Key Insights

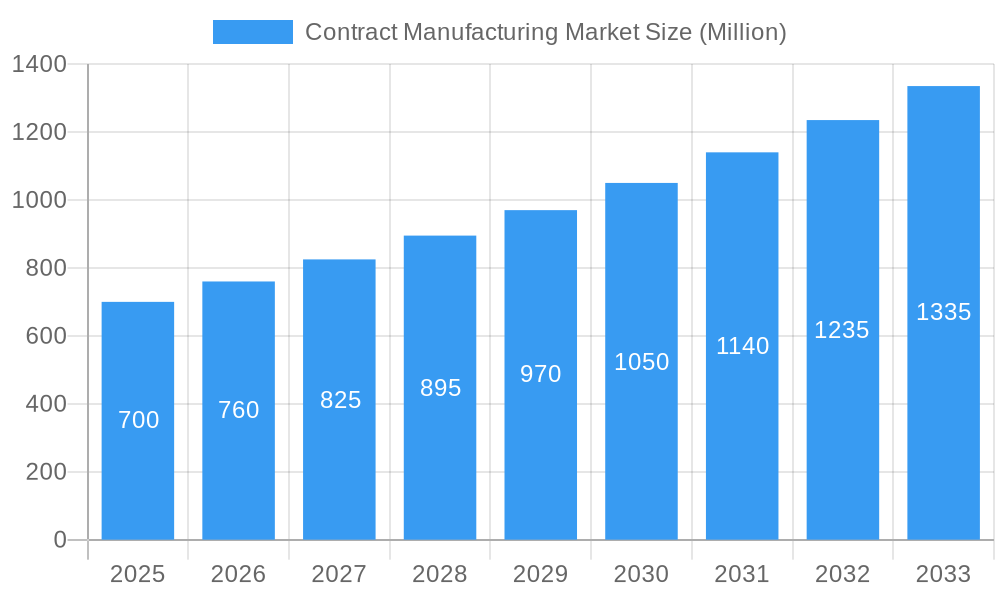

The global contract manufacturing market is poised for robust expansion, projected to reach a substantial valuation with a Compound Annual Growth Rate (CAGR) of 8.70%. This dynamic growth is fueled by several significant drivers. The increasing demand for specialized manufacturing expertise and advanced technological capabilities from Original Equipment Manufacturers (OEMs) is a primary catalyst. OEMs are increasingly outsourcing their production processes to contract manufacturers to optimize costs, reduce time-to-market, and focus on core competencies like research, development, and marketing. Furthermore, the growing complexity of products across various end-user verticals, including the rapidly evolving electronics sector, the stringent requirements of the pharmaceuticals and healthcare industries, the high-volume demands of automotive manufacturing, and the constant innovation in consumer goods, necessitates specialized manufacturing solutions that contract manufacturers are well-equipped to provide. This trend is further amplified by the drive for supply chain flexibility and resilience, allowing companies to adapt more readily to fluctuating market demands and potential disruptions.

Contract Manufacturing Market Market Size (In Million)

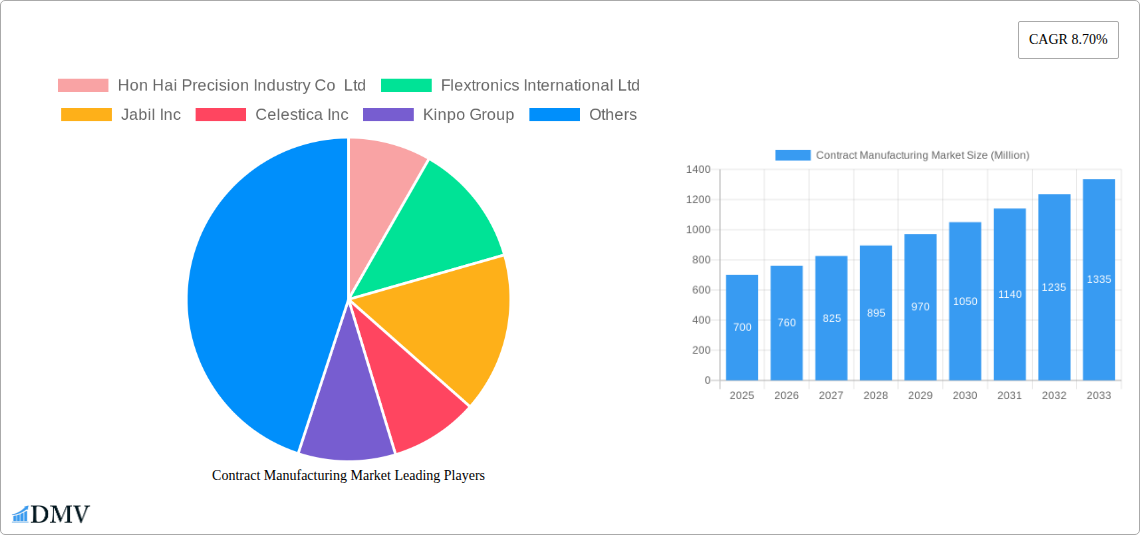

The contract manufacturing landscape is characterized by distinct service segments and a diverse range of end-user verticals, each contributing to the overall market dynamism. Manufacturing services represent the core offering, encompassing assembly, fabrication, and full-scale production. Design services are also gaining prominence as manufacturers offer integrated solutions from product conception to realization. Post-manufacturing services, including testing, repair, and logistics, further enhance the value proposition. The electronics sector remains a dominant end-user, driven by the proliferation of smart devices and the continuous innovation in consumer electronics. Pharmaceuticals and healthcare are experiencing significant growth due to the increasing outsourcing of drug manufacturing and medical device production. The automotive industry's shift towards electric vehicles and advanced driver-assistance systems also presents substantial opportunities. Trends such as Industry 4.0 adoption, including automation, AI, and IoT integration within manufacturing facilities, are enhancing efficiency and precision. However, restraints such as intellectual property protection concerns, stringent quality control demands, and potential geopolitical instabilities impacting global supply chains require careful consideration by market players. The market is further segmented by contract type, with long-term contracts offering stability and short-term contracts providing flexibility for project-based needs. Key players like Hon Hai Precision Industry Co Ltd, Flextronics International Ltd, and Jabil Inc are at the forefront, driving innovation and capacity expansion within this competitive environment.

Contract Manufacturing Market Company Market Share

Dive deep into the dynamic contract manufacturing market with this comprehensive report, meticulously analyzing trends, innovations, and growth projections from 2019 to 2033. This in-depth exploration provides stakeholders with actionable intelligence on the global CMO market, OEM services, EMS providers, and the burgeoning CDMO sector. We dissect the intricate interplay of manufacturing services, design services, and post-manufacturing services across key end-user verticals including electronics, pharmaceuticals and healthcare, automotive, and consumer goods. Discover the strategic advantages offered by long-term contracts versus short-term contracts, and understand the impact of key industry developments on market expansion. With a base year of 2025 and a detailed forecast period of 2025–2033, this report is your indispensable guide to navigating the future of outsourced production.

Contract Manufacturing Market Market Composition & Trends

The contract manufacturing market is characterized by a moderate to high level of concentration, with several large players holding significant market share, alongside a fragmented base of smaller, specialized providers. Innovation is a key catalyst, driven by the relentless pursuit of cost efficiency, advanced technological integration (e.g., Industry 4.0, AI in manufacturing), and specialized material science. Regulatory landscapes, particularly in the pharmaceuticals and healthcare sector, impose stringent compliance requirements that shape market entry and operational strategies. Substitute products are less of a direct threat to core contract manufacturing services but rather manifest in the form of in-house manufacturing capabilities by larger corporations or the evolution of entirely new production paradigms. End-user profiles are increasingly sophisticated, demanding not just reliable production but also value-added services such as supply chain optimization and sustainability initiatives. Mergers and acquisitions (M&A) are prevalent, with significant deal values reflecting the consolidation of expertise and market reach. Recent M&A activities have focused on expanding geographical footprints and acquiring specialized technological capabilities, aiming to capture a larger share of the estimated market value of over $100 Million in strategic acquisitions.

Contract Manufacturing Market Industry Evolution

The contract manufacturing market has undergone a profound transformation, evolving from basic assembly operations to becoming integral strategic partners for businesses across diverse sectors. Over the historical period from 2019 to 2024, we observed a consistent growth trajectory, fueled by increasing globalization, the pursuit of operational efficiencies, and the desire for companies to focus on core competencies like R&D and marketing. The market’s growth rate averaged an impressive 6.5% annually during this period. Technological advancements have been a significant driver, with the adoption of automation, robotics, and advanced analytics revolutionizing production processes, leading to enhanced precision, reduced lead times, and improved quality control. The introduction of Industry 4.0 principles and the Internet of Things (IoT) has enabled greater connectivity and data-driven decision-making within manufacturing facilities, further boosting productivity. Shifting consumer demands, particularly the call for customized products and faster delivery cycles, have also propelled the contract manufacturing sector. This necessitates agile manufacturing capabilities and flexible production lines that contract manufacturers are uniquely positioned to provide. The increasing complexity of product designs, especially in the electronics and automotive industries, has also created a demand for specialized manufacturing expertise that many companies outsource. The estimated market value reached approximately $800 Billion by the end of 2024, showcasing robust expansion. The forecast period (2025–2033) is expected to witness continued robust growth, with projected annual growth rates of around 7-8%, driven by emerging markets, ongoing technological innovation, and the persistent trend of outsourcing non-core manufacturing activities.

Leading Regions, Countries, or Segments in Contract Manufacturing Market

The contract manufacturing market exhibits distinct regional dominance and segment leadership, driven by a confluence of factors.

Dominant End-user Vertical: Electronics The electronics vertical consistently leads the contract manufacturing market, propelled by the insatiable global demand for consumer electronics, telecommunications equipment, and advanced technological devices. Key drivers include:

- Rapid Technological Obsolescence: The short product lifecycles in electronics necessitate agile and cost-effective manufacturing solutions, a forte of contract manufacturers.

- Economies of Scale: The sheer volume of electronic components and finished goods manufactured globally allows for significant economies of scale, which contract manufacturers leverage.

- Specialized Expertise: The intricate nature of electronic assembly and the constant introduction of new materials and components require specialized knowledge and advanced manufacturing infrastructure, often best provided by dedicated CMOs and EMS providers.

- Global Supply Chain Hubs: Asia-Pacific, particularly China, remains a powerhouse for electronics contract manufacturing due to its established supply chains, skilled labor force, and cost advantages. The estimated market share for electronics contract manufacturing hovers around 40% of the total market value.

Dominant Service Type: Manufacturing Services Within the service landscape, manufacturing services remain the bedrock of the contract manufacturing market. This encompasses the core activities of production, assembly, and fabrication.

- Core Competency Outsourcing: Companies frequently outsource their primary manufacturing operations to leverage specialized facilities and expertise, allowing them to concentrate on design, marketing, and sales.

- Cost Optimization: Contract manufacturers often achieve lower production costs through economies of scale and optimized supply chain management, a critical factor for many industries.

- Scalability and Flexibility: Manufacturing services allow clients to scale production up or down rapidly in response to market demand without significant capital investment in fixed assets.

Dominant Contract Type: Long-term Contract While short-term contracts cater to specific project needs, long-term contracts are pivotal for stable growth and strategic partnerships within the contract manufacturing ecosystem.

- Supply Chain Stability: Long-term agreements provide predictability for both the manufacturer and the client, ensuring a consistent supply of goods and predictable revenue streams.

- Investment in Infrastructure: Clients are more likely to invest in specialized equipment and process improvements when they have a guaranteed long-term commitment from a contract manufacturer.

- R&D Collaboration: Extended partnerships foster deeper collaboration, leading to joint innovation and product development initiatives, often involving intricate design services and early-stage involvement.

The dominance of these segments underscores the fundamental role contract manufacturers play in enabling product realization across industries, particularly within the fast-paced electronics sector.

Contract Manufacturing Market Product Innovations

Product innovation within the contract manufacturing market is not solely about novel end-products but also about the enhancement of manufacturing processes and materials. Companies are increasingly focusing on developing advanced materials, sustainable manufacturing techniques, and integrated smart factory solutions. For instance, the development of specialized cleanroom environments for sensitive pharmaceutical and healthcare products, coupled with advanced sterilization and packaging technologies, represents a significant innovation. In the electronics sector, innovations include miniaturization, enhanced thermal management solutions, and the integration of flexible circuit technologies. Performance metrics such as yield rates, defect reduction, and energy efficiency are continuously being improved through these advancements, offering unique selling propositions to clients seeking cutting-edge production capabilities.

Propelling Factors for Contract Manufacturing Market Growth

The contract manufacturing market is propelled by a powerful synergy of technological, economic, and regulatory influences.

- Technological Advancements: The integration of Industry 4.0, AI, and advanced automation is enabling contract manufacturers to offer greater precision, efficiency, and scalability, attracting clients seeking sophisticated production capabilities.

- Economic Pressures: The constant drive for cost reduction and optimized supply chains leads companies to outsource manufacturing to regions or specialized providers with lower overheads and established efficiencies.

- Focus on Core Competencies: Many businesses choose to focus their resources on R&D, marketing, and sales, entrusting their production to expert contract manufacturers.

- Globalization and Market Access: Contract manufacturers provide a gateway to global markets, offering established distribution networks and compliance with international standards.

- Regulatory Expertise: For highly regulated industries like pharmaceuticals and healthcare, contract manufacturers offer specialized knowledge and adherence to complex compliance requirements, reducing risk for clients.

Obstacles in the Contract Manufacturing Market Market

Despite robust growth, the contract manufacturing market faces several significant obstacles. Regulatory challenges, particularly navigating diverse international standards and compliance requirements, can be complex and costly. Supply chain disruptions, as evidenced by recent global events, pose a substantial threat, impacting lead times and material availability. Intense competitive pressures, especially from low-cost manufacturing regions, can drive down profit margins. Intellectual property (IP) protection remains a concern for clients outsourcing sensitive designs and proprietary technologies. Furthermore, the increasing demand for highly specialized skills and advanced technologies requires continuous investment in workforce training and infrastructure upgrades, which can be a barrier for smaller players.

Future Opportunities in Contract Manufacturing Market

The future of the contract manufacturing market is brimming with opportunities. The burgeoning demand for personalized medicine and advanced medical devices presents significant growth potential within the healthcare sector. The ongoing electrification of vehicles and the development of next-generation battery technologies are creating new avenues for automotive contract manufacturing. The rise of the circular economy and increased emphasis on sustainability will drive demand for eco-friendly manufacturing processes and materials. Emerging markets in Southeast Asia and Latin America offer untapped potential for expanding production footprints and catering to growing local demands. Furthermore, the continued advancement of digital manufacturing technologies, such as additive manufacturing (3D printing) and advanced robotics, will create new service offerings and enhance competitive advantages for forward-thinking contract manufacturers.

Major Players in the Contract Manufacturing Market Ecosystem

- Hon Hai Precision Industry Co Ltd

- Flextronics International Ltd

- Jabil Inc

- Celestica Inc

- Kinpo Group

- Shenzhen Kaifa Technology Co Ltd

- Benchmark Electronics Inc

- Universal Scientific Industrial Co Ltd

- Venture Corporation Limited

- Wistron Coporation

Key Developments in Contract Manufacturing Market Industry

- August 2024: Eckert & Ziegler and Telix Pharmaceuticals Limited (Telix) announced a significant multi-year agreement. Eckert & Ziegler will serve as the European contract manufacturing organization (CMO) for Telix's ProstACT GLOBAL Phase III study, ensuring supply for the entire European patient base from its Berlin facility by providing high-purity, non-carrier-added GMP-grade Lutetium-177 (Lu-177).

- August 2024: Salt Medical, a Contract Development and Manufacturing Organization (CDMO) specializing in medical device manufacturing, is set to establish its presence at Claregalway Corporate Park in Co. Galway. Salt Medical leverages an international platform bolstered by a global R&D and manufacturing network, with established hubs in Ireland, alongside sourcing and large-scale manufacturing operations in the United States and Asia-Pacific.

Strategic Contract Manufacturing Market Market Forecast

The strategic contract manufacturing market is poised for substantial growth, driven by an optimistic forecast for the period 2025–2033. Continued global demand for sophisticated electronics, coupled with the expanding healthcare sector's need for specialized pharmaceutical and medical device manufacturing, will serve as major growth catalysts. Economic imperatives for cost optimization and supply chain resilience will further encourage outsourcing. Emerging technologies like AI-driven manufacturing and advanced robotics will empower contract manufacturers to offer enhanced value, precision, and scalability. The increasing focus on sustainable production practices also presents a significant opportunity for differentiation and market capture. Overall, the market's trajectory indicates a steady upward trend, with key players strategically positioned to capitalize on these evolving industry dynamics and capture significant market share.

Contract Manufacturing Market Segmentation

-

1. Service Type

- 1.1. Manufacturing Services

- 1.2. Design Services

- 1.3. Post Manufacturing Services

-

2. End-user Vertical

- 2.1. Electronics

- 2.2. Pharmaceuticals and Healthcare

- 2.3. Automotive

- 2.4. Consumer Goods

- 2.5. Other End-user Verticals

-

3. Contract Type

- 3.1. Long-term Contract

- 3.2. Short-term Contract

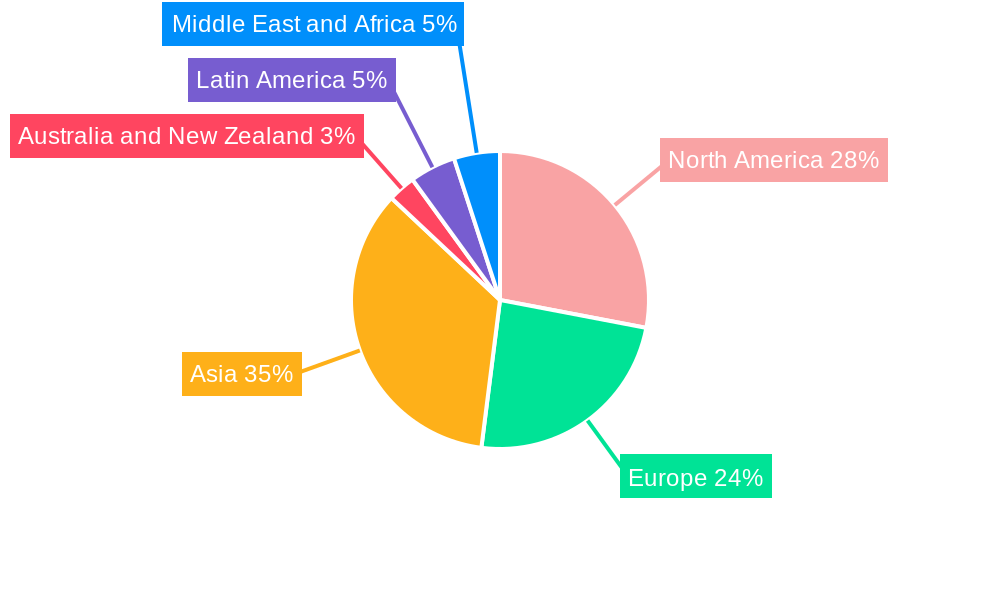

Contract Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Contract Manufacturing Market Regional Market Share

Geographic Coverage of Contract Manufacturing Market

Contract Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency; Globalization and Market Expansion

- 3.3. Market Restrains

- 3.3.1. Cost Efficiency; Globalization and Market Expansion

- 3.4. Market Trends

- 3.4.1. Electronics Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Manufacturing Services

- 5.1.2. Design Services

- 5.1.3. Post Manufacturing Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Electronics

- 5.2.2. Pharmaceuticals and Healthcare

- 5.2.3. Automotive

- 5.2.4. Consumer Goods

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Contract Type

- 5.3.1. Long-term Contract

- 5.3.2. Short-term Contract

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Manufacturing Services

- 6.1.2. Design Services

- 6.1.3. Post Manufacturing Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Electronics

- 6.2.2. Pharmaceuticals and Healthcare

- 6.2.3. Automotive

- 6.2.4. Consumer Goods

- 6.2.5. Other End-user Verticals

- 6.3. Market Analysis, Insights and Forecast - by Contract Type

- 6.3.1. Long-term Contract

- 6.3.2. Short-term Contract

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Manufacturing Services

- 7.1.2. Design Services

- 7.1.3. Post Manufacturing Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Electronics

- 7.2.2. Pharmaceuticals and Healthcare

- 7.2.3. Automotive

- 7.2.4. Consumer Goods

- 7.2.5. Other End-user Verticals

- 7.3. Market Analysis, Insights and Forecast - by Contract Type

- 7.3.1. Long-term Contract

- 7.3.2. Short-term Contract

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Manufacturing Services

- 8.1.2. Design Services

- 8.1.3. Post Manufacturing Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Electronics

- 8.2.2. Pharmaceuticals and Healthcare

- 8.2.3. Automotive

- 8.2.4. Consumer Goods

- 8.2.5. Other End-user Verticals

- 8.3. Market Analysis, Insights and Forecast - by Contract Type

- 8.3.1. Long-term Contract

- 8.3.2. Short-term Contract

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Manufacturing Services

- 9.1.2. Design Services

- 9.1.3. Post Manufacturing Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Electronics

- 9.2.2. Pharmaceuticals and Healthcare

- 9.2.3. Automotive

- 9.2.4. Consumer Goods

- 9.2.5. Other End-user Verticals

- 9.3. Market Analysis, Insights and Forecast - by Contract Type

- 9.3.1. Long-term Contract

- 9.3.2. Short-term Contract

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Manufacturing Services

- 10.1.2. Design Services

- 10.1.3. Post Manufacturing Services

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Electronics

- 10.2.2. Pharmaceuticals and Healthcare

- 10.2.3. Automotive

- 10.2.4. Consumer Goods

- 10.2.5. Other End-user Verticals

- 10.3. Market Analysis, Insights and Forecast - by Contract Type

- 10.3.1. Long-term Contract

- 10.3.2. Short-term Contract

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Contract Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Manufacturing Services

- 11.1.2. Design Services

- 11.1.3. Post Manufacturing Services

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Electronics

- 11.2.2. Pharmaceuticals and Healthcare

- 11.2.3. Automotive

- 11.2.4. Consumer Goods

- 11.2.5. Other End-user Verticals

- 11.3. Market Analysis, Insights and Forecast - by Contract Type

- 11.3.1. Long-term Contract

- 11.3.2. Short-term Contract

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hon Hai Precision Industry Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flextronics International Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jabil Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Celestica Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kinpo Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shenzhen Kaifa Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Benchmark Electronics Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Universal Scientific Industrial Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Venture Corporation Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wistron Coporation*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hon Hai Precision Industry Co Ltd

List of Figures

- Figure 1: Global Contract Manufacturing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Contract Manufacturing Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 5: North America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 9: North America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 12: North America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 13: North America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 14: North America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 15: North America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: North America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 20: Europe Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 21: Europe Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Europe Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 24: Europe Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 25: Europe Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 26: Europe Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 27: Europe Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 28: Europe Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 29: Europe Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 30: Europe Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 31: Europe Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Europe Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 36: Asia Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 37: Asia Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Asia Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Asia Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 40: Asia Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 41: Asia Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 42: Asia Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 43: Asia Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 44: Asia Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 45: Asia Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 46: Asia Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 47: Asia Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Asia Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 53: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 57: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 60: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 61: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 62: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 63: Australia and New Zealand Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 68: Latin America Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 69: Latin America Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 70: Latin America Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 71: Latin America Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 72: Latin America Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 73: Latin America Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 74: Latin America Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 75: Latin America Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 76: Latin America Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 77: Latin America Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 78: Latin America Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 79: Latin America Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Latin America Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Service Type 2025 & 2033

- Figure 84: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 85: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 86: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Service Type 2025 & 2033

- Figure 87: Middle East and Africa Contract Manufacturing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 88: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by End-user Vertical 2025 & 2033

- Figure 89: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 90: Middle East and Africa Contract Manufacturing Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 91: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Contract Type 2025 & 2033

- Figure 92: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Contract Type 2025 & 2033

- Figure 93: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Contract Type 2025 & 2033

- Figure 94: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Contract Type 2025 & 2033

- Figure 95: Middle East and Africa Contract Manufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Contract Manufacturing Market Volume (Trillion), by Country 2025 & 2033

- Figure 97: Middle East and Africa Contract Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Contract Manufacturing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 3: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 6: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 7: Global Contract Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Contract Manufacturing Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 13: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 14: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 15: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 19: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 22: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 23: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 27: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 30: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 31: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 33: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 34: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 35: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 36: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 37: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 38: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 39: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 41: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 43: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 44: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 45: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 46: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 47: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: Global Contract Manufacturing Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 50: Global Contract Manufacturing Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 51: Global Contract Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 52: Global Contract Manufacturing Market Volume Trillion Forecast, by End-user Vertical 2020 & 2033

- Table 53: Global Contract Manufacturing Market Revenue Million Forecast, by Contract Type 2020 & 2033

- Table 54: Global Contract Manufacturing Market Volume Trillion Forecast, by Contract Type 2020 & 2033

- Table 55: Global Contract Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Contract Manufacturing Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the Contract Manufacturing Market?

Key companies in the market include Hon Hai Precision Industry Co Ltd, Flextronics International Ltd, Jabil Inc, Celestica Inc, Kinpo Group, Shenzhen Kaifa Technology Co Ltd, Benchmark Electronics Inc, Universal Scientific Industrial Co Ltd, Venture Corporation Limited, Wistron Coporation*List Not Exhaustive.

3. What are the main segments of the Contract Manufacturing Market?

The market segments include Service Type, End-user Vertical, Contract Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency; Globalization and Market Expansion.

6. What are the notable trends driving market growth?

Electronics Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Cost Efficiency; Globalization and Market Expansion.

8. Can you provide examples of recent developments in the market?

August 2024: Eckert & Ziegler and Telix Pharmaceuticals Limited (Telix) announced a significant multi-year agreement. Under this contract, Eckert & Ziegler will act as the European contract manufacturing organization (CMO) for Telix's ProstACT GLOBAL Phase III study. The contract ensures the supply for the entire European patient base from Eckert & Ziegler's state-of-the-art facility in Berlin. Eckert & Ziegler will supply the essential starting material: their high-purity, non-carrier-added GMP-grade Lutetium-177 (Lu-177).August 2024: Salt Medical, a Contract Development and Manufacturing Organization (CDMO) focusing on medical device manufacturing, is set to debut at Claregalway Corporate Park in Co. Galway. Salt Medical boasts a distinguished international platform in the medical device arena, bolstered by a robust global research and development (R&D) and manufacturing network. While the company has established R&D and manufacturing hubs in Ireland, it also sources raw materials and precision components, complemented by large-scale manufacturing operations in both the United States and the Asia-Pacific region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Market?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence