Key Insights

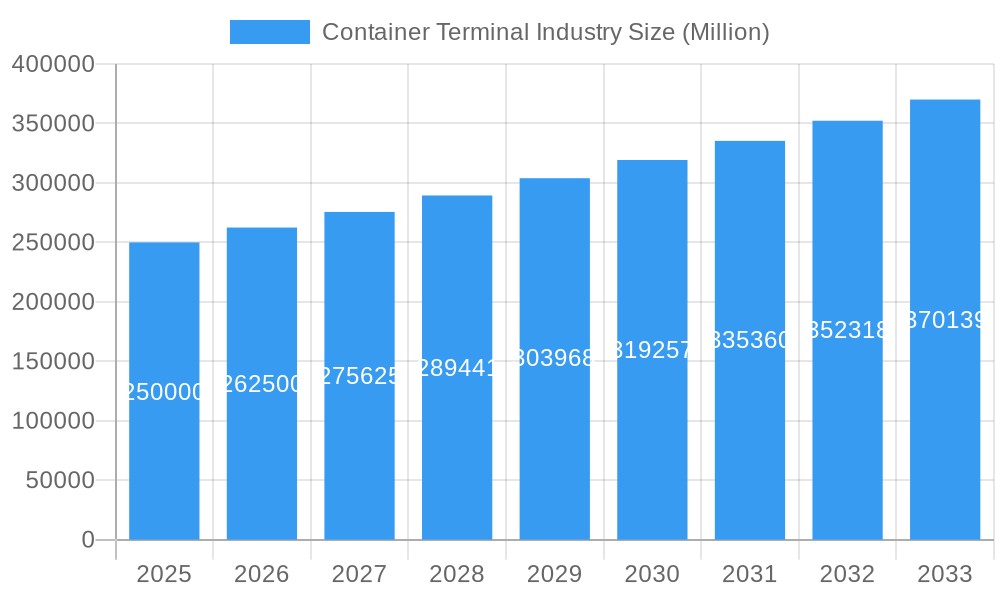

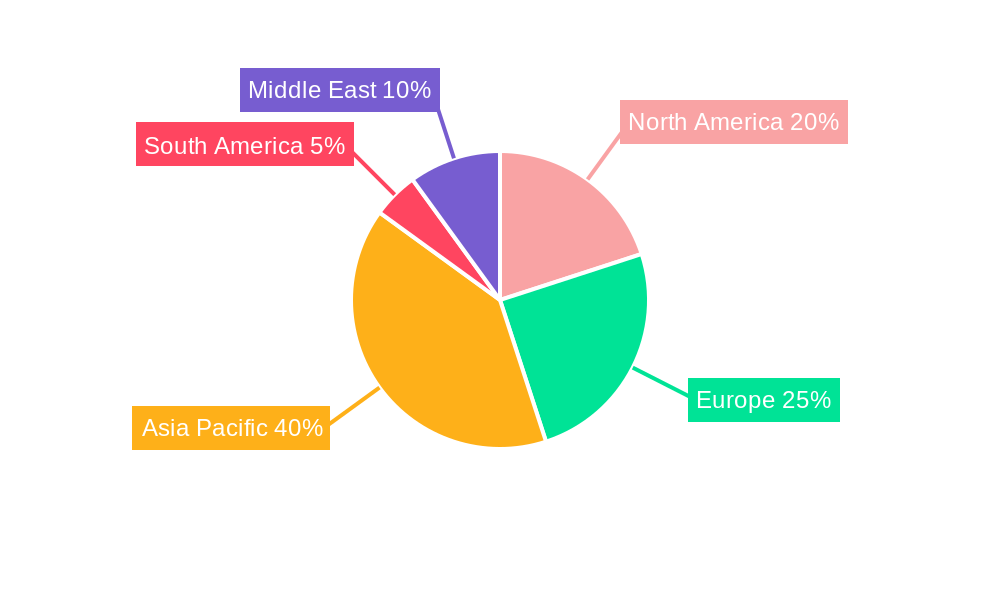

The global container terminal industry is experiencing robust growth, driven by the expansion of global trade, increasing e-commerce activities, and the ongoing development of port infrastructure. A CAGR exceeding 5% indicates a significant and sustained upward trajectory for the market, projected to reach substantial value over the forecast period (2025-2033). Key service segments include stevedoring, cargo handling and transportation, with crude oil, dry cargo, and other liquid cargo representing major cargo types. Leading players such as PSA International, DP World, and APM Terminals are shaping the competitive landscape, continuously investing in technological advancements and operational efficiency to maintain their market share. Regional growth is diverse; Asia-Pacific, fueled by rapid industrialization and rising trade volumes within and beyond the region, is expected to dominate the market. However, significant opportunities exist in North America and Europe, driven by infrastructure upgrades and ongoing expansion of port facilities to accommodate larger vessels and increasing cargo throughput. The industry faces restraints such as port congestion, geopolitical instability impacting trade routes, and the fluctuating prices of fuel and raw materials which impacts operational costs. Despite these challenges, the long-term outlook remains positive, driven by the fundamental growth of global trade and the increasing reliance on containerized shipping.

Container Terminal Industry Market Size (In Billion)

Growth in the container terminal industry is intrinsically linked to global economic health and technological advancements. The continued rise of containerization as the preferred method of transporting goods worldwide ensures consistent demand. Investments in automation, such as automated guided vehicles (AGVs) and remote-controlled cranes, are significantly improving efficiency and reducing operational costs, boosting profitability and attracting further investment. Furthermore, the implementation of sophisticated technologies like blockchain and artificial intelligence (AI) for improved supply chain transparency and optimized cargo management is expected to further enhance the industry's competitiveness. While the specific market size for 2025 and beyond requires further details, the current data strongly suggests that the container terminal industry is poised for continued expansion, offering lucrative prospects for both established players and new entrants. The industry's success will heavily depend on adaptability to technological changes, strategic infrastructure development, and effective management of operational challenges such as port congestion and labor relations.

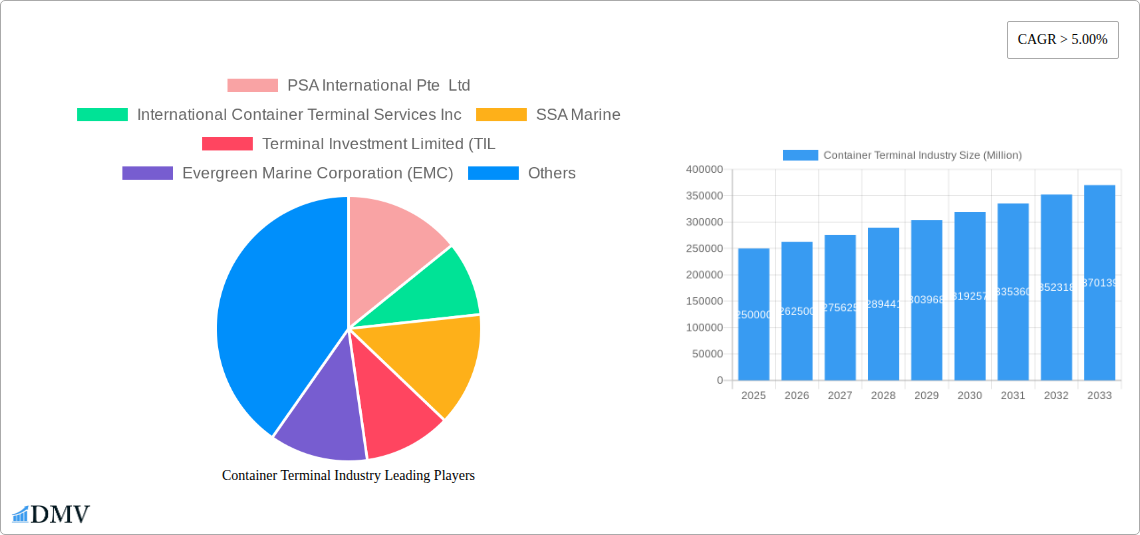

Container Terminal Industry Company Market Share

Container Terminal Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Container Terminal Industry, projecting a market valued at xx Million by 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities within this crucial sector of global trade.

Container Terminal Industry Market Composition & Trends

This section evaluates the market concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity within the container terminal industry. The analysis encompasses the historical period (2019-2024) and extends to the forecast period (2025-2033).

The container terminal industry exhibits a moderately concentrated market structure, with key players like PSA International Pte Ltd, International Container Terminal Services Inc, and DP World holding significant market share. However, regional players and smaller operators contribute significantly to overall market volume. Market share distribution varies regionally, influenced by factors such as port infrastructure development and government policies. M&A activity has played a crucial role in shaping the industry landscape. Deal values have ranged from xx Million to xx Million in recent years, driven by strategic expansion and consolidation efforts. For example, xx Million was invested by X company in the year 20XX.

- Market Concentration: Moderately concentrated, with significant regional variations.

- Innovation Catalysts: Automation, digitalization, and sustainable practices.

- Regulatory Landscape: Varies by region; influences investment and operational efficiency.

- Substitute Products: Limited direct substitutes, but competition from other transportation modes exists.

- End-User Profiles: Primarily shipping lines, freight forwarders, and importers/exporters.

- M&A Activity: Significant consolidation through acquisitions and joint ventures, with total deal values exceeding xx Million over the past five years.

Container Terminal Industry Evolution

The container terminal industry has undergone significant transformation, driven by technological advancements, evolving consumer demands, and global trade patterns. From 2019 to 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, reflecting the increasing reliance on containerized shipping for global trade. Technological advancements, such as automated guided vehicles (AGVs), remote-controlled cranes, and blockchain-based tracking systems, have improved operational efficiency and reduced costs. This has also led to a significant shift in labor requirements towards higher-skilled roles in maintenance and system management. Furthermore, increasing consumer demand for faster delivery times has exerted pressure on the industry to optimize processes and improve supply chain reliability. The forecast period (2025-2033) projects a CAGR of xx%, driven by increasing global trade volumes, infrastructure investment, and technological innovations.

Leading Regions, Countries, or Segments in Container Terminal Industry

This section identifies dominant regions, countries, and segments within the container terminal industry, focusing on "By Service" (Stevedoring, Cargo Handling & Transportation, Others) and "By Cargo Type" (Crude Oil, Dry Cargo, Other Liquid Cargo).

- By Service:

- Cargo Handling & Transportation: This segment holds the largest market share, driven by the high volume of containerized goods globally.

- Stevedoring: This represents a significant portion of the market, focused on loading and unloading containers.

- Others: This includes value-added services such as warehousing and customs brokerage.

- By Cargo Type:

- Dry Cargo: This segment dominates due to the extensive use of containers for manufactured goods and consumer products.

- Crude Oil & Other Liquid Cargo: While significant, this represents a smaller share compared to dry cargo.

Dominance Factors:

The dominance of specific regions is significantly influenced by the concentration of major ports, the level of infrastructure development, and government policies fostering economic growth and trade. Countries with strategically located ports and substantial investment in terminal infrastructure often experience higher growth rates, attracting significant foreign investment. Regulatory support and favorable trade policies play a critical role in creating a conducive environment for the industry to thrive.

Container Terminal Industry Product Innovations

Recent innovations include the adoption of autonomous vehicles, advanced port management systems, and real-time cargo tracking. These enhancements increase efficiency, enhance security, and improve data-driven decision-making. Smart sensors, big data analytics, and AI-powered solutions are being integrated into terminal operations to predict and address potential disruptions proactively. These innovations are resulting in improved turnaround times, reduced congestion, and increased overall operational efficiency, offering unique selling propositions based on speed, reliability, and cost-effectiveness.

Propelling Factors for Container Terminal Industry Growth

Several factors drive the growth of the container terminal industry:

- Technological Advancements: Automation, digitalization, and data analytics improve efficiency and reduce operational costs.

- Economic Growth: Global trade expansion increases demand for containerized shipping.

- Regulatory Support: Government investments in port infrastructure and streamlined customs procedures facilitate growth.

Obstacles in the Container Terminal Industry Market

The industry faces several challenges:

- Regulatory Hurdles: Complex regulations and varying standards across different regions can hamper expansion.

- Supply Chain Disruptions: Geopolitical events and natural disasters can significantly disrupt operations.

- Competitive Pressures: Intense competition among terminal operators requires continuous improvement and innovation.

Future Opportunities in Container Terminal Industry

The future holds several promising opportunities:

- Expansion into Emerging Markets: Growth in developing economies presents significant potential for new terminal development.

- Technological Innovation: The adoption of advanced technologies offers scope for enhanced efficiency and revenue generation.

- Sustainable Practices: Growing emphasis on reducing carbon emissions creates opportunities for environmentally-friendly solutions.

Major Players in the Container Terminal Industry Ecosystem

- PSA International Pte Ltd

- International Container Terminal Services Inc

- SSA Marine

- Terminal Investment Limited (TIL)

- Evergreen Marine Corporation (EMC)

- Hutchison Port Holdings Trust

- APM Terminals Management BV

- Dubai Ports World (DPW)

- DP World PLC

- China Merchants Port Holdings Co Ltd

- Eurogate Container Terminal Ltd

- AP Moller Maersk

Key Developments in Container Terminal Industry Industry

- June 2022: AP Moller Maersk launched "Maersk Coastal Connect," a new coastal service in New Zealand, deploying two 2,500 TEU vessels and adding 250,000 TEU annual capacity. This enhances New Zealand's supply chain resilience and connectivity.

- June 2022: TecPlata S.A. (ICTSI's Argentinian unit) partnered with Vessel S.A. to launch a new weekly service between La Plata and Montevideo ports, expanding service reach to the Gulf Region, US East Coast, Mediterranean, and Northern Europe.

Strategic Container Terminal Industry Market Forecast

The container terminal industry is poised for robust growth, driven by increasing global trade volumes, infrastructure development, and the adoption of innovative technologies. The forecast period indicates a positive outlook, with opportunities for significant expansion in emerging markets and substantial returns for early adopters of cutting-edge technologies. The industry's trajectory is characterized by steady growth, fueled by factors such as continuous improvements in operational efficiency, technological advancements, and expanding global trade.

Container Terminal Industry Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo Handling & Transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

Container Terminal Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. South Korea

- 3.7. Australia

- 3.8. Rest Of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. UAE

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Container Terminal Industry Regional Market Share

Geographic Coverage of Container Terminal Industry

Container Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Rise in Container Seaborne Trade is a Major Driver

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo Handling & Transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. UAE

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Stevedoring

- 6.1.2. Cargo Handling & Transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Crude Oil

- 6.2.2. Dry Cargo

- 6.2.3. Other Liquid Cargo

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Stevedoring

- 7.1.2. Cargo Handling & Transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Crude Oil

- 7.2.2. Dry Cargo

- 7.2.3. Other Liquid Cargo

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Stevedoring

- 8.1.2. Cargo Handling & Transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Crude Oil

- 8.2.2. Dry Cargo

- 8.2.3. Other Liquid Cargo

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Stevedoring

- 9.1.2. Cargo Handling & Transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Crude Oil

- 9.2.2. Dry Cargo

- 9.2.3. Other Liquid Cargo

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Stevedoring

- 10.1.2. Cargo Handling & Transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Crude Oil

- 10.2.2. Dry Cargo

- 10.2.3. Other Liquid Cargo

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. UAE Container Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Stevedoring

- 11.1.2. Cargo Handling & Transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Crude Oil

- 11.2.2. Dry Cargo

- 11.2.3. Other Liquid Cargo

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PSA International Pte Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 International Container Terminal Services Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SSA Marine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Terminal Investment Limited (TIL

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Evergreen Marine Corporation (EMC)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hutchison Port Holdings Trust

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 APM Terminals Management BV**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dubai Ports World (DPW)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DP World PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 China Merchants Port Holdings Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Eurogate Container Terminal Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 AP Moller Maersk

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 PSA International Pte Ltd

List of Figures

- Figure 1: Global Container Terminal Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 3: North America Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 5: North America Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 6: North America Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 9: Europe Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 11: Europe Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 12: Europe Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 15: Asia Pacific Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 17: Asia Pacific Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 18: Asia Pacific Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 21: South America Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: South America Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 23: South America Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 24: South America Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 27: Middle East Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 29: Middle East Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 30: Middle East Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: UAE Container Terminal Industry Revenue (undefined), by Service 2025 & 2033

- Figure 33: UAE Container Terminal Industry Revenue Share (%), by Service 2025 & 2033

- Figure 34: UAE Container Terminal Industry Revenue (undefined), by Cargo Type 2025 & 2033

- Figure 35: UAE Container Terminal Industry Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 36: UAE Container Terminal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: UAE Container Terminal Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: Global Container Terminal Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 5: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: US Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 11: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 12: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: UK Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Russia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 20: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 21: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: India Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: China Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Japan Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Singapore Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Malaysia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Korea Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Australia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest Of Asia Pacific Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 31: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 32: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 37: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 38: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Global Container Terminal Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 40: Global Container Terminal Industry Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 41: Global Container Terminal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Africa Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East Container Terminal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Terminal Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Container Terminal Industry?

Key companies in the market include PSA International Pte Ltd, International Container Terminal Services Inc, SSA Marine, Terminal Investment Limited (TIL, Evergreen Marine Corporation (EMC), Hutchison Port Holdings Trust, APM Terminals Management BV**List Not Exhaustive, Dubai Ports World (DPW), DP World PLC, China Merchants Port Holdings Co Ltd, Eurogate Container Terminal Ltd, AP Moller Maersk.

3. What are the main segments of the Container Terminal Industry?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Rise in Container Seaborne Trade is a Major Driver.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

On 15 June 2022, One of the leading player, AP Mollar Maersk announced it's expansion in New Zealand. Maersk is launching a new dedicated New Zealand coastal service - 'Maersk Coastal Connect', to enable a more resilient New Zealand supply chain and improve vessel schedule reliability. By deploying two 2,500 TEU container vessels, Maersk Nadi and Maersk Nansha on a weekly basis, five main ports in New Zealand, namely Timaru, Lyttelton, Nelson, Auckland and Tauranga will be called respectively in the service rotation, enhancing connectivity and providing easy access to Maersk's global network. The combined North to South and South to North capacity will reach 250,000 TEU each year. Maersk Coastal Connect will start on the 12th of July 2022. The service will be operated with New Zealand crew to support the local community and ensure continued to investment in New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Terminal Industry?

To stay informed about further developments, trends, and reports in the Container Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence