Key Insights

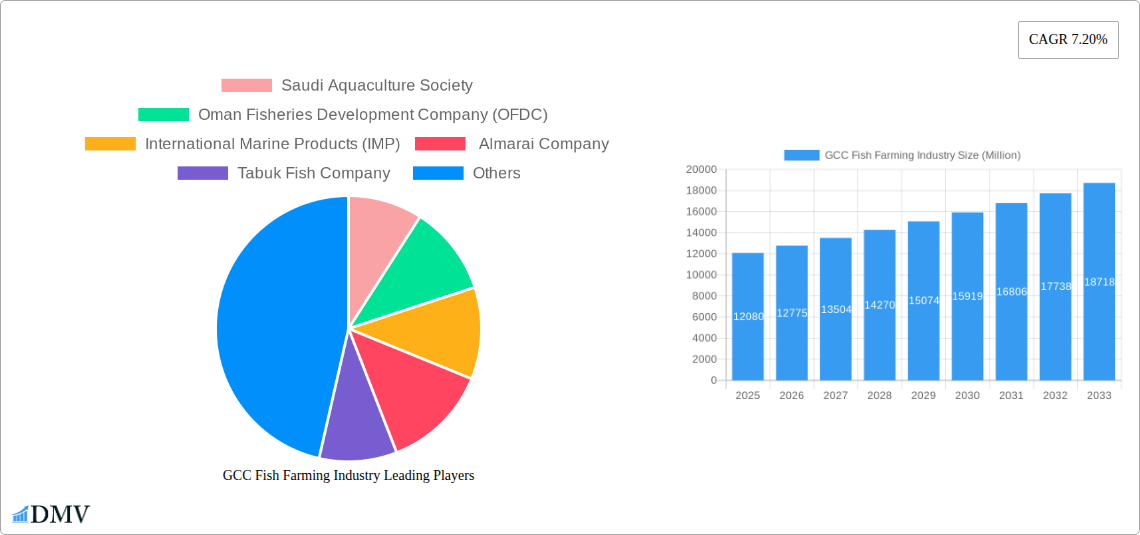

The GCC Fish Farming Industry is poised for significant expansion, driven by robust demand for sustainable protein sources and supportive government initiatives across the region. The market is projected to reach an estimated USD 12.08 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.76% anticipated from 2025 through 2033. This upward trajectory is primarily fueled by increasing seafood consumption, a growing preference for farmed fish due to its consistent availability and quality, and substantial investments in advanced aquaculture technologies aimed at enhancing production efficiency and environmental sustainability. Key drivers include a rising population, evolving dietary habits leaning towards healthier protein options, and government strategies focused on food security and economic diversification through aquaculture development. Emerging trends highlight a surge in demand for premium species like shrimp and lobster, alongside a growing interest in recirculating aquaculture systems (RAS) for freshwater and marine species, which offer improved water management and higher stocking densities.

GCC Fish Farming Industry Market Size (In Billion)

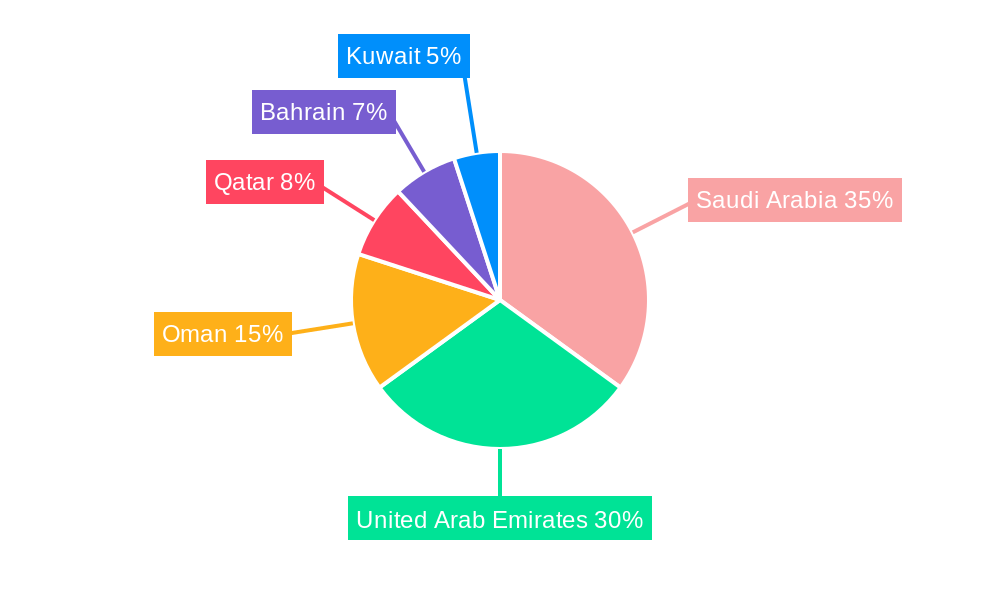

Despite its promising outlook, the GCC Fish Farming Industry faces certain restraints that could temper growth. These include the high initial capital investment required for setting up modern aquaculture facilities, the potential for disease outbreaks in intensive farming environments, and the challenges associated with obtaining and managing suitable coastal and inland water resources. Additionally, stringent environmental regulations and the need for skilled labor in advanced aquaculture operations present ongoing hurdles. However, the market’s segmentation reveals a diverse landscape, with Pelagic and Demersal fish dominating current production, while freshwater fish like Tilapia and high-value species such as Scallop and Lobster are gaining traction. Geographically, Saudi Arabia and the United Arab Emirates are expected to lead the market due to their strong economic foundations and active promotion of aquaculture, followed by other GCC nations diligently working to boost their domestic seafood production capabilities.

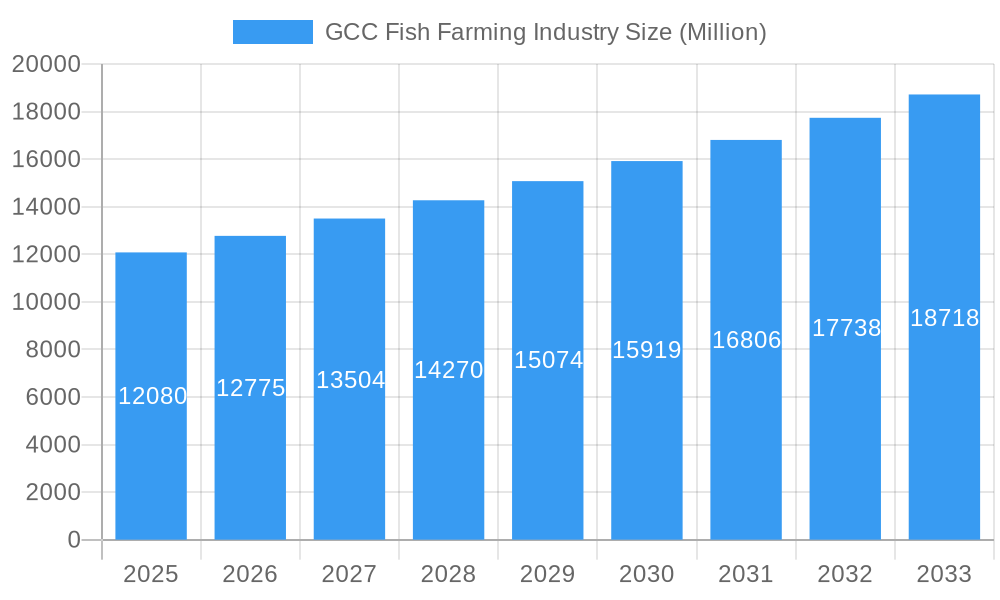

GCC Fish Farming Industry Company Market Share

This comprehensive report delves deep into the burgeoning GCC fish farming industry, offering a detailed analysis of its market composition, trends, and a robust forecast for the period of 2019–2033. With a base year of 2025, the report meticulously examines key segments, dominant geographies, pivotal industry developments, and major market players shaping this dynamic sector. This essential resource is designed to equip aquaculture investors, industry professionals, policymakers, and stakeholders with actionable insights to navigate and capitalize on the immense growth potential within the Gulf Cooperation Council's aquaculture landscape.

GCC Fish Farming Industry Market Composition & Trends

The GCC fish farming industry is characterized by a moderate market concentration, with significant investments flowing into sustainable aquaculture practices and technological advancements. Innovation catalysts are primarily driven by the region's commitment to food security, leading to the adoption of advanced hatchery technologies, recirculating aquaculture systems (RAS), and improved feed formulations. The regulatory landscape is evolving, with governments actively promoting private sector participation through favorable policies and incentives. Substitute products, such as imported frozen fish and alternative protein sources, present a competitive challenge, but the increasing consumer preference for fresh, locally sourced seafood, particularly organic aquaculture and sustainable seafood, is a strong counter-trend. End-user profiles span retail consumers, the foodservice industry, and international export markets. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate market share and expand their operational capabilities. For instance, strategic partnerships are emerging, with M&A deal values projected to reach billions in the coming years as companies aim for vertical integration and economies of scale within the Middle East aquaculture sector. Expected market share distribution indicates a significant growth for shrimp farming, tilapia aquaculture, and grouper farming within the GCC.

GCC Fish Farming Industry Industry Evolution

The GCC fish farming industry has witnessed a remarkable evolutionary trajectory, transitioning from nascent stages to a sophisticated and rapidly expanding sector. Over the historical period of 2019–2024, significant investments have been channeled into infrastructure development, research and development, and the adoption of cutting-edge aquaculture technologies. Market growth trajectories are strongly influenced by national visions aimed at diversifying economies and enhancing food self-sufficiency, with aquaculture development becoming a cornerstone of these strategies. Technological advancements have been pivotal, with the widespread adoption of RAS, smart monitoring systems, and disease management protocols contributing to increased production efficiency and reduced environmental impact. For example, the adoption rate of advanced filtration systems has seen a staggering XXX% increase since 2019. Shifting consumer demands are playing an increasingly crucial role, with a growing emphasis on traceability, sustainability, and the health benefits associated with consuming farm-raised fish. The demand for premium species like caviar and lobsters is also on the rise, creating niche market opportunities. Overall growth rates for the GCC aquaculture market have consistently exceeded XX% annually, outperforming many traditional agricultural sectors. The increasing awareness of the environmental benefits of sustainable fish farming over wild capture fisheries is further accelerating this evolution, positioning the GCC as a future leader in global aquaculture.

Leading Regions, Countries, or Segments in GCC Fish Farming Industry

Within the GCC fish farming industry, Saudi Arabia has emerged as a dominant force, driven by substantial government support, ambitious national aquaculture strategies, and significant private sector investment. The country's strategic geographical location, extensive coastline, and commitment to innovation have positioned it at the forefront of aquaculture growth in the region. Key drivers of Saudi Arabia's dominance include substantial investment trends, exemplified by the billions invested in developing large-scale hatcheries and aquaculture farms. Regulatory support is robust, with streamlined licensing processes and incentives encouraging both domestic and international players.

Among the various species, Pelagic Fish such as Sardine, Mackerel, Tuna, and Barracuda, alongside Shrimp and Freshwater Fish like Tilapia, represent significant segments due to their high market demand and suitability for large-scale farming. The freshwater fish segment, particularly Tilapia, benefits from its adaptability to inland farming systems and its consistent popularity among consumers. The shrimp farming sector is experiencing exponential growth, driven by advancements in disease management and high market value.

The United Arab Emirates and Oman are also key contributors to the GCC aquaculture market, with focused efforts on diversifying their aquaculture portfolios and enhancing processing capabilities. Investment trends in the UAE are geared towards high-tech RAS facilities, while Oman is leveraging its coastal resources for both marine and freshwater aquaculture.

The dominance factors in these leading segments and geographies are multifaceted:

- Investment Trends: Billions in direct investment for infrastructure, technology, and R&D.

- Regulatory Support: Favorable policies, tax incentives, and streamlined permitting processes.

- Technological Adoption: High uptake of advanced farming techniques, including RAS and automated feeding systems.

- Market Demand: Growing domestic and international demand for sustainably farmed seafood.

- Resource Availability: Favorable climatic conditions and access to suitable water bodies for aquaculture.

The demersal fish segment, including Grouper, Trevally, Emperor, and Pomfret, holds significant potential, driven by increasing demand for high-value marine species. The scallop and lobster segments, while currently smaller, are poised for growth due to their premium market positioning. The caviar segment, though nascent, represents a high-value niche with substantial future export potential.

GCC Fish Farming Industry Product Innovations

The GCC fish farming industry is witnessing a wave of product innovations focused on enhancing yield, improving sustainability, and meeting evolving consumer preferences. Innovations include the development of specialized, nutrient-rich feeds that promote faster growth and improved fish health, contributing to higher production volumes and better feed conversion ratios. Advanced disease prevention and treatment solutions, often incorporating biotechnological approaches, are reducing mortality rates and ensuring the biosecurity of farms. Furthermore, there's a growing focus on value-added products, such as pre-portioned and seasoned fish fillets, ready-to-cook meals, and sustainably sourced fish oil supplements, catering to the convenience-seeking consumer. Performance metrics from these innovations demonstrate improvements in growth rates by up to XX% and a reduction in feed wastage by XX%.

Propelling Factors for GCC Fish Farming Industry Growth

The GCC fish farming industry is propelled by a confluence of potent growth factors. Technological advancements, particularly the widespread adoption of Recirculating Aquaculture Systems (RAS), are enhancing efficiency and sustainability. Economic drivers include substantial government investment and a growing consumer demand for sustainable seafood and protein diversification strategies. Regulatory influences are positive, with governments actively promoting aquaculture through supportive policies and incentives aimed at achieving food security. For instance, the Saudi government has allocated billions for aquaculture development, significantly boosting investor confidence and driving fish production volumes. The increasing global demand for aquaculture products further fuels this growth.

Obstacles in the GCC Fish Farming Industry Market

Despite its promising outlook, the GCC fish farming industry faces several obstacles. Regulatory challenges, including complex permitting processes and evolving environmental standards, can sometimes hinder rapid expansion. Supply chain disruptions, exacerbated by global events, can impact the availability of essential inputs like feed and fingerlings. Competitive pressures from established international aquaculture markets and fluctuating global fish prices also present challenges. Furthermore, the high initial capital investment required for advanced aquaculture technology and the need for skilled labor can be significant barriers, potentially costing billions in setup and operational expenses.

Future Opportunities in GCC Fish Farming Industry

Emerging opportunities within the GCC fish farming industry are abundant. Expansion into untapped export markets, particularly in Asia and Europe, presents significant revenue potential. The development and adoption of novel aquaculture technologies, such as AI-driven monitoring and advanced genetic selection, offer avenues for increased efficiency and resilience. Consumer trends favoring traceable seafood and a growing interest in niche, high-value species like barracuda and certain caviar varieties create new market segments. Furthermore, increased collaboration between public and private sectors can unlock further investment and innovation, driving the GCC aquaculture market towards a future valued in the billions.

Major Players in the GCC Fish Farming Industry Ecosystem

- Saudi Aquaculture Society

- Oman Fisheries Development Company (OFDC)

- International Marine Products (IMP)

- Almarai Company

- Tabuk Fish Company

Key Developments in GCC Fish Farming Industry Industry

- June 2022: The Ministry of Environment, Water, and Agriculture (MEWA) has decided to make the Kingdom of Saudi Arabia one of the first in the world in the aquaculture sector to be a member of the Network of Aquaculture Centres in Asia-Pacific (NACA), significantly bolstering research and international collaboration for the Saudi aquaculture sector.

- September 2021: Oman Fisheries Development Company (OFDC) is expanding its presence at every stage of the fish value chain. To increase the volume of catch, it is expanding its own fleet of vessels and entering into strategic agreements with international vessel owners. It is also expanding its existing processing facilities and establishing a value-added products plant to significantly increase output from current levels, a move projected to boost Oman's fish exports by billions.

- April 2021: NEOM, the Saudi megacity development project, signed an agreement with Tabuk Fish Company that includes plans for a fish farm with a production capacity of 70 million fingerlings. This would make it the biggest hatchery in the MENA region, a monumental step for GCC aquaculture infrastructure.

Strategic GCC Fish Farming Industry Market Forecast

The strategic forecast for the GCC fish farming industry is exceptionally positive, projecting substantial growth driven by increasing regional food security initiatives and burgeoning consumer demand for high-quality, sustainably farmed seafood. Billions in investments are anticipated to fuel technological advancements, including expanded adoption of RAS and innovative feed solutions. Emerging opportunities in niche markets like caviar and premium species, coupled with a strong push towards value-added products, will further diversify revenue streams. The commitment of GCC governments to developing a robust and competitive aquaculture sector ensures a favorable regulatory environment, paving the way for the industry to reach market valuations in the billions by the end of the forecast period.

GCC Fish Farming Industry Segmentation

-

1. Type

-

1.1. Pelagic Fish

- 1.1.1. Sardine

- 1.1.2. Mackerel

- 1.1.3. Tuna

- 1.1.4. Barracuda

-

1.2. Demersal Fish

- 1.2.1. Grouper

- 1.2.2. Trevally

- 1.2.3. Emperor

- 1.2.4. Pomfret

-

1.3. Freshwater Fish

- 1.3.1. Tilapia

- 1.4. Scallop

- 1.5. Lobster

- 1.6. Shrimp

- 1.7. Caviar

- 1.8. Other Types

-

1.1. Pelagic Fish

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Oman

- 2.4. Qatar

- 2.5. Bahrain

- 2.6. Kuwait

-

3. Type

-

3.1. Pelagic Fish

- 3.1.1. Sardine

- 3.1.2. Mackerel

- 3.1.3. Tuna

- 3.1.4. Barracuda

-

3.2. Demersal Fish

- 3.2.1. Grouper

- 3.2.2. Trevally

- 3.2.3. Emperor

- 3.2.4. Pomfret

-

3.3. Freshwater Fish

- 3.3.1. Tilapia

- 3.4. Scallop

- 3.5. Lobster

- 3.6. Shrimp

- 3.7. Caviar

- 3.8. Other Types

-

3.1. Pelagic Fish

GCC Fish Farming Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Oman

- 4. Qatar

- 5. Bahrain

- 6. Kuwait

GCC Fish Farming Industry Regional Market Share

Geographic Coverage of GCC Fish Farming Industry

GCC Fish Farming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Sustainable Fish Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pelagic Fish

- 5.1.1.1. Sardine

- 5.1.1.2. Mackerel

- 5.1.1.3. Tuna

- 5.1.1.4. Barracuda

- 5.1.2. Demersal Fish

- 5.1.2.1. Grouper

- 5.1.2.2. Trevally

- 5.1.2.3. Emperor

- 5.1.2.4. Pomfret

- 5.1.3. Freshwater Fish

- 5.1.3.1. Tilapia

- 5.1.4. Scallop

- 5.1.5. Lobster

- 5.1.6. Shrimp

- 5.1.7. Caviar

- 5.1.8. Other Types

- 5.1.1. Pelagic Fish

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Oman

- 5.2.4. Qatar

- 5.2.5. Bahrain

- 5.2.6. Kuwait

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Pelagic Fish

- 5.3.1.1. Sardine

- 5.3.1.2. Mackerel

- 5.3.1.3. Tuna

- 5.3.1.4. Barracuda

- 5.3.2. Demersal Fish

- 5.3.2.1. Grouper

- 5.3.2.2. Trevally

- 5.3.2.3. Emperor

- 5.3.2.4. Pomfret

- 5.3.3. Freshwater Fish

- 5.3.3.1. Tilapia

- 5.3.4. Scallop

- 5.3.5. Lobster

- 5.3.6. Shrimp

- 5.3.7. Caviar

- 5.3.8. Other Types

- 5.3.1. Pelagic Fish

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Oman

- 5.4.4. Qatar

- 5.4.5. Bahrain

- 5.4.6. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pelagic Fish

- 6.1.1.1. Sardine

- 6.1.1.2. Mackerel

- 6.1.1.3. Tuna

- 6.1.1.4. Barracuda

- 6.1.2. Demersal Fish

- 6.1.2.1. Grouper

- 6.1.2.2. Trevally

- 6.1.2.3. Emperor

- 6.1.2.4. Pomfret

- 6.1.3. Freshwater Fish

- 6.1.3.1. Tilapia

- 6.1.4. Scallop

- 6.1.5. Lobster

- 6.1.6. Shrimp

- 6.1.7. Caviar

- 6.1.8. Other Types

- 6.1.1. Pelagic Fish

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Oman

- 6.2.4. Qatar

- 6.2.5. Bahrain

- 6.2.6. Kuwait

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Pelagic Fish

- 6.3.1.1. Sardine

- 6.3.1.2. Mackerel

- 6.3.1.3. Tuna

- 6.3.1.4. Barracuda

- 6.3.2. Demersal Fish

- 6.3.2.1. Grouper

- 6.3.2.2. Trevally

- 6.3.2.3. Emperor

- 6.3.2.4. Pomfret

- 6.3.3. Freshwater Fish

- 6.3.3.1. Tilapia

- 6.3.4. Scallop

- 6.3.5. Lobster

- 6.3.6. Shrimp

- 6.3.7. Caviar

- 6.3.8. Other Types

- 6.3.1. Pelagic Fish

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pelagic Fish

- 7.1.1.1. Sardine

- 7.1.1.2. Mackerel

- 7.1.1.3. Tuna

- 7.1.1.4. Barracuda

- 7.1.2. Demersal Fish

- 7.1.2.1. Grouper

- 7.1.2.2. Trevally

- 7.1.2.3. Emperor

- 7.1.2.4. Pomfret

- 7.1.3. Freshwater Fish

- 7.1.3.1. Tilapia

- 7.1.4. Scallop

- 7.1.5. Lobster

- 7.1.6. Shrimp

- 7.1.7. Caviar

- 7.1.8. Other Types

- 7.1.1. Pelagic Fish

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Oman

- 7.2.4. Qatar

- 7.2.5. Bahrain

- 7.2.6. Kuwait

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Pelagic Fish

- 7.3.1.1. Sardine

- 7.3.1.2. Mackerel

- 7.3.1.3. Tuna

- 7.3.1.4. Barracuda

- 7.3.2. Demersal Fish

- 7.3.2.1. Grouper

- 7.3.2.2. Trevally

- 7.3.2.3. Emperor

- 7.3.2.4. Pomfret

- 7.3.3. Freshwater Fish

- 7.3.3.1. Tilapia

- 7.3.4. Scallop

- 7.3.5. Lobster

- 7.3.6. Shrimp

- 7.3.7. Caviar

- 7.3.8. Other Types

- 7.3.1. Pelagic Fish

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Oman GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pelagic Fish

- 8.1.1.1. Sardine

- 8.1.1.2. Mackerel

- 8.1.1.3. Tuna

- 8.1.1.4. Barracuda

- 8.1.2. Demersal Fish

- 8.1.2.1. Grouper

- 8.1.2.2. Trevally

- 8.1.2.3. Emperor

- 8.1.2.4. Pomfret

- 8.1.3. Freshwater Fish

- 8.1.3.1. Tilapia

- 8.1.4. Scallop

- 8.1.5. Lobster

- 8.1.6. Shrimp

- 8.1.7. Caviar

- 8.1.8. Other Types

- 8.1.1. Pelagic Fish

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Oman

- 8.2.4. Qatar

- 8.2.5. Bahrain

- 8.2.6. Kuwait

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Pelagic Fish

- 8.3.1.1. Sardine

- 8.3.1.2. Mackerel

- 8.3.1.3. Tuna

- 8.3.1.4. Barracuda

- 8.3.2. Demersal Fish

- 8.3.2.1. Grouper

- 8.3.2.2. Trevally

- 8.3.2.3. Emperor

- 8.3.2.4. Pomfret

- 8.3.3. Freshwater Fish

- 8.3.3.1. Tilapia

- 8.3.4. Scallop

- 8.3.5. Lobster

- 8.3.6. Shrimp

- 8.3.7. Caviar

- 8.3.8. Other Types

- 8.3.1. Pelagic Fish

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Qatar GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pelagic Fish

- 9.1.1.1. Sardine

- 9.1.1.2. Mackerel

- 9.1.1.3. Tuna

- 9.1.1.4. Barracuda

- 9.1.2. Demersal Fish

- 9.1.2.1. Grouper

- 9.1.2.2. Trevally

- 9.1.2.3. Emperor

- 9.1.2.4. Pomfret

- 9.1.3. Freshwater Fish

- 9.1.3.1. Tilapia

- 9.1.4. Scallop

- 9.1.5. Lobster

- 9.1.6. Shrimp

- 9.1.7. Caviar

- 9.1.8. Other Types

- 9.1.1. Pelagic Fish

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Oman

- 9.2.4. Qatar

- 9.2.5. Bahrain

- 9.2.6. Kuwait

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Pelagic Fish

- 9.3.1.1. Sardine

- 9.3.1.2. Mackerel

- 9.3.1.3. Tuna

- 9.3.1.4. Barracuda

- 9.3.2. Demersal Fish

- 9.3.2.1. Grouper

- 9.3.2.2. Trevally

- 9.3.2.3. Emperor

- 9.3.2.4. Pomfret

- 9.3.3. Freshwater Fish

- 9.3.3.1. Tilapia

- 9.3.4. Scallop

- 9.3.5. Lobster

- 9.3.6. Shrimp

- 9.3.7. Caviar

- 9.3.8. Other Types

- 9.3.1. Pelagic Fish

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Bahrain GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pelagic Fish

- 10.1.1.1. Sardine

- 10.1.1.2. Mackerel

- 10.1.1.3. Tuna

- 10.1.1.4. Barracuda

- 10.1.2. Demersal Fish

- 10.1.2.1. Grouper

- 10.1.2.2. Trevally

- 10.1.2.3. Emperor

- 10.1.2.4. Pomfret

- 10.1.3. Freshwater Fish

- 10.1.3.1. Tilapia

- 10.1.4. Scallop

- 10.1.5. Lobster

- 10.1.6. Shrimp

- 10.1.7. Caviar

- 10.1.8. Other Types

- 10.1.1. Pelagic Fish

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Oman

- 10.2.4. Qatar

- 10.2.5. Bahrain

- 10.2.6. Kuwait

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Pelagic Fish

- 10.3.1.1. Sardine

- 10.3.1.2. Mackerel

- 10.3.1.3. Tuna

- 10.3.1.4. Barracuda

- 10.3.2. Demersal Fish

- 10.3.2.1. Grouper

- 10.3.2.2. Trevally

- 10.3.2.3. Emperor

- 10.3.2.4. Pomfret

- 10.3.3. Freshwater Fish

- 10.3.3.1. Tilapia

- 10.3.4. Scallop

- 10.3.5. Lobster

- 10.3.6. Shrimp

- 10.3.7. Caviar

- 10.3.8. Other Types

- 10.3.1. Pelagic Fish

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Kuwait GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Pelagic Fish

- 11.1.1.1. Sardine

- 11.1.1.2. Mackerel

- 11.1.1.3. Tuna

- 11.1.1.4. Barracuda

- 11.1.2. Demersal Fish

- 11.1.2.1. Grouper

- 11.1.2.2. Trevally

- 11.1.2.3. Emperor

- 11.1.2.4. Pomfret

- 11.1.3. Freshwater Fish

- 11.1.3.1. Tilapia

- 11.1.4. Scallop

- 11.1.5. Lobster

- 11.1.6. Shrimp

- 11.1.7. Caviar

- 11.1.8. Other Types

- 11.1.1. Pelagic Fish

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. United Arab Emirates

- 11.2.3. Oman

- 11.2.4. Qatar

- 11.2.5. Bahrain

- 11.2.6. Kuwait

- 11.3. Market Analysis, Insights and Forecast - by Type

- 11.3.1. Pelagic Fish

- 11.3.1.1. Sardine

- 11.3.1.2. Mackerel

- 11.3.1.3. Tuna

- 11.3.1.4. Barracuda

- 11.3.2. Demersal Fish

- 11.3.2.1. Grouper

- 11.3.2.2. Trevally

- 11.3.2.3. Emperor

- 11.3.2.4. Pomfret

- 11.3.3. Freshwater Fish

- 11.3.3.1. Tilapia

- 11.3.4. Scallop

- 11.3.5. Lobster

- 11.3.6. Shrimp

- 11.3.7. Caviar

- 11.3.8. Other Types

- 11.3.1. Pelagic Fish

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Saudi Aquaculture Society

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Oman Fisheries Development Company (OFDC)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 International Marine Products (IMP)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Almarai Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tabuk Fish Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 Saudi Aquaculture Society

List of Figures

- Figure 1: Global GCC Fish Farming Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global GCC Fish Farming Industry Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 5: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 8: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 12: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 13: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 15: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 17: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 21: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 24: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 25: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 26: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 27: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 28: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 29: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 33: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Oman GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 36: Oman GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 37: Oman GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Oman GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Oman GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 40: Oman GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 41: Oman GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Oman GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 43: Oman GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 44: Oman GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 45: Oman GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Oman GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 47: Oman GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Oman GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 49: Oman GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Oman GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Qatar GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 52: Qatar GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 53: Qatar GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Qatar GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Qatar GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 56: Qatar GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 57: Qatar GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Qatar GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 59: Qatar GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 60: Qatar GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 61: Qatar GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 62: Qatar GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 63: Qatar GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Qatar GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 65: Qatar GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Qatar GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Bahrain GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 68: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 69: Bahrain GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Bahrain GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Bahrain GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 72: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 73: Bahrain GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 74: Bahrain GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 75: Bahrain GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 76: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 77: Bahrain GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 78: Bahrain GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 79: Bahrain GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 81: Bahrain GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Bahrain GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Kuwait GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 84: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 85: Kuwait GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 86: Kuwait GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 87: Kuwait GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 88: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 89: Kuwait GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 90: Kuwait GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 91: Kuwait GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 92: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 93: Kuwait GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 94: Kuwait GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 95: Kuwait GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 96: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 97: Kuwait GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Kuwait GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 3: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 7: Global GCC Fish Farming Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 9: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 11: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 13: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 15: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 17: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 19: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 21: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 23: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 27: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 29: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 31: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 33: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 35: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 36: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 37: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 39: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 41: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 42: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 43: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 44: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 45: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 46: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 47: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 51: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 52: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 53: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 54: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 55: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Fish Farming Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the GCC Fish Farming Industry?

Key companies in the market include Saudi Aquaculture Society , Oman Fisheries Development Company (OFDC) , International Marine Products (IMP), Almarai Company , Tabuk Fish Company .

3. What are the main segments of the GCC Fish Farming Industry?

The market segments include Type, Geography, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Government Initiatives for Sustainable Fish Farming.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

June 2022: The Ministry of Environment, Water, and Agriculture (MEWA) has decided to make the Kingdom of Saudi Arabia one of the first in the world in the aquaculture sector to be a member of the Network of Aquaculture Centres in Asia-Pacific (NACA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Fish Farming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Fish Farming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Fish Farming Industry?

To stay informed about further developments, trends, and reports in the GCC Fish Farming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence