Key Insights

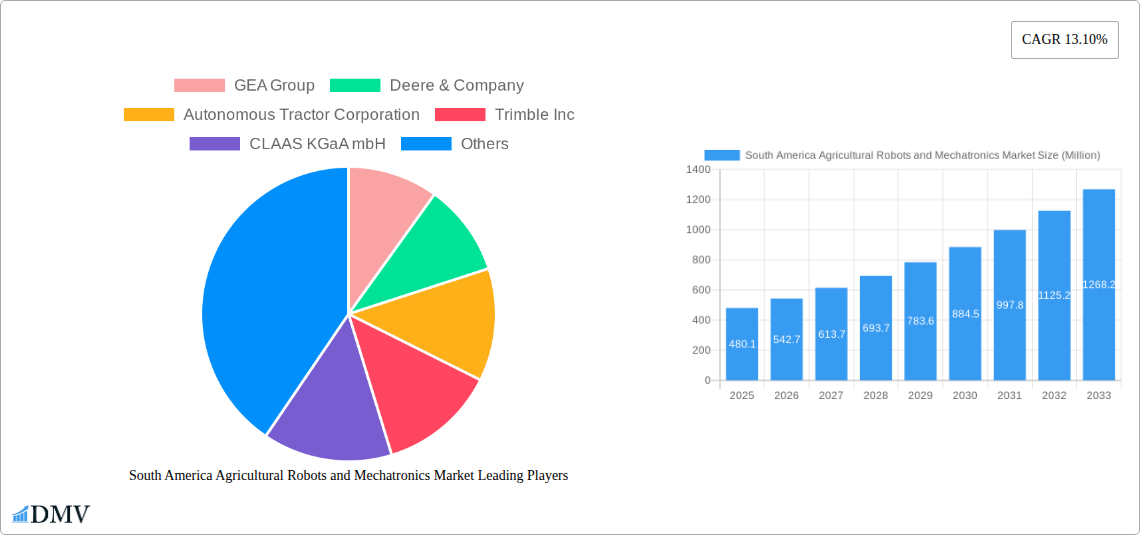

The South American Agricultural Robots and Mechatronics Market is poised for significant expansion, projecting a market size of USD 480.1 million in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 13.1% from 2025 to 2033. This robust growth is primarily fueled by the increasing adoption of advanced technologies to enhance agricultural productivity and efficiency across the region. Key drivers include the growing demand for precision agriculture solutions to optimize resource utilization, reduce labor costs, and mitigate environmental impact. The rising need for autonomous farming equipment, such as autonomous tractors and unmanned aerial vehicles (UAVs), is paramount in addressing labor shortages and enabling large-scale, efficient farming operations, particularly in crop production. Furthermore, advancements in robotics for animal husbandry, like automated milking systems, are contributing to improved animal welfare and farm management.

South America Agricultural Robots and Mechatronics Market Market Size (In Million)

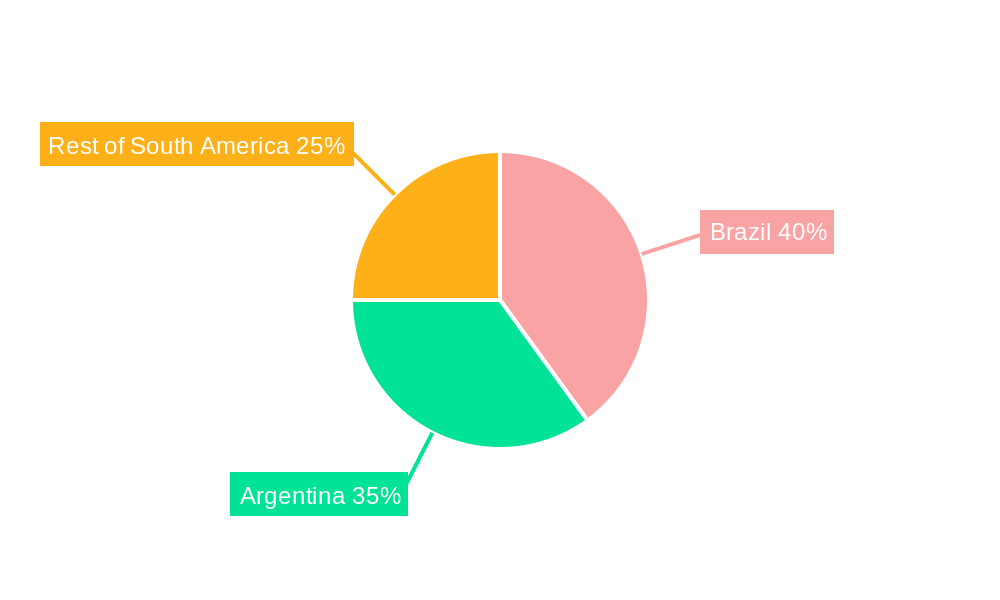

The market's trajectory is further shaped by several emerging trends. The integration of AI and IoT in agricultural machinery is enabling real-time data analysis for informed decision-making, leading to smarter farming practices. Geographically, Brazil and Argentina are expected to lead market growth due to their extensive agricultural sectors and increasing investment in technological innovation. The "Rest of South America" will also witness substantial growth as other nations embrace similar technological advancements. While the market exhibits strong potential, certain restraints, such as the high initial investment costs for advanced agricultural machinery and the need for skilled labor to operate and maintain these sophisticated systems, could pose challenges. However, the long-term benefits of increased yields, reduced operational costs, and enhanced sustainability are expected to outweigh these hurdles, driving sustained market development.

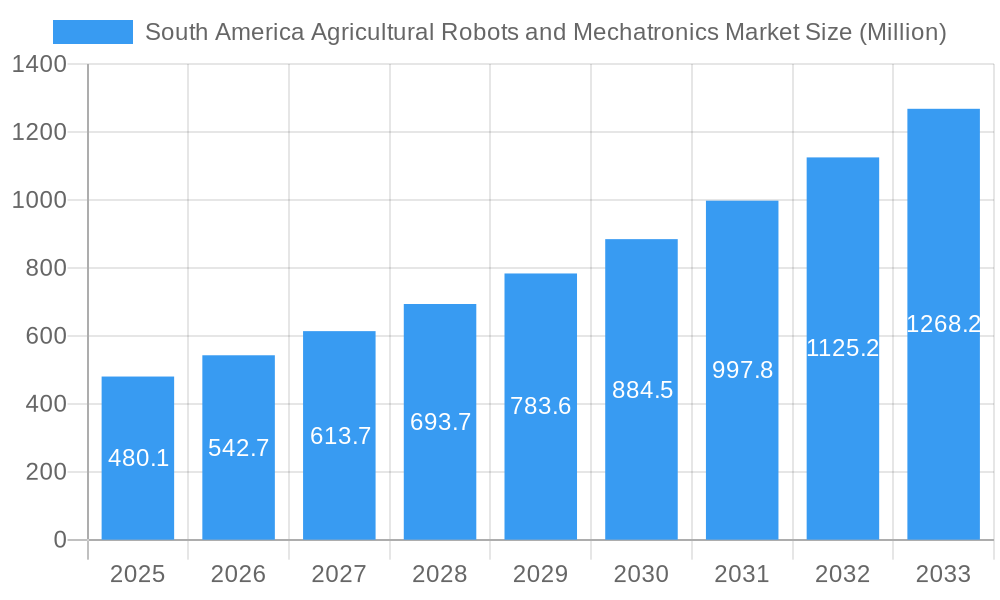

South America Agricultural Robots and Mechatronics Market Company Market Share

This in-depth report provides a strategic outlook on the burgeoning South America Agricultural Robots and Mechatronics Market. With a study period spanning from 2019 to 2033, and a base year of 2025, this analysis delves into market composition, industry evolution, leading regional players, product innovations, growth drivers, obstacles, and future opportunities. We present precise forecasts for the period 2025-2033, alongside historical data from 2019-2024, offering unparalleled insights for stakeholders seeking to capitalize on this dynamic sector. This report is designed for immediate use without any modification, featuring high-ranking keywords such as "agricultural robots South America," "mechatronics agriculture," "precision farming South America," "autonomous tractors Brazil," "dairy robots Argentina," and "drone agriculture LATAM."

South America Agricultural Robots and Mechatronics Market Market Composition & Trends

The South America Agricultural Robots and Mechatronics Market is characterized by a moderate level of concentration, with key players like GEA Group and Deere & Company holding significant market share. Innovation is primarily driven by advancements in artificial intelligence, IoT integration, and the increasing demand for sustainable agricultural practices. The regulatory landscape is evolving, with governments in countries like Brazil and Argentina showing increasing support for technological adoption in agriculture through subsidies and favorable policies. Substitute products, while present in traditional farming methods, are rapidly being overtaken by the efficiency and precision offered by robotic solutions. End-user profiles range from large-scale commercial farms to smaller cooperatives, all seeking to enhance productivity and reduce operational costs. Mergers and acquisitions are a notable trend, with significant deal values seen in the acquisition of smaller technology firms by established agricultural machinery giants. For instance, a recent acquisition valued at an estimated $50 million by a major player aimed to bolster its autonomous solutions portfolio.

- Market Share Distribution: Dominated by a few key players, with a growing number of innovative startups emerging.

- Innovation Catalysts: AI, IoT, robotics, sensor technology, cloud computing.

- Regulatory Landscape: Emerging supportive policies, data privacy concerns, standardization efforts.

- Substitute Products: Traditional machinery, manual labor.

- End-User Profiles: Large agribusinesses, medium-sized farms, agricultural cooperatives, research institutions.

- M&A Activities: Strategic acquisitions to gain market access and technological capabilities.

South America Agricultural Robots and Mechatronics Market Industry Evolution

The South America Agricultural Robots and Mechatronics Market has witnessed a transformative evolution, propelled by a confluence of technological breakthroughs and shifting agricultural paradigms. From its nascent stages, the market has surged forward, driven by the imperative to enhance agricultural productivity and sustainability across the continent. The historical period (2019-2024) saw initial investments in foundational technologies, with a gradual increase in adoption rates as the benefits of automation became more evident. The base year, 2025, marks a pivotal point where more sophisticated solutions, such as advanced AI-powered autonomous tractors and sophisticated milking robots, are becoming mainstream. The forecast period (2025-2033) is poised for exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 18.5%. This robust expansion is fueled by escalating labor costs, the shrinking availability of skilled agricultural labor, and a growing awareness among farmers regarding the substantial return on investment offered by these technologies.

Technological advancements have been the bedrock of this evolution. The integration of robotics with mechatronics has enabled the development of highly precise and efficient agricultural machinery. Autonomous tractors, equipped with GPS and sensor technology, are revolutionizing fieldwork, enabling tasks like planting, tilling, and harvesting to be performed with unprecedented accuracy and minimal human intervention. Unmanned Aerial Vehicles (UAVs), or agricultural drones, have become indispensable tools for crop monitoring, spraying, and yield assessment, providing real-time data that informs critical farming decisions. Milking robots are transforming dairy operations, offering round-the-clock milking capabilities, improved cow comfort, and enhanced milk quality, thereby reducing operational burdens on farmers. The increasing affordability and accessibility of these technologies, coupled with growing government incentives and a rising trend towards precision agriculture, are further accelerating adoption. Shifting consumer demands towards sustainably produced food and a desire for greater traceability in the food supply chain are also indirectly contributing to the uptake of these advanced farming solutions. This dynamic interplay of technological innovation, economic drivers, and market demand solidifies the trajectory of significant growth for the South America Agricultural Robots and Mechatronics Market.

Leading Regions, Countries, or Segments in South America Agricultural Robots and Mechatronics Market

Within the South America Agricultural Robots and Mechatronics Market, Brazil emerges as the undisputed leader, showcasing exceptional dominance across key segments. This leadership is not merely a matter of market size but is underpinned by a strategic confluence of factors that position Brazil at the forefront of agricultural automation in the region.

Dominant Region: Brazil

- Crop Production Application Dominance: Brazil's vast agricultural expanse, particularly in soybean, corn, and sugarcane cultivation, creates a significant demand for autonomous tractors and precision spraying drones. The sheer scale of operations necessitates the efficiencies that robotic solutions provide.

- Autonomous Tractors Segment Leadership: The adoption rate of autonomous tractors is highest in Brazil, driven by large agribusinesses seeking to optimize labor utilization and improve operational efficiency. Companies like John Deere and CNH Industrial have a strong presence here.

- Unmanned Aerial Vehicles (UAVs) in Crop Monitoring: Brazil's extensive farmlands benefit immensely from drone technology for aerial surveillance, pest detection, and targeted pesticide application. This leads to reduced chemical usage and improved crop yields.

- Governmental Support and Investment Trends: The Brazilian government actively promotes the adoption of new agricultural technologies through various incentive programs and subsidies, encouraging farmers to invest in advanced mechatronic systems.

- Technological Infrastructure Development: Significant investments in connectivity and digital infrastructure across Brazil's agricultural heartlands are facilitating the seamless integration and operation of sophisticated robotic systems.

Significant Contributor: Argentina

- Animal Husbandry Application Growth: Argentina's strong cattle industry presents a growing opportunity for advanced milking robots and automated feeding systems, contributing to improved herd management and productivity.

- Precision Farming Initiatives: Similar to Brazil, Argentina is embracing precision farming techniques, leading to increased demand for sensor-equipped machinery and data analytics platforms.

- Emerging Drone Usage: While not as widespread as in Brazil, drone adoption for crop monitoring and spraying is steadily increasing in Argentina's key agricultural regions.

Rest of South America (Chile, Colombia, Peru, etc.)

- Niche Application Growth: These regions exhibit a growing interest in specific robotic applications tailored to their unique agricultural landscapes, such as automated harvesting for specialty crops in Chile or vineyard management in Peru.

- Increasing Awareness and Gradual Adoption: As the benefits of agricultural robots and mechatronics become more apparent, adoption is gradually increasing across these diverse economies.

- Focus on Specific Segments: Countries with a strong dairy sector are showing increased interest in milking robots, while those with extensive fruit and vegetable production are exploring robotic harvesting solutions.

The dominance of Brazil is a testament to its large-scale agricultural operations, proactive government policies, and robust adoption of cutting-edge technologies like autonomous tractors and agricultural drones, making it the most dynamic market segment for agricultural robots and mechatronics in South America.

South America Agricultural Robots and Mechatronics Market Product Innovations

Product innovations are rapidly transforming agricultural practices in South America. Autonomous tractors are now equipped with advanced AI for intelligent path planning and obstacle avoidance, offering unparalleled precision in fieldwork. Unmanned Aerial Vehicles (UAVs) are evolving with multispectral and hyperspectral imaging capabilities for detailed crop health analysis, alongside autonomous spraying systems that precisely target pests and diseases, minimizing chemical usage. Milking robots are incorporating sophisticated sensor suites for real-time health monitoring of individual cows, predicting estrus cycles, and optimizing milk production. The development of modular robotic platforms, adaptable to various tasks from planting to harvesting, and advancements in swarm robotics for large-scale operations, are also significant innovations poised to reshape the market.

Propelling Factors for South America Agricultural Robots and Mechatronics Market Growth

The growth of the South America Agricultural Robots and Mechatronics Market is propelled by several key factors. Firstly, the persistent labor shortage and rising labor costs across the region necessitate automated solutions for efficient farm operations. Secondly, the growing emphasis on precision agriculture, driven by the need to optimize resource utilization (water, fertilizers, pesticides) and enhance crop yields, directly fuels demand for sophisticated robotic and mechatronic systems. Thirdly, supportive government policies and initiatives aimed at modernizing the agricultural sector, including subsidies and tax incentives for technology adoption, play a crucial role. Finally, the increasing awareness among farmers about the long-term return on investment and the competitive advantage offered by these technologies is a significant driver.

Obstacles in the South America Agricultural Robots and Mechatronics Market Market

Despite the promising growth, the South America Agricultural Robots and Mechatronics Market faces several obstacles. High initial investment costs for advanced robotic systems remain a significant barrier, particularly for small and medium-sized farms. The lack of widespread high-speed internet connectivity and digital infrastructure in some rural areas hinders the seamless operation and data management capabilities of these technologies. Furthermore, a shortage of skilled technicians and operators capable of maintaining and repairing complex mechatronic systems poses a challenge. Regulatory hurdles related to data privacy, autonomous vehicle operation, and standardization of robotic systems can also slow down adoption. Finally, resistance to change and a lack of awareness among a segment of the farming community can impede the widespread implementation of these innovative solutions.

Future Opportunities in South America Agricultural Robots and Mechatronics Market

Emerging opportunities in the South America Agricultural Robots and Mechatronics Market are vast. The increasing adoption of AI and machine learning in agricultural robots will lead to more predictive analytics and autonomous decision-making capabilities, further enhancing farm efficiency. The expansion of the "as-a-service" model for agricultural robotics, allowing farmers to lease equipment rather than purchase it outright, could significantly lower adoption barriers. There is also a substantial opportunity in the development of specialized robotic solutions for niche crops and regional farming challenges. Furthermore, the integration of robotics with blockchain technology for enhanced traceability and supply chain transparency presents a significant avenue for growth, catering to the increasing consumer demand for provenance and sustainability. The "Rest of South America" segment offers untapped potential for tailored solutions.

Major Players in the South America Agricultural Robots and Mechatronics Market Ecosystem

- GEA Group

- Deere & Company

- Autonomous Tractor Corporation

- Trimble Inc

- CLAAS KGaA mbH

- Autonomous Solutions Inc

- CNH Industrial

- Harvest Automation

- AGCO Corporation

Key Developments in South America Agricultural Robots and Mechatronics Market Industry

- 2023: Launch of new AI-powered autonomous tractor models with advanced navigation capabilities in Brazil.

- 2023: Expansion of drone spraying services for crop protection in Argentina, targeting soybean and corn fields.

- 2024: Introduction of next-generation milking robots with enhanced cow health monitoring features in the region.

- 2024: Strategic partnerships formed between technology providers and local agricultural cooperatives to facilitate technology adoption.

- 2024: Increased investment in R&D for robotic harvesting solutions for fruits and vegetables in Chile and Colombia.

Strategic South America Agricultural Robots and Mechatronics Market Market Forecast

The strategic forecast for the South America Agricultural Robots and Mechatronics Market indicates robust and sustained growth throughout the study period. The confluence of increasing arable land mechanization, a rising need for enhanced food production to meet global demands, and supportive governmental policies are key growth catalysts. The market is expected to witness significant penetration of autonomous tractors and agricultural drones, particularly in Brazil and Argentina, driven by their economic advantages and operational efficiencies. Investments in animal husbandry automation, especially milking robots, will also rise. The "Rest of South America" is projected to emerge as a significant growth frontier as awareness and affordability of these technologies increase, creating a fertile ground for innovation and market expansion. The estimated market value is expected to reach approximately $2,500 million by 2033, underscoring its substantial future potential.

South America Agricultural Robots and Mechatronics Market Segmentation

-

1. Product Type

- 1.1. Autonomous Tractors

- 1.2. Unmanned Aerial Vehicles

- 1.3. Milking Robots

- 1.4. Other Types

-

2. Application

- 2.1. Crop Production

- 2.2. Animal Husbandry

- 2.3. Forest Control

- 2.4. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

-

4. Product Type

- 4.1. Autonomous Tractors

- 4.2. Unmanned Aerial Vehicles

- 4.3. Milking Robots

- 4.4. Other Types

-

5. Application

- 5.1. Crop Production

- 5.2. Animal Husbandry

- 5.3. Forest Control

- 5.4. Other Applications

South America Agricultural Robots and Mechatronics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Agricultural Robots and Mechatronics Market Regional Market Share

Geographic Coverage of South America Agricultural Robots and Mechatronics Market

South America Agricultural Robots and Mechatronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Growth of Precision farming Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Autonomous Tractors

- 5.1.2. Unmanned Aerial Vehicles

- 5.1.3. Milking Robots

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Crop Production

- 5.2.2. Animal Husbandry

- 5.2.3. Forest Control

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Autonomous Tractors

- 5.4.2. Unmanned Aerial Vehicles

- 5.4.3. Milking Robots

- 5.4.4. Other Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Crop Production

- 5.5.2. Animal Husbandry

- 5.5.3. Forest Control

- 5.5.4. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Autonomous Tractors

- 6.1.2. Unmanned Aerial Vehicles

- 6.1.3. Milking Robots

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Crop Production

- 6.2.2. Animal Husbandry

- 6.2.3. Forest Control

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.4. Market Analysis, Insights and Forecast - by Product Type

- 6.4.1. Autonomous Tractors

- 6.4.2. Unmanned Aerial Vehicles

- 6.4.3. Milking Robots

- 6.4.4. Other Types

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Crop Production

- 6.5.2. Animal Husbandry

- 6.5.3. Forest Control

- 6.5.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Autonomous Tractors

- 7.1.2. Unmanned Aerial Vehicles

- 7.1.3. Milking Robots

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Crop Production

- 7.2.2. Animal Husbandry

- 7.2.3. Forest Control

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.4. Market Analysis, Insights and Forecast - by Product Type

- 7.4.1. Autonomous Tractors

- 7.4.2. Unmanned Aerial Vehicles

- 7.4.3. Milking Robots

- 7.4.4. Other Types

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Crop Production

- 7.5.2. Animal Husbandry

- 7.5.3. Forest Control

- 7.5.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Autonomous Tractors

- 8.1.2. Unmanned Aerial Vehicles

- 8.1.3. Milking Robots

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Crop Production

- 8.2.2. Animal Husbandry

- 8.2.3. Forest Control

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.4. Market Analysis, Insights and Forecast - by Product Type

- 8.4.1. Autonomous Tractors

- 8.4.2. Unmanned Aerial Vehicles

- 8.4.3. Milking Robots

- 8.4.4. Other Types

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Crop Production

- 8.5.2. Animal Husbandry

- 8.5.3. Forest Control

- 8.5.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GEA Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Deere & Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Autonomous Tractor Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Trimble Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 CLAAS KGaA mbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Autonomous Solutions Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 CNH Industrial

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Harvest Automatio

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 AGCO Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 GEA Group

List of Figures

- Figure 1: South America Agricultural Robots and Mechatronics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Robots and Mechatronics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: South America Agricultural Robots and Mechatronics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Robots and Mechatronics Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the South America Agricultural Robots and Mechatronics Market?

Key companies in the market include GEA Group, Deere & Company, Autonomous Tractor Corporation, Trimble Inc, CLAAS KGaA mbH, Autonomous Solutions Inc, CNH Industrial, Harvest Automatio, AGCO Corporation.

3. What are the main segments of the South America Agricultural Robots and Mechatronics Market?

The market segments include Product Type, Application, Geography, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Growth of Precision farming Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Robots and Mechatronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Robots and Mechatronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Robots and Mechatronics Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Robots and Mechatronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence