Key Insights

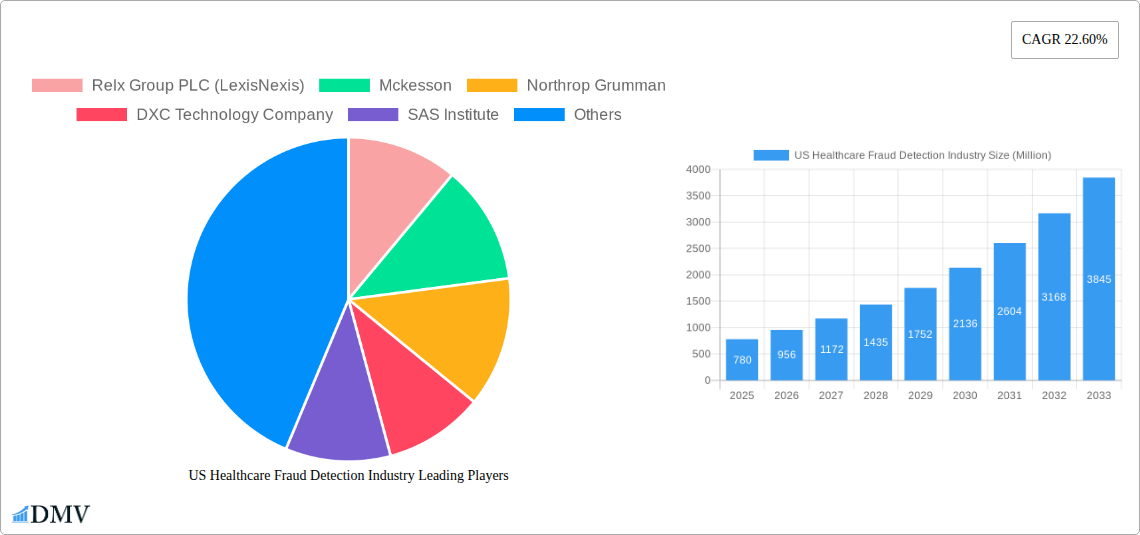

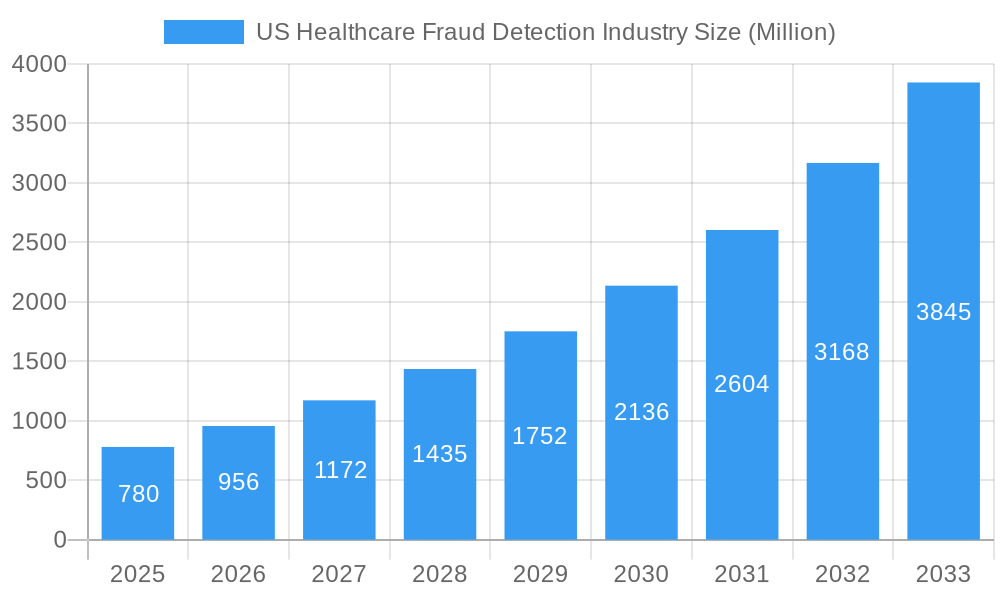

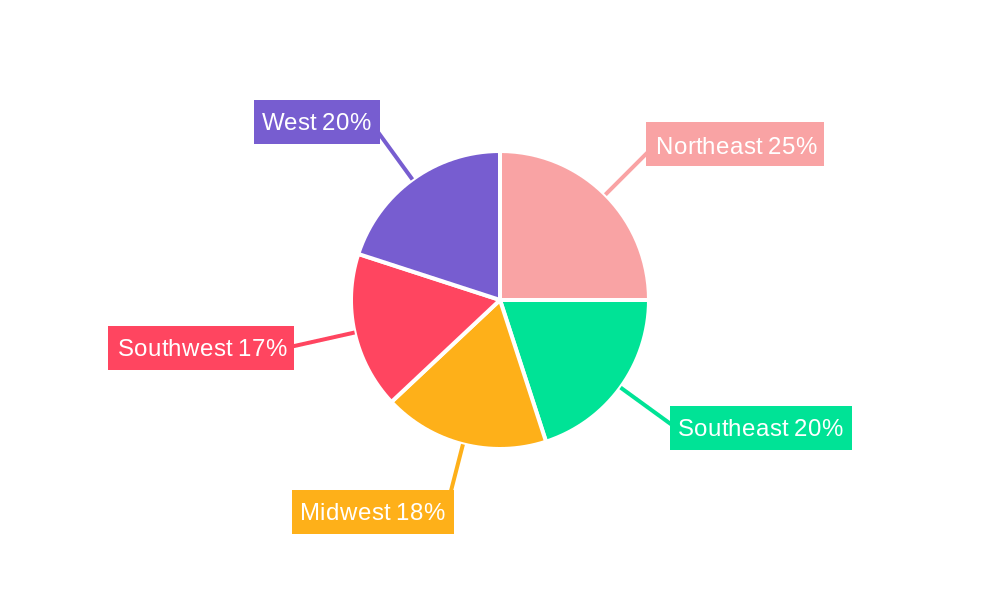

The US healthcare fraud detection market, valued at $0.78 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 22.60% from 2025 to 2033. This surge is driven by several key factors. Rising healthcare costs and increasing instances of fraudulent activities necessitate advanced analytical solutions. The increasing adoption of data analytics, particularly predictive and prescriptive analytics, empowers payers and government agencies to proactively identify and prevent fraud, waste, and abuse. Furthermore, stringent regulatory compliance requirements and the growing emphasis on data security are accelerating the market's expansion. Key segments within the market include descriptive, predictive, and prescriptive analytics, applied across insurance claims reviews and payment integrity initiatives. Major players like Relx Group PLC (LexisNexis), McKesson, and IBM are leveraging their technological expertise to offer comprehensive fraud detection solutions. The market's regional distribution mirrors the US population density, with higher adoption rates expected in states with larger populations and higher healthcare spending, such as those in the Northeast and West regions. The increasing sophistication of fraud schemes, however, presents a challenge and necessitates ongoing innovation in the market.

US Healthcare Fraud Detection Industry Market Size (In Million)

The market's significant growth is underpinned by technological advancements such as machine learning and artificial intelligence (AI). These technologies enhance the accuracy and efficiency of fraud detection systems, enabling earlier identification of suspicious patterns and reducing false positives. Government initiatives aimed at curbing healthcare fraud also contribute to the market's expansion. However, factors like data privacy concerns and the complexity of implementing sophisticated analytical systems could potentially act as restraints to growth. Overcoming these challenges through robust data security measures and user-friendly solutions will be crucial for sustained market expansion. The market’s future will see a continued shift toward AI-powered solutions, enabling the detection of more complex and sophisticated fraudulent activities. The integration of these technologies across diverse healthcare settings will further consolidate the market’s growth trajectory.

US Healthcare Fraud Detection Industry Company Market Share

US Healthcare Fraud Detection Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US healthcare fraud detection industry, offering critical insights for stakeholders seeking to navigate this rapidly evolving landscape. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The market is projected to reach xx Million by 2033, presenting significant opportunities and challenges.

US Healthcare Fraud Detection Industry Market Composition & Trends

The US healthcare fraud detection market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Relx Group PLC (LexisNexis), McKesson, and IBM are among the leading companies, contributing to a combined market share of approximately xx%. However, the market also features several smaller, specialized firms competing aggressively, particularly in niche segments like prescriptive analytics. Innovation is driven by advancements in AI, machine learning, and big data analytics, continually enhancing the accuracy and efficiency of fraud detection systems. The regulatory environment is complex and dynamic, with ongoing efforts by government agencies like CMS and OIG to combat fraud, influencing market growth and technology adoption. Substitute products, such as manual review processes, are becoming increasingly inefficient and costly, further boosting demand for sophisticated detection solutions. Mergers and acquisitions (M&A) activity has been significant in recent years, with deal values exceeding xx Million in the historical period (2019-2024). Key M&A trends include strategic acquisitions by larger technology firms to expand their healthcare analytics portfolios and consolidate market share.

- Market Share Distribution (2024): Relx Group PLC (LexisNexis): xx%; McKesson: xx%; IBM: xx%; Others: xx%

- M&A Deal Value (2019-2024): > xx Million

- Key M&A Trends: Consolidation through acquisitions by large technology players.

US Healthcare Fraud Detection Industry Industry Evolution

The US healthcare fraud detection market has witnessed robust growth throughout the historical period (2019-2024), driven by increasing healthcare expenditures, rising fraud rates, and the adoption of advanced analytics technologies. The market experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, reaching xx Million in 2024. This growth trajectory is projected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033). The increasing sophistication of fraud schemes necessitates continuous innovation in detection technologies, pushing the adoption of advanced analytics like AI and machine learning. Furthermore, government initiatives to improve payment integrity and strengthen data security are bolstering market growth. The demand for predictive and prescriptive analytics is rapidly increasing, enabling proactive fraud prevention and improved resource allocation. Consumer demand is shifting towards solutions offering greater accuracy, real-time insights, and seamless integration with existing healthcare systems.

Leading Regions, Countries, or Segments in US Healthcare Fraud Detection Industry

The US healthcare fraud detection market is dominated by the private insurance payers segment, driven by high healthcare costs and the significant financial incentives to curb fraud. Government agencies, particularly at the federal and state levels, represent another substantial segment, owing to their extensive regulatory role and substantial financial investment in fraud prevention.

Dominant Segments:

- By Type: Predictive analytics is currently the leading segment, followed by descriptive analytics and prescriptive analytics.

- By Application: Review of insurance claims accounts for the largest share of the market, followed by payment integrity.

- By End User: Private insurance payers hold the largest market share, followed by government agencies.

Key Drivers:

- High healthcare expenditures and rising fraud rates: This necessitates robust fraud detection solutions.

- Government regulations and initiatives: These initiatives incentivize the adoption of advanced fraud detection technologies.

- Technological advancements: AI, machine learning, and big data analytics are driving innovation and improving detection accuracy.

US Healthcare Fraud Detection Industry Product Innovations

Recent product innovations focus on enhancing accuracy, efficiency, and scalability of fraud detection systems. AI-powered solutions are becoming increasingly prevalent, offering real-time fraud detection and predictive capabilities. Integration with existing healthcare systems is also prioritized, streamlining workflows and enhancing data sharing. Key performance metrics include improved detection rates, reduced false positives, and faster processing times. Unique selling propositions include advanced algorithms, user-friendly interfaces, and customizable solutions tailored to specific needs of different stakeholders.

Propelling Factors for US Healthcare Fraud Detection Industry Growth

Several factors are driving the growth of the US healthcare fraud detection industry. Technological advancements, such as AI and machine learning algorithms, are enhancing detection accuracy and efficiency. Economic factors, including rising healthcare costs and the need to control expenses, are pushing demand for sophisticated fraud detection solutions. Stringent government regulations and initiatives targeting fraud prevention are further strengthening market growth. The increasing volume and complexity of healthcare data further necessitates advanced analytical tools.

Obstacles in the US Healthcare Fraud Detection Industry Market

Despite significant growth potential, the US healthcare fraud detection market faces several challenges. Regulatory hurdles and compliance requirements can be complex and costly to navigate. Data privacy concerns and security risks associated with handling sensitive patient data present significant challenges. Supply chain disruptions, particularly in the procurement of specialized hardware and software, can impact the availability and pricing of solutions. Intense competition among established players and emerging companies also contributes to market pressure.

Future Opportunities in US Healthcare Fraud Detection Industry

The future of the US healthcare fraud detection industry holds significant opportunities. Expansion into emerging markets, such as telehealth and remote patient monitoring, presents immense potential. The integration of blockchain technology to enhance data security and transparency can further improve market dynamics. The increasing adoption of cloud-based solutions and edge computing can offer scalable and cost-effective solutions to healthcare providers.

Major Players in the US Healthcare Fraud Detection Industry Ecosystem

- Relx Group PLC (LexisNexis)

- McKesson

- Northrop Grumman

- DXC Technology Company

- SAS Institute

- EXL (Scio Health Analytics)

- International Business Machines Corporation (IBM)

- Conduent Inc

- United Health Group Incorporated (Optum Inc)

- OSP Labs

Key Developments in US Healthcare Fraud Detection Industry Industry

- April 2022: Hewlett Packard Enterprise launched HPE Swarm Learning, an AI solution accelerating insights in various sectors, including healthcare fraud detection.

- April 2022: IBM introduced the IBM z16, a system with an integrated AI accelerator enabling real-time transaction evaluation, crucial for healthcare fraud detection.

Strategic US Healthcare Fraud Detection Industry Market Forecast

The US healthcare fraud detection market is poised for continued growth, driven by technological advancements, increasing regulatory scrutiny, and rising healthcare expenditures. The market's future potential is significant, with opportunities in advanced analytics, AI-powered solutions, and expanded applications across various healthcare settings. The market is expected to witness substantial expansion in the coming years, with a projected CAGR of xx% during the forecast period (2025-2033). This growth will be fueled by the ongoing need for robust and efficient fraud detection mechanisms in the face of evolving fraud tactics and increasing healthcare data volumes.

US Healthcare Fraud Detection Industry Segmentation

-

1. Type

- 1.1. Descriptive Analytics

- 1.2. Predictive Analytics

- 1.3. Prescriptive Analytics

-

2. Application

- 2.1. Review of Insurance Claims

- 2.2. Payment Integrity

-

3. End User

- 3.1. Private Insurance Payers

- 3.2. Government Agencies

- 3.3. Other End Users

US Healthcare Fraud Detection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Healthcare Fraud Detection Industry Regional Market Share

Geographic Coverage of US Healthcare Fraud Detection Industry

US Healthcare Fraud Detection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Fraudulent Activities in the US Healthcare Sector; Growing Pressure to Increase the Operation Efficiency and Reduce Healthcare Spending; Prepayment Review Model

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Healthcare IT Labors in the Country

- 3.4. Market Trends

- 3.4.1. Insurance Claims Segment is is Expected to Witness a Healthy Growth in Future.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Descriptive Analytics

- 5.1.2. Predictive Analytics

- 5.1.3. Prescriptive Analytics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Review of Insurance Claims

- 5.2.2. Payment Integrity

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Private Insurance Payers

- 5.3.2. Government Agencies

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Descriptive Analytics

- 6.1.2. Predictive Analytics

- 6.1.3. Prescriptive Analytics

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Review of Insurance Claims

- 6.2.2. Payment Integrity

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Private Insurance Payers

- 6.3.2. Government Agencies

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Descriptive Analytics

- 7.1.2. Predictive Analytics

- 7.1.3. Prescriptive Analytics

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Review of Insurance Claims

- 7.2.2. Payment Integrity

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Private Insurance Payers

- 7.3.2. Government Agencies

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Descriptive Analytics

- 8.1.2. Predictive Analytics

- 8.1.3. Prescriptive Analytics

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Review of Insurance Claims

- 8.2.2. Payment Integrity

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Private Insurance Payers

- 8.3.2. Government Agencies

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Descriptive Analytics

- 9.1.2. Predictive Analytics

- 9.1.3. Prescriptive Analytics

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Review of Insurance Claims

- 9.2.2. Payment Integrity

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Private Insurance Payers

- 9.3.2. Government Agencies

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Healthcare Fraud Detection Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Descriptive Analytics

- 10.1.2. Predictive Analytics

- 10.1.3. Prescriptive Analytics

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Review of Insurance Claims

- 10.2.2. Payment Integrity

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Private Insurance Payers

- 10.3.2. Government Agencies

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Relx Group PLC (LexisNexis)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mckesson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Northrop Grumman

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DXC Technology Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SAS Institute

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EXL (Scio Health Analytics)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Business Machines Corporation (IBM)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Conduent Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United Health Group Incorporated (Optum Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OSP Labs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Relx Group PLC (LexisNexis)

List of Figures

- Figure 1: Global US Healthcare Fraud Detection Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Healthcare Fraud Detection Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America US Healthcare Fraud Detection Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Healthcare Fraud Detection Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Healthcare Fraud Detection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Healthcare Fraud Detection Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America US Healthcare Fraud Detection Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America US Healthcare Fraud Detection Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Healthcare Fraud Detection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Healthcare Fraud Detection Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: South America US Healthcare Fraud Detection Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America US Healthcare Fraud Detection Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Healthcare Fraud Detection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Healthcare Fraud Detection Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: South America US Healthcare Fraud Detection Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America US Healthcare Fraud Detection Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Healthcare Fraud Detection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Healthcare Fraud Detection Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe US Healthcare Fraud Detection Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe US Healthcare Fraud Detection Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Healthcare Fraud Detection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Healthcare Fraud Detection Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe US Healthcare Fraud Detection Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe US Healthcare Fraud Detection Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Healthcare Fraud Detection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Healthcare Fraud Detection Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa US Healthcare Fraud Detection Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa US Healthcare Fraud Detection Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Healthcare Fraud Detection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Healthcare Fraud Detection Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa US Healthcare Fraud Detection Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa US Healthcare Fraud Detection Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Healthcare Fraud Detection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Healthcare Fraud Detection Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific US Healthcare Fraud Detection Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific US Healthcare Fraud Detection Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Healthcare Fraud Detection Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Healthcare Fraud Detection Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific US Healthcare Fraud Detection Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific US Healthcare Fraud Detection Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Healthcare Fraud Detection Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global US Healthcare Fraud Detection Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Healthcare Fraud Detection Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Healthcare Fraud Detection Industry?

The projected CAGR is approximately 22.60%.

2. Which companies are prominent players in the US Healthcare Fraud Detection Industry?

Key companies in the market include Relx Group PLC (LexisNexis), Mckesson, Northrop Grumman, DXC Technology Company, SAS Institute, EXL (Scio Health Analytics), International Business Machines Corporation (IBM), Conduent Inc, United Health Group Incorporated (Optum Inc ), OSP Labs.

3. What are the main segments of the US Healthcare Fraud Detection Industry?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Fraudulent Activities in the US Healthcare Sector; Growing Pressure to Increase the Operation Efficiency and Reduce Healthcare Spending; Prepayment Review Model.

6. What are the notable trends driving market growth?

Insurance Claims Segment is is Expected to Witness a Healthy Growth in Future..

7. Are there any restraints impacting market growth?

Lack of Skilled Healthcare IT Labors in the Country.

8. Can you provide examples of recent developments in the market?

In April 2022, Hewlett Packard Enterprise reported the launch of HPE Swarm Learning, a breakthrough AI solution to accelerate insights at the edge, from diagnosing diseases to detecting credit card fraud, by sharing and unifying AI model learnings without compromising data privacy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Healthcare Fraud Detection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Healthcare Fraud Detection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Healthcare Fraud Detection Industry?

To stay informed about further developments, trends, and reports in the US Healthcare Fraud Detection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence