Key Insights

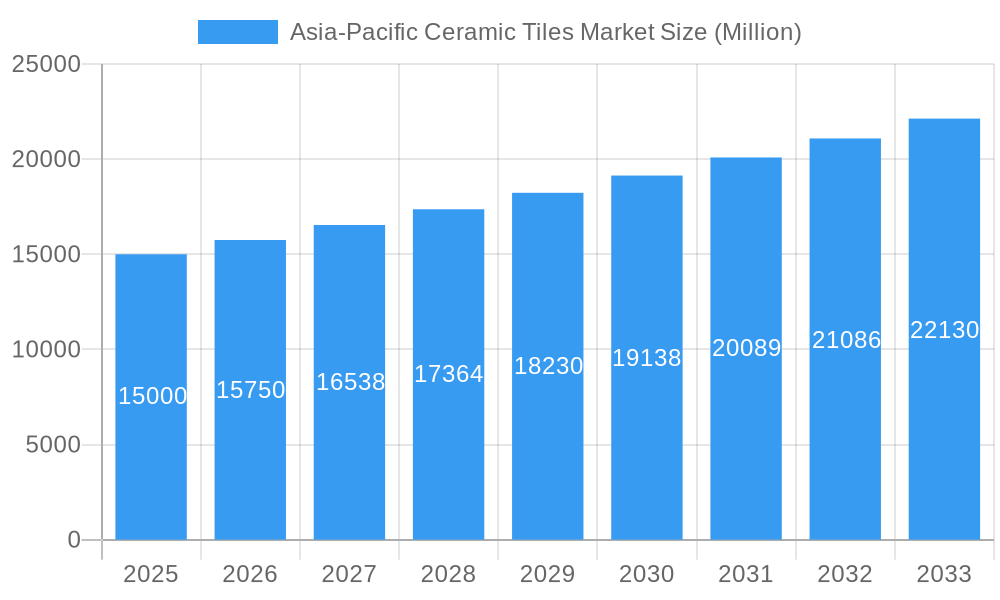

The Asia-Pacific ceramic tile market is projected to expand significantly, driven by robust urbanization, increasing disposable incomes, and a growing demand for durable, aesthetically pleasing surfaces. The residential replacement and commercial construction sectors are key growth engines. Innovations in glazed and porcelain tiles, favored for their enhanced durability and versatility, further propel market expansion. The market is segmented by application, with floor tiles leading, followed closely by wall tiles, particularly in residential segments.

Asia-Pacific Ceramic Tiles Market Market Size (In Billion)

Key players like RAK Ceramics, Kajaria Ceramics, and China Ceramics Co Ltd, alongside international competitors, are actively influencing market dynamics through strategic collaborations and product development. The forecast period (2025-2033) anticipates sustained growth, with the market size estimated at 13.59 billion by 2025, at a CAGR of 9.02%. Despite challenges such as raw material price volatility, competition from alternative flooring, and environmental regulations, the industry is adapting through sustainable practices and technological advancements.

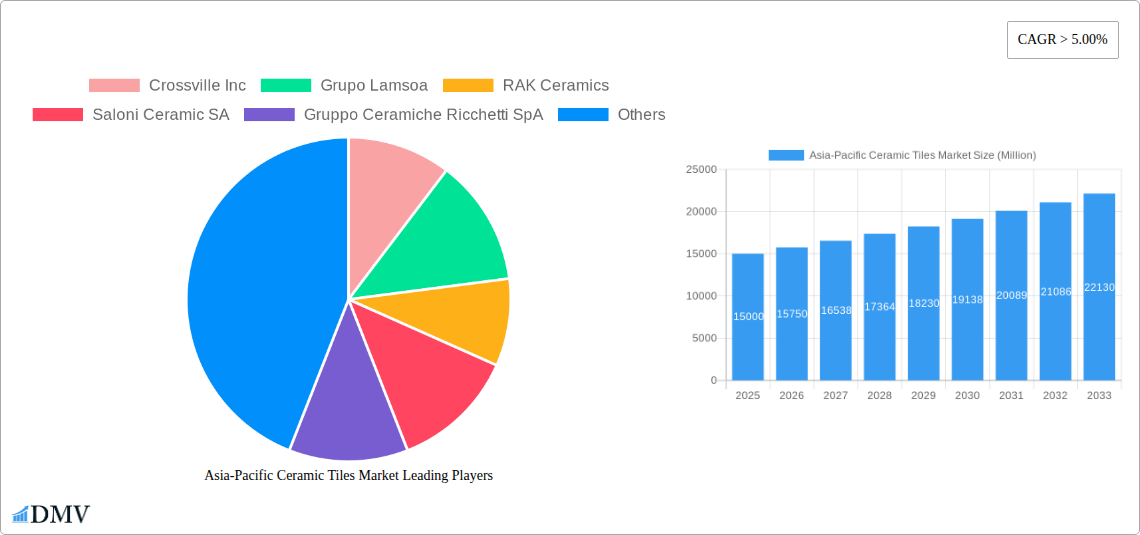

Asia-Pacific Ceramic Tiles Market Company Market Share

Asia-Pacific Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific ceramic tiles market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders including manufacturers, investors, and industry professionals seeking to navigate this dynamic market. The market is expected to reach xx Million by 2033.

Asia-Pacific Ceramic Tiles Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific ceramic tiles market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with key players like RAK Ceramics, Porcelanosa Grupo, and Atlas Concorde S P A holding significant market shares. However, numerous regional players also contribute substantially to the overall market volume.

Market Share Distribution: RAK Ceramics holds approximately 15% of the market share in 2025, while Porcelanosa Grupo and Atlas Concorde hold approximately 10% and 8% respectively. The remaining share is distributed among other major and regional players.

Innovation Catalysts: The market is driven by innovations in material science, design, and manufacturing processes, leading to the development of advanced products such as scratch-free and antibacterial tiles.

Regulatory Landscape: Government regulations concerning building codes and environmental standards significantly influence market dynamics.

Substitute Products: Alternative flooring materials like vinyl and wood pose a competitive threat, although ceramic tiles remain dominant due to their durability and aesthetics.

End-User Profiles: The market caters to diverse end-users, including residential, commercial, and industrial sectors. Residential construction accounts for the largest share of the market.

M&A Activities: In the period 2019-2024, the total value of M&A deals within the Asia-Pacific ceramic tiles market reached approximately xx Million. This activity is expected to continue, driven by consolidation and expansion strategies among industry players.

Asia-Pacific Ceramic Tiles Market Industry Evolution

The Asia-Pacific ceramic tiles market has witnessed robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to rapid urbanization, rising disposable incomes, and increasing construction activities across the region. Technological advancements, such as the introduction of digital printing techniques and large-format tiles, have enhanced product aesthetics and performance, fueling market expansion. Consumer preferences are shifting towards eco-friendly and sustainable products, driving the demand for tiles made from recycled materials and with reduced environmental impact. The forecast period (2025-2033) anticipates continued growth, with a projected CAGR of xx%, driven by ongoing infrastructure development and a preference for aesthetically pleasing and durable flooring solutions. The adoption rate of advanced tile technologies, such as antibacterial tiles, is steadily increasing, indicating a strong future demand.

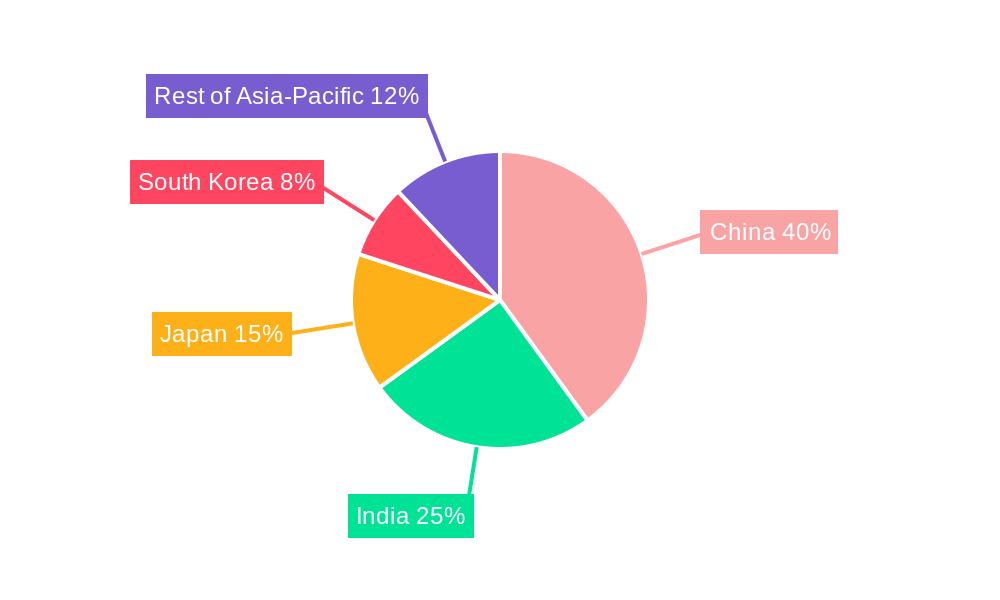

Leading Regions, Countries, or Segments in Asia-Pacific Ceramic Tiles Market

The Asia-Pacific ceramic tiles market is geographically diverse, with significant variations in demand and growth rates across different regions and countries.

Dominant Regions: China, India, and Australia are the leading markets for ceramic tiles in the Asia-Pacific region.

Dominant Segments:

By Application: Floor tiles command the largest market share, driven by their widespread use in residential and commercial buildings.

By End-User: Residential construction accounts for the largest share, reflecting the high volume of new housing projects and renovations across the region.

By Construction Type: New construction remains the primary driver, although the replacement and renovation segment is also showing considerable growth.

By Product: Porcelain tiles are gaining popularity due to their durability and aesthetic appeal, leading to increased market share compared to glazed tiles.

Key Drivers:

- Investment Trends: Significant investments in infrastructure development projects across the region are driving demand for ceramic tiles.

- Regulatory Support: Government initiatives promoting sustainable construction practices are supporting the adoption of eco-friendly tiles.

- Economic Growth: Rising disposable incomes, especially in emerging economies, are boosting consumer spending on home improvement and construction.

Asia-Pacific Ceramic Tiles Market Product Innovations

Recent innovations in the Asia-Pacific ceramic tiles market focus on enhancing product aesthetics, durability, and functionality. Manufacturers are introducing tiles with enhanced scratch resistance, antibacterial properties, and improved water absorption characteristics. The use of advanced digital printing techniques allows for the creation of highly realistic designs, mimicking the appearance of natural materials such as wood and stone. Large-format tiles are also gaining traction, simplifying installation and creating a seamless aesthetic appeal. These innovations cater to the growing demand for sophisticated and high-performance flooring solutions.

Propelling Factors for Asia-Pacific Ceramic Tiles Market Growth

Several factors propel the growth of the Asia-Pacific ceramic tiles market. Rapid urbanization and infrastructure development in emerging economies create significant demand. Increasing disposable incomes and changing lifestyles are driving home improvement and construction activities. Technological advancements, such as the development of high-performance, aesthetically appealing tiles, further fuel market expansion. Government initiatives promoting sustainable construction practices also contribute to market growth by encouraging the adoption of eco-friendly tiles.

Obstacles in the Asia-Pacific Ceramic Tiles Market

Despite significant growth potential, the Asia-Pacific ceramic tiles market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from both domestic and international players can put pressure on profit margins. Stricter environmental regulations can increase compliance costs for manufacturers. These factors can collectively dampen market growth, although the overall outlook remains positive.

Future Opportunities in Asia-Pacific Ceramic Tiles Market

The Asia-Pacific ceramic tiles market presents promising opportunities for growth. The increasing adoption of sustainable construction practices opens avenues for eco-friendly tiles. The rising demand for aesthetically pleasing and high-performance tiles offers opportunities for innovative product development. Expanding into new markets and leveraging digital marketing strategies can broaden market reach and customer engagement.

Major Players in the Asia-Pacific Ceramic Tiles Market Ecosystem

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Del Conca USA

- Mosa

- NITCO

- Porcelanosa Grupo

- Atlas Concorde S P A

- Johnson Tiles

- Florida Tile Inc

- Iris Ceramica

- Siam Cement Group

- Grespania

- Centura Tile Inc

- Mohawk Industries

- Blackstone Industrial (Foshan) Ltd

- Kajaria Ceramics

- China Ceramics Co Ltd

Key Developments in Asia-Pacific Ceramic Tiles Market Industry

- July 2023: Crossville Inc expands its porcelain portfolio with the launch of its Access Point collection, offering on-trend designs and improved availability.

- September 2022: Dongpeng launches an antibacterial ceramic tile range incorporating Microban technology, catering to hygiene-conscious consumers.

- March 2022: Kajaria Ceramics opens its largest store in India, expanding its retail presence and market reach.

Strategic Asia-Pacific Ceramic Tiles Market Forecast

The Asia-Pacific ceramic tiles market is poised for sustained growth over the forecast period (2025-2033). Continued urbanization, rising disposable incomes, and infrastructure development will drive demand. Innovation in product design and manufacturing processes will further enhance market appeal. Opportunities exist for companies to capitalize on the growing preference for sustainable and high-performance tiles. The market's trajectory indicates significant potential for expansion and profitability.

Asia-Pacific Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Others

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

-

4. Construction Type

- 4.1. New Construction

- 4.2. Replacement & Renovation

-

5. Geography

- 5.1. China

- 5.2. Japan

- 5.3. India

- 5.4. South Korea

- 5.5. Australia

- 5.6. Rest of Asia-Pacific

Asia-Pacific Ceramic Tiles Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

Asia-Pacific Ceramic Tiles Market Regional Market Share

Geographic Coverage of Asia-Pacific Ceramic Tiles Market

Asia-Pacific Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth

- 3.4. Market Trends

- 3.4.1. China is One of the Leading Producers of Ceramic Tiles in Asia- Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Construction Type

- 5.4.1. New Construction

- 5.4.2. Replacement & Renovation

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Australia

- 5.5.6. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. Japan

- 5.6.3. India

- 5.6.4. South Korea

- 5.6.5. Australia

- 5.6.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential Replacement

- 6.3.2. Commercial

- 6.4. Market Analysis, Insights and Forecast - by Construction Type

- 6.4.1. New Construction

- 6.4.2. Replacement & Renovation

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. Japan

- 6.5.3. India

- 6.5.4. South Korea

- 6.5.5. Australia

- 6.5.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential Replacement

- 7.3.2. Commercial

- 7.4. Market Analysis, Insights and Forecast - by Construction Type

- 7.4.1. New Construction

- 7.4.2. Replacement & Renovation

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. Japan

- 7.5.3. India

- 7.5.4. South Korea

- 7.5.5. Australia

- 7.5.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential Replacement

- 8.3.2. Commercial

- 8.4. Market Analysis, Insights and Forecast - by Construction Type

- 8.4.1. New Construction

- 8.4.2. Replacement & Renovation

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. Japan

- 8.5.3. India

- 8.5.4. South Korea

- 8.5.5. Australia

- 8.5.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South Korea Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential Replacement

- 9.3.2. Commercial

- 9.4. Market Analysis, Insights and Forecast - by Construction Type

- 9.4.1. New Construction

- 9.4.2. Replacement & Renovation

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. Japan

- 9.5.3. India

- 9.5.4. South Korea

- 9.5.5. Australia

- 9.5.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Australia Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential Replacement

- 10.3.2. Commercial

- 10.4. Market Analysis, Insights and Forecast - by Construction Type

- 10.4.1. New Construction

- 10.4.2. Replacement & Renovation

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. Japan

- 10.5.3. India

- 10.5.4. South Korea

- 10.5.5. Australia

- 10.5.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by End-User

- 11.3.1. Residential Replacement

- 11.3.2. Commercial

- 11.4. Market Analysis, Insights and Forecast - by Construction Type

- 11.4.1. New Construction

- 11.4.2. Replacement & Renovation

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. China

- 11.5.2. Japan

- 11.5.3. India

- 11.5.4. South Korea

- 11.5.5. Australia

- 11.5.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Crossville Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Grupo Lamsoa

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 RAK Ceramics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Saloni Ceramic SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gruppo Ceramiche Ricchetti SpA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Del Conca USA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mosa

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NITCO

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Porcelanosa Grupo

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Atlas Concorde S P A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Johnson Tiles

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Florida Tile Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Iris Ceramica

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Siam Cement Group

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Grespania

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Centura Tile Inc **List Not Exhaustive

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Mohawk Industries

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Blackstone Industrial (Foshan) Ltd

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Kajaria Ceramics

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 China Ceramics Co Ltd

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.1 Crossville Inc

List of Figures

- Figure 1: Asia-Pacific Ceramic Tiles Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 5: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 11: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 17: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 23: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 29: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 32: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 34: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 35: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 36: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 41: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 42: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ceramic Tiles Market?

The projected CAGR is approximately 9.02%.

2. Which companies are prominent players in the Asia-Pacific Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Del Conca USA, Mosa, NITCO, Porcelanosa Grupo, Atlas Concorde S P A, Johnson Tiles, Florida Tile Inc, Iris Ceramica, Siam Cement Group, Grespania, Centura Tile Inc **List Not Exhaustive, Mohawk Industries, Blackstone Industrial (Foshan) Ltd, Kajaria Ceramics, China Ceramics Co Ltd.

3. What are the main segments of the Asia-Pacific Ceramic Tiles Market?

The market segments include Product, Application, End-User, Construction Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market.

6. What are the notable trends driving market growth?

China is One of the Leading Producers of Ceramic Tiles in Asia- Pacific Region.

7. Are there any restraints impacting market growth?

Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth.

8. Can you provide examples of recent developments in the market?

July 2023: Crossville expand its porcelain portfolio with the launch of its Access Point porcelain tile collection. Crossville developed the tile collection offering designers and installers on-trend products, including concrete, travertine and white marble visuals, that will be deeply inventoried and readily available for immediate shipping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence