulation, and injectable dose formulation, also plays a crucial role, driven by the increasing demand for complex drug delivery systems and the outsourcing of manufacturing by pharmaceutical giants. Secondary Packaging services are integral to ensuring product integrity and regulatory compliance across all pharmaceutical offerings.

In Food processing & manufacturing, the Food Manufacturing Services sub-segment is experiencing robust growth, particularly in Convenience Foods, Bakery Products, and Confectionary Products. The increasing consumer preference for ready-to-eat meals and customized food solutions fuels this expansion. Research & Development services are also gaining traction as food companies seek innovative product development and formulation expertise from contract manufacturers. Food Packaging Services are evolving to meet demands for sustainable and functional packaging solutions.

The Beverage segment is significantly influenced by the growing popularity of Carbonated Drinks & Fruit-based Beverages and Bottled Water, driven by health-conscious consumers and on-the-go lifestyles. The Beer market also represents a substantial portion of contract manufacturing services.

The Personal Care segment is experiencing strong growth, with Skin Care and Hair Care products leading the market breakdown. The burgeoning demand for premium and specialized cosmetic formulations, including Make up & Color Cosmetics, further propels this segment.

Key drivers for dominance in these segments include:

- Investment Trends: Significant capital investment by major players like Catalent Inc and Lonza Group into advanced manufacturing capabilities and R&D, particularly in high-value pharmaceutical segments.

- Regulatory Support: Favorable regulatory environments for pharmaceutical manufacturing, coupled with stringent quality control mandates, drive demand for specialized contract services. The collaboration between Lonza and Israel Biotech Fund exemplifies strategic partnerships to leverage market access and specialized expertise.

- Technological Advancements: The adoption of cutting-edge technologies in formulation, packaging, and quality assurance across all segments, enabling greater efficiency and product innovation.

- Consumer Demand: Shifting consumer preferences towards convenience, personalization, health, and sustainability in food, beverage, and personal care products, creating niche markets for contract manufacturers.

- Outsourcing by Major Brands: Large corporations increasingly rely on contract manufacturers to manage production complexities, reduce costs, and accelerate time-to-market.

US Contract Manufacturing Services Industry Product Innovations

Product innovations in the US contract manufacturing services industry are pivotal to maintaining a competitive edge. Within the pharmaceutical sector, advancements in Active Pharmaceutical Ingredient (API) synthesis, particularly for High Potency API (HPAPI), are critical. Innovations in Finished dosage formulations, such as advanced Injectable Dose Formulations and novel Solid Dose Formulations, are enhancing drug efficacy and patient compliance. In food processing, contract manufacturers are innovating in Convenience Foods with healthier ingredient profiles and extended shelf lives, alongside advancements in Food Packaging Services featuring sustainable materials and smart technology. For beverages, the development of novel Carbonated Drinks & Fruit-based Beverages with unique flavor profiles and functional ingredients is on the rise. The personal care segment sees continuous innovation in Skin Care and Hair Care formulations, driven by demand for natural, organic, and personalized products. These innovations are directly supported by significant investments in research and development by leading contract manufacturers, ensuring they remain at the forefront of industry trends and client needs.

Propelling Factors for US Contract Manufacturing Services Industry Growth

Several key factors are propelling the growth of the US contract manufacturing services industry.

- Technological Advancements: The continuous adoption of cutting-edge technologies like automation, AI in process optimization, and advanced analytics is enhancing efficiency, quality, and speed-to-market across all segments.

- Outsourcing Trends: A growing number of companies, from large pharmaceutical giants to emerging CPG brands, are opting to outsource their manufacturing to specialized contract manufacturers to leverage expertise, reduce capital expenditure, and focus on core competencies like R&D and marketing.

- Specialized Capabilities: The demand for highly specialized manufacturing processes, particularly in pharmaceuticals for complex biologics and HPAPIs, and in food for niche product development, drives growth for contract manufacturers with these unique capabilities.

- Regulatory Compliance Expertise: Contract manufacturers often possess deep expertise in navigating complex regulatory landscapes, particularly in pharmaceuticals, providing a significant advantage for clients.

- Cost Efficiencies: By leveraging economies of scale and optimized production processes, contract manufacturers can offer cost savings to their clients, making outsourcing an attractive financial proposition.

Obstacles in the US Contract Manufacturing Services Industry Market

Despite robust growth, the US contract manufacturing services industry faces several obstacles.

- Regulatory Scrutiny: The pharmaceutical sector, in particular, is subject to rigorous and evolving regulatory requirements, demanding significant investment in compliance and quality assurance, which can be a barrier for smaller players.

- Supply Chain Disruptions: Global supply chain vulnerabilities, including raw material shortages and logistics challenges, can impact production timelines and costs for contract manufacturers and their clients.

- Intense Competition: The market is highly competitive, with numerous players vying for contracts, leading to price pressures and the need for continuous innovation to differentiate services.

- Intellectual Property Protection: Ensuring the robust protection of client intellectual property is paramount and requires sophisticated security measures and legal frameworks, which can be costly to implement and maintain.

- Skilled Workforce Shortage: A persistent challenge across manufacturing sectors is the shortage of skilled labor, which can impact operational efficiency and the ability to adopt advanced technologies.

Future Opportunities in US Contract Manufacturing Services Industry

The US contract manufacturing services industry is poised for significant future opportunities. The growing demand for biologics and advanced therapies in pharmaceuticals presents a substantial growth avenue, requiring specialized manufacturing expertise. The increasing consumer focus on sustainability and ethical sourcing in food, beverage, and personal care products opens doors for contract manufacturers offering eco-friendly solutions and transparent supply chains. The expansion of personalized medicine and niche product development across all segments will require agile and adaptable contract manufacturing partners. Furthermore, the ongoing trend of digital transformation and Industry 4.0 adoption will create opportunities for contract manufacturers who can integrate advanced technologies to offer smart, data-driven manufacturing solutions.

Major Players in the US Contract Manufacturing Services Industry Ecosystem

- Catalent Inc

- Jubilant

- Lonza Group

- Aenova Group

- Amerilab Technologies Inc

- Bernet Food & Beverage

- Big Brands LLC

- Delamaine Fine Foods Limited

- Brooklyn Bottling

- CSD Co-Packers

- Southeast Bottling & Beverages

- G3 Enterprises

- Western Innovations

- Niagara Bottling

- Robinsons Breweries

- KIK Custom Products

- Sensible Organics

- Colep

- Cosmetic Essence LLC

- Formula Cap

Key Developments in US Contract Manufacturing Services Industry Industry

- May 2022: Lonza and Israel Biotech Fund Collaborated Framework Agreement to Support Biologics and Small Molecules Development and Manufacture for Portfolio Companies which Facilitate Access to Israeli Market for Lonza.

- July 2021: Catalent Inc launched GPEx lightning, a next-generation cell line technology, and the new development would shorten the duration drug the timeline by three months.

Strategic US Contract Manufacturing Services Industry Market Forecast

The US contract manufacturing services industry is set for continued strategic growth, driven by escalating demand for specialized pharmaceutical production, particularly in biologics and HPAPIs. The market will further expand by catering to the evolving needs of the food and beverage sectors, with an emphasis on convenience and sustainable packaging solutions. Innovations in personal care formulations, responding to consumer trends for natural and personalized products, will also fuel market potential. The strategic forecast highlights an industry poised to benefit from technological integration, increased outsourcing by major brands seeking efficiency and expertise, and a growing emphasis on regulatory compliance. With an estimated market size projected in the Millions by 2025, the industry's future opportunities are substantial, promising significant returns for agile and forward-thinking contract manufacturers.

US Contract Manufacturing Services Industry Segmentation

-

1. pharmaceutical

- 1.1. Current Market Scenario and growth influencers

- 1.2. Market B

-

1.3. Active P

- 1.3.1. Small molecule

- 1.3.2. Large Molecule

- 1.3.3. High Potency API (HPAPI)

-

1.4. Finished

- 1.4.1. Solid Dose Formulation

- 1.4.2. Liquid Dose Formulation

- 1.4.3. Injectable Dose Formulation

- 1.5. Secondary Packaging

-

2. Food processing & manufacturing

- 2.1. Market Breakdown - by Service Type

- 2.2. Current Market Scenario and growth influencers

-

2.3. Food Manufacturing Services

- 2.3.1. Convenience Foods

- 2.3.2. Bakery Products

- 2.3.3. Confectionary Products

- 2.3.4. Dairy Products

- 2.3.5. Research & Development

- 2.3.6. Food Packaging Services

-

3. Beverage

- 3.1. Current Market Scenario and growth influencers

-

3.2. Market B

- 3.2.1. Beer

- 3.2.2. Carbonated Drinks & Fruit-based Beverages

- 3.2.3. Bottled Water

- 3.2.4. Others (Sport Drinks)

-

4. Personal Care

- 4.1. Current Market Scenario and growth influencers

-

4.2. Market Breakdown - by Type

- 4.2.1. Skin Care

- 4.2.2. Hair Care

- 4.2.3. Make up & Color Cosmetics

- 4.2.4. Others

US Contract Manufacturing Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Contract Manufacturing Services Industry Regional Market Share

Geographic Coverage of US Contract Manufacturing Services Industry

US Contract Manufacturing Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.3. Market Restrains

- 3.3.1. Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers

- 3.4. Market Trends

- 3.4.1. Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 5.1.1. Current Market Scenario and growth influencers

- 5.1.2. Market B

- 5.1.3. Active P

- 5.1.3.1. Small molecule

- 5.1.3.2. Large Molecule

- 5.1.3.3. High Potency API (HPAPI)

- 5.1.4. Finished

- 5.1.4.1. Solid Dose Formulation

- 5.1.4.2. Liquid Dose Formulation

- 5.1.4.3. Injectable Dose Formulation

- 5.1.5. Secondary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 5.2.1. Market Breakdown - by Service Type

- 5.2.2. Current Market Scenario and growth influencers

- 5.2.3. Food Manufacturing Services

- 5.2.3.1. Convenience Foods

- 5.2.3.2. Bakery Products

- 5.2.3.3. Confectionary Products

- 5.2.3.4. Dairy Products

- 5.2.3.5. Research & Development

- 5.2.3.6. Food Packaging Services

- 5.3. Market Analysis, Insights and Forecast - by Beverage

- 5.3.1. Current Market Scenario and growth influencers

- 5.3.2. Market B

- 5.3.2.1. Beer

- 5.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 5.3.2.3. Bottled Water

- 5.3.2.4. Others (Sport Drinks)

- 5.4. Market Analysis, Insights and Forecast - by Personal Care

- 5.4.1. Current Market Scenario and growth influencers

- 5.4.2. Market Breakdown - by Type

- 5.4.2.1. Skin Care

- 5.4.2.2. Hair Care

- 5.4.2.3. Make up & Color Cosmetics

- 5.4.2.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6. North America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 6.1.1. Current Market Scenario and growth influencers

- 6.1.2. Market B

- 6.1.3. Active P

- 6.1.3.1. Small molecule

- 6.1.3.2. Large Molecule

- 6.1.3.3. High Potency API (HPAPI)

- 6.1.4. Finished

- 6.1.4.1. Solid Dose Formulation

- 6.1.4.2. Liquid Dose Formulation

- 6.1.4.3. Injectable Dose Formulation

- 6.1.5. Secondary Packaging

- 6.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 6.2.1. Market Breakdown - by Service Type

- 6.2.2. Current Market Scenario and growth influencers

- 6.2.3. Food Manufacturing Services

- 6.2.3.1. Convenience Foods

- 6.2.3.2. Bakery Products

- 6.2.3.3. Confectionary Products

- 6.2.3.4. Dairy Products

- 6.2.3.5. Research & Development

- 6.2.3.6. Food Packaging Services

- 6.3. Market Analysis, Insights and Forecast - by Beverage

- 6.3.1. Current Market Scenario and growth influencers

- 6.3.2. Market B

- 6.3.2.1. Beer

- 6.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 6.3.2.3. Bottled Water

- 6.3.2.4. Others (Sport Drinks)

- 6.4. Market Analysis, Insights and Forecast - by Personal Care

- 6.4.1. Current Market Scenario and growth influencers

- 6.4.2. Market Breakdown - by Type

- 6.4.2.1. Skin Care

- 6.4.2.2. Hair Care

- 6.4.2.3. Make up & Color Cosmetics

- 6.4.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7. South America US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 7.1.1. Current Market Scenario and growth influencers

- 7.1.2. Market B

- 7.1.3. Active P

- 7.1.3.1. Small molecule

- 7.1.3.2. Large Molecule

- 7.1.3.3. High Potency API (HPAPI)

- 7.1.4. Finished

- 7.1.4.1. Solid Dose Formulation

- 7.1.4.2. Liquid Dose Formulation

- 7.1.4.3. Injectable Dose Formulation

- 7.1.5. Secondary Packaging

- 7.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 7.2.1. Market Breakdown - by Service Type

- 7.2.2. Current Market Scenario and growth influencers

- 7.2.3. Food Manufacturing Services

- 7.2.3.1. Convenience Foods

- 7.2.3.2. Bakery Products

- 7.2.3.3. Confectionary Products

- 7.2.3.4. Dairy Products

- 7.2.3.5. Research & Development

- 7.2.3.6. Food Packaging Services

- 7.3. Market Analysis, Insights and Forecast - by Beverage

- 7.3.1. Current Market Scenario and growth influencers

- 7.3.2. Market B

- 7.3.2.1. Beer

- 7.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 7.3.2.3. Bottled Water

- 7.3.2.4. Others (Sport Drinks)

- 7.4. Market Analysis, Insights and Forecast - by Personal Care

- 7.4.1. Current Market Scenario and growth influencers

- 7.4.2. Market Breakdown - by Type

- 7.4.2.1. Skin Care

- 7.4.2.2. Hair Care

- 7.4.2.3. Make up & Color Cosmetics

- 7.4.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8. Europe US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 8.1.1. Current Market Scenario and growth influencers

- 8.1.2. Market B

- 8.1.3. Active P

- 8.1.3.1. Small molecule

- 8.1.3.2. Large Molecule

- 8.1.3.3. High Potency API (HPAPI)

- 8.1.4. Finished

- 8.1.4.1. Solid Dose Formulation

- 8.1.4.2. Liquid Dose Formulation

- 8.1.4.3. Injectable Dose Formulation

- 8.1.5. Secondary Packaging

- 8.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 8.2.1. Market Breakdown - by Service Type

- 8.2.2. Current Market Scenario and growth influencers

- 8.2.3. Food Manufacturing Services

- 8.2.3.1. Convenience Foods

- 8.2.3.2. Bakery Products

- 8.2.3.3. Confectionary Products

- 8.2.3.4. Dairy Products

- 8.2.3.5. Research & Development

- 8.2.3.6. Food Packaging Services

- 8.3. Market Analysis, Insights and Forecast - by Beverage

- 8.3.1. Current Market Scenario and growth influencers

- 8.3.2. Market B

- 8.3.2.1. Beer

- 8.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 8.3.2.3. Bottled Water

- 8.3.2.4. Others (Sport Drinks)

- 8.4. Market Analysis, Insights and Forecast - by Personal Care

- 8.4.1. Current Market Scenario and growth influencers

- 8.4.2. Market Breakdown - by Type

- 8.4.2.1. Skin Care

- 8.4.2.2. Hair Care

- 8.4.2.3. Make up & Color Cosmetics

- 8.4.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9. Middle East & Africa US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 9.1.1. Current Market Scenario and growth influencers

- 9.1.2. Market B

- 9.1.3. Active P

- 9.1.3.1. Small molecule

- 9.1.3.2. Large Molecule

- 9.1.3.3. High Potency API (HPAPI)

- 9.1.4. Finished

- 9.1.4.1. Solid Dose Formulation

- 9.1.4.2. Liquid Dose Formulation

- 9.1.4.3. Injectable Dose Formulation

- 9.1.5. Secondary Packaging

- 9.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 9.2.1. Market Breakdown - by Service Type

- 9.2.2. Current Market Scenario and growth influencers

- 9.2.3. Food Manufacturing Services

- 9.2.3.1. Convenience Foods

- 9.2.3.2. Bakery Products

- 9.2.3.3. Confectionary Products

- 9.2.3.4. Dairy Products

- 9.2.3.5. Research & Development

- 9.2.3.6. Food Packaging Services

- 9.3. Market Analysis, Insights and Forecast - by Beverage

- 9.3.1. Current Market Scenario and growth influencers

- 9.3.2. Market B

- 9.3.2.1. Beer

- 9.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 9.3.2.3. Bottled Water

- 9.3.2.4. Others (Sport Drinks)

- 9.4. Market Analysis, Insights and Forecast - by Personal Care

- 9.4.1. Current Market Scenario and growth influencers

- 9.4.2. Market Breakdown - by Type

- 9.4.2.1. Skin Care

- 9.4.2.2. Hair Care

- 9.4.2.3. Make up & Color Cosmetics

- 9.4.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10. Asia Pacific US Contract Manufacturing Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 10.1.1. Current Market Scenario and growth influencers

- 10.1.2. Market B

- 10.1.3. Active P

- 10.1.3.1. Small molecule

- 10.1.3.2. Large Molecule

- 10.1.3.3. High Potency API (HPAPI)

- 10.1.4. Finished

- 10.1.4.1. Solid Dose Formulation

- 10.1.4.2. Liquid Dose Formulation

- 10.1.4.3. Injectable Dose Formulation

- 10.1.5. Secondary Packaging

- 10.2. Market Analysis, Insights and Forecast - by Food processing & manufacturing

- 10.2.1. Market Breakdown - by Service Type

- 10.2.2. Current Market Scenario and growth influencers

- 10.2.3. Food Manufacturing Services

- 10.2.3.1. Convenience Foods

- 10.2.3.2. Bakery Products

- 10.2.3.3. Confectionary Products

- 10.2.3.4. Dairy Products

- 10.2.3.5. Research & Development

- 10.2.3.6. Food Packaging Services

- 10.3. Market Analysis, Insights and Forecast - by Beverage

- 10.3.1. Current Market Scenario and growth influencers

- 10.3.2. Market B

- 10.3.2.1. Beer

- 10.3.2.2. Carbonated Drinks & Fruit-based Beverages

- 10.3.2.3. Bottled Water

- 10.3.2.4. Others (Sport Drinks)

- 10.4. Market Analysis, Insights and Forecast - by Personal Care

- 10.4.1. Current Market Scenario and growth influencers

- 10.4.2. Market Breakdown - by Type

- 10.4.2.1. Skin Care

- 10.4.2.2. Hair Care

- 10.4.2.3. Make up & Color Cosmetics

- 10.4.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by pharmaceutical

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Catalent Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jubilant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lonza Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aenova Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amerilab Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bernet Food & Beverage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Brands LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Delamaine Fine Foods Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brooklyn Bottling

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSD Co-Packers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Southeast Bottling & Beverages

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 G3 Enterprises

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Western Innovations

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Niagara Bottling and Robinsons Breweries

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KIK Custom Products

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sensible Organics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Colep

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Cosmetic Essence LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Formula Cap*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Catalent Inc

List of Figures

- Figure 1: Global US Contract Manufacturing Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 3: North America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 4: North America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 5: North America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 6: North America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 7: North America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 8: North America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 9: North America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 10: North America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 13: South America US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 14: South America US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 15: South America US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 16: South America US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 17: South America US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 18: South America US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 19: South America US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 20: South America US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 23: Europe US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 24: Europe US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 25: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 26: Europe US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 27: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 28: Europe US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 29: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 30: Europe US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 33: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 34: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 35: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 36: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 37: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 38: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 39: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 40: Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by pharmaceutical 2025 & 2033

- Figure 43: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by pharmaceutical 2025 & 2033

- Figure 44: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Food processing & manufacturing 2025 & 2033

- Figure 45: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Food processing & manufacturing 2025 & 2033

- Figure 46: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Beverage 2025 & 2033

- Figure 47: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Beverage 2025 & 2033

- Figure 48: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Personal Care 2025 & 2033

- Figure 49: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Personal Care 2025 & 2033

- Figure 50: Asia Pacific US Contract Manufacturing Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US Contract Manufacturing Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 2: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 3: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 4: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 5: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 7: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 8: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 9: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 10: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 15: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 16: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 17: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 18: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 23: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 24: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 25: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 26: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 37: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 38: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 39: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 40: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by pharmaceutical 2020 & 2033

- Table 48: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Food processing & manufacturing 2020 & 2033

- Table 49: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Beverage 2020 & 2033

- Table 50: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Personal Care 2020 & 2033

- Table 51: Global US Contract Manufacturing Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Contract Manufacturing Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Contract Manufacturing Services Industry?

The projected CAGR is approximately 25.10%.

2. Which companies are prominent players in the US Contract Manufacturing Services Industry?

Key companies in the market include Catalent Inc, Jubilant, Lonza Group, Aenova Group, Amerilab Technologies Inc, Bernet Food & Beverage, Big Brands LLC, Delamaine Fine Foods Limited, Brooklyn Bottling, CSD Co-Packers, Southeast Bottling & Beverages, G3 Enterprises, Western Innovations, Niagara Bottling and Robinsons Breweries, KIK Custom Products, Sensible Organics, Colep, Cosmetic Essence LLC, Formula Cap*List Not Exhaustive.

3. What are the main segments of the US Contract Manufacturing Services Industry?

The market segments include pharmaceutical, Food processing & manufacturing, Beverage, Personal Care.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

6. What are the notable trends driving market growth?

Growth of Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs.

7. Are there any restraints impacting market growth?

Evolution of service offerings has enabled organizations to increasingly rely on contract manufacturers for their production needs; Challenges due to outsourcing of manufacturing to Asian countries has played a key role in prompting organizations to rely on local contract manufacturers.

8. Can you provide examples of recent developments in the market?

May 2022 - Lonza and Israel Biotech Fund Collaborated Framework Agreement to Support Biologics and Small Molecules Development and Manufacture for Portfolio Companies which Facilitate Access to Israeli Market for Lonza.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Contract Manufacturing Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Contract Manufacturing Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Contract Manufacturing Services Industry?

To stay informed about further developments, trends, and reports in the US Contract Manufacturing Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence