Key Insights

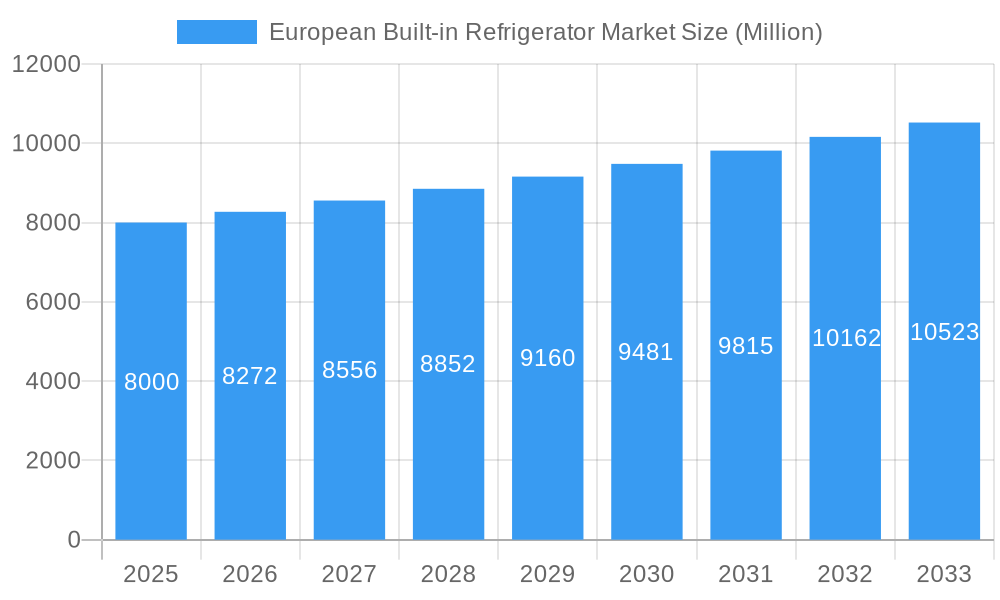

The European built-in refrigerator market is experiencing robust growth, driven by increasing disposable incomes, a preference for modern kitchen aesthetics, and the rising popularity of integrated appliances. The market, valued at approximately €[Estimate based on CAGR and market size; e.g., €8 billion] in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.59% through 2033. Key segments driving this growth include double-door and French-door models, reflecting consumer demand for enhanced storage capacity and sophisticated design features. The online channel is also witnessing significant expansion, as consumers increasingly embrace e-commerce for appliance purchases, facilitated by improved logistics and online retailer offerings. Germany, France, and the UK are the leading national markets within Europe, contributing a significant share of the overall market volume. However, growth opportunities exist in other European nations as consumer preferences evolve and purchasing power increases. Leading manufacturers like General Electric, LG, Miele, Liebherr, Haier, Whirlpool, Electrolux, Samsung, and Bosch are fiercely competing, fueling innovation and offering a diverse range of products to cater to varying consumer needs and budgets.

European Built-in Refrigerator Market Market Size (In Billion)

The market's growth is further propelled by several factors including increased urbanization, a shift towards smaller living spaces demanding space-saving appliances, and rising demand for energy-efficient models due to growing environmental awareness. Despite these positive trends, challenges remain, including potential economic fluctuations impacting consumer spending, rising raw material costs potentially increasing product prices, and competition from other types of refrigeration. The industry is likely to see further consolidation as manufacturers seek economies of scale and invest in research and development to offer advanced features like smart connectivity and improved energy efficiency. This combination of favorable market dynamics, technological advancements, and competitive landscape positions the European built-in refrigerator market for sustained growth in the coming years. Strategic partnerships, targeted marketing, and investment in product innovation will be crucial for companies seeking to gain a competitive advantage in this dynamic market.

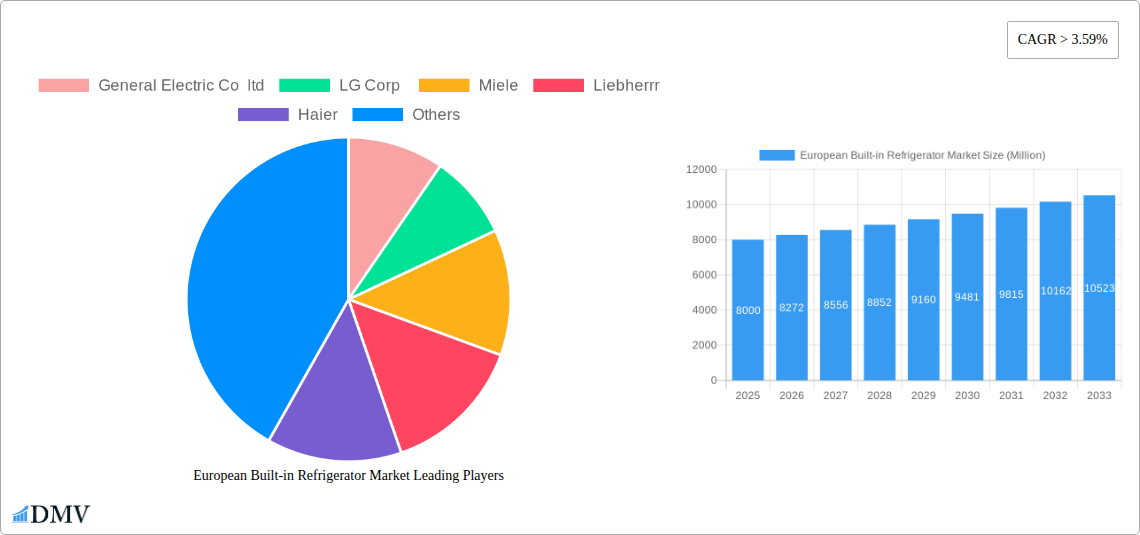

European Built-in Refrigerator Market Company Market Share

European Built-in Refrigerator Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the European built-in refrigerator market, offering a comprehensive overview of market trends, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

European Built-in Refrigerator Market Composition & Trends

This section delves into the intricate structure of the European built-in refrigerator market, examining key aspects influencing its evolution. We analyze market concentration, revealing the dominance of key players like Whirlpool, SAMSUNG Electronics, Bosch Ltd, LG Corp, Miele, Liebherrr, Haier, Electrolux AB, and General Electric Co ltd. Market share distribution is meticulously examined, highlighting the competitive landscape. Innovation catalysts, such as advancements in energy efficiency and smart technology, are discussed, along with their impact on market dynamics.

The report also explores the regulatory landscape, including the significant impact of the EU's new energy labeling requirements implemented in March 2022. The shift from A+++ to a simpler A-G scale is analyzed for its potential influence on manufacturing and consumer choices. Furthermore, the analysis includes an assessment of substitute products, end-user profiles (commercial vs. residential), and merger & acquisition (M&A) activities within the industry, including an estimation of deal values (xx Million).

- Market Concentration: High, with top 10 players holding xx% market share.

- Innovation Catalysts: Smart technology integration, energy efficiency improvements.

- Regulatory Landscape: EU energy labeling changes (March 2022) significantly impacting market dynamics.

- Substitute Products: Free-standing refrigerators, other cooling solutions.

- End-User Profiles: Residential segment dominates, with growing commercial demand.

- M&A Activities: xx M&A deals recorded between 2019-2024, with a total estimated value of xx Million.

European Built-in Refrigerator Market Industry Evolution

This section provides a detailed analysis of the European built-in refrigerator market's growth trajectory from 2019 to 2033. We examine the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Market growth rates are analyzed, highlighting fluctuations and trends driven by technological advancements such as improved energy efficiency, smart features (e.g., Wi-Fi connectivity, internal cameras), and enhanced design aesthetics. The changing consumer demands, including a growing preference for eco-friendly and smart appliances, are also meticulously explored. We also analyze the adoption rate of different product types, including single-door, double-door, side-by-side, and French door refrigerators. Specific data points illustrate the market’s evolution, including growth rates (xx% CAGR from 2025-2033) and adoption metrics for smart refrigerators (xx% penetration by 2033).

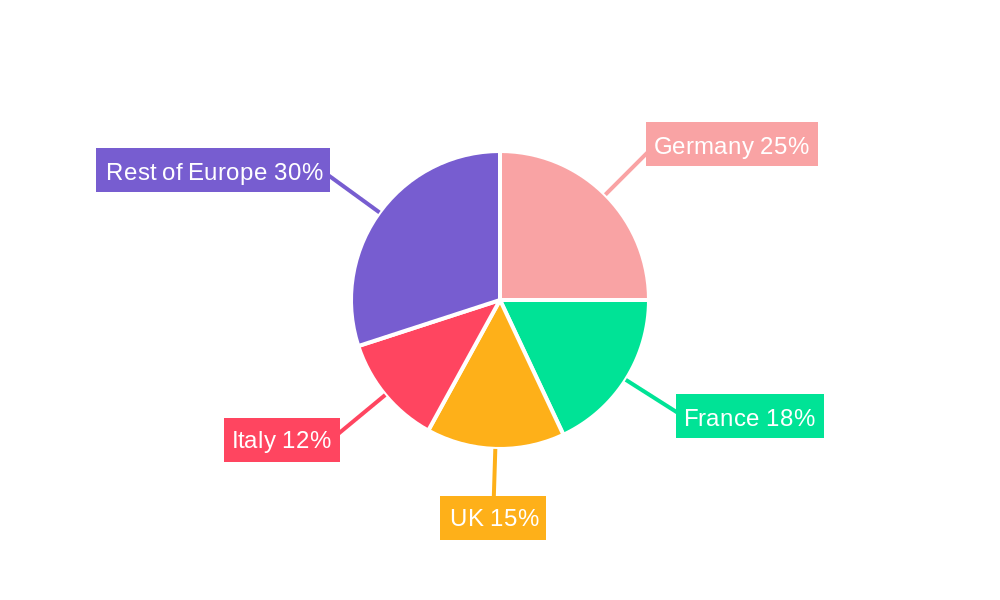

Leading Regions, Countries, or Segments in European Built-in Refrigerator Market

This section identifies the leading regions, countries, and segments within the European built-in refrigerator market. We analyze market performance across various segments:

Application:

- Residential: Dominates the market due to higher household penetration and increasing disposable incomes. Key drivers include rising consumer preference for built-in appliances and improved kitchen aesthetics.

- Commercial: Shows steady growth, driven by the increasing demand for refrigerators in hospitality, retail, and healthcare settings. Key drivers include demand for energy-efficient models and specialized features.

Distribution Channel:

- Offline Channel: Remains the dominant distribution channel, leveraging established retail networks and customer familiarity.

- Online Channel: Shows significant growth potential, facilitated by e-commerce expansion and consumer preference for online shopping convenience.

Product Type:

- French Door: The fastest-growing segment, driven by its spacious design and aesthetic appeal.

- Side-by-Side: Maintains a substantial market share due to its large capacity and convenient access.

- Double Door: Continues to be a popular choice due to its balance of capacity and cost-effectiveness.

- Single Door: Maintains a niche market for smaller households or specific applications.

Germany, France, and the UK emerge as leading countries within the European market, influenced by high disposable incomes, strong consumer demand for premium appliances, and well-established retail networks.

European Built-in Refrigerator Market Product Innovations

Recent years have witnessed significant product innovations in the European built-in refrigerator market. Manufacturers are focusing on enhancing energy efficiency, integrating smart features like Wi-Fi connectivity, internal cameras, and voice control, and improving design aesthetics to cater to consumer preferences for modern and stylish kitchens. Unique selling propositions now include features like precise temperature control, improved food preservation techniques, and advanced filtration systems to enhance product value and user experience. These innovations are driving market growth and creating a competitive landscape.

Propelling Factors for European Built-in Refrigerator Market Growth

Several factors drive the growth of the European built-in refrigerator market. These include rising disposable incomes leading to increased consumer spending on premium home appliances, a growing preference for built-in appliances for improved kitchen aesthetics, and technological advancements in energy efficiency and smart features. Moreover, supportive government policies promoting energy efficiency and sustainable practices further contribute to market expansion. The increasing adoption of smart home technology and the growing demand for convenience and connected devices are also key propellants.

Obstacles in the European Built-in Refrigerator Market

Despite significant growth potential, the European built-in refrigerator market faces several challenges. Supply chain disruptions caused by global events can impact production and availability, leading to price fluctuations and potential delays. Intense competition among established manufacturers and the emergence of new players exert pressure on profit margins. Furthermore, stringent regulatory requirements, including energy efficiency standards and safety regulations, necessitate significant investments for manufacturers to comply.

Future Opportunities in European Built-in Refrigerator Market

Future opportunities in the European built-in refrigerator market include the expansion into niche markets, such as energy-efficient and sustainable models, smart home integration with voice assistants and other smart appliances, and the growing demand for bespoke and customized appliances. The increasing adoption of innovative materials and manufacturing techniques creates opportunities for differentiated products. Further development and integration of smart features will attract tech-savvy consumers.

Major Players in the European Built-in Refrigerator Market Ecosystem

- General Electric Co ltd

- LG Corp

- Miele

- Liebherrr

- Haier

- Whirlpool

- Electrolux AB

- SAMSUNG Electronics

- Bosch Ltd

Key Developments in European Built-in Refrigerator Market Industry

- March 2022: The EU's new energy label requirements came into effect, impacting appliance energy ratings and requiring manufacturers to adapt their products.

- February 2022: Samsung Electronics Italia launched the Family Hub smart refrigerator with a 'View Inside' feature, aligning with initiatives against food waste.

Strategic European Built-in Refrigerator Market Forecast

The European built-in refrigerator market exhibits robust growth potential, driven by technological advancements, changing consumer preferences, and supportive regulatory frameworks. Continued innovation in energy efficiency, smart features, and design aesthetics will further stimulate market growth. The expansion of e-commerce and the increasing adoption of smart home technology are poised to create new opportunities for manufacturers and retailers. The market is expected to witness a substantial increase in both volume and value in the coming years.

European Built-in Refrigerator Market Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

-

2. distribution channel

- 2.1. Online Channel

- 2.2. Offline Channel

-

3. Product Type

- 3.1. Single Door

- 3.2. Double Door

- 3.3. Side by Side Door

- 3.4. French Door

- 3.5. Other

-

4. Geography

- 4.1. United Kingdom

- 4.2. France

- 4.3. Germany

- 4.4. Others*

European Built-in Refrigerator Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Others

European Built-in Refrigerator Market Regional Market Share

Geographic Coverage of European Built-in Refrigerator Market

European Built-in Refrigerator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Frozen Food Products is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Awareness on Environmental Protection to Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Online Purchase of Household Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by distribution channel

- 5.2.1. Online Channel

- 5.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Single Door

- 5.3.2. Double Door

- 5.3.3. Side by Side Door

- 5.3.4. French Door

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United Kingdom

- 5.4.2. France

- 5.4.3. Germany

- 5.4.4. Others*

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. France

- 5.5.3. Germany

- 5.5.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.2. Market Analysis, Insights and Forecast - by distribution channel

- 6.2.1. Online Channel

- 6.2.2. Offline Channel

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Single Door

- 6.3.2. Double Door

- 6.3.3. Side by Side Door

- 6.3.4. French Door

- 6.3.5. Other

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United Kingdom

- 6.4.2. France

- 6.4.3. Germany

- 6.4.4. Others*

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.2. Market Analysis, Insights and Forecast - by distribution channel

- 7.2.1. Online Channel

- 7.2.2. Offline Channel

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Single Door

- 7.3.2. Double Door

- 7.3.3. Side by Side Door

- 7.3.4. French Door

- 7.3.5. Other

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United Kingdom

- 7.4.2. France

- 7.4.3. Germany

- 7.4.4. Others*

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.2. Market Analysis, Insights and Forecast - by distribution channel

- 8.2.1. Online Channel

- 8.2.2. Offline Channel

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Single Door

- 8.3.2. Double Door

- 8.3.3. Side by Side Door

- 8.3.4. French Door

- 8.3.5. Other

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United Kingdom

- 8.4.2. France

- 8.4.3. Germany

- 8.4.4. Others*

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Others European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.2. Market Analysis, Insights and Forecast - by distribution channel

- 9.2.1. Online Channel

- 9.2.2. Offline Channel

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Single Door

- 9.3.2. Double Door

- 9.3.3. Side by Side Door

- 9.3.4. French Door

- 9.3.5. Other

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United Kingdom

- 9.4.2. France

- 9.4.3. Germany

- 9.4.4. Others*

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 General Electric Co ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LG Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Miele

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Liebherrr

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Haier

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Whirlpool

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electrolux AB

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAMSUNG Electronics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 General Electric Co ltd

List of Figures

- Figure 1: European Built-in Refrigerator Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: European Built-in Refrigerator Market Share (%) by Company 2025

List of Tables

- Table 1: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 4: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 5: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 7: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: European Built-in Refrigerator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: European Built-in Refrigerator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 14: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 15: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 17: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 24: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 25: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 34: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 35: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 37: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 42: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 44: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 45: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 46: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 47: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 48: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Built-in Refrigerator Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the European Built-in Refrigerator Market?

Key companies in the market include General Electric Co ltd, LG Corp , Miele, Liebherrr, Haier, Whirlpool, Electrolux AB, SAMSUNG Electronics, Bosch Ltd.

3. What are the main segments of the European Built-in Refrigerator Market?

The market segments include Application, distribution channel, Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Frozen Food Products is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Online Purchase of Household Appliances.

7. Are there any restraints impacting market growth?

Rising Awareness on Environmental Protection to Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2022, the EU's new energy label requirements were enacted. All white goods sold in EU countries from this time will need to feature an updated sticker communicating their energy rating, with the current classifications of 'A+,' 'A++,' and 'A+++' replaced by a new scale of lettering from A to G, with 'A' being the most ecologically friendly. This could entail manufacturers undertaking significant work to bring their models up to the desired rating.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Built-in Refrigerator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Built-in Refrigerator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Built-in Refrigerator Market?

To stay informed about further developments, trends, and reports in the European Built-in Refrigerator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence