Key Insights

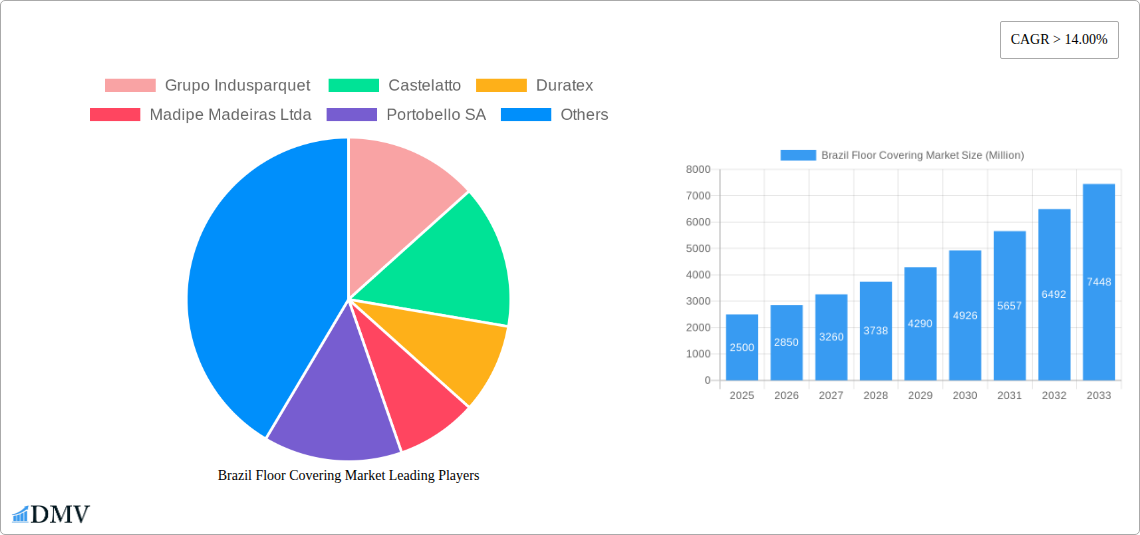

The Brazil floor covering market, valued at approximately $7.8 billion in 2025, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 11.78%. This robust growth trajectory, spanning from 2025 to 2033, is propelled by a confluence of dynamic market forces. The booming construction industry, characterized by escalating new residential and commercial developments, stands as a primary catalyst. Concurrently, rising disposable incomes and an expanding middle class are fueling consumer demand for enhanced home aesthetics and superior flooring materials. The replacement and renovation segments are also demonstrating considerable momentum, driven by homeowners seeking upgrades and modernization. The market is comprehensively segmented by construction type (new construction, replacement & renovation), end-user (residential, commercial), distribution channel (B2C/retail, B2B/contractors/dealers), and flooring type (carpet and area rugs, hard/non-resilient, soft/resilient, ceramic). A clear preference for durable and aesthetically appealing flooring solutions, particularly ceramic and hard flooring options, is a key contributor to this market expansion.

Brazil Floor Covering Market Market Size (In Billion)

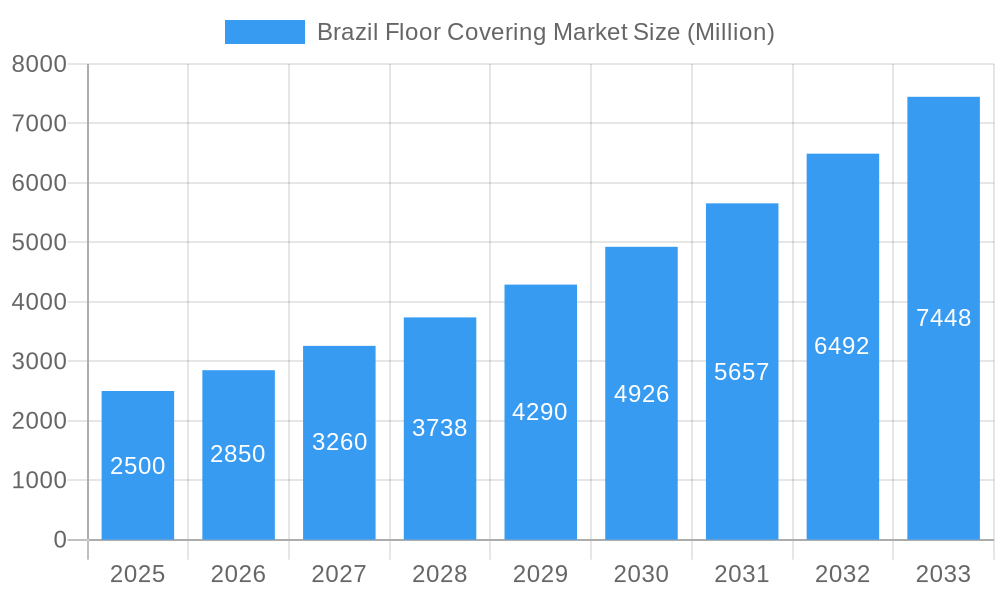

Despite the positive outlook, certain challenges warrant consideration. Economic volatility and fluctuations in raw material pricing could potentially temper market growth. Intense competition among established entities such as Grupo Indusparquet, Castelatto, and Duratex necessitates ongoing innovation and strategic marketing initiatives to sustain and grow market share. Evolving government regulations pertaining to building materials and environmental considerations may also shape market trends. Nevertheless, the Brazil floor covering market presents substantial growth opportunities for both domestic and international stakeholders throughout the forecast period. The increasing adoption of sustainable and eco-friendly flooring solutions represents a significant avenue for growth and market differentiation in this competitive landscape.

Brazil Floor Covering Market Company Market Share

Brazil Floor Covering Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Brazil floor covering market, offering a comprehensive overview of its current state and future trajectory. From market size and segmentation to key players and emerging trends, this report is an essential resource for stakeholders seeking to navigate this lucrative market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report value is xx Million.

Brazil Floor Covering Market Composition & Trends

This section delves into the intricate composition of the Brazilian floor covering market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user preferences, and merger & acquisition (M&A) activities. The market is characterized by a moderately concentrated landscape, with key players like Grupo Indusparquet, Castelatto, and Duratex holding significant market share. However, the presence of numerous smaller regional players fosters competition. Innovation is driven by increasing demand for sustainable and aesthetically pleasing flooring solutions, with technological advancements in material science and manufacturing processes playing a crucial role.

- Market Share Distribution (2024): Grupo Indusparquet (15%), Castelatto (12%), Duratex (10%), Others (63%).

- M&A Activity (2019-2024): A total of xx Million in M&A deals were recorded during this period, with a significant increase in activity in the last two years. The acquisition of Elizabeth Revestimentos Ltda by Mohawk Industries in February 2023 exemplifies the consolidation trend.

- Regulatory Landscape: Brazilian regulations concerning building materials and environmental standards significantly influence market dynamics. Stricter environmental norms promote the adoption of eco-friendly flooring options.

- Substitute Products: The market faces competition from alternative flooring materials like vinyl and laminate, necessitating continuous innovation to maintain competitiveness.

- End-User Profiles: Residential construction constitutes the largest segment, followed by commercial projects. Demand from both segments is influenced by economic growth, real estate development, and consumer preferences.

Brazil Floor Covering Market Industry Evolution

The Brazilian floor covering market has witnessed substantial growth over the past five years, driven by robust economic expansion and rising disposable incomes. This growth trajectory is expected to continue, albeit at a moderated pace, during the forecast period. Technological advancements, such as the development of high-performance, durable, and aesthetically diverse flooring materials, have contributed significantly to market expansion. Changing consumer preferences towards eco-friendly and sustainable products are also shaping industry evolution. The market's growth rate from 2019 to 2024 was approximately x%, while projections suggest a y% growth rate from 2025 to 2033. Adoption of new technologies like digital printing for customized designs is expected to reach z% by 2033. The increasing popularity of resilient flooring, driven by ease of maintenance and cost-effectiveness, is a key growth driver.

Leading Regions, Countries, or Segments in Brazil Floor Covering Market

The Southeast region of Brazil dominates the floor covering market due to high population density, robust economic activity, and significant construction activity. Within the market, the residential segment represents the largest share, fueled by a burgeoning middle class and increasing urbanization. New construction projects constitute a significant portion of demand, though replacement and renovation activities contribute considerably. B2C retail channels remain the dominant distribution pathway, though B2B channels catering to contractors and dealers are also significant. Hard/non-resilient floor coverings, particularly ceramic tiles, hold the largest market share, reflecting consumer preference for durability and aesthetics.

- Key Drivers for Southeast Region Dominance: High population density, concentrated economic activity, significant infrastructure development projects.

- Key Drivers for Residential Segment Dominance: Growing middle class, increasing urbanization, preference for improved living standards.

- Key Drivers for New Construction Segment Dominance: Booming real estate sector, government initiatives promoting housing development.

Brazil Floor Covering Market Product Innovations

Recent years have witnessed a surge in innovative floor covering products in Brazil, primarily focused on enhanced durability, aesthetic appeal, and sustainability. Manufacturers are incorporating advanced materials and manufacturing techniques to create products with superior performance characteristics. The introduction of waterproof and scratch-resistant flooring solutions is gaining traction, particularly in high-traffic areas. Moreover, eco-friendly options made from recycled or renewable materials are increasingly popular among environmentally conscious consumers. The use of advanced digital printing techniques allows for highly customized designs.

Propelling Factors for Brazil Floor Covering Market Growth

Several factors contribute to the sustained growth of the Brazilian floor covering market. Firstly, the country's robust economic growth fuels increased construction activity, both residential and commercial. Secondly, rising disposable incomes are driving consumer demand for higher-quality and aesthetically pleasing flooring solutions. Thirdly, government initiatives aimed at improving infrastructure and housing further stimulate market growth. Finally, the influx of innovative products with enhanced performance and sustainability features attracts a broader consumer base.

Obstacles in the Brazil Floor Covering Market

The Brazilian floor covering market faces several challenges. Fluctuations in the economy can impact construction activity and consumer spending, thus affecting market demand. Supply chain disruptions, particularly those related to raw material imports, can cause production delays and price increases. Intense competition among domestic and international players necessitates continuous innovation and efficient cost management to maintain profitability. Lastly, stringent regulatory compliance adds to operational costs.

Future Opportunities in Brazil Floor Covering Market

The future of the Brazilian floor covering market appears bright, presenting numerous growth opportunities. The growing demand for sustainable and eco-friendly flooring solutions creates significant potential for manufacturers offering such products. The expansion of the middle class and increasing urbanization fuels demand for improved housing quality, including advanced flooring solutions. Furthermore, the rising adoption of smart home technologies opens up opportunities for integrating smart features into flooring products.

Major Players in the Brazil Floor Covering Market Ecosystem

- Grupo Indusparquet

- Castelatto

- Duratex

- Madipe Madeiras Ltda

- Portobello SA

- Ceramica Almeida

- Grupo Cedasa

- Ceramica Aurora S A

- Grupo Embramaco

- Eucatex

Key Developments in Brazil Floor Covering Market Industry

- May 2023: The Cedasa Group launched its new Liverpool Polido and Matte tiles, expanding its product portfolio in the ceramic tile segment.

- February 2023: Mohawk Industries, Inc. acquired Elizabeth Revestimentos Ltda, consolidating its position in the Brazilian market.

Strategic Brazil Floor Covering Market Forecast

The Brazilian floor covering market is poised for sustained growth in the coming years. The combination of robust economic growth, rising disposable incomes, and increasing urbanization will continue to drive demand for high-quality flooring solutions. The adoption of sustainable and innovative products will shape market trends, offering exciting opportunities for manufacturers who embrace technological advancements and cater to evolving consumer preferences. The market is anticipated to reach xx Million by 2033.

Brazil Floor Covering Market Segmentation

-

1. Type

- 1.1. Carpet and Area Rugs

-

1.2. Hard/Non-Resilient Floor Covering

- 1.2.1. Wood Flooring

- 1.2.2. Laminate Flooring

- 1.2.3. Stone/Marble Flooring?

- 1.2.4. Ceramic Flooring

-

1.3. Soft/Resilient Floor Covering

- 1.3.1. Vinyl Sheets

- 1.3.2. Luxury Vinyl Tiles

- 1.3.3. Rubber

- 1.3.4. Linoleum

-

2. Construction Type

- 2.1. New Construction

- 2.2. Replacement & Renovation

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

-

4. Distribution Channel

-

4.1. B2C/Retail Channels

- 4.1.1. Specialty Stores

- 4.1.2. Home Centers

- 4.1.3. Online

- 4.1.4. Other Distribution Channels

- 4.2. B2B/Contractors/Dealers

-

4.1. B2C/Retail Channels

Brazil Floor Covering Market Segmentation By Geography

- 1. Brazil

Brazil Floor Covering Market Regional Market Share

Geographic Coverage of Brazil Floor Covering Market

Brazil Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Sector is Driving the Floor Covering Market; Growing Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Skill Gap and Labor Shortages Strikes as Major Restraints For Floor Covering Manufacturing And Maintenance

- 3.4. Market Trends

- 3.4.1. The Increasing Population in Brazil is Driving the Flooring Covering Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Hard/Non-Resilient Floor Covering

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Laminate Flooring

- 5.1.2.3. Stone/Marble Flooring?

- 5.1.2.4. Ceramic Flooring

- 5.1.3. Soft/Resilient Floor Covering

- 5.1.3.1. Vinyl Sheets

- 5.1.3.2. Luxury Vinyl Tiles

- 5.1.3.3. Rubber

- 5.1.3.4. Linoleum

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Replacement & Renovation

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. B2C/Retail Channels

- 5.4.1.1. Specialty Stores

- 5.4.1.2. Home Centers

- 5.4.1.3. Online

- 5.4.1.4. Other Distribution Channels

- 5.4.2. B2B/Contractors/Dealers

- 5.4.1. B2C/Retail Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grupo Indusparquet

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Castelatto

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Duratex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Madipe Madeiras Ltda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Portobello SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ceramica Almeida

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grupo Cedasa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceramica Aurora S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Embramaco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eucatex

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grupo Indusparquet

List of Figures

- Figure 1: Brazil Floor Covering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Floor Covering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Floor Covering Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Brazil Floor Covering Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 4: Brazil Floor Covering Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 5: Brazil Floor Covering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Brazil Floor Covering Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Brazil Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Brazil Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: Brazil Floor Covering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Brazil Floor Covering Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Brazil Floor Covering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Brazil Floor Covering Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Brazil Floor Covering Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 14: Brazil Floor Covering Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 15: Brazil Floor Covering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Brazil Floor Covering Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Brazil Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Brazil Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 19: Brazil Floor Covering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Brazil Floor Covering Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Floor Covering Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the Brazil Floor Covering Market?

Key companies in the market include Grupo Indusparquet , Castelatto, Duratex, Madipe Madeiras Ltda, Portobello SA, Ceramica Almeida, Grupo Cedasa, Ceramica Aurora S A, Grupo Embramaco, Eucatex.

3. What are the main segments of the Brazil Floor Covering Market?

The market segments include Type, Construction Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Sector is Driving the Floor Covering Market; Growing Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

The Increasing Population in Brazil is Driving the Flooring Covering Market.

7. Are there any restraints impacting market growth?

Skill Gap and Labor Shortages Strikes as Major Restraints For Floor Covering Manufacturing And Maintenance.

8. Can you provide examples of recent developments in the market?

In May 2023, The Cedasa Group, renowned in the ceramic tile sector, announced the launch of its latest creation, Liverpool Polidoand Matte tiles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Floor Covering Market?

To stay informed about further developments, trends, and reports in the Brazil Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence