Key Insights

The Asia-Pacific waste management market, valued at $111.78 million in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental concerns, and stringent government regulations promoting sustainable waste disposal practices. This growth is further fueled by the expanding industrial sector and a burgeoning middle class leading to increased waste generation. The market's Compound Annual Growth Rate (CAGR) of 6.04% from 2025 to 2033 signifies a significant expansion opportunity for waste management companies. Key drivers include the adoption of advanced waste-to-energy technologies, a heightened focus on recycling and resource recovery, and increasing public-private partnerships to enhance infrastructure and services. The market is segmented by waste type (municipal solid waste, industrial waste, hazardous waste, etc.), service type (collection, transportation, processing, disposal), and technology (landfilling, incineration, composting, recycling). Competition is intense, with established players like Suez Environment SA, Waste Management Inc., and Veolia Environmental Services vying for market share alongside regional players. The market's success will depend on the implementation of innovative solutions, efficient regulatory frameworks, and substantial investment in infrastructure to accommodate the rapidly increasing waste volume across the diverse regions of Asia-Pacific.

Asia-Pacific Waste Management Market Market Size (In Million)

While the provided data focuses on a specific year (2025), understanding the historical context is crucial for accurate forecasting. Considering the CAGR of 6.04%, we can anticipate a continuous market expansion throughout the forecast period (2025-2033). This growth will likely be uneven across different segments and regions within Asia-Pacific. Countries with rapidly developing economies and high population density will exhibit higher growth rates compared to others. Challenges remain, particularly regarding the lack of adequate infrastructure in certain areas and the need to address informal waste management practices. However, proactive government policies, technological advancements, and evolving consumer awareness regarding waste management are expected to mitigate these challenges and drive sustained market growth throughout the forecast period.

Asia-Pacific Waste Management Market Company Market Share

Asia-Pacific Waste Management Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific waste management market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes a robust methodology, incorporating historical data (2019-2024) and forecasting market trends from 2025 to 2033, providing valuable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%.

Asia-Pacific Waste Management Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific waste management market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and merger & acquisition (M&A) activities.

Market Concentration & Share Distribution: The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2025. Suez Environment SA, Waste Management Inc., and Veolia Environmental Services are among the leading players, each commanding a significant share. However, smaller, regional players also hold substantial influence, particularly in specific segments and geographic locations.

- Market Share (2025): Suez Environment SA (xx%), Waste Management Inc. (xx%), Veolia Environmental Services (xx%), Cleanaway Waste Management (xx%), Others (xx%).

- M&A Activity (2019-2024): A total of xx M&A deals were recorded during this period, with an aggregate deal value of approximately xx Million. These transactions primarily involved acquisitions of smaller waste management companies by larger multinational corporations, aiming to expand geographic reach and service offerings.

Innovation Catalysts & Regulatory Landscape: Stringent environmental regulations across the region are driving innovation in waste management technologies, including advanced recycling techniques, waste-to-energy solutions, and smart waste management systems. Government incentives and policies further accelerate adoption of sustainable waste management practices. The increasing awareness of environmental issues and the growing emphasis on circular economy models are additional key drivers.

Substitute Products & End-User Profiles: While traditional landfill remains a prominent method, substitute products such as anaerobic digestion and incineration are gaining traction. End-users span diverse sectors including municipal authorities, industrial facilities, commercial establishments, and residential consumers.

Asia-Pacific Waste Management Market Industry Evolution

This section delves into the dynamic evolution of the Asia-Pacific waste management market, examining its growth trajectories, the integration of cutting-edge technologies, and the evolving landscape of consumer and industrial demands.

The market has experienced robust expansion, propelled by relentless urbanization, escalating industrialization, and a growing imperative for environmental stewardship. During the historical period (2019-2024), the market demonstrated an average annual growth rate of [Insert Specific XX%]. Projections for the forecast period (2025-2033) indicate a Compound Annual Growth Rate (CAGR) of approximately [Insert Specific XX%]. This anticipated growth is underpinned by amplified government investments in sophisticated waste management infrastructure and the widespread adoption of pioneering waste processing technologies. Innovations such as AI-driven waste sorting systems, advanced chemical and mechanical recycling methodologies, and enhanced waste-to-energy solutions are revolutionizing operational efficiency and elevating sustainability benchmarks across the region. Concurrently, consumer and corporate preferences are decisively shifting towards eco-conscious waste management solutions, thereby stimulating a heightened demand for sustainable and forward-thinking services and products.

For granular insights into specific growth rates, adoption metrics for various technologies, and detailed breakdowns by segment and geographical sub-region, please refer to the comprehensive data presented within the full market report.

Leading Regions, Countries, or Segments in Asia-Pacific Waste Management Market

This section meticulously identifies and analyzes the dominant regions, key countries, and significant market segments shaping the Asia-Pacific waste management landscape.

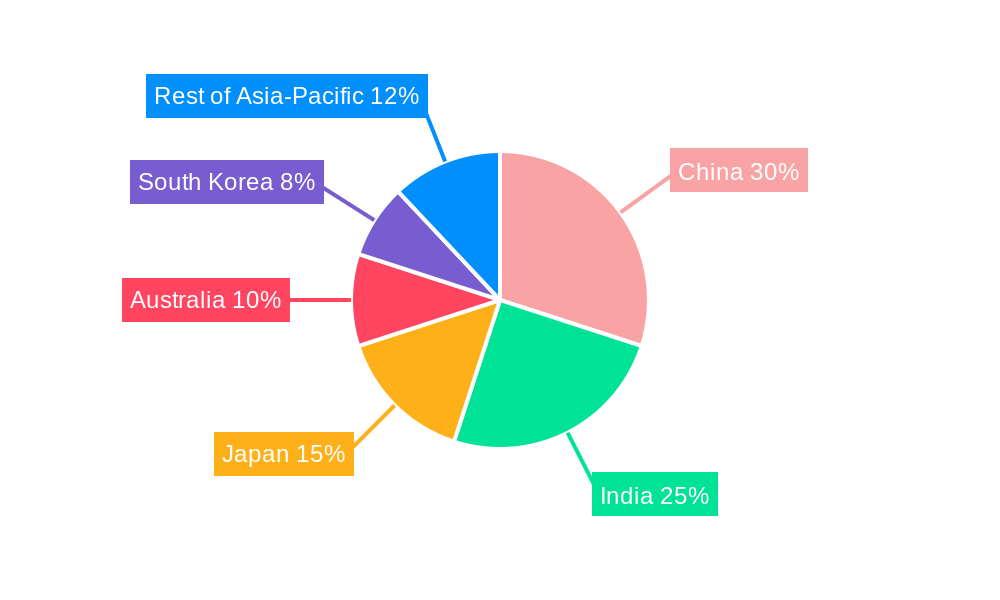

- Dominant Region: China, followed by India and Japan, collectively command the largest market share. This dominance is attributed to their substantial population densities, vigorous economic growth trajectories, and increasingly stringent environmental regulations mandating advanced waste management practices.

- Key Growth Catalysts:

- High Population Density: Directly correlating to significant waste generation volumes, necessitating efficient collection and processing solutions.

- Rapid Urbanization: Intensifying waste management challenges while simultaneously creating substantial opportunities for innovative service providers and infrastructure development.

- Stringent Environmental Regulations: Serving as a powerful impetus for the adoption of sustainable waste management practices, circular economy principles, and advanced pollution control technologies.

- Government Investments: Significant public funding directed towards developing state-of-the-art waste management infrastructure, research and development, and the deployment of cutting-edge technologies.

- Rising Environmental Awareness: A palpable increase in environmental consciousness among both consumers and corporations, driving the demand for transparent, ethical, and eco-friendly waste management solutions and services.

The report provides an in-depth analysis of the unique market dynamics within China and India, exploring their distinct regulatory frameworks, varying rates of technological assimilation, and prevailing waste management methodologies. Furthermore, the growth potential and market penetration of other significant economies, including Australia, South Korea, and Singapore, are thoroughly examined.

Asia-Pacific Waste Management Market Product Innovations

The Asia-Pacific waste management sector is a hotbed of groundbreaking product innovations designed to enhance efficiency, minimize environmental impact, and bolster overall system sustainability. Notable advancements include the development of intelligent, sensor-equipped smart bins that optimize waste collection routes through real-time data analytics, thereby reducing operational costs and carbon emissions. Furthermore, sophisticated recycling technologies are emerging, capable of processing increasingly complex waste streams, including mixed plastics and electronic waste, to recover valuable materials. Waste-to-energy (WtE) plants are also a significant area of innovation, transforming waste into a viable source of renewable energy. The unique selling propositions of these innovations lie in their ability to achieve higher waste sorting accuracy, significantly boost recycling rates, and contribute to a substantial reduction in greenhouse gas emissions, aligning with global climate goals.

Propelling Factors for Asia-Pacific Waste Management Market Growth

Several factors propel the growth of the Asia-Pacific waste management market. Firstly, escalating environmental concerns and stringent government regulations are driving the adoption of sustainable waste management practices. Secondly, the rapid urbanization and industrialization in the region generate massive amounts of waste, creating a significant demand for efficient waste management solutions. Thirdly, increasing investments in infrastructure and technological advancements are improving the efficiency and sustainability of waste management systems. The initiatives such as the Indian government's Swachh Bharat Mission significantly contribute to market growth.

Obstacles in the Asia-Pacific Waste Management Market

Despite the growth opportunities, challenges persist. High initial investment costs associated with advanced waste management technologies can hinder adoption, particularly for smaller companies and municipalities with limited budgets. Furthermore, inconsistent waste collection and disposal practices and the lack of awareness among citizens about proper waste segregation create obstacles. Supply chain disruptions and the lack of skilled labor further compound the challenges. These factors contribute to reduced efficiency and higher operational costs, impacting overall market growth.

Future Opportunities in Asia-Pacific Waste Management Market

Future opportunities lie in expanding waste-to-energy projects, promoting advanced recycling technologies, and developing smart waste management systems. The growing focus on the circular economy presents significant opportunities for innovative businesses. Untapped markets in rural areas and the increasing adoption of sustainable consumption patterns present additional avenues for growth. Furthermore, the development of innovative financing mechanisms and public-private partnerships can accelerate the adoption of sustainable waste management practices.

Major Players in the Asia-Pacific Waste Management Market Ecosystem

- Suez Environment SA [Suez Website]

- Waste Management Inc. [Waste Management Website]

- Cleanaway Waste Management [Cleanaway Website]

- Veolia Environmental Services [Veolia Website]

- BRISEA Group Inc

- Attero

- Remondis AG & Co Kg

- Daiseki Co Ltd

- Averda

- Clean Harbors Inc

- 7 Other Companies

- 3 Other Companies

Key Developments in Asia-Pacific Waste Management Market Industry

- December 2023: The Asian Development Bank (ADB) has allocated a substantial loan of USD 200 Million to bolster solid waste management and sanitation services across numerous Indian cities, integral to the nation's Swachh Bharat Mission–Urban 2.0. This initiative is poised to accelerate the adoption of sustainable waste management practices and foster technological advancements within the sector.

- April 2023: SUEZ, a global leader in water and waste management, has formalized a strategic cooperation agreement with Wanhua Chemical Group and China Railway Shanghai Engineering Bureau Group. This collaboration focuses on a significant seawater desalination project in Shandong province, underscoring SUEZ's steadfast commitment to driving sustainable development and championing green initiatives within the Chinese market.

Strategic Asia-Pacific Waste Management Market Forecast

The Asia-Pacific waste management market is poised for substantial growth driven by increasing environmental awareness, government initiatives, and technological advancements. Opportunities abound in developing and implementing innovative waste management solutions, particularly in emerging economies. The market's future hinges on collaborative efforts between governments, businesses, and communities to promote sustainable waste management practices and achieve a circular economy. The projected growth indicates a significant market potential for businesses involved in providing sustainable waste management solutions across the region.

Asia-Pacific Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. E-waste

- 1.4. Plastic Waste

- 1.5. Biomedic

-

2. Disposal Methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

- 2.4. Other Disposal Methods

Asia-Pacific Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waste Management Market Regional Market Share

Geographic Coverage of Asia-Pacific Waste Management Market

Asia-Pacific Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization and Population Growth; Government Regulations and Initiatives

- 3.3. Market Restrains

- 3.3.1. Rapid Urbanization and Population Growth; Government Regulations and Initiatives

- 3.4. Market Trends

- 3.4.1. Plastic Waste Driving Waste Management in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. E-waste

- 5.1.4. Plastic Waste

- 5.1.5. Biomedic

- 5.2. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.2.4. Other Disposal Methods

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Suez Environment SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Waste Management Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cleanaway Waste Management

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Veolia Environmental Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BRISEA Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Attero

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remondis AG & Co Kg

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daiseki Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Averda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Clean Harbors Inc **List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Suez Environment SA

List of Figures

- Figure 1: Asia-Pacific Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Asia-Pacific Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Asia-Pacific Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 4: Asia-Pacific Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 5: Asia-Pacific Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 8: Asia-Pacific Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 9: Asia-Pacific Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 10: Asia-Pacific Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 11: Asia-Pacific Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waste Management Market?

The projected CAGR is approximately 6.04%.

2. Which companies are prominent players in the Asia-Pacific Waste Management Market?

Key companies in the market include Suez Environment SA, Waste Management Inc, Cleanaway Waste Management, Veolia Environmental Services, BRISEA Group Inc, Attero, Remondis AG & Co Kg, Daiseki Co Ltd, Averda, Clean Harbors Inc **List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Asia-Pacific Waste Management Market?

The market segments include Waste Type, Disposal Methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization and Population Growth; Government Regulations and Initiatives.

6. What are the notable trends driving market growth?

Plastic Waste Driving Waste Management in Asia-Pacific.

7. Are there any restraints impacting market growth?

Rapid Urbanization and Population Growth; Government Regulations and Initiatives.

8. Can you provide examples of recent developments in the market?

December 2023: The Asian Development Bank sanctioned a USD 200 million loan to enhance solid waste management and sanitation in Indian cities. This funding supports the Indian government's Swachh Bharat (Clean India) Mission–Urban 2.0, which aims to make all cities garbage-free by 2026. The program will implement international best practices, new technologies, and climate and disaster-resilient approaches in municipal solid waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence