Key Insights

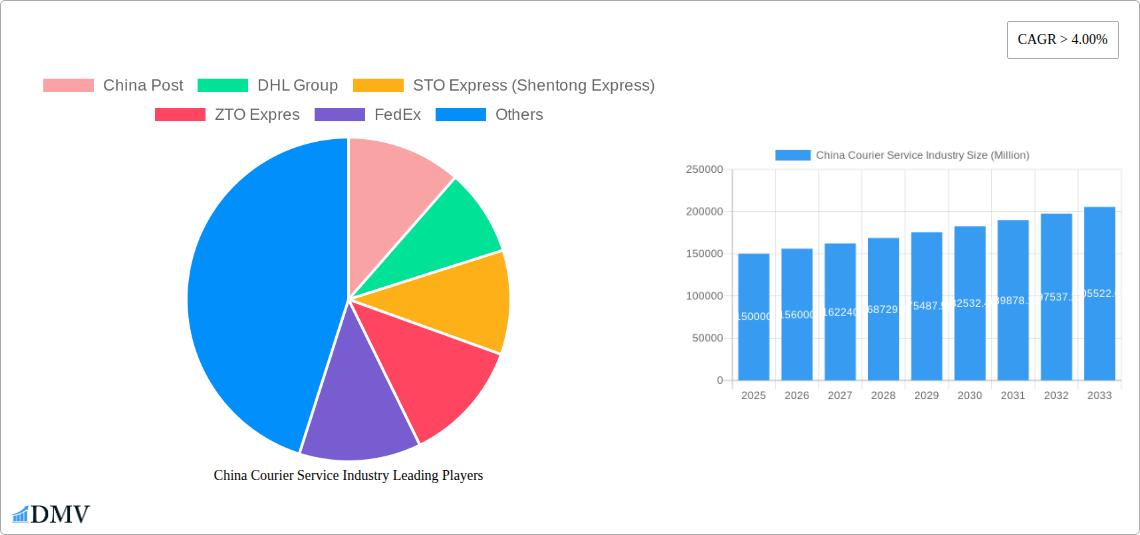

The China Courier Service Market is poised for substantial expansion, propelled by the thriving e-commerce ecosystem and escalating demand for expedited delivery solutions. With an estimated market size of 131.84 billion in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 7.21%, the industry anticipates significant growth through 2033. This upward trajectory is primarily attributed to the rapid proliferation of online retail, particularly within the B2C and C2C segments, and the increasing adoption of express logistics. Key market drivers include technological advancements such as automated sorting systems and drone deployment, the expansion of distribution networks, and a noticeable shift towards handling heavier shipments as larger goods gain popularity in online sales. However, the industry navigates challenges including intense market competition, rising operational expenses, and evolving regulatory landscapes concerning environmental stewardship and data protection.

China Courier Service Industry Market Size (In Billion)

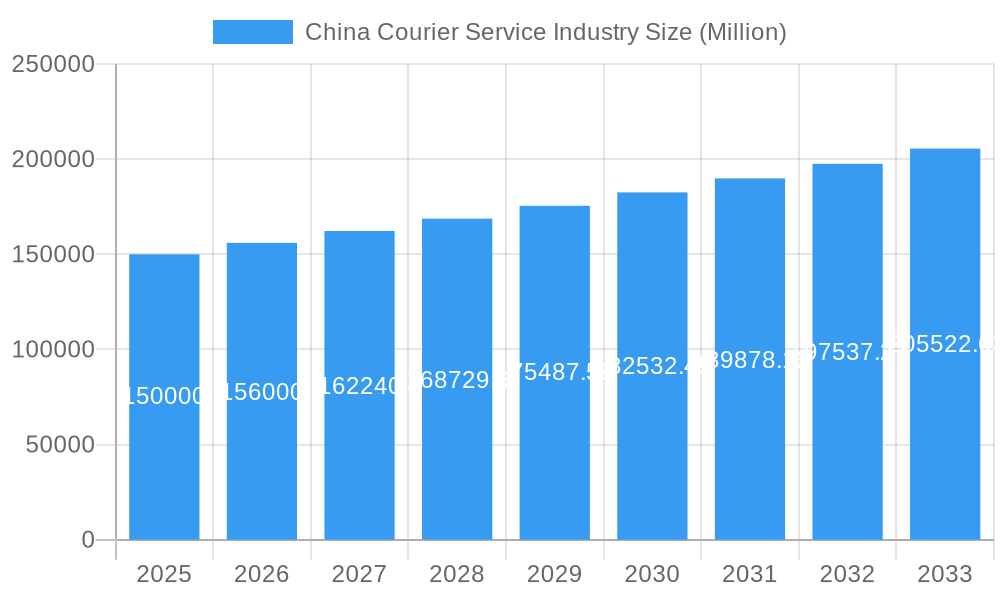

The market is segmented by destination (domestic and international), delivery speed (express and standard), business model (B2B, B2C, C2C), shipment weight (light, medium, heavy), transportation mode (air, road, and others), and end-user industry (e-commerce, BFSI, healthcare, manufacturing, primary industry, wholesale and retail trade, and others). Leading entities such as China Post, DHL, STO Express, ZTO Express, and SF Express are key market participants, continuously innovating to sustain their competitive advantage.

China Courier Service Industry Company Market Share

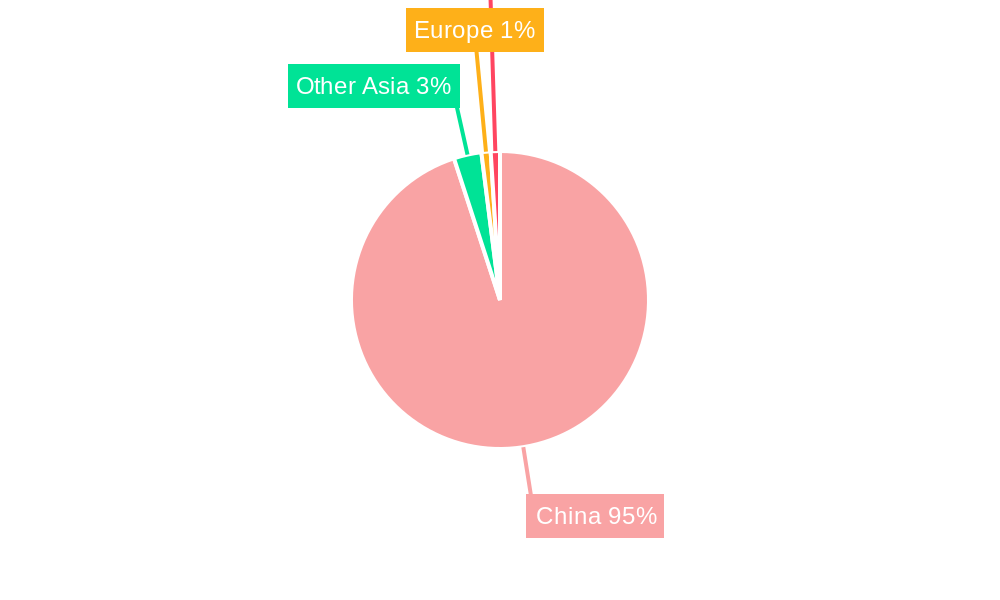

Segmental analysis highlights B2C e-commerce as the primary revenue contributor, with domestic deliveries forming a substantial portion. Express delivery services are also experiencing robust growth, underscoring consumer preference for speed and convenience. Road transportation is expected to maintain its dominant position, though air freight remains critical for international and time-sensitive consignments. While China remains the core market, expansion into regional territories and strategic international partnerships are anticipated as key growth strategies for major players. Companies that demonstrate adaptability to regulatory changes, invest judiciously in technology, and cultivate resilient supply chains will be best positioned for success amidst increasing shipment volumes and complexity. Further in-depth analysis is recommended to precisely quantify the contribution of each segment and the impact of specific regulatory shifts.

China Courier Service Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China courier service industry, covering market size, trends, leading players, and future forecasts. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The forecast period extends from 2025 to 2033, building upon the historical period of 2019-2024. The report projects a market value of XX Million by 2033.

China Courier Service Industry Market Composition & Trends

This section delves into the competitive landscape of the Chinese courier service market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user demographics. We examine the landscape of mergers and acquisitions (M&A), detailing deal values and their impact on market share distribution. Key players like China Post, SF Express, STO Express, and ZTO Express dominate the market, however, the level of market concentration is currently being assessed and will be detailed in the full report. The increasing adoption of e-commerce and technological advancements like AI-powered logistics are driving innovation. Stringent regulations regarding data privacy and delivery standards are shaping industry practices. Substitute services, such as postal services, remain a factor, particularly for lower-value shipments. Finally, M&A activities, valued at approximately XX Million in the last 5 years, are reshaping market dynamics, leading to greater efficiency and expanded service offerings.

- Market Share Distribution (2024): China Post (XX%), SF Express (XX%), STO Express (XX%), ZTO Express (XX%), Others (XX%)

- M&A Deal Value (2019-2024): Approximately XX Million

- Key Innovation Catalysts: AI-powered logistics, automation, drone delivery.

- Regulatory Landscape: Focus on data privacy, environmental sustainability, and delivery standards.

China Courier Service Industry Industry Evolution

The China courier service industry has experienced remarkable growth, fueled by the explosive expansion of e-commerce, technological advancements, and changing consumer expectations. From 2019 to 2024, the market witnessed a compound annual growth rate (CAGR) of approximately XX%, driven primarily by the surge in B2C deliveries. The increasing demand for faster and more reliable delivery options has propelled the growth of express delivery segments. Technological innovations, such as automated sorting facilities and real-time tracking systems, have enhanced efficiency and transparency. Consumers increasingly demand convenient and flexible delivery options, such as same-day delivery and designated time slots. These factors have collectively fueled industry growth, with a projected CAGR of XX% from 2025 to 2033.

Leading Regions, Countries, or Segments in China Courier Service Industry

The domestic market constitutes the largest segment, driven by the robust growth of e-commerce within China. Express delivery services dominate due to consumer preference for speed and reliability. The B2C segment holds a significant share, reflecting the prevalence of online shopping. Medium-weight shipments are the most prevalent, aligning with typical e-commerce package sizes. Road transport remains the predominant mode, with air transport playing a crucial role for longer distances and time-sensitive shipments. E-commerce continues as the leading end-user industry, followed by wholesale and retail trade (offline).

- Key Drivers:

- Domestic Market Dominance: Rapid expansion of e-commerce, large and densely populated urban centers.

- Express Delivery Preference: Consumer demand for speed and reliability.

- B2C Segment Growth: Increased online shopping and a rising middle class.

- Road Transport Predominance: Cost-effective and efficient for shorter distances.

- E-commerce Dependence: Direct correlation between growth and e-commerce expansion.

China Courier Service Industry Product Innovations

Recent innovations focus on enhancing delivery speed, efficiency, and tracking capabilities. AI-powered routing optimization, autonomous delivery robots, and improved package tracking systems are improving last-mile delivery and customer experience. The integration of IoT devices and big data analytics enhances delivery management and predictive maintenance of logistics assets. Companies are increasingly focusing on specialized services, like temperature-controlled shipping for pharmaceuticals and cold chain logistics for fresh produce. The unique selling propositions (USPs) revolve around speed, reliability, and technological advancements.

Propelling Factors for China Courier Service Industry Growth

Several factors fuel the industry's growth. The rapid expansion of e-commerce and the increasing adoption of online shopping are key drivers. Government initiatives supporting infrastructure development and technological advancements (like 5G) further accelerate growth. Economic growth and rising disposable incomes are driving higher consumer spending, including on online purchases. Favorable regulatory environments promoting competition and innovation support industry expansion.

Obstacles in the China Courier Service Industry Market

The industry faces challenges like intense competition, leading to price wars that impact profitability. Supply chain disruptions, including labor shortages and fuel price volatility, impact operational efficiency. Stricter environmental regulations increase operational costs and require more sustainable practices. The rising cost of labor and increasingly complex regulations present ongoing hurdles to profitability and growth.

Future Opportunities in China Courier Service Industry

Emerging opportunities lie in expanding into rural markets, leveraging technological advancements like drone delivery and AI, and catering to specialized segments, including healthcare logistics and cold chain supply. The growth of cross-border e-commerce presents significant expansion potential. Developing sustainable and environmentally friendly logistics solutions will become increasingly important.

Major Players in the China Courier Service Industry Ecosystem

- China Post

- DHL Group

- STO Express (Shentong Express)

- ZTO Express

- FedEx

- United Parcel Service of America Inc (UPS)

- Hongkong Post

- Yunda Express

- YTO Express

- La Poste Group

- SF Express (KEX-SF)

Key Developments in China Courier Service Industry Industry

- June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution.

- April 2023: China Post and Ping An Bank launched an intelligent archives service center.

- March 2023: UPS partnered with Google Cloud for enhanced package tracking using RFID chips.

Strategic China Courier Service Industry Market Forecast

The China courier service industry is poised for continued growth, driven by robust e-commerce expansion, technological innovation, and rising consumer expectations. Emerging opportunities in specialized logistics and sustainable practices will shape the market landscape. The increasing demand for efficient and reliable last-mile delivery solutions presents lucrative prospects for market players. Further investment in technology and infrastructure will be crucial for maintaining growth momentum.

China Courier Service Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

China Courier Service Industry Segmentation By Geography

- 1. China

China Courier Service Industry Regional Market Share

Geographic Coverage of China Courier Service Industry

China Courier Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Courier Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. China

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STO Express (Shentong Express)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZTO Expres

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 United Parcel Service of America Inc (UPS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yunda Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 YTO Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Poste Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SF Express (KEX-SF)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 China Post

List of Figures

- Figure 1: China Courier Service Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Courier Service Industry Share (%) by Company 2025

List of Tables

- Table 1: China Courier Service Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: China Courier Service Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: China Courier Service Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 4: China Courier Service Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: China Courier Service Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: China Courier Service Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: China Courier Service Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: China Courier Service Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: China Courier Service Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: China Courier Service Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 11: China Courier Service Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: China Courier Service Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: China Courier Service Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: China Courier Service Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Courier Service Industry?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the China Courier Service Industry?

Key companies in the market include China Post, DHL Group, STO Express (Shentong Express), ZTO Expres, FedEx, United Parcel Service of America Inc (UPS), Hongkong Post, Yunda Express, YTO Express, La Poste Group, SF Express (KEX-SF).

3. What are the main segments of the China Courier Service Industry?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 131.84 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

June 2023: China Post launched its first integrated indoor and outdoor “Robot Plus” AI delivery solution in China. The intelligent delivery solution relies on a combination of unmanned vehicles outdoors and robots indoors, constructing an integrated indoor and outdoor unmanned distribution mode and developing a last-mile logistics network with AI transport capacity sharing.April 2023: China Post and the Automobile Consumption Financial Center of Ping An Bank Co. Ltd launched an intelligent archives service center in Guangdong to promote the service integration of auto finance and express and logistics businesses.March 2023: UPS entered a partnership with Google Cloud, where Google will help UPS by putting radio-frequency identification chips on packages to track them efficiently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Courier Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Courier Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Courier Service Industry?

To stay informed about further developments, trends, and reports in the China Courier Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence