Key Insights

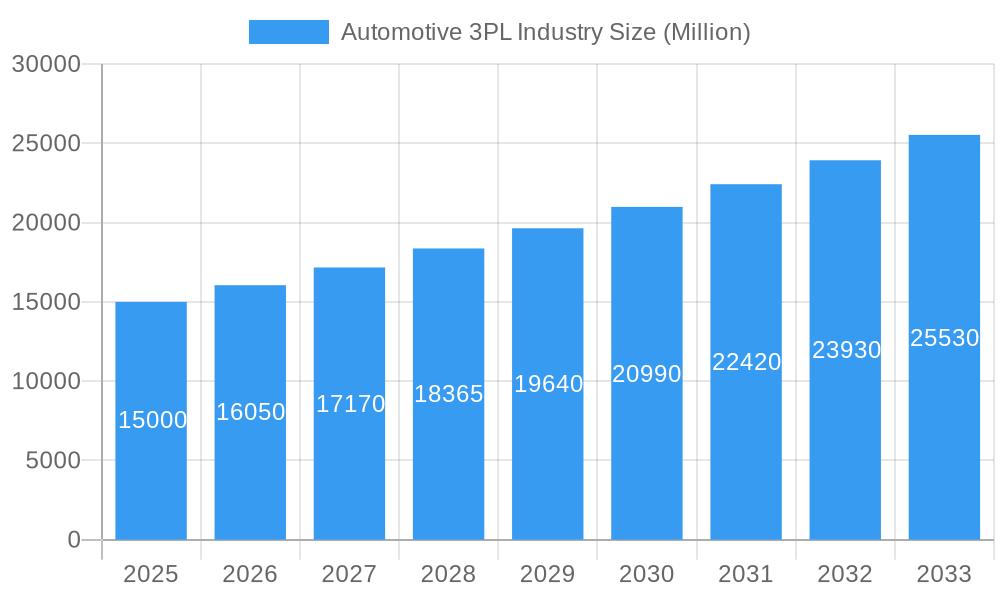

The global Automotive Third-Party Logistics (3PL) market is poised for significant expansion, driven by escalating supply chain complexities and the demand for optimized logistics. The market, currently valued at $1260.98 billion, is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.1% from the base year 2025 through 2033. Key growth catalysts include the worldwide expansion of automotive manufacturing, the proliferation of e-commerce and direct-to-consumer sales models, and the critical need for just-in-time inventory management to reduce costs and streamline production. The integration of advanced technologies like automation, AI, and blockchain in logistics operations is further enhancing efficiency and transparency, accelerating market growth. The market is segmented by service type (transportation, warehousing, distribution, inventory management), vehicle type (finished vehicles, auto components), and geography, with North America, Europe, and Asia-Pacific being key regions. Established providers such as DHL, DB Schenker, and XPO Logistics, alongside emerging regional players, are shaping a competitive landscape.

Automotive 3PL Industry Market Size (In Million)

While the market exhibits a strong positive outlook, certain factors present challenges. These include geopolitical uncertainties, volatile fuel prices, and persistent issues with driver shortages and port congestion. Nevertheless, the overarching growth trend is sustained by the automotive industry's continuous pursuit of efficiency and cost reduction. The increasing adoption of sustainable logistics practices, including the utilization of electric vehicles and optimized route planning, represents both emerging opportunities and evolving challenges for 3PL providers. The future of the Automotive 3PL sector is defined by ongoing innovation, strategic collaborations, and the development of customized solutions to address the dynamic needs of automotive manufacturers and suppliers. This evolution will foster deeper market segmentation and specialization, leading to a more vibrant and competitive industry.

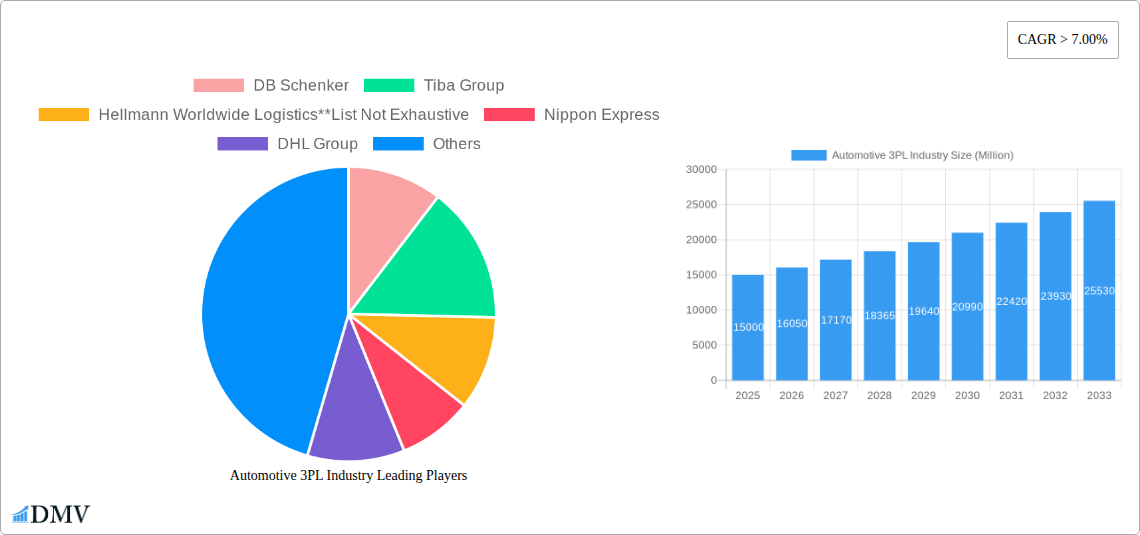

Automotive 3PL Industry Company Market Share

Automotive 3PL Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive 3PL industry, projecting a market value of $XX Million by 2033. It examines market trends, leading players, and future opportunities, offering invaluable insights for stakeholders across the automotive supply chain. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering a complete picture of this dynamic sector.

Automotive 3PL Industry Market Composition & Trends

This section delves into the intricate landscape of the Automotive 3PL market, evaluating its concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and the significant impact of mergers and acquisitions (M&A). The report analyzes market share distribution among key players such as DB Schenker, Tiba Group, Hellmann Worldwide Logistics, Nippon Express, DHL Group, XPO Logistics, CEVA Logistics, GEFCO, Kerry Logistics, and DSV, providing a comprehensive overview of the competitive environment. The analysis includes an assessment of M&A deal values exceeding $XX Million, highlighting the strategic shifts and consolidation within the industry. Furthermore, the report explores the influence of technological advancements, evolving customer expectations, and regulatory changes on the market's trajectory. Specific metrics such as market concentration ratios and the average deal size of M&A transactions are presented.

- Market Concentration: Analysis of market share distribution among key players.

- Innovation Catalysts: Examination of technological advancements impacting the industry.

- Regulatory Landscape: Assessment of regulations affecting Automotive 3PL operations.

- Substitute Products: Identification of alternative solutions and their market impact.

- End-User Profiles: Detailed analysis of automotive manufacturers and their 3PL needs.

- M&A Activities: Detailed review of significant mergers and acquisitions, including deal values.

Automotive 3PL Industry Industry Evolution

This section provides a comprehensive analysis of the Automotive 3PL industry's dynamic evolution, meticulously charting its growth trajectory from 2019 to 2033. We delve into the transformative impact of cutting-edge technological innovations, including advanced automation and sophisticated data analytics, on enhancing operational efficiency and achieving significant cost reductions. Furthermore, the report scrutinizes the evolving landscape of consumer demands, characterized by an insatiable appetite for expedited delivery times and a paramount need for enhanced supply chain transparency, thereby necessitating the development and adoption of highly sophisticated logistics solutions. Quantified growth rates are presented to clearly illustrate the industry's robust expansion across diverse geographical regions and distinct market segments. Inclusion of adoption metrics for emerging technologies, such as blockchain and artificial intelligence (AI), offers a holistic and forward-looking perspective on the ongoing market transformation. The report also critically examines the profound influence of macroeconomic factors, intricate geopolitical events, and disruptive technological advancements on the industry's overarching growth trajectory, offering a nuanced and insightful understanding of the multifaceted forces shaping its continuous evolution.

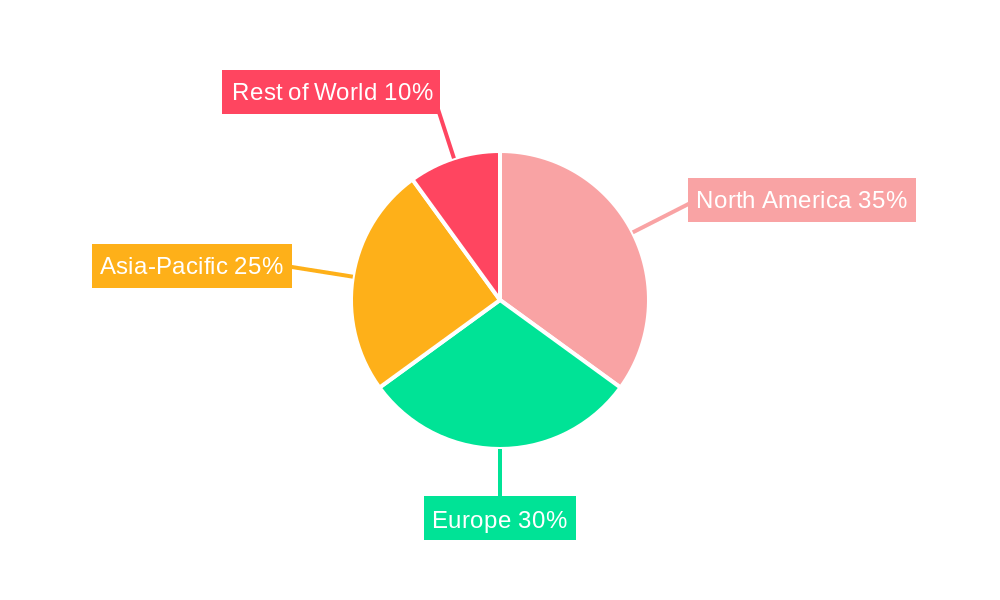

Leading Regions, Countries, or Segments in Automotive 3PL Industry

This section identifies the dominant regions, countries, and segments within the Automotive 3PL market. We analyze key performance indicators across various geographical areas (North America, Mexico, South America, Asia-Pacific, Middle East & Africa, Europe) and service types (Finished Vehicle, Auto Component; Transportation, Warehousing, Distribution, and Inventory Management).

By Region: North America consistently demonstrates strong growth fueled by robust automotive production and a developed logistics infrastructure. The Asia-Pacific region experiences rapid expansion driven by increasing automotive manufacturing in countries like China and India. South America shows steady but slower growth due to economic fluctuations. Europe maintains a significant market share due to its established automotive industry and sophisticated logistics networks. Mexico is a key player due to its strategic location and proximity to the North American market.

By Type: The Finished Vehicle segment holds a larger market share compared to the Auto Component segment, owing to the higher value and complexity of finished vehicle logistics.

By Service: Transportation remains the most significant segment, while warehousing and distribution are experiencing considerable growth driven by the need for efficient inventory management.

Key Drivers: Factors such as substantial investments in infrastructure, supportive government regulations, and the growing demand for efficient supply chain solutions contribute to the dominance of these leading segments and regions.

Automotive 3PL Industry Product Innovations

The Automotive 3PL sector witnesses continuous innovation, introducing advanced technologies like AI-powered route optimization, real-time tracking systems, and blockchain-based security solutions. These enhance efficiency, transparency, and security across the supply chain. Unique selling propositions include customized solutions catering to specific client needs and the integration of advanced analytics for proactive risk management.

Propelling Factors for Automotive 3PL Industry Growth

The robust growth of the Automotive 3PL industry is propelled by a confluence of impactful factors. Revolutionary technological advancements, particularly in AI and automation, are instrumental in streamlining operations, leading to substantial cost reductions and significant efficiency gains. The burgeoning e-commerce sector, coupled with escalating consumer expectations for increasingly rapid delivery times, serves as a powerful catalyst for the adoption of advanced and agile logistics solutions. Moreover, supportive government regulations implemented across numerous regions foster a conducive environment for industry development. Concurrently, sustained economic growth stimulates greater demand for automotive products and the specialized logistics services required to support their efficient movement throughout the supply chain.

Obstacles in the Automotive 3PL Industry Market

The Automotive 3PL industry faces challenges such as fluctuating fuel prices, increasing labor costs, and global supply chain disruptions. Regulatory changes can impact operational costs, while intense competition necessitates continuous innovation to maintain a competitive edge. These factors can significantly influence profitability and overall market performance.

Future Opportunities in Automotive 3PL Industry

The Automotive 3PL industry stands on the cusp of numerous exciting future opportunities. Key among these is the strategic expansion into nascent markets exhibiting substantial growth potential within their automotive sectors. A critical focus will be the widespread adoption of sustainable logistics practices, aligning with global environmental imperatives. Furthermore, the seamless integration of advanced technologies, including the Internet of Things (IoT) for real-time tracking and monitoring, and the eventual deployment of autonomous vehicles for enhanced delivery capabilities, presents significant avenues for innovation and operational improvement. The escalating demand for highly customized and bespoke logistics solutions, alongside the imperative for greater end-to-end supply chain visibility, also represents lucrative and highly sought-after opportunities for forward-thinking industry players.

Major Players in the Automotive 3PL Industry Ecosystem

- DB Schenker

- Tiba Group

- Hellmann Worldwide Logistics

- Nippon Express

- DHL Group

- XPO Logistics

- CEVA Logistics

- GEFCO

- Kerry Logistics

- DSV

Key Developments in Automotive 3PL Industry Industry

- January 2023: CEVA Logistics acquired GEFCO, creating a significant player in finished vehicle logistics.

- October 2022: Red Arts Capital's acquisition of FLEX Logistics expands its warehousing and distribution capabilities on the West Coast.

Strategic Automotive 3PL Industry Market Forecast

The Automotive 3PL market is strategically positioned for substantial and sustained growth, fueled by the relentless pace of technological advancements, the increasing interconnectedness of global trade, and the escalating demand for highly efficient and agile supply chain solutions. The expanding automotive industry in emerging economies presents a wealth of lucrative opportunities for market participants. Concurrently, ongoing advancements in automation and sophisticated data analytics are set to further revolutionize and enhance operational efficiencies. The market is anticipated to experience considerable expansion throughout the forecast period, with key industry players prioritizing innovation, forging strategic partnerships, and proactively adapting to emerging trends to secure and maintain a competitive advantage in this dynamic landscape.

Automotive 3PL Industry Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

Automotive 3PL Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive 3PL Industry Regional Market Share

Geographic Coverage of Automotive 3PL Industry

Automotive 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Increasing partnerships between automotive manufacturers and logistics companies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Finished Vehicle

- 6.1.2. Auto Component

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Transportation

- 6.2.2. Warehous

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Finished Vehicle

- 7.1.2. Auto Component

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Transportation

- 7.2.2. Warehous

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Finished Vehicle

- 8.1.2. Auto Component

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Transportation

- 8.2.2. Warehous

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Finished Vehicle

- 9.1.2. Auto Component

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Transportation

- 9.2.2. Warehous

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Automotive 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Finished Vehicle

- 10.1.2. Auto Component

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Transportation

- 10.2.2. Warehous

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tiba Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hellmann Worldwide Logistics**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Express

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DHL Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XPO Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CEVA Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GEFCO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kerry Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DSV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global Automotive 3PL Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive 3PL Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Automotive 3PL Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive 3PL Industry Revenue (billion), by Service 2025 & 2033

- Figure 5: North America Automotive 3PL Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Automotive 3PL Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive 3PL Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Automotive 3PL Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Automotive 3PL Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Automotive 3PL Industry Revenue (billion), by Service 2025 & 2033

- Figure 11: South America Automotive 3PL Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America Automotive 3PL Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Automotive 3PL Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Automotive 3PL Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Automotive 3PL Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Automotive 3PL Industry Revenue (billion), by Service 2025 & 2033

- Figure 17: Europe Automotive 3PL Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Automotive 3PL Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Automotive 3PL Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Automotive 3PL Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Automotive 3PL Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Automotive 3PL Industry Revenue (billion), by Service 2025 & 2033

- Figure 23: Middle East & Africa Automotive 3PL Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Middle East & Africa Automotive 3PL Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Automotive 3PL Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Automotive 3PL Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Automotive 3PL Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Automotive 3PL Industry Revenue (billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Automotive 3PL Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Automotive 3PL Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive 3PL Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Automotive 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Automotive 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Automotive 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Automotive 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Global Automotive 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Automotive 3PL Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Automotive 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 39: Global Automotive 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Automotive 3PL Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive 3PL Industry?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the Automotive 3PL Industry?

Key companies in the market include DB Schenker, Tiba Group, Hellmann Worldwide Logistics**List Not Exhaustive, Nippon Express, DHL Group, XPO Logistics, CEVA Logistics, GEFCO, Kerry Logistics, DSV.

3. What are the main segments of the Automotive 3PL Industry?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 1260.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Increasing partnerships between automotive manufacturers and logistics companies.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

January 2023: CEVA Logistics, a member of the CMA CGM group, has successfully acquired GEFCO. As part of this adjustment and its merger with GEFCO, CEVA Logistics has announced the formation of a specific finished vehicle logistics organization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive 3PL Industry?

To stay informed about further developments, trends, and reports in the Automotive 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence