Key Insights

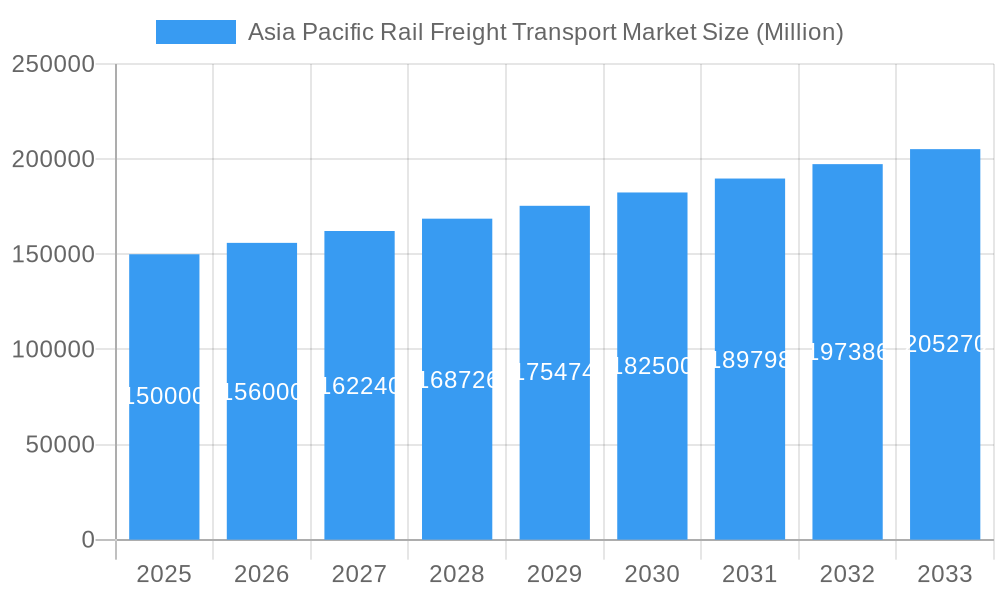

The Asia-Pacific rail freight transport market is poised for substantial expansion, fueled by escalating industrial activity, the burgeoning e-commerce sector, and an increased demand for sustainable logistics. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.2% from 2024 to 2033. Key growth catalysts include government-led initiatives to enhance rail infrastructure in nations such as India, China, and Australia, alongside a strategic shift towards intermodal transportation to mitigate reliance on road freight. Containerized cargo significantly contributes to market value, underscoring the widespread adoption of standardized shipping. While domestic freight continues to hold a dominant share, international rail freight is accelerating due to robust cross-border trade and regional economic integration. Major economies like China and India, with their extensive rail networks, are significant contributors to the market size, estimated at 51067.2 million in the base year 2024. However, challenges such as aging infrastructure and competition from alternative transport modes, particularly road, necessitate continuous investment in modernization and network upgrades to realize the market's full potential.

Asia Pacific Rail Freight Transport Market Market Size (In Billion)

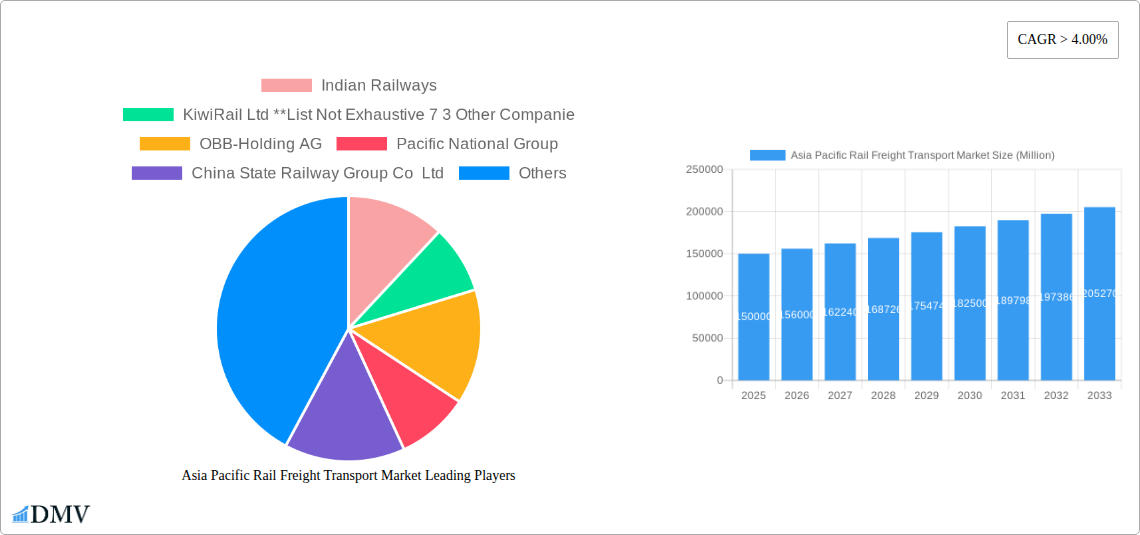

The competitive environment features a blend of state-owned enterprises and private entities. Dominant state-owned operators, including Indian Railways and China State Railway Group Co Ltd, leverage extensive networks and government backing. Private companies are increasingly vital, specializing in niche services, intermodal solutions, and operational enhancements. Future market success hinges on strategic collaborations, technological innovations like automation and digitalization, and consistent infrastructure investment to manage escalating freight volumes and boost efficiency. The diverse economic landscapes across the Asia-Pacific region present both opportunities and challenges, demanding adaptable strategies for market penetration and meeting evolving shipper requirements. Analysis of individual country performance highlights significant regional disparities in market dynamics, influenced by economic growth, infrastructure development, and policy frameworks.

Asia Pacific Rail Freight Transport Market Company Market Share

Asia Pacific Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia Pacific rail freight transport market, encompassing market size, trends, leading players, and future growth projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented by cargo type (containerized, non-containerized, liquid bulk), destination (domestic, international), and country (India, China, Australia, Japan, Indonesia, Thailand, and the Rest of Asia-Pacific). The total market value in 2025 is estimated at xx Million.

Asia Pacific Rail Freight Transport Market Composition & Trends

The Asia Pacific rail freight transport market exhibits a complex interplay of factors influencing its composition and future trajectory. Market concentration is moderate, with a few dominant players like Indian Railways, KiwiRail Ltd, China State Railway Group Co Ltd, and others holding significant market share. However, the presence of numerous smaller players ensures a competitive landscape. The market share distribution is dynamic, with ongoing consolidation through mergers and acquisitions (M&A) influencing market structure. Recent M&A activity, such as Aurizon's acquisition of One Rail Australia for USD 2.35 Billion in July 2022, highlights the strategic importance of scale and diversification. Innovation is driven by advancements in technologies such as automation, improved train control systems, and digitalization of logistics. Stringent regulatory frameworks across different countries influence operational efficiency and investment decisions. Substitute modes of transport, including road and maritime, pose competitive pressure, necessitating continuous improvement in cost-effectiveness and service reliability. End-user profiles vary significantly across industries, encompassing manufacturing, mining, agriculture, and retail.

- Market Concentration: Moderate, with a few dominant players and several smaller operators.

- M&A Activity: Significant, with deals like Aurizon’s acquisition of One Rail Australia driving consolidation. Total M&A deal value in the last 5 years is estimated at xx Million.

- Regulatory Landscape: Varies across countries, impacting operational efficiency and investments.

- Substitute Products: Road and maritime transport pose significant competition.

Asia Pacific Rail Freight Transport Market Industry Evolution

The Asia Pacific rail freight transport market has witnessed significant evolution during the historical period (2019-2024). Growth has been driven by increasing industrialization, expanding e-commerce, and government initiatives promoting rail as a sustainable mode of transportation. Technological advancements, such as the implementation of advanced train control systems and the adoption of digital logistics platforms, have enhanced operational efficiency and service reliability. However, challenges such as aging infrastructure, limited capacity in certain regions, and competition from alternative modes of transport have also impacted growth trajectories. The market experienced a compound annual growth rate (CAGR) of xx% during the historical period and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). The adoption of containerized freight has significantly increased, driven by improved intermodal connectivity and enhanced supply chain efficiency. Shifting consumer demands for faster and more reliable delivery solutions are prompting ongoing investments in infrastructure upgrades and technological innovation.

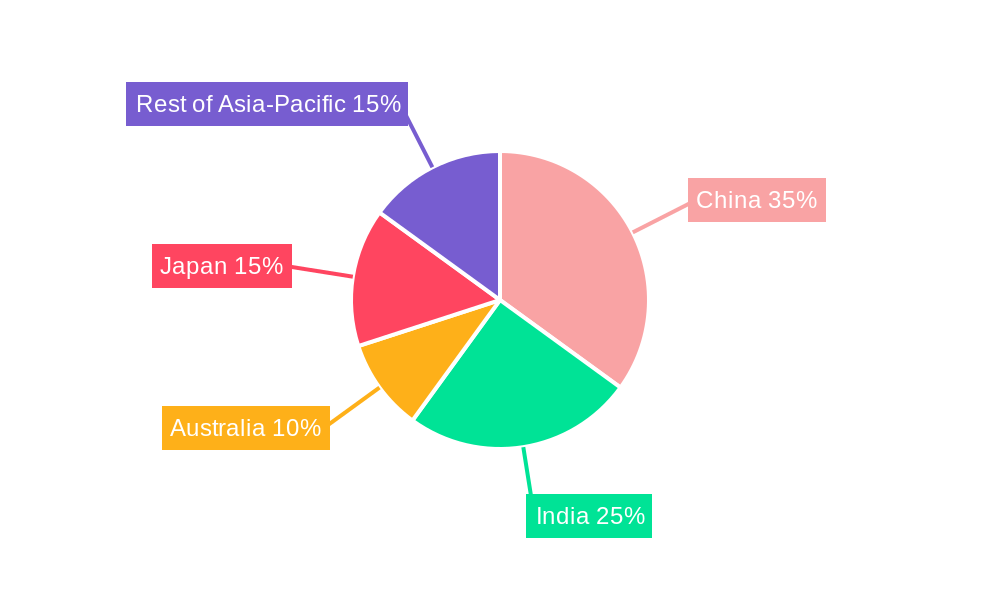

Leading Regions, Countries, or Segments in Asia Pacific Rail Freight Transport Market

China and India emerge as dominant players in the Asia-Pacific rail freight transport market, driven by their vast economies, expanding infrastructure projects, and significant government investment. Australia also holds a strong position, benefiting from its resources sector and well-established rail network. The containerized cargo segment dominates by type, fueled by the growth of intermodal transportation. Domestic freight transport accounts for a larger share compared to international, highlighting the importance of regional connectivity.

- Key Drivers for China: Massive infrastructure development, robust industrial base, and government support for rail transport.

- Key Drivers for India: Increasing industrial production, government investments in infrastructure modernization, and expanding intermodal capabilities.

- Key Drivers for Australia: Strong resources sector, well-established rail network, and efficient logistics infrastructure.

- Key Drivers for Containerized Cargo: Enhanced intermodal capabilities, efficient supply chain management, and growth of e-commerce.

- Key Drivers for Domestic Freight: Regional trade, industrial activity concentrated within national borders, and cost-effectiveness of domestic rail transport.

Asia Pacific Rail Freight Transport Market Product Innovations

Recent innovations include advanced train control systems enhancing safety and efficiency, the adoption of digital platforms for real-time tracking and management of freight, and the development of specialized rolling stock for specific cargo types, like liquid bulk and temperature-sensitive goods. These innovations improve operational efficiency, reduce transit times, and enhance overall supply chain resilience. Unique selling propositions include improved safety features, reduced fuel consumption, and enhanced trackability.

Propelling Factors for Asia Pacific Rail Freight Transport Market Growth

Several key factors are driving the growth of the Asia-Pacific rail freight transport market. Government initiatives promoting sustainable transportation modes and significant investments in infrastructure development are crucial. The increasing demand for efficient and reliable freight transportation, driven by expanding e-commerce and industrialization, further propels market expansion. Technological advancements, such as automation and digitalization, optimize operations and enhance overall efficiency.

Obstacles in the Asia Pacific Rail Freight Transport Market

The Asia-Pacific rail freight transport market faces significant challenges, including aging infrastructure in some regions requiring substantial investment for upgrades. Supply chain disruptions, influenced by global events and regional instability, impact operational efficiency and reliability. Intense competition from alternative transportation modes, such as road and maritime, puts pressure on pricing and service offerings. Regulatory hurdles and varying standards across countries create complexities for operators. These factors collectively limit market growth potential.

Future Opportunities in Asia Pacific Rail Freight Transport Market

Significant opportunities exist for expansion into new markets with underdeveloped rail infrastructure and the adoption of advanced technologies, such as autonomous train operation and blockchain-based tracking systems. Growth is expected in high-value, time-sensitive cargo segments, demanding improved speed and reliability. Sustainable practices, including electrification and the use of alternative fuels, will drive market growth.

Major Players in the Asia Pacific Rail Freight Transport Market Ecosystem

- Indian Railways

- KiwiRail Ltd

- OBB-Holding AG

- Pacific National Group

- China State Railway Group Co Ltd

- Qube Holdings Ltd

- Aurizon Holdings Ltd

- Japan Freight Railway Co

- M & W China Limited

- PT Kereta Api Indonesia

Key Developments in Asia Pacific Rail Freight Transport Market Industry

- July 2022: Aurizon completed the acquisition of One Rail Australia (ORA) for USD 2.35 billion, significantly expanding its market presence and capabilities.

- September 2022: KiwiRail signed a contract with Alstom for a major upgrade to its Train Control System (TCS), enhancing safety, automation, and resilience across its network.

Strategic Asia Pacific Rail Freight Transport Market Forecast

The Asia Pacific rail freight transport market is poised for significant growth over the forecast period (2025-2033), driven by ongoing infrastructure investments, technological advancements, and increasing demand for efficient and sustainable transportation solutions. The focus on enhancing intermodal connectivity, integrating digital technologies, and adopting sustainable practices will shape the market’s future trajectory. The market's potential is substantial, with opportunities for both established players and new entrants to capitalize on the evolving landscape.

Asia Pacific Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

Asia Pacific Rail Freight Transport Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Rail Freight Transport Market Regional Market Share

Geographic Coverage of Asia Pacific Rail Freight Transport Market

Asia Pacific Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Investments in New and Existing Rail Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Indian Railways

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KiwiRail Ltd **List Not Exhaustive 7 3 Other Companie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OBB-Holding AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pacific National Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China State Railway Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qube Holdings Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aurizon Holdings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Japan Freight Railway Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W China Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Kereta Api Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Indian Railways

List of Figures

- Figure 1: Asia Pacific Rail Freight Transport Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Type of Cargo 2020 & 2033

- Table 2: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Destination 2020 & 2033

- Table 3: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Type of Cargo 2020 & 2033

- Table 5: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Destination 2020 & 2033

- Table 6: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Rail Freight Transport Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Asia Pacific Rail Freight Transport Market?

Key companies in the market include Indian Railways, KiwiRail Ltd **List Not Exhaustive 7 3 Other Companie, OBB-Holding AG, Pacific National Group, China State Railway Group Co Ltd, Qube Holdings Ltd, Aurizon Holdings Ltd, Japan Freight Railway Co, M & W China Limited, PT Kereta Api Indonesia.

3. What are the main segments of the Asia Pacific Rail Freight Transport Market?

The market segments include Type of Cargo, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 51067.2 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Investments in New and Existing Rail Systems.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

September 2022 - KiwiRail has signed a supply contract, supported by a fifteen-year maintenance contract, with French multinational Alstom for a once-in-a-generation upgrade to its Train Control System (TCS). The Train Control team manages the movement of freight, commuter and scenic trains across New Zealand and this new computer control system will provide greater automation, resiliency, and safety across the national rail network

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence