Key Insights

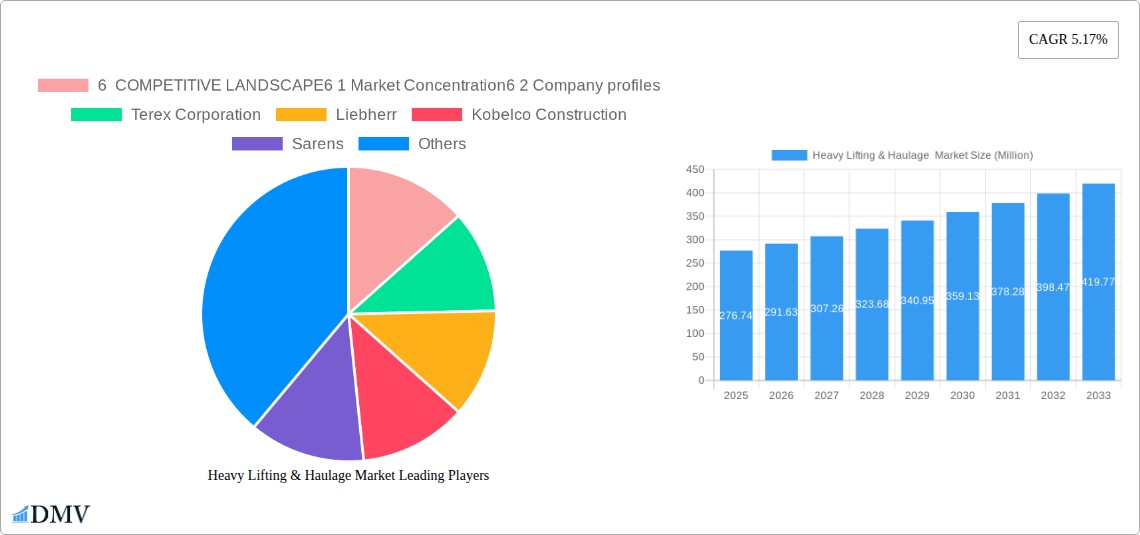

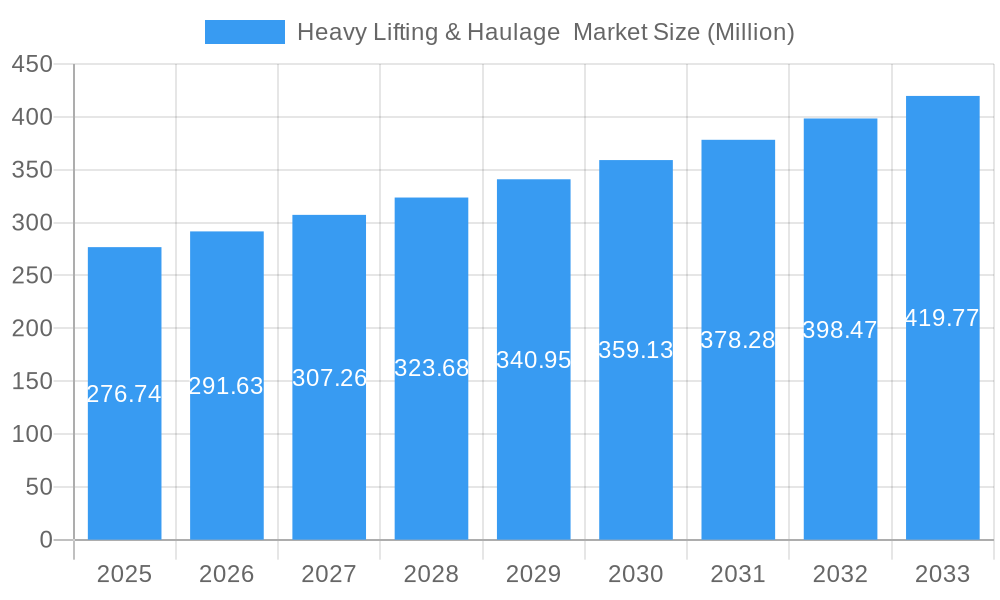

The global heavy lifting and haulage market, valued at $276.74 million in 2025, is projected to experience robust growth, driven by expanding infrastructure development globally, particularly in emerging economies. The increasing demand for specialized heavy lifting equipment in sectors like construction, energy, and manufacturing fuels this expansion. Furthermore, advancements in technology, such as the adoption of automation and remote operation capabilities in cranes and other heavy lifting machinery, contribute significantly to market growth. Rising construction activities related to both residential and commercial projects, coupled with large-scale infrastructure projects like highways, bridges, and power plants, necessitate the use of heavy lifting and haulage services. This creates a substantial demand for specialized equipment and skilled operators, driving market growth. The projected Compound Annual Growth Rate (CAGR) of 5.17% from 2025 to 2033 indicates a steady and consistent expansion of this market.

Heavy Lifting & Haulage Market Market Size (In Million)

However, the market faces certain restraints. Fluctuations in raw material prices, particularly steel, directly impact the cost of manufacturing heavy lifting equipment. Stringent safety regulations and the need for skilled labor, along with potentially high insurance costs associated with heavy lifting operations, pose challenges to market growth. Furthermore, economic downturns can significantly affect investment in infrastructure projects, leading to reduced demand for heavy lifting services. Despite these challenges, the long-term outlook for the heavy lifting and haulage market remains positive, driven by ongoing infrastructure development and technological advancements that enhance efficiency and safety. Major players like Terex, Liebherr, and Kobelco, along with numerous regional companies, are strategically positioned to benefit from this growth. The competitive landscape is moderately concentrated, suggesting opportunities for both established players and innovative entrants to capture market share.

Heavy Lifting & Haulage Market Company Market Share

Heavy Lifting & Haulage Market: A Comprehensive Market Analysis (2019-2033)

This insightful report provides a deep dive into the Heavy Lifting & Haulage Market, offering a comprehensive analysis of market trends, competitive dynamics, and future growth prospects. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Heavy Lifting & Haulage Market Composition & Trends

This section analyzes the market's current state, exploring key aspects influencing its trajectory. The market concentration is moderately high, with a few major players holding significant market share. However, several smaller companies are actively innovating, leading to a dynamic competitive landscape. The report details market share distribution amongst key players (e.g., Terex Corporation holds an estimated xx% market share in 2025). Recent M&A activities, while not frequent, have involved deals valued at approximately xx Million in the past five years. The regulatory landscape is characterized by varying safety standards across regions, influencing equipment design and operational procedures. Substitute products, such as specialized trucking solutions, pose a moderate threat, particularly in niche applications. End-user profiles include construction, energy, and logistics sectors, with construction remaining the largest end-user segment.

- Market Concentration: Moderately high, with leading players holding xx% of the market share collectively.

- Innovation Catalysts: Focus on automation, improved safety features, and enhanced lifting capacities.

- Regulatory Landscape: Varying safety standards across regions impacting equipment design and operation.

- Substitute Products: Specialized trucking solutions pose a moderate threat in niche markets.

- End-User Profiles: Construction, energy, and logistics are the primary end-users.

- M&A Activities: Deal values in the past five years totaling approximately xx Million.

Heavy Lifting & Haulage Market Industry Evolution

The Heavy Lifting & Haulage market has witnessed significant evolution driven by technological advancements and changing consumer demands. The historical period (2019-2024) saw steady growth, fueled by infrastructure development and increasing industrial activity. The market experienced a growth rate of xx% annually during this time. Technological advancements, such as autonomous haulage solutions and improved crane technology, are transforming operational efficiency and safety. Demand for heavier lifting capacities and specialized equipment for unique projects is also shaping market growth. The rising adoption of autonomous solutions is projected to increase by xx% annually during the forecast period, driven by safety concerns and cost-effectiveness. Shifting consumer demands include a preference for sustainable practices, leading to increased demand for fuel-efficient and environmentally friendly equipment.

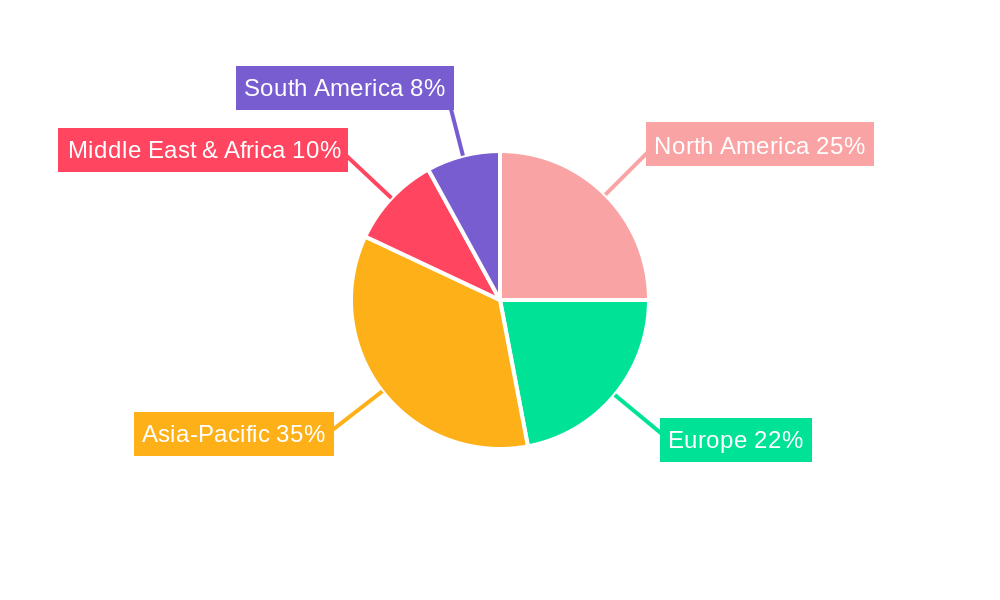

Leading Regions, Countries, or Segments in Heavy Lifting & Haulage Market

North America currently dominates the Heavy Lifting & Haulage market, driven by robust construction activity and significant investments in infrastructure projects.

- Key Drivers in North America:

- Strong government investments in infrastructure development.

- High demand for heavy lifting equipment in the oil & gas sector.

- A well-established network of equipment suppliers and service providers.

- Dominance Factors: High infrastructure spending, strong economic growth, and a large base of end-users.

The European market is also substantial, experiencing consistent growth. Asia-Pacific shows high potential for future growth driven by rapid urbanization and industrialization.

Heavy Lifting & Haulage Market Product Innovations

Recent innovations include the development of autonomous haulage systems, enhancing safety and efficiency. Improved crane designs with increased lifting capacities and enhanced maneuverability are also prominent. These advancements cater to the growing demand for sophisticated equipment capable of handling complex projects in challenging environments. Unique selling propositions now include features like self-mounting counterweights and multiple steering modes for enhanced ease of use. Furthermore, the focus on minimizing environmental impact drives the development of fuel-efficient and sustainable equipment.

Propelling Factors for Heavy Lifting & Haulage Market Growth

Several factors fuel the market's growth: increasing infrastructure investments globally, particularly in developing economies; rising demand for large-scale construction projects; technological advancements enhancing efficiency and safety; and supportive government regulations promoting industrial growth. The growing adoption of renewable energy sources further supports the demand for specialized heavy lifting and haulage solutions for installation and maintenance.

Obstacles in the Heavy Lifting & Haulage Market

Significant challenges include stringent safety regulations increasing equipment costs; supply chain disruptions impacting production and delivery times; and intense competition leading to price pressures. These factors can constrain market growth, especially during periods of economic uncertainty. The impact of supply chain disruptions is estimated to have reduced market growth by approximately xx% in 2022.

Future Opportunities in Heavy Lifting & Haulage Market

Emerging opportunities include the expansion into new geographic markets, particularly in Africa and South America; the development of specialized equipment for renewable energy projects; and the integration of advanced technologies such as AI and IoT for improved equipment management and predictive maintenance. These areas hold significant potential for future market expansion.

Major Players in the Heavy Lifting & Haulage Market Ecosystem

- Terex Corporation (Terex Corporation)

- Liebherr (Liebherr)

- Kobelco Construction

- Sarens

- Mammoet

- Global Rigging & Transport

- HSC Cranes

- Volvo Construction Equipment (Volvo Construction Equipment)

- XCMG Construction

- KATO

- Konecranes (Konecranes)

- Other companies

Key Developments in Heavy Lifting & Haulage Market Industry

- July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution, validating a fleet of four T 264 autonomous trucks.

- June 2024: Terex Rough Terrain Cranes launched the TRT 80 l, an 80-tonne crane with enhanced maneuverability and setup efficiency.

Strategic Heavy Lifting & Haulage Market Forecast

The Heavy Lifting & Haulage market is poised for continued growth, driven by ongoing infrastructure development, technological innovation, and increasing demand from diverse sectors. The focus on automation and sustainable practices will further shape market dynamics. The market's potential remains significant, with substantial growth opportunities across various segments and geographic regions.

Heavy Lifting & Haulage Market Segmentation

-

1. End User

- 1.1. Oil and Gas

- 1.2. Mining and Quarrying

- 1.3. Energy and Power

- 1.4. Construction

- 1.5. Manufacturing

- 1.6. Other End Users

Heavy Lifting & Haulage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Heavy Lifting & Haulage Market Regional Market Share

Geographic Coverage of Heavy Lifting & Haulage Market

Heavy Lifting & Haulage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.4. Market Trends

- 3.4.1. Increased Demand From Energy and Power Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Oil and Gas

- 5.1.2. Mining and Quarrying

- 5.1.3. Energy and Power

- 5.1.4. Construction

- 5.1.5. Manufacturing

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Oil and Gas

- 6.1.2. Mining and Quarrying

- 6.1.3. Energy and Power

- 6.1.4. Construction

- 6.1.5. Manufacturing

- 6.1.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Oil and Gas

- 7.1.2. Mining and Quarrying

- 7.1.3. Energy and Power

- 7.1.4. Construction

- 7.1.5. Manufacturing

- 7.1.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Oil and Gas

- 8.1.2. Mining and Quarrying

- 8.1.3. Energy and Power

- 8.1.4. Construction

- 8.1.5. Manufacturing

- 8.1.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Oil and Gas

- 9.1.2. Mining and Quarrying

- 9.1.3. Energy and Power

- 9.1.4. Construction

- 9.1.5. Manufacturing

- 9.1.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Oil and Gas

- 10.1.2. Mining and Quarrying

- 10.1.3. Energy and Power

- 10.1.4. Construction

- 10.1.5. Manufacturing

- 10.1.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terex Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liebherr

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kobelco Construction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sarens

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mammoet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Global Rigging & Transport

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HSC Cranes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Volvo Constructioon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XCMG Construction

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KATO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Konecranes**List Not Exhaustive 6 3 Other companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Heavy Lifting & Haulage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Heavy Lifting & Haulage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 5: North America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Europe Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 13: Europe Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 21: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 29: South America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 36: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 37: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Spain Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: China Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: India Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Singapore Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Singapore Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 43: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: Brazil Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Mexico Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Mexico Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of South America Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of South America Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 53: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Egypt Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Egypt Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Lifting & Haulage Market?

The projected CAGR is approximately 5.17%.

2. Which companies are prominent players in the Heavy Lifting & Haulage Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, Terex Corporation, Liebherr, Kobelco Construction, Sarens, Mammoet, Global Rigging & Transport, HSC Cranes, Volvo Constructioon, XCMG Construction, KATO, Konecranes**List Not Exhaustive 6 3 Other companie.

3. What are the main segments of the Heavy Lifting & Haulage Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 276.74 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

6. What are the notable trends driving market growth?

Increased Demand From Energy and Power Segment.

7. Are there any restraints impacting market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

8. Can you provide examples of recent developments in the market?

July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution. Currently, they are validating a fleet of four T 264 autonomous trucks alongside the AHS at a dedicated facility in Fortescue's Christmas Creek mine. The AHS ecosystem will encompass creating and validating a fleet management system and a machine guidance solution.June 2024: In Italy, Terex Rough Terrain Cranes unveiled its latest offering, the TRT 80 l, boasting an impressive 80-tonne lifting capacity. Terex emphasizes its lifting prowess and transport convenience, which are standout features of this new two-axle model. With a width of 3 m, the TRT 80 l is well-suited for navigating tight spaces and busy job sites. Enhancing its setup efficiency, the crane features a self-mounting counterweight, ensuring quicker assembly and disassembly. With four steering modes, maneuvering and setup become more manageable. Once in place, the TRT 90 l can fully utilize its 47-m telescopic boom, complemented by jib options of 9 and 17 m. With its blend of advanced features and user-centric design, the TRT 80 l stands out as a valuable addition to any fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heavy Lifting & Haulage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heavy Lifting & Haulage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heavy Lifting & Haulage Market?

To stay informed about further developments, trends, and reports in the Heavy Lifting & Haulage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence