Key Insights

The Colombian Third-Party Logistics (3PL) market is demonstrating substantial expansion, driven by the surge in e-commerce, escalating supply chain complexity, and a growing demand for efficient logistics solutions across various industries. Projected to achieve a Compound Annual Growth Rate (CAGR) of 8.1% and estimated at 1.27 billion in 2025, the industry offers significant opportunities for both domestic and international stakeholders. Key growth catalysts include the thriving Fast-Moving Consumer Goods (FMCG) sector, particularly in beauty and personal care, beverages, and home care, alongside the rapid growth of e-commerce retail. The automotive and technology sectors also represent substantial demand drivers for advanced 3PL services, including value-added warehousing and distribution. Domestic transportation management is likely a dominant market segment due to its direct relevance to Colombian businesses. The increasing requirement for specialized services, such as refrigerated transport for temperature-sensitive pharmaceuticals and perishable foods, further fuels market growth.

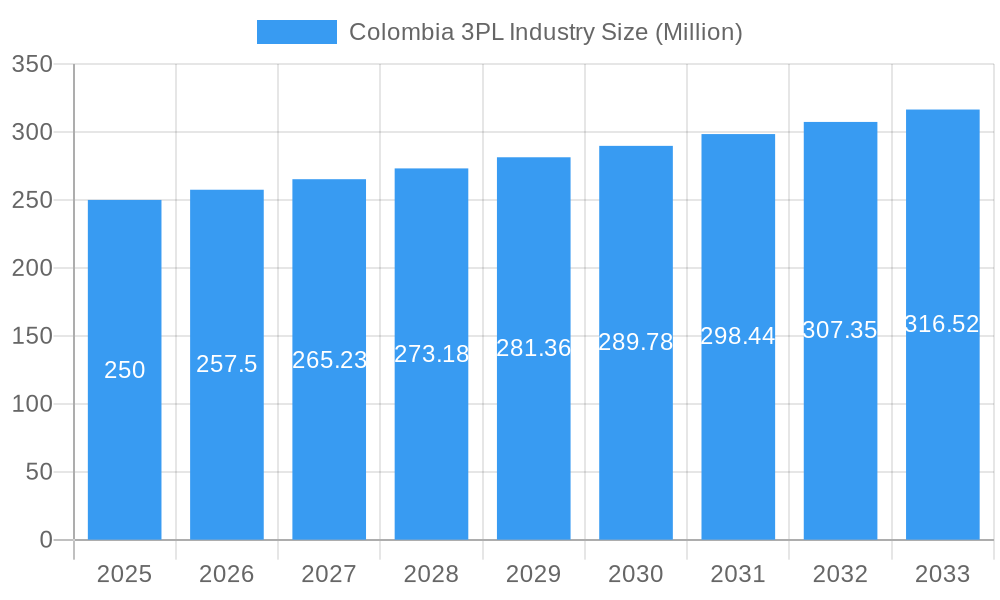

Colombia 3PL Industry Market Size (In Billion)

Despite positive growth indicators, the Colombian 3PL market encounters obstacles. Infrastructure limitations, particularly outside major urban centers, and the necessity for enhanced technological adoption to improve supply chain visibility and efficiency pose potential constraints. Intense competition from established entities such as Coordinadora Mercantil SA, DHL, and Kuehne + Nagel, alongside regional and local providers, mandates continuous innovation and strategic alliances. The burgeoning e-commerce landscape requires significant investment in last-mile delivery and robust order fulfillment capabilities, crucial for market success. Government initiatives in infrastructure development and regulatory simplification will significantly influence the industry's future trajectory. Strategic focus on niche segments, including specialized refrigerated transport or tailored industry-specific solutions, presents a promising avenue for market players.

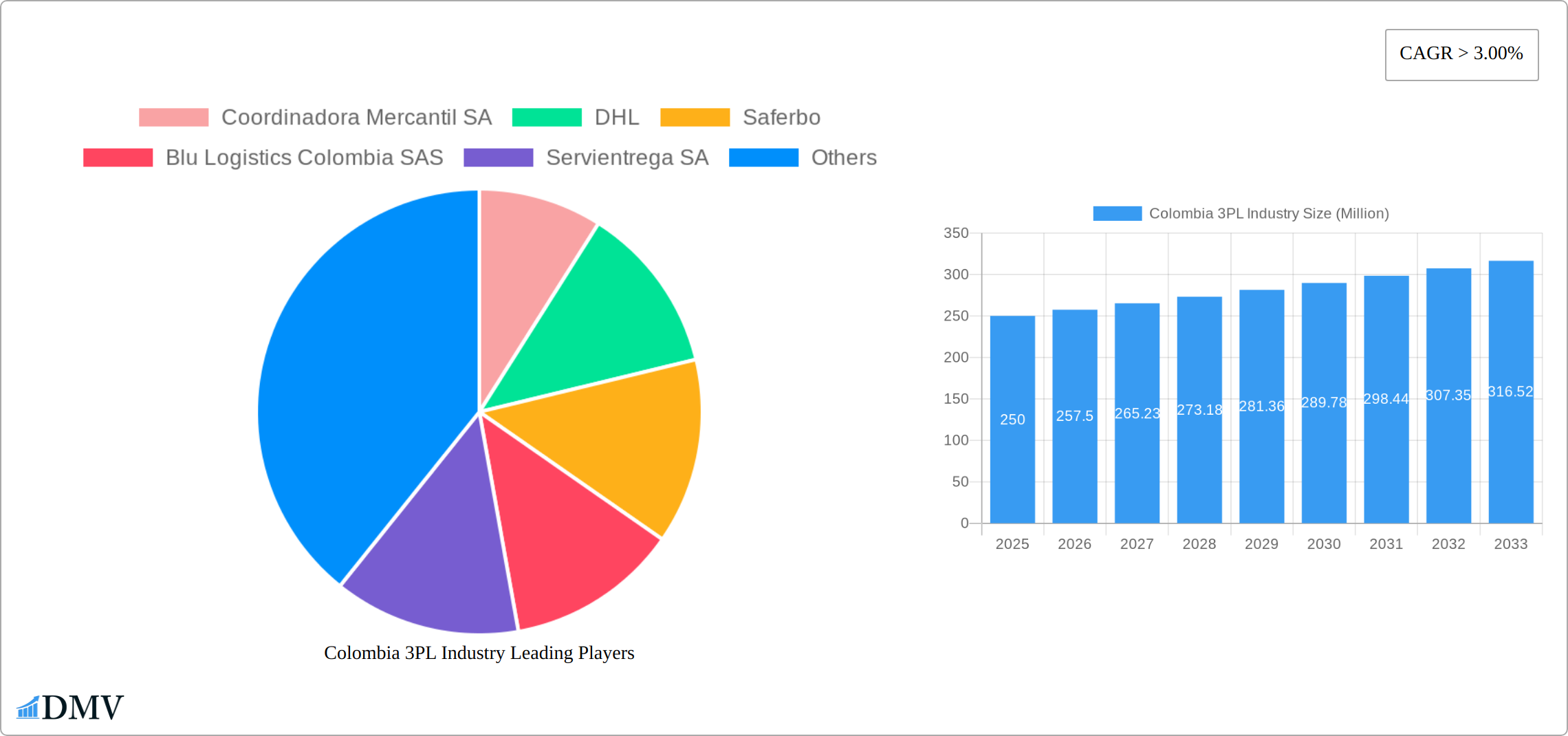

Colombia 3PL Industry Company Market Share

Colombia 3PL Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Colombia 3PL (Third-Party Logistics) industry, offering invaluable market intelligence for stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the key trends, growth drivers, and challenges shaping this dynamic sector. With a market size projected to reach XX Million by 2025 and continuing to grow, understanding this market is crucial for businesses seeking investment and expansion opportunities within Colombia.

Colombia 3PL Industry Market Composition & Trends

This section delves into the competitive landscape of the Colombian 3PL market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activity. The report details the market share distribution amongst key players like Coordinadora Mercantil SA, DHL, Saferbo, Blu Logistics Colombia SAS, Servientrega SA, EGA - KAT, Kuehne + Nagel, Icoltrans, TCC SAS, and Almaviva (list not exhaustive), providing a comprehensive understanding of the industry's structure. We analyze M&A activity, assessing the value of deals and their impact on market consolidation. Further, the report explores the influence of regulatory changes and the emergence of substitute products on market dynamics. The analysis includes detailed profiling of end-users across diverse sectors, including automotive, FMCG, retail, fashion, technology, and reefer logistics. The report also evaluates the impact of innovation on the market, considering advancements in technology and their adoption rates. The market size in 2025 is estimated at XX Million.

- Market Concentration: XX% of the market is controlled by the top 5 players.

- M&A Activity (2019-2024): Total deal value estimated at XX Million.

- Innovation Catalysts: Focus on technology adoption (e.g., AI, blockchain) and sustainable practices.

- Regulatory Landscape: Analysis of relevant Colombian regulations and their influence.

- Substitute Products: Assessment of alternative solutions and their market penetration.

Colombia 3PL Industry Industry Evolution

This section provides a comprehensive analysis of the evolution of the Colombia 3PL industry from 2019 to 2033. We examine the market's growth trajectory, highlighting key periods of expansion and contraction. Technological advancements, such as the adoption of Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), are analyzed for their impact on efficiency and cost reduction. The report also explores how evolving consumer demands, including increased expectations for speed, transparency, and sustainability, are shaping the industry. We examine growth rates and adoption metrics for key technologies and highlight significant shifts in market dynamics over time. The report forecasts a compound annual growth rate (CAGR) of XX% from 2025 to 2033, reaching a projected market value of XX Million.

Leading Regions, Countries, or Segments in Colombia 3PL Industry

This section analyzes the dominant regions, countries, and segments within Colombia's dynamic 3PL market. We delve into market share and growth rates for each key service area—Domestic Transportation Management, International Transportation Management, and Value-added Warehousing and Distribution—and across diverse end-user sectors including Automotive, Fast-Moving Consumer Goods (FMCG), Retail, Fashion & Lifestyle, Technology, Reefer (temperature-controlled goods), and Others. This in-depth analysis highlights the factors driving the success of specific segments and provides a nuanced understanding of the market landscape.

- Key Growth Drivers (By Service & End-User):

- Domestic Transportation Management: Experiencing robust growth fueled by the expansion of domestic trade and the explosive growth of e-commerce, creating significant demand for efficient last-mile delivery solutions.

- International Transportation Management: Driven by increasing foreign trade volumes and ongoing improvements in Colombia's infrastructure, facilitating smoother cross-border logistics.

- Value-added Warehousing & Distribution: Strong growth is being fueled by the rising demand for specialized services, including temperature-controlled storage, order fulfillment, and customized inventory management solutions tailored to diverse client needs.

- Automotive: Significant investments in the Colombian automotive manufacturing sector are driving strong growth within this segment, requiring specialized logistics for vehicle parts and finished products.

- FMCG: The sector's high demand for efficient and reliable supply chain solutions reflects the need to meet ever-increasing consumer demands for fast delivery and product availability.

- Retail: The booming e-commerce sector necessitates robust and adaptable logistics solutions to manage the complexities of online order fulfillment, returns, and omnichannel distribution.

- Reefer: The expanding demand for specialized cold chain logistics underscores the crucial role of maintaining the integrity of perishable goods throughout the supply chain, from farm to table.

- Technology: The growing tech sector in Colombia demands secure and efficient logistics for sensitive electronics and related products.

- Fashion & Lifestyle: This sector benefits from streamlined logistics solutions that ensure timely delivery and effective inventory management for seasonal trends and diverse product lines.

Colombia 3PL Industry Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Colombian 3PL industry. We showcase unique selling propositions (USPs) of new offerings and analyze the impact of technological advancements on service delivery. The focus is on enhancing efficiency, improving transparency, and providing greater value to customers. Companies are increasingly integrating advanced technologies such as AI and IoT to optimize operations, improve forecasting, and track shipments in real-time.

Propelling Factors for Colombia 3PL Industry Growth

Several factors are driving the growth of the Colombia 3PL industry. Technological advancements, including automation and data analytics, are improving efficiency and reducing costs. Strong economic growth in Colombia provides a favorable environment for business expansion. Government initiatives to improve infrastructure and streamline regulations further enhance the industry's growth potential. The rise of e-commerce also significantly boosts demand for 3PL services.

Obstacles in the Colombia 3PL Industry Market

Despite its considerable growth potential, the Colombian 3PL industry faces significant challenges. Navigating complex regulatory environments can hinder business operations. Supply chain disruptions, such as port congestion, infrastructure limitations, and labor shortages, frequently impact operational efficiency and lead to delays. Furthermore, intense competition among 3PL providers creates pressure on pricing and profitability, potentially impacting overall market growth. These combined factors can collectively reduce overall market growth in certain periods, necessitating strategic adaptation and innovation from market players.

Future Opportunities in Colombia 3PL Industry

The Colombian 3PL industry presents substantial future opportunities. The continued expansion of e-commerce, coupled with the growth of emerging sectors such as technology and renewable energy, offer significant potential for expansion. The adoption of advanced technologies, including automation, artificial intelligence (AI), and blockchain, will create opportunities for innovation, efficiency gains, and enhanced supply chain transparency. Furthermore, a focus on sustainable logistics practices, including the reduction of carbon emissions and the adoption of eco-friendly transportation methods, aligns with growing environmental concerns and provides a competitive edge.

Major Players in the Colombia 3PL Industry Ecosystem

- Coordinadora Mercantil SA

- DHL

- Saferbo

- Blu Logistics Colombia SAS

- Servientrega SA

- EGA - KAT

- Kuehne + Nagel

- Icoltrans

- TCC SAS

- Almaviva

Key Developments in Colombia 3PL Industry Industry

- December 2022: CEVA Logistics opens a new carbon-neutral, 15,000-square-meter warehouse in Bogota, expanding its capacity and serving new automotive clients. This significantly enhances their market position and showcases a commitment to sustainability.

- December 2022: Leschaco acquires Coltrans S.A.S., expanding its global network and strengthening its presence in the Colombian market. This acquisition consolidates market share and expands service offerings.

Strategic Colombia 3PL Industry Market Forecast

The Colombian 3PL market is poised for continued growth, driven by strong economic fundamentals, the increasing adoption of e-commerce, and ongoing investments in infrastructure development. The forecast period of 2025-2033 anticipates robust expansion, with a projected market value of [Insert Projected Market Value] Million USD. Strategic partnerships, technological innovation, and a focus on sustainability will play key roles in shaping the industry's future trajectory.

Colombia 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Automotive

- 2.2. FMCG (Fa

- 2.3. Retail (

- 2.4. Fashion and Lifestyle (Apparel and Footwear)

- 2.5. Technolo

- 2.6. Reefer (

- 2.7. Other End Users

Colombia 3PL Industry Segmentation By Geography

- 1. Colombia

Colombia 3PL Industry Regional Market Share

Geographic Coverage of Colombia 3PL Industry

Colombia 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services

- 3.3. Market Restrains

- 3.3.1. High Labour Cost; High Pricing

- 3.4. Market Trends

- 3.4.1. Colombia Third-party Logistics (3PL) Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. FMCG (Fa

- 5.2.3. Retail (

- 5.2.4. Fashion and Lifestyle (Apparel and Footwear)

- 5.2.5. Technolo

- 5.2.6. Reefer (

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coordinadora Mercantil SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saferbo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blu Logistics Colombia SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Servientrega SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EGA - KAT**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Icoltrans

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TCC SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Almaviva

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Coordinadora Mercantil SA

List of Figures

- Figure 1: Colombia 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Colombia 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Colombia 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Colombia 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Colombia 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Colombia 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Colombia 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Colombia 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia 3PL Industry?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Colombia 3PL Industry?

Key companies in the market include Coordinadora Mercantil SA, DHL, Saferbo, Blu Logistics Colombia SAS, Servientrega SA, EGA - KAT**List Not Exhaustive, Kuehne + Nagel, Icoltrans, TCC SAS, Almaviva.

3. What are the main segments of the Colombia 3PL Industry?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services.

6. What are the notable trends driving market growth?

Colombia Third-party Logistics (3PL) Market Trends.

7. Are there any restraints impacting market growth?

High Labour Cost; High Pricing.

8. Can you provide examples of recent developments in the market?

December 2022: CEVA Logistics opened a new multi-client, 15,000-square-meter warehouse in Bogota, Colombia, allowing the company to better serve the strategic growth needs of its customers in South and Latin America. The new facility is the first carbon-neutral CEVA warehouse in the country and consolidates the operations of three other former sites in Colombia, while also adding space for new customers. The Bogota facility will serve existing technology, industrial and automotive clients, who have shifted from other CEVA operations in Colombia. The new warehouse also serves several new customers, including a new automaker, whose spare parts operation will occupy roughly one-third of the total space. In addition to its sustainability measures, the Bogota warehouse will employ advanced security measures, as well as leading-edge software, workflow, and picking and sorting technologies. The facility also positions CEVA for future growth in a thriving region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia 3PL Industry?

To stay informed about further developments, trends, and reports in the Colombia 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence