Key Insights

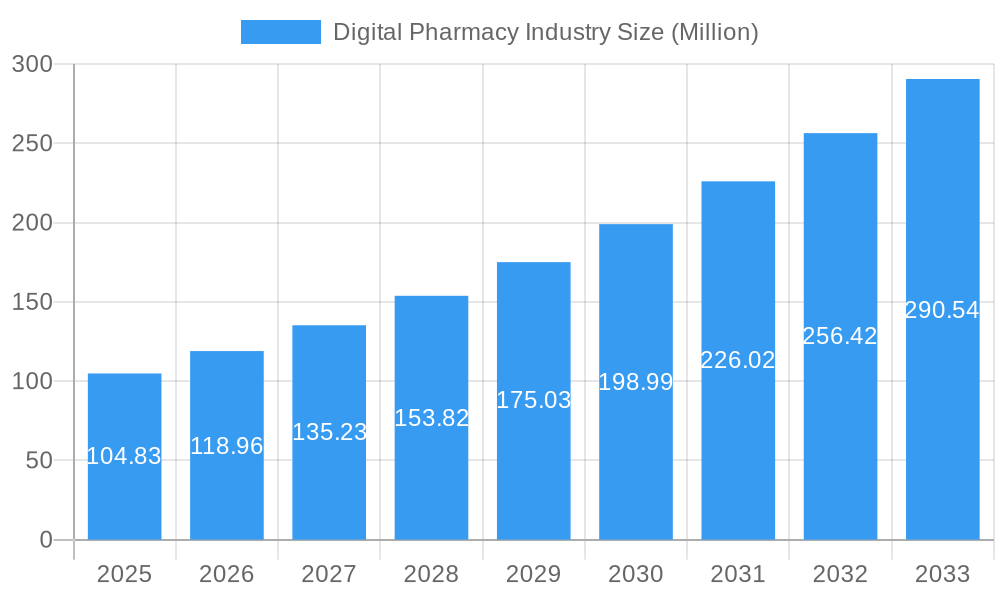

The digital pharmacy market, valued at $104.83 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.60% from 2025 to 2033. This surge is driven by several key factors. Increased consumer adoption of e-commerce for healthcare needs, coupled with the convenience and accessibility offered by online pharmacies, is a significant driver. Furthermore, technological advancements, such as telehealth integration and sophisticated prescription management systems, are streamlining the process and improving patient experience. The rising prevalence of chronic diseases and the consequent demand for regular medication refills are also contributing to market expansion. The market segmentation reveals significant opportunities across various drug types (prescription and OTC) and product categories (skincare, dental, cold & flu remedies, vitamins, weight loss supplements, and others). Major players like OptumRx, Kroger, CVS Health, and Amazon are actively shaping the market landscape through strategic acquisitions, technological innovations, and aggressive expansion into new geographical regions. Competition is intensifying, particularly with the entry of numerous online-only pharmacies and the expansion of established players into the digital space.

Digital Pharmacy Industry Market Size (In Million)

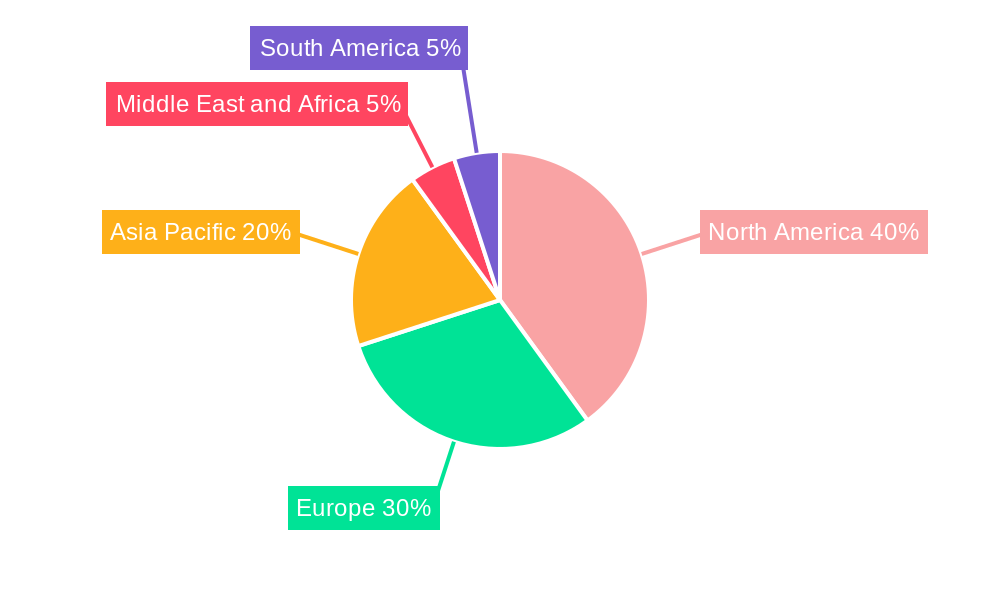

The geographical distribution of the market reflects significant regional variations in market penetration and growth potential. North America, with its established e-commerce infrastructure and high healthcare expenditure, currently holds a substantial market share. However, Asia-Pacific is poised for rapid expansion, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing awareness of online healthcare services. Europe and other regions are also witnessing significant growth, though at varying rates, influenced by factors such as regulatory environments, healthcare infrastructure, and consumer behavior. Future growth will likely be influenced by factors such as regulatory changes concerning online prescription dispensing, data privacy concerns, and the ongoing integration of artificial intelligence and machine learning in the provision of digital pharmacy services. The successful navigation of these challenges and opportunities will be crucial for continued market expansion and profitability for all stakeholders.

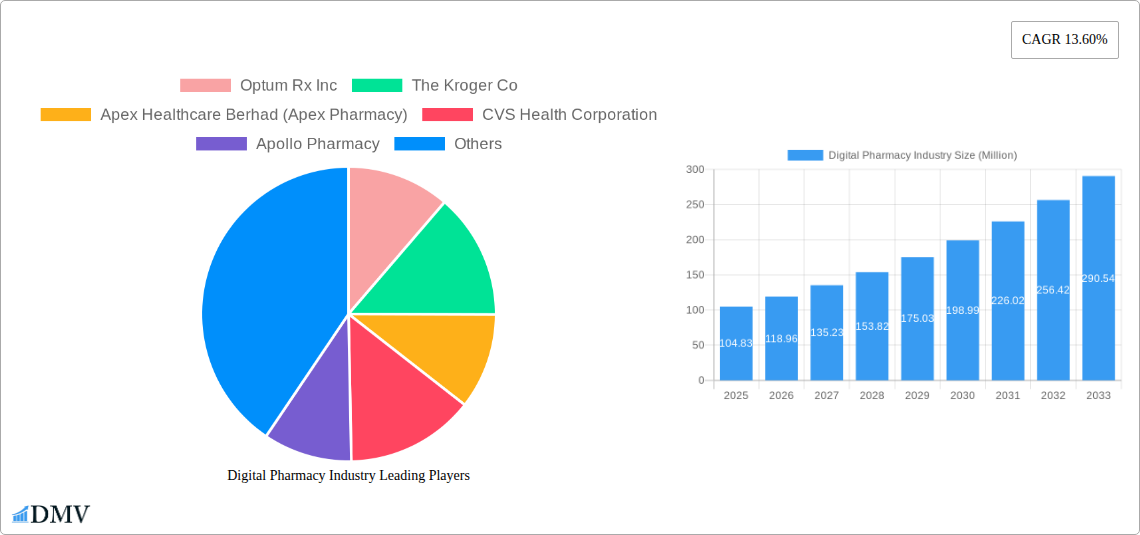

Digital Pharmacy Industry Company Market Share

Digital Pharmacy Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the digital pharmacy industry, offering valuable insights for stakeholders seeking to navigate this rapidly evolving market. With a focus on market trends, technological advancements, and competitive landscapes, this report projects a market valuation of $XXX Million by 2033, representing substantial growth from the $XXX Million recorded in 2024. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024.

Digital Pharmacy Industry Market Composition & Trends

The digital pharmacy market is characterized by a dynamic interplay of established players and emerging disruptors. Market concentration is moderate, with key players like CVS Health Corporation, Walgreens Boots Alliance, and Amazon.com Inc. holding significant shares, but numerous smaller players vying for market share. Innovation is driven by advancements in telehealth, AI-powered diagnostics, and personalized medicine, while regulatory landscapes vary widely across regions, influencing market entry and operational strategies. Substitute products, such as mail-order pharmacies, represent a competitive threat. The end-user profile is diverse, encompassing individuals, healthcare providers, and insurance companies. Mergers and acquisitions (M&A) are frequent, as evidenced by the $XX Million deal between [Insert Example M&A Deal if available, otherwise use placeholder] in [year], reflecting a consolidation trend within the sector.

- Market Share Distribution (2024): CVS Health: XX%, Walgreens Boots Alliance: XX%, Amazon.com Inc: XX%, Others: XX%

- M&A Deal Values (2019-2024): Total value exceeding $XXX Million.

- Key Market Drivers: Technological advancements, increasing internet penetration, rising demand for convenience, and government initiatives promoting telehealth.

Digital Pharmacy Industry Industry Evolution

The digital pharmacy industry has experienced explosive growth, fueled by the convergence of technological innovation and evolving consumer preferences. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of XX%, driven by factors such as increased smartphone penetration and the growing adoption of online healthcare services. Technological advancements, including mobile apps, e-prescribing systems, and AI-powered chatbots are streamlining processes and improving patient experience. Consumer demand is shifting towards convenient, personalized, and cost-effective healthcare solutions, leading to the rapid adoption of digital pharmacy services. This trend is expected to continue, with the market projected to reach $XXX Million by 2033, showcasing a CAGR of XX% during the forecast period (2025-2033). The increasing integration of telemedicine platforms with digital pharmacies is further accelerating market expansion. Adoption metrics, such as the number of online prescriptions filled, are experiencing significant year-on-year growth, indicating a strong upward trend.

Leading Regions, Countries, or Segments in Digital Pharmacy Industry

The North American market currently dominates the digital pharmacy landscape, driven by high internet penetration rates, robust healthcare infrastructure, and favorable regulatory environments. However, Asia-Pacific is experiencing rapid growth, propelled by increasing smartphone ownership and a burgeoning middle class.

- Key Drivers for North America: High healthcare expenditure, established regulatory frameworks for online pharmacies, and high adoption of telehealth services.

- Key Drivers for Asia-Pacific: Rapidly growing internet and smartphone penetration, increasing disposable incomes, and government initiatives promoting digital healthcare.

- Dominant Segment (By Drug Type): Prescription drugs account for the largest share, driven by the convenience and accessibility offered by online platforms.

- Dominant Segment (By Product Type): Prescription drugs (Within the By Product type segment) continue to dominate, with Over-the-Counter (OTC) drugs, skincare, and vitamins exhibiting strong growth.

The dominance of certain regions and segments is attributed to a combination of factors, including technological advancements, supportive government policies, and consumer preferences. The market is expected to see a shift in regional dominance with Asia-Pacific closing the gap with North America.

Digital Pharmacy Industry Product Innovations

Recent innovations include AI-powered medication adherence tools, personalized medication management platforms, and virtual consultations integrated with online pharmacies. These innovations enhance patient engagement, improve medication adherence, and offer personalized healthcare experiences. Unique selling propositions are centered on convenience, personalized service, and cost-effectiveness. Technological advancements in drug delivery systems, such as smart pill dispensers and drone delivery, are also gaining traction.

Propelling Factors for Digital Pharmacy Industry Growth

Several factors are driving the growth of the digital pharmacy industry. Technological advancements, such as mobile apps and telehealth platforms, are improving access and convenience for patients. Economic factors, including the rising cost of healthcare and the increasing demand for cost-effective solutions, are also contributing to the industry's growth. Furthermore, supportive government regulations and initiatives promoting telehealth are fostering market expansion. The increasing adoption of online healthcare services by both patients and healthcare providers is fueling this growth.

Obstacles in the Digital Pharmacy Industry Market

The digital pharmacy industry faces several challenges. Regulatory hurdles, varying significantly across jurisdictions, pose significant barriers to market entry and expansion. Supply chain disruptions, particularly during global health crises, can impact medication availability and delivery times. Intense competition from established players and new entrants also creates pressure on pricing and profitability. Data security and privacy concerns are major regulatory hurdles.

Future Opportunities in Digital Pharmacy Industry

Emerging opportunities lie in the expansion into underserved markets, particularly in developing countries. Technological advancements, such as AI-powered drug discovery and personalized medicine, will create new growth avenues. Changing consumer preferences, with an increased demand for personalized and convenient healthcare solutions, offer significant potential. Expansion into niche therapeutic areas and integration with wearable technology are also poised for future growth.

Major Players in the Digital Pharmacy Industry Ecosystem

- Optum Rx Inc

- The Kroger Co

- Apex Healthcare Berhad (Apex Pharmacy)

- CVS Health Corporation

- Apollo Pharmacy

- Axelia Solutions (Pharmeasy)

- DocMorris (Zur Rose Group AG)

- Walgreen Boots Alliance (Walgreen Co)

- Amazon com Inc

- Netmeds com

- Cigna Corporation (Express Scripts Holdings)

- Giant Eagle Inc

Key Developments in Digital Pharmacy Industry Industry

- September 2022: Amazon announced plans to sell prescription medications online in Japan, collaborating with small and medium-sized pharmacies to deliver medications directly to customers' homes.

- September 2022: Walmart Canada partnered with Canada Health Infoway, expanding access to electronic prescribing services in multiple pharmacies across Canada.

Strategic Digital Pharmacy Industry Market Forecast

The digital pharmacy industry is poised for continued growth, driven by technological innovation, evolving consumer preferences, and supportive regulatory environments. Future opportunities lie in personalized medicine, AI-powered services, and expansion into new markets. The market is expected to witness significant growth, driven by factors such as increasing smartphone penetration, rising adoption of telemedicine, and government initiatives promoting digital health. This growth will create substantial opportunities for industry players to innovate, expand their market reach, and capitalize on the rising demand for convenient and accessible healthcare solutions.

Digital Pharmacy Industry Segmentation

-

1. Drug Type

- 1.1. Prescription Drugs

- 1.2. Over-the-Counter (OTC) Drugs

-

2. Product Type

- 2.1. Skin Care

- 2.2. Dental

- 2.3. Cold and Flu

- 2.4. Vitamins

- 2.5. Weight Loss

- 2.6. Other Product Types

Digital Pharmacy Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Digital Pharmacy Industry Regional Market Share

Geographic Coverage of Digital Pharmacy Industry

Digital Pharmacy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Access to Web-based and Online Services; Rising Implementation of E-prescriptions in Hospitals and Other Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Illegal Online Pharmacies; Low Penetration in Rural Areas in Developing Countries

- 3.4. Market Trends

- 3.4.1 The Over-the-Counter Drugs Segment

- 3.4.2 under Drug Type

- 3.4.3 is Expected to Grow at the Fastest Rate during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Prescription Drugs

- 5.1.2. Over-the-Counter (OTC) Drugs

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Dental

- 5.2.3. Cold and Flu

- 5.2.4. Vitamins

- 5.2.5. Weight Loss

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. Prescription Drugs

- 6.1.2. Over-the-Counter (OTC) Drugs

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Dental

- 6.2.3. Cold and Flu

- 6.2.4. Vitamins

- 6.2.5. Weight Loss

- 6.2.6. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. Prescription Drugs

- 7.1.2. Over-the-Counter (OTC) Drugs

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Dental

- 7.2.3. Cold and Flu

- 7.2.4. Vitamins

- 7.2.5. Weight Loss

- 7.2.6. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. Prescription Drugs

- 8.1.2. Over-the-Counter (OTC) Drugs

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Dental

- 8.2.3. Cold and Flu

- 8.2.4. Vitamins

- 8.2.5. Weight Loss

- 8.2.6. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. Prescription Drugs

- 9.1.2. Over-the-Counter (OTC) Drugs

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Dental

- 9.2.3. Cold and Flu

- 9.2.4. Vitamins

- 9.2.5. Weight Loss

- 9.2.6. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Digital Pharmacy Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. Prescription Drugs

- 10.1.2. Over-the-Counter (OTC) Drugs

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Dental

- 10.2.3. Cold and Flu

- 10.2.4. Vitamins

- 10.2.5. Weight Loss

- 10.2.6. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Optum Rx Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Kroger Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Apex Healthcare Berhad (Apex Pharmacy)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CVS Health Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apollo Pharmacy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axelia Solutions (Pharmeasy)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DocMorris (Zur Rose Group AG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Walgreen Boots Alliance (Walgreen Co )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amazon com Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Netmeds com*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cigna Corporation (Express Scripts Holdings)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Giant Eagle Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Optum Rx Inc

List of Figures

- Figure 1: Global Digital Pharmacy Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Pharmacy Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 3: North America Digital Pharmacy Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 4: North America Digital Pharmacy Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Digital Pharmacy Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Digital Pharmacy Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Digital Pharmacy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Pharmacy Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 9: Europe Digital Pharmacy Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 10: Europe Digital Pharmacy Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Digital Pharmacy Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Digital Pharmacy Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Digital Pharmacy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 15: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 16: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 21: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Digital Pharmacy Industry Revenue (Million), by Drug Type 2025 & 2033

- Figure 27: South America Digital Pharmacy Industry Revenue Share (%), by Drug Type 2025 & 2033

- Figure 28: South America Digital Pharmacy Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: South America Digital Pharmacy Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: South America Digital Pharmacy Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Digital Pharmacy Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 2: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Digital Pharmacy Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 5: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 11: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 20: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 29: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 35: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Pharmacy Industry?

The projected CAGR is approximately 13.60%.

2. Which companies are prominent players in the Digital Pharmacy Industry?

Key companies in the market include Optum Rx Inc, The Kroger Co, Apex Healthcare Berhad (Apex Pharmacy), CVS Health Corporation, Apollo Pharmacy, Axelia Solutions (Pharmeasy), DocMorris (Zur Rose Group AG), Walgreen Boots Alliance (Walgreen Co ), Amazon com Inc, Netmeds com*List Not Exhaustive, Cigna Corporation (Express Scripts Holdings), Giant Eagle Inc.

3. What are the main segments of the Digital Pharmacy Industry?

The market segments include Drug Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 104.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Access to Web-based and Online Services; Rising Implementation of E-prescriptions in Hospitals and Other Healthcare Services.

6. What are the notable trends driving market growth?

The Over-the-Counter Drugs Segment. under Drug Type. is Expected to Grow at the Fastest Rate during the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Number of Illegal Online Pharmacies; Low Penetration in Rural Areas in Developing Countries.

8. Can you provide examples of recent developments in the market?

In September 2022, Amazon stated that it was planning to sell prescription medications online in Japan. To build a platform where patients can get online instructions on taking medications, it aims to collaborate with small and medium-sized pharmacies. Without visiting a pharmacy, customers could have their drugs delivered to their homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Pharmacy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Pharmacy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Pharmacy Industry?

To stay informed about further developments, trends, and reports in the Digital Pharmacy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence