Key Insights

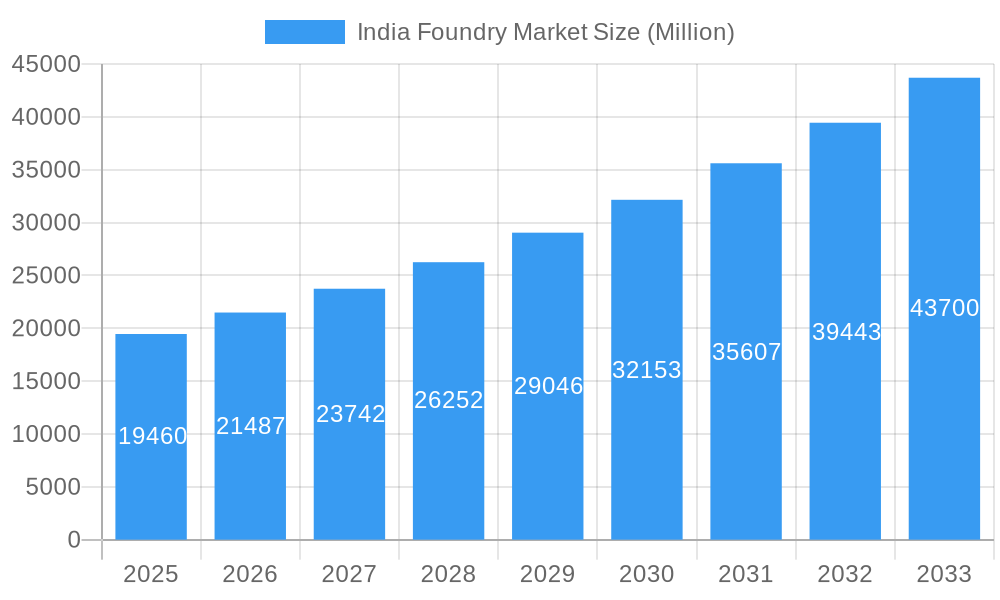

The India Foundry Market, valued at $19.46 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.30% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning automotive industry, particularly the rise of electric vehicles and the increasing demand for lightweight components, significantly boosts the demand for castings. Furthermore, the construction sector's steady growth, coupled with infrastructure development initiatives across the nation, contributes significantly to the market's expansion. Government policies promoting "Make in India" and encouraging domestic manufacturing further amplify this positive trajectory. Technological advancements in casting processes, leading to improved quality, efficiency, and precision, also play a vital role. While challenges like fluctuating raw material prices and stringent environmental regulations exist, the overall market outlook remains optimistic due to the sustained growth in end-use sectors and technological innovations.

India Foundry Market Market Size (In Billion)

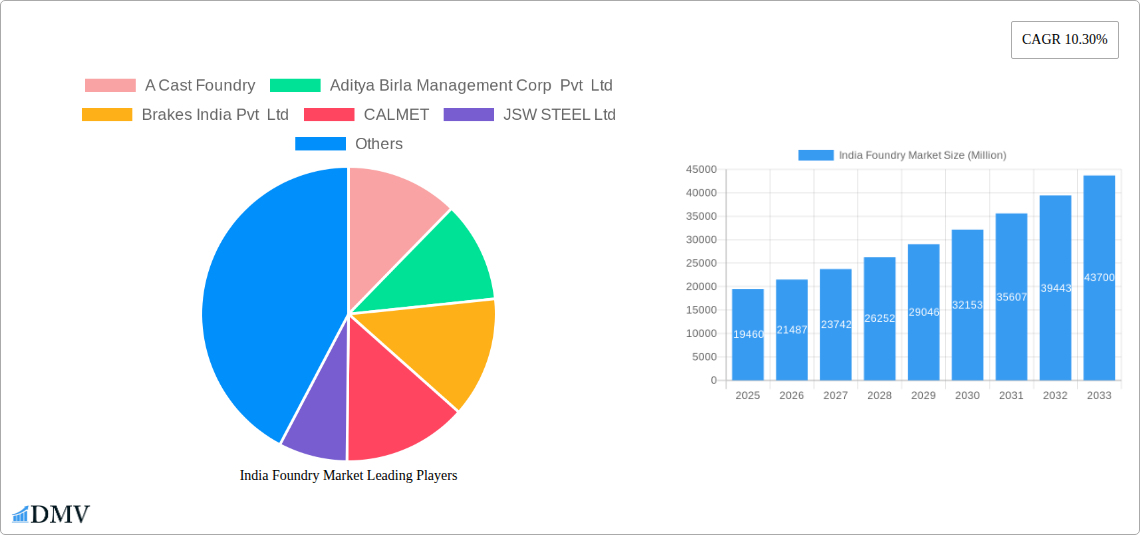

Key players like A Cast Foundry, Aditya Birla Management Corp Pvt Ltd, Brakes India Pvt Ltd, and JSW STEEL Ltd are driving innovation and market share. However, the market also presents opportunities for smaller players to specialize in niche segments and leverage emerging technologies. The forecast period (2025-2033) suggests continuous market expansion driven by consistent demand across sectors like automotive, construction, and machinery. The market segmentation, while not explicitly provided, likely includes distinctions based on casting types (e.g., iron, steel, aluminum), application industries, and geographical regions. Analyzing these segments will provide a more granular understanding of growth opportunities within the Indian Foundry Market. Competitive analysis should also focus on the strategies employed by leading players, considering factors like technological advancements, vertical integration, and strategic partnerships.

India Foundry Market Company Market Share

India Foundry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the India Foundry Market, offering invaluable insights for stakeholders seeking to understand its current state and future trajectory. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's dynamics, key players, and growth opportunities. The study period spans 2019–2024 (Historical Period), with 2025 as the base and estimated year, and forecasts extending to 2033 (Forecast Period).

India Foundry Market Composition & Trends

The Indian foundry market, valued at xx Million in 2025, exhibits a complex interplay of factors influencing its growth and evolution. Market concentration is moderate, with several large players alongside numerous smaller, specialized foundries. Innovation is driven by the increasing demand for high-performance materials, particularly in automotive and aerospace sectors. The regulatory landscape, including environmental regulations and safety standards, plays a significant role in shaping industry practices. Substitute materials, such as plastics and composites, pose a competitive challenge, though the inherent strength and versatility of metal castings maintain its dominance in several applications. End-users span diverse sectors including automotive, construction, machinery, and aerospace. M&A activities are notable, reflecting consolidation and expansion within the industry.

- Market Share Distribution: While precise figures for individual market share are unavailable (xx), the market is characterized by a few dominant players and a large number of smaller players.

- M&A Deal Values: Recent deals such as the Kirloskar Ferrous Industries Limited acquisition of Oliver Engineering highlight a trend towards consolidation, though precise deal values are often undisclosed. The total value of M&A activity in the last 5 years is estimated at xx Million.

India Foundry Market Industry Evolution

The Indian foundry market has experienced significant growth over the past decade, driven by factors such as industrialization, infrastructure development, and increasing domestic demand across various sectors. This growth trajectory reflects expanding production capacity and adoption of advanced technologies. Technological advancements, encompassing automation, digitalization, and the use of advanced materials, are enhancing efficiency, quality, and precision in casting processes. Shifting consumer demands for lighter, stronger, and more sustainable products are pushing the foundry industry to embrace innovative materials and manufacturing processes. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024 and is projected to maintain a CAGR of xx% between 2025 and 2033. The adoption of additive manufacturing and 3D printing technologies is slowly increasing, representing a potential future growth driver.

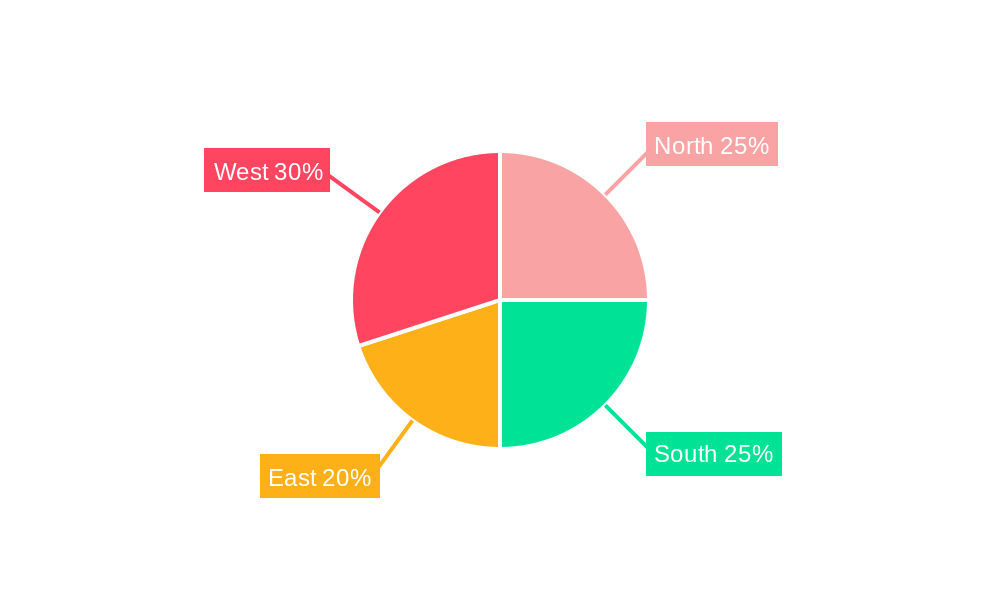

Leading Regions, Countries, or Segments in India Foundry Market

While precise regional data is not readily available (xx), the automotive and industrial manufacturing hubs are likely to be dominant regions within the India Foundry Market. The concentration of automobile manufacturing in states like Tamil Nadu and Maharashtra will be a crucial factor in influencing regional growth.

- Key Drivers:

- Investment in infrastructure: Significant investments in infrastructure projects across India contribute substantially to foundry market growth.

- Government support and policy: Favorable industrial policies and support for domestic manufacturing boost the growth of the foundry sector.

- Growing automotive industry: The booming automotive sector is a major driver of the foundry market's demand for castings.

The dominance of these regions is largely attributable to existing manufacturing infrastructure, skilled labor pool, and proximity to key end-user industries.

India Foundry Market Product Innovations

Recent innovations encompass the development of high-strength, lightweight alloys optimized for specific applications. Advanced casting techniques such as investment casting and high-pressure die casting are improving precision and reducing defects. The adoption of Industry 4.0 technologies such as digital twinning and machine learning is optimizing production processes and enhancing quality control. These advancements result in improved performance metrics, such as reduced scrap rates and enhanced dimensional accuracy. Unique selling propositions (USPs) often revolve around the precise control over material properties and the ability to produce complex geometries.

Propelling Factors for India Foundry Market Growth

Several factors propel the India Foundry Market's growth. The ongoing expansion of the automotive and construction industries creates significant demand for castings. Government initiatives to promote 'Make in India' encourage domestic production, fostering growth within the foundry sector. Technological advancements, including automation and precision casting techniques, improve efficiency and quality, stimulating demand. Additionally, the increasing adoption of sustainable manufacturing practices enhances the market's prospects.

Obstacles in the India Foundry Market

The India Foundry Market faces challenges, including fluctuations in raw material prices, especially metal costs. Stringent environmental regulations necessitate investments in pollution control measures. Intense competition among numerous players and the availability of substitute materials add pressure. Supply chain disruptions and skilled labor shortages also hinder growth. The overall impact of these factors results in reduced profitability and operational complexities for some market participants.

Future Opportunities in India Foundry Market

Future opportunities lie in tapping into the expanding renewable energy sector's demand for castings in wind turbines and solar panels. The aerospace sector presents a high-growth segment, requiring specialized alloys and casting techniques. Advances in additive manufacturing and 3D printing create potential for customized and complex castings. The shift towards lightweighting in vehicles is fueling the demand for innovative, high-strength alloys.

Major Players in the India Foundry Market Ecosystem

- A Cast Foundry

- Aditya Birla Management Corp Pvt Ltd

- Brakes India Pvt Ltd

- CALMET

- JSW STEEL Ltd

- Larsen and Toubro Ltd

- Ashok Iron Works Pvt Ltd

- Gujarat Metal Cast Industries Pvt Ltd

- Electrosteel Castings Ltd

- Menon and Menod Ltd

- List Not Exhaustive

Key Developments in India Foundry Market Industry

- September 2023: Kirloskar Ferrous Industries Limited (KFIL) acquires Oliver Engineering Pvt. Ltd., expanding its casting capacity by 28,000 MT per annum.

- February 2023: Hindustan Aeronautics Limited and Bharat Forge Limited sign an MoU for developing aerospace-grade steel alloys, indicating growth in the high-value segment.

- January 2023: Bharat Forge Ltd's subsidiary acquires Indo Shell Mould Ltd.'s SEZ unit, strengthening its presence in the casting sector.

Strategic India Foundry Market Forecast

The India Foundry Market is poised for robust growth, driven by industrial expansion, infrastructure development, and technological advancements. Opportunities in high-growth sectors such as renewable energy and aerospace will further fuel market expansion. While challenges persist, the market's inherent strength and the potential for innovation suggest a positive outlook over the forecast period. The overall market is expected to reach xx Million by 2033.

India Foundry Market Segmentation

-

1. End-user

- 1.1. Automotive

- 1.2. Electrical and Construction

- 1.3. Industrial Machinery

- 1.4. Other End-Users

-

2. Type

- 2.1. Gray Iron Casting

- 2.2. Non-ferrous Casting

- 2.3. Ductile Iron Casting

- 2.4. Steel Casting

- 2.5. Malleable Casting

India Foundry Market Segmentation By Geography

- 1. India

India Foundry Market Regional Market Share

Geographic Coverage of India Foundry Market

India Foundry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters

- 3.4. Market Trends

- 3.4.1. Growing Automobile Sector is Driving the Foundry Market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Foundry Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Automotive

- 5.1.2. Electrical and Construction

- 5.1.3. Industrial Machinery

- 5.1.4. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gray Iron Casting

- 5.2.2. Non-ferrous Casting

- 5.2.3. Ductile Iron Casting

- 5.2.4. Steel Casting

- 5.2.5. Malleable Casting

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A Cast Foundry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aditya Birla Management Corp Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brakes India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CALMET

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSW STEEL Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Larsen and Toubro Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashok Iron Works Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gujarat Metal Cast Industries Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrosteel Castings Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Menon and Menod Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 A Cast Foundry

List of Figures

- Figure 1: India Foundry Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Foundry Market Share (%) by Company 2025

List of Tables

- Table 1: India Foundry Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: India Foundry Market Volume Billion Forecast, by End-user 2020 & 2033

- Table 3: India Foundry Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: India Foundry Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: India Foundry Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Foundry Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Foundry Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: India Foundry Market Volume Billion Forecast, by End-user 2020 & 2033

- Table 9: India Foundry Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Foundry Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: India Foundry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Foundry Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Foundry Market?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the India Foundry Market?

Key companies in the market include A Cast Foundry, Aditya Birla Management Corp Pvt Ltd, Brakes India Pvt Ltd, CALMET, JSW STEEL Ltd, Larsen and Toubro Ltd, Ashok Iron Works Pvt Ltd, Gujarat Metal Cast Industries Pvt Ltd, Electrosteel Castings Ltd, Menon and Menod Ltd **List Not Exhaustive.

3. What are the main segments of the India Foundry Market?

The market segments include End-user, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.46 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters.

6. What are the notable trends driving market growth?

Growing Automobile Sector is Driving the Foundry Market in India.

7. Are there any restraints impacting market growth?

4.; Increasing Focus on Technology Upgrades4.; Formation of Foundry Clusters.

8. Can you provide examples of recent developments in the market?

September 2023: Kirloskar Ferrous Industries Limited (KFIL), one of the leading castings and pig iron manufacturers in India, announced the acquisition of Oliver Engineering Pvt. Ltd. Oliver Engineering is engaged in the business of ferrous casting and machining with its manufacturing facility located in Village Sandharsi, Tehsil Rajpura, State Punjab. Its present castings capacity is 28,000 MT per annum. KFIL also produces various grades of pig iron such as SG iron grade, basic steel grade, and foundry grade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Foundry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Foundry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Foundry Market?

To stay informed about further developments, trends, and reports in the India Foundry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence