Key Insights

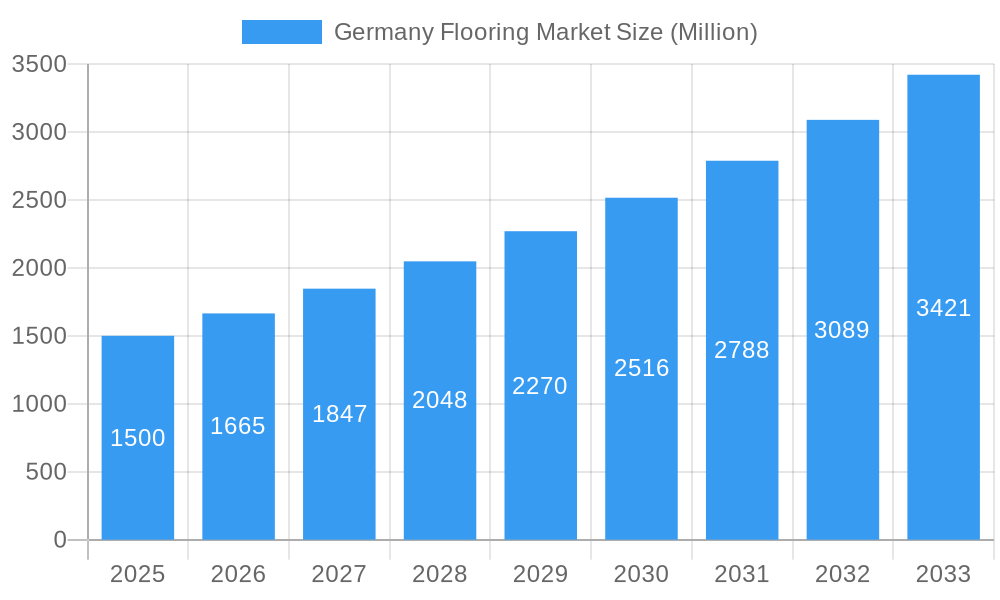

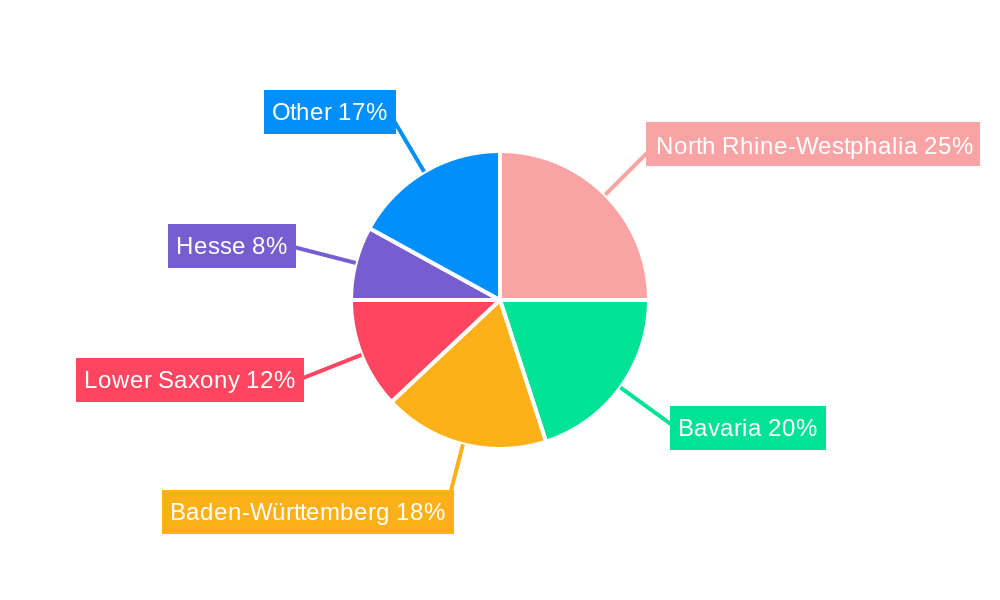

The German flooring market, estimated at 16.3 billion in 2025, is projected for substantial growth. This expansion is driven by escalating investments in residential and commercial construction, a rising demand for aesthetically appealing and durable flooring, and the increasing adoption of sustainable options such as LVT and cork. E-commerce channels and government initiatives promoting energy-efficient buildings further bolster market dynamism. Despite potential economic headwinds and raw material price volatility, the market's diverse product segments and distribution networks offer resilience. Leading players are focusing on innovation, product diversification, and digital presence to capture evolving consumer needs. Key regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg are anticipated to lead market penetration. The forecast period of 2025-2033 anticipates a robust CAGR of 1.9%, signaling significant market expansion.

Germany Flooring Market Market Size (In Billion)

Heightened awareness of health and hygiene, particularly post-pandemic, is driving demand for easily maintained and hypoallergenic flooring. The burgeoning smart home sector also presents opportunities for technologically integrated flooring solutions. Competitive dynamics, marked by both established and emerging players offering innovative and sustainable products, are shaping the market. Strategic marketing, exceptional customer service, and after-sales support are critical for success. While detailed regional market share analysis necessitates further localized data, the overall outlook for the German flooring sector is exceptionally positive.

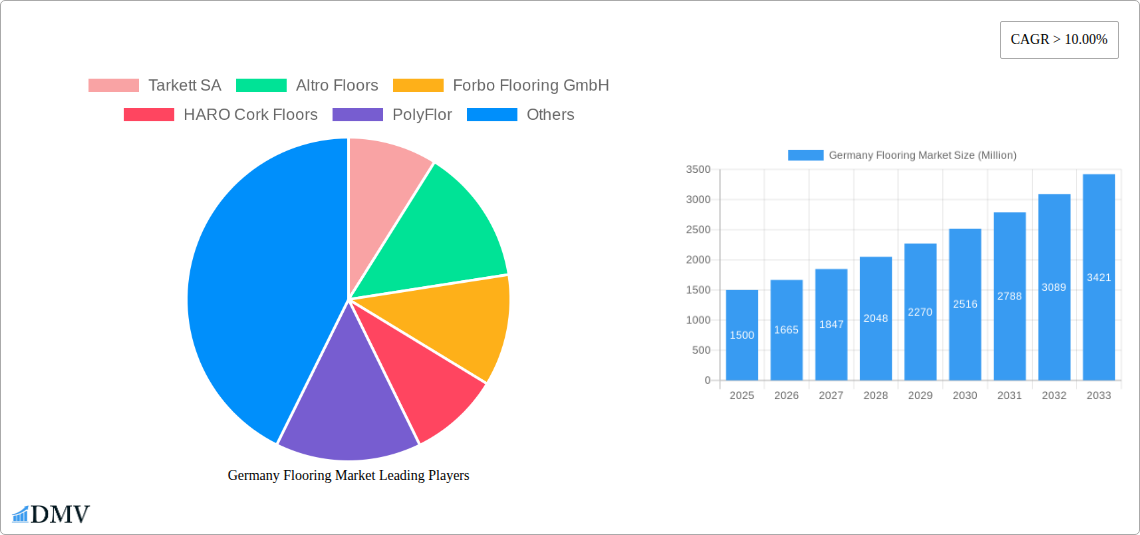

Germany Flooring Market Company Market Share

Germany Flooring Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany flooring market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). We delve deep into market segmentation, competitive dynamics, and future growth potential, equipping stakeholders with the crucial intelligence needed to navigate this dynamic landscape. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Germany Flooring Market Composition & Trends

The German flooring market exhibits a moderately consolidated structure, with key players like Tarkett SA, Forbo Flooring GmbH, and Milliken Flooring holding significant market share. However, smaller, specialized companies like HARO Cork Floors and mbb-Ihr Bodenausstatter GmbH also contribute significantly to the market's diversity. Market share distribution fluctuates based on product type, distribution channel, and end-user segment. The current market share distribution is estimated as follows: Tarkett SA (xx%), Forbo Flooring GmbH (xx%), Milliken Flooring (xx%), and Others (xx%). Innovation is driven by increasing demand for sustainable and aesthetically pleasing flooring solutions, prompting the development of recycled content products and novel designs. Stringent environmental regulations in Germany influence material selection and manufacturing processes, pushing companies towards eco-friendly options. Substitute products, such as carpeting and specialized coatings, pose moderate competition. The residential segment is a dominant end-user, fueled by renovations and new constructions.

- Market Concentration: Moderately consolidated.

- Innovation Catalysts: Sustainability, aesthetics, and regulatory pressures.

- Regulatory Landscape: Stringent environmental standards.

- Substitute Products: Carpeting, specialized coatings.

- End-User Profiles: Primarily residential, followed by commercial.

- M&A Activities: Significant M&A activity includes Milliken’s acquisition of Zebra-chem GmbH in March 2021, illustrating a push towards integrating chemical expertise for innovative flooring solutions. Deal values are not publicly disclosed. Further M&A activity is anticipated due to the consolidation trend.

Germany Flooring Market Industry Evolution

The German flooring market has demonstrated steady growth over the past few years, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing and durable flooring solutions. Technological advancements, particularly in LVT and other innovative materials, are contributing to market expansion. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033. Consumer demand is shifting towards sustainable and eco-friendly flooring options. This is evident in the increasing adoption of recycled content products, as exemplified by Interface's initiative in May 2020, which utilized 39% pre-consumer recycled content in their LVTs. Technological advancements such as improved click-locking systems and enhanced durability are driving premiumization. The adoption of online sales channels is also steadily increasing, albeit more slowly than in other sectors.

Leading Regions, Countries, or Segments in Germany Flooring Market

The German flooring market is geographically diverse, with no single region dominating. However, major urban centers and high-population density areas demonstrate stronger demand. The residential segment constitutes the largest end-user segment, driven by renovations and new constructions. The online distribution channel is growing but still significantly trails the established offline retail network. LVT (Luxury Vinyl Tile) is currently the dominant product type due to its durability, versatility, and relative affordability.

- Key Drivers (Residential Segment): High housing turnover rates, increasing renovation projects, and rising consumer spending on home improvement.

- Key Drivers (Offline Stores): Established distribution networks, customer preference for physical product examination.

- Key Drivers (LVT): Durability, aesthetic appeal, and cost-effectiveness.

- Dominance Factors: Strong demand for residential upgrades and renovations, established offline distribution networks, and increasing popularity of LVT.

Germany Flooring Market Product Innovations

Recent innovations have focused on enhancing sustainability, durability, and aesthetics. LVT continues to dominate due to its design flexibility and ease of installation, showcasing improvements in realistic wood and stone aesthetics and enhanced wear resistance. Other innovations include the incorporation of recycled materials and the development of antimicrobial properties in flooring solutions to meet evolving consumer demand for hygiene.

Propelling Factors for Germany Flooring Market Growth

The German flooring market is propelled by several key factors. Strong economic conditions and steady consumer spending support demand. Government initiatives promoting sustainable building practices encourage the use of eco-friendly flooring materials. Technological advancements in LVT and other product types continuously improve performance and aesthetics, attracting consumers. The rising demand for comfortable and high-quality interiors in both residential and commercial properties is further driving the growth of the market.

Obstacles in the Germany Flooring Market

Challenges faced by the market include fluctuating raw material prices, impacting production costs and profitability. Supply chain disruptions, especially post-pandemic, have presented temporary setbacks. Intense competition, particularly from foreign manufacturers, creates downward price pressure. The increasing complexity and costs associated with complying with stringent environmental regulations also pose a challenge to players operating in the market.

Future Opportunities in Germany Flooring Market

Future opportunities lie in the increasing adoption of smart flooring technologies, integrating features such as underfloor heating and sensor capabilities. Expansion into niche markets, such as specialized flooring for healthcare facilities or sports arenas, offers significant potential. Leveraging e-commerce and adopting improved online sales strategies will be vital to capturing market share. The growing awareness of sustainable materials and practices represents a significant opportunity for eco-friendly product offerings.

Major Players in the Germany Flooring Market Ecosystem

- Tarkett SA

- Altro Floors

- Forbo Flooring GmbH

- HARO Cork Floors

- PolyFlor

- mbb-Ihr Bodenausstatter GmbH

- Milliken Flooring

- Nora Systems GmbH

- Amtico International Germany

- Gerflor

Key Developments in Germany Flooring Market Industry

- March 2021: Milliken & Company acquired Zebra-chem GmbH, expanding its chemical expertise and product innovation capabilities.

- May 2020: Interface incorporated 39% pre-consumer recycled content in its LVTs, demonstrating a commitment to sustainability.

Strategic Germany Flooring Market Forecast

The German flooring market is poised for continued growth, fueled by rising consumer demand, technological advancements, and increasing focus on sustainability. Opportunities in smart flooring and niche segments will shape future market dynamics. The market's strong fundamentals and consistent growth trajectory suggest a positive outlook for the forecast period.

Germany Flooring Market Segmentation

-

1. Product Type

- 1.1. LVT

- 1.2. Vinyl Sheets

- 1.3. Linoluem

- 1.4. Rubber

- 1.5. Fiberglass

- 1.6. Other Product Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

Germany Flooring Market Segmentation By Geography

- 1. Germany

Germany Flooring Market Regional Market Share

Geographic Coverage of Germany Flooring Market

Germany Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances

- 3.3. Market Restrains

- 3.3.1. High power consumption from smart home appliances; Limited spaces in households for appliances

- 3.4. Market Trends

- 3.4.1. Rapid Growth in the Construction Industry and Increasing Infrastructure Activities are the Key Factors for Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. LVT

- 5.1.2. Vinyl Sheets

- 5.1.3. Linoluem

- 5.1.4. Rubber

- 5.1.5. Fiberglass

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tarkett SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Altro Floors

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Forbo Flooring GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HARO Cork Floors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PolyFlor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 mbb-Ihr Bodenausstatter GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milliken Flooring

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nora Systems GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amtico International Germany*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gerflor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tarkett SA

List of Figures

- Figure 1: Germany Flooring Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Flooring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Germany Flooring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Germany Flooring Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Flooring Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Flooring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Germany Flooring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Germany Flooring Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Germany Flooring Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Flooring Market?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Germany Flooring Market?

Key companies in the market include Tarkett SA, Altro Floors, Forbo Flooring GmbH, HARO Cork Floors, PolyFlor, mbb-Ihr Bodenausstatter GmbH, Milliken Flooring, Nora Systems GmbH, Amtico International Germany*List Not Exhaustive, Gerflor.

3. What are the main segments of the Germany Flooring Market?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization leads to increased demand for kitchen appliances; Growth in the demand for commercial kitchen appliances.

6. What are the notable trends driving market growth?

Rapid Growth in the Construction Industry and Increasing Infrastructure Activities are the Key Factors for Growth.

7. Are there any restraints impacting market growth?

High power consumption from smart home appliances; Limited spaces in households for appliances.

8. Can you provide examples of recent developments in the market?

In March 2021, Milliken & Company ('Milliken'), a globally diversified manufacturer with more than a century and a half of materials science expertise, formally acquired Zebra-chem GmbH (Zebra-chem), a global chemicals company known for its peroxide and blowing agent masterbatches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Flooring Market?

To stay informed about further developments, trends, and reports in the Germany Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence