Key Insights

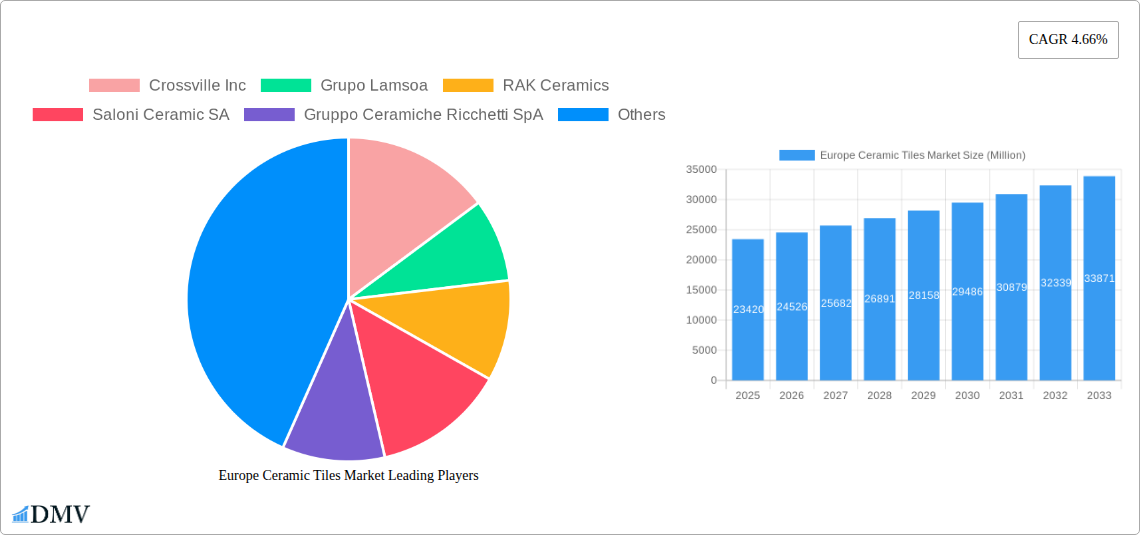

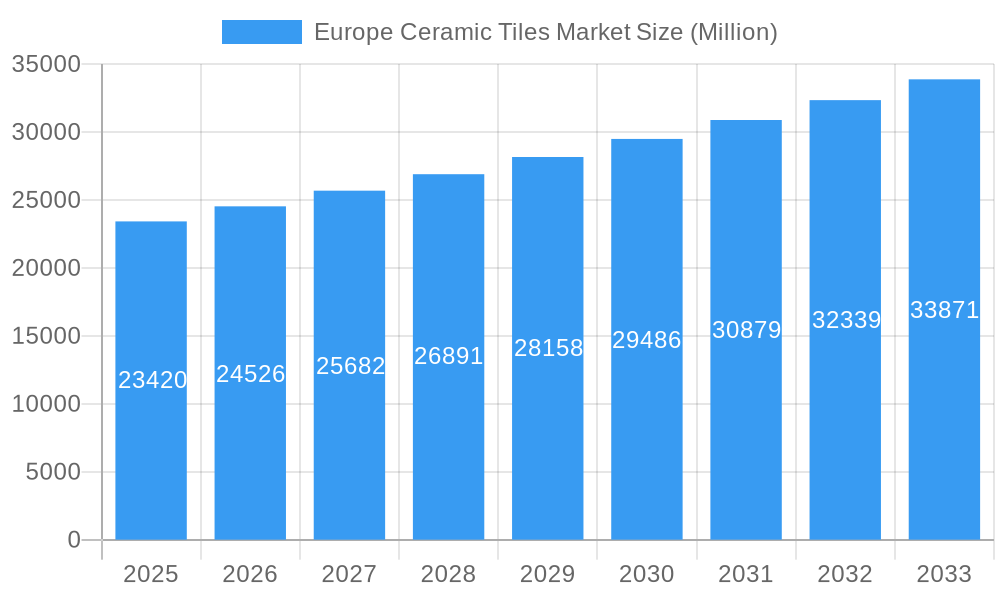

The European ceramic tile market, valued at €23.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, particularly in new construction and renovation projects across residential and commercial segments, significantly boosts demand. A rising preference for aesthetically pleasing and durable flooring and wall solutions further fuels market growth. Within the product segment, glazed and porcelain tiles maintain a dominant market share due to their versatility, ease of maintenance, and wide array of design options. However, the increasing popularity of scratch-free tiles is driving a notable shift in consumer preferences, contributing to the overall market dynamism. Furthermore, growth is geographically diverse across Europe, with Germany, France, Italy, and the United Kingdom representing significant national markets, underpinned by strong construction activity and consumer spending. However, economic fluctuations and material cost pressures pose potential restraints to market expansion. The market is also witnessing an increasing focus on sustainability, with manufacturers introducing eco-friendly production processes and tile compositions, in line with growing consumer environmental awareness.

Europe Ceramic Tiles Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established international players and regional manufacturers. Companies like RAK Ceramics, Porcelanosa Group, and Mohawk Industries are key players, leveraging their brand recognition and distribution networks. However, the market also features a significant presence of smaller, regional players specializing in niche product segments and catering to local market demands. Future growth will be influenced by technological advancements in tile manufacturing, the development of innovative tile designs, and the increasing adoption of sustainable practices throughout the value chain. The ongoing focus on energy efficiency within buildings, particularly in the context of broader European sustainability goals, creates a fertile ground for innovative, energy-efficient ceramic tiles and further boosts market expansion.

Europe Ceramic Tiles Market Company Market Share

Europe Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Ceramic Tiles Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic industry. The report covers the historical period from 2019-2024, providing a solid foundation for future projections. The market size is estimated at xx Million in 2025.

Europe Ceramic Tiles Market Composition & Trends

This section delves into the intricate composition of the European ceramic tile market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We examine the market share distribution among key players, including Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc, Blackstone Industrial (Foshan) Ltd, and China Ceramics Co Ltd (list not exhaustive). The report further explores the impact of M&A activities, quantifying deal values where possible and analyzing their influence on market consolidation and competitive dynamics.

- Market Concentration: Analysis of market share held by top players and assessment of market fragmentation. xx% market share held by top 5 players (estimated).

- Innovation Catalysts: Exploration of technological advancements driving innovation, including new materials, manufacturing processes, and design aesthetics.

- Regulatory Landscape: Examination of relevant EU regulations impacting production, distribution, and environmental sustainability.

- Substitute Products: Evaluation of competitive threats from alternative flooring materials (e.g., wood, vinyl, stone).

- End-User Profiles: Detailed analysis of the residential and commercial sectors, including purchasing patterns and preferences.

- M&A Activities: Review of significant M&A deals in the European ceramic tile market, including deal values (where available) and their impact on market structure. Estimated total M&A deal value for 2019-2024: xx Million.

Europe Ceramic Tiles Market Industry Evolution

This section provides a detailed analysis of the European ceramic tile market's evolutionary trajectory. We examine market growth trajectories, technological advancements, and the evolution of consumer preferences from 2019 to the present. We present data points on growth rates, adoption metrics of new technologies, and analyze the factors driving changes in consumer demand, including design trends, sustainability concerns, and price sensitivity. The report includes an in-depth examination of technological advancements impacting manufacturing processes, product design, and supply chain efficiency, resulting in improved product performance and reduced manufacturing costs. Key drivers of market evolution include: increased urbanization, renovation activities, rising disposable incomes, and the growing adoption of sustainable building materials. The estimated Compound Annual Growth Rate (CAGR) for the period 2025-2033 is xx%.

Leading Regions, Countries, or Segments in Europe Ceramic Tiles Market

This section identifies the leading regions, countries, and segments within the European ceramic tile market. We analyze market dominance by construction type (new construction vs. replacement & renovation), end-user type (residential vs. commercial), product type (glazed, porcelain, scratch-free, and others), and application (floor tiles, wall tiles, and others). Dominance is assessed based on market size, growth rate, and key driving factors.

- Key Drivers: We use bullet points to highlight key drivers for each dominant segment, including investment trends, regulatory support, and consumer preferences.

- In-depth Analysis: Paragraphs provide an in-depth analysis of the factors contributing to the dominance of specific regions, countries, or segments. For example, the strong growth in the residential segment is driven by increasing housing construction and renovations across key European markets.

Europe Ceramic Tiles Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics in the European ceramic tile market. We analyze unique selling propositions (USPs) of new products and discuss technological advancements that have improved tile durability, aesthetics, and functionality. The introduction of large format tiles, innovative surface textures, and improved printing technologies are among the key innovations driving market growth.

Propelling Factors for Europe Ceramic Tiles Market Growth

Several factors contribute to the growth of the Europe Ceramic Tiles Market. Technological advancements like improved printing techniques and manufacturing processes allow for greater design flexibility and durability. Economically, rising disposable incomes and increased investment in infrastructure projects fuel demand. Furthermore, supportive regulations focused on sustainable building materials promote the market’s expansion.

Obstacles in the Europe Ceramic Tiles Market

The Europe Ceramic Tiles Market faces several challenges. Regulatory hurdles like stringent environmental regulations can increase production costs. Supply chain disruptions, including raw material shortages and transportation delays, impact production and delivery timelines. Intense competition among numerous manufacturers also puts pressure on profit margins.

Future Opportunities in Europe Ceramic Tiles Market

The Europe Ceramic Tiles Market presents significant future opportunities. Emerging markets in Eastern Europe offer untapped potential. Technological advancements in smart tiles and energy-efficient materials present avenues for innovation. Growing awareness of sustainability and eco-friendly construction practices further boost demand for sustainable tile options.

Major Players in the Europe Ceramic Tiles Market Ecosystem

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- NITCO

- Atlas Concorde S P A

- Johnson Tiles

- Mohawk Industries Inc

- Siam Cement Group

- Centura Tile Inc

- Blackstone Industrial (Foshan) Ltd

- China Ceramics Co Ltd

Key Developments in Europe Ceramic Tiles Market Industry

- February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, featuring a comprehensive product system and stylish surfaces for coordinated environments. This launch broadens design options and strengthens Atlas Concorde's market position.

- March 2022: Johnson Tile's collaboration with the Material Lab for the Tile Trace Trend & Format Forum provided insights into latest interior design trends, translating them into commercial tiling products. This demonstrates a commitment to innovation and market responsiveness.

Strategic Europe Ceramic Tiles Market Market Forecast

The European ceramic tile market is poised for sustained growth driven by factors including rising construction activity, increasing disposable incomes, and a growing preference for aesthetically pleasing and durable flooring solutions. Technological advancements and a focus on sustainability will further shape market evolution, creating opportunities for innovative product development and expansion into new market segments. The long-term outlook remains positive, with significant growth potential throughout the forecast period.

Europe Ceramic Tiles Market Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Product Types

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential

- 4.2. Commercial

Europe Ceramic Tiles Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

Europe Ceramic Tiles Market Regional Market Share

Geographic Coverage of Europe Ceramic Tiles Market

Europe Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Italy is the Major Exporter of Ceramic Tiles in Europe Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Germany

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Russia

- 5.5.6. Belgium

- 5.5.7. Poland

- 5.5.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Other Tiles

- 11.3. Market Analysis, Insights and Forecast - by Construction Type

- 11.3.1. New Construction

- 11.3.2. Replacement & Renovation

- 11.4. Market Analysis, Insights and Forecast - by End-User Type

- 11.4.1. Residential

- 11.4.2. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Glazed

- 12.1.2. Porcelain

- 12.1.3. Scratch Free

- 12.1.4. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Floor Tiles

- 12.2.2. Wall Tiles

- 12.2.3. Other Tiles

- 12.3. Market Analysis, Insights and Forecast - by Construction Type

- 12.3.1. New Construction

- 12.3.2. Replacement & Renovation

- 12.4. Market Analysis, Insights and Forecast - by End-User Type

- 12.4.1. Residential

- 12.4.2. Commercial

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Glazed

- 13.1.2. Porcelain

- 13.1.3. Scratch Free

- 13.1.4. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Floor Tiles

- 13.2.2. Wall Tiles

- 13.2.3. Other Tiles

- 13.3. Market Analysis, Insights and Forecast - by Construction Type

- 13.3.1. New Construction

- 13.3.2. Replacement & Renovation

- 13.4. Market Analysis, Insights and Forecast - by End-User Type

- 13.4.1. Residential

- 13.4.2. Commercial

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Crossville Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Grupo Lamsoa

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 RAK Ceramics

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Saloni Ceramic SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gruppo Ceramiche Ricchetti SpA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Porcelanosa Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NITCO

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Atlas Concorde S P A

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Johnson Tiles

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mohawk Industries Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Siam Cement Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Centura Tile Inc **List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Blackstone Industrial (Foshan) Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 China Ceramics Co Ltd

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Crossville Inc

List of Figures

- Figure 1: Europe Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 15: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 19: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 20: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 24: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 25: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 29: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 30: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 34: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 35: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 40: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 44: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 45: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ceramic Tiles Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Europe Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc **List Not Exhaustive, Blackstone Industrial (Foshan) Ltd, China Ceramics Co Ltd.

3. What are the main segments of the Europe Ceramic Tiles Market?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Italy is the Major Exporter of Ceramic Tiles in Europe Region.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, The Atlas Concorde product system and a stylish assortment of surfaces are both inside to help customers design finished coordinated environments. Large slabs, kitchen counters, tables, and accessories, as well as sinks and bathroom fixtures, are all design elements that can broaden the design options for any intended application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Europe Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence