Key Insights

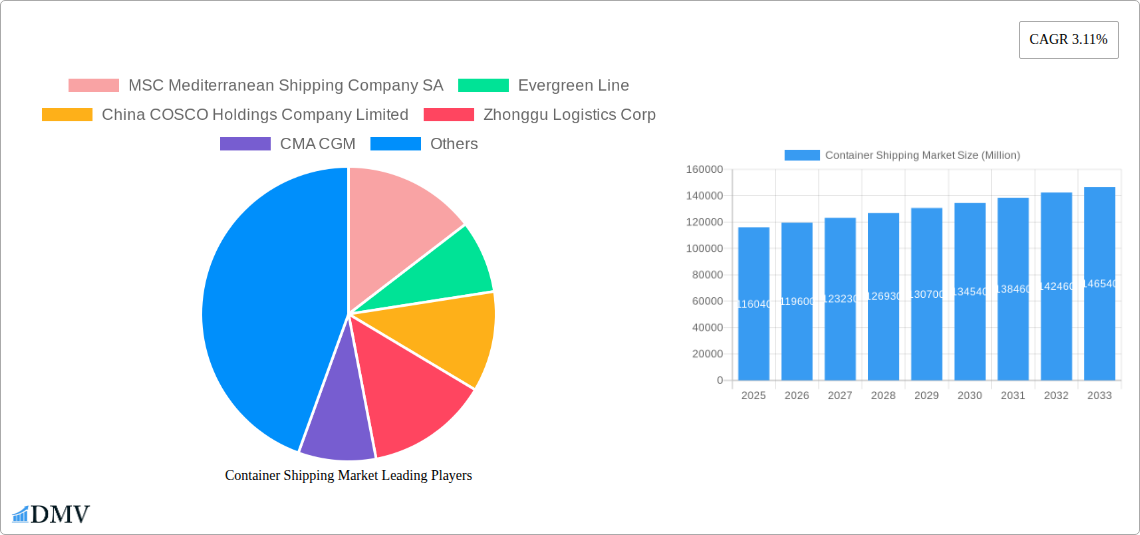

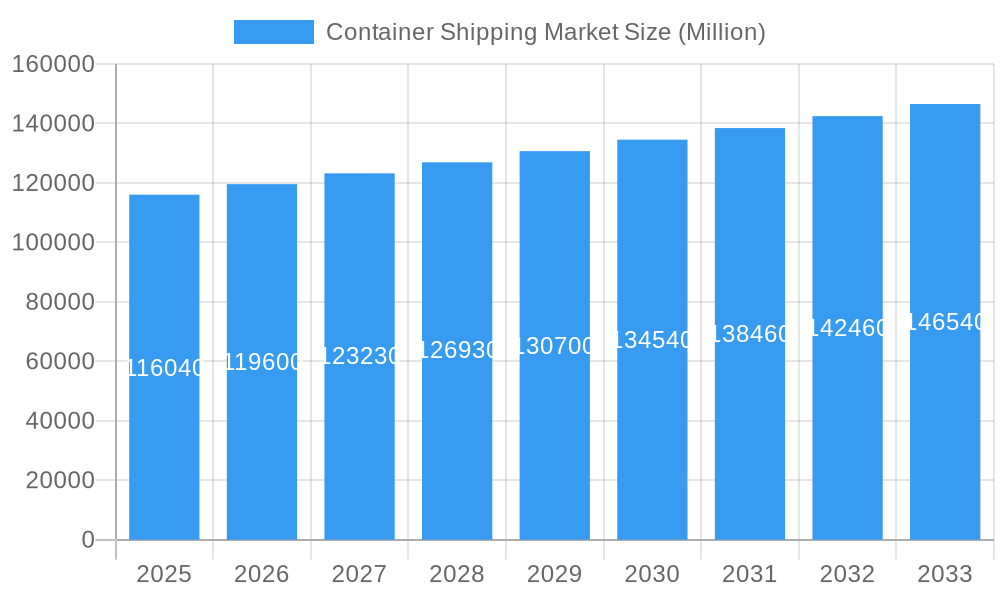

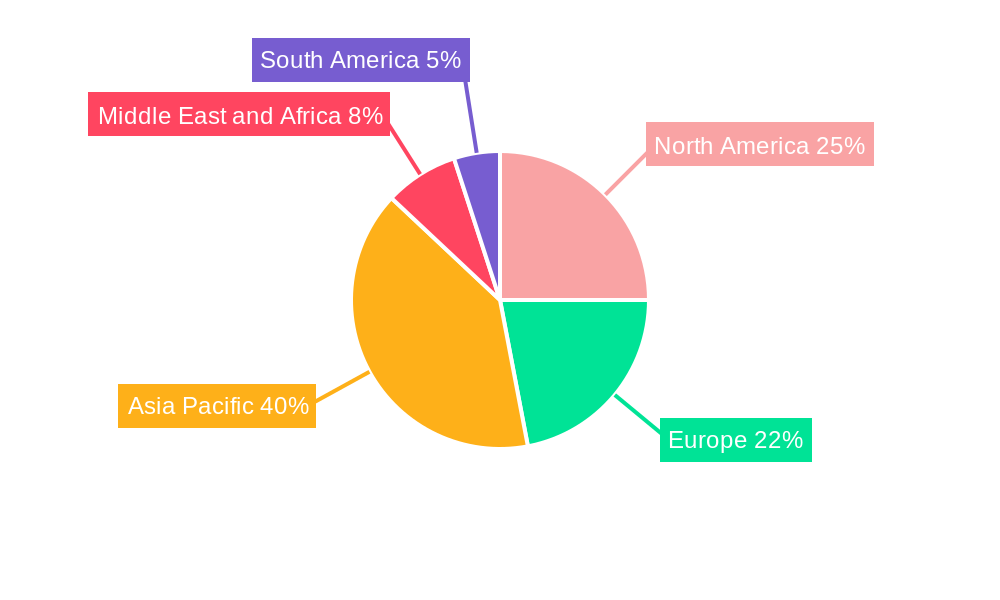

The global container shipping market, valued at $116.04 billion in 2025, is projected to experience steady growth, driven by the increasing global trade volume and the expansion of e-commerce. A Compound Annual Growth Rate (CAGR) of 3.11% is anticipated from 2025 to 2033, indicating a continued, albeit moderate, expansion. Key market drivers include the rising demand for efficient and reliable logistics solutions across various industries, particularly manufacturing and retail. Furthermore, technological advancements in vessel automation and port operations are streamlining shipping processes and enhancing efficiency, contributing to market growth. The market is segmented by container size (small, large, high cube) and type (general cargo, reefer), with the reefer segment experiencing faster growth due to the increasing demand for temperature-sensitive goods. Geographic expansion, particularly in emerging economies in Asia-Pacific and Africa, is expected to further fuel market growth. However, factors like geopolitical instability, fluctuating fuel prices, and potential port congestion could pose challenges. Major players, including MSC, Maersk, CMA CGM, and COSCO, dominate the market, fiercely competing on pricing, service quality, and network reach. The ongoing consolidation within the industry and the focus on sustainability initiatives will shape the market landscape in the coming years.

Container Shipping Market Market Size (In Billion)

The competitive landscape is highly concentrated, with a few major players holding significant market share. These companies are continuously investing in fleet modernization, digitalization, and strategic partnerships to maintain their competitive edge. The growing emphasis on sustainable shipping practices, including the reduction of carbon emissions and adoption of eco-friendly technologies, is a significant trend impacting the market. Regulations aimed at decarbonizing the shipping industry will likely influence the choice of fuels and technologies adopted by shipping companies. Future growth will hinge on adapting to evolving global trade patterns, managing geopolitical risks, and effectively responding to evolving consumer demand. Regional variations in growth rates are expected, with faster expansion projected in developing economies experiencing rapid industrialization and urbanization.

Container Shipping Market Company Market Share

Container Shipping Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Container Shipping Market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It delves into market dynamics, competitive landscapes, and future growth prospects, offering invaluable insights for stakeholders across the shipping and logistics industries. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033.

Container Shipping Market Composition & Trends

This section analyzes the structure and trends shaping the container shipping market. We evaluate market concentration, highlighting the market share distribution amongst key players like MSC Mediterranean Shipping Company SA, Evergreen Line, China COSCO Holdings Company Limited, Zhonggu Logistics Corp, CMA CGM, ONE (Ocean Network Express), Zim, Wan Hai Lines, SITC, Antong Holdings (QASC), AP Moller-Maersk AS, and Hapag-Lloyd, along with 63 other companies. The report examines innovation drivers, including technological advancements in vessel design and port automation, and the impact of regulatory landscapes, such as environmental regulations and trade policies. We also consider substitute products and their market penetration, end-user profiles across diverse industries, and the influence of mergers and acquisitions (M&A) activities, including deal values and their impact on market concentration. For example, the acquisition of Martin Bencher Group by Maersk in January 2023 significantly expanded their project logistics capabilities.

- Market Concentration: Analysis of market share held by top 10 players.

- M&A Activity: Detailed overview of significant M&A deals (2019-2024), including deal values and their strategic implications. Examples include Maersk's acquisition of Martin Bencher and the impact of such deals on market consolidation.

- Innovation Catalysts: Discussion of technological advancements, such as autonomous vessels and digitalization of supply chains.

- Regulatory Landscape: Assessment of environmental regulations (e.g., IMO 2020) and their impact on market players.

Container Shipping Market Industry Evolution

This section provides a comprehensive overview of the container shipping market's evolution, examining growth trajectories, technological advancements, and evolving consumer demands throughout the study period (2019-2033). We analyze historical growth rates and project future growth, considering factors like global trade volume, economic fluctuations, and technological disruptions. The adoption of new technologies, like AI-powered route optimization and blockchain-based supply chain transparency, are examined for their impact on efficiency and cost reduction. The evolving demands of consumers, focusing on faster delivery times, enhanced visibility, and sustainable practices, are also analyzed in detail. The section provides quantifiable data points illustrating market growth rates, technology adoption metrics, and changes in consumer preferences.

Leading Regions, Countries, or Segments in Container Shipping Market

This section identifies the leading regions, countries, and segments within the container shipping market. We analyze dominance factors for each segment (By Size: Small, Large, High Cube Containers; By Type: General, Reefer Container Shipping) and provide a comprehensive assessment.

Dominant Regions/Countries: [Analysis of leading regions and countries, highlighting factors driving their dominance.]

- Key Drivers (e.g., Investment Trends, Regulatory Support): [Detailed analysis using bullet points for each region/country segment.]

- Dominance Factors: [In-depth analysis of the factors leading to the dominance of specific regions/countries in paragraph form.]

Dominant Segments: [Analysis of leading segments (By Size and Type), highlighting factors driving their dominance.]

- Key Drivers (e.g., Investment Trends, Regulatory Support): [Detailed analysis using bullet points for each segment.]

- Dominance Factors: [In-depth analysis of the factors leading to the dominance of specific segments in paragraph form.]

Container Shipping Market Product Innovations

This section highlights recent product innovations in container shipping, such as improvements in container design (e.g., enhanced strength, specialized containers for specific goods), advancements in container tracking and monitoring technologies, and the development of more efficient and sustainable vessels. We will analyze the unique selling propositions of these innovations and evaluate their performance metrics, discussing their impact on operational efficiency, cost reduction, and environmental sustainability.

Propelling Factors for Container Shipping Market Growth

Several factors contribute to the growth of the container shipping market. These include increasing global trade volumes driven by globalization and e-commerce, technological advancements enhancing efficiency and reducing costs (e.g., autonomous vessels, digitalization), and supportive government policies promoting infrastructure development and trade facilitation. Furthermore, the expanding adoption of reefer containers to facilitate the transportation of perishable goods fuels market expansion.

Obstacles in the Container Shipping Market

The container shipping market faces several challenges. These include fluctuations in global trade volumes due to economic downturns or geopolitical instability, port congestion leading to delays and increased costs, and intense competition amongst shipping lines leading to price pressures. Furthermore, increasing environmental regulations and the need for decarbonization impose significant costs on shipping companies. Supply chain disruptions, as exemplified by the COVID-19 pandemic, have also highlighted the vulnerability of the industry to unforeseen events. These obstacles impact profitability and overall market growth.

Future Opportunities in Container Shipping Market

Future opportunities in the container shipping market include the expansion of e-commerce and its related demand for efficient delivery solutions, the growth of specialized container shipping segments (e.g., refrigerated containers for pharmaceuticals), and the adoption of innovative technologies such as autonomous vessels and blockchain for improved supply chain transparency and security. New markets in developing economies and the growing focus on sustainability represent additional opportunities.

Major Players in the Container Shipping Market Ecosystem

- MSC Mediterranean Shipping Company SA

- Evergreen Line

- China COSCO Holdings Company Limited

- Zhonggu Logistics Corp

- CMA CGM

- ONE (Ocean Network Express)

- Zim

- Wan Hai Lines

- SITC

- Antong Holdings (QASC)

- 63 Other Companies

- AP Moller-Maersk AS

- Hapag-Lloyd

Key Developments in Container Shipping Market Industry

- January 2024: SITC and Xiamen Port Holdings Group signed a framework agreement to boost logistics cooperation, focusing on route networks, international transit, complete logistics chains, cross-border e-commerce, and digital transformation.

- May 2023: Mazagon Dock Shipbuilders entered the container manufacturing business after receiving a 2,500-unit order from CONCOR.

- January 2023: AP Moller-Maersk completed its acquisition of Martin Bencher Group, enhancing its project logistics capabilities.

Strategic Container Shipping Market Forecast

The container shipping market is poised for continued growth, driven by increasing global trade, technological advancements leading to enhanced efficiency and reduced costs, and a growing focus on sustainable practices within the industry. The adoption of new technologies, coupled with strategic partnerships and mergers and acquisitions, will shape the competitive landscape and drive future market expansion, creating considerable opportunities for established players and new entrants alike. The market's resilience to global economic fluctuations and its ability to adapt to evolving consumer demands will be key factors in determining its future trajectory.

Container Shipping Market Segmentation

-

1. Size

- 1.1. Small Containers

- 1.2. Large Containers

- 1.3. High Cube Containers

-

2. Type

- 2.1. General Container Shipping

- 2.2. Reefer Container Shipping

Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Egypt

- 4.2. Qatar

- 4.3. Saudi Arabia

- 4.4. United Arab Emirates

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Rest of South America

Container Shipping Market Regional Market Share

Geographic Coverage of Container Shipping Market

Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. Increasing high cube containers segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small Containers

- 5.1.2. Large Containers

- 5.1.3. High Cube Containers

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. General Container Shipping

- 5.2.2. Reefer Container Shipping

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small Containers

- 6.1.2. Large Containers

- 6.1.3. High Cube Containers

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. General Container Shipping

- 6.2.2. Reefer Container Shipping

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small Containers

- 7.1.2. Large Containers

- 7.1.3. High Cube Containers

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. General Container Shipping

- 7.2.2. Reefer Container Shipping

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small Containers

- 8.1.2. Large Containers

- 8.1.3. High Cube Containers

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. General Container Shipping

- 8.2.2. Reefer Container Shipping

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East and Africa Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small Containers

- 9.1.2. Large Containers

- 9.1.3. High Cube Containers

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. General Container Shipping

- 9.2.2. Reefer Container Shipping

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. South America Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small Containers

- 10.1.2. Large Containers

- 10.1.3. High Cube Containers

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. General Container Shipping

- 10.2.2. Reefer Container Shipping

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MSC Mediterranean Shipping Company SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Evergreen Line

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China COSCO Holdings Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zhonggu Logistics Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CMA CGM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ONE (Ocean Network Express)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zim

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wan Hai Lines

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SITC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AP Moller-Maersk AS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hapag-Lloyd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 MSC Mediterranean Shipping Company SA

List of Figures

- Figure 1: Global Container Shipping Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 3: North America Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 4: North America Container Shipping Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Container Shipping Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 9: Europe Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 10: Europe Container Shipping Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Container Shipping Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 15: Asia Pacific Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 16: Asia Pacific Container Shipping Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Container Shipping Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 21: Middle East and Africa Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 22: Middle East and Africa Container Shipping Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East and Africa Container Shipping Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East and Africa Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 27: South America Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 28: South America Container Shipping Market Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Container Shipping Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Container Shipping Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 2: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Container Shipping Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 5: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 12: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 20: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Singapore Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Indonesia Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Thailand Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 32: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Egypt Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: United Arab Emirates Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 41: Global Container Shipping Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Colombia Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Shipping Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the Container Shipping Market?

Key companies in the market include MSC Mediterranean Shipping Company SA, Evergreen Line, China COSCO Holdings Company Limited, Zhonggu Logistics Corp, CMA CGM, ONE (Ocean Network Express), Zim, Wan Hai Lines, SITC, Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie, AP Moller-Maersk AS, Hapag-Lloyd.

3. What are the main segments of the Container Shipping Market?

The market segments include Size, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

Increasing high cube containers segment.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

January 2024: SITC signed a framework agreement with Xiamen Port Holdings Group on January 2024, aiming to boost logistics jointly. Headquartered in Hong Kong, SITC is an intra-Asia shipping logistics company. The new agreement will see the two parties focus their cooperation on route network layout, international transit, complete logistics service chain, cross-border e-commerce, hinterland cargo source expansion, port intelligence, and digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Shipping Market?

To stay informed about further developments, trends, and reports in the Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence