Key Insights

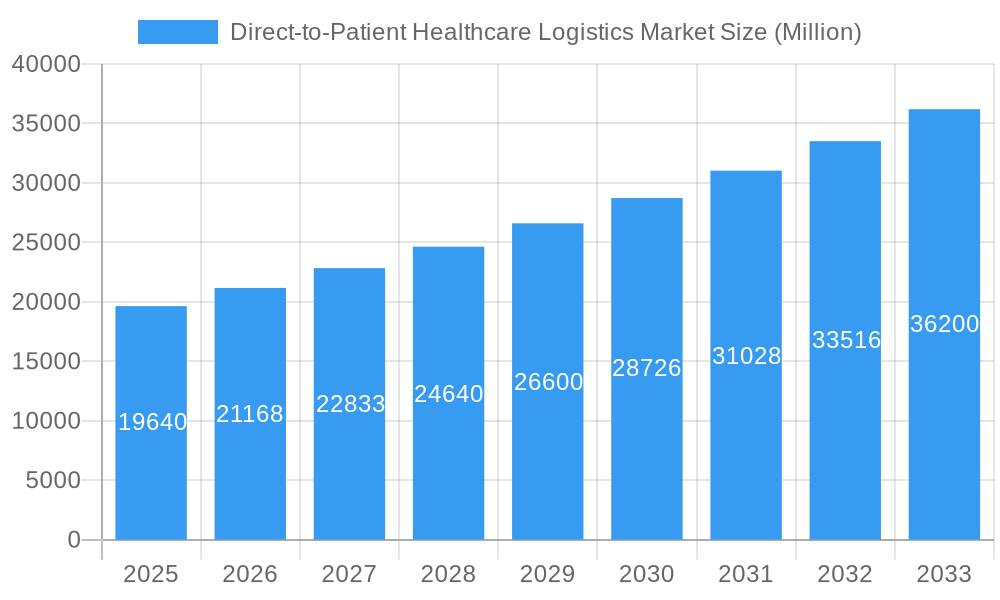

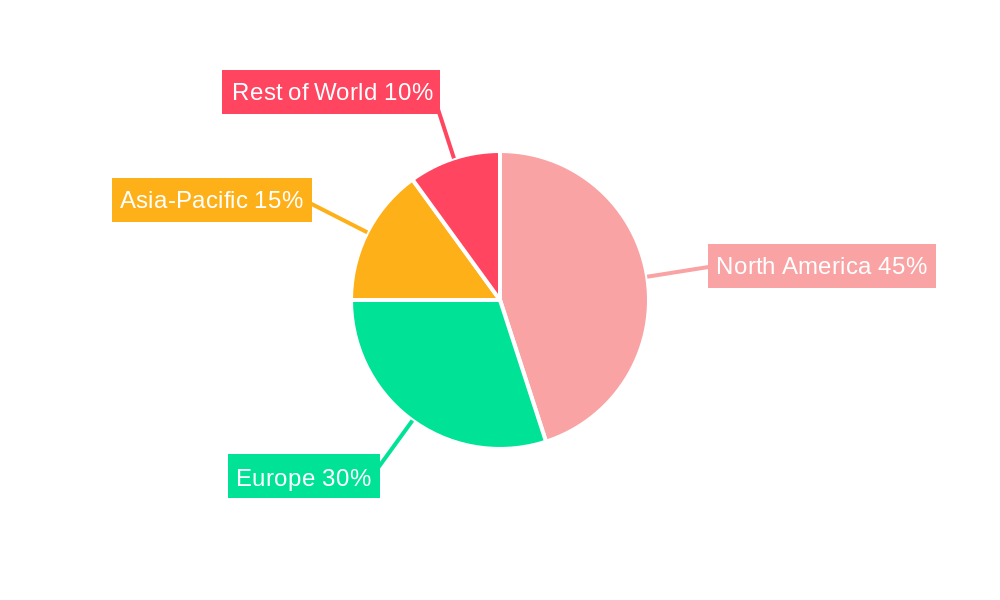

The Direct-to-Patient (DTP) Healthcare Logistics market is experiencing robust growth, projected to reach \$19.64 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 7.89% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of chronic diseases necessitates consistent medication delivery, fueling demand for reliable DTP solutions. Furthermore, the increasing adoption of telehealth and remote patient monitoring necessitates efficient logistics for test sample collection and the delivery of prescribed medications, clinical trial supplies, and home healthcare kits. The convenience and personalized care offered by DTP models are also significantly impacting market growth, particularly among aging populations and those in geographically remote areas. Technological advancements, such as real-time tracking and temperature-controlled packaging, enhance the safety and efficacy of DTP logistics, further bolstering market expansion. Competition is fierce, with established players like Marken and Teladoc Health Inc. alongside emerging companies like Avera eCARE and Practo Technologies Private Limited vying for market share. The market is segmented by product type (prescribed medicine delivery, pre-clinical supplies, etc.), temperature requirements (ambient, chilled, frozen, cryogenic), and geographic region, reflecting diverse needs and logistical challenges across the globe. North America currently holds a significant market share, followed by Europe and the Asia-Pacific region, but growth is expected across all regions due to increasing healthcare expenditure and technological adoption.

Direct-to-Patient Healthcare Logistics Market Market Size (In Billion)

The significant market size and CAGR indicate a lucrative opportunity for investors and stakeholders in the DTP healthcare logistics sector. While challenges remain, such as stringent regulatory compliance and the need for robust infrastructure in certain regions, the overall outlook for the market is overwhelmingly positive. The continued convergence of telehealth, remote patient monitoring, and advanced logistics technologies will further drive market expansion in the coming years. The focus on enhancing patient experience and improving healthcare accessibility across different demographics and geographic locations will remain a key driver. Companies will need to differentiate themselves through innovative solutions, strong technological capabilities, and reliable service delivery to succeed in this competitive market.

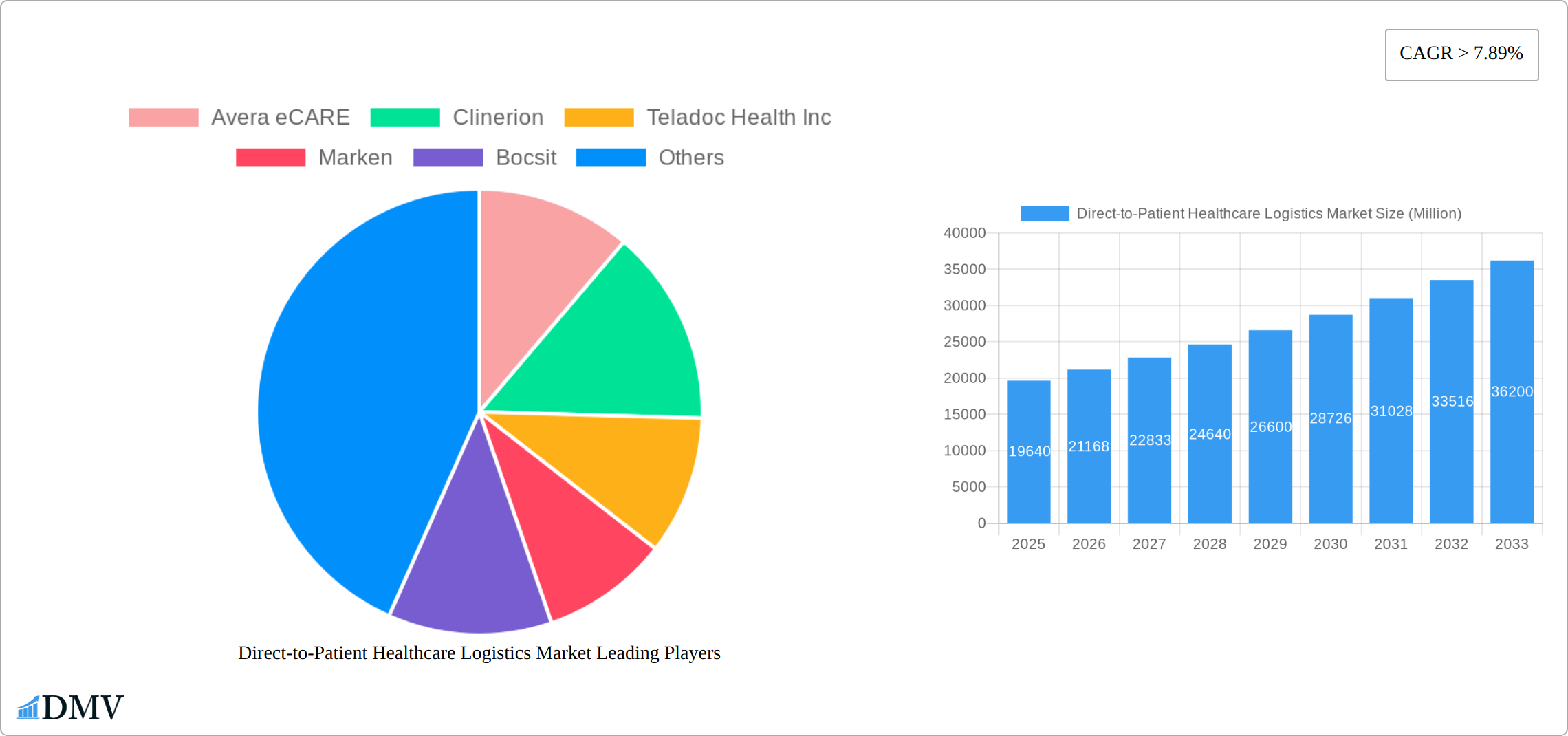

Direct-to-Patient Healthcare Logistics Market Company Market Share

Direct-to-Patient Healthcare Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Direct-to-Patient (DTP) Healthcare Logistics market, offering a detailed understanding of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report is essential for stakeholders seeking to navigate this rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Direct-to-Patient Healthcare Logistics Market Market Composition & Trends

The DTP Healthcare Logistics market is characterized by a moderately concentrated landscape with key players vying for market share. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the total market share in 2025. Innovation is driven by advancements in temperature-controlled packaging, real-time tracking technologies, and automated logistics solutions. Stringent regulatory frameworks, particularly concerning data privacy and drug safety, significantly impact market operations. Substitute products, such as traditional in-person healthcare delivery models, continue to compete with the growing convenience and accessibility of DTP services. The market is primarily driven by end-users including hospitals, pharmaceutical companies, and individual patients seeking efficient and personalized healthcare solutions. Significant M&A activity is observed, with deal values totaling approximately xx Million in the last 5 years.

- Market Share Distribution (2025): Top 5 players: xx%; Others: xx%

- M&A Deal Values (2020-2024): Approximately xx Million

- Key Innovation Catalysts: AI-powered logistics, IoT-enabled tracking, personalized medicine delivery.

- Regulatory Landscape: Stringent regulations on data security, cold chain maintenance, and drug handling.

Direct-to-Patient Healthcare Logistics Market Industry Evolution

The Direct-to-Patient (DTP) Healthcare Logistics market is undergoing a transformative evolution, propelled by the accelerating adoption of telehealth, the precision of personalized medicine, and the increasing preference for home-based healthcare services. Historically, the period spanning 2019-2024 has seen robust expansion, characterized by a Compound Annual Growth Rate (CAGR) of **[Insert CAGR Here for 2019-2024]**%. This growth was underpinned by significant technological advancements in supply chain management, coupled with a strong consumer desire for more accessible and convenient healthcare solutions. Looking ahead to the forecast period of 2025-2033, the market is projected to maintain its upward trajectory, with an anticipated CAGR of **[Insert CAGR Here for 2025-2033]**%. This growth is expected to be particularly pronounced in emerging markets. Innovations such as sophisticated temperature-controlled packaging and AI-driven route optimization are not only enhancing operational efficiency and reliability but also actively driving market expansion. The increasing global prevalence of chronic diseases, coupled with a burgeoning aging population, represents a fundamental driver for DTP logistics. Furthermore, substantial investments in digital health infrastructure and the implementation of supportive government policies across various regions are contributing to this positive trend. Consumers are increasingly seeking seamless, integrated healthcare experiences that prioritize convenience and tailored solutions, thus accelerating the adoption of DTP logistics services.

Leading Regions, Countries, or Segments in Direct-to-Patient Healthcare Logistics Market

North America currently dominates the DTP Healthcare Logistics market, driven by robust healthcare infrastructure, high adoption rates of telehealth, and a significant investment in digital health technologies. Europe follows closely, with significant growth anticipated in Western European countries. The Asia-Pacific region is emerging as a high-growth market due to increasing healthcare expenditure and rising awareness of convenient healthcare solutions.

- Key Drivers:

- North America: High technological adoption, advanced healthcare infrastructure, substantial private investment.

- Europe: Growing telehealth adoption, favorable regulatory environment, focus on improving patient experience.

- Asia-Pacific: Rising healthcare spending, increasing smartphone penetration, growing elderly population.

- By Product: Prescribed medicine delivery holds the largest market share due to high demand, followed by clinical trial supplies.

- By Temperature Type: Chilled/Refrigerated segment leads due to the majority of pharmaceutical products requiring temperature control during transportation.

Direct-to-Patient Healthcare Logistics Market Product Innovations

Recent innovations include the development of smart packaging with integrated sensors for real-time temperature monitoring and automated delivery systems. These advancements enable enhanced drug safety, improved tracking capabilities, and optimized delivery routes, ultimately improving the efficiency and reliability of DTP healthcare logistics. The integration of AI and machine learning facilitates predictive analytics, enabling proactive management of potential supply chain disruptions. These innovations provide unique selling propositions by enhancing delivery reliability and improving overall patient experience.

Propelling Factors for Direct-to-Patient Healthcare Logistics Market Growth

The expansion of the DTP Healthcare Logistics market is significantly influenced by a confluence of potent factors. Cutting-edge technological advancements, including AI-powered route optimization and Internet of Things (IoT) enabled real-time tracking, are instrumental in elevating operational efficiency and ensuring unwavering reliability. The escalating global healthcare expenditure is a direct catalyst, driving a heightened demand for sophisticated and efficient healthcare delivery solutions. Moreover, the presence of favorable regulatory frameworks in numerous countries is actively endorsing the growth of telehealth and home healthcare services, thereby further stimulating market expansion. Illustrative examples include forward-thinking government initiatives designed to promote digital health adoption and strategic investments aimed at developing robust healthcare infrastructure.

Obstacles in the Direct-to-Patient Healthcare Logistics Market Market

Challenges include stringent regulatory compliance requirements, potential supply chain disruptions due to unforeseen events (like pandemics), and intense competition among existing and emerging players. These factors can impact operational efficiency and profitability. The need for significant investment in technology and infrastructure also represents a considerable barrier to entry for new players. Furthermore, maintaining the cold chain integrity for temperature-sensitive products remains a significant challenge across certain regions.

Future Opportunities in Direct-to-Patient Healthcare Logistics Market

The future landscape of the DTP Healthcare Logistics market is rich with opportunities. A key area for expansion lies in penetrating untapped markets, particularly within developing economies. The exploration and adoption of nascent technologies such as drone delivery and autonomous vehicles promise to revolutionize logistical efficiency. Furthermore, the integration of blockchain technology is poised to significantly enhance supply chain security and transparency, opening up new avenues for growth. The continuous evolution and expansion of the personalized medicine sector present a substantial growth potential. Additionally, the increasing emphasis on integrating patient data to facilitate more effective and proactive care delivery offers further promising opportunities for innovation and market development.

Major Players in the Direct-to-Patient Healthcare Logistics Market Ecosystem

- Avera eCARE

- Clinerion

- Teladoc Health Inc

- Marken

- Bocsit

- Access TeleCare

- Practo Technologies Private Limited

- Babylon Health

- AMD Global Telemedicine

- Dropoff

- Axs Healthcare

- Hims & Hers Health Inc

- [List of other significant players or indicate the scale of the ecosystem]

Key Developments in Direct-to-Patient Healthcare Logistics Market Industry

- November 2023: UPS acquired MNX Global Logistics, expanding its time-critical logistics capabilities for healthcare customers in the US, Europe, and Asia.

- June 2023: SkyCell partnered with Marken to provide advanced shipping solutions for clinical trials using temperature-controlled containers.

Strategic Direct-to-Patient Healthcare Logistics Market Market Forecast

The DTP Healthcare Logistics market is strongly positioned for sustained and significant growth. This expansion will be propelled by ongoing technological innovation, a surging demand for convenient and accessible healthcare solutions, and the establishment of supportive regulatory frameworks. The market's future potential is considerable, with substantial opportunities awaiting in emerging markets and through the adoption of pioneering technologies. Continued strategic investment in infrastructure development and the advancement of technological capabilities will be paramount to fully realizing this potential. The market's trajectory is expected to be profoundly shaped by critical factors such as the increasing incidence of chronic diseases, the widespread adoption of telehealth and remote patient monitoring, and the growing need for highly efficient drug delivery systems.

Direct-to-Patient Healthcare Logistics Market Segmentation

-

1. Product

- 1.1. Prescribed Medicine Delivery

- 1.2. Pre-Clinical Supplies

- 1.3. Clinical Trial Supplies

- 1.4. Home Trial Support

- 1.5. Test Samples Collection

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled/Refrigerated

- 2.3. Frozen

- 2.4. Cryogenic

Direct-to-Patient Healthcare Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Direct-to-Patient Healthcare Logistics Market Regional Market Share

Geographic Coverage of Direct-to-Patient Healthcare Logistics Market

Direct-to-Patient Healthcare Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming Telehealth to Fuel Market

- 3.3. Market Restrains

- 3.3.1. Legal Restrictions

- 3.4. Market Trends

- 3.4.1. Increase in Prescribed Medicine Delivery Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Prescribed Medicine Delivery

- 5.1.2. Pre-Clinical Supplies

- 5.1.3. Clinical Trial Supplies

- 5.1.4. Home Trial Support

- 5.1.5. Test Samples Collection

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled/Refrigerated

- 5.2.3. Frozen

- 5.2.4. Cryogenic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Prescribed Medicine Delivery

- 6.1.2. Pre-Clinical Supplies

- 6.1.3. Clinical Trial Supplies

- 6.1.4. Home Trial Support

- 6.1.5. Test Samples Collection

- 6.2. Market Analysis, Insights and Forecast - by Temperature Type

- 6.2.1. Ambient

- 6.2.2. Chilled/Refrigerated

- 6.2.3. Frozen

- 6.2.4. Cryogenic

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Prescribed Medicine Delivery

- 7.1.2. Pre-Clinical Supplies

- 7.1.3. Clinical Trial Supplies

- 7.1.4. Home Trial Support

- 7.1.5. Test Samples Collection

- 7.2. Market Analysis, Insights and Forecast - by Temperature Type

- 7.2.1. Ambient

- 7.2.2. Chilled/Refrigerated

- 7.2.3. Frozen

- 7.2.4. Cryogenic

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Prescribed Medicine Delivery

- 8.1.2. Pre-Clinical Supplies

- 8.1.3. Clinical Trial Supplies

- 8.1.4. Home Trial Support

- 8.1.5. Test Samples Collection

- 8.2. Market Analysis, Insights and Forecast - by Temperature Type

- 8.2.1. Ambient

- 8.2.2. Chilled/Refrigerated

- 8.2.3. Frozen

- 8.2.4. Cryogenic

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Prescribed Medicine Delivery

- 9.1.2. Pre-Clinical Supplies

- 9.1.3. Clinical Trial Supplies

- 9.1.4. Home Trial Support

- 9.1.5. Test Samples Collection

- 9.2. Market Analysis, Insights and Forecast - by Temperature Type

- 9.2.1. Ambient

- 9.2.2. Chilled/Refrigerated

- 9.2.3. Frozen

- 9.2.4. Cryogenic

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Direct-to-Patient Healthcare Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Prescribed Medicine Delivery

- 10.1.2. Pre-Clinical Supplies

- 10.1.3. Clinical Trial Supplies

- 10.1.4. Home Trial Support

- 10.1.5. Test Samples Collection

- 10.2. Market Analysis, Insights and Forecast - by Temperature Type

- 10.2.1. Ambient

- 10.2.2. Chilled/Refrigerated

- 10.2.3. Frozen

- 10.2.4. Cryogenic

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avera eCARE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clinerion

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teladoc Health Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marken

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bocsit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Access TeleCare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Practo Technologies Private Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Babylon Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AMD Global Telemedicine

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dropoff

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Axs Healthcare

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hims & Hers Health Inc **List Not Exhaustive 6 3 Other Companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Avera eCARE

List of Figures

- Figure 1: Global Direct-to-Patient Healthcare Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: North America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: North America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 9: South America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 11: South America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 12: South America Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 17: Europe Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 18: Europe Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 23: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 24: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Temperature Type 2025 & 2033

- Figure 29: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 30: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 6: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 12: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 18: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 30: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 39: Global Direct-to-Patient Healthcare Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Direct-to-Patient Healthcare Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct-to-Patient Healthcare Logistics Market?

The projected CAGR is approximately > 7.89%.

2. Which companies are prominent players in the Direct-to-Patient Healthcare Logistics Market?

Key companies in the market include Avera eCARE, Clinerion, Teladoc Health Inc, Marken, Bocsit, Access TeleCare, Practo Technologies Private Limited, Babylon Health, AMD Global Telemedicine, Dropoff, Axs Healthcare, Hims & Hers Health Inc **List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Direct-to-Patient Healthcare Logistics Market?

The market segments include Product, Temperature Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Booming Telehealth to Fuel Market.

6. What are the notable trends driving market growth?

Increase in Prescribed Medicine Delivery Dominating the Market.

7. Are there any restraints impacting market growth?

Legal Restrictions.

8. Can you provide examples of recent developments in the market?

November 2023: UPS announced that it completed the acquisition of MNX Global Logistics (MNX), a global time-critical logistics provider. The acquisition closed on November 2023, following all required regulatory approvals. The acquisition of MNX expands UPS's time-critical logistics capabilities, especially for the United States, Europe, and Asia healthcare customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct-to-Patient Healthcare Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct-to-Patient Healthcare Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct-to-Patient Healthcare Logistics Market?

To stay informed about further developments, trends, and reports in the Direct-to-Patient Healthcare Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence