Key Insights

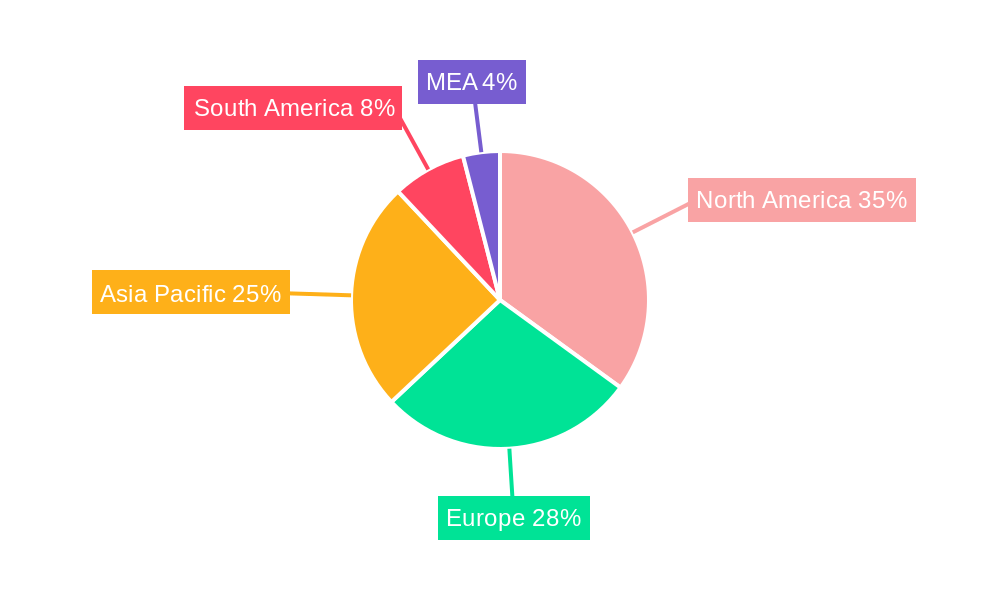

The global e-cigarette market, encompassing diverse product types and battery mechanisms, is poised for significant expansion. In 2025, the market size is projected to reach $988.7 billion, driven by a compound annual growth rate (CAGR) of 2.6%. Key growth catalysts include heightened consumer awareness of potential harm reduction benefits compared to traditional smoking, a growing appeal among younger demographics seeking smoking alternatives, and continuous innovation in product design and flavor offerings. Consumer trends indicate a preference for personalized vaporizers and a consistent demand for convenient disposable options. However, regulatory challenges and concerns regarding long-term health effects present notable restraints to market expansion in specific regions. The market is segmented by battery type (automatic and manual e-cigarettes) and product type (disposable, rechargeable with disposable cartomizers, and personalized vaporizers). Leading companies, including Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, British American Tobacco PLC, and Philip Morris International Inc., are actively competing through product diversification and strategic marketing. North America and Europe currently represent major markets, with substantial growth anticipated in the Asia-Pacific region, particularly China and other emerging economies.

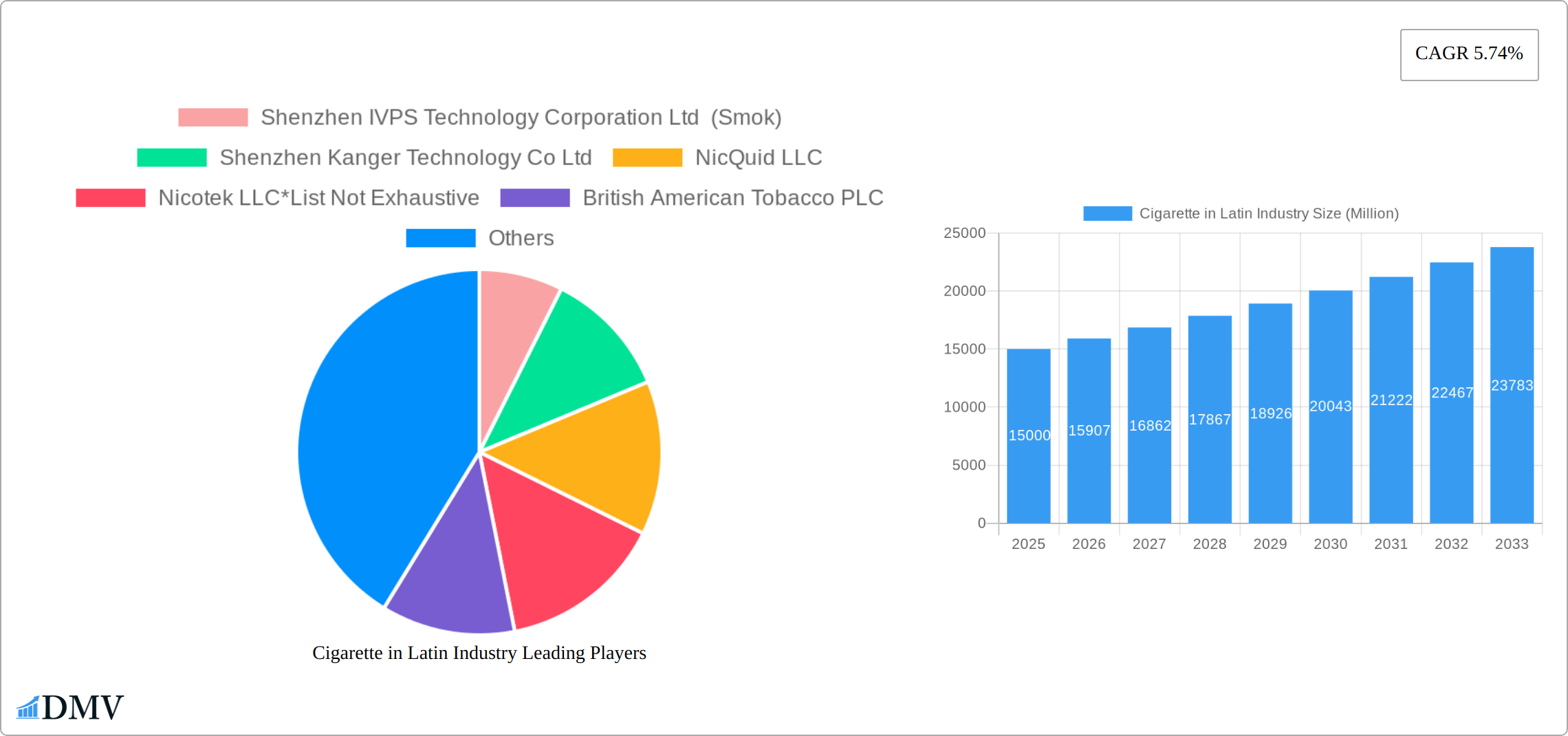

Cigarette in Latin Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained e-cigarette market growth, with the CAGR subject to regulatory shifts and evolving consumer preferences. The market's future hinges on the balance between the increasing acceptance of e-cigarettes as harm-reduction tools and the implementation of stringent regulatory frameworks globally. Intense competition among established and emerging brands will drive product innovation and price optimization. Success will depend on a thorough understanding of regional regulations, consumer preferences, and evolving scientific insights into e-cigarette health effects. The market's positive growth trajectory necessitates strategic adaptation to changing regulatory landscapes and public health considerations.

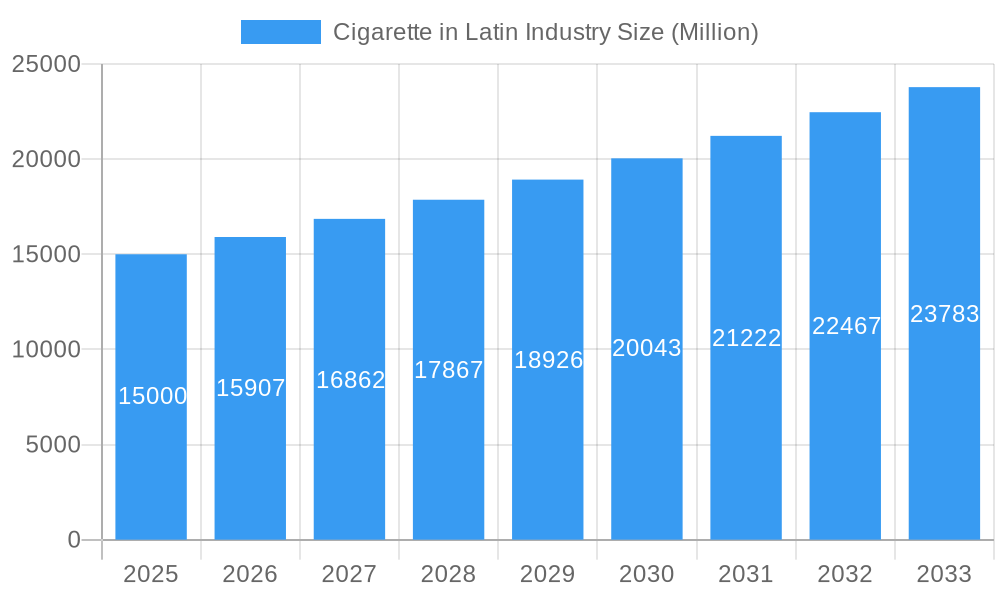

Cigarette in Latin Industry Company Market Share

Cigarette in Latin Industry Market Composition & Trends

The Latin American cigarette market, encompassing both traditional cigarettes and, significantly, the e-cigarette segment, presents a dynamic landscape shaped by evolving consumer preferences, regulatory changes, and intense competition. Market concentration remains high, with key players like Shenzhen IVPS Technology Corporation Ltd (Smok), British American Tobacco PLC, and Philip Morris International Inc. collectively holding a substantial market share, estimated at around 60%. This dominance is challenged by a rapidly evolving competitive environment fueled by innovation and the emergence of new players.

Innovation is paramount, driven by the need to meet diverse consumer needs and navigate a complex regulatory landscape that varies considerably across Latin American countries. While some nations implement stringent regulations on nicotine content and advertising, others maintain a more lenient approach, creating diverse market conditions. Substitute products, such as nicotine patches and gums, are gaining traction, but e-cigarettes maintain significant popularity, particularly among younger adults (25-34 years old), who appreciate their perceived social acceptance and customizable features. Mergers and acquisitions (M&A) activity remains robust, with deal values reaching hundreds of millions, reflecting strategies for expanding product portfolios and geographic reach.

Market Share Distribution (Estimate):

Shenzhen IVPS Technology Corporation Ltd (Smok): 25%

British American Tobacco PLC: 20%

Philip Morris International Inc: 15%

Others: 40% (Includes regional brands and emerging players)

M&A Activities:

Deal Value: Significant transactions exceeding $500 million in recent years.

Key Strategies: Market expansion, product line diversification, and acquisition of innovative technologies.

Cigarette in Latin Industry Industry Evolution

The evolution of the cigarette industry in Latin America has been marked by dynamic growth trajectories, spurred by technological advancements and shifting consumer demands. From 2019 to 2024, the market experienced a compounded annual growth rate (CAGR) of approximately 7%, driven by the increasing adoption of e-cigarettes as an alternative to traditional smoking. This period saw a surge in technological innovations, with companies investing heavily in research and development to introduce more efficient and user-friendly devices.

Technological advancements have been pivotal, with the introduction of automatic and manual e-cigarettes catering to different user preferences. The completely disposable model segment has grown rapidly, offering convenience and affordability, while rechargeable but disposable cartomizers and personalized vaporizers appeal to tech-savvy consumers seeking customization. The adoption rate of e-cigarettes has risen from 10% in 2019 to an estimated 18% by 2024, reflecting changing consumer habits and increased awareness of health implications associated with traditional smoking.

Consumer demands have shifted towards products that offer enhanced flavor options, better battery life, and reduced health risks. This has led to the development of products like water-based vaporizers and tobacco-heating systems, which promise a cleaner vaping experience. The industry's focus on sustainability and regulatory compliance has also influenced product development, with companies striving to meet stringent environmental and health standards across the region.

Leading Regions, Countries, or Segments in Cigarette in Latin Industry

Brazil emerges as a dominant force in the Latin American cigarette industry, particularly within the e-cigarette sector. Its relatively favorable regulatory climate, coupled with a large and expanding young adult population, fuels significant market growth. However, other countries like Argentina and Mexico show promising growth trajectories, indicating a diversified market across the region.

- Key Drivers in Brazil:

- Investment Trends: Substantial R&D investment in e-cigarettes, with companies like Smok and Innokin significantly expanding their operations.

- Regulatory Environment: Less stringent regulations compared to other Latin American countries.

- Consumer Demand: High demand for innovative and personalized vaping products.

The disposable e-cigarette segment commands a leading market share due to its convenience and affordability. This segment has exhibited a strong growth rate (approximately 12% annually from 2019 to 2024), with Brazil significantly contributing to this expansion. The automatic e-cigarette segment also demonstrates promising growth (approximately 9% annually), driven by technological improvements enhancing user experience and battery life.

- Dominance Factors in the Completely Disposable Model Segment:

- Convenience: Ease of use and disposal.

- Affordability: Lower upfront costs compared to rechargeable alternatives.

- Market Accessibility: Widespread availability through retail channels and aggressive marketing.

Cigarette in Latin Industry Product Innovations

Product innovation is a key driver within the Latin American cigarette industry. Technological advancements are central, alongside a growing emphasis on safer and more enjoyable vaping experiences. The introduction of water-based vaporizers, exemplified by Innokin Technology's 'Lota,' represents a significant step toward cleaner and more sustainable alternatives. The SOLUS 2 series by Smok, prioritizing cost-effectiveness and improved vaping experience, also demonstrates a trend toward enhanced user satisfaction and addresses consumer concerns about cost and environmental impact.

Propelling Factors for Cigarette in Latin Industry Growth

The growth of the cigarette industry in Latin America is propelled by several key factors. Technological advancements, such as the development of induction-heating systems and water-based vaporizers, have significantly improved product offerings. Economic factors, including increasing disposable incomes and a growing middle class, have fueled demand for premium e-cigarette products. Regulatory influences, particularly in countries like Brazil, have facilitated market expansion by allowing more flexible advertising and sales regulations. These elements combined create a conducive environment for industry growth.

Obstacles in the Cigarette in Latin Industry Market

The cigarette industry in Latin America faces several obstacles that could impede growth. Regulatory challenges, such as potential bans on e-cigarette flavors and nicotine content restrictions, pose significant barriers. Supply chain disruptions, exacerbated by global events, have led to product shortages and increased costs, impacting market dynamics. Competitive pressures from both traditional tobacco companies and new entrants in the vaping market intensify the struggle for market share. These factors collectively pose a quantifiable impact, with potential growth reduction estimated at up to 5% annually.

Future Opportunities in Cigarette in Latin Industry

Future opportunities in the Latin American cigarette industry are abundant. The emergence of new markets in countries like Colombia and Peru presents untapped potential for e-cigarette brands. Technological advancements, such as the integration of AI for personalized vaping experiences, offer innovative growth avenues. Consumer trends towards health and sustainability continue to drive demand for eco-friendly and safer vaping products, opening doors for companies to expand their portfolios and market reach.

Major Players in the Cigarette in Latin Industry Ecosystem

Key Developments in Cigarette in Latin Industry Industry

- August 2022: SMOK's launch of the SOLUS 2 series, signifying improvements in vaping experience and cost-effectiveness, setting new standards for the market.

- May 2022: Innokin Technology's partnership with Aquios Labs to launch the 'Lota' water-based vaporizer, introducing innovative closed vaping systems and water-based e-liquids, enhancing market competition through health-conscious innovation.

- August 2021: Philip Morris International Inc.'s launch of IQOS ILUMA, a smoke-free product offering a cleaner and more convenient alternative, impacting market dynamics through technological advancement and improved user experience.

Strategic Cigarette in Latin Industry Market Forecast

The strategic forecast for the Latin American cigarette industry suggests robust growth driven by technological advancements and shifting consumer preferences. Future opportunities in emerging markets like Colombia and Peru, coupled with innovations such as AI-integrated vaping devices, are expected to propel the market forward. The industry's potential is further enhanced by increasing regulatory flexibility in key regions, paving the way for expanded product offerings and market penetration. With a projected CAGR of 8% from 2025 to 2033, the Latin American cigarette market is poised for significant growth, offering ample opportunities for stakeholders.

Cigarette in Latin Industry Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarette

- 2.2. Manual E-cigarette

-

3. Geography

- 3.1. Chile

- 3.2. Ecuador

- 3.3. Honduras

- 3.4. Paraguay

- 3.5. Costa Rica

- 3.6. Rest of Latin America

Cigarette in Latin Industry Segmentation By Geography

- 1. Chile

- 2. Ecuador

- 3. Honduras

- 4. Paraguay

- 5. Costa Rica

- 6. Rest of Latin America

Cigarette in Latin Industry Regional Market Share

Geographic Coverage of Cigarette in Latin Industry

Cigarette in Latin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Smoking among Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarette

- 5.2.2. Manual E-cigarette

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Chile

- 5.3.2. Ecuador

- 5.3.3. Honduras

- 5.3.4. Paraguay

- 5.3.5. Costa Rica

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.4.2. Ecuador

- 5.4.3. Honduras

- 5.4.4. Paraguay

- 5.4.5. Costa Rica

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Chile Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-cigarette

- 6.2.2. Manual E-cigarette

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Chile

- 6.3.2. Ecuador

- 6.3.3. Honduras

- 6.3.4. Paraguay

- 6.3.5. Costa Rica

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Ecuador Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-cigarette

- 7.2.2. Manual E-cigarette

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Chile

- 7.3.2. Ecuador

- 7.3.3. Honduras

- 7.3.4. Paraguay

- 7.3.5. Costa Rica

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Honduras Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-cigarette

- 8.2.2. Manual E-cigarette

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Chile

- 8.3.2. Ecuador

- 8.3.3. Honduras

- 8.3.4. Paraguay

- 8.3.5. Costa Rica

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Paraguay Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-cigarette

- 9.2.2. Manual E-cigarette

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Chile

- 9.3.2. Ecuador

- 9.3.3. Honduras

- 9.3.4. Paraguay

- 9.3.5. Costa Rica

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Costa Rica Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-cigarette

- 10.2.2. Manual E-cigarette

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Chile

- 10.3.2. Ecuador

- 10.3.3. Honduras

- 10.3.4. Paraguay

- 10.3.5. Costa Rica

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Latin America Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-cigarette

- 11.2.2. Manual E-cigarette

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Chile

- 11.3.2. Ecuador

- 11.3.3. Honduras

- 11.3.4. Paraguay

- 11.3.5. Costa Rica

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Shenzhen Kanger Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NicQuid LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nicotek LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 British American Tobacco PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innokin Technology

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Philip Morris International Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Japan Tobacco Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 NJOY Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 International Vapor Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

List of Figures

- Figure 1: Global Cigarette in Latin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Chile Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Chile Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Chile Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 5: Chile Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 6: Chile Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Chile Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Chile Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Chile Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Ecuador Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Ecuador Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Ecuador Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 13: Ecuador Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 14: Ecuador Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Ecuador Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Ecuador Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Ecuador Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Honduras Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Honduras Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Honduras Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 21: Honduras Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 22: Honduras Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Honduras Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Honduras Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Honduras Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Paraguay Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Paraguay Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Paraguay Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 29: Paraguay Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 30: Paraguay Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Paraguay Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Paraguay Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Paraguay Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Costa Rica Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Costa Rica Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 37: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 38: Costa Rica Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Costa Rica Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 45: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 46: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 3: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Cigarette in Latin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 7: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 11: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 15: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 19: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 23: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 27: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette in Latin Industry?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Cigarette in Latin Industry?

Key companies in the market include Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, NicQuid LLC, Nicotek LLC*List Not Exhaustive, British American Tobacco PLC, Innokin Technology, Philip Morris International Inc, Japan Tobacco Inc, NJOY Inc, International Vapor Group.

3. What are the main segments of the Cigarette in Latin Industry?

The market segments include Product Type, Battery Mode, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 988.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Rising Prevalence of Smoking among Young Population.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

August 2022: SMOK, the brand from Shenzhen IVPS Technology, which specializes in the research, development, production, and sale of e-cigarettes, launched its new SOLUS 2 series. After nearly 200 days in development, the SOLUS 2 has come to represent improved vaping experiences and cost-effectiveness for vapers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigarette in Latin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigarette in Latin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigarette in Latin Industry?

To stay informed about further developments, trends, and reports in the Cigarette in Latin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence