Key Insights

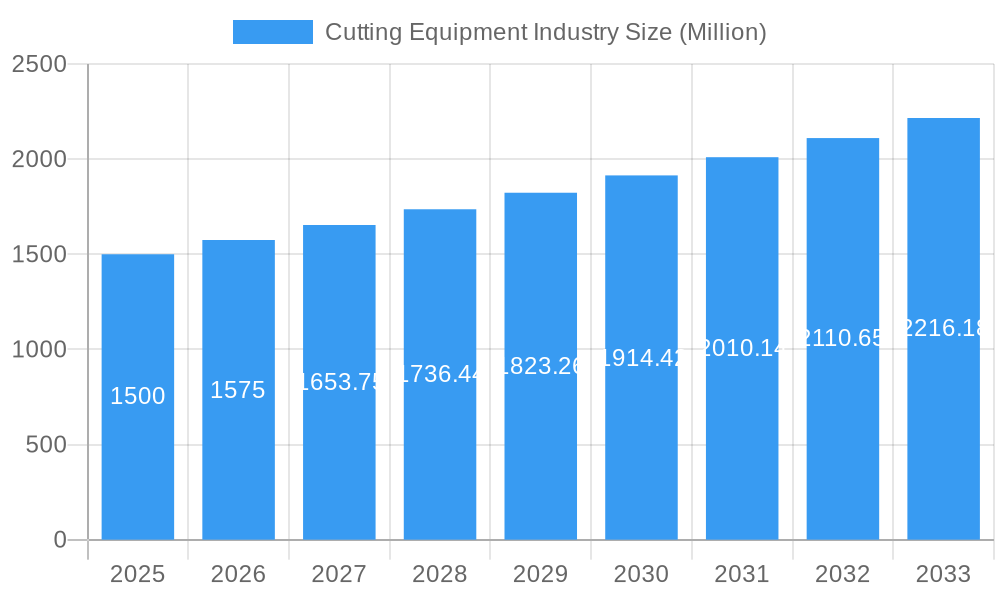

The global cutting equipment market, valued at $5.3 billion in the base year 2025, is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This growth is propelled by escalating automation in manufacturing sectors, notably automotive, aerospace, and electronics, driving demand for advanced, high-precision cutting solutions. The increasing adoption of cutting-edge technologies such as laser, waterjet, and plasma cutting, renowned for their superior speed, accuracy, and material versatility, is a key market contributor. Additionally, a growing emphasis on sustainability and waste reduction is stimulating the demand for efficient and precise cutting machinery. While high initial investment costs and potential skill gaps present challenges, ongoing technological innovation and rising global industrial production ensure a robust market outlook.

Cutting Equipment Industry Market Size (In Billion)

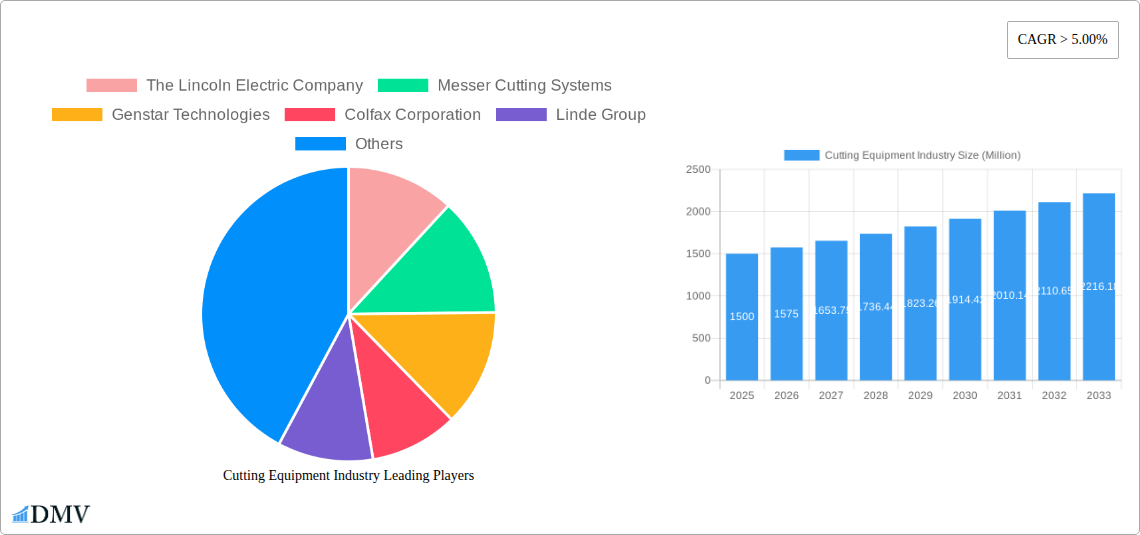

Key industry participants, including The Lincoln Electric Company, Messer Cutting Systems, and Hypertherm, are actively investing in research and development to enhance equipment performance and broaden their product offerings. This dynamic competitive environment fuels innovation, leading to improvements in cutting precision, processing speeds, and material compatibility. The market is segmented by cutting equipment type (e.g., laser, plasma, waterjet), end-use industries (e.g., automotive, aerospace, construction), and geographical regions. While specific regional data is not detailed, the market is geographically diverse, with varying growth opportunities dependent on industrial development and infrastructure. The forecast period (2025-2033) anticipates sustained growth, driven by continuous technological advancements and evolving industry requirements.

Cutting Equipment Industry Company Market Share

Cutting Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Cutting Equipment Industry, offering valuable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities. The study covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market is projected to reach xx Million by 2033, exhibiting significant growth potential driven by technological advancements and increasing industrialization.

Cutting Equipment Industry Market Composition & Trends

This section evaluates the market concentration, innovation catalysts, regulatory landscape, substitute products, end-user profiles, and M&A activities within the cutting equipment industry. The market is characterized by a moderately concentrated structure, with key players holding significant market share. However, the emergence of innovative technologies and the entry of new players are gradually shaping a more competitive landscape.

- Market Share Distribution (2024): The top 5 players command approximately 60% of the global market, while the remaining share is dispersed among numerous smaller companies and niche players. Precise figures will be detailed in the full report.

- M&A Activity: Significant mergers and acquisitions have reshaped the industry landscape. For example, the February 2022 acquisition of Flame Technologies, Inc. by Messer Cutting Systems demonstrates the strategic moves being made to consolidate market positions and expand product portfolios. The total value of M&A deals within the industry between 2019 and 2024 is estimated at xx Million.

- Innovation Catalysts: Technological advancements like laser cutting, waterjet cutting, and robotic automation are driving significant innovation. These improvements deliver enhanced precision, efficiency, and material versatility.

- Regulatory Landscape: Stringent safety and environmental regulations impact manufacturing processes and product design, influencing market dynamics.

- Substitute Products: While cutting equipment remains a dominant solution, alternative methods like additive manufacturing and 3D printing are emerging as potential substitutes in niche applications.

- End-User Profiles: The primary end-users include automotive, aerospace, construction, shipbuilding, and manufacturing industries.

Cutting Equipment Industry Industry Evolution

The cutting equipment industry has undergone significant transformation, driven by a confluence of accelerating technological innovation, dynamic market demands, and a global push towards enhanced industrial efficiency. Historically, from 2019 to 2024, the market experienced a robust annual growth rate of [Insert Historical Growth Rate]%. This upward trajectory was primarily propelled by burgeoning industrial output across key sectors, substantial investments in infrastructure development projects worldwide, and the relentless pursuit of technological advancements that deliver superior cutting efficiency, precision, and automation capabilities. The widespread adoption of automated cutting systems, for instance, has seen a remarkable surge of [Insert Automation Adoption Percentage]% over the last five years, directly translating into significant productivity gains for businesses. Looking ahead, the forecast period from 2025 to 2033 anticipates this positive momentum to continue, with an projected annual growth rate of [Insert Projected Growth Rate]%. A key driver of this sustained growth is the escalating demand for high-precision cutting equipment, essential for achieving intricate designs and delivering uncompromising quality in industries ranging from aerospace and automotive to electronics and medical devices. Furthermore, the growing emphasis on sustainable manufacturing practices is profoundly influencing market dynamics, compelling manufacturers to prioritize and invest in eco-friendly cutting solutions that minimize environmental impact and optimize resource utilization.

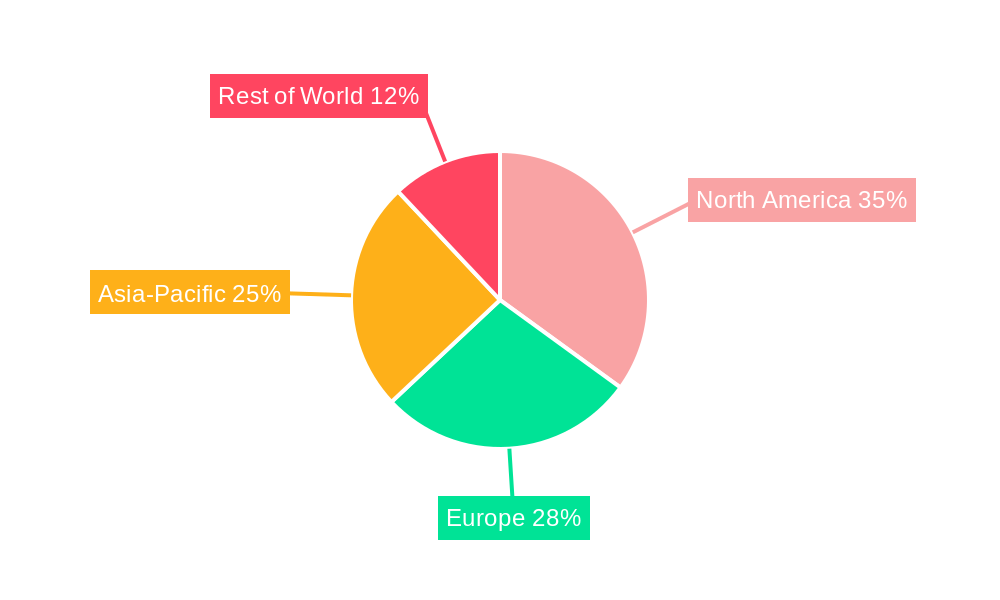

Leading Regions, Countries, or Segments in Cutting Equipment Industry

Currently, North America and Europe stand as the dominant forces in the global cutting equipment market, a leadership position attributed to their highly developed industrial sectors, widespread adoption of cutting-edge technologies, and strong consumer demand. However, the Asia-Pacific region is rapidly emerging as a powerhouse of growth potential. This surge is significantly fueled by its ongoing rapid industrialization, extensive infrastructure development initiatives, and a growing manufacturing base that is increasingly adopting advanced cutting technologies.

- Key Drivers for North America: A high degree of automation across industries, advanced technological integration, and a consistently strong demand from a diverse spectrum of manufacturing and service sectors.

- Key Drivers for Europe: A well-established and sophisticated manufacturing base, a pronounced focus on developing and deploying high-precision cutting technologies, and a supportive ecosystem of robust regulatory frameworks that actively promote industrial expansion and innovation.

- Key Drivers for Asia-Pacific: Remarkable economic expansion characterized by rapid growth, a significant increase in overall industrial production, and substantial government-led investments in ambitious infrastructure projects that necessitate advanced cutting solutions.

A comprehensive and granular breakdown of regional contributions, key market segments, and their respective growth dynamics will be thoroughly detailed within the complete industry report.

Cutting Equipment Industry Product Innovations

Recent advancements have focused on enhanced precision, speed, and material compatibility. Laser cutting systems are becoming more powerful and versatile, enabling the processing of a wider range of materials. Waterjet cutting technology continues to improve, offering exceptional precision and reduced material waste. The integration of automation and robotics is improving operational efficiency and overall productivity. Unique selling propositions include advanced control systems, reduced operational costs, and enhanced safety features.

Propelling Factors for Cutting Equipment Industry Growth

The continuous expansion of the cutting equipment market is fueled by a dynamic interplay of several critical factors. Paramount among these are relentless technological advancements. Innovations such as the development of higher-powered laser cutting systems, sophisticated multi-axis cutting heads, and intelligent control software are consistently pushing the boundaries of productivity, precision, and versatility. On the economic front, sustained growth in global industrial production, coupled with significant investments in infrastructure development across various nations, directly translates into heightened demand for cutting equipment across a broad range of applications. Moreover, supportive government policies and targeted incentives, often designed to encourage industrial modernization, automation adoption, and domestic manufacturing capabilities, play a crucial role in further accelerating the market's expansion and fostering a conducive business environment.

Obstacles in the Cutting Equipment Industry Market

Despite its strong growth trajectory, the cutting equipment industry navigates several significant challenges. Persistent global supply chain disruptions remain a key concern, often leading to increased raw material costs, longer lead times, and potential production delays, impacting overall operational efficiency and profitability. Furthermore, increasingly stringent environmental regulations worldwide necessitate a proactive adoption of more sustainable manufacturing practices and materials, which can lead to higher initial investment costs and ongoing operational expenses for manufacturers. The competitive landscape is also intensely crowded, with a mix of well-established industry giants and agile emerging players vying for market share, which can exert considerable downward pressure on profit margins and necessitate continuous innovation and cost optimization strategies.

Future Opportunities in Cutting Equipment Industry

Emerging opportunities lie in the development and adoption of advanced technologies such as additive manufacturing and 3D printing. The expansion into new markets, particularly in developing economies, presents substantial growth potential. The increasing focus on sustainability presents opportunities for manufacturers to develop and market eco-friendly cutting solutions.

Major Players in the Cutting Equipment Industry Ecosystem

- The Lincoln Electric Company

- Messer Cutting Systems

- Genstar Technologies

- Colfax Corporation

- Linde Group

- Struers

- Ador Welding Ltd

- GCE Group

- DAIHEN Corporation

- Hypertherm

- Amada Miyachi

- Koike Aronson Inc

- Kennametal

- TRUMPF GmbH + Co KG

- Bystronic Laser AG

Key Developments in Cutting Equipment Industry Industry

- July 2022: Lincoln Electric introduced the POWER MIG 215 MPi multi-process welder, enhancing its product portfolio.

- February 2022: Messer Cutting Systems acquired Flame Technologies, Inc., strengthening its market position in oxyfuel solutions.

Strategic Cutting Equipment Industry Market Forecast

The cutting equipment market is poised for continued growth, driven by technological innovation and increasing demand from diverse industries. The focus on automation, precision, and sustainability will shape future market dynamics. New markets and applications will further expand the market’s potential, leading to significant growth over the forecast period.

Cutting Equipment Industry Segmentation

-

1. Technology

- 1.1. Laser

- 1.2. Plasma

- 1.3. Waterjet

- 1.4. Flame

- 1.5. Other Technologies

-

2. End-user

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Electrical and Electronics

- 2.4. Construction

- 2.5. Other End-Users

Cutting Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Cutting Equipment Industry Regional Market Share

Geographic Coverage of Cutting Equipment Industry

Cutting Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Positive Outlook for the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Laser

- 5.1.2. Plasma

- 5.1.3. Waterjet

- 5.1.4. Flame

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Electrical and Electronics

- 5.2.4. Construction

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Laser

- 6.1.2. Plasma

- 6.1.3. Waterjet

- 6.1.4. Flame

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Electrical and Electronics

- 6.2.4. Construction

- 6.2.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Laser

- 7.1.2. Plasma

- 7.1.3. Waterjet

- 7.1.4. Flame

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Electrical and Electronics

- 7.2.4. Construction

- 7.2.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Laser

- 8.1.2. Plasma

- 8.1.3. Waterjet

- 8.1.4. Flame

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Electrical and Electronics

- 8.2.4. Construction

- 8.2.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Laser

- 9.1.2. Plasma

- 9.1.3. Waterjet

- 9.1.4. Flame

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Electrical and Electronics

- 9.2.4. Construction

- 9.2.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Cutting Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Laser

- 10.1.2. Plasma

- 10.1.3. Waterjet

- 10.1.4. Flame

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Automotive

- 10.2.2. Aerospace and Defense

- 10.2.3. Electrical and Electronics

- 10.2.4. Construction

- 10.2.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Lincoln Electric Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Messer Cutting Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Genstar Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Colfax Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Linde Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Struers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ador Welding Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GCE Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAIHEN Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hypertherm

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amada Miyachi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Koike Aronson Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kennametal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TRUMPF GmbH + Co KG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bystronic Laser AG**List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 The Lincoln Electric Company

List of Figures

- Figure 1: Global Cutting Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: South America Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: South America Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: South America Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cutting Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Cutting Equipment Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Cutting Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cutting Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Cutting Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 21: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: South Korea Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 29: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Cutting Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Global Cutting Equipment Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 35: Global Cutting Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: UAE Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Egypt Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Cutting Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cutting Equipment Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Cutting Equipment Industry?

Key companies in the market include The Lincoln Electric Company, Messer Cutting Systems, Genstar Technologies, Colfax Corporation, Linde Group, Struers, Ador Welding Ltd, GCE Group, DAIHEN Corporation, Hypertherm, Amada Miyachi, Koike Aronson Inc, Kennametal, TRUMPF GmbH + Co KG, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Cutting Equipment Industry?

The market segments include Technology, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Positive Outlook for the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022 - Lincoln Electric has introduced the POWER MIG 215 MPi multi-process welder, a lightweight dual-input voltage machine with a new ergonomic design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cutting Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cutting Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cutting Equipment Industry?

To stay informed about further developments, trends, and reports in the Cutting Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence