Key Insights

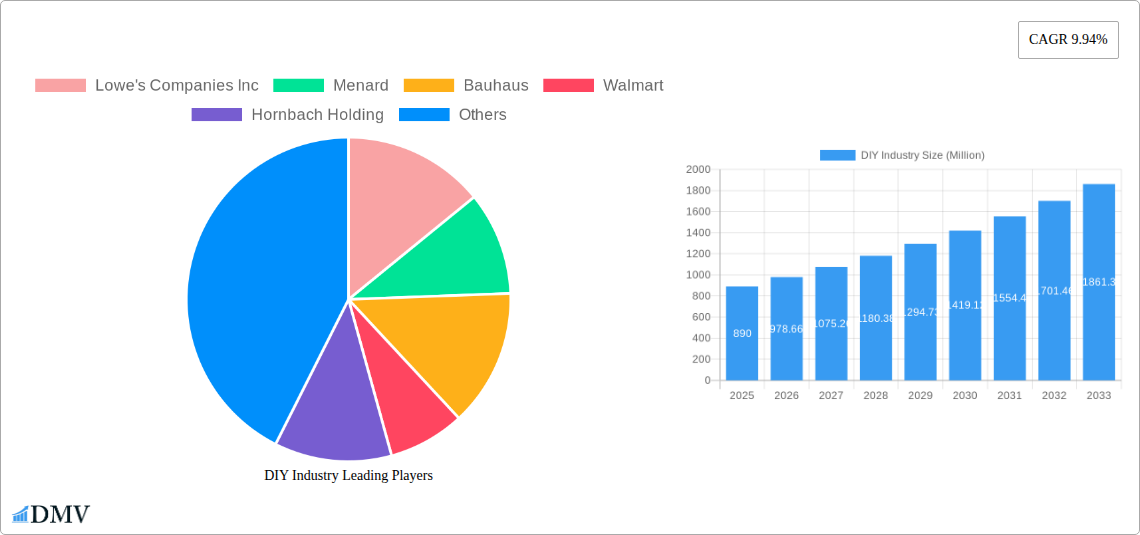

The global DIY home improvement market, valued at $890 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.94% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising homeowner population, particularly in developing economies, fuels demand for home improvement projects. Secondly, the increasing preference for personalized living spaces and aesthetic upgrades is a significant driver. Consumers are investing more in enhancing their homes' functionality and appearance, leading to increased spending on DIY projects. Thirdly, the proliferation of online retail channels and improved access to DIY tools and materials have significantly broadened market reach and convenience. The availability of how-to videos, online tutorials, and design inspiration platforms further empowers individuals to undertake DIY projects. Finally, government initiatives promoting homeownership and sustainable construction practices also contribute to market growth.

DIY Industry Market Size (In Million)

However, the market faces some challenges. Economic downturns can significantly impact discretionary spending on home improvements, leading to reduced market demand. Furthermore, the increasing complexity of some home renovation projects may deter potential DIY enthusiasts, driving them towards professional services. Competition among established players and the emergence of new entrants are also shaping the market dynamics. Growth is segmented across various product types (lumber, decor, kitchen fittings, tools, building materials etc.) and distribution channels (DIY stores, online platforms, specialty retailers). North America and Europe currently represent substantial market shares, but Asia Pacific is poised for significant growth, fueled by rising disposable incomes and urbanization. Leading players like Lowe's, Home Depot, and Kingfisher are leveraging both online and offline channels to enhance customer reach and capture market share within this competitive landscape.

DIY Industry Company Market Share

DIY Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global DIY industry, encompassing market trends, competitive landscapes, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Valuations are expressed in millions. The report offers invaluable insights for stakeholders, including manufacturers, distributors, retailers, and investors, enabling informed strategic decision-making in this dynamic market.

DIY Industry Market Composition & Trends

The global DIY market, valued at $XXX million in 2024, is characterized by a moderately concentrated landscape. Key players such as Lowe's Companies Inc, Home Depot, Kingfisher PLC, and Groupe ADEO hold significant market share, but a multitude of smaller players, including regional chains and specialty stores, contribute to the overall market dynamism. The market share distribution among these giants is approximately as follows: Home Depot (20%), Lowe's (18%), Kingfisher (15%), and Groupe ADEO (12%), with the remaining 35% shared among other players. Innovation is driven by technological advancements in smart home technology, sustainable building materials, and online platforms. Regulatory landscapes vary by region, influencing product safety and environmental standards. Substitute products, such as professional contractors' services, exert competitive pressure. End-users are diverse, including homeowners, renters, and small-scale construction projects. M&A activity is moderate, with recent deals such as the August 2023 acquisition of DIY Home Center LLC by DecksDirect (a Harbour Group company) showcasing a focus on expanding online distribution channels. The total value of M&A deals in the sector for the last five years is estimated to be $xx million.

- Market Concentration: Moderately concentrated with a few dominant players.

- Innovation Catalysts: Smart home technology, sustainable materials, online platforms.

- Regulatory Landscape: Varies regionally, impacting product safety and environmental standards.

- Substitute Products: Professional contractor services.

- End-User Profile: Homeowners, renters, small-scale construction projects.

- M&A Activity: Moderate, with a focus on online distribution expansion.

DIY Industry Industry Evolution

The DIY industry has experienced significant growth from 2019 to 2024, driven by several converging factors. The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) of approximately xx%, fueled by rising disposable incomes, increasing homeownership rates, and a growing preference for home improvement projects. Technological advancements, such as 3D printing for customized fixtures and the proliferation of online DIY tutorials and instructional videos, have empowered consumers and broadened access to DIY projects. Consumer demands are shifting towards sustainable and eco-friendly products, prompting manufacturers to innovate and offer environmentally conscious options. Furthermore, the increasing integration of smart home technologies is enhancing the appeal of DIY projects, leading to higher adoption rates and expanded market opportunities. The estimated market value in 2025 is $XXX million, with projected growth continuing at a CAGR of xx% during the forecast period (2025-2033), ultimately reaching a projected value of $XXX million by 2033. This growth trajectory is influenced by the continued rise in consumer spending on home improvements, supported by technological advancements and an evolving understanding of sustainable practices. The adoption rate of smart home technologies within DIY projects is expected to reach approximately xx% by 2033.

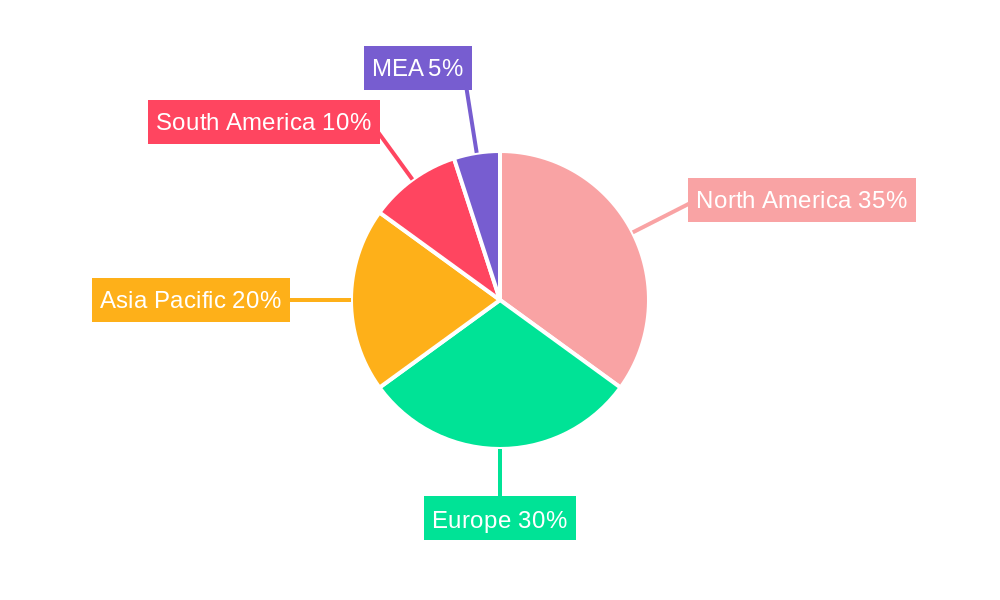

Leading Regions, Countries, or Segments in DIY Industry

The North American region currently dominates the DIY market, driven by strong consumer spending power and a robust homeownership rate. Within product types, the "Tools and Hardware" segment shows the strongest growth, particularly fueled by the increasing popularity of power tools and smart home devices. The "Building Materials" segment maintains a substantial market share due to ongoing construction and renovation activities. The online distribution channel is experiencing rapid growth, leveraging technological advancements and broader internet access. Key drivers contributing to the dominance of specific segments and channels include:

- North America (Dominant Region): High disposable incomes, strong homeownership rates.

- Tools and Hardware (Dominant Product Type): Increased popularity of power tools and smart home devices.

- Building Materials (Large Market Share): Ongoing construction and renovation activities.

- Online (Fastest Growing Distribution Channel): Technological advancements and improved internet access.

DIY Industry Product Innovations

Recent innovations include smart tools with integrated sensors and connectivity, eco-friendly building materials with recycled components, and modular kitchen systems for easy installation. These innovations enhance user experience, improve sustainability, and offer unique selling propositions compared to traditional products. Performance metrics like durability, energy efficiency, and ease of use are significantly improved.

Propelling Factors for DIY Industry Growth

The DIY industry is experiencing robust expansion fueled by a confluence of influential factors. Technological advancements are at the forefront, with the advent of intuitive tools, advanced power equipment, and smart home integration simplifying complex tasks and opening up DIY possibilities to a broader audience. Simultaneously, favorable economic conditions, characterized by increasing disposable incomes and accessible financing options, are empowering consumers to invest more confidently in home improvement projects. Furthermore, supportive regulatory environments, such as government rebates and tax credits for energy-efficient upgrades and renovations, are actively incentivizing homeowners to undertake DIY endeavors.

Obstacles in the DIY Industry Market

Despite its growth trajectory, the DIY industry navigates several significant challenges. Supply chain vulnerabilities remain a persistent concern, leading to unpredictable raw material availability and fluctuating prices, which can directly impact project costs and completion timelines. Navigating complex and evolving regulatory landscapes, including stringent building codes, zoning laws, and environmental compliance requirements, can add layers of complexity and increase project overhead. The market also faces intense competition from both established industry giants and nimble new entrants, often leading to price pressures and the need for continuous innovation to maintain market share. These combined obstacles may contribute to an estimated xx% reduction in projected growth within specific geographical areas during certain periods of the forecast horizon.

Future Opportunities in DIY Industry

The future of the DIY industry is bright with numerous opportunities. Significant potential exists in emerging markets, where a growing middle class and increasing homeownership rates present a fertile ground for DIY products and services. The integration of cutting-edge technologies like augmented reality (AR) and virtual reality (VR) offers transformative possibilities, enabling immersive project planning, visualization, and even virtual assistance, thereby elevating the overall DIY experience and spawning novel product categories. Moreover, a pronounced and accelerating consumer demand for sustainable and eco-friendly solutions presents a compelling avenue for growth, with a focus on green building materials, energy-efficient products, and waste-reducing practices poised to resonate deeply with environmentally conscious consumers.

Major Players in the DIY Industry Ecosystem

- Lowe's Companies Inc.

- Menard, Inc.

- Bauhaus AG

- Walmart Inc.

- Hornbach Holding AG

- Ace Hardware Corporation

- The Home Depot, Inc.

- Groupe ADEO

- Hagebau Handelsgesellschaft für Baustoffe mbH & Co. KG

- Travis Perkins plc

- Obi (Tengelmann Group)

- Kingfisher plc

- Crate & Barrel (part of Williams-Sonoma, Inc.)

- Maxeda DIY Group

Key Developments in DIY Industry Industry

- August 2023: DecksDirect acquired DIY Home Center LLC, expanding its online presence in building products.

- January 2024: Mahogany launched Mahogany Songs, a DIY artist distribution solution, indicating a possible indirect impact on the DIY market through music-related home projects or content creation tools.

Strategic DIY Industry Market Forecast

The DIY industry is strategically positioned for sustained and significant expansion, driven by the synergistic forces of ongoing technological innovation, rapidly evolving consumer preferences, and persistently favorable economic conditions. The untapped potential within emerging markets, coupled with the increasing mainstream adoption of sustainable building practices and smart home technologies, will undoubtedly shape the industry's future trajectory. Projections for the market value in 2033 indicate a substantial increase in overall market size, offering considerable opportunities for stakeholders who adeptly position themselves to harness these potent growth drivers and capitalize on emerging trends.

DIY Industry Segmentation

-

1. Product Type

- 1.1. Lumber and Landscape Management

- 1.2. Decor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Lighting

- 1.8. Plumbing and Equipment

- 1.9. Flooring, Repair, and Replacement

- 1.10. Electrical Work

-

2. Distribution Channel

- 2.1. DIY Home Improvement Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Furniture and Other Physical Stores

DIY Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. Japan

- 3.3. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Peru

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

DIY Industry Regional Market Share

Geographic Coverage of DIY Industry

DIY Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint

- 3.4. Market Trends

- 3.4.1. DIY Shops are Preferable Distribution Channels for the Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DIY Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lumber and Landscape Management

- 5.1.2. Decor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Lighting

- 5.1.8. Plumbing and Equipment

- 5.1.9. Flooring, Repair, and Replacement

- 5.1.10. Electrical Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Furniture and Other Physical Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America DIY Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lumber and Landscape Management

- 6.1.2. Decor and Indoor Garden

- 6.1.3. Kitchen

- 6.1.4. Painting and Wallpaper

- 6.1.5. Tools and Hardware

- 6.1.6. Building Materials

- 6.1.7. Lighting

- 6.1.8. Plumbing and Equipment

- 6.1.9. Flooring, Repair, and Replacement

- 6.1.10. Electrical Work

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. DIY Home Improvement Stores

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Furniture and Other Physical Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe DIY Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lumber and Landscape Management

- 7.1.2. Decor and Indoor Garden

- 7.1.3. Kitchen

- 7.1.4. Painting and Wallpaper

- 7.1.5. Tools and Hardware

- 7.1.6. Building Materials

- 7.1.7. Lighting

- 7.1.8. Plumbing and Equipment

- 7.1.9. Flooring, Repair, and Replacement

- 7.1.10. Electrical Work

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. DIY Home Improvement Stores

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Furniture and Other Physical Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific DIY Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lumber and Landscape Management

- 8.1.2. Decor and Indoor Garden

- 8.1.3. Kitchen

- 8.1.4. Painting and Wallpaper

- 8.1.5. Tools and Hardware

- 8.1.6. Building Materials

- 8.1.7. Lighting

- 8.1.8. Plumbing and Equipment

- 8.1.9. Flooring, Repair, and Replacement

- 8.1.10. Electrical Work

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. DIY Home Improvement Stores

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Furniture and Other Physical Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America DIY Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lumber and Landscape Management

- 9.1.2. Decor and Indoor Garden

- 9.1.3. Kitchen

- 9.1.4. Painting and Wallpaper

- 9.1.5. Tools and Hardware

- 9.1.6. Building Materials

- 9.1.7. Lighting

- 9.1.8. Plumbing and Equipment

- 9.1.9. Flooring, Repair, and Replacement

- 9.1.10. Electrical Work

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. DIY Home Improvement Stores

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Furniture and Other Physical Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa DIY Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lumber and Landscape Management

- 10.1.2. Decor and Indoor Garden

- 10.1.3. Kitchen

- 10.1.4. Painting and Wallpaper

- 10.1.5. Tools and Hardware

- 10.1.6. Building Materials

- 10.1.7. Lighting

- 10.1.8. Plumbing and Equipment

- 10.1.9. Flooring, Repair, and Replacement

- 10.1.10. Electrical Work

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. DIY Home Improvement Stores

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Furniture and Other Physical Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lowe's Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Menard

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bauhaus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Walmart

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hornbach Holding

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ace Hardware

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Home Depot

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Groupe ADEO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hagebau

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Travis Perkins

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Obi (Tengelmann)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kingfisher PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Crate and Barrel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxeda

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Lowe's Companies Inc

List of Figures

- Figure 1: Global DIY Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America DIY Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America DIY Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America DIY Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America DIY Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America DIY Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America DIY Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe DIY Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe DIY Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe DIY Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe DIY Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe DIY Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe DIY Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific DIY Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific DIY Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific DIY Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific DIY Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific DIY Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific DIY Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America DIY Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America DIY Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America DIY Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America DIY Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America DIY Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America DIY Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa DIY Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa DIY Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa DIY Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa DIY Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa DIY Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa DIY Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global DIY Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global DIY Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global DIY Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global DIY Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global DIY Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Brazil DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Peru DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global DIY Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global DIY Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global DIY Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Saudi Arabia DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Arab Emirates DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa DIY Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DIY Industry?

The projected CAGR is approximately 9.94%.

2. Which companies are prominent players in the DIY Industry?

Key companies in the market include Lowe's Companies Inc, Menard, Bauhaus, Walmart, Hornbach Holding, Ace Hardware, Home Depot, Groupe ADEO, Hagebau, Travis Perkins, Obi (Tengelmann), Kingfisher PLC, Crate and Barrel, Maxeda.

3. What are the main segments of the DIY Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends.

6. What are the notable trends driving market growth?

DIY Shops are Preferable Distribution Channels for the Industry.

7. Are there any restraints impacting market growth?

Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint.

8. Can you provide examples of recent developments in the market?

January 2024: Mahogany, the global music brand behind video channels Mahogany Sessions, COVERS, and Lagoon, partnered with Believe, a digital music firm based in France, for an extended period. The collaboration is a launchpad for Mahogany Songs, the company's DIY artist distribution solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DIY Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DIY Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DIY Industry?

To stay informed about further developments, trends, and reports in the DIY Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence