Key Insights

The North American fabricated metal products market is poised for significant expansion, projected to reach $65.5 billion by 2025, with a compound annual growth rate (CAGR) of 9.7%. This robust growth is propelled by escalating demand from key industries including construction, automotive, and energy. Primary growth drivers include ongoing infrastructure development in the US and Canada, the automotive industry's increasing reliance on lightweight metals for enhanced fuel efficiency, and the burgeoning renewable energy sector, especially wind and solar power. Advancements in fabrication technologies, such as laser cutting and robotic welding, are also boosting productivity and enabling the creation of sophisticated, customized metal products. This dynamic market offers substantial opportunities for established companies like Valmont Industries, Mayville Engineering, and Colfax, as well as innovative new entrants.

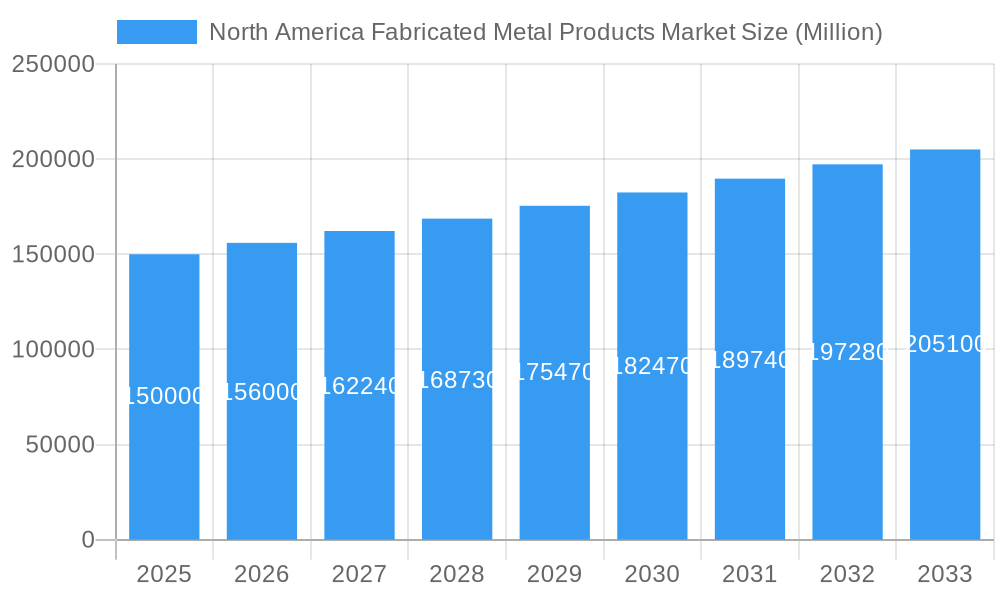

North America Fabricated Metal Products Market Market Size (In Billion)

Despite positive growth prospects, the market confronts challenges such as volatile raw material prices for steel and aluminum, impacting profitability. There is also a growing imperative to adopt sustainable manufacturing practices, necessitating investment in eco-friendly technologies and materials to reduce carbon emissions and waste. Intensifying competition requires continuous innovation and a strategic focus on specialized market segments. Furthermore, evolving trade dynamics and geopolitical uncertainties demand vigilant risk management. Nevertheless, the long-term outlook for the North American fabricated metal products market remains strong, with considerable growth anticipated throughout the forecast period. A detailed understanding of market segmentation will be crucial for identifying specific product category trends and competitive dynamics.

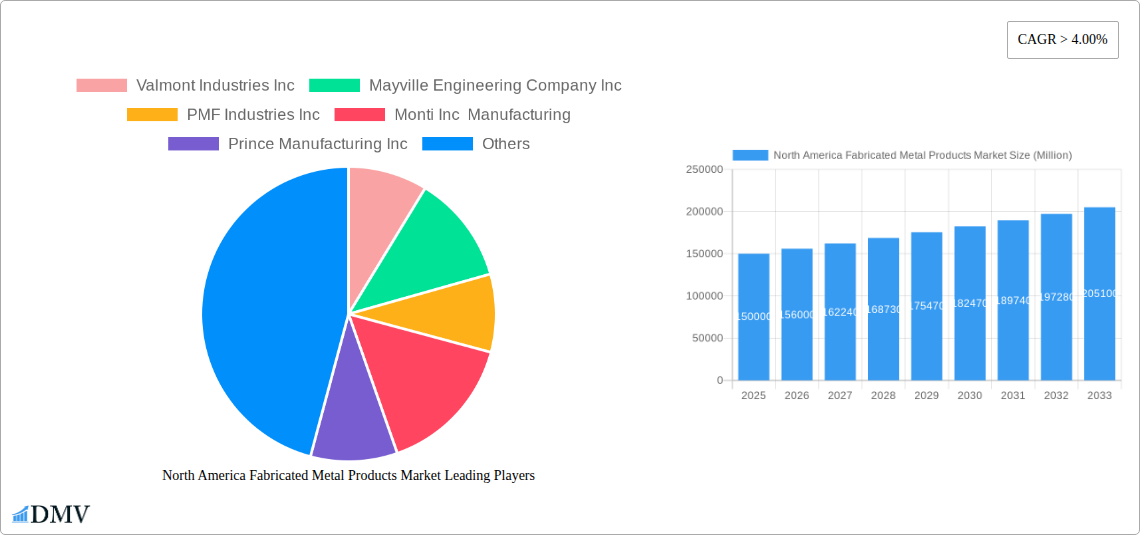

North America Fabricated Metal Products Market Company Market Share

North America Fabricated Metal Products Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America Fabricated Metal Products market, offering a detailed overview of market dynamics, key players, and future growth prospects. Spanning the period from 2019 to 2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Fabricated Metal Products Market Composition & Trends

This section delves into the intricacies of the North American fabricated metal products market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. Innovation is primarily driven by advancements in additive manufacturing and automation technologies, improving efficiency and enabling the creation of complex designs. Regulatory compliance, particularly concerning environmental standards and safety regulations, significantly influences market dynamics. Substitute materials, like plastics and composites, pose a competitive challenge, particularly in cost-sensitive applications. End-users span diverse sectors, including construction, automotive, aerospace, and energy. M&A activity has been relatively robust in recent years, with deals averaging xx Million in value.

- Market Share Distribution (2025): Top 5 players: xx%; Remaining players: xx%

- Average M&A Deal Value (2019-2024): xx Million

- Key End-User Sectors: Construction, Automotive, Aerospace, Energy, Manufacturing

North America Fabricated Metal Products Market Industry Evolution

The North America fabricated metal products market has witnessed significant evolution over the past decade. Market growth has been driven by robust infrastructure investment, increasing industrial activity, and a growing demand for durable goods. Technological advancements, particularly in areas like automation, additive manufacturing (3D printing), and robotics, have enhanced manufacturing efficiency and opened up new possibilities in design and customization. Consumer demand shifts toward lightweighting and sustainability are influencing material selection and manufacturing processes. The market experienced a growth rate of xx% from 2019 to 2024, and this trend is expected to continue, albeit at a slightly moderated pace, over the forecast period. The adoption rate of automation technologies is projected to increase by xx% by 2033.

Leading Regions, Countries, or Segments in North America Fabricated Metal Products Market

The report identifies [Specific Region/State e.g., the Midwest region of the US] as the leading region within the North America fabricated metal products market. This dominance is attributed to several key factors.

- Key Drivers:

- Strong Manufacturing Base: Presence of established manufacturing facilities and skilled workforce.

- Significant Infrastructure Investments: Ongoing projects in construction and infrastructure development.

- Government Support and Incentives: Targeted policies promoting industrial growth.

This region benefits from a robust ecosystem of suppliers, manufacturers, and end-users, fostering a synergistic environment conducive to market expansion. The analysis encompasses a detailed examination of factors contributing to the region's dominance, including investment trends, regulatory support, and the presence of key players.

North America Fabricated Metal Products Market Product Innovations

Recent years have witnessed the emergence of innovative fabricated metal products incorporating advanced materials, such as high-strength steels and lightweight alloys, coupled with improved manufacturing processes. Additive manufacturing technologies are enabling the creation of intricate and complex components with enhanced performance characteristics. Key innovations include the development of corrosion-resistant coatings and the integration of smart sensors for real-time monitoring. These advancements enhance product durability, improve efficiency, and reduce overall costs. Unique selling propositions center around customized solutions, reduced weight, and improved performance.

Propelling Factors for North America Fabricated Metal Products Market Growth

Several factors are driving the expansion of the North America fabricated metal products market. These include increased government spending on infrastructure projects, the growing demand for durable goods across various end-user sectors (automotive, construction, aerospace), and technological advancements boosting productivity and efficiency. Favorable economic conditions and supportive regulatory frameworks further fuel market growth.

Obstacles in the North America Fabricated Metal Products Market

The North America fabricated metal products market navigates a complex landscape characterized by significant headwinds. Persistent supply chain disruptions, exacerbated by geopolitical events and logistical bottlenecks, continue to impact the availability and timely delivery of essential components. Simultaneously, escalating raw material costs for steel, aluminum, and other key metals are directly affecting production expenses and squeezing profit margins. The market also contends with intense competition from a diverse range of domestic and international manufacturers, driving price pressures and demanding continuous innovation. Furthermore, increasingly stringent environmental regulations necessitate significant investment in cleaner production technologies and waste reduction, while fluctuating energy prices introduce unpredictability into operational costs. These intertwined challenges collectively impact production efficiency, influence lead times for customers, and pose a continuous threat to overall market profitability.

Future Opportunities in North America Fabricated Metal Products Market

The future trajectory of the North America fabricated metal products market is poised for expansion driven by strategic adaptations and technological advancements. A significant opportunity lies in the widespread adoption of sustainable manufacturing practices, aligning with growing environmental consciousness and regulatory demands. This includes embracing energy-efficient processes, utilizing recycled materials, and minimizing waste generation. The exploration and integration of new lightweight materials, such as advanced alloys and composites, present a avenue for developing innovative products with enhanced performance and reduced weight, particularly in sectors like aerospace and automotive. The integration of advanced technologies, including artificial intelligence (AI) for predictive maintenance and quality control, machine learning for optimizing production scheduling, and robotics for increased automation, holds the key to enhancing efficiency and driving down costs. Furthermore, expanding into emerging markets within North America and strategically focusing on high-growth niche applications, such as renewable energy infrastructure, medical devices, and specialized industrial equipment, will unlock substantial growth prospects and diversify revenue streams.

Major Players in the North America Fabricated Metal Products Market Ecosystem

- Valmont Industries Inc

- Mayville Engineering Company Inc

- PMF Industries Inc

- Monti Inc Manufacturing

- Prince Manufacturing Inc

- O' Neal Manufacturing Services

- BTD Manufacturing Inc

- United Steel Inc

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- Other significant regional and specialized manufacturers.

Key Developments in North America Fabricated Metal Products Market Industry

- September 2022: Victaulic's strategic acquisition of Tennessee Metal Fabricating Corporation significantly broadened its footprint in the infrastructure market and bolstered its capabilities in providing large-diameter pipe solutions, a critical segment within fabricated metal products.

- October 2022: The pivotal partnership between Siemens and Desktop Metal marked a significant stride towards accelerating additive manufacturing adoption in metal fabrication. This collaboration focuses on integrating Siemens' advanced digital manufacturing technologies into Desktop Metal's AM 2.0 systems, a move anticipated to revolutionize the production of complex and customized fabricated metal parts.

- Ongoing: Increasing investment in automation and Industry 4.0 technologies by various players to enhance efficiency, reduce labor costs, and improve product quality.

- Emerging Trend: Growing emphasis on advanced welding techniques and joining technologies to meet the demand for higher-strength and more durable metal components across diverse industries.

Strategic North America Fabricated Metal Products Market Forecast

The North America fabricated metal products market is poised for continued growth, driven by technological advancements, infrastructure development, and rising demand across key sectors. Emerging opportunities in sustainable manufacturing and the adoption of innovative materials present significant potential. The market's long-term prospects remain positive, although navigating supply chain complexities and adapting to evolving regulatory landscapes will be crucial for success.

North America Fabricated Metal Products Market Segmentation

-

1. Material Type

- 1.1. Steel

- 1.2. Aluminum

- 1.3. Other Material Types

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. Power and Utilities

- 2.3. Construction

- 2.4. Oil & Gas

- 2.5. Other End-user Industries

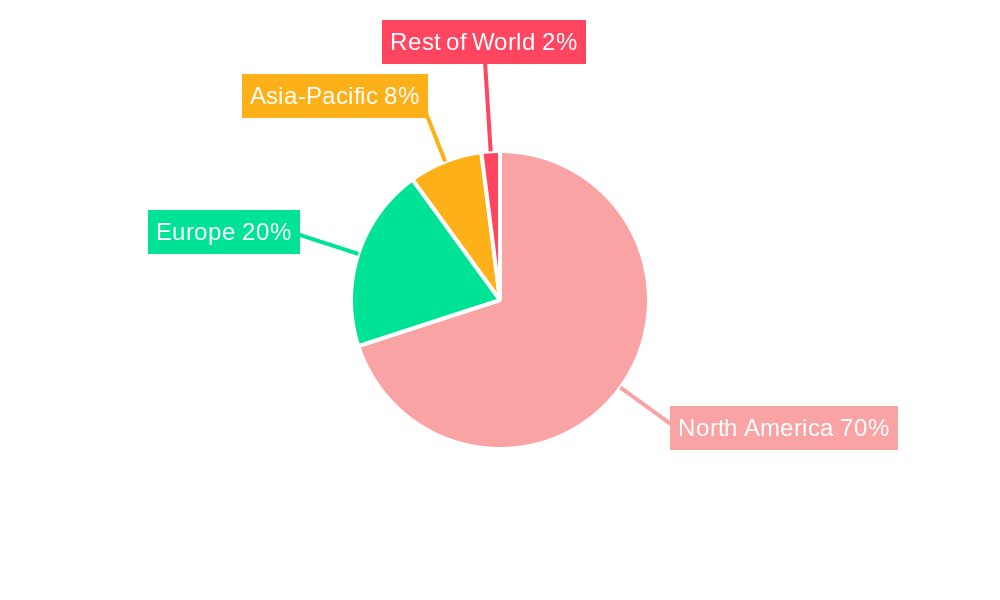

North America Fabricated Metal Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fabricated Metal Products Market Regional Market Share

Geographic Coverage of North America Fabricated Metal Products Market

North America Fabricated Metal Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Demand for Advanced Automotive and Industrial Parts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fabricated Metal Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Steel

- 5.1.2. Aluminum

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. Power and Utilities

- 5.2.3. Construction

- 5.2.4. Oil & Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Valmont Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mayville Engineering Company Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PMF Industries Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Monti Inc Manufacturing

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prince Manufacturing Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 O' Neal Manufacturing Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BTD Manufacturing Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Steel Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komaspec

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Matcor Matsu Group Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sandvik Mining and Construction Canada Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Valmont Industries Inc

List of Figures

- Figure 1: North America Fabricated Metal Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fabricated Metal Products Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fabricated Metal Products Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Fabricated Metal Products Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Fabricated Metal Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Fabricated Metal Products Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Fabricated Metal Products Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Fabricated Metal Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Fabricated Metal Products Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fabricated Metal Products Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the North America Fabricated Metal Products Market?

Key companies in the market include Valmont Industries Inc, Mayville Engineering Company Inc, PMF Industries Inc, Monti Inc Manufacturing, Prince Manufacturing Inc, O' Neal Manufacturing Services, BTD Manufacturing Inc, United Steel Inc, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc **List Not Exhaustive.

3. What are the main segments of the North America Fabricated Metal Products Market?

The market segments include Material Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Demand for Advanced Automotive and Industrial Parts.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Siemens and Desktop Metal have announced a multifaceted partnership aimed at accelerating the adoption of additive manufacturing for production applications, with a particular emphasis on the world's largest manufacturers. The collaboration will cover a wide range of aspects of the desktop metal business. This includes increased integration of Siemens technology, such as operational technology, information technology, and automation, into Desktop Metal's AM 2.0 systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fabricated Metal Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fabricated Metal Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fabricated Metal Products Market?

To stay informed about further developments, trends, and reports in the North America Fabricated Metal Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence