Key Insights

The GCC gas hob market, while not explicitly detailed in the provided data, shows significant growth potential mirroring global trends. Considering the high adoption of modern kitchens and a rising middle class in the region, we can project strong growth driven by factors such as increasing urbanization, a preference for convenient cooking solutions, and the introduction of energy-efficient models. The market is segmented by product type (desktop and embedded) and end-use (household and commercial), with embedded gas hobs likely holding a larger share due to their integration with modern kitchen designs prevalent in the GCC. Key players like LG, Siemens, and Bosch are expected to compete intensely, focusing on product innovation and brand recognition to capture market share. The preference for premium brands and features will likely drive higher average selling prices compared to some other regions. While challenges like fluctuating energy prices and potential competition from induction cooktops exist, the overall outlook remains positive, particularly in the household segment, given the region's increasing population and propensity for homeownership.

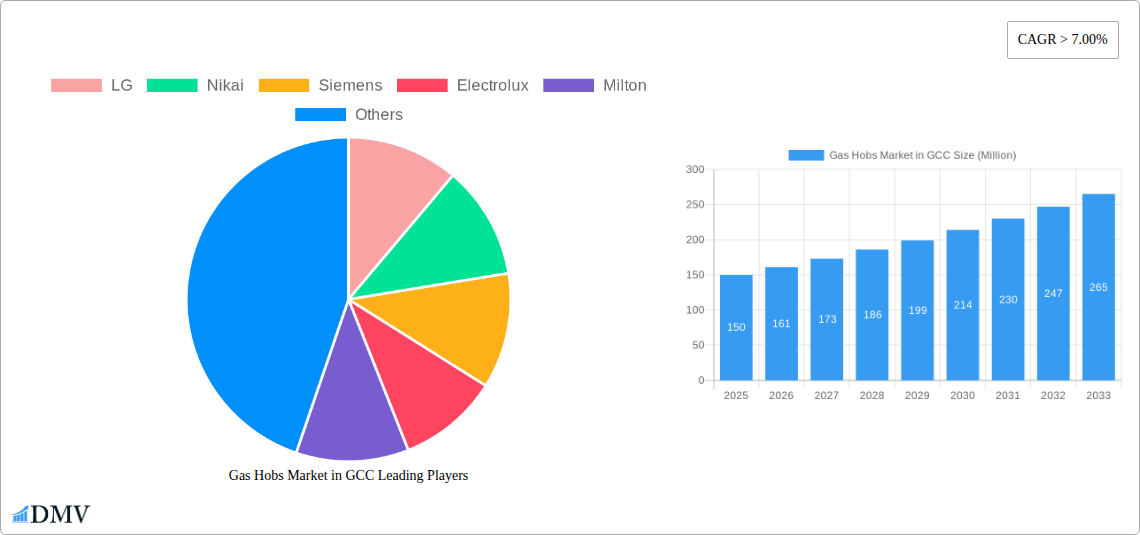

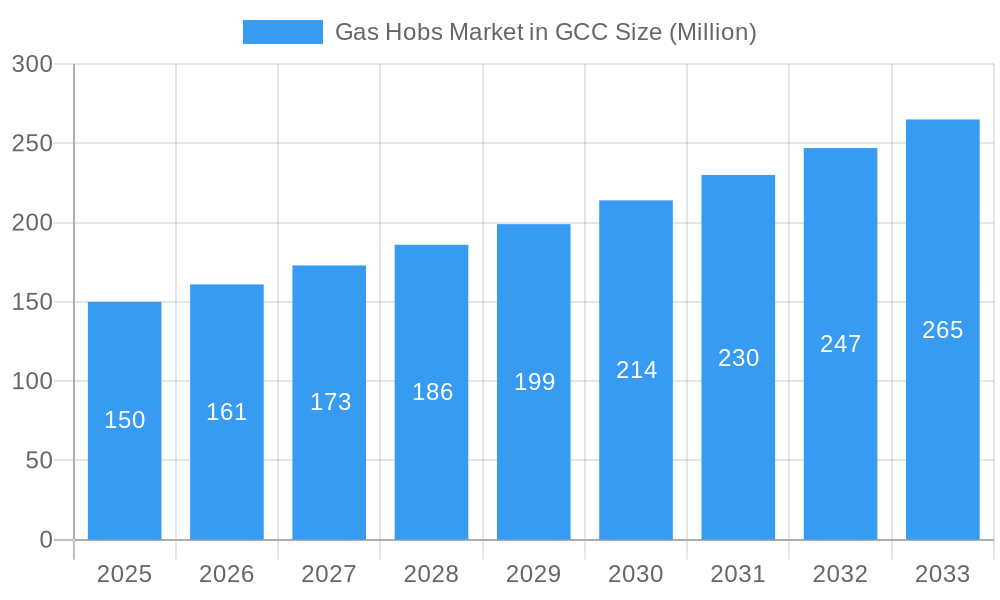

Gas Hobs Market in GCC Market Size (In Million)

The projected CAGR of >7% for the global gas hob market suggests a similar, if not higher, growth trajectory for the GCC region. This is supported by the significant investments in infrastructure and rising disposable incomes witnessed in several GCC countries. Further analysis, considering the specific market dynamics within the GCC, including local preferences for brands and product features, is needed for a more precise prediction. However, the market is expected to experience steady expansion throughout the forecast period (2025-2033), driven primarily by new housing construction, renovations, and the growing popularity of built-in kitchen appliances. Competitive pricing strategies from both international and local brands will also play a significant role in shaping market growth.

Gas Hobs Market in GCC Company Market Share

Gas Hobs Market in GCC: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Gas Hobs market in the Gulf Cooperation Council (GCC) region, covering the period from 2019 to 2033. It offers a comprehensive overview of market trends, competitive landscape, growth drivers, and future opportunities, equipping stakeholders with crucial data for strategic decision-making. The report leverages extensive research to provide a precise forecast, using 2025 as the base and estimated year, with a forecast period extending to 2033 and a historical period spanning 2019-2024. Key players analyzed include LG, Nikai, Siemens, Electrolux, Milton, Haier, Sonashi, Bosch, Whirlpool, and Better Life. Market segmentation encompasses product type (Desktop Gas Hobs, Embedded Gas Hobs) and end-use (Household, Commercial). The report projects a market value of xx Million by 2033.

Gas Hobs Market in GCC Market Composition & Trends

The GCC gas hob market demonstrates a moderately concentrated landscape, with key players holding significant market share. LG and Bosch currently command approximately 30% combined market share, while other players like Siemens and Electrolux maintain a share between 10-15% each. The remaining share is distributed among smaller players like Nikai, Haier, and Milton. Innovation is driven by increased consumer demand for energy-efficient and aesthetically pleasing models, prompting manufacturers to introduce smart features and improved designs. The regulatory landscape remains relatively stable, with focus on safety standards. Substitute products such as induction hobs are gaining traction, but gas hobs retain a significant presence due to affordability and familiarity. M&A activities have been relatively limited in recent years, with the largest deal valuing approximately 150 Million in 2022 involving a merger between two smaller regional players.

- Market Share Distribution (2024): LG (15%), Bosch (15%), Siemens (12%), Electrolux (10%), Others (48%)

- M&A Deal Value (2022): 150 Million (estimated)

- Key Innovation Drivers: Energy efficiency, Smart features, Design aesthetics.

Gas Hobs Market in GCC Industry Evolution

The GCC gas hob market has experienced steady growth during the historical period (2019-2024), driven by rising disposable incomes and urbanization. The average annual growth rate (AAGR) was approximately 5% during this period, with household end-use segment contributing the most. Technological advancements, including the introduction of glass-top designs and improved burner technologies, have enhanced product appeal. Consumer preferences are shifting towards more sophisticated models with advanced safety features such as automatic ignition and flame failure devices. This trend is particularly strong in the upscale segment, where embedded gas hobs are gaining popularity. The market has also witnessed a gradual shift towards online sales channels, augmenting traditional retail distribution models. This trend is expected to increase by 15% over the next 5 years with online sales growing by an average of 7% year on year. This has led to a gradual increase in competitive pressure, leading to pricing strategies and innovative product offerings to attract buyers. We expect this to contribute a 2% increase in overall sales year on year.

Leading Regions, Countries, or Segments in Gas Hobs Market in GCC

The UAE and Saudi Arabia dominate the GCC gas hob market, accounting for over 70% of total sales. This dominance is primarily attributed to higher population density, increased disposable income, and a more developed retail infrastructure. Within product types, embedded gas hobs are gaining traction, particularly in the premium segment. This is driven by the increasing preference for modern kitchen aesthetics. The household sector remains the largest end-use segment, fueled by a growing housing market and rising urbanization.

- Key Drivers for UAE & Saudi Arabia Dominance:

- Higher per capita income.

- Robust Real Estate Market driving new housing constructions.

- Developed retail and distribution networks.

- Key Drivers for Embedded Gas Hob Growth:

- Modern kitchen designs and aesthetics.

- Increased preference for built-in appliances.

- Willingness to spend on higher-quality products.

- Key Drivers for Household Segment Dominance:

- Rising urbanization and population growth.

- Increased disposable incomes enabling purchase of high-end kitchen appliances.

Gas Hobs Market in GCC Product Innovations

Recent innovations focus on enhanced safety features, such as automatic ignition systems and improved flame failure safety devices. Energy-efficient burners and smart functionalities, including integration with smart home ecosystems, are also gaining traction. Manufacturers are emphasizing sleek designs and durable materials to cater to evolving consumer preferences. Unique selling propositions include improved cooking performance, ease of cleaning, and intuitive user interfaces. These innovations are aimed at improving cooking experiences and promoting energy efficiency.

Propelling Factors for Gas Hobs Market in GCC Growth

The GCC gas hob market's growth is propelled by several factors, including rising disposable incomes within the region, expanding housing markets, increased urbanization, and governmental investments. Government initiatives focusing on infrastructure development also drive up the demand for housing and other appliances, contributing to market expansion. Furthermore, the increasing popularity of modern kitchen designs and the desire for advanced cooking technologies further boost market expansion.

Obstacles in the Gas Hobs Market in GCC Market

Challenges include the price sensitivity of certain consumer segments, the increasing availability of substitute products (induction hobs), and occasional supply chain disruptions impacting import costs and availability. Fluctuations in raw material prices pose an additional challenge for manufacturers, impacting overall profit margins. The competitive landscape, characterized by both established and emerging brands, also creates pricing pressure. These factors, while not severely restrictive, require manufacturers to adopt flexible strategies to navigate these challenges.

Future Opportunities in Gas Hobs Market in GCC

Future growth opportunities lie in the expansion into rural areas, targeting the growing middle class. The integration of smart home technologies, such as Wi-Fi connectivity and app-based controls, will be a major driver of innovation. Focusing on sustainable and eco-friendly options, including energy-efficient models, will also capture environmentally conscious consumers.

Key Developments in Gas Hobs Market in GCC Industry

- Q3 2023: LG launched a new line of energy-efficient gas hobs with integrated smart features.

- Q1 2024: Bosch partnered with a local distributor to expand its market reach in Saudi Arabia.

- Q2 2024: A new safety standard for gas hobs was implemented across the GCC, impacting product designs.

Strategic Gas Hobs Market in GCC Market Forecast

The GCC gas hob market is poised for continued growth, driven by factors such as increasing urbanization, rising disposable incomes, and the adoption of advanced kitchen technologies. The market's expansion is expected to continue into the forecast period (2025-2033), with significant growth opportunities in the premium segment and the increasing demand for embedded gas hobs. The market’s focus on energy-efficient and smart features will also contribute to growth.

Gas Hobs Market in GCC Segmentation

-

1. Product Type

- 1.1. Desktop Gas Hobs

- 1.2. Embedded Gas Hobs

-

2. End Use

- 2.1. Household

- 2.2. Commercial

-

3. Geography

- 3.1. UAE

- 3.2. Saudi Arabia

- 3.3. Qatar

- 3.4. Oman

- 3.5. Kuwait

- 3.6. Bahrain

Gas Hobs Market in GCC Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. Qatar

- 4. Oman

- 5. Kuwait

- 6. Bahrain

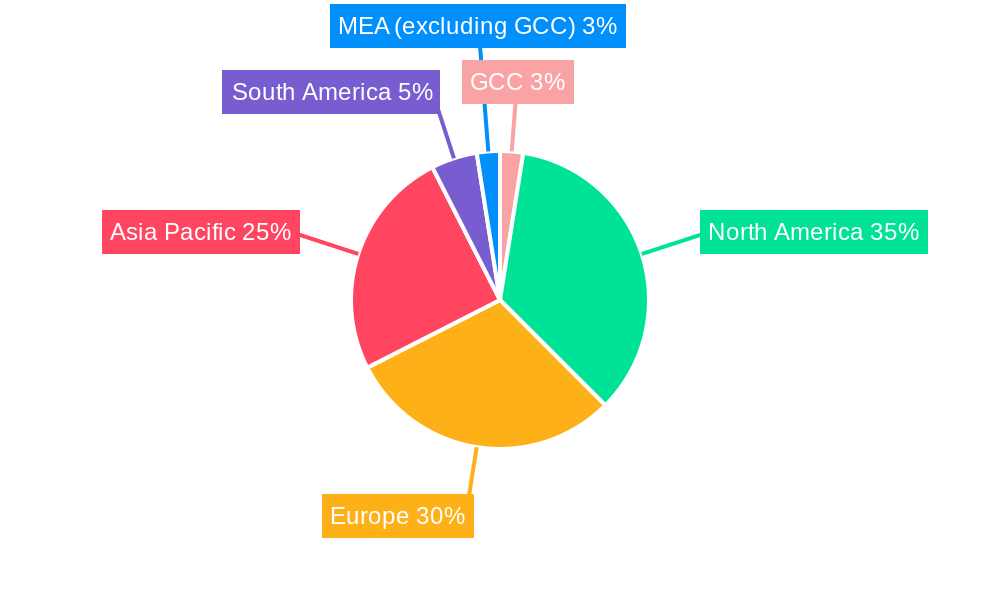

Gas Hobs Market in GCC Regional Market Share

Geographic Coverage of Gas Hobs Market in GCC

Gas Hobs Market in GCC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges

- 3.4. Market Trends

- 3.4.1. Growing Urbanization in GCC will drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Desktop Gas Hobs

- 5.1.2. Embedded Gas Hobs

- 5.2. Market Analysis, Insights and Forecast - by End Use

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Oman

- 5.3.5. Kuwait

- 5.3.6. Bahrain

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UAE

- 5.4.2. Saudi Arabia

- 5.4.3. Qatar

- 5.4.4. Oman

- 5.4.5. Kuwait

- 5.4.6. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Desktop Gas Hobs

- 6.1.2. Embedded Gas Hobs

- 6.2. Market Analysis, Insights and Forecast - by End Use

- 6.2.1. Household

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. UAE

- 6.3.2. Saudi Arabia

- 6.3.3. Qatar

- 6.3.4. Oman

- 6.3.5. Kuwait

- 6.3.6. Bahrain

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Desktop Gas Hobs

- 7.1.2. Embedded Gas Hobs

- 7.2. Market Analysis, Insights and Forecast - by End Use

- 7.2.1. Household

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. UAE

- 7.3.2. Saudi Arabia

- 7.3.3. Qatar

- 7.3.4. Oman

- 7.3.5. Kuwait

- 7.3.6. Bahrain

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Desktop Gas Hobs

- 8.1.2. Embedded Gas Hobs

- 8.2. Market Analysis, Insights and Forecast - by End Use

- 8.2.1. Household

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. UAE

- 8.3.2. Saudi Arabia

- 8.3.3. Qatar

- 8.3.4. Oman

- 8.3.5. Kuwait

- 8.3.6. Bahrain

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Oman Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Desktop Gas Hobs

- 9.1.2. Embedded Gas Hobs

- 9.2. Market Analysis, Insights and Forecast - by End Use

- 9.2.1. Household

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. UAE

- 9.3.2. Saudi Arabia

- 9.3.3. Qatar

- 9.3.4. Oman

- 9.3.5. Kuwait

- 9.3.6. Bahrain

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Kuwait Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Desktop Gas Hobs

- 10.1.2. Embedded Gas Hobs

- 10.2. Market Analysis, Insights and Forecast - by End Use

- 10.2.1. Household

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. UAE

- 10.3.2. Saudi Arabia

- 10.3.3. Qatar

- 10.3.4. Oman

- 10.3.5. Kuwait

- 10.3.6. Bahrain

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Bahrain Gas Hobs Market in GCC Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Desktop Gas Hobs

- 11.1.2. Embedded Gas Hobs

- 11.2. Market Analysis, Insights and Forecast - by End Use

- 11.2.1. Household

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. UAE

- 11.3.2. Saudi Arabia

- 11.3.3. Qatar

- 11.3.4. Oman

- 11.3.5. Kuwait

- 11.3.6. Bahrain

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 LG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nikai

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siemens

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Electrolux

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Milton

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Haier

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sonashi

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bosch

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Whirpool

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Better Life

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG

List of Figures

- Figure 1: Global Gas Hobs Market in GCC Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Gas Hobs Market in GCC Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: UAE Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: UAE Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: UAE Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: UAE Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 7: UAE Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 8: UAE Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 9: UAE Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 10: UAE Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 11: UAE Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 12: UAE Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 13: UAE Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 14: UAE Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 15: UAE Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 16: UAE Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 17: UAE Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 18: UAE Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

- Figure 19: Saudi Arabia Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Saudi Arabia Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Saudi Arabia Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Saudi Arabia Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Saudi Arabia Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 24: Saudi Arabia Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 25: Saudi Arabia Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 26: Saudi Arabia Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 27: Saudi Arabia Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 28: Saudi Arabia Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 29: Saudi Arabia Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Saudi Arabia Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 31: Saudi Arabia Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 32: Saudi Arabia Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 33: Saudi Arabia Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 34: Saudi Arabia Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

- Figure 35: Qatar Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 36: Qatar Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Qatar Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Qatar Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Qatar Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 40: Qatar Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 41: Qatar Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 42: Qatar Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 43: Qatar Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 44: Qatar Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 45: Qatar Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Qatar Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 47: Qatar Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 48: Qatar Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 49: Qatar Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 50: Qatar Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

- Figure 51: Oman Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Oman Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Oman Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Oman Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Oman Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 56: Oman Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 57: Oman Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 58: Oman Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 59: Oman Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 60: Oman Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 61: Oman Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Oman Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 63: Oman Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 64: Oman Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 65: Oman Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 66: Oman Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

- Figure 67: Kuwait Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 68: Kuwait Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Kuwait Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Kuwait Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Kuwait Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 72: Kuwait Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 73: Kuwait Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 74: Kuwait Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 75: Kuwait Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 76: Kuwait Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 77: Kuwait Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Kuwait Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 79: Kuwait Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 80: Kuwait Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 81: Kuwait Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 82: Kuwait Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

- Figure 83: Bahrain Gas Hobs Market in GCC Revenue (undefined), by Product Type 2025 & 2033

- Figure 84: Bahrain Gas Hobs Market in GCC Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: Bahrain Gas Hobs Market in GCC Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: Bahrain Gas Hobs Market in GCC Volume Share (%), by Product Type 2025 & 2033

- Figure 87: Bahrain Gas Hobs Market in GCC Revenue (undefined), by End Use 2025 & 2033

- Figure 88: Bahrain Gas Hobs Market in GCC Volume (K Unit), by End Use 2025 & 2033

- Figure 89: Bahrain Gas Hobs Market in GCC Revenue Share (%), by End Use 2025 & 2033

- Figure 90: Bahrain Gas Hobs Market in GCC Volume Share (%), by End Use 2025 & 2033

- Figure 91: Bahrain Gas Hobs Market in GCC Revenue (undefined), by Geography 2025 & 2033

- Figure 92: Bahrain Gas Hobs Market in GCC Volume (K Unit), by Geography 2025 & 2033

- Figure 93: Bahrain Gas Hobs Market in GCC Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Bahrain Gas Hobs Market in GCC Volume Share (%), by Geography 2025 & 2033

- Figure 95: Bahrain Gas Hobs Market in GCC Revenue (undefined), by Country 2025 & 2033

- Figure 96: Bahrain Gas Hobs Market in GCC Volume (K Unit), by Country 2025 & 2033

- Figure 97: Bahrain Gas Hobs Market in GCC Revenue Share (%), by Country 2025 & 2033

- Figure 98: Bahrain Gas Hobs Market in GCC Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 4: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 5: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 12: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 13: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 19: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 20: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 21: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 28: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 29: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 35: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 36: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 37: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 42: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 44: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 45: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 50: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Global Gas Hobs Market in GCC Revenue undefined Forecast, by End Use 2020 & 2033

- Table 52: Global Gas Hobs Market in GCC Volume K Unit Forecast, by End Use 2020 & 2033

- Table 53: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Geography 2020 & 2033

- Table 54: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Geography 2020 & 2033

- Table 55: Global Gas Hobs Market in GCC Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global Gas Hobs Market in GCC Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Hobs Market in GCC?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Gas Hobs Market in GCC?

Key companies in the market include LG, Nikai, Siemens, Electrolux, Milton, Haier, Sonashi, Bosch, Whirpool, Better Life.

3. What are the main segments of the Gas Hobs Market in GCC?

The market segments include Product Type, End Use, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Growing Urbanization in GCC will drive the Market.

7. Are there any restraints impacting market growth?

Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Hobs Market in GCC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Hobs Market in GCC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Hobs Market in GCC?

To stay informed about further developments, trends, and reports in the Gas Hobs Market in GCC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence