Key Insights

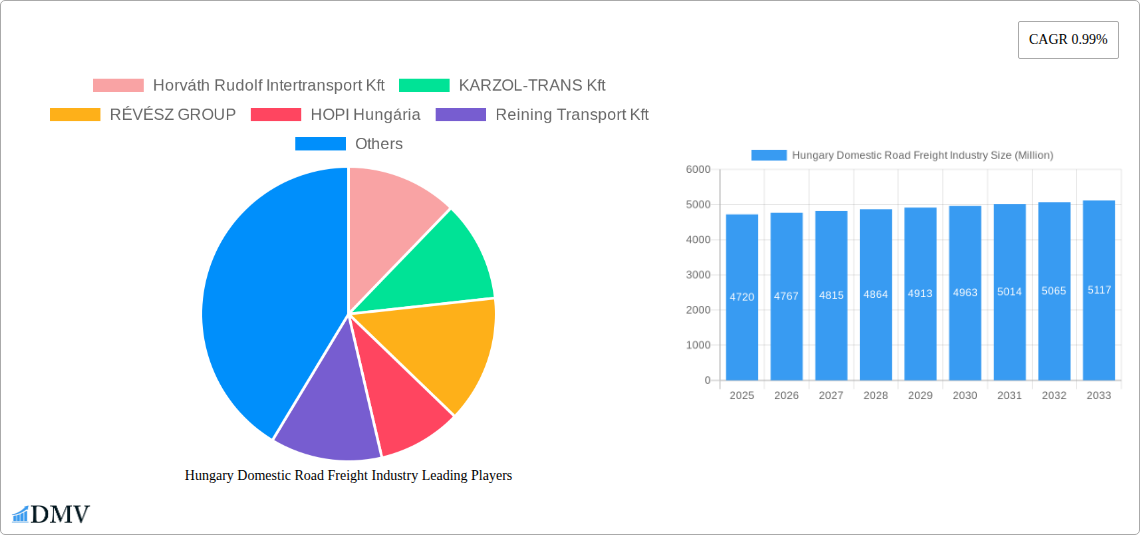

The Hungarian domestic road freight industry, valued at €4.72 billion in 2025, exhibits moderate growth potential, reflected in its 0.99% CAGR (2025-2033). This relatively low CAGR suggests a mature market with existing infrastructure and established players. Key drivers include the country's robust manufacturing sector (particularly automotive), growing e-commerce leading to increased last-mile delivery demands, and the expansion of agricultural and construction activities. However, restraints such as fuel price volatility, driver shortages (a common issue across Europe), and potential disruptions to supply chains due to geopolitical factors could temper growth. Segmentation reveals that manufacturing, including the automotive industry, is a major end-user, followed by distributive trade (wholesale and retail). The dominance of these sectors indicates a reliance on efficient logistics for just-in-time manufacturing and consumer goods distribution. Furthermore, the industry landscape is competitive, with both large multinational corporations like Deutsche Post DHL Group and numerous smaller, local companies operating within the market. The forecast period (2025-2033) presents opportunities for companies that can adapt to evolving technological advancements (e.g., improved fleet management systems, autonomous driving technologies) and effectively address the challenges of driver shortages and fuel costs.

Hungary Domestic Road Freight Industry Market Size (In Billion)

Growth in the coming years will likely be driven by investments in infrastructure improvements aiming to enhance connectivity and efficiency. The focus on sustainability and environmental concerns could also influence the market by encouraging the adoption of cleaner transportation technologies and more efficient logistics practices. Companies that successfully integrate technology, enhance supply chain resilience, and prioritize sustainable operations are likely to achieve better performance. The competitive landscape suggests a need for companies to differentiate themselves through specialized services, enhanced customer relationships, and advanced technological capabilities to maintain profitability and market share within the Hungarian domestic road freight sector.

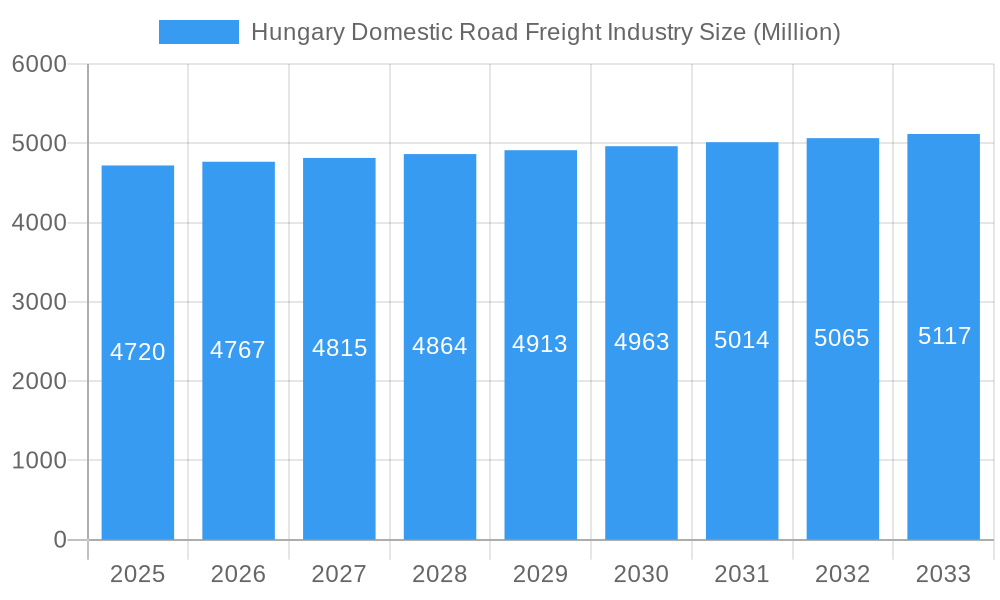

Hungary Domestic Road Freight Industry Company Market Share

Hungary Domestic Road Freight Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Hungary domestic road freight industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study covers the period from 2019 to 2033, with a focus on 2025 as the base and estimated year. This report is crucial for stakeholders seeking to understand the complexities of this dynamic sector and make informed strategic decisions. The Hungarian road freight market, valued at xx Million in 2024, is poised for significant growth, reaching xx Million by 2033. This report unveils the driving forces behind this expansion and the challenges companies must navigate.

Hungary Domestic Road Freight Industry Market Composition & Trends

This section delves into the competitive landscape of the Hungarian domestic road freight market, examining market concentration, innovation, regulatory frameworks, and industry dynamics. We analyze the interplay of various factors influencing market share distribution, including mergers and acquisitions (M&A) activity.

Market Concentration: The Hungarian domestic road freight market exhibits a [Describe Concentration Level: e.g., moderately concentrated] structure, with [Number] key players commanding a significant share. Waberer's International Nyrt holds an estimated [xx]% market share, followed by [Company Name] with [xx]% and [Company Name] with [xx]%. Smaller players account for the remaining [xx]%.

Innovation Catalysts: Technological advancements, such as telematics and route optimization software, are driving efficiency gains and transforming operational models. The increasing adoption of sustainable transport solutions, including electric and hybrid trucks, is also shaping the industry's trajectory.

Regulatory Landscape: EU regulations on driver hours, emissions, and cabotage significantly impact the market, necessitating continuous adaptation by operators. The Hungarian government's infrastructure investments and policies related to road maintenance and logistics further shape the market's trajectory.

Substitute Products and Services: While road freight remains dominant, alternative modes of transport, including rail and inland waterways, compete for certain freight segments. The competitiveness of these alternatives is influenced by factors such as infrastructure development and cost efficiency.

End-User Profiles: The report segments end users into key categories, including manufacturing (automotive, etc.), distributive trade, and other sectors, analyzing their respective freight demands and their impact on the market.

M&A Activities: The past five years have witnessed [Number] significant M&A deals in the Hungarian domestic road freight market, with a total deal value of approximately xx Million. These transactions reflect the industry's consolidation trends and strategic shifts.

Hungary Domestic Road Freight Industry Industry Evolution

This section analyzes the evolutionary path of the Hungarian domestic road freight market, examining long-term growth trends, technological advancements, and changing consumer demands. The report projects a [Growth Rate]% Compound Annual Growth Rate (CAGR) from 2025 to 2033, driven by a combination of factors such as increasing e-commerce penetration, improving infrastructure, and economic growth. The adoption rate of telematics solutions is expected to reach [xx]% by 2033, enhancing operational efficiency and reducing transportation costs. Shifting consumer demands for faster and more reliable delivery services are also influencing the development of specialized logistics solutions, such as last-mile delivery services, influencing the growth trajectory. The increasing focus on sustainability is leading to the adoption of greener technologies and practices within the industry, contributing to the overall evolution of the market. The impact of global events, such as the COVID-19 pandemic and geopolitical shifts, on supply chains and transportation patterns are also explored in detail.

Leading Regions, Countries, or Segments in Hungary Domestic Road Freight Industry

This section pinpoints the leading regions, countries, and segments within the Hungarian domestic road freight market. The Budapest region is the dominant area, due to its central location and high concentration of manufacturing and distribution centers.

Key Drivers for Budapest's Dominance:

- High concentration of manufacturing and distribution facilities.

- Extensive road infrastructure and connectivity to major transportation hubs.

- Strong economic activity and robust consumer demand.

Dominant End-User Segments:

- Manufacturing (including Automotive): This segment represents the largest share of domestic freight volumes, driven by Hungary's significant automotive manufacturing sector. Growth is fueled by continued investment in automotive production facilities and the expanding supply chain.

- Distributive Trade (wholesale and retail trade): The growth of e-commerce and changing consumer shopping habits have fueled demand for efficient and reliable delivery services within this segment.

International/Cross-border Segment: While this report focuses on domestic freight, the integration of Hungary into the EU's transportation network creates significant cross-border traffic, impacting the overall market dynamics and influencing pricing and competitiveness.

Hungary Domestic Road Freight Industry Product Innovations

Recent product innovations have focused on enhancing efficiency and sustainability. Telematics systems provide real-time tracking and optimization of routes, reducing fuel consumption and delivery times. The introduction of hybrid and electric trucks is addressing environmental concerns and improving fuel efficiency. These innovations are enhancing delivery speeds, lowering operating costs, and reducing the industry's carbon footprint. Companies are also leveraging advanced route planning software and developing specialized logistics solutions to meet the evolving needs of various end-user segments.

Propelling Factors for Hungary Domestic Road Freight Industry Growth

Several factors are driving the growth of the Hungarian domestic road freight industry. Strong economic growth fuels increased demand for transportation services, particularly within the manufacturing and retail sectors. Government investments in infrastructure development and improvements to the national road network enhance transportation efficiency and reduce transit times. Technological advancements, such as GPS tracking and fleet management systems, improve operational efficiency and cost-effectiveness. The increasing adoption of e-commerce further fuels the growth of last-mile delivery services.

Obstacles in the Hungary Domestic Road Freight Industry Market

The Hungarian domestic road freight industry faces challenges, including fluctuations in fuel prices, which directly impact operating costs. Driver shortages and the increasing cost of attracting and retaining qualified drivers represent a significant operational hurdle. Stringent environmental regulations and the need for investments in cleaner vehicles impose added costs. Increased competition from other modes of transport, such as rail, and the impact of global supply chain disruptions can also affect market stability and profitability.

Future Opportunities in Hungary Domestic Road Freight Industry

Future growth opportunities exist in expanding into niche markets, such as specialized temperature-controlled transport and hazardous materials handling. Investing in technological advancements, such as autonomous vehicles and drone delivery systems, offers potential efficiency gains and cost reductions. Collaborating with other logistics providers to offer comprehensive supply chain solutions enhances market competitiveness. The growing emphasis on sustainability presents opportunities for companies to invest in environmentally friendly transport solutions and attract environmentally conscious clients.

Major Players in the Hungary Domestic Road Freight Industry Ecosystem

- Horváth Rudolf Intertransport Kft

- KARZOL-TRANS Kft

- RÉVÉSZ GROUP

- HOPI Hungária

- Reining Transport Kft

- Huncargo Holding Zrt

- Genezis-Trans Kft

- Qualitrans - Cargo Kft

- GEFCO

- K&V Nemzetközi Fuvarozó Kft

- Alba-Zöchling Kft

- GARTNER group

- Transintertop Kft

- Deutsche Post DHL Group

- BHS Trans

- Gelbmann Kft

- Waberer's International Nyrt

- DUVENBECK Logisztikai Kft

- DOMINÓ TRANS Kft

- Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság

Key Developments in Hungary Domestic Road Freight Industry Industry

- 2022 Q3: Waberer's International Nyrt announces a strategic investment in new, fuel-efficient trucks.

- 2023 Q1: New regulations regarding driver working hours come into effect.

- 2023 Q4: A major merger between two mid-sized Hungarian logistics companies is finalized. (Further details on specific mergers and acquisitions require additional research for accurate reporting.)

Strategic Hungary Domestic Road Freight Industry Market Forecast

The Hungarian domestic road freight market is projected to experience robust growth in the coming years, driven by continued economic expansion, infrastructure improvements, and technological advancements. The increasing focus on sustainable logistics solutions presents significant opportunities for companies adopting green technologies and practices. The consolidation trend within the industry, through mergers and acquisitions, is likely to continue, shaping the competitive landscape and influencing pricing strategies. However, challenges such as driver shortages, fuel price volatility, and evolving regulations will require continuous adaptation and innovation to ensure long-term success.

Hungary Domestic Road Freight Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International/Cross-border

-

2. End User

- 2.1. Manufacturing (Including Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade (wholesale and retail trade)

- 2.6. Pharmaceutical and Healthcare

- 2.7. Other End Users (Telecommunications, etc.)

Hungary Domestic Road Freight Industry Segmentation By Geography

- 1. Hungary

Hungary Domestic Road Freight Industry Regional Market Share

Geographic Coverage of Hungary Domestic Road Freight Industry

Hungary Domestic Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Domestic road freight transport witness higher growth rate through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Domestic Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International/Cross-border

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing (Including Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade (wholesale and retail trade)

- 5.2.6. Pharmaceutical and Healthcare

- 5.2.7. Other End Users (Telecommunications, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Horváth Rudolf Intertransport Kft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KARZOL-TRANS Kft

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RÉVÉSZ GROUP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HOPI Hungária

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reining Transport Kft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huncargo Holding Zrt

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genezis-Trans Kft

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qualitrans - Cargo Kft

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEFCO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 K&V Nemzetközi Fuvarozó Kft

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alba-Zöchling Kft

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GARTNER group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Transintertop Kft

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Deutsche Post DHL Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 BHS Trans

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Gelbmann Kft

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Waberer's International Nyrt

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 DUVENBECK Logisztikai Kft**List Not Exhaustive

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 DOMINÓ TRANS Kft

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Horváth Rudolf Intertransport Kft

List of Figures

- Figure 1: Hungary Domestic Road Freight Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Domestic Road Freight Industry Share (%) by Company 2025

List of Tables

- Table 1: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Hungary Domestic Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 5: Hungary Domestic Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Domestic Road Freight Industry?

The projected CAGR is approximately 0.99%.

2. Which companies are prominent players in the Hungary Domestic Road Freight Industry?

Key companies in the market include Horváth Rudolf Intertransport Kft, KARZOL-TRANS Kft, RÉVÉSZ GROUP, HOPI Hungária, Reining Transport Kft, Huncargo Holding Zrt, Genezis-Trans Kft, Qualitrans - Cargo Kft, GEFCO, K&V Nemzetközi Fuvarozó Kft, Alba-Zöchling Kft, GARTNER group, Transintertop Kft, Deutsche Post DHL Group, BHS Trans, Gelbmann Kft, Waberer's International Nyrt, DUVENBECK Logisztikai Kft**List Not Exhaustive, DOMINÓ TRANS Kft, Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság.

3. What are the main segments of the Hungary Domestic Road Freight Industry?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Domestic road freight transport witness higher growth rate through the forecast period.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Domestic Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Domestic Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Domestic Road Freight Industry?

To stay informed about further developments, trends, and reports in the Hungary Domestic Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence