Key Insights

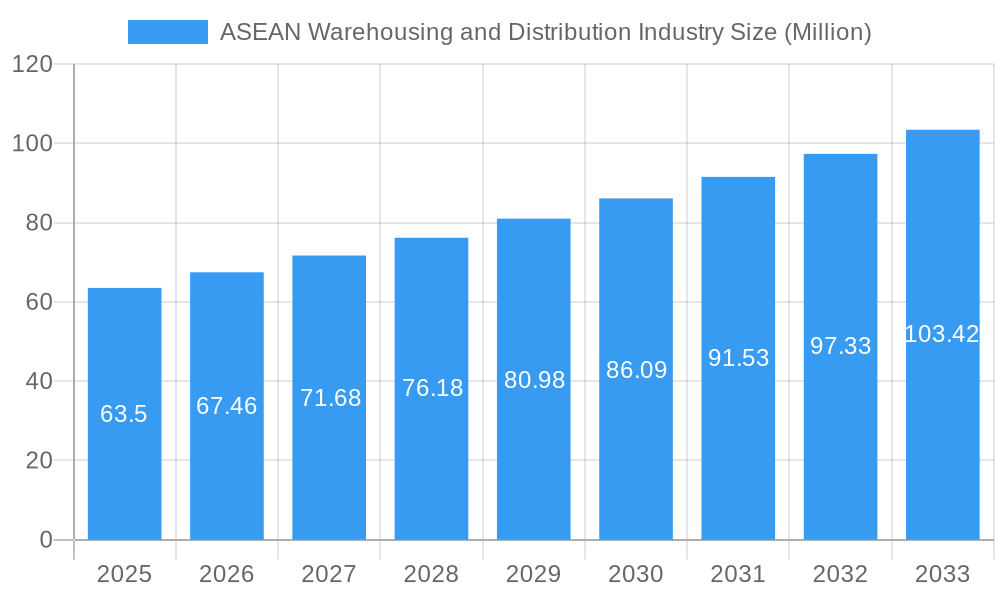

The ASEAN warehousing and distribution industry is experiencing robust growth, driven by the region's expanding e-commerce sector, rising consumer spending, and increasing focus on supply chain optimization. The market, valued at $63.50 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This growth is fueled by several key factors. The surge in e-commerce necessitates efficient warehousing and distribution networks to handle the escalating volume of online orders. Furthermore, the rise of manufacturing and industrial activities within ASEAN, particularly in sectors like FMCG, automotive, and electronics, are creating significant demand for warehousing and logistics services. The increasing adoption of advanced technologies, such as automation and data analytics, is further enhancing efficiency and optimizing supply chain operations, contributing to market expansion. While challenges such as infrastructure limitations and labor costs exist, the overall positive economic outlook and government initiatives aimed at improving logistics infrastructure are expected to mitigate these restraints. The industry is segmented by service type (warehousing, distribution, value-added services) and end-user industry (retail & e-commerce, automotive, pharmaceutical & healthcare, FMCG, manufacturing, electronics). Key players like DB Schenker, Kuehne + Nagel, and Kerry Logistics are actively shaping the market landscape through strategic investments and expansion initiatives.

ASEAN Warehousing and Distribution Industry Market Size (In Million)

The diverse range of services offered caters to the varied needs of different industries. Value-added services, encompassing activities such as packaging, labeling, and inventory management, are witnessing significant demand as businesses seek to enhance their supply chain efficiency and responsiveness. Regional variations in market growth are anticipated, with countries experiencing rapid economic expansion and urbanization likely to show faster growth rates. While data on specific regional breakdowns within ASEAN is not provided, it's reasonable to assume that major economies like Singapore, Thailand, and Vietnam will be significant contributors to the overall market growth. The forecast period (2025-2033) presents substantial opportunities for industry players to capitalize on the expanding market and implement innovative strategies to enhance their competitiveness. The long-term outlook for the ASEAN warehousing and distribution industry remains optimistic, driven by continued economic growth, technological advancements, and the region's strategic importance in global supply chains.

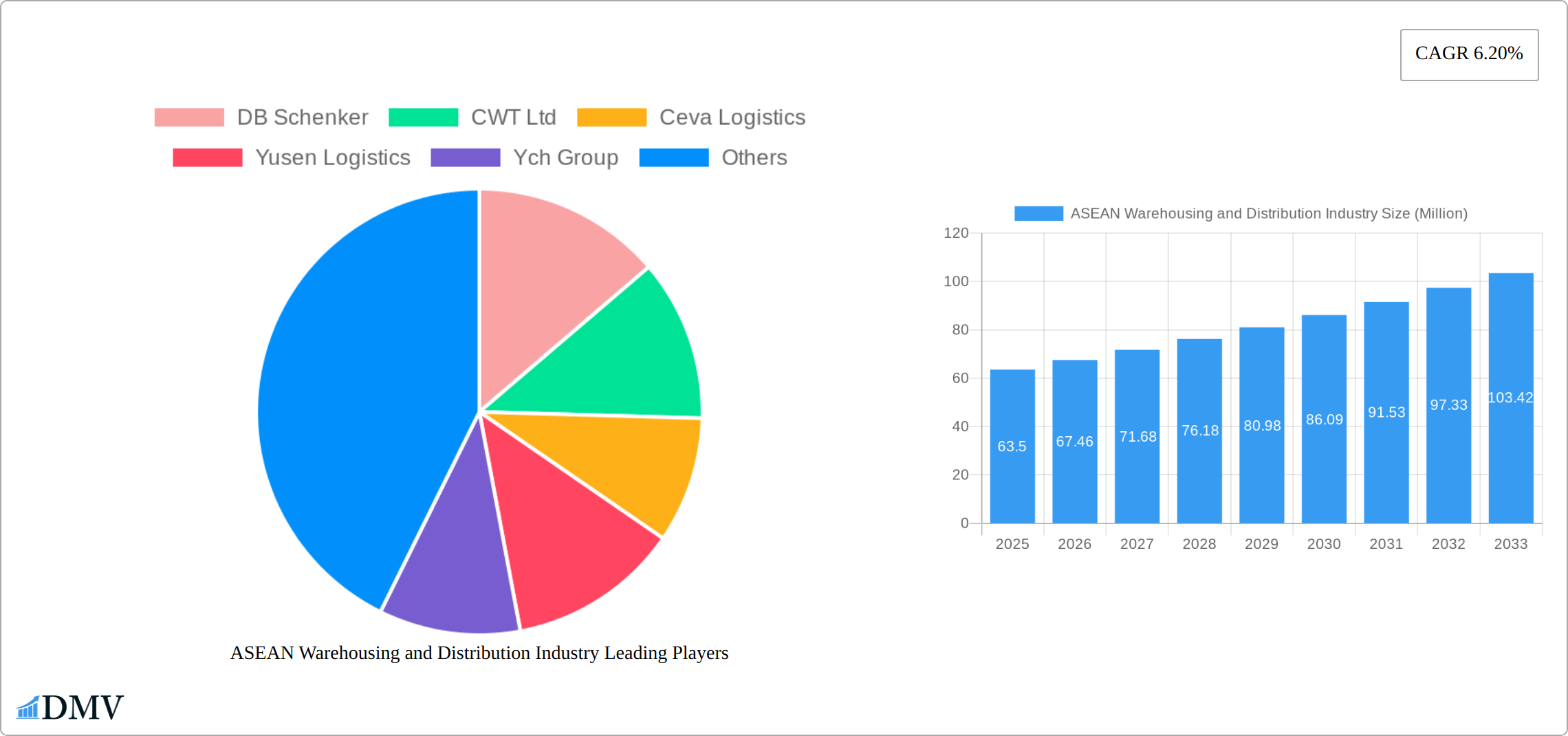

ASEAN Warehousing and Distribution Industry Company Market Share

ASEAN Warehousing and Distribution Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the ASEAN warehousing and distribution industry, offering crucial data and forecasts for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. The report leverages historical data from 2019-2024 to provide a comprehensive understanding of market trends and future growth potential. The ASEAN warehousing and distribution market is projected to reach XX Million by 2033, driven by factors such as the growth of e-commerce, rising consumer demand, and increasing foreign direct investment.

ASEAN Warehousing and Distribution Industry Market Composition & Trends

The ASEAN warehousing and distribution market is experiencing dynamic growth, driven by the region's expanding e-commerce sector, rising middle class, and increasing urbanization. This section analyzes the competitive landscape, highlighting key trends influencing market structure, innovation, and regulatory frameworks. We examine market concentration, the role of mergers and acquisitions (M&A), technological advancements, and the evolving regulatory landscape, providing key metrics and insights into market share distribution and M&A deal values.

- Market Concentration and Competitive Dynamics: The ASEAN warehousing and distribution market displays a moderately concentrated structure, with several large multinational players and a significant number of smaller, regional operators. The top 10 companies currently hold approximately [Insert Percentage]% of the total market revenue. However, increased competition from both established players and emerging technology-driven businesses is reshaping the landscape. This section details the competitive strategies employed by key players.

- Innovation Catalysts: Driving Efficiency and Optimization: Technological advancements are revolutionizing the industry. Automation (including robotics and automated guided vehicles – AGVs), data analytics (leveraging AI and machine learning for predictive analytics and inventory optimization), and the adoption of sophisticated Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) are key drivers of innovation. Furthermore, government initiatives promoting digitalization and infrastructure development significantly influence market dynamics.

- Regulatory Landscape and Harmonization Efforts: Diverse regulatory frameworks across ASEAN nations create complexities for seamless operations. While harmonization efforts are underway to improve consistency and streamline cross-border logistics, inconsistencies remain a challenge. This section provides a comprehensive overview of these regulations and their impact on market players.

- Substitute Products & Services and Emerging Competitive Threats: The rise of alternative delivery models, such as crowdsourced logistics and the expansion of third-party logistics providers (3PLs), presents both challenges and opportunities. This analysis explores the evolving competitive landscape, considering the strengths and weaknesses of different service providers and the impact on traditional warehousing and distribution businesses.

- End-User Industry Segmentation and Specific Needs: The report segments the end-user industries, providing in-depth analysis of the warehousing and distribution needs of key sectors: retail & e-commerce, automotive, pharmaceutical & healthcare, FMCG (fast-moving consumer goods), manufacturing, and electronics. Each industry's unique logistics challenges and opportunities are discussed, along with tailored solutions and emerging trends.

- Mergers and Acquisitions (M&A) Activity and its Impact: Significant M&A activity has reshaped the industry landscape. Recent notable examples include Maersk's acquisition of LF Logistics (August 2022), adding 223 warehouses and 9.5 million square meters of space, and Geodis' acquisition of Keppel Logistics (April 2022), expanding its Southeast Asian presence. This section analyzes the impact of these and other key transactions, forecasting future M&A activity and projected deal values, including the potential for further consolidation.

ASEAN Warehousing and Distribution Industry Industry Evolution

This section examines the evolutionary trajectory of the ASEAN warehousing and distribution market, analyzing market growth trends, technological advancements, and shifting consumer expectations. The report details growth rates, adoption metrics of new technologies, and the impact of evolving consumer behavior. Specific data points on market growth trajectories and adoption rates of key technologies are provided.

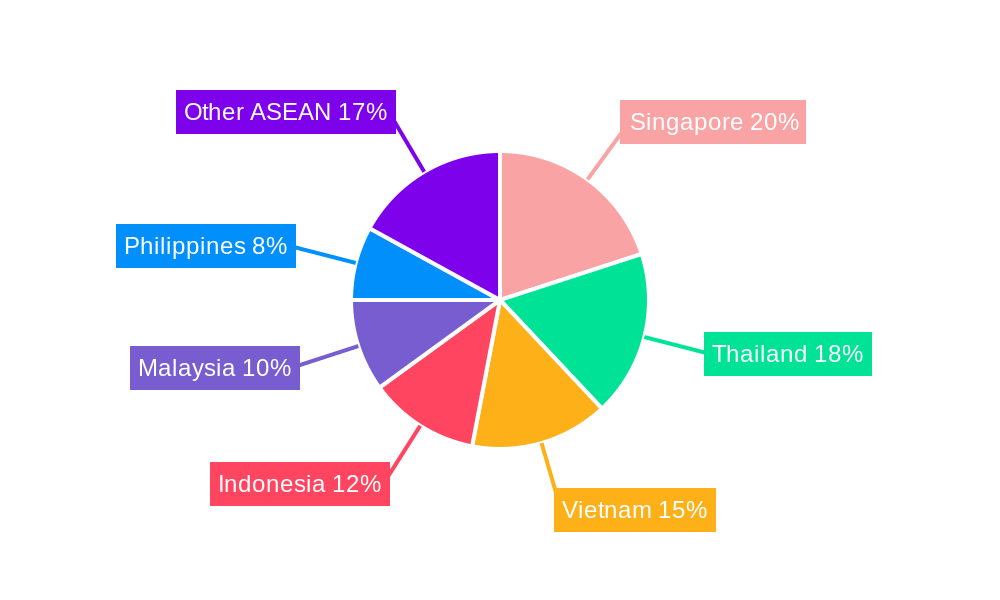

Leading Regions, Countries, or Segments in ASEAN Warehousing and Distribution Industry

This section identifies the leading regions, countries, and segments within the ASEAN warehousing and distribution market, analyzing the key factors driving their success. We examine market share by service type and end-user industry, providing detailed insights into growth drivers and competitive dynamics within each segment.

By Service Type:

- Warehousing Services: Experiencing robust growth driven by the surge in e-commerce and the increasing demand for efficient inventory management. The need for specialized warehousing solutions (e.g., cold storage for pharmaceuticals and temperature-sensitive goods) and the widespread adoption of advanced Warehouse Management Systems (WMS) are major growth catalysts. The analysis also considers the emergence of automated warehousing and its impact on operational efficiency and cost reduction.

- Distribution Services: Significant expansion is fueled by the growth of intra-ASEAN and cross-border trade, demanding timely and reliable delivery solutions. Investment in improved logistics infrastructure, particularly transportation networks and technology upgrades, including the use of sophisticated Transportation Management Systems (TMS), are key factors contributing to growth.

- Value-Added Services: This segment is witnessing rapid growth, driven by increasing demand for customized services such as packaging, labeling, kitting, and order fulfillment, particularly within the e-commerce sector. The report examines the specific value-added services that are most in demand and the key players offering these specialized services.

By End-User Industry:

- Retail & E-commerce: Remains the largest segment, driven by the explosive growth of online shopping and the need for efficient omnichannel fulfillment strategies. The report analyzes the specific logistics challenges and solutions within this dynamic segment.

- Automotive: Steady growth continues, driven by automotive manufacturing and increasingly complex supply chains, requiring specialized warehousing and logistics solutions for handling large, often sensitive, components and vehicles.

- Pharmaceutical & Healthcare: This sector demands stringent regulatory compliance and specialized cold chain logistics, driving growth in specialized warehousing and distribution solutions equipped to handle temperature-sensitive products.

- FMCG (Fast-Moving Consumer Goods): High-volume, time-sensitive deliveries necessitate efficient and cost-effective warehousing and distribution solutions. The report assesses the specific logistical needs of this sector and explores strategies for optimizing delivery speeds and minimizing costs.

- Manufacturing: Growth is fueled by rising production capacity and the need for reliable supply chain management to ensure timely delivery of materials and finished goods.

- Electronics: This sector requires efficient warehousing and distribution solutions designed to manage high volumes of small, valuable products while minimizing risks of damage or loss.

The report provides a detailed analysis of each segment's specific growth drivers, including investment trends, regulatory support, and evolving market dynamics.

ASEAN Warehousing and Distribution Industry Product Innovations

The ASEAN warehousing and distribution industry is experiencing a wave of product innovations aimed at enhancing efficiency and optimizing supply chain management. These innovations include advanced Warehouse Management Systems (WMS), automated guided vehicles (AGVs), and the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and optimized inventory management. The adoption of robotics, autonomous mobile robots (AMRs), and blockchain technology is also transforming operations. These innovations result in improved accuracy, faster processing times, reduced operational costs, increased throughput, reduced labor costs, improved inventory control, and enhanced traceability.

Propelling Factors for ASEAN Warehousing and Distribution Industry Growth

Several factors contribute to the growth of the ASEAN warehousing and distribution industry. These include the rapid expansion of e-commerce, increasing foreign direct investment (FDI) in the region, the development of improved infrastructure (roads, ports, airports), and government initiatives promoting regional economic integration. Technological advancements, such as automation and digitization, further enhance efficiency and drive growth.

Obstacles in the ASEAN Warehousing and Distribution Industry Market

Despite the positive outlook, challenges remain. These include inconsistent regulatory frameworks across ASEAN countries, infrastructure gaps in certain regions, a shortage of skilled labor, and intense competition from both local and international players. Supply chain disruptions caused by global events (e.g., pandemics) pose further challenges. These obstacles have a quantifiable impact on costs and efficiency, which are analyzed in detail within the report.

Future Opportunities in ASEAN Warehousing and Distribution Industry

The ASEAN warehousing and distribution industry presents significant future opportunities. The ongoing growth of e-commerce, the expansion of the middle class, and rapid urbanization create substantial demand for warehousing and distribution services. The increasing adoption of advanced technologies such as blockchain, Internet of Things (IoT), and cloud-based solutions will further enhance efficiency and transparency throughout the supply chain. Expanding into new, underserved markets within the region and specializing in niche services, such as cold chain logistics or e-commerce fulfillment, presents significant growth potential for innovative businesses. The strategic development of sustainable and environmentally conscious logistics practices will also become increasingly crucial.

Major Players in the ASEAN Warehousing and Distribution Industry Ecosystem

- DB Schenker

- CWT Ltd

- Ceva Logistics

- Yusen Logistics

- YCH Group

- Gemadept

- WHA Corporation

- Kuehne + Nagel

- Singapore Post

- Agility

- Kerry Logistics

- CJ Century Logistics

- Tiong Nam Logistics

- Keppel Logistics

- DHL Supply Chain

- [6 additional companies]

- [3 other companies]

Key Developments in ASEAN Warehousing and Distribution Industry Industry

- August 2022: Maersk's acquisition of LF Logistics significantly expanded its warehouse network in ASEAN, adding 223 warehouses and 9.5 Million square meters of space, strengthening its position in omnichannel fulfillment, e-commerce, and inland shipping. This illustrates the ongoing trend of large-scale consolidation within the sector.

- April 2022: Geodis' acquisition of Keppel Logistics broadened Geodis' contract logistics presence and e-commerce fulfillment capabilities in Singapore and Southeast Asia, highlighting the competitive drive for market share within the region.

- [Add other key developments with dates and descriptions]

Strategic ASEAN Warehousing and Distribution Industry Market Forecast

The ASEAN warehousing and distribution market is poised for sustained growth, driven by robust economic expansion, rising e-commerce penetration, and technological advancements. The increasing adoption of automation, AI, and data analytics will further enhance efficiency and optimize supply chain management. The market's potential is substantial, with continued expansion projected across various segments and geographies within the ASEAN region. The report provides a detailed forecast, outlining growth trajectories and market size projections for the coming years.

ASEAN Warehousing and Distribution Industry Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Malaysia

- 1.4. Vietnam

- 1.5. Indonesia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Indonesia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Regional Market Share

Geographic Coverage of ASEAN Warehousing and Distribution Industry

ASEAN Warehousing and Distribution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Cargo Restrictions

- 3.4. Market Trends

- 3.4.1. Increase in Warehousing Space in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Malaysia

- 5.1.4. Vietnam

- 5.1.5. Indonesia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Malaysia

- 5.2.4. Vietnam

- 5.2.5. Indonesia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Malaysia

- 6.1.4. Vietnam

- 6.1.5. Indonesia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Malaysia

- 7.1.4. Vietnam

- 7.1.5. Indonesia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Malaysia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Malaysia

- 8.1.4. Vietnam

- 8.1.5. Indonesia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Vietnam ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Malaysia

- 9.1.4. Vietnam

- 9.1.5. Indonesia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Indonesia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Malaysia

- 10.1.4. Vietnam

- 10.1.5. Indonesia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Malaysia

- 11.1.4. Vietnam

- 11.1.5. Indonesia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Malaysia

- 12.1.4. Vietnam

- 12.1.5. Indonesia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 DB Schenker

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CWT Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ceva Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Yusen Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ych Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gemadept

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 WHA Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kuehne + Nagel

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Singapore Post

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agility

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kerry Logistics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 CJ Century Logistics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Tiong Nam Logistics

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 DHL Supply Chain

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Warehousing and Distribution Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 15: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Warehousing and Distribution Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the ASEAN Warehousing and Distribution Industry?

Key companies in the market include DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, Ych Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, DHL Supply Chain.

3. What are the main segments of the ASEAN Warehousing and Distribution Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce.

6. What are the notable trends driving market growth?

Increase in Warehousing Space in Thailand.

7. Are there any restraints impacting market growth?

Cargo Restrictions.

8. Can you provide examples of recent developments in the market?

August 2022: A.P. Moller - Maersk (Maersk) announced the successful completion of its acquisition of LF Logistics, a logistics firm with premium capabilities in omnichannel fulfillment services, e-commerce, and inland shipping in the ASEAN region. Following the acquisition, Maersk will expand its warehouse network by adding 223 warehouses to its current network and increasing the total number of facilities, spread across 9.5 million square meters, to 549.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Warehousing and Distribution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Warehousing and Distribution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Warehousing and Distribution Industry?

To stay informed about further developments, trends, and reports in the ASEAN Warehousing and Distribution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence