Key Insights

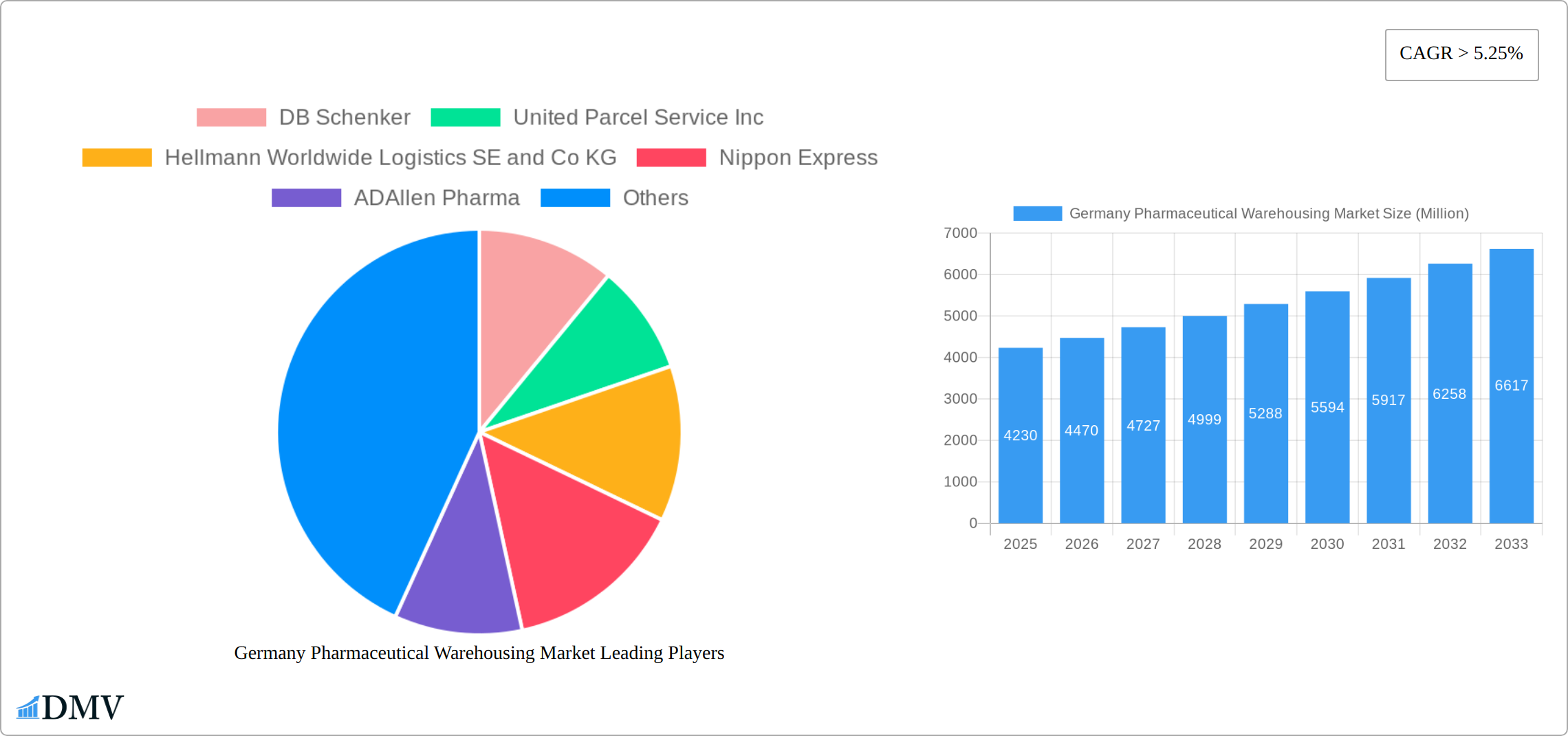

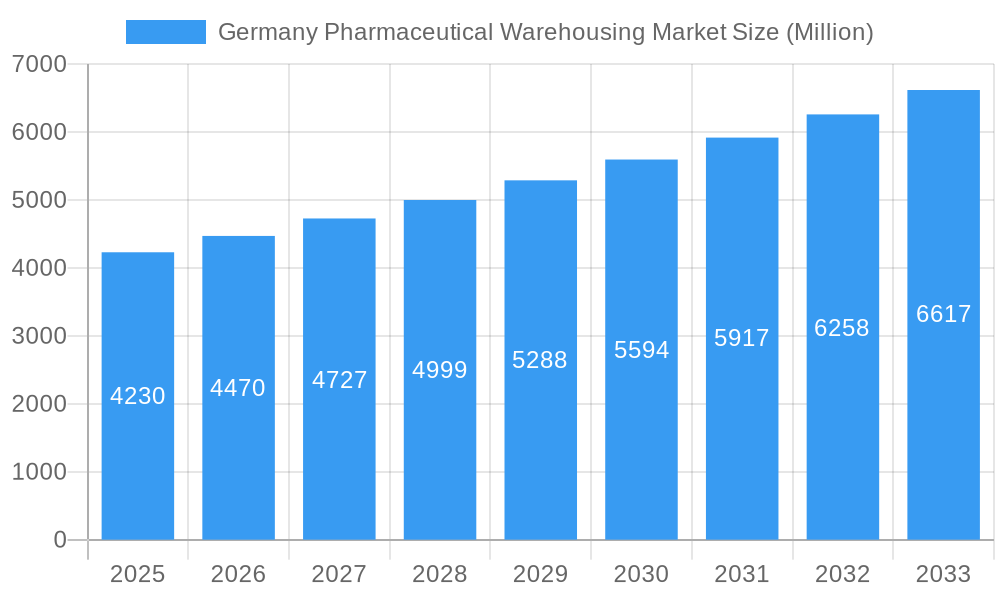

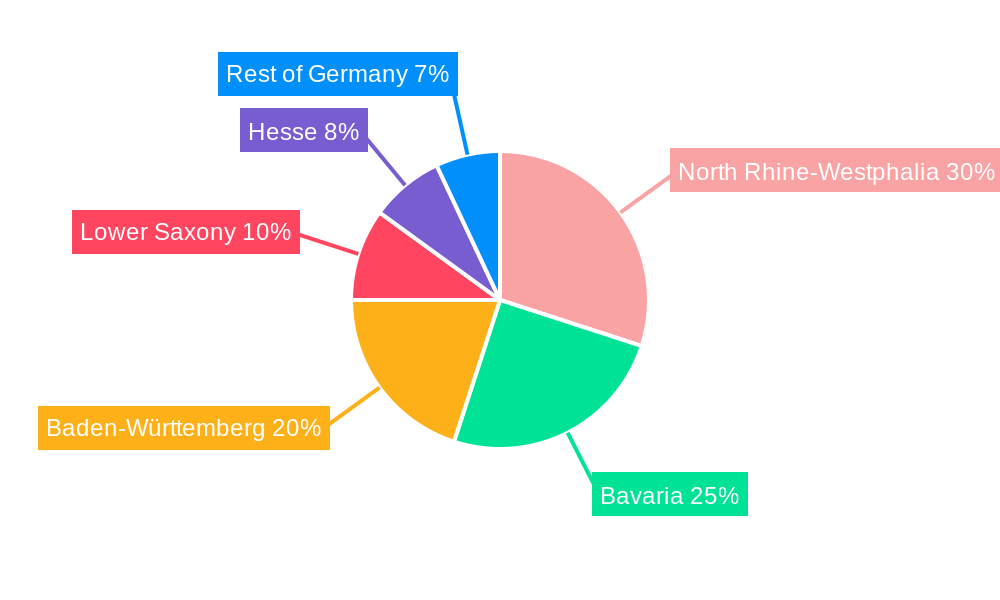

The German pharmaceutical warehousing market, valued at €4.23 billion in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5.25% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for pharmaceutical products, coupled with stringent regulatory requirements for storage and handling, necessitates sophisticated and specialized warehousing solutions. The rise of e-commerce in pharmaceuticals and the growing adoption of temperature-sensitive drug delivery systems further contribute to market expansion. Germany's well-established pharmaceutical industry, with major players based in regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, creates a high concentration of demand for warehousing services. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), offering diverse service options to cater to varying needs. Leading logistics providers like DB Schenker, UPS, and Kuehne + Nagel are major players, competing based on their infrastructure, technological capabilities, and specialized expertise in handling sensitive pharmaceutical goods. However, challenges such as rising real estate costs and the need for continuous investment in advanced technology and skilled labor could potentially restrain market growth in the coming years.

Germany Pharmaceutical Warehousing Market Market Size (In Billion)

The market’s regional concentration within Germany reflects the established pharmaceutical manufacturing hubs. North Rhine-Westphalia, Bavaria, and Baden-Württemberg, being home to numerous pharmaceutical companies and research institutions, experience higher demand for warehousing services. The competitive landscape features both large multinational logistics providers and specialized pharmaceutical logistics companies, indicating a blend of scale and specialized expertise shaping market dynamics. Future growth will likely be driven by technological advancements such as automation, improved tracking and traceability systems, and the adoption of sustainable practices within the cold chain. Furthermore, the increasing focus on personalized medicine and the growth of clinical trials will continue to contribute to the demand for efficient and reliable pharmaceutical warehousing.

Germany Pharmaceutical Warehousing Market Company Market Share

Germany Pharmaceutical Warehousing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany pharmaceutical warehousing market, encompassing market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for stakeholders seeking to understand the dynamics of this vital sector and make informed strategic decisions. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Germany Pharmaceutical Warehousing Market Composition & Trends

This section delves into the intricate structure of the German pharmaceutical warehousing market, examining its concentration, innovative forces, regulatory environment, substitute products, and key players. The market's competitive landscape is analyzed, highlighting the market share distribution among leading players like DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics, and others. The report also examines the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible. Innovation in cold chain logistics and the implementation of advanced technologies are key drivers. Stringent regulatory compliance adds complexity, while the presence of substitute storage solutions impacts market share. End-user profiles – pharmaceutical factories, pharmacies, hospitals, and other entities – are meticulously analyzed to understand their specific warehousing needs.

- Market Concentration: The German pharmaceutical warehousing market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Adoption of automation, IoT, and AI in warehouse management systems is driving innovation.

- Regulatory Landscape: Stringent regulations governing the storage and handling of pharmaceuticals significantly influence market dynamics.

- Substitute Products: Alternative storage solutions and third-party logistics providers influence the market's competitive dynamics.

- M&A Activity: Significant M&A activity, including deals valued at xx Million in recent years, is reshaping the market landscape.

Germany Pharmaceutical Warehousing Market Industry Evolution

The German pharmaceutical warehousing market has experienced robust growth from 2019 to 2024, driven by a confluence of factors. Increased pharmaceutical production, coupled with increasingly stringent regulatory requirements emphasizing the unwavering integrity of the cold chain, has fueled this expansion. The demand for efficient and reliable logistics solutions, crucial for handling sensitive pharmaceutical products, further contributes to market growth. This period saw significant technological advancements, with the implementation of automated guided vehicles (AGVs), sophisticated warehouse management systems (WMS), and real-time tracking technologies playing a pivotal role in enhancing operational efficiency and minimizing costs. Furthermore, evolving consumer demands, particularly the rise of personalized medicine and specialized pharmaceutical products, have necessitated adaptations in warehousing infrastructure to accommodate unique storage and handling needs. Looking ahead to the forecast period (2025-2033), the market is projected to maintain a strong growth trajectory, with a projected Compound Annual Growth Rate (CAGR) of xx%. This continued growth is fueled by ongoing technological innovation and the expanding needs of the pharmaceutical sector.

Leading Regions, Countries, or Segments in Germany Pharmaceutical Warehousing Market

This section identifies the dominant segments within the German pharmaceutical warehousing market. Analyzing market share by warehouse type (cold chain vs. non-cold chain) and application (pharmaceutical factory, pharmacy, hospital, others) reveals key trends. The cold chain segment is expected to dominate due to the need for temperature-controlled storage of sensitive pharmaceutical products. Geographic variations in market dominance are also explored.

- Cold Chain Warehouse: Dominates due to strict temperature requirements for pharmaceuticals. Growth is fueled by increasing investment in advanced cold chain technologies and supportive government regulations.

- Non-Cold Chain Warehouse: Significant but smaller than the cold chain segment, mainly driven by the storage needs for stable pharmaceutical products.

- Pharmaceutical Factory: High demand for warehousing services due to large volumes and complex supply chains.

- Pharmacy: Growing demand for efficient warehousing solutions to manage inventory and streamline distribution.

- Hospital: Specialized needs for storage and handling of pharmaceuticals used in hospitals.

Germany Pharmaceutical Warehousing Market Product Innovations

Innovation is a key driver within the German pharmaceutical warehousing market. We are witnessing the adoption of cutting-edge technologies, including advanced automated storage and retrieval systems (AS/RS) capable of handling diverse pharmaceutical products with precision. State-of-the-art temperature monitoring systems ensure the consistent maintenance of crucial temperature parameters throughout the storage and transportation processes, guaranteeing product integrity. Integrated warehouse management software (WMS) optimizes inventory control and streamlines workflows, contributing to significant efficiency gains. The integration of robotics and artificial intelligence (AI) is revolutionizing warehouse operations, automating tasks, enhancing productivity, and minimizing human error. These innovations collectively contribute to a more resilient, efficient, and cost-effective pharmaceutical supply chain.

Propelling Factors for Germany Pharmaceutical Warehousing Market Growth

Several factors are driving the growth of the German pharmaceutical warehousing market. Increased pharmaceutical production, stringent regulatory requirements for cold chain logistics, advancements in warehousing technology, and the rising demand for efficient and reliable pharmaceutical distribution networks are all major contributors. Furthermore, the growing focus on personalized medicine and specialized drug development is further boosting the need for sophisticated warehousing solutions.

Obstacles in the Germany Pharmaceutical Warehousing Market

Despite strong growth potential, several challenges hinder market expansion. Stringent regulatory compliance adds complexity and cost, while disruptions in the global supply chain can cause delays and shortages. The market's competitive landscape with established players and new entrants presents ongoing competitive pressures. These factors impact overall market growth and profitability.

Future Opportunities in Germany Pharmaceutical Warehousing Market

The German pharmaceutical warehousing market presents a wealth of exciting opportunities for growth and innovation. The expansion into emerging market segments, such as the rapidly growing personalized medicine and specialized drug delivery sectors, necessitates the development and implementation of advanced warehousing solutions tailored to their specific needs. The integration of transformative technologies, including blockchain for enhanced security and traceability, and AI for optimized resource allocation and predictive maintenance, promises significant improvements in efficiency and operational effectiveness. Furthermore, a growing emphasis on sustainability is creating a demand for eco-friendly warehousing practices, such as energy-efficient facilities and the adoption of sustainable logistics solutions, representing a significant opportunity for businesses committed to environmental responsibility. These opportunities underscore the dynamic and evolving nature of the German pharmaceutical warehousing market, promising significant growth and innovation in the years to come.

Major Players in the Germany Pharmaceutical Warehousing Market Ecosystem

- DB Schenker

- United Parcel Service Inc (UPS)

- Hellmann Worldwide Logistics SE and Co KG

- Nippon Express

- ADAllen Pharma

- FedEx Corp (FedEx)

- Rhenus SE and Co KG

- CEVA Logistics

- GXO Logistics

- Bio Pharma Logistics

- Kuehne Nagel Management AG (Kuehne + Nagel)

- XPO Logistics Inc (XPO Logistics)

- GEODIS SA (GEODIS)

- CDS Hackner GmbH

- Pfenning Logistics

- Wagner Group GmbH

Key Developments in Germany Pharmaceutical Warehousing Market Industry

- March 2023: GEODIS's acquisition of trans-o-flex significantly strengthens its position in the temperature-controlled pharmaceutical logistics market in Germany and Europe.

- January 2023: Allcargo Logistics' acquisition of Fair Trade GmbH expands its service network in Germany.

- August 2022: Maersk's construction of a large warehouse in Duisburg enhances its warehousing capabilities and capacity in a strategically important location.

Strategic Germany Pharmaceutical Warehousing Market Forecast

The German pharmaceutical warehousing market is poised for continued growth, driven by technological advancements, increasing demand for efficient logistics, and regulatory changes. The market's evolution toward automation, data-driven decision-making, and sustainable practices presents significant opportunities for companies to capture market share and achieve sustainable growth. The focus on personalized medicine and specialized pharmaceuticals will continue to drive demand for advanced cold chain and specialized warehousing solutions.

Germany Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Germany Pharmaceutical Warehousing Market Segmentation By Geography

- 1. Germany

Germany Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Germany Pharmaceutical Warehousing Market

Germany Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADAllen Pharma

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus SE and Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GXO Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bio Pharma Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kuehne Nagel Management AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 XPO Logistics Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 GEODIS SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 CDS Hackner GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Pfenning Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Wagner Group GmbH

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Germany Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 5.25%.

2. Which companies are prominent players in the Germany Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Nippon Express, ADAllen Pharma, FedEx Corp, Rhenus SE and Co KG, CEVA Logistics, GXO Logistics, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, CDS Hackner GmbH, Pfenning Logistics, Wagner Group GmbH.

3. What are the main segments of the Germany Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy.

6. What are the notable trends driving market growth?

Growth of E-commerce in the market.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support.

8. Can you provide examples of recent developments in the market?

March 2023: GEODIS announced the finalization of the acquisition of trans-o-flex following regulatory approval. Trans-o-flex is a leading German network for temperature-controlled pharmaceutical goods and express premium delivery. This acquisition will establish GEODIS as one of the most prominent players in the key market of healthcare and will significantly enhance its delivery capabilities in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Germany Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence