Key Insights

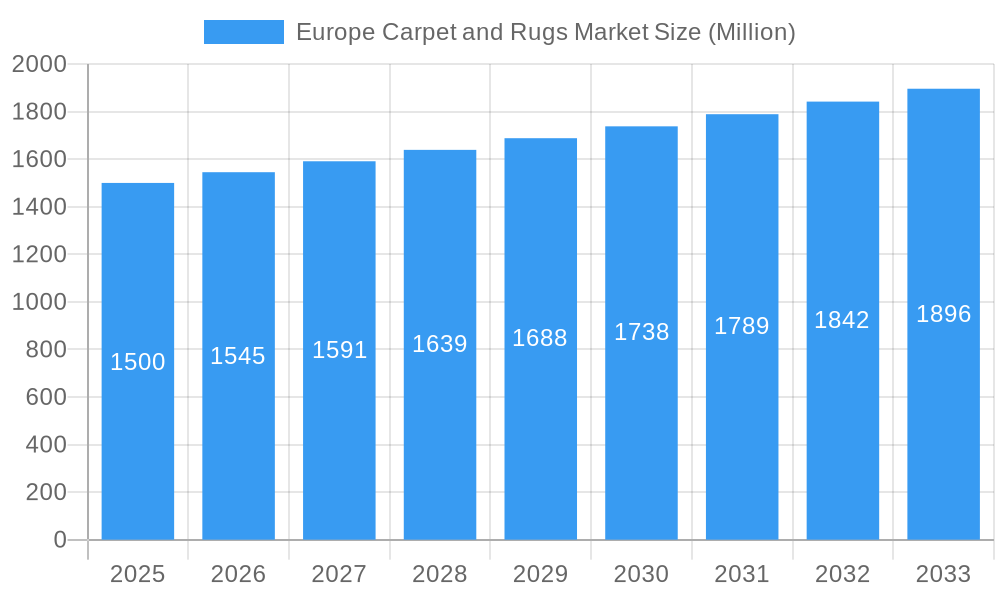

The European carpet and rug market is forecast to reach a size of 12.35 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.41% from the base year 2025 to 2033. This expansion is underpinned by rising disposable incomes, growing investments in home improvement and interior design, and a notable revival of both traditional and contemporary rug aesthetics. The market is segmented by product type (tufted wall-to-wall, woven wall-to-wall, and rugs), application (residential and commercial), and distribution channels (contractors, retail, and others). Key markets include Germany, the United Kingdom, and France, owing to their strong construction industries and sophisticated interior design sectors. Consumer demand for sustainable and eco-friendly carpet materials is a significant trend, driving product innovation. The commercial segment specifically is seeing increased demand for carpets offering enhanced durability, acoustic properties, and fire resistance.

Europe Carpet and Rugs Market Market Size (In Billion)

Growth projections, with a CAGR of 5.41% from 2025 to 2033, will be shaped by evolving European economic conditions. Despite potential short-term economic fluctuations, the long-term outlook remains positive, fueled by ongoing urbanization and the persistent appeal of carpets and rugs in both residential and commercial spaces. The market is characterized by intense competition among established global brands and regional manufacturers. Key industry players include Tarkett/Desso, Balsan, and Associated Weavers. Strategic success will hinge on continuous innovation in design, functionality, and sustainable manufacturing. Additionally, increasing consumer awareness regarding the health benefits associated with specific carpet materials and proper cleaning techniques is expected to further stimulate market growth.

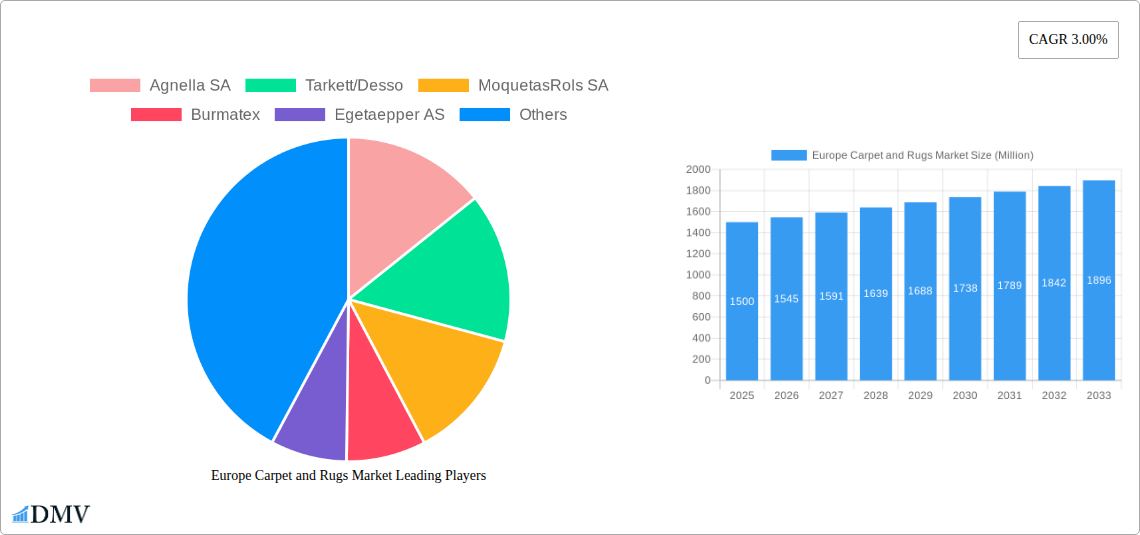

Europe Carpet and Rugs Market Company Market Share

Europe Carpet and Rugs Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe Carpet and Rugs Market, offering a detailed overview of market size, growth trends, competitive landscape, and future prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report features a detailed analysis of key segments, including by type (Wall-to-Wall Tufted Carpets, Wall-to-Wall Woven Carpets, Rugs), application (Residential, Commercial), and distribution channel (Contractors, Retail, Other Distribution Channels). Geographical coverage includes Germany, the United Kingdom, France, Spain, and the Rest of Europe. The report’s value is further enhanced by its in-depth examination of key players such as Agnella SA, Tarkett/Desso, MoquetasRols SA, Burmatex, Egetaepper AS, Balsan, Milliken, Fletco Carpets AS, Creatuft NV, Associated Weavers, Brintons Carpets, Balta Group, and Royal Carpet SA. The estimated market value for 2025 is xx Million.

Europe Carpet and Rugs Market Market Composition & Trends

This section delves into the intricate structure of the European carpet and rug market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We analyze the market share distribution among key players and assess the financial implications of significant M&A deals.

- Market Concentration: The European carpet and rug market exhibits a moderately concentrated structure, with a few major players commanding a significant share. The exact market share distribution will be detailed in the full report, but we anticipate a top 5 holding approximately xx% of the market.

- Innovation Catalysts: Technological advancements such as sustainable materials, improved manufacturing processes, and innovative designs are driving market innovation. The increasing demand for eco-friendly carpets is spurring the development of recycled and bio-based materials.

- Regulatory Landscape: EU regulations concerning emissions, materials, and worker safety significantly influence market dynamics. Compliance costs and evolving standards are key considerations for manufacturers.

- Substitute Products: The market faces competition from alternative flooring solutions such as hardwood, vinyl, and laminate flooring. However, carpets and rugs continue to retain their appeal due to their comfort, insulation properties, and aesthetic value.

- End-User Profiles: The report profiles key end-users across residential and commercial sectors, analyzing their purchasing behavior, preferences, and needs. This includes identifying key factors influencing buying decisions and segment-specific trends.

- M&A Activities: Significant M&A activity, as evidenced by the GBP 117 Million (USD 141.5 Million) acquisition of Balta Group's rug division by Victoria in November 2021, highlights ongoing consolidation and strategic positioning within the market. The full report details further M&A transactions and their impact on market dynamics.

Europe Carpet and Rugs Market Industry Evolution

This section examines the historical and projected growth trajectories of the Europe Carpet and Rugs Market, analyzing technological advancements, shifting consumer preferences, and market dynamics. We provide specific data points such as year-on-year growth rates and the adoption of new technologies. The analysis encompasses the period from 2019 to 2033, providing both historical context and future projections. Key factors driving market evolution include sustainability concerns, the rise of e-commerce, and evolving design trends. The impact of the COVID-19 pandemic on consumer spending and supply chains will also be analyzed. Furthermore, this section will investigate the influence of technological innovation on production processes and product development within the industry, examining the adoption of automated manufacturing systems and novel materials. Finally, this detailed overview will also assess changing consumer preferences relating to carpet and rug styles, materials, and functionalities.

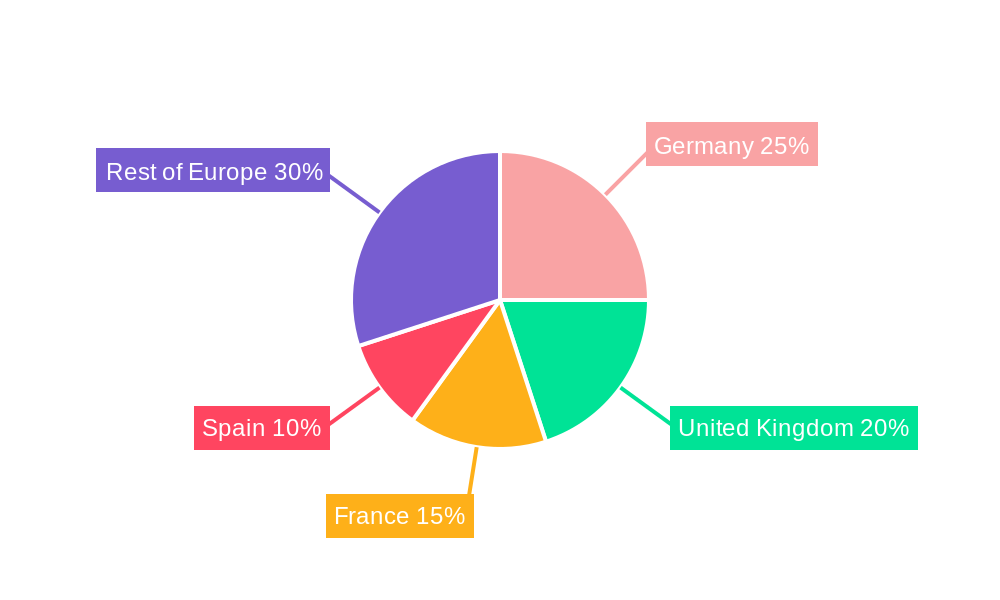

Leading Regions, Countries, or Segments in Europe Carpet and Rugs Market

This section identifies and analyzes the leading regions, countries, and segments within the European carpet and rug market. The report dissects the dominance factors for each segment, pinpointing key drivers such as investment trends and regulatory support.

By Type: Wall-to-wall tufted carpets are projected to remain the leading segment due to their cost-effectiveness and wide availability. However, the demand for rugs is anticipated to grow steadily due to their versatility and design flexibility.

By Application: The residential sector is expected to be the largest application segment, driven by growing homeownership rates and renovation activities. The commercial sector will also witness significant growth due to increasing infrastructural development.

By Distribution Channel: Retail channels will maintain their dominance, although online sales are gaining traction, enhancing consumer accessibility and fostering growth.

By Country: Germany, the United Kingdom, and France are expected to remain the leading national markets due to large populations, substantial construction activities, and high disposable incomes. Detailed analysis of each country's specific market drivers and challenges is provided.

Key Drivers:

- Strong residential construction activity in several European countries.

- Increasing disposable incomes and a preference for home improvement.

- Government initiatives promoting sustainable construction practices.

Europe Carpet and Rugs Market Product Innovations

Recent product innovations focus on sustainability, improved performance, and enhanced aesthetics. Manufacturers are increasingly incorporating recycled materials, utilizing innovative manufacturing techniques to minimize waste and incorporating advanced fiber technologies for enhanced durability and stain resistance. These innovations cater to the growing demand for eco-friendly and high-performance flooring solutions. Unique selling propositions often revolve around improved sustainability credentials, increased durability, and innovative design features.

Propelling Factors for Europe Carpet and Rugs Market Growth

Several factors contribute to the growth of the European carpet and rugs market. Economic growth and rising disposable incomes are fueling demand, particularly in the residential sector. Technological advancements in manufacturing processes and material science have resulted in improved product quality and durability, thus increasing consumer appeal. Furthermore, supportive government regulations and initiatives promoting sustainable construction practices are also fostering market expansion.

Obstacles in the Europe Carpet and Rugs Market Market

The European carpet and rug market faces several challenges. Stringent environmental regulations can increase production costs and limit the use of certain materials. Supply chain disruptions, as witnessed during the COVID-19 pandemic, can impact production and availability. Furthermore, intense competition from substitute products and evolving consumer preferences pose a significant challenge.

Future Opportunities in Europe Carpet and Rugs Market

Future opportunities include expansion into niche markets, such as specialized rugs for specific applications (e.g., healthcare facilities) and further development of eco-friendly products using sustainable materials like recycled fibers and bio-based polymers. Leveraging e-commerce platforms to enhance market reach and utilizing data analytics to understand consumer trends represent further growth avenues.

Major Players in the Europe Carpet and Rugs Market Ecosystem

- Agnella SA

- Tarkett/Desso

- MoquetasRols SA

- Burmatex

- Egetaepper AS

- Balsan

- Milliken

- Fletco Carpets AS

- Creatuft NV

- Associated Weavers

- Brintons Carpets

- Balta Group

- Royal Carpet SA

Key Developments in Europe Carpet and Rugs Market Industry

- November 2021: UK-based Victoria acquired Balta Group's rugs division for GBP 117 million (USD 141.5 million), significantly altering the market landscape.

- April 2022: Milliken & Company expanded its capacity by 60% by purchasing Zebra-chem GmbH, enhancing its production capabilities and market competitiveness.

Strategic Europe Carpet and Rugs Market Market Forecast

The European carpet and rugs market is poised for continued growth, driven by sustained economic expansion, rising disposable incomes, and the ongoing development of innovative, sustainable products. The market's future trajectory will be significantly influenced by factors such as evolving consumer preferences, technological advancements, and the regulatory environment. The report projects substantial growth in the forecast period (2025-2033), presenting significant opportunities for established players and new entrants alike.

Europe Carpet and Rugs Market Segmentation

-

1. Type

- 1.1. Wall to Wall Tufted Carpets

- 1.2. Wall to Wall Woven Carpets

- 1.3. Rugs

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Contractors

- 3.2. Retail

- 3.3. Other Distibution Channels

Europe Carpet and Rugs Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Carpet and Rugs Market Regional Market Share

Geographic Coverage of Europe Carpet and Rugs Market

Europe Carpet and Rugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances

- 3.3. Market Restrains

- 3.3.1. Changing Needs of Customers; Limited Usage of the Product

- 3.4. Market Trends

- 3.4.1. Germany Accounts for a Major Percentage of the Market Share in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall to Wall Tufted Carpets

- 5.1.2. Wall to Wall Woven Carpets

- 5.1.3. Rugs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Contractors

- 5.3.2. Retail

- 5.3.3. Other Distibution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agnella SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tarkett/Desso

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MoquetasRols SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Burmatex

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Egetaepper AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Balsan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milliken

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fletco Carpets AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Creatuft NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Associated Weavers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brintons Carpets

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Balta Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Royal Carpet SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Agnella SA

List of Figures

- Figure 1: Europe Carpet and Rugs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Carpet and Rugs Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Carpet and Rugs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Carpet and Rugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Carpet and Rugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Carpet and Rugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Carpet and Rugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Carpet and Rugs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Europe Carpet and Rugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Europe Carpet and Rugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Carpet and Rugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Carpet and Rugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Carpet and Rugs Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Europe Carpet and Rugs Market?

Key companies in the market include Agnella SA, Tarkett/Desso, MoquetasRols SA, Burmatex, Egetaepper AS, Balsan, Milliken, Fletco Carpets AS, Creatuft NV, Associated Weavers, Brintons Carpets, Balta Group, Royal Carpet SA.

3. What are the main segments of the Europe Carpet and Rugs Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances.

6. What are the notable trends driving market growth?

Germany Accounts for a Major Percentage of the Market Share in the Region.

7. Are there any restraints impacting market growth?

Changing Needs of Customers; Limited Usage of the Product.

8. Can you provide examples of recent developments in the market?

November 2021: UK-based Victoria, engaged in the manufacturing of carpets and floor coverings, acquired the rugs division of Balta Group for GBP 117 million (around USD 141.5 million). Balta Group is headquartered in Belgium and is the largest manufacturer of carpets in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Carpet and Rugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Carpet and Rugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Carpet and Rugs Market?

To stay informed about further developments, trends, and reports in the Europe Carpet and Rugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence