Key Insights

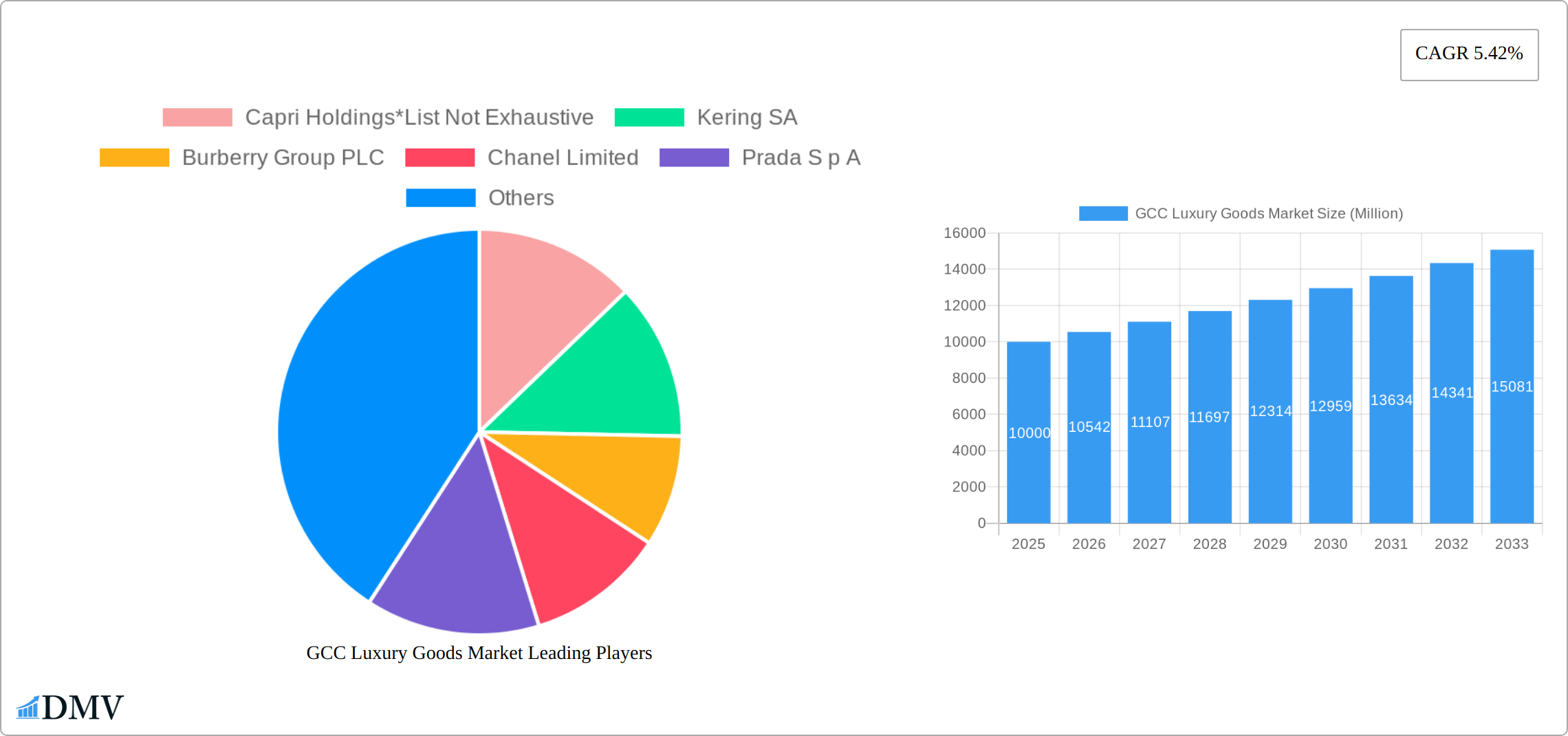

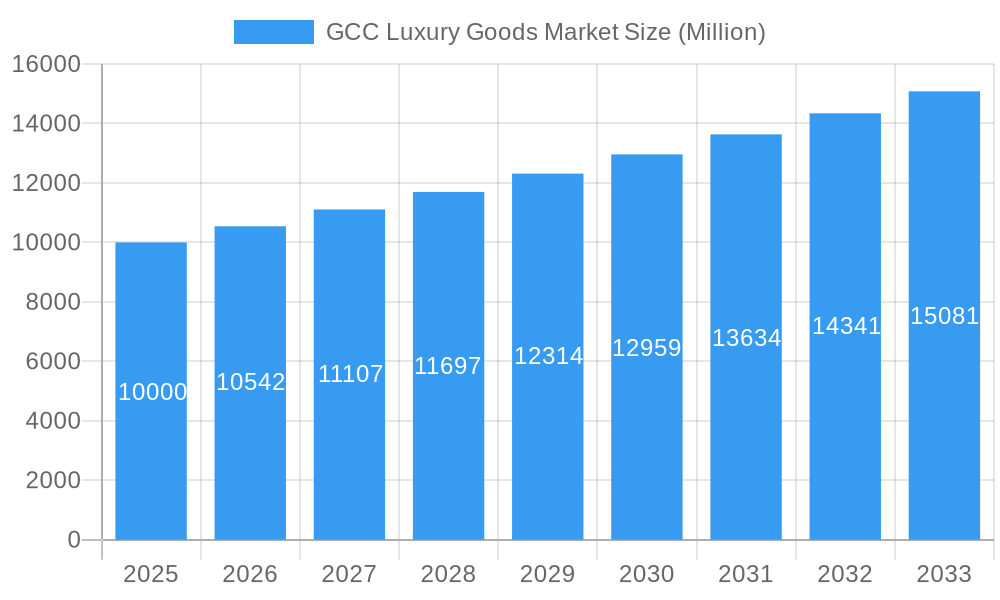

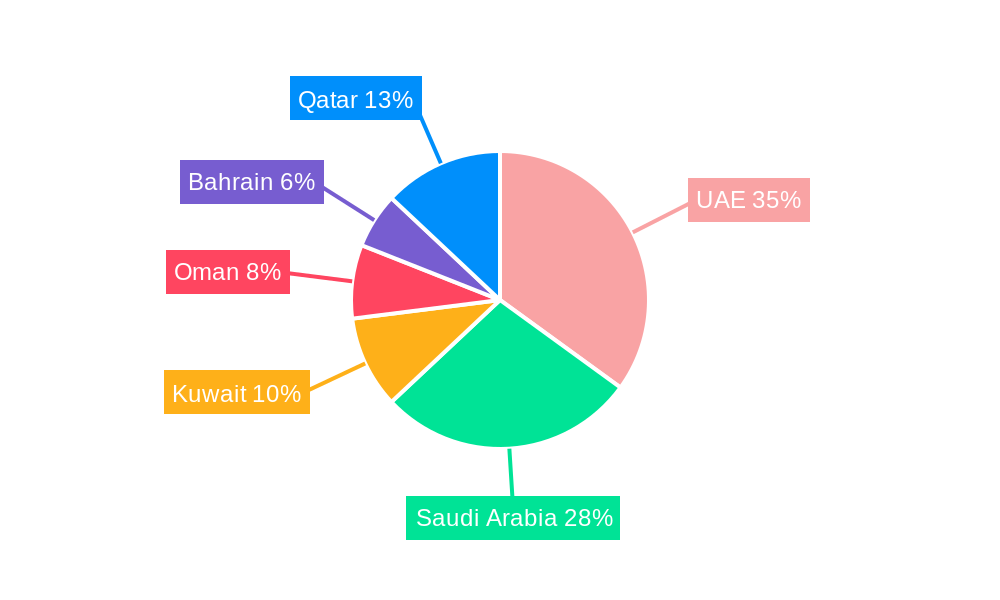

The GCC luxury goods market, encompassing clothing and apparel, footwear, bags, jewelry, watches, and other accessories, exhibits robust growth potential. Driven by a burgeoning affluent population with a high disposable income, a strong tourism sector, and a preference for high-end brands, the market is projected to maintain a significant Compound Annual Growth Rate (CAGR) of 5.42% from 2025 to 2033. The market segmentation reveals a strong demand across both genders, with online channels witnessing considerable expansion alongside established single-branded and multi-branded retail stores. Key players like Capri Holdings, Kering SA, and LVMH Moët Hennessy Louis Vuitton are vying for market share, indicating high competition and innovation within the sector. The regional breakdown suggests that the UAE and Saudi Arabia are major contributors to market revenue, followed by other GCC nations. Future growth will likely be fueled by increased investment in e-commerce infrastructure, strategic partnerships between luxury brands and local retailers, and the introduction of personalized luxury experiences tailored to the discerning GCC consumer. Continued economic stability within the region and targeted marketing campaigns focusing on the unique preferences of the GCC consumer will play crucial roles in shaping the market's trajectory.

GCC Luxury Goods Market Market Size (In Billion)

The current market size in 2025 is estimated to be significantly influenced by the strong growth trajectory and the presence of major luxury brands. Assuming a conservative estimate based on global luxury market trends and the provided CAGR, the GCC luxury market size in 2025 could be estimated around $10 billion. This figure serves as a realistic approximation pending access to precise data. Growth in the coming years will be facilitated by favorable demographic trends, including a growing young population eager to embrace luxury brands, along with ongoing infrastructural developments and government initiatives supporting economic diversification and tourism. Strategic brand positioning, leveraging social media influence, and adapting product offerings to local cultural nuances will be essential strategies for brands seeking to capitalize on this promising market.

GCC Luxury Goods Market Company Market Share

GCC Luxury Goods Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the GCC luxury goods market, encompassing market size, growth trajectory, key players, and future prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for stakeholders seeking to understand the dynamics of this lucrative market and capitalize on its growth potential. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

GCC Luxury Goods Market Composition & Trends

This section delves into the current state of the GCC luxury goods market, analyzing market concentration, innovation, regulations, and competitive dynamics. We examine the market share distribution among key players like Kering SA, Burberry Group PLC, Prada S p A, LVMH Moët Hennessy Louis Vuitton, and others, providing a detailed understanding of the competitive landscape. The report also explores the impact of M&A activities, with an estimated xx Million in deal values during the historical period (2019-2024).

- Market Concentration: High concentration with a few dominant players controlling significant market share.

- Innovation Catalysts: Growing demand for personalized luxury experiences and technological advancements in product design and retail.

- Regulatory Landscape: Analysis of existing regulations and their impact on market growth, including import/export policies and taxation.

- Substitute Products: Examination of potential substitute products and their impact on market dynamics.

- End-User Profiles: Detailed segmentation of consumers based on demographics, lifestyle, and purchasing behavior.

- M&A Activities: Analysis of merger and acquisition activities, including deal values and their implications for market structure.

GCC Luxury Goods Market Industry Evolution

This section traces the evolution of the GCC luxury goods market from 2019 to 2024 and projects its future trajectory until 2033. It analyzes the market's growth rate, driven by factors such as rising disposable incomes, a growing affluent population, and increasing tourism. Technological advancements, such as e-commerce platforms and personalized marketing strategies, have also significantly impacted the market's evolution. The report further examines the shift in consumer preferences towards sustainable and ethically sourced luxury goods. The market experienced a growth rate of xx% during the historical period (2019-2024) and is projected to maintain a growth rate of xx% during the forecast period. The adoption rate of online luxury shopping is expected to reach xx% by 2033.

Leading Regions, Countries, or Segments in GCC Luxury Goods Market

This section identifies the leading regions, countries, and segments within the GCC luxury goods market. The analysis covers different product types (Clothing and Apparel, Footwear, Bags, Jewellery, Watches, Other Accessories), genders (Male, Female), and distribution channels (Single branded stores, Multibranded stores, Online Stores, Other Distribution Channels). The report pinpoints the dominant segment and provides a detailed explanation of the factors contributing to its success.

- Key Drivers (Examples):

- Investment Trends: Significant investments in luxury retail infrastructure and online platforms in leading regions.

- Regulatory Support: Favorable government policies promoting tourism and luxury retail in specific regions.

The UAE is identified as the leading market within the GCC, driven by factors such as high disposable incomes, a large expatriate population, and a thriving tourism sector. Online channels exhibit the highest growth rate due to increased internet penetration and digital adoption among luxury consumers.

GCC Luxury Goods Market Product Innovations

The GCC luxury goods market is experiencing a wave of transformative product innovations, driven by both technological advancements and evolving consumer preferences. This dynamic landscape is characterized by a strong emphasis on unique selling propositions (USPs), pushing brands to differentiate themselves through creativity and sustainability. Key areas of innovation include the integration of sustainable and ethically sourced materials, reflecting a growing consumer demand for responsible luxury. Advanced manufacturing techniques, from 3D printing to bespoke craftsmanship, are enhancing product quality and customization. Furthermore, the seamless integration of technology, ranging from smart features within products to personalized digital experiences, is enhancing the customer journey and building brand loyalty. This focus on innovation is not merely about technological advancement, but also a response to the sophisticated and discerning GCC consumer who values exclusivity and craftsmanship.

Propelling Factors for GCC Luxury Goods Market Growth

Several factors contribute to the robust growth of the GCC luxury goods market. These include rising disposable incomes among the affluent population, increasing tourism, a preference for high-quality goods, and government initiatives to promote luxury retail. Technological advancements, such as personalized marketing and e-commerce platforms, are also key growth drivers.

Obstacles in the GCC Luxury Goods Market

Despite its considerable potential, the GCC luxury goods market faces significant headwinds. Economic volatility within the region, coupled with fluctuating currency exchange rates, presents a challenge for both pricing strategies and market predictability. The persistent threat of counterfeiting continues to undermine brand integrity and consumer trust, demanding robust anti-counterfeiting measures. Supply chain disruptions, exacerbated by global events, can lead to delays and increased costs. Furthermore, the intensely competitive landscape, with both established international brands and emerging local players vying for market share, necessitates constant innovation and strategic adaptation. Navigating these challenges requires agility, resilience, and a deep understanding of the regional market dynamics.

Future Opportunities in GCC Luxury Goods Market

The future of the GCC luxury goods market is bright, offering substantial growth opportunities for both established players and new entrants. Untapped regional markets within the GCC and beyond present significant potential for expansion, particularly as consumer affluence continues to rise. Leveraging technological innovations, such as immersive metaverse experiences and personalized online platforms, is key to engaging with the digitally savvy luxury consumer. The increasing demand for sustainable and ethically produced luxury goods presents a compelling opportunity for brands that prioritize responsible sourcing and manufacturing practices. By embracing these opportunities and responding effectively to evolving consumer preferences, companies can capitalize on the considerable growth potential within the GCC luxury market.

Major Players in the GCC Luxury Goods Market Ecosystem

- Capri Holdings

- Kering SA

- Burberry Group PLC

- Chanel Limited

- Prada S p A

- Alshaya Franchise Group

- Dolce & Gabbana Luxembourg S À R L

- AW Rostamani Group

- Rolex SA

- Etoile Group

- LVMH Moët Hennessy Louis Vuitton

Key Developments in GCC Luxury Goods Market Industry

- July 2021: Capri Holdings' Versace opened a new flagship store at the Galleria Al Maryah Island in Abu Dhabi, significantly enhancing its luxury retail presence and showcasing its commitment to the GCC market.

- April 2021: Alshaya Franchise Company successfully launched the first Aerie store in the Middle East in Kuwait, introducing a popular, premium clothing brand to the region and tapping into the growing demand for contemporary fashion.

- March 2022: Gucci's launch in the UAE, featuring its prestigious high-jewelry collection, underscored the brand's commitment to the region and broadened the high-end jewelry options available to GCC consumers.

- [Add more recent developments here with dates and brief descriptions]

Strategic GCC Luxury Goods Market Forecast

The GCC luxury goods market is poised for significant growth in the coming years, driven by a multitude of factors such as increasing affluence, evolving consumer preferences, and technological advancements. The market's future potential is substantial, promising lucrative opportunities for both established and emerging players in the industry. The report provides a detailed forecast of the market's future trajectory, allowing businesses to make informed strategic decisions.

GCC Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Gender

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Single branded stores

- 3.2. Multi-branded stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. Kuwait

- 4.5. Oman

- 4.6. Bahrain

GCC Luxury Goods Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Kuwait

- 5. Oman

- 6. Bahrain

GCC Luxury Goods Market Regional Market Share

Geographic Coverage of GCC Luxury Goods Market

GCC Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Use of E-commerce Platform for Buying Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Single branded stores

- 5.3.2. Multi-branded stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Kuwait

- 5.4.5. Oman

- 5.4.6. Bahrain

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Qatar

- 5.5.4. Kuwait

- 5.5.5. Oman

- 5.5.6. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Gender

- 6.2.1. Male

- 6.2.2. Female

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Single branded stores

- 6.3.2. Multi-branded stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. Qatar

- 6.4.4. Kuwait

- 6.4.5. Oman

- 6.4.6. Bahrain

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Gender

- 7.2.1. Male

- 7.2.2. Female

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Single branded stores

- 7.3.2. Multi-branded stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. Qatar

- 7.4.4. Kuwait

- 7.4.5. Oman

- 7.4.6. Bahrain

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Gender

- 8.2.1. Male

- 8.2.2. Female

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Single branded stores

- 8.3.2. Multi-branded stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. Qatar

- 8.4.4. Kuwait

- 8.4.5. Oman

- 8.4.6. Bahrain

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Kuwait GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Gender

- 9.2.1. Male

- 9.2.2. Female

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Single branded stores

- 9.3.2. Multi-branded stores

- 9.3.3. Online Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. Qatar

- 9.4.4. Kuwait

- 9.4.5. Oman

- 9.4.6. Bahrain

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Oman GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Gender

- 10.2.1. Male

- 10.2.2. Female

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Single branded stores

- 10.3.2. Multi-branded stores

- 10.3.3. Online Stores

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Saudi Arabia

- 10.4.2. United Arab Emirates

- 10.4.3. Qatar

- 10.4.4. Kuwait

- 10.4.5. Oman

- 10.4.6. Bahrain

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Bahrain GCC Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Clothing and Apparel

- 11.1.2. Footwear

- 11.1.3. Bags

- 11.1.4. Jewellery

- 11.1.5. Watches

- 11.1.6. Other Accessories

- 11.2. Market Analysis, Insights and Forecast - by Gender

- 11.2.1. Male

- 11.2.2. Female

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Single branded stores

- 11.3.2. Multi-branded stores

- 11.3.3. Online Stores

- 11.3.4. Other Distribution Channels

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Saudi Arabia

- 11.4.2. United Arab Emirates

- 11.4.3. Qatar

- 11.4.4. Kuwait

- 11.4.5. Oman

- 11.4.6. Bahrain

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Capri Holdings*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kering SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Burberry Group PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Chanel Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Prada S p A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alshaya Franchise Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dolce & Gabbana Luxembourg S À R L

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AW Rostamani Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Rolex SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Etoile Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 LVMH Moët Hennessy Louis Vuitton

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Capri Holdings*List Not Exhaustive

List of Figures

- Figure 1: Global GCC Luxury Goods Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 5: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 6: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Saudi Arabia GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 13: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 15: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 16: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 19: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: United Arab Emirates GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 21: United Arab Emirates GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Qatar GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Qatar GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Qatar GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 25: Qatar GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 26: Qatar GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 27: Qatar GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Qatar GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 29: Qatar GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Qatar GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Qatar GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Kuwait GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Kuwait GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Kuwait GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 35: Kuwait GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 36: Kuwait GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Kuwait GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Kuwait GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Kuwait GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Kuwait GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Kuwait GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Oman GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Oman GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Oman GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 45: Oman GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 46: Oman GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Oman GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Oman GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 49: Oman GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Oman GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Oman GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Bahrain GCC Luxury Goods Market Revenue (Million), by Type 2025 & 2033

- Figure 53: Bahrain GCC Luxury Goods Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Bahrain GCC Luxury Goods Market Revenue (Million), by Gender 2025 & 2033

- Figure 55: Bahrain GCC Luxury Goods Market Revenue Share (%), by Gender 2025 & 2033

- Figure 56: Bahrain GCC Luxury Goods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 57: Bahrain GCC Luxury Goods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Bahrain GCC Luxury Goods Market Revenue (Million), by Geography 2025 & 2033

- Figure 59: Bahrain GCC Luxury Goods Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Bahrain GCC Luxury Goods Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Bahrain GCC Luxury Goods Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 3: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Luxury Goods Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 8: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 13: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 18: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 23: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 28: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global GCC Luxury Goods Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global GCC Luxury Goods Market Revenue Million Forecast, by Gender 2020 & 2033

- Table 33: Global GCC Luxury Goods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global GCC Luxury Goods Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 35: Global GCC Luxury Goods Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Luxury Goods Market?

The projected CAGR is approximately 5.42%.

2. Which companies are prominent players in the GCC Luxury Goods Market?

Key companies in the market include Capri Holdings*List Not Exhaustive, Kering SA, Burberry Group PLC, Chanel Limited, Prada S p A, Alshaya Franchise Group, Dolce & Gabbana Luxembourg S À R L, AW Rostamani Group, Rolex SA, Etoile Group, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the GCC Luxury Goods Market?

The market segments include Type, Gender, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Increasing Use of E-commerce Platform for Buying Luxury Goods.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2022: The Italian House of Gucci, a subsidiary of Kering Group, was newly launched in the United Arab Emirates. The brand's new launch featured its glittering high jewelry pieces encompassing necklaces, rings, and bracelets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Luxury Goods Market?

To stay informed about further developments, trends, and reports in the GCC Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence