Key Insights

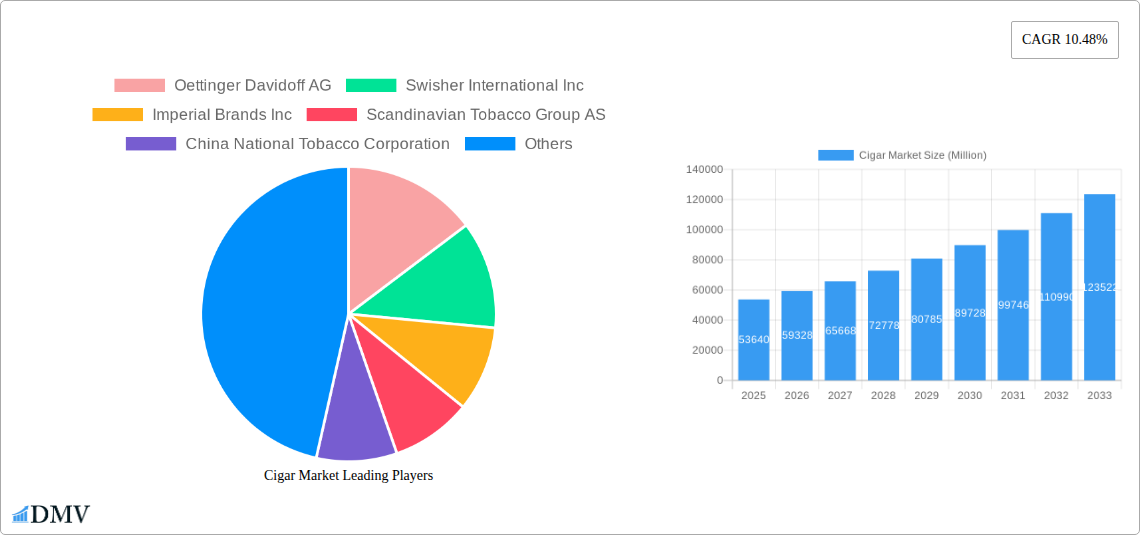

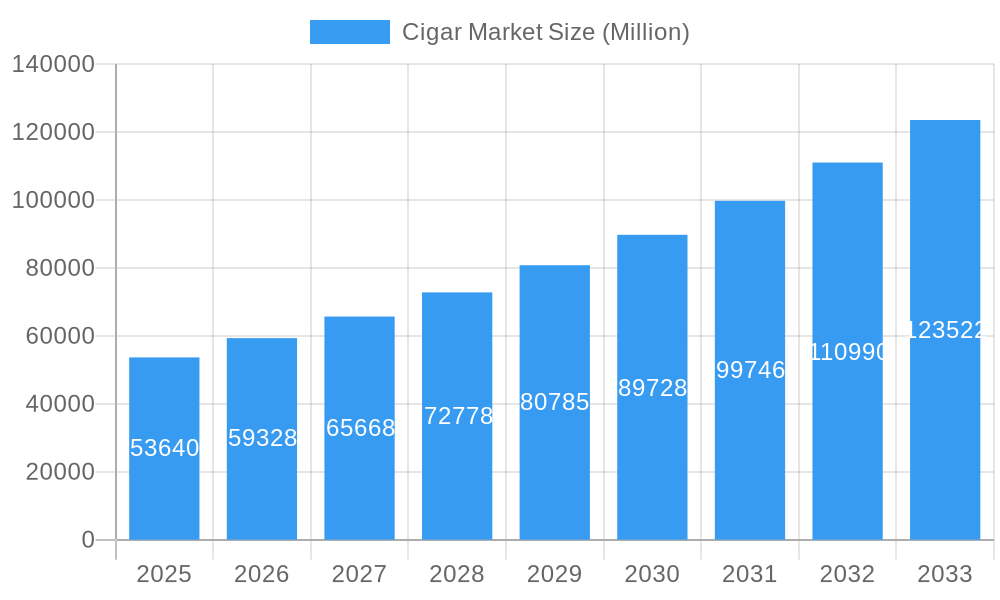

The global cigar market, valued at $53.64 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.48% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing disposable incomes in emerging economies, particularly in Asia-Pacific, are fueling demand for premium cigar brands, representing a significant growth opportunity. Secondly, the evolving preferences of consumers towards sophisticated and luxury goods are boosting sales within the premium cigar segment. Strategic marketing initiatives focusing on the exclusivity and heritage associated with cigars are also contributing to this trend. Furthermore, the expansion of online retail channels is making cigars more accessible to a wider consumer base, facilitating market penetration and growth. However, stringent government regulations on tobacco products, coupled with increasing health concerns regarding smoking, pose significant restraints to market expansion. The market is segmented by product type (conventional and premium cigars) and distribution channel (offline and online retail stores). Premium cigars are expected to command a higher market share due to their price point and associated lifestyle appeal. The dominance of offline retail stores is anticipated to continue, although online sales are expected to grow considerably during the forecast period, driven by e-commerce penetration and convenient access. Key players like Oettinger Davidoff AG, Swisher International Inc., and Imperial Brands Inc. are constantly innovating to meet evolving consumer demands and maintain their market positions. Geographic expansion into emerging markets and strategic partnerships will be vital for sustained growth.

Cigar Market Market Size (In Billion)

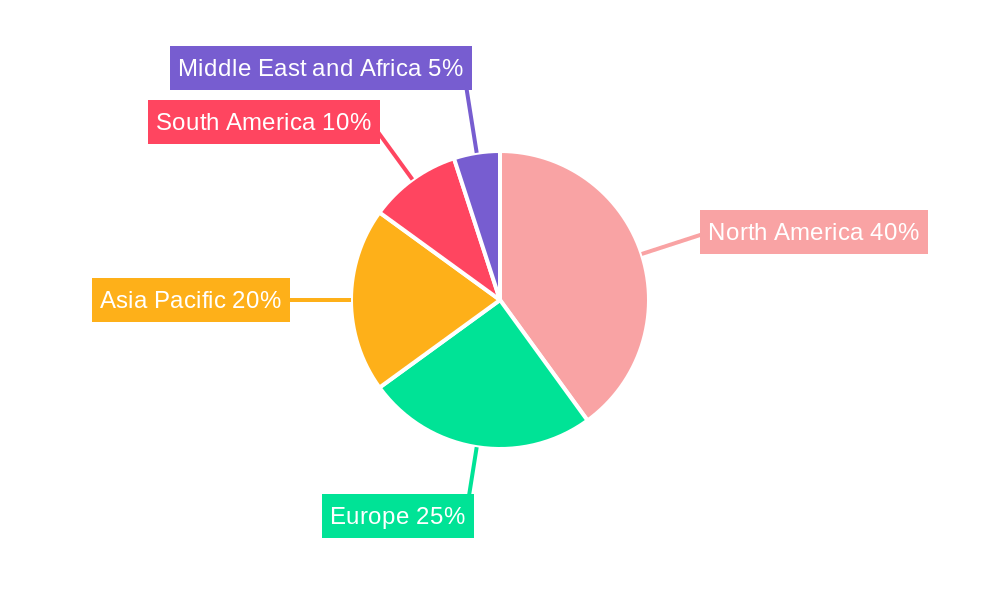

The regional breakdown reveals significant market variations. North America currently holds a dominant share, fuelled by established consumer bases and a strong tradition of cigar consumption. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by rising affluence and increasing consumer interest. Europe and South America will maintain steady growth, while the Middle East and Africa are anticipated to showcase moderate expansion, primarily driven by localized consumer preferences and economic development. Competitive landscape analysis suggests that established players are focusing on brand diversification, product innovation, and strategic acquisitions to consolidate their market positions and capitalize on emerging opportunities. This intense competition will likely drive further innovation and create a dynamic market environment throughout the forecast period.

Cigar Market Company Market Share

Cigar Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the global cigar market, analyzing its current state, future trajectory, and key players. With a comprehensive study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report offers invaluable insights for stakeholders seeking to navigate this dynamic industry. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%.

Cigar Market Composition & Trends

This section delves into the intricate structure of the cigar market, evaluating its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated landscape, with key players like Oettinger Davidoff AG, Swisher International Inc., and Imperial Brands Inc. holding significant market share. However, smaller, niche players also contribute significantly to the overall market volume.

- Market Share Distribution (2025): Oettinger Davidoff AG (xx%), Swisher International Inc. (xx%), Imperial Brands Inc. (xx%), Scandinavian Tobacco Group AS (xx%), Others (xx%). The exact figures remain unavailable, but the distribution will reflect the relative market positions of these players.

- M&A Activity: The past five years have witnessed xx Million in M&A deals, primarily driven by consolidation efforts and expansion strategies. Specific deal values are unavailable due to the confidential nature of this information.

- Innovation Catalysts: The industry witnesses continuous innovation in terms of flavor profiles, cigar sizes, and packaging formats. Premiumization and the growing demand for unique blends are major drivers of innovation.

- Regulatory Landscape: Government regulations regarding tobacco products, including taxation and advertising restrictions, significantly impact market growth and profitability. The level of impact varies between countries and regions globally.

- Substitute Products: While cigars hold a unique appeal, substitute products like vaping devices and other tobacco alternatives pose some competitive threat.

- End-User Profiles: The primary end-users are adult smokers, segmented by demographics (age, income, location), preferences (conventional vs. premium cigars), and purchasing behavior (online vs. offline).

Cigar Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the cigar market, considering technological advancements and evolving consumer preferences. From 2019 to 2024, the market experienced a CAGR of xx%, primarily driven by the increasing popularity of premium cigars and the expansion of online retail channels. The forecast period (2025-2033) anticipates a continuation of this growth trend, although at a slightly moderated pace. Technological advancements are playing a crucial role in streamlining production, enhancing product quality control, and improving marketing and distribution strategies. Consumer preferences are shifting towards more sophisticated, premium cigars with distinct flavor profiles, highlighting a trend towards niche products and premium experiences. The rise of online retailers and e-commerce has transformed distribution patterns.

Leading Regions, Countries, or Segments in Cigar Market

This section identifies the dominant regions, countries, and segments within the cigar market.

- Product Type: The premium cigar segment commands a higher price point and contributes significantly to the overall market value due to its unique product quality and prestige associated with the brand. The conventional cigar segment remains popular due to its affordability and established consumer base.

- Distribution Channel: Offline retail stores continue to be the dominant distribution channel for conventional cigars. However, online retail channels are gaining significant traction for premium cigars, aided by improved logistics and greater access to a wider consumer base.

- Geographic Regions: The North American and European markets traditionally hold the largest market share of this segment, but the Asian market is gaining increasing momentum, driven by rising disposable incomes and changing lifestyle preferences.

Key Drivers:

- High disposable incomes: Particularly in developing and developed economies.

- Regulatory support (varies regionally): While certain regions tighten restrictions, some others continue to provide supportive market regulations.

- Rising consumer preference for premium products and lifestyle enhancement: Premium brands command higher margins and significant revenue streams.

Cigar Market Product Innovations

Recent innovations involve unique flavor profiles, using diverse tobacco varieties and blends, along with advanced packaging to enhance shelf life and reduce spoilage. Technological advancements focus on improving product quality control and using data to understand consumer preferences better. The introduction of unique size and shape formats aims to expand the appeal to a wider consumer base.

Propelling Factors for Cigar Market Growth

Growth is driven by factors including the rising disposable incomes in developing economies, increasing preference for premium products, and the expansion of online retail channels. Technological advancements in cultivation and processing also contribute to improved product quality and efficiency, sustaining the growth momentum.

Obstacles in the Cigar Market Market

Key barriers include stringent government regulations on tobacco products, supply chain disruptions, and intense competition. The significant impact of these challenges and potential changes in consumer preferences for other products also pose challenges.

Future Opportunities in Cigar Market

Emerging opportunities lie in expanding into new markets (particularly in Asia), the utilization of new cultivation and production technologies, and adapting to changing consumer preferences. Furthermore, focusing on premium and niche products is expected to drive market growth significantly.

Major Players in the Cigar Market Ecosystem

- Oettinger Davidoff AG

- Swisher International Inc.

- Imperial Brands Inc.

- Scandinavian Tobacco Group AS

- China National Tobacco Corporation

- Japan Tobacco Inc.

- Manifatture Sigaro Toscano SPA

- JC Newman Cigar Co

- Philip Morris International Inc.

- Altria Group Inc

Key Developments in Cigar Market Industry

- November 2023: Drew Estate launched its Chateau Real brand exclusively through Drew Diplomat online retailers, packaged in 20-count boxes, targeting the premium cigar segment. This signifies a strategic shift towards exclusive online distribution for premium products.

- September 2023: Imperial Brand's Altadis U.S.A. launched the Trinidad Espiritu No. 3 in five sizes, expanding its premium offering and targeting various consumer preferences (prices range from USD 11.13 to USD 12.68). This demonstrates a commitment to product diversification and catering to a broader market.

- November 2022: China National Tobacco Corp.'s Great Wall Cigar released a limited-edition Year of the Rabbit cigar, leveraging cultural themes to boost sales and brand appeal. This reflects a smart marketing strategy that aligns with specific cultural events and consumer interests.

Strategic Cigar Market Market Forecast

The cigar market is poised for continued growth, driven by a confluence of factors: rising disposable incomes, premiumization trends, and the increasing acceptance of online sales channels. The focus on premium and limited-edition cigars promises lucrative opportunities. Furthermore, innovations in production and marketing strategies offer significant potential for market expansion.

Cigar Market Segmentation

-

1. Product Type

- 1.1. Conventional Cigar

- 1.2. Premium Cigar

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Cigar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Cigar Market Regional Market Share

Geographic Coverage of Cigar Market

Cigar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes

- 3.4. Market Trends

- 3.4.1. Offline Retail Channels are the Widely Preferred Distribution Channel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Conventional Cigar

- 5.1.2. Premium Cigar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Conventional Cigar

- 6.1.2. Premium Cigar

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cigar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Conventional Cigar

- 7.1.2. Premium Cigar

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cigar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Conventional Cigar

- 8.1.2. Premium Cigar

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Conventional Cigar

- 9.1.2. Premium Cigar

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Cigar Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Conventional Cigar

- 10.1.2. Premium Cigar

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Oettinger Davidoff AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swisher International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Imperial Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Scandinavian Tobacco Group AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China National Tobacco Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Manifatture Sigaro Toscano SPA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JC Newman Cigar Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Philip Morris International Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Altria Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Oettinger Davidoff AG

List of Figures

- Figure 1: Global Cigar Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cigar Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cigar Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigar Market?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the Cigar Market?

Key companies in the market include Oettinger Davidoff AG, Swisher International Inc, Imperial Brands Inc, Scandinavian Tobacco Group AS, China National Tobacco Corporation, Japan Tobacco Inc, Manifatture Sigaro Toscano SPA, JC Newman Cigar Co, Philip Morris International Inc *List Not Exhaustive, Altria Group Inc.

3. What are the main segments of the Cigar Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role.

6. What are the notable trends driving market growth?

Offline Retail Channels are the Widely Preferred Distribution Channel.

7. Are there any restraints impacting market growth?

Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes.

8. Can you provide examples of recent developments in the market?

November 2023: Drew Estate’s Chateau Real brand was exclusively made available at Drew Diplomat Digital retailers, and its products were packaged in 20-count boxes. Drew Estate launched this brand specifically for the Drew Diplomat online premium cigar retailers. The Drew Estate Chateau Real brand was claimed to be a luxurious blend of premium cigars crafted to highlight the cigar’s compelling Connecticut Shade-forward flavor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigar Market?

To stay informed about further developments, trends, and reports in the Cigar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence