Key Insights

The India metal fabrication market is projected for substantial growth, driven by robust infrastructure development, increasing urbanization, and expansion in the automotive and renewable energy sectors. With a projected Compound Annual Growth Rate (CAGR) of 5.27%, the market is anticipated to reach a size of $2.91 billion by the base year 2025. Key market participants, including Salasar Techno Engineering Ltd, Kirby Building Systems, and Larsen & Toubro Ltd, are instrumental in shaping the market through their diverse product portfolios and project executions. Future growth will be further fueled by technological advancements in fabrication processes, the adoption of sustainable practices, and supportive government initiatives for domestic manufacturing. Potential challenges, such as raw material price volatility, supply chain disruptions, and skilled labor scarcity, may impact growth trajectories.

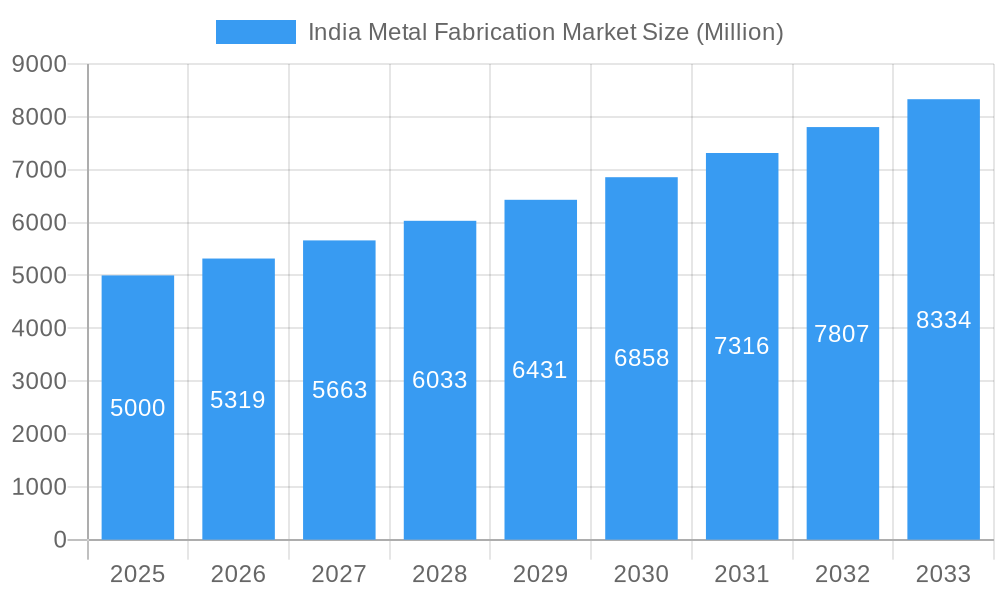

India Metal Fabrication Market Market Size (In Billion)

Understanding market segmentation is vital for strategic planning and investment. The India metal fabrication market can be segmented by material type (e.g., steel, aluminum), application (e.g., construction, automotive, energy), and geography. Each segment is expected to experience unique growth patterns influenced by specific industry dynamics and policy frameworks. In-depth analysis of these segments will reveal opportunities for companies to target niche markets effectively. A comprehensive competitive analysis, examining company performance, market share, and strategic approaches, is essential for identifying competitive advantages and navigating market complexities.

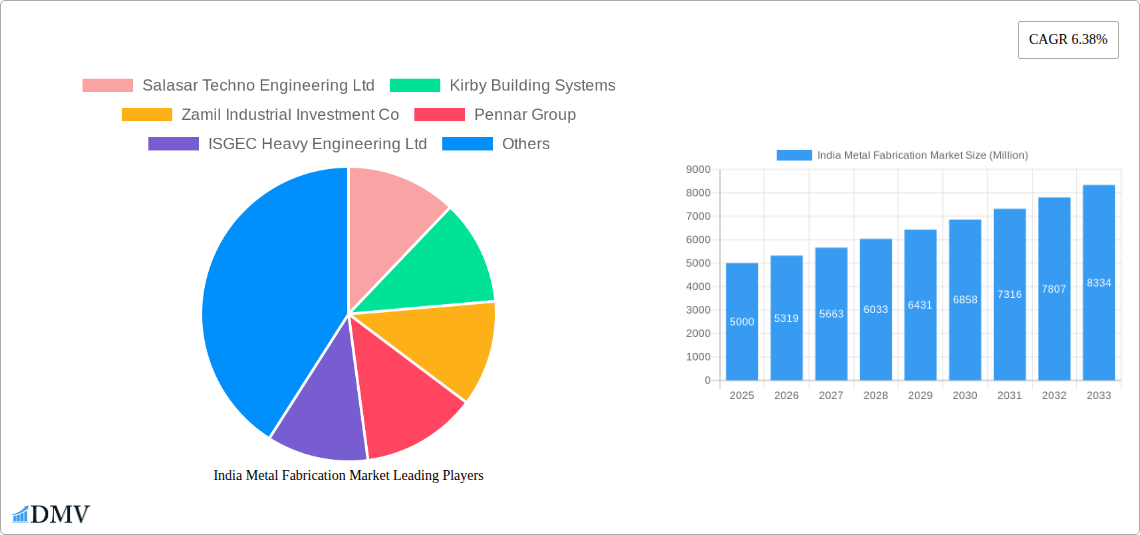

India Metal Fabrication Market Company Market Share

India Metal Fabrication Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Metal Fabrication Market, encompassing market size, trends, leading players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers valuable insights for stakeholders, including manufacturers, investors, and industry professionals seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

India Metal Fabrication Market Market Composition & Trends

This section delves into the intricate structure of the India Metal Fabrication Market, analyzing market concentration, innovation drivers, regulatory influences, substitute product impacts, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, numerous smaller players contribute to the market's vibrancy and competition.

- Market Share Distribution: The top 5 players collectively hold approximately xx% of the market share in 2025, with Salasar Techno Engineering Ltd., Kirby Building Systems, and Zamil Industrial Investment Co. among the leading companies. Precise figures are detailed within the full report.

- Innovation Catalysts: Government initiatives promoting infrastructure development and "Make in India" are key catalysts driving innovation in metal fabrication techniques and materials. The adoption of advanced technologies like 3D printing and automation is further accelerating innovation.

- Regulatory Landscape: Government regulations regarding safety, environmental compliance, and import/export policies significantly influence market dynamics. Changes in these regulations can present both opportunities and challenges for market players.

- Substitute Products: The availability of alternative materials like plastics and composites poses a competitive threat. However, the superior strength and durability of metal continue to ensure strong demand.

- End-User Profiles: The key end-users include construction, automotive, and manufacturing sectors. Detailed analysis of each segment's contribution and growth potential is included.

- M&A Activities: The report analyzes recent M&A activities within the market, including deal values and their impact on market consolidation. While specific deal values are confidential, the report analyzes the overall trends and impacts.

India Metal Fabrication Market Industry Evolution

This section explores the historical and projected growth trajectories of the India Metal Fabrication Market, analyzing technological advancements and evolving consumer preferences. The market witnessed significant growth during the historical period (2019-2024), driven by robust infrastructure development and industrialization. This trend is anticipated to continue during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) projected at xx%. Technological advancements, such as the increased adoption of automation, robotic welding, and laser cutting technologies, are streamlining production processes and improving efficiency. Simultaneously, shifting consumer preferences towards sustainable and lightweight materials are influencing product development and design. Detailed analysis of these factors and quantified data points regarding growth rates and adoption metrics are provided in the full report.

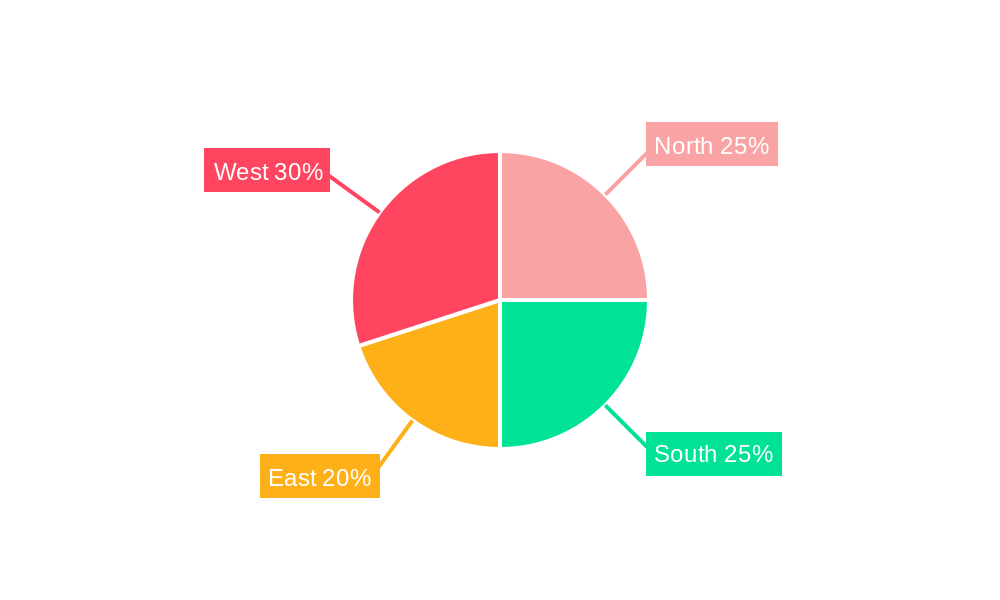

Leading Regions, Countries, or Segments in India Metal Fabrication Market

The report identifies the leading regions and segments within the India Metal Fabrication Market. While specific regional dominance requires further analysis, the report provides a nuanced breakdown of the factors driving growth in different regions and segments. The comprehensive analysis presented in the full report includes insights into the influence of investment trends, government support, and infrastructure development on regional market dominance.

- Key Drivers of Dominance:

- Favorable government policies and incentives.

- Robust infrastructure development.

- Strong industrial growth in target regions.

- Availability of skilled labor.

- Strategic location advantages.

India Metal Fabrication Market Product Innovations

The India Metal Fabrication Market is witnessing rapid product innovation, with a focus on developing lightweight, high-strength materials and advanced manufacturing techniques. Companies are incorporating innovative materials like high-strength steel and aluminum alloys to meet the increasing demand for cost-effective and durable solutions. The adoption of advanced technologies, including laser cutting, robotic welding, and 3D printing, has significantly enhanced the precision, speed, and efficiency of fabrication processes. These innovations are leading to improved product performance metrics, including increased strength, reduced weight, and enhanced aesthetics.

Propelling Factors for India Metal Fabrication Market Growth

The growth of the India Metal Fabrication Market is driven by a confluence of factors. Firstly, the government's focus on infrastructure development through projects like the Bharatmala Pariyojana and Smart Cities Mission is fueling demand for metal fabrication products. Secondly, the rapid expansion of the automotive and construction sectors is creating strong demand. Thirdly, technological advancements in fabrication processes and materials are driving efficiency gains and cost reductions. Finally, the increasing adoption of sustainable practices within the industry is encouraging the development of environmentally friendly products.

Obstacles in the India Metal Fabrication Market Market

Several factors could hinder the growth of the India Metal Fabrication Market. Fluctuations in raw material prices, particularly steel, pose a significant challenge. Supply chain disruptions can impact production and delivery timelines. Furthermore, intense competition among domestic and international players puts pressure on pricing and profitability. The lack of skilled labor in certain regions can also constrain market growth.

Future Opportunities in India Metal Fabrication Market

The India Metal Fabrication Market presents several promising future opportunities. The increasing adoption of renewable energy technologies, such as solar and wind power, will drive demand for specialized metal fabrication components. The growing focus on sustainable and lightweight materials offers opportunities for companies to develop and market innovative products. Furthermore, the expansion of the e-commerce sector and the rise of digital manufacturing present new avenues for growth.

Major Players in the India Metal Fabrication Market Ecosystem

- Salasar Techno Engineering Ltd

- Kirby Building Systems

- Zamil Industrial Investment Co

- Pennar Group

- ISGEC Heavy Engineering Ltd

- Godrej Process Equipment

- TEMA India

- Larsen & Toubro Ltd

- Diamond Group

- Novatech Projects (India) Private Limited

- SKV Engineering India Pvt LTD

- Karamtara Engineering Pvt Ltd

- 63 Other Companies

Key Developments in India Metal Fabrication Market Industry

- October 2023: JSP's Angul unit expansion to become India's largest single-location steel plant, significantly increasing steel availability for fabrication. This development will impact the supply chain positively and boost the overall market capacity.

- July 2023: The MoU between ArcelorMittal Nippon Steel India and Festo India to develop NAMTECH, focusing on high-quality engineering and specialized education, will enhance the skills pool for the metal fabrication industry in India, ensuring a higher quality workforce. This positive development will impact long-term industry growth.

Strategic India Metal Fabrication Market Market Forecast

The India Metal Fabrication Market is poised for significant growth over the forecast period, driven by robust infrastructure development, industrial expansion, and technological advancements. The continued focus on "Make in India" initiatives, coupled with the growing adoption of sustainable practices, will create further opportunities for market players. The market's expansion will be influenced by the government's commitment to infrastructure projects, the evolving needs of various industry sectors, and the ongoing innovation in fabrication techniques and materials. The report projects strong growth, with opportunities particularly evident in the renewable energy and lightweight materials segments.

India Metal Fabrication Market Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Utilities

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

- 2.3. Other Material Types

-

3. Service Type

- 3.1. Casting

- 3.2. Forging

- 3.3. Machining

- 3.4. Welding and Tubing

- 3.5. Other Services

India Metal Fabrication Market Segmentation By Geography

- 1. India

India Metal Fabrication Market Regional Market Share

Geographic Coverage of India Metal Fabrication Market

India Metal Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market

- 3.4. Market Trends

- 3.4.1. Manufacturing Sector is Shaping the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Metal Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Utilities

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.2.3. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Casting

- 5.3.2. Forging

- 5.3.3. Machining

- 5.3.4. Welding and Tubing

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Salasar Techno Engineering Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kirby Building Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zamil Industrial Investment Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pennar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISGEC Heavy Engineering Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej Process Equipment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TEMA India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Larsen & Toubro Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Diamond Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novatech Projects (India) Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SKV Engineering India Pvt LTD

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Karamtara Engineering Pvt Ltd**List Not Exhaustive 6 3 Other Companie

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Salasar Techno Engineering Ltd

List of Figures

- Figure 1: India Metal Fabrication Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Metal Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: India Metal Fabrication Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: India Metal Fabrication Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: India Metal Fabrication Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: India Metal Fabrication Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Metal Fabrication Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: India Metal Fabrication Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: India Metal Fabrication Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: India Metal Fabrication Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Metal Fabrication Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the India Metal Fabrication Market?

Key companies in the market include Salasar Techno Engineering Ltd, Kirby Building Systems, Zamil Industrial Investment Co, Pennar Group, ISGEC Heavy Engineering Ltd, Godrej Process Equipment, TEMA India, Larsen & Toubro Ltd, Diamond Group, Novatech Projects (India) Private Limited, SKV Engineering India Pvt LTD, Karamtara Engineering Pvt Ltd**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the India Metal Fabrication Market?

The market segments include End-user Industry, Material Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market.

6. What are the notable trends driving market growth?

Manufacturing Sector is Shaping the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Fabricated Metal Products Driving the Market; Technological Advancements Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: JSP’s Angul unit, located in Odisha, was set to become India’s biggest single-location steel manufacturing plant. The capacity of the current Angul plant is estimated to be 5.6 mtpa per annum. However, the plan was to double it to 11 mtpa and 24 mtpa by 2023 and 2027, respectively. JSP’s steel plant, located in Raghurhat, was also expected to expand its capacity from 3.6 tpa per annum to 9 tpa by 2023. JSP finalized trial production at Angul in 2023 and commercial production by 2024. Jindal Steel and Power expects the Indian steel industry to grow in line with government infrastructure projects and domestic demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Metal Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Metal Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Metal Fabrication Market?

To stay informed about further developments, trends, and reports in the India Metal Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence