Key Insights

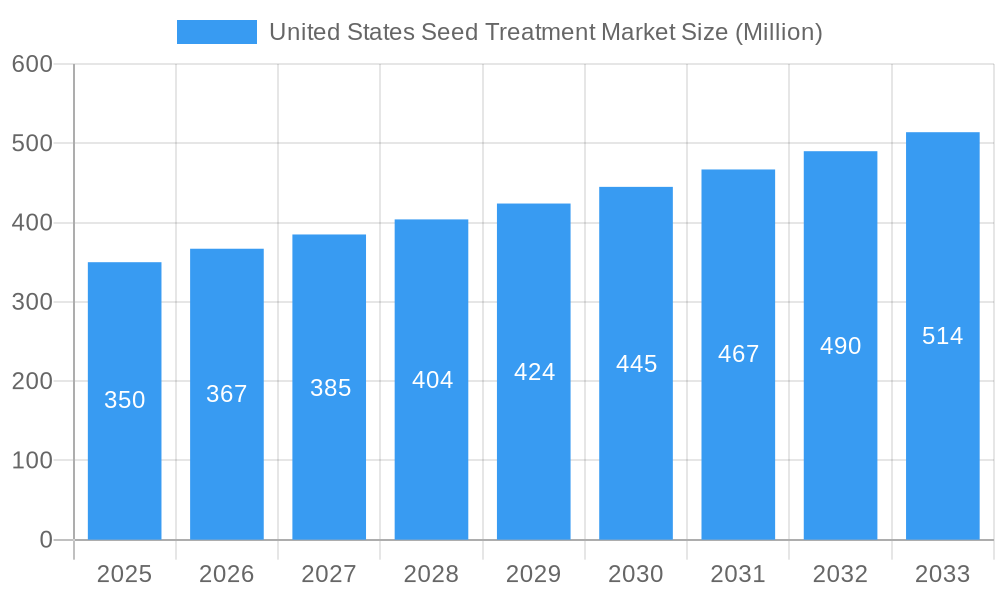

The United States seed treatment market, valued at approximately $350 million in 2025, is projected to experience robust growth, driven by increasing demand for high-yielding crops and the escalating adoption of precision agriculture techniques. The market's Compound Annual Growth Rate (CAGR) of 4.80% from 2019 to 2024 suggests a continued upward trajectory through 2033. Key drivers include the growing awareness of crop protection strategies among farmers, stringent government regulations promoting sustainable agriculture practices, and increasing incidences of crop diseases and pests necessitating effective seed treatment solutions. The Insecticides segment within the Product Type category holds a significant market share, reflecting the prevalent need for pest control. Similarly, the Grains and Cereals segment under Crop Type dominates, reflecting the substantial acreage devoted to these crops in the U.S. Major players like Syngenta, Bayer, BASF, and Corteva are investing heavily in research and development to introduce innovative seed treatment products, further fueling market growth. While challenges such as regulatory hurdles and potential environmental concerns exist, the overall market outlook remains positive, supported by the rising global population and increasing demand for food security. The market segmentation reflects specialized needs within various crop types, leading to targeted product development and increased market penetration. The focus on sustainable practices and precision agriculture offers opportunities for enhanced product efficiency and reduced environmental impact.

United States Seed Treatment Market Market Size (In Million)

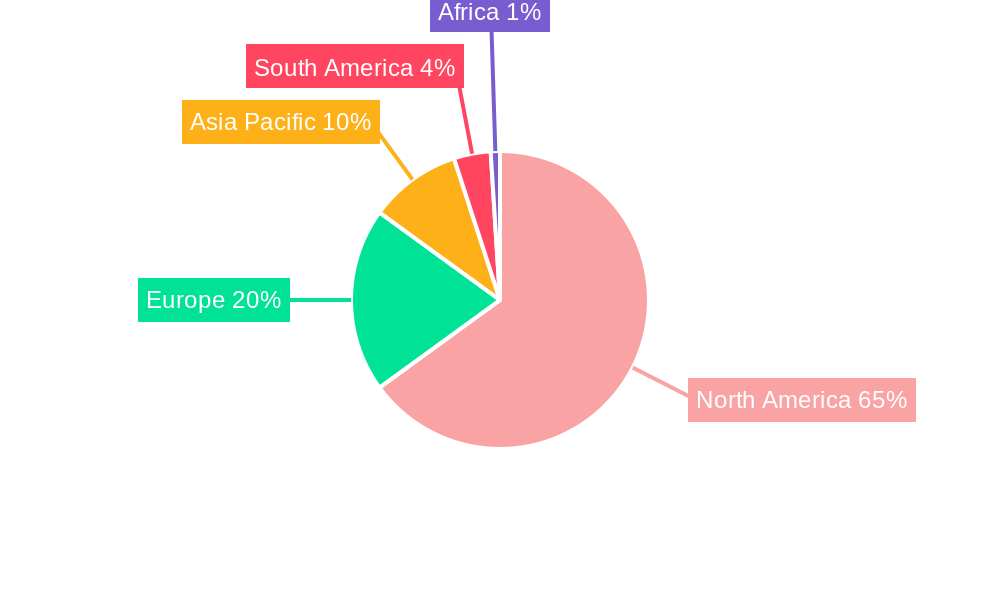

The regional dominance of North America, particularly the United States, is anticipated to continue due to the advanced agricultural infrastructure and widespread adoption of modern farming techniques. The strong presence of leading seed treatment companies within the U.S. also contributes to this regional dominance. However, increasing competition from global players and evolving consumer preferences towards organic and sustainably produced food could influence market dynamics in the coming years. This will likely result in a greater focus on the development of environmentally friendly seed treatments and a shift towards integrated pest management strategies. The forecast period from 2025 to 2033 shows continuous growth, influenced by factors such as technological advancements in seed treatment technologies, the increasing prevalence of diseases and pests, and the growing awareness of the importance of seed health in maximizing crop yields. This will stimulate demand for improved and innovative seed treatment solutions.

United States Seed Treatment Market Company Market Share

United States Seed Treatment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States seed treatment market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed strategic decisions. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

United States Seed Treatment Market Composition & Trends

This section delves into the intricate structure of the US seed treatment market, analyzing key aspects influencing its growth and evolution. We examine market concentration, revealing the share held by major players such as Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, Corteva Agriscience, Bayer CropScience AG, and BASF SE. The report also assesses the impact of innovation, specifically highlighting advancements in seed treatment technologies and their adoption rates. Furthermore, it explores the regulatory landscape, analyzing its influence on market access and product development. The analysis considers substitute products and their competitive impact, detailing end-user profiles across various crop types (grains and cereals, oilseeds and pulses, fruits and vegetables, commercial crops, turf and ornamentals). Finally, we examine recent mergers and acquisitions (M&A) activities, quantifying their impact on market consolidation and competitive dynamics. Examples include the value and impact of specific M&A deals, providing a comprehensive picture of market evolution.

- Market Share Distribution: A detailed breakdown of market share among key players in 2025, including Germains Seed Technology, Incotec Group B, Syngenta International AG and others.

- M&A Activity Analysis: Review of significant M&A transactions in the historical period (2019-2024), including deal values and their impact on market dynamics.

- Regulatory Landscape Assessment: Analysis of current regulations and their projected influence on market growth over the forecast period.

- Innovation Catalysts: Identification of key technological advancements driving innovation within the seed treatment sector.

United States Seed Treatment Market Industry Evolution

This section offers a detailed analysis of the US seed treatment market’s historical and projected growth trajectory. We examine the key factors influencing market expansion, including technological advancements (e.g., development of novel seed treatment formulations and application technologies), shifting consumer demands (e.g., increased preference for sustainable and high-yielding crop varieties), and economic factors (e.g., fluctuating commodity prices and government agricultural policies). Specific data points, such as historical and projected growth rates, adoption rates of new technologies, and changes in consumer preferences, are incorporated throughout to provide a quantitative understanding of market evolution. The analysis considers the influence of global economic trends and their ripple effect on the domestic market. We also explore the impact of evolving agricultural practices and their influence on seed treatment demand.

Leading Regions, Countries, or Segments in United States Seed Treatment Market

This section identifies the leading regions, countries, and segments within the US seed treatment market. The analysis focuses on key product types (Insecticides, Fungicides, Nematicides) and crop types (Grains and Cereals, Oilseeds and Pulses, Fruits and Vegetables, Commercial crops, Turf and Ornamentals). We pinpoint the dominant segment, providing a thorough analysis of the factors contributing to its leadership position.

- Dominant Segment: Identification of the leading segment by product type and crop type based on market size and growth rate in 2025.

- Key Drivers (Bullet Points):

- Investment trends in specific segments.

- Regulatory support and incentives for specific crop types or product types.

- Market size and growth potential for each segment.

- Consumer demand for specific seed treatment types.

United States Seed Treatment Market Product Innovations

This section highlights recent product innovations in the US seed treatment market. We focus on the unique selling propositions (USPs) of novel seed treatments, detailing their applications and performance metrics. The analysis covers technological advancements, showcasing innovative formulations and application methods that enhance crop yield and protect against pests and diseases. We discuss the improved efficacy and sustainability of new products and their market acceptance.

Propelling Factors for United States Seed Treatment Market Growth

Several factors are driving the growth of the US seed treatment market. Technological advancements in seed treatment formulations are enhancing crop protection and yield. Favorable government policies and support for sustainable agriculture are encouraging adoption. The increasing demand for high-yielding crops is fueling market expansion, and rising consumer awareness of food safety and security further boosts market growth.

Obstacles in the United States Seed Treatment Market Market

The US seed treatment market faces several challenges. Stricter environmental regulations and increasing concerns about pesticide residues can limit product development and market access. Supply chain disruptions and fluctuations in raw material prices can impact production costs and profitability. Intense competition from established and emerging players puts pressure on margins and market share.

Future Opportunities in United States Seed Treatment Market

The US seed treatment market presents several promising opportunities. The growing adoption of precision agriculture and the development of targeted seed treatments are creating new avenues for growth. The demand for organic and bio-based seed treatments is expected to increase, presenting further opportunities. Expansion into new markets and untapped crop types offer additional potential for market expansion.

Major Players in the United States Seed Treatment Market Ecosystem

Key Developments in United States Seed Treatment Market Industry

- [Month, Year]: [Description of development and its impact on market dynamics – e.g., Launch of a new seed treatment product by Company X, resulting in increased market competition].

- [Month, Year]: [Description of development and its impact on market dynamics – e.g., Merger between Company Y and Company Z, leading to greater market consolidation].

- [Month, Year]: [Add more developments as needed, following the same format.]

Strategic United States Seed Treatment Market Market Forecast

The US seed treatment market is poised for continued growth, driven by factors such as technological advancements, increasing demand for high-yielding crops, and supportive government policies. Emerging opportunities in precision agriculture and sustainable seed treatments will further fuel market expansion. The market's future trajectory indicates significant potential for growth and profitability for stakeholders.

United States Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Seed Treatment Market Segmentation By Geography

- 1. United States

United States Seed Treatment Market Regional Market Share

Geographic Coverage of United States Seed Treatment Market

United States Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increase in Cost of High-quality Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Seed Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Germains Seed Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Incotec Group B

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adama Agricultural Solutions Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corteva Agriscience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bayer CropScience AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Germains Seed Technology

List of Figures

- Figure 1: United States Seed Treatment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Seed Treatment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Seed Treatment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Seed Treatment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Seed Treatment Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the United States Seed Treatment Market?

Key companies in the market include Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, Corteva Agriscience, Bayer CropScience AG, BASF SE.

3. What are the main segments of the United States Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increase in Cost of High-quality Seeds.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Seed Treatment Market?

To stay informed about further developments, trends, and reports in the United States Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence