Key Insights

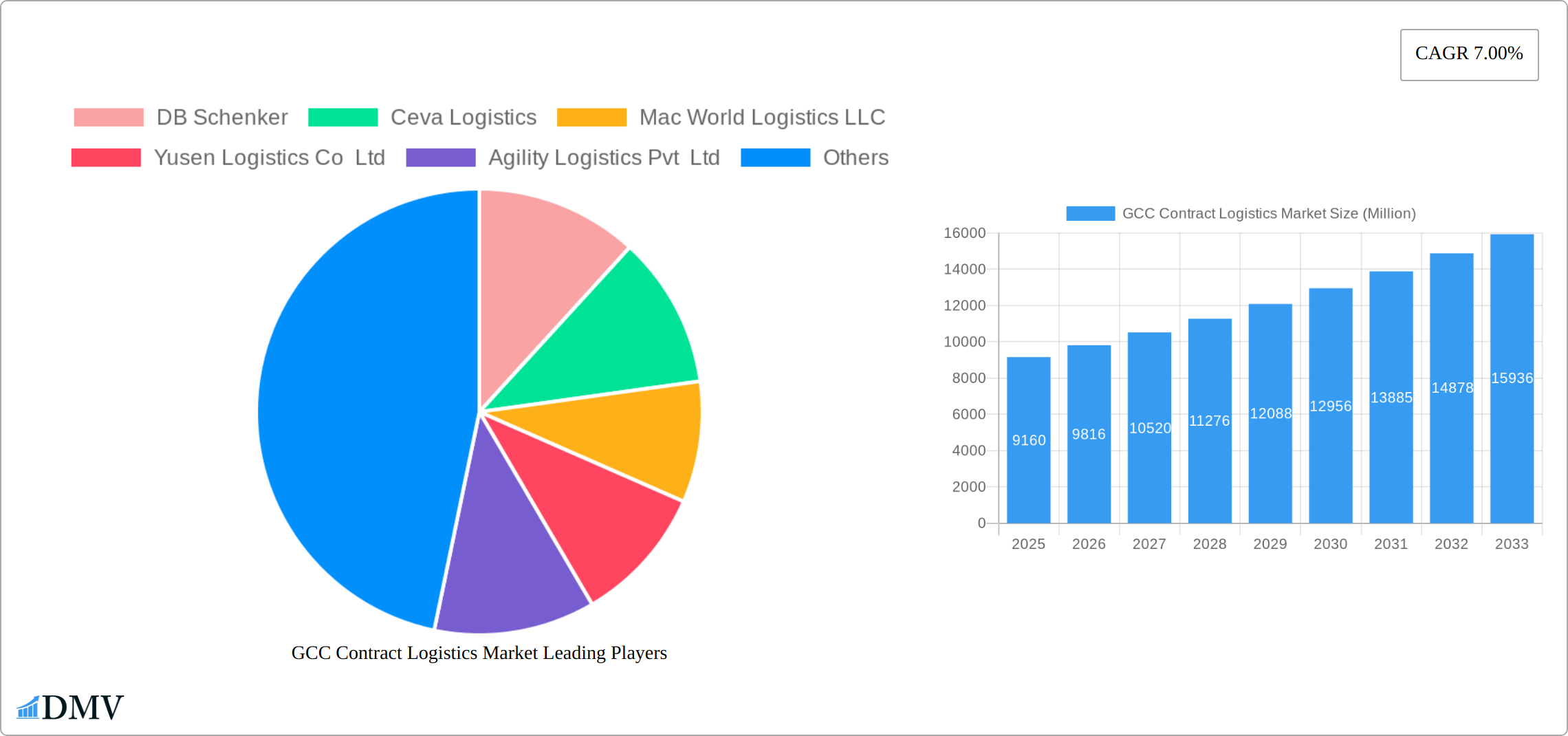

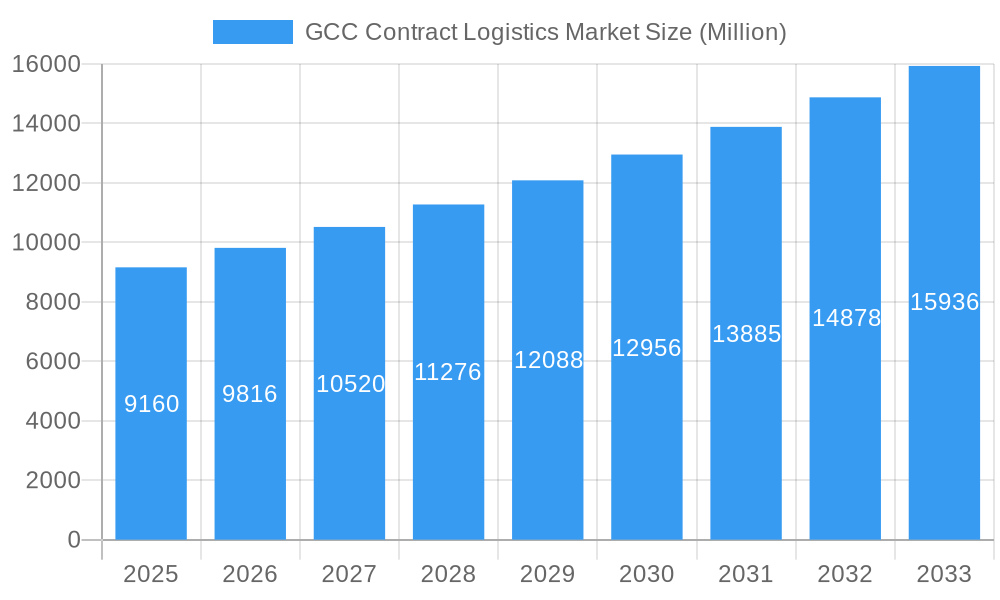

The GCC contract logistics market, valued at $9.16 billion in 2025, is projected to experience robust growth, driven by the region's expanding e-commerce sector, increasing industrialization, and significant investments in infrastructure development. The market's 7% Compound Annual Growth Rate (CAGR) indicates a steady upward trajectory through 2033, reaching an estimated value exceeding $16 billion. Key drivers include the diversification of the GCC economies beyond oil, leading to increased manufacturing and trade activities. The rising demand for efficient supply chain solutions, particularly from sectors like manufacturing, automotive, consumer goods, and healthcare, fuels the growth. Outsourcing of logistics functions is a prevalent trend, enabling companies to focus on core competencies while benefiting from the expertise and scalability offered by contract logistics providers. However, factors such as fluctuating oil prices and geopolitical uncertainties pose potential restraints to market growth. The market is segmented by type (insourced vs. outsourced), end-user industry (manufacturing, automotive, consumer goods, healthcare, etc.), and country (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain), reflecting the diverse needs and market dynamics across the region. Leading players like DB Schenker, Ceva Logistics, and Agility Logistics are well-positioned to capitalize on the market's expansion, while smaller regional players also contribute significantly.

GCC Contract Logistics Market Market Size (In Billion)

The competitive landscape is characterized by a mix of global and regional players. Global giants bring established expertise and extensive networks, while local companies offer regional specialization and cost advantages. This dynamic competition ensures continuous innovation and adaptation to the evolving needs of businesses in the GCC. Future growth will likely be influenced by advancements in technology like automation, data analytics, and the integration of sustainable practices into logistics operations. Government initiatives supporting logistics infrastructure and streamlining regulations also contribute to a positive outlook for the GCC contract logistics market. The market’s fragmentation presents opportunities for both established and emerging players, and strategic alliances and mergers and acquisitions are likely to shape the market further in the coming years.

GCC Contract Logistics Market Company Market Share

GCC Contract Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamics of the GCC contract logistics market, offering a comprehensive analysis of market size, trends, leading players, and future projections. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for stakeholders seeking to understand the current landscape and strategize for future growth within this rapidly evolving sector. The market is projected to reach xx Million by 2033.

GCC Contract Logistics Market Composition & Trends

This section delves into the competitive landscape of the GCC contract logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report meticulously examines market share distribution amongst key players, including DB Schenker, Ceva Logistics, Agility Logistics Pvt Ltd, and DHL Supply Chain, alongside other significant contributors. M&A deal values are also analyzed to provide a clearer understanding of market consolidation trends.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The report quantifies this concentration using metrics like the Herfindahl-Hirschman Index (HHI).

- Innovation Catalysts: Technological advancements such as AI-powered logistics solutions and blockchain implementation are key innovation drivers.

- Regulatory Landscape: Government initiatives aimed at diversifying economies and improving infrastructure are shaping the market.

- Substitute Products: The report evaluates the impact of alternative logistics solutions on market growth.

- End-User Profiles: Detailed profiles of end-users across manufacturing and automotive, consumer goods and retail, high-tech, healthcare, and other sectors are provided.

- M&A Activities: The report analyzes recent M&A deals, assessing their impact on market consolidation and competition. For example, the xx Million acquisition of [Company X] by [Company Y] in [Year] significantly reshaped the competitive dynamics.

GCC Contract Logistics Market Industry Evolution

This section provides a detailed analysis of the GCC contract logistics market's growth trajectory from 2019 to 2033. It examines the influence of technological advancements, shifting consumer demands, and evolving industry practices on market expansion. Specific data points, including compound annual growth rates (CAGR) and adoption rates of new technologies, are presented to support the analysis. The report also explores the impact of macro-economic factors, such as fluctuations in oil prices and regional geopolitical events on market growth. Growth in the market has been propelled by factors like increasing e-commerce activity, the growth of the manufacturing sector, and the expansion of regional trade. The report details how technological advancements, such as the Internet of Things (IoT) and automation, have improved efficiency and reduced costs within the industry, driving further growth. The anticipated CAGR for the forecast period (2025-2033) is xx%.

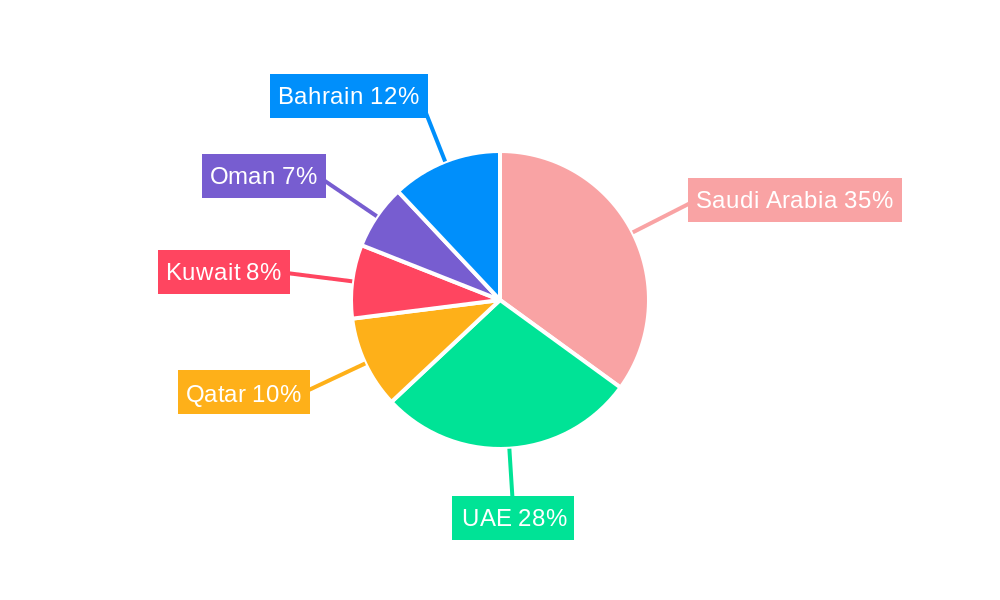

Leading Regions, Countries, or Segments in GCC Contract Logistics Market

This section provides a comprehensive overview of the dominant regions, key countries, and most impactful segments within the GCC contract logistics market. Our analysis is grounded in current data and future projections across several critical areas:

- By Type: A detailed breakdown of Insourced versus Outsourced logistics solutions. We analyze market share, historical growth trends, and forecast the future trajectory of each, with a particular emphasis on the compelling factors that are accelerating the adoption of outsourced logistics. This includes evaluating the cost-effectiveness, specialized expertise, and scalability offered by third-party logistics (3PL) providers.

- By End User: An in-depth look at key industries including Manufacturing & Automotive, Consumer Goods & Retail, High-tech, Healthcare & Pharmaceuticals, and a consolidated "Other End Users" category. This segment identifies and ranks the highest-growth end-user industries based on a confluence of factors such as burgeoning industry-specific demand, the impact of evolving regulatory landscapes, the pace of technological adoption within these sectors, and their overall contribution to the GCC's economic diversification efforts.

- By Country: A granular assessment of Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain. The report meticulously ranks these nations based on current market size, projected growth rates, and strategic importance. Furthermore, it outlines the unique key drivers, specific challenges, and localized opportunities that shape the contract logistics landscape within each country.

Key Country-Specific Growth Drivers (Illustrative Examples):

- Saudi Arabia: The Kingdom's ambitious Vision 2030 agenda, characterized by monumental investments in infrastructure development (including new ports, airports, and road networks) and a strong push for economic diversification away from oil, is a significant catalyst for contract logistics market expansion.

- UAE: The continued rapid growth of e-commerce, fueled by a digitally savvy population and a strategic geographic position as a global trade hub, is relentlessly driving demand for sophisticated and agile contract logistics services, including warehousing, last-mile delivery, and fulfillment.

- Qatar: While the immediate post-FIFA World Cup surge may be moderating, substantial investments in infrastructure and the ongoing development of a knowledge-based economy continue to create a favorable environment for specialized logistics solutions, particularly in sectors like healthcare and technology.

GCC Contract Logistics Market Product Innovations

This section dives deep into the cutting edge of product innovations, novel applications, and measurable performance enhancements within the GCC contract logistics market. We highlight the unique selling propositions (USPs) and transformative technological advancements that are fundamentally reshaping how goods are stored, moved, and managed across the region. Specific examples of these innovations include the widespread adoption of sophisticated Warehouse Management Systems (WMS) for optimized inventory control, the deployment of Automated Guided Vehicles (AGVs) for enhanced warehouse automation, and the exploration and implementation of drone delivery systems for faster, more targeted last-mile solutions. These advancements are collectively contributing to significant improvements in operational efficiency, substantial cost reductions, and a demonstrably elevated level of customer satisfaction.

Propelling Factors for GCC Contract Logistics Market Growth

The robust expansion of the GCC contract logistics market is underpinned by several interconnected and powerful factors:

- Accelerated Technological Advancements: The strategic integration of automation, Artificial Intelligence (AI), the Internet of Things (IoT), and advanced analytics is revolutionizing supply chain operations. These technologies are instrumental in improving operational efficiency, enabling real-time visibility, optimizing inventory management, and creating more resilient and agile supply chains.

- Sustained Economic Growth and Diversification: The continued rise in Gross Domestic Product (GDP) across the GCC, coupled with increasing consumer spending power and the successful diversification of economies into non-oil sectors, is generating a consistent and growing demand for comprehensive logistics services.

- Proactive Regulatory Support and Infrastructure Development: Governments across the GCC are actively investing in and implementing policies aimed at enhancing national infrastructure (including ports, airports, and rail networks) and streamlining trade facilitation processes. These initiatives are creating a more conducive and efficient environment for logistics businesses to thrive and expand.

- Surging E-commerce Penetration: The exponential growth of online retail across the region necessitates sophisticated fulfillment, warehousing, and last-mile delivery solutions, directly benefiting the contract logistics sector.

Obstacles in the GCC Contract Logistics Market

Despite its growth potential, the GCC contract logistics market faces certain challenges:

- Regulatory Hurdles: Navigating varying regulations across different GCC countries can pose complexities.

- Supply Chain Disruptions: Global events and geopolitical instability can impact supply chain reliability and lead to increased costs.

- Competitive Pressures: The market is becoming increasingly competitive, requiring companies to constantly innovate and adapt.

Future Opportunities in GCC Contract Logistics Market

The GCC contract logistics market is poised for continued growth, presenting a wealth of lucrative opportunities for market players:

- Strategic Expansion into Emerging Markets: Significant untapped potential exists in less developed or underserved areas within the GCC region, offering opportunities for early movers to establish strong market footholds and cater to growing local demands.

- Deepening Adoption of Advanced Technologies: Further integration and sophisticated application of AI for predictive analytics, blockchain for enhanced supply chain transparency and security, and advanced robotics for automated warehousing and material handling promise substantial gains in efficiency, cost savings, and service differentiation.

- Pioneering Sustainable Logistics Solutions: With a growing global and regional emphasis on environmental responsibility, there is a significant opportunity for contract logistics providers to develop and offer eco-friendly solutions, including green warehousing, optimized route planning for reduced emissions, and the use of electric or alternative fuel vehicles.

- Specialization in Niche Verticals: Developing specialized expertise in high-growth or complex sectors such as cold chain logistics for pharmaceuticals and food, or specialized handling for project cargo, can create significant competitive advantages.

Major Players in the GCC Contract Logistics Market Ecosystem

- DB Schenker

- Ceva Logistics

- Mac World Logistics LLC

- Yusen Logistics Co Ltd

- Agility Logistics Pvt Ltd

- Almajdouie Logistics Co LLC

- Gulf Warehousing Company QPSC (GWC)

- Hellmann Worldwide Logistics GmbH & Co KG

- Al Futtaim Logistics

- Al Naboodah Group Enterprises

- Hala Supply Chain Services

- Mohebi Logistics

- Integrated National Logistics

- Global Shipping & Logistics

- United Parcel Service Inc

- Globus Logistics

- Al-Jabri Logistics

- LSC Logistics and Warehousing Co

- Deutsche Post DHL Group (DHL Supply Chain)

- 3 Other Companies (Key Information/Overview)

Key Developments in GCC Contract Logistics Market Industry

- March 2023: Agility, a global logistics leader, announced a significant strategic move by forming a USD 100 Million joint venture named Yanmu with Hassan Allam Holding. This collaboration is focused on the development of state-of-the-art logistics parks in Egypt, underscoring a commitment to expanding infrastructure and services within the broader MENA region.

- February 2023: DSV, a prominent global transport and logistics company, further solidified its presence in the Gulf market by investing USD 18 Million in a fourth expansion project in Bahrain. This substantial investment signifies DSV's ongoing commitment to strengthening its operational capabilities and expanding its reach across key Gulf nations.

Strategic GCC Contract Logistics Market Forecast

The GCC contract logistics market is poised for robust growth driven by technological advancements, economic expansion, and supportive government policies. The forecast period (2025-2033) anticipates significant market expansion, particularly in high-growth segments like e-commerce and healthcare. Continued investment in infrastructure and the adoption of innovative logistics solutions will further propel market growth, creating significant opportunities for established players and new entrants alike.

GCC Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

GCC Contract Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Contract Logistics Market Regional Market Share

Geographic Coverage of GCC Contract Logistics Market

GCC Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Trade Activities4.; Growth in the manufacturing industry

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Challenges

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Consumer Goods and Retail

- 6.2.3. High-tech

- 6.2.4. Healthcare and Pharmaceuticals

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Consumer Goods and Retail

- 7.2.3. High-tech

- 7.2.4. Healthcare and Pharmaceuticals

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Consumer Goods and Retail

- 8.2.3. High-tech

- 8.2.4. Healthcare and Pharmaceuticals

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Consumer Goods and Retail

- 9.2.3. High-tech

- 9.2.4. Healthcare and Pharmaceuticals

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Consumer Goods and Retail

- 10.2.3. High-tech

- 10.2.4. Healthcare and Pharmaceuticals

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ceva Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mac World Logistics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yusen Logistics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agility Logistics Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Almajdouie Logistics Co LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gulf Warehousing Company QPSC (GWC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hellmann Worldwide Logistics GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Futtaim Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global GCC Contract Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global GCC Contract Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Contract Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the GCC Contract Logistics Market?

Key companies in the market include DB Schenker, Ceva Logistics, Mac World Logistics LLC, Yusen Logistics Co Ltd, Agility Logistics Pvt Ltd, Almajdouie Logistics Co LLC, Gulf Warehousing Company QPSC (GWC), Hellmann Worldwide Logistics GmbH & Co KG, Al Futtaim Logistics, Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co, Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview).

3. What are the main segments of the GCC Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Trade Activities4.; Growth in the manufacturing industry.

6. What are the notable trends driving market growth?

Growth in E-commerce Driving the Market.

7. Are there any restraints impacting market growth?

4.; Regulatory Challenges.

8. Can you provide examples of recent developments in the market?

March 2023: Kuwaiti logistics specialist Agility has formed a joint venture with the development arm of Hassan Allam Holding to build and run warehouses in Egypt. The venture, Yanmu, is due to open its first logistics park in August with an initial investment of about USD 100 million, Agility said in a stock market filing. The development, a 270,000sq m site about 10 miles from Cairo airport, will be part-financed by equity and debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Contract Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence