Key Insights

The Central and Eastern European (CEE) refrigerated transport market is experiencing significant expansion, driven by escalating demand for temperature-controlled logistics across critical sectors. Key growth factors include the burgeoning food and beverage industry, propelled by e-commerce grocery delivery and increased consumer preference for fresh produce. The pharmaceutical sector's stringent requirements for the integrity of temperature-sensitive medicines, including biopharmaceuticals, also significantly fuels market growth. An evolving consumer base and a growing middle class in the region are contributing to higher demand for quality and convenience in food products. While infrastructure limitations and fuel price volatility present challenges, substantial investments in modern cold storage and advanced transportation technologies sustain the market's positive trajectory. Market segmentation spans service types (storage, transportation, value-added services such as blast freezing and inventory management), temperature requirements (chilled and frozen), and application sectors (fruits & vegetables, dairy, fish, meat, processed food, pharmaceuticals, bakery & confectionery). Prominent market players include Baltic Logistic Solutions, Beno-Trans, and Nagel-Group, who are actively adapting their services to meet evolving customer needs and regulatory standards. The market is projected to achieve a compound annual growth rate (CAGR) of 8.3%, indicating a robust and expanding sector poised for sustained growth.

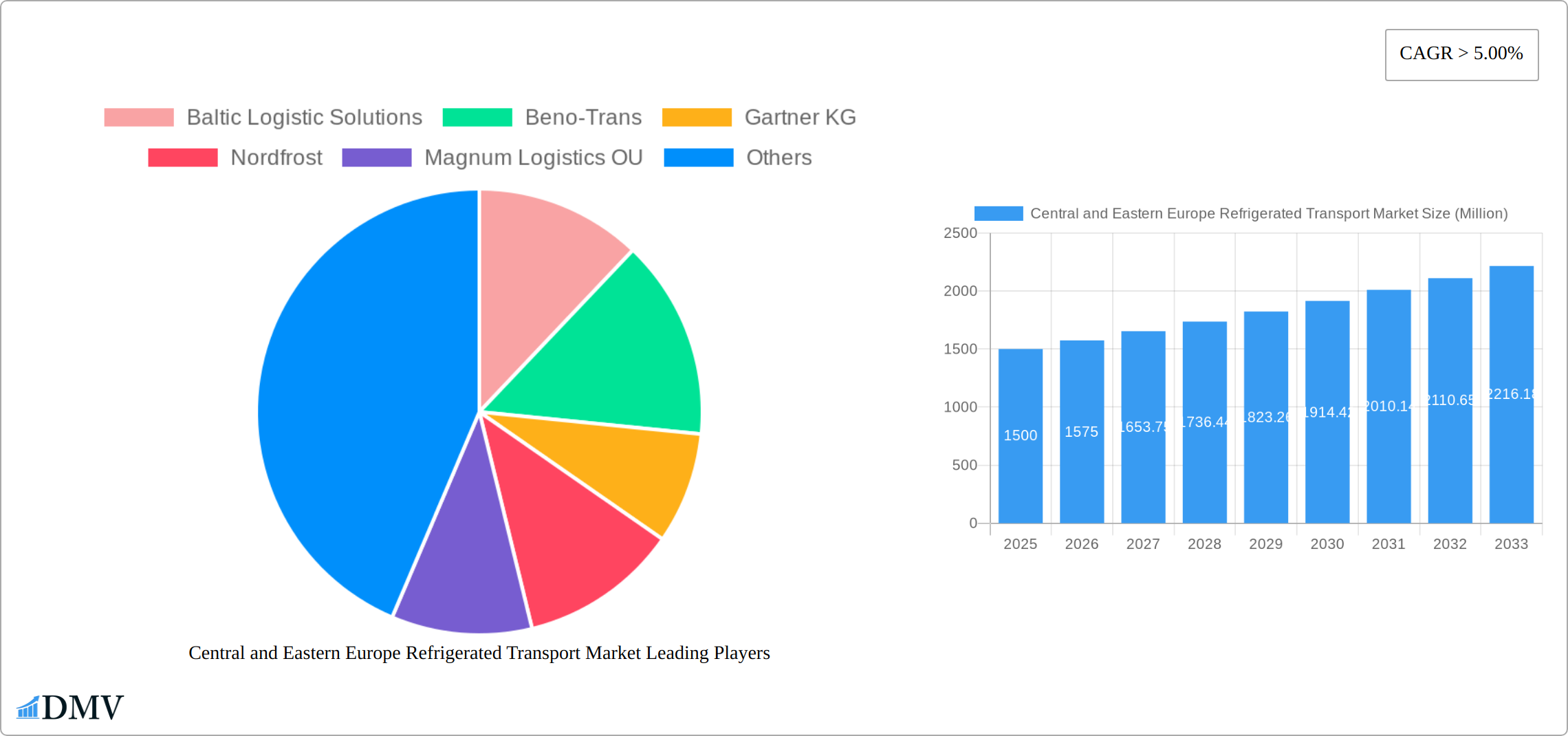

Central and Eastern Europe Refrigerated Transport Market Market Size (In Billion)

Market expansion is anticipated to continue through the forecast period, with the market size estimated to reach $113.5 billion by 2025. This growth will be further supported by increasing cross-border trade within the CEE region and internationally, alongside the expansion of supermarket chains and the widespread adoption of efficient cold chain practices. While logistical challenges, particularly concerning last-mile delivery in less developed areas, persist, technological advancements like real-time temperature monitoring and route optimization software are effectively mitigating these obstacles. Ongoing infrastructure investments and a growing emphasis on sustainability within the logistics sector further contribute to a positive market outlook. Segmentation by service, temperature, and application offers specialized providers opportunities to cater to niche requirements within the broader CEE refrigerated transport market.

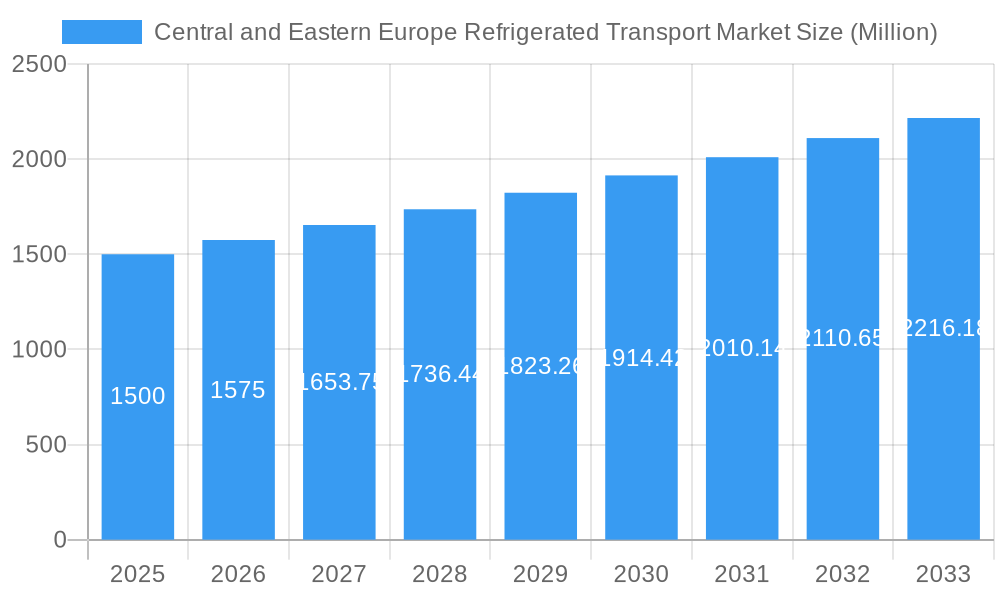

Central and Eastern Europe Refrigerated Transport Market Company Market Share

Central and Eastern Europe Refrigerated Transport Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Central and Eastern Europe Refrigerated Transport Market, offering a detailed overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Central and Eastern Europe Refrigerated Transport Market Composition & Trends

This section delves into the market's competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user behavior, and mergers & acquisitions (M&A) activity. The report provides a granular view of market share distribution amongst key players and analyzes the financial implications of significant M&A deals.

- Market Concentration: The CEE refrigerated transport market exhibits a [Describe market concentration - e.g., moderately concentrated] structure, with [Number] major players holding approximately [Percentage]% of the total market share in 2024. Smaller, regional players also contribute significantly.

- Innovation Catalysts: Technological advancements, such as advancements in temperature control technologies and the adoption of IoT-enabled monitoring systems, are driving market innovation.

- Regulatory Landscape: EU regulations concerning food safety and transportation standards significantly impact market operations and drive the adoption of best practices. Specific country-level regulations within CEE also play a crucial role.

- Substitute Products: While direct substitutes are limited, alternative transportation methods and storage solutions present indirect competitive pressures.

- End-User Profiles: The report profiles end-users across various sectors, including food & beverage, pharmaceuticals, and others. Understanding their specific needs and preferences is crucial for effective market strategy.

- M&A Activity: The report analyzes recent M&A activity, including the deal value and strategic implications of key transactions. For example, the June 2021 acquisition of Kloosterboer by Lineage Logistics signifies a significant consolidation trend within the sector. [Insert details of other M&A activity with values, if available, otherwise use "xx Million".]

Central and Eastern Europe Refrigerated Transport Market Industry Evolution

This section examines the historical and projected growth trajectories of the CEE refrigerated transport market. It explores technological advancements shaping the industry and analyzes the evolving demands of consumers and businesses. Detailed growth rates for key segments are provided, alongside an analysis of adoption metrics for new technologies.

The market has witnessed consistent growth throughout the historical period (2019-2024), driven primarily by [mention specific factors, e.g. rising disposable income, increasing demand for fresh produce]. This trend is projected to continue during the forecast period (2025-2033), with an estimated Compound Annual Growth Rate (CAGR) of xx%. Technological advancements such as automated temperature monitoring, GPS tracking, and advanced refrigeration systems are significantly improving efficiency and reducing spoilage. Shifting consumer preferences toward healthier and fresher food products are also boosting demand. The adoption of cold chain solutions is steadily increasing, with [Insert Data Point, e.g., xx% of businesses now utilizing these solutions], showing a positive growth trajectory.

Leading Regions, Countries, or Segments in Central and Eastern Europe Refrigerated Transport Market

This section identifies the dominant regions, countries, and market segments within the CEE refrigerated transport market, considering factors across "By Service," "By Temperature," and "By Application".

By Service: The Transportation segment currently holds the largest market share, driven by the increasing need for efficient and reliable delivery of temperature-sensitive goods. The Value-added Services segment is witnessing rapid growth, driven by rising demand for specialized services like blast freezing and inventory management. Storage also represents a significant segment, offering support for the other segments.

By Temperature: The Frozen segment is the leading temperature category, owing to the high volume of frozen food products transported and stored within the region. The Chilled segment also shows significant growth, driven by increasing demand for fresh produce and dairy products.

By Application: The Food & Beverage sector dominates the application landscape, with segments such as Dairy Products, Fruits and Vegetables, Meat and Poultry showing strong growth, fuelled by rising consumption and changing dietary habits. The Pharmaceutical segment is an important niche showing increasing demand for temperature controlled transport solutions for sensitive biopharma products.

Key Drivers:

- Increasing investment in cold chain infrastructure: Significant investments are being made in new warehousing facilities, and advanced transportation vehicles.

- Government support and incentives: Various government initiatives and subsidies designed to promote the growth of the cold chain industry are acting as growth catalysts.

- Growing e-commerce penetration: The surge in e-commerce has significantly increased the demand for efficient and reliable refrigerated transportation, particularly for perishable goods.

Central and Eastern Europe Refrigerated Transport Market Product Innovations

The Central and Eastern European (CEE) refrigerated transport market is experiencing a dynamic wave of product innovations aimed at enhancing efficiency, sustainability, and product integrity. Leading the charge are advancements in next-generation refrigeration technologies, including the widespread adoption of eco-friendly CO2 refrigeration systems that offer superior cooling performance with a reduced environmental footprint. Complementing these are enhanced insulation materials, such as vacuum-insulated panels and advanced foam composites, which significantly minimize thermal bridging and drastically reduce energy consumption for maintaining precise temperature ranges. Furthermore, the integration of smart containers and advanced telematics is revolutionizing the sector. These solutions provide real-time, granular monitoring of temperature, humidity, and location data throughout the supply chain, enabling proactive intervention, minimizing spoilage, and optimizing delivery routes. The development of modular and adaptable reefer units also allows for greater flexibility in handling diverse product needs, from frozen goods to delicate pharmaceuticals.

Propelling Factors for Central and Eastern Europe Refrigerated Transport Market Growth

The robust growth trajectory of the CEE refrigerated transport market is underpinned by a confluence of powerful economic, societal, and technological drivers. A notable catalyst is the increasing purchasing power and evolving dietary preferences across the region, leading to a surge in consumer demand for a wider variety of fresh produce, dairy products, frozen foods, and ready-to-eat meals that necessitate sophisticated temperature-controlled logistics. Simultaneously, ever-tightening food safety regulations and quality standards mandated by national and international bodies are compelling businesses to invest in reliable and transparent cold chain solutions to ensure product safety and compliance. The rapid technological advancements, particularly in areas like the Industrial Internet of Things (IIoT) with the deployment of sophisticated sensors for real-time data collection and analysis, coupled with more energy-efficient refrigeration systems, are significantly boosting operational efficiency and driving down costs. Lastly, the deepening economic integration and expanding cross-border trade within the CEE region are creating expanded market opportunities and increasing the reliance on specialized, temperature-sensitive logistics services to connect producers with consumers across diverse geographies.

Obstacles in the Central and Eastern Europe Refrigerated Transport Market Market

Despite its promising growth potential, the CEE refrigerated transport market navigates a landscape dotted with significant challenges. Geopolitical instability and its ripple effects on supply chain resilience continue to pose a considerable threat, potentially disrupting the smooth flow of goods and increasing operational risks. A persistent hurdle is the lack of standardized and modern infrastructure in certain sub-regions, which can impede efficient transit and increase transit times for temperature-sensitive cargo. The substantial capital investment required for acquiring and maintaining advanced cold chain solutions, including specialized vehicles and warehousing facilities, presents a significant barrier for smaller players. Furthermore, the inherent volatility of fuel prices directly impacts transportation costs, adding uncertainty to operational budgets, while the increasingly competitive market landscape intensifies pressure on profit margins, demanding continuous innovation and cost optimization.

Future Opportunities in Central and Eastern Europe Refrigerated Transport Market

Future opportunities for growth exist in expanding into new markets within the region, improving logistics infrastructure, and adopting new technologies like blockchain for greater transparency in the cold chain. Focusing on sustainable solutions, such as eco-friendly refrigerants and improved fuel efficiency, will also create competitive advantages and appeal to environmentally conscious consumers.

Major Players in the Central and Eastern Europe Refrigerated Transport Market Ecosystem

- Baltic Logistic Solutions

- Beno-Trans

- Gartner KG

- Nordfrost

- Magnum Logistics OU

- PLG Logistics and Warehousing

- NewCold

- FRIGO Coldstore Logistics

- Nagel-Group

- Wilms Frozen Food Service (List Not Exhaustive)

Key Developments in Central and Eastern Europe Refrigerated Transport Market Industry

March 2021: Danone Sp. z o.o. solidified its commitment to supply chain excellence in Poland by extending its strategic cooperation with Kuehne+Nagel. This collaboration led to the inauguration of a new, state-of-the-art 11,079 sqm distribution center. This facility is meticulously designed to accommodate a wide range of temperature-controlled storage requirements, including precise ranges of 4-6°C, and offers integrated co-packing services. This expansion underscores the escalating demand from major food corporations for dependable and technologically advanced, temperature-controlled logistics solutions.

June 2021: In a significant move towards market consolidation and capacity expansion, Lineage Logistics announced the acquisition of the Kloosterboer Group. This strategic acquisition substantially bolstered Lineage Logistics' temperature-controlled storage and logistics footprint across Europe, signaling a trend of increased investment and M&A activity within the cold chain sector as key players aim to broaden their service offerings and geographic reach.

Q4 2022: Several logistics providers in the CEE region introduced fleets equipped with advanced telematics and real-time temperature monitoring systems, allowing for enhanced visibility and control over sensitive cargo. This includes the integration of AI-powered route optimization to further reduce transit times and energy consumption, meeting the growing demand for efficient and sustainable cold chain operations.

Early 2023: A rise in investments in intermodal cold chain solutions has been observed, with a focus on developing seamless transitions between road, rail, and sea transport. This initiative aims to improve the sustainability of refrigerated logistics and reduce reliance on single modes of transport, particularly for longer-distance movements within and beyond the CEE.

Strategic Central and Eastern Europe Refrigerated Transport Market Market Forecast

The CEE refrigerated transport market is poised for sustained growth, driven by a combination of factors including rising consumer demand, technological innovation, and supportive government policies. Continued investment in cold chain infrastructure and the adoption of sustainable practices will shape the market's future. The focus on enhancing efficiency, improving traceability, and implementing advanced technologies will be crucial for success in this competitive landscape.

Central and Eastern Europe Refrigerated Transport Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other Applications

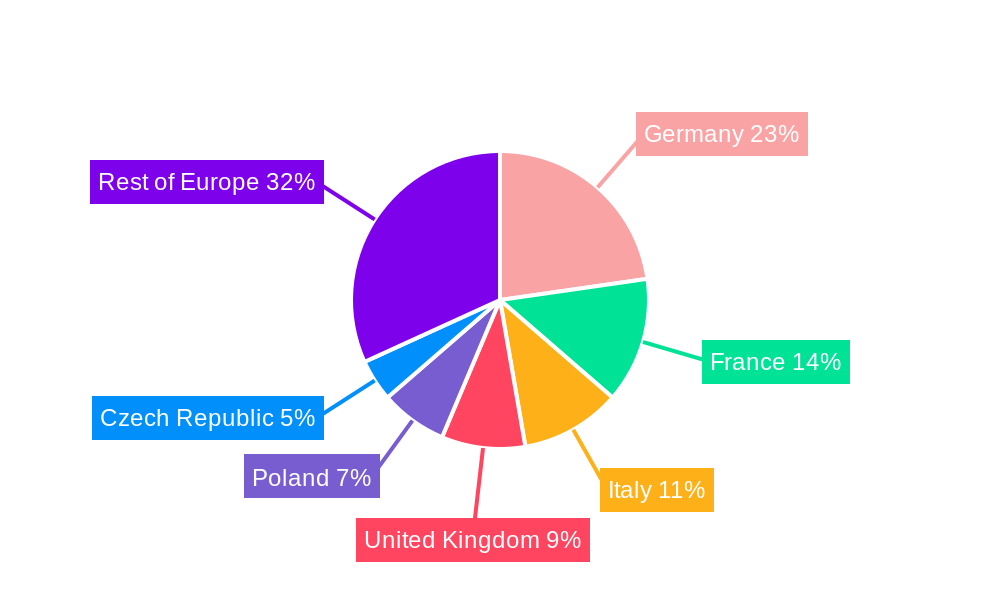

Central and Eastern Europe Refrigerated Transport Market Segmentation By Geography

- 1. Poland

- 2. Slovakia

- 3. Czech Republic

- 4. Hungary

- 5. Romania

- 6. Rest of Central and Eastern Europe

Central and Eastern Europe Refrigerated Transport Market Regional Market Share

Geographic Coverage of Central and Eastern Europe Refrigerated Transport Market

Central and Eastern Europe Refrigerated Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.4.2. Slovakia

- 5.4.3. Czech Republic

- 5.4.4. Hungary

- 5.4.5. Romania

- 5.4.6. Rest of Central and Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Poland Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits and Vegetables

- 6.3.2. Dairy Pr

- 6.3.3. Fish, Meat and Poultry

- 6.3.4. Processed Food

- 6.3.5. Pharmaceutical (Including Biopharma)

- 6.3.6. Bakery and Confectionery

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Slovakia Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits and Vegetables

- 7.3.2. Dairy Pr

- 7.3.3. Fish, Meat and Poultry

- 7.3.4. Processed Food

- 7.3.5. Pharmaceutical (Including Biopharma)

- 7.3.6. Bakery and Confectionery

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Czech Republic Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits and Vegetables

- 8.3.2. Dairy Pr

- 8.3.3. Fish, Meat and Poultry

- 8.3.4. Processed Food

- 8.3.5. Pharmaceutical (Including Biopharma)

- 8.3.6. Bakery and Confectionery

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Hungary Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits and Vegetables

- 9.3.2. Dairy Pr

- 9.3.3. Fish, Meat and Poultry

- 9.3.4. Processed Food

- 9.3.5. Pharmaceutical (Including Biopharma)

- 9.3.6. Bakery and Confectionery

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Romania Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Fruits and Vegetables

- 10.3.2. Dairy Pr

- 10.3.3. Fish, Meat and Poultry

- 10.3.4. Processed Food

- 10.3.5. Pharmaceutical (Including Biopharma)

- 10.3.6. Bakery and Confectionery

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Rest of Central and Eastern Europe Central and Eastern Europe Refrigerated Transport Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Storage

- 11.1.2. Transportation

- 11.1.3. Value-ad

- 11.2. Market Analysis, Insights and Forecast - by Temperature

- 11.2.1. Chilled

- 11.2.2. Frozen

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Fruits and Vegetables

- 11.3.2. Dairy Pr

- 11.3.3. Fish, Meat and Poultry

- 11.3.4. Processed Food

- 11.3.5. Pharmaceutical (Including Biopharma)

- 11.3.6. Bakery and Confectionery

- 11.3.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Baltic Logistic Solutions

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Beno-Trans

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gartner KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nordfrost

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Magnum Logistics OU

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PLG Logistics and Warehousing

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NewCold

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 FRIGO Coldstore Logistics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nagel-Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wilms Frozen Food Service**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Baltic Logistic Solutions

List of Figures

- Figure 1: Central and Eastern Europe Refrigerated Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Central and Eastern Europe Refrigerated Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 3: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 7: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 11: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 15: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 19: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 23: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Temperature 2020 & 2033

- Table 27: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Central and Eastern Europe Refrigerated Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe Refrigerated Transport Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Central and Eastern Europe Refrigerated Transport Market?

Key companies in the market include Baltic Logistic Solutions, Beno-Trans, Gartner KG, Nordfrost, Magnum Logistics OU, PLG Logistics and Warehousing, NewCold, FRIGO Coldstore Logistics, Nagel-Group, Wilms Frozen Food Service**List Not Exhaustive.

3. What are the main segments of the Central and Eastern Europe Refrigerated Transport Market?

The market segments include Service, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

March 2021 : Danone Sp. z o.o., part of the global food company Danone, extends its cooperation with Kuehne+Nagel in Poland for another seven years. In conjunction, a new distribution center spanning 11,079 sqm has been opened in Ruda Śląska. The facility is equipped to store goods at a controlled temperature of 4 - 6°C, including co-packing in cold and ambient chambers. While unloading and loading goods, product integrity is ensured by insulated cooling aprons, gates and platforms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe Refrigerated Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe Refrigerated Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe Refrigerated Transport Market?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe Refrigerated Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence