Key Insights

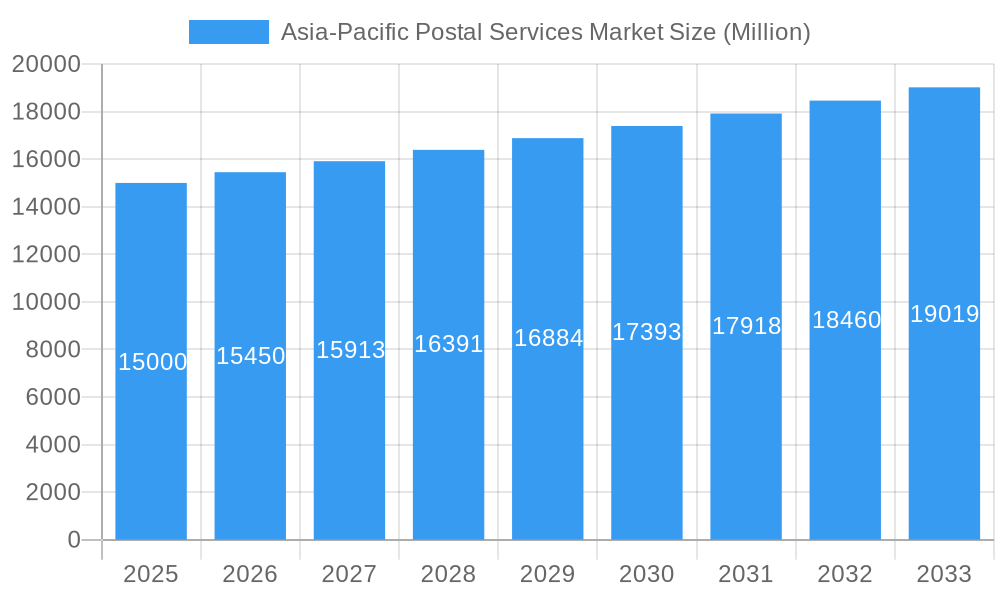

The Asia-Pacific postal services market, including express and standard delivery for letters and parcels across domestic and international routes, is poised for significant expansion. Driven by the region's burgeoning e-commerce, escalating cross-border trade, and accelerating urbanization, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.7% between 2025 and 2033. Key industry participants, including Korea Post, China Post, Japan Post, and global logistics leaders such as DHL and FedEx, are engaging in intense competition, actively investing in infrastructure development, technological innovation, and service diversification to define market trajectories. The parcel delivery segment holds a substantial market share, propelled by the rapid growth of e-commerce, particularly in major economies like China, India, and Japan. Government-led initiatives to enhance logistics infrastructure and streamline international trade further support market expansion. However, potential impediments to growth include volatile fuel costs, rising labor expenses, and diverse regulatory landscapes across different markets. The market's future performance will be contingent upon sustained economic development, advancements in logistics technology, and effective adaptation to evolving consumer demands for speed, reliability, and cost-effective delivery solutions.

Asia-Pacific Postal Services Market Market Size (In Billion)

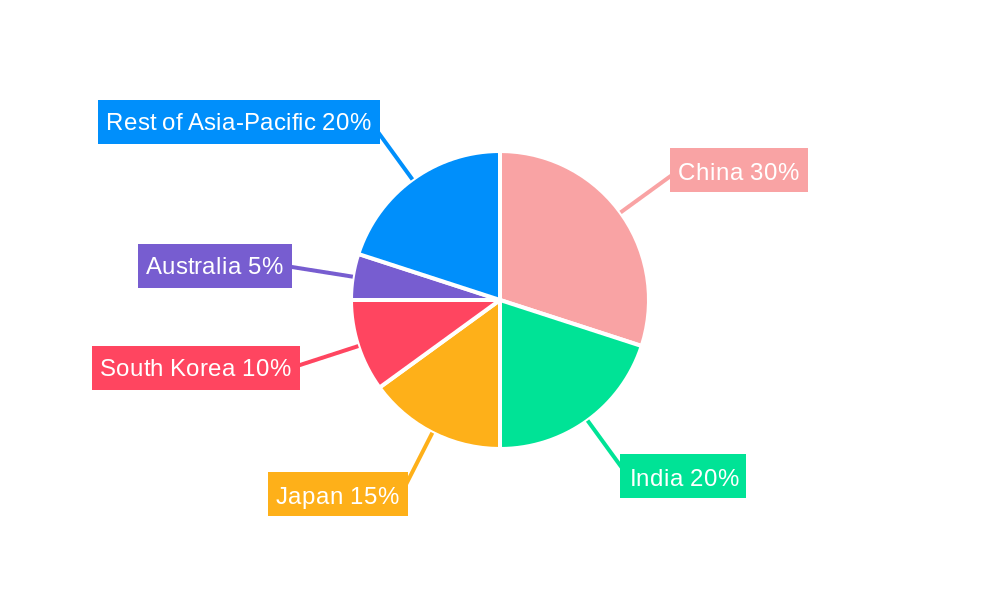

Country-specific market analysis reveals varied growth prospects. Mature markets such as Japan, South Korea, and Australia demonstrate consistent growth, while emerging economies like India and other "Rest of Asia-Pacific" nations present substantial untapped potential, offering lucrative opportunities for both incumbent and new market entrants. Future market expansion will be heavily influenced by the integration of advanced technologies, including automation, AI-driven sorting, and enhanced tracking and delivery management systems. Competitive strategies centered on establishing resilient delivery networks, optimizing efficiency through technology, and offering tailored solutions will be paramount for companies aiming to secure market share in this dynamic and growing sector. Furthermore, a growing emphasis on sustainability and eco-friendly delivery options is increasingly shaping consumer preferences and influencing the overall market landscape.

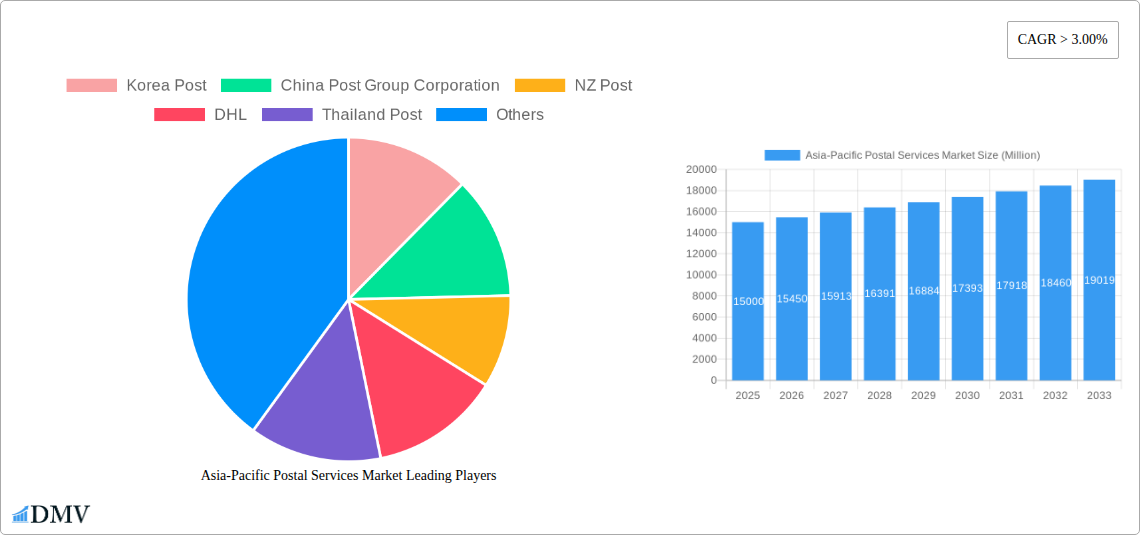

Asia-Pacific Postal Services Market Company Market Share

Asia-Pacific Postal Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific postal services market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Asia-Pacific Postal Services Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific postal services market, examining its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a growing number of smaller, specialized players are also emerging, adding to the market's complexity.

- Market Share Distribution: China Post Group Corporation holds the largest market share, followed by Japan Post Co Ltd and India Post. Korea Post and Australia Post also hold significant shares. Precise figures are detailed within the report.

- Innovation Catalysts: Technological advancements such as automation, e-commerce integration, and improved tracking systems are major drivers of innovation. Government initiatives promoting digitalization are further fueling this trend.

- Regulatory Landscape: Varying regulations across different countries within the Asia-Pacific region create both opportunities and challenges for market players. The report provides a detailed overview of the regulatory environment in key countries.

- Substitute Products: The rise of digital communication channels and courier services poses a competitive threat to traditional postal services. However, the market's resilience stems from its continued relevance for certain types of mail and its essential role in e-commerce logistics.

- End-User Profiles: The market caters to a diverse range of end-users, including businesses, individuals, government agencies, and e-commerce platforms.

- M&A Activities: The report documents significant M&A activities in the industry, analyzing the value and impact of past deals and predicting future consolidation trends. Total M&A deal value over the historical period was approximately xx Million.

Asia-Pacific Postal Services Market Industry Evolution

This section provides an in-depth analysis of the Asia-Pacific postal services market's growth trajectory, technological advancements, and evolving consumer demands. The market experienced significant growth during the historical period (2019-2024), driven by factors such as the rise of e-commerce and the increasing reliance on parcel delivery services. The forecast period (2025-2033) is expected to witness continued growth, albeit at a potentially moderated pace. Technological advancements such as automated sorting systems, enhanced tracking capabilities, and the integration of blockchain technology are streamlining operations and improving efficiency. Shifting consumer demands, particularly the preference for faster and more reliable delivery services, continue to shape the industry's evolution. The report details specific growth rates (xx%) for both the historical and forecast periods, along with adoption metrics for key technologies.

Leading Regions, Countries, or Segments in Asia-Pacific Postal Services Market

This section identifies the dominant regions, countries, and segments within the Asia-Pacific postal services market.

- Dominant Regions: China and India are the leading countries in terms of market size, driven by their large populations and rapidly expanding e-commerce sectors. Japan, South Korea, and Australia also hold significant positions.

- Dominant Segments: Express postal services represent a rapidly growing segment, fueled by the rising demand for faster delivery options. Parcel delivery also dominates, reflecting the increasing popularity of online shopping. International postal services are gaining traction with the increase in cross-border e-commerce.

- Key Drivers:

- China: Government support for the green transformation of the postal sector, coupled with investments in infrastructure, are propelling market growth.

- India: The expansion of e-commerce and a growing middle class are fueling demand for postal services.

- Japan: Technological advancements and efficient logistics networks contribute to the country's strong market position.

- Australia: Government initiatives like the Pacific Postal Development Partnership are fostering growth in the region.

- South Korea: Strong domestic e-commerce and integration of technology into postal services.

Asia-Pacific Postal Services Market Product Innovations

Recent innovations in the Asia-Pacific postal services market include advanced tracking systems, automated sorting facilities, and the integration of mobile applications for enhanced customer experience. These innovations improve efficiency, reduce delivery times, and provide greater transparency throughout the shipping process. The adoption of green technologies like electric vehicles and recyclable packaging materials is also gaining momentum. These innovations are creating unique selling propositions for postal service providers, leading to enhanced competitiveness.

Propelling Factors for Asia-Pacific Postal Services Market Growth

The Asia-Pacific postal services market's growth is fueled by several factors: the exponential rise of e-commerce, requiring efficient and reliable delivery solutions; increased cross-border trade, driving demand for international postal services; government initiatives promoting digitalization and infrastructure development; and technological advancements leading to increased efficiency and improved customer experience. The development of robust logistics networks is further enhancing the industry's growth.

Obstacles in the Asia-Pacific Postal Services Market

Challenges facing the market include infrastructural limitations in certain regions, impacting delivery times and efficiency; fluctuating fuel prices, impacting operational costs; intense competition from private courier services; and varying regulatory environments across countries, creating operational complexities. Supply chain disruptions have also impacted the market, resulting in estimated xx Million in revenue loss.

Future Opportunities in Asia-Pacific Postal Services Market

Future opportunities lie in expanding into underserved rural markets; leveraging technological advancements such as drone delivery and AI-powered logistics; increasing investment in sustainable practices, such as green logistics; and further integrating with e-commerce platforms to provide seamless delivery solutions. The development of specialized services tailored to specific industries or customer segments also represents a significant opportunity.

Major Players in the Asia-Pacific Postal Services Market Ecosystem

- Korea Post

- China Post Group Corporation

- NZ Post

- DHL

- Thailand Post

- Australian Postal Corporation

- Hongkong Post

- FedEx

- India Post

- Singapore Post Limited

- Japan Post Co Ltd

- DTDC EXPRESS LTD

- Pos Malaysia Berhad

- Pos Indonesia

Key Developments in Asia-Pacific Postal Services Market Industry

September 2022: The Australian Government and Australia Post launched the Pacific Postal Development Partnership, a USD 450,000 initiative aimed at improving postal services across the Pacific region. This development signifies a move towards greater regional cooperation and improved service delivery.

July 2022: China's postal and courier sector announced its commitment to a green transformation, aiming to recycle 700 Million corrugated boxes and utilize 10 Million boxes with recyclable packaging. This demonstrates the increasing focus on environmental sustainability within the industry.

Strategic Asia-Pacific Postal Services Market Forecast

The Asia-Pacific postal services market is poised for sustained growth over the forecast period (2025-2033), driven by the ongoing expansion of e-commerce, technological advancements, and government support for infrastructure development. The market's potential is significant, particularly in emerging economies with rapidly growing populations and increasing digital adoption. Continued innovation and strategic partnerships will be crucial for market players to capture this potential and remain competitive.

Asia-Pacific Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Asia-Pacific Postal Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Postal Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Postal Services Market

Asia-Pacific Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Liberalization Affecting the Market Share of Designated Operators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NZ Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thailand Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Australian Postal Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 India Post

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Post Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Japan Post Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC EXPRESS LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pos Malaysia Berhad

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pos Indonesia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Korea Post

List of Figures

- Figure 1: Asia-Pacific Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia-Pacific Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Asia-Pacific Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Postal Services Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Postal Services Market?

Key companies in the market include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post**List Not Exhaustive, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, Pos Indonesia.

3. What are the main segments of the Asia-Pacific Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Liberalization Affecting the Market Share of Designated Operators.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Australian Government and Australia Post announced a new Pacific Postal Development Partnership to strengthen postal services in the Pacific by signing a joint declaration with the Universal Postal Union (UPU) and Asian-Pacific Postal Union (APPU) to improve the efficiency and security of postal services between Australia and Pacific island countries, benefiting consumers and businesses. To support the three-year partnership, the government has provided Australia Post with a USD 450,000 contribution to target improvements to postal systems, processes, technology, and training in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Postal Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence