Key Insights

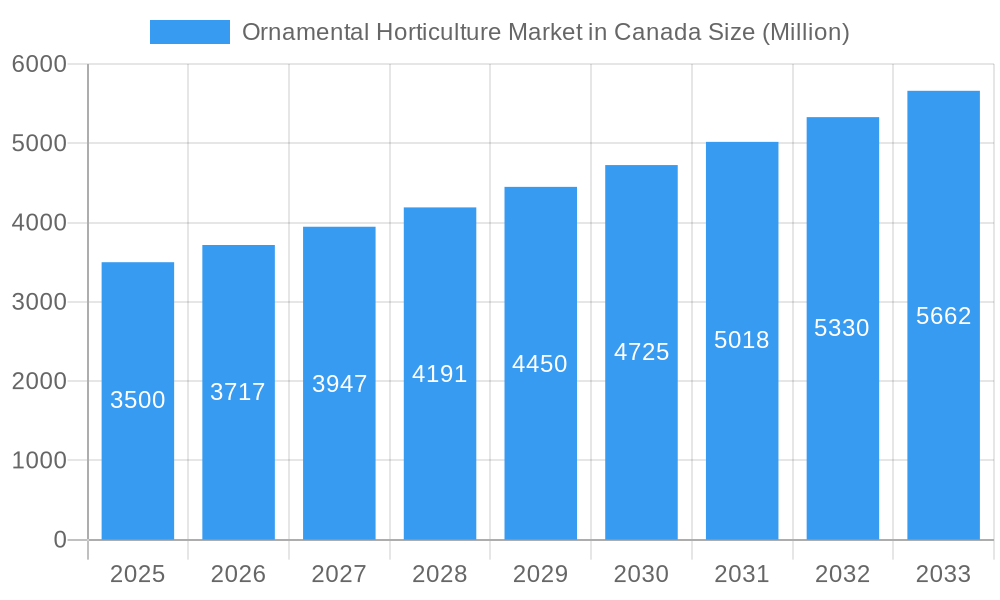

The ornamental horticulture market in Canada is poised for robust expansion, driven by increasing consumer interest in home gardening, landscaping, and the aesthetic enhancement of living spaces. With an estimated market size of approximately $3.5 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.20%, the sector is expected to reach significant value by 2033. Key growth drivers include a rising disposable income among Canadians, a growing trend towards biophilic design in urban environments, and the continued popularity of DIY home improvement projects, which often incorporate floral and plant elements. The demand for a diverse range of products, from vibrant bedding plants and elegant cut flowers to resilient outdoor hanging pots and indoor foliage, fuels this expansion. Furthermore, the influence of social media trends showcasing lush gardens and indoor plant collections is stimulating consumer engagement and purchasing decisions, particularly among younger demographics.

Ornamental Horticulture Market in Canada Market Size (In Billion)

The market segmentation reveals a dynamic landscape. Floriculture, encompassing greenhouse flowers and potted plants, forms the core. Within greenhouse flowers, bedding plants and various cuttings like chrysanthemums and poinsettias are consistently popular, while cut flowers such as roses, lilies, and tulips remain essential for gifting and events. Potted plants, including tropical foliage, fine herb plants, and perennial flowering plants, cater to both indoor décor and outdoor gardening enthusiasts. Distribution channels are also varied, with traditional retail florists and garden centres playing a crucial role, complemented by the increasing influence of flower chain stores and online retail outlets offering convenience. Challenges, such as seasonal weather dependency and evolving consumer preferences requiring constant adaptation in product offerings, are present. However, the overarching trend of Canadians investing in their living environments, both indoors and outdoors, ensures a positive trajectory for the ornamental horticulture market.

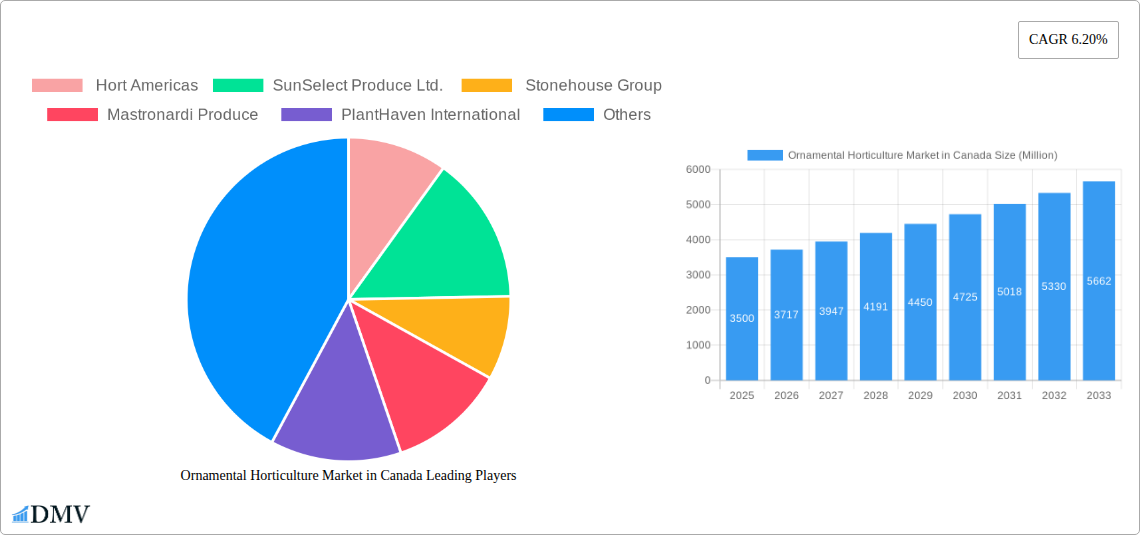

Ornamental Horticulture Market in Canada Company Market Share

Unlocking Growth: The Canadian Ornamental Horticulture Market Report (2019-2033)

Gain unparalleled insights into the dynamic Canadian Ornamental Horticulture Market with this comprehensive report. Covering the period from 2019 to 2033, with a detailed analysis of the 2025 base and estimated year, this report delves deep into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Discover the strategic landscape, key players, and pivotal developments shaping the future of ornamental horticulture in Canada. This report is essential for stakeholders seeking to navigate and capitalize on market trends, from floriculture to nursery production and diverse distribution channels.

Ornamental Horticulture Market in Canada Market Composition & Trends

The Canadian ornamental horticulture market exhibits a moderately concentrated landscape, driven by ongoing innovation in cultivation techniques and a growing consumer appreciation for green spaces and aesthetic enhancements. Key catalysts for innovation include advancements in greenhouse technology, sustainable growing practices, and the development of disease-resistant plant varieties. Regulatory frameworks, primarily managed by federal and provincial agricultural bodies, focus on plant health, biosecurity, and environmental protection, fostering a stable yet evolving operational environment. While direct substitute products are limited, the increasing adoption of artificial plants and floral displays presents a competitive pressure. End-user profiles are diverse, ranging from individual consumers and landscape contractors to large-scale retail outlets and floral chains. Mergers and acquisitions (M&A) activities, while not dominant, are observed as companies seek to expand their product portfolios and market reach, with recent deal values ranging from several hundred thousand to several million. The distribution channel analysis reveals a significant role for garden centers and domestic wholesalers, complemented by the growing influence of online retail platforms.

- Market Concentration: Moderate, with a mix of large established players and numerous smaller enterprises.

- Innovation Catalysts: Advanced greenhouse technologies (e.g., LED lighting, climate control), sustainable practices, new plant breeding.

- Regulatory Landscape: Focus on plant health, biosecurity, environmental sustainability, and trade regulations.

- Substitute Products: Artificial plants, décor items, and subscription box services for plants.

- End-User Profiles: Residential consumers, commercial landscapers, retail florists, garden centers, hospitality industry.

- M&A Activities: Strategic acquisitions to gain market share, expand product lines, and enhance operational efficiencies. Recent M&A transactions have ranged in value from approximately USD 500,000 to USD 2 Million, indicating consolidation efforts within specific niches.

- Market Share Distribution: Floriculture segments, particularly potted plants and cut flowers, hold significant shares, driven by consistent demand. The nursery segment contributes substantially through landscaping and perennial sales.

Ornamental Horticulture Market in Canada Industry Evolution

The Canadian ornamental horticulture industry has experienced a robust growth trajectory over the historical period of 2019-2024, driven by a confluence of shifting consumer demands and significant technological advancements. Consumer preferences have increasingly leaned towards aesthetically pleasing living spaces, a trend amplified by greater awareness of mental well-being and the biophilic design movement. This has translated into a surge in demand for a wide array of ornamental plants, from vibrant bedding plants for annual color to sophisticated tropical foliage for indoor aesthetics and hardy perennials for sustainable landscaping. The "grow-your-own" trend has also bolstered the market for vegetable plants and fine herb plants, further diversifying demand.

Technological advancements have been instrumental in enhancing both production efficiency and product quality. The adoption of sophisticated greenhouse technologies, including advanced climate control systems, automated irrigation, and energy-efficient LED lighting, has allowed for year-round production and the cultivation of a broader spectrum of species. For instance, the increasing use of LED lighting systems in greenhouses, as seen with Eurosa Farms, has demonstrably boosted winter production capabilities and improved energy efficiency, leading to higher yields and better quality produce. Furthermore, advancements in plant breeding and propagation techniques have led to the introduction of novel varieties with improved disease resistance, extended bloom times, and unique aesthetic appeal. This has allowed Canadian growers to cater to evolving market tastes and gain a competitive edge both domestically and internationally.

The distribution channels have also evolved, with a growing emphasis on direct-to-consumer (DTC) sales and e-commerce platforms. While traditional channels like garden centers and retail florists remain vital, the pandemic accelerated the adoption of online ordering and delivery services for plants and related horticultural products. This shift has necessitated investments in logistics and digital marketing strategies by industry players. Government initiatives, such as the investments made by the Ministry of Agriculture and Agri-Food, have played a crucial role in supporting industry growth. These investments have focused on enhancing market access, promoting Canadian floriculture products domestically and in export markets, and fostering innovation. For example, investments in Flowers Canada Growers Inc. (FCG) aim to strengthen the industry through marketing activities, highlighting the benefits of Canadian floriculture products, which directly contributes to increased sales across Canada and the United States. The Canadian Nursery Landscape Association (CNLA) has also received significant investment to capture new market opportunities and boost exports, underscoring the strategic importance of the ornamental horticulture sector to the Canadian economy. The overall market growth rate has been estimated at an average of XX% annually during the historical period, with projections indicating continued expansion throughout the forecast period, albeit at a potentially moderated pace.

Leading Regions, Countries, or Segments in Ornamental Horticulture Market in Canada

The Canadian Ornamental Horticulture Market is a complex tapestry woven with diverse segments, distribution channels, and regional strengths. At its core, Floriculture stands out as the dominant segment, driven by consistent demand for both decorative and functional plants. Within Floriculture, Greenhouse Flowers represent a substantial sub-segment, encompassing a wide array of products that cater to various occasions and aesthetic preferences.

Floriculture Dominance:

- Greenhouse Flowers: This sub-segment is a powerhouse, generating significant revenue through Bedding Plants which are essential for seasonal landscaping and home gardening. The consistent demand for vibrant, easy-to-grow annuals ensures a steady market share.

- Cuttings: The production of various cuttings forms the backbone of the broader floriculture industry, supplying growers with the raw materials for a vast range of finished products. Key varieties include:

- Chrysanthemums: Popular for their diverse colors and long-lasting blooms.

- Geraniums: A staple for hanging baskets and garden beds, known for their resilience.

- Impatiens: Valued for their shade tolerance and vibrant floral displays.

- Poinsettias: Crucial for the lucrative holiday season market.

- Other Cuttings: Including a wide variety of popular and niche species.

- Cut Flowers: While facing international competition, Canadian-grown cut flowers command a premium due to quality and freshness. Key varieties contributing to market share include:

- Tulips: Especially popular in the spring season.

- Gerberas: Known for their bright, cheerful colors.

- Snapdragons: Adding height and architectural interest to bouquets.

- Lilies: Cherished for their fragrance and elegant blooms.

- Alstroemerias: Offering a long vase life and vibrant hues.

- Freesias: Valued for their delicate beauty and distinct fragrance.

- Lisianthus: Providing an elegant, rose-like appearance.

- Roses: A perennial favorite, with increasing domestic production facilitated by technological advancements.

- Daffodils: Signaling the arrival of spring.

- Irises: Known for their distinctive and colorful petals.

- Other Cut Flowers: A broad category encompassing specialty and seasonal varieties.

- Potted Plants: This sub-segment is experiencing significant growth, catering to both indoor and outdoor gardening trends.

- Tropical Foliage and Green Plants: Highly sought after for interior décor and air purification benefits.

- Fine Herb Plants: Driven by the culinary trend and a desire for fresh, home-grown ingredients.

- Outdoor Hanging Pots: Popular for adding color and charm to balconies and patios.

- Vegetable Plants: A direct beneficiary of the growing interest in urban agriculture and home gardening.

- Miniature Roses: Offering the charm of roses in a compact, manageable size.

- Kalanchoes: Popular for their vibrant, long-lasting blooms, especially as gifts.

- Herbaceous Flowering Perennials: Valued for their long-term garden impact and reduced annual replacement needs.

- Begonias: Offering diverse foliage and flower types for various light conditions.

- Petunias: A garden staple for vibrant, continuous blooms.

- African Violets: Cherished for their delicate blooms and ease of care indoors.

- Hawker's Balsams: Known for their lush foliage and attractive flowers.

- Orchids: Increasingly popular for their exotic beauty and long bloom times.

- Calibrachoas: Offering a cascading profusion of small, colorful flowers.

- Cyclamens: Popular for their distinctive blooms, often associated with specific seasons.

- Other Potted Plants: Encompassing a wide variety of annuals, perennials, and succulents.

Nursery Dominance: The Nursery segment plays a critical role in supplying the foundational elements for landscaping projects and retail garden centers. This includes trees, shrubs, and perennials, forming the structural and long-term aesthetic components of outdoor spaces.

Distribution Channel Dynamics: The effectiveness of distribution channels is paramount to market access.

- Garden Centres: Remain a primary sales point for consumers, offering a broad selection and expert advice.

- Landscape Contractors: Drive significant demand for nursery stock and large-scale planting projects.

- Domestic Wholesalers: Crucial for consolidating production and distributing to a wide network of retailers.

- Retail Florists: Cater to the demand for cut flowers, potted plants for gifting, and arrangements.

- Flower Chain Stores: Increasing their market presence by offering a curated selection of popular floral products.

- Retail Outlets: Including supermarkets and big-box stores that increasingly feature a range of ornamental plants.

- Other Distribution Channels: Encompassing online retailers, direct-to-consumer sales, and specialty horticultural suppliers.

Key Drivers of Dominance:

- Investment Trends: Government investments in floriculture and nursery associations (e.g., CNLA, FCG) directly bolster market growth and export potential. These investments act as significant catalysts for expansion and innovation.

- Regulatory Support: Favorable policies promoting Canadian agricultural products and sustainable practices enhance market competitiveness.

- Consumer Demand: Growing interest in home improvement, gardening, and biophilic design fuels demand across all floriculture and nursery segments.

- Technological Advancements: Innovations in greenhouse production and plant breeding enable the cultivation of a wider variety of species and improve yield efficiency, particularly in floriculture.

- Seasonality: While some segments are seasonal, others like indoor potted plants offer year-round demand, contributing to overall market stability.

Ornamental Horticulture Market in Canada Product Innovations

Product innovation within the Canadian ornamental horticulture market is increasingly focused on enhanced consumer appeal, improved sustainability, and greater resilience. Growers are actively developing and marketing new plant varieties with extended bloom times, unique foliage colors, and disease resistance, reducing the need for chemical interventions. For instance, research into drought-tolerant perennials and native plant species is gaining traction, aligning with consumer interest in low-maintenance and eco-friendly gardening. The application of advanced breeding techniques, including tissue culture and molecular marker-assisted selection, allows for the rapid development and propagation of these superior varieties. Performance metrics such as increased yield per square meter in greenhouse operations and enhanced survival rates in landscape applications are key indicators of successful product innovation. The integration of smart technologies, such as self-watering pots and sensor-equipped plant displays, is also emerging, offering convenience and improved plant care for consumers.

Propelling Factors for Ornamental Horticulture Market in Canada Growth

Several key factors are propelling the growth of the Canadian ornamental horticulture market. The increasing urbanization and the subsequent desire for green spaces within homes and cities continue to drive demand for ornamental plants. This is complemented by a growing consumer consciousness around mental well-being and the therapeutic benefits of indoor plants and gardening. Technological advancements in greenhouse management, including automated irrigation, climate control, and LED lighting, are significantly boosting production efficiency and enabling year-round cultivation, thereby expanding market supply and product availability. Furthermore, government support through initiatives like the AgriMarketing Program and investments in industry associations are fostering innovation, export development, and promotional activities, all contributing to market expansion.

- Urbanization and Biophilic Design: Increasing demand for indoor plants and green spaces in urban environments.

- Mental Well-being Trend: Growing consumer awareness of the positive impact of plants on mental health.

- Technological Advancements: Innovations in greenhouse technology enhancing efficiency and enabling year-round production.

- Government Support: Investments and programs aimed at boosting exports, promoting Canadian products, and fostering innovation.

- Growing Interest in Home Gardening: Particularly the "grow-your-own" movement for herbs and vegetables.

Obstacles in the Ornamental Horticulture Market in Canada Market

Despite robust growth, the Canadian ornamental horticulture market faces several significant obstacles. Stringent import/export regulations and phytosanitary requirements can create barriers to international trade and increase operational complexities. The reliance on specific climate conditions in certain regions can lead to vulnerability to extreme weather events and climate change impacts, affecting crop yields and availability. Labor shortages, particularly skilled labor for cultivation and greenhouse management, pose a persistent challenge, driving up labor costs. Furthermore, supply chain disruptions, exacerbated by global events, can impact the availability of essential inputs such as fertilizers, growing media, and packaging materials. Finally, intense competition from international markets, particularly from regions with lower production costs, puts pressure on pricing and profit margins for domestic producers.

- Regulatory Hurdles: Complex import/export regulations and phytosanitary compliance.

- Climate Change Vulnerability: Susceptibility to extreme weather events impacting crop yields.

- Labor Shortages: Difficulty in sourcing and retaining skilled labor for cultivation and operations.

- Supply Chain Disruptions: Challenges in sourcing essential inputs and managing logistics.

- International Competition: Price pressures from countries with lower production costs.

Future Opportunities in Ornamental Horticulture Market in Canada

The Canadian ornamental horticulture market is poised for significant future opportunities, driven by evolving consumer trends and technological advancements. The increasing demand for sustainable and eco-friendly products presents a prime avenue for growth, with opportunities in organic cultivation, native plant promotion, and biodegradable packaging solutions. The e-commerce surge continues to offer expansion potential for online sales channels, direct-to-consumer models, and subscription-based plant services. Furthermore, advancements in vertical farming and controlled environment agriculture offer potential for increased production efficiency and localized supply chains, particularly in urban areas. The growing interest in edible landscaping and functional plants, such as those with air-purifying qualities, opens new product development avenues. Finally, exploring niche markets, such as specialty orchids, rare succulents, and heritage plant varieties, can offer premium pricing and cater to a discerning consumer base.

- Sustainability Focus: Growth in organic produce, native plants, and eco-friendly packaging.

- E-commerce Expansion: Opportunities in online sales, DTC models, and subscription services.

- Controlled Environment Agriculture: Potential for increased efficiency and localized production through vertical farming.

- Functional and Edible Plants: Growing demand for air-purifying plants and edible landscaping.

- Niche Market Development: Opportunities in specialty and heritage plant varieties.

Major Players in the Ornamental Horticulture Market in Canada Ecosystem

- Hort Americas

- SunSelect Produce Ltd.

- Stonehouse Group

- Mastronardi Produce

- PlantHaven International

Key Developments in Ornamental Horticulture Market in Canada Industry

- March 2022: The Ministry of Agriculture and Agri-Food invested USD 1.5 million for two projects with the Canadian Nursery Landscape Association (CNLA) to help capture new opportunities for market growth and boost exports.

- February 2022: The Ministry of Agriculture and Agri-Food invested USD 535,000 to support Flowers Canada Growers Inc. (FCG) in its efforts to further improve and strengthen Canada's floriculture industry. With an investment of nearly USD 460,000 through the AgriMarketing Program, FCG is supporting marketing activities to promote the benefits of Canada's floriculture products, which will help increase sales throughout Canada and the United States.

- February 2022: Eurosa Farms launched greenhouse cultivation of cut flowers, producing about 70,000 roses ahead of Valentine's Day. Eurosa Farms upgraded its greenhouse lights with a new LED system last fall, to increase efficiency and boost winter production.

Strategic Ornamental Horticulture Market in Canada Market Forecast

The Canadian ornamental horticulture market is projected for sustained growth through 2033, fueled by evolving consumer lifestyle choices and ongoing technological innovation. The increasing demand for aesthetically pleasing living spaces, coupled with a heightened awareness of the therapeutic benefits of plants, will continue to be a primary growth catalyst. Advancements in greenhouse technology, particularly in LED lighting and climate control, are expected to enhance production efficiency, expand cultivation possibilities for diverse species, and improve overall yield, supporting the floriculture and nursery segments. Government initiatives focused on market development and export promotion, such as those supporting Flowers Canada Growers Inc. and the Canadian Nursery Landscape Association, will play a pivotal role in boosting domestic sales and international competitiveness. The market's future trajectory will also be shaped by the growing emphasis on sustainability, with opportunities arising from organic production, native plant cultivation, and the development of eco-friendly horticultural solutions, indicating a resilient and expanding market.

Ornamental Horticulture Market in Canada Segmentation

-

1. Type

-

1.1. Floriculture

-

1.1.1. Greenhouse Flowers

- 1.1.1.1. Bedding plants

-

1.1.1.2. Cuttings

- 1.1.1.2.1. Chrysanthemums

- 1.1.1.2.2. Geraniums

- 1.1.1.2.3. Impatiens

- 1.1.1.2.4. Poinsettias

- 1.1.1.2.5. Other cuttings

-

1.1.1.3. Cut Flowers

- 1.1.1.3.1. Tulips

- 1.1.1.3.2. Gerberas

- 1.1.1.3.3. Snapdragons

- 1.1.1.3.4. Lilies

- 1.1.1.3.5. Alstroemerias

- 1.1.1.3.6. Freesias

- 1.1.1.3.7. Lisianthus

- 1.1.1.3.8. Roses

- 1.1.1.3.9. Daffodils

- 1.1.1.3.10. Irises

- 1.1.1.3.11. Other cut flowers

-

1.1.2. Potted Plants

- 1.1.2.1. Tropical foliage and green plants

- 1.1.2.2. Fine herb plants

- 1.1.2.3. Outdoor hanging pots

- 1.1.2.4. Vegetable plants

- 1.1.2.5. Miniature roses

- 1.1.2.6. Kalanchoes

- 1.1.2.7. Herbaceous flowering perennials

- 1.1.2.8. Begonias

- 1.1.2.9. Petunias

- 1.1.2.10. African violets

- 1.1.2.11. Hawker's balsams

- 1.1.2.12. Orchids

- 1.1.2.13. Calibrachoas

- 1.1.2.14. Cyclamens

- 1.1.2.15. Other Potted Plants

-

1.1.1. Greenhouse Flowers

- 1.2. Nursery

-

1.1. Floriculture

-

2. Distribution Channel

- 2.1. Flower Chain Stores

- 2.2. Domestic Wholesalers

- 2.3. Retail Outlet

- 2.4. Retail Florists

- 2.5. Garden Centres

- 2.6. Landscape Contractors

- 2.7. Other Distribution Channels

-

3. Type

-

3.1. Floriculture

-

3.1.1. Greenhouse Flowers

- 3.1.1.1. Bedding plants

-

3.1.1.2. Cuttings

- 3.1.1.2.1. Chrysanthemums

- 3.1.1.2.2. Geraniums

- 3.1.1.2.3. Impatiens

- 3.1.1.2.4. Poinsettias

- 3.1.1.2.5. Other cuttings

-

3.1.1.3. Cut Flowers

- 3.1.1.3.1. Tulips

- 3.1.1.3.2. Gerberas

- 3.1.1.3.3. Snapdragons

- 3.1.1.3.4. Lilies

- 3.1.1.3.5. Alstroemerias

- 3.1.1.3.6. Freesias

- 3.1.1.3.7. Lisianthus

- 3.1.1.3.8. Roses

- 3.1.1.3.9. Daffodils

- 3.1.1.3.10. Irises

- 3.1.1.3.11. Other cut flowers

-

3.1.2. Potted Plants

- 3.1.2.1. Tropical foliage and green plants

- 3.1.2.2. Fine herb plants

- 3.1.2.3. Outdoor hanging pots

- 3.1.2.4. Vegetable plants

- 3.1.2.5. Miniature roses

- 3.1.2.6. Kalanchoes

- 3.1.2.7. Herbaceous flowering perennials

- 3.1.2.8. Begonias

- 3.1.2.9. Petunias

- 3.1.2.10. African violets

- 3.1.2.11. Hawker's balsams

- 3.1.2.12. Orchids

- 3.1.2.13. Calibrachoas

- 3.1.2.14. Cyclamens

- 3.1.2.15. Other Potted Plants

-

3.1.1. Greenhouse Flowers

- 3.2. Nursery

-

3.1. Floriculture

-

4. Distribution Channel

- 4.1. Flower Chain Stores

- 4.2. Domestic Wholesalers

- 4.3. Retail Outlet

- 4.4. Retail Florists

- 4.5. Garden Centres

- 4.6. Landscape Contractors

- 4.7. Other Distribution Channels

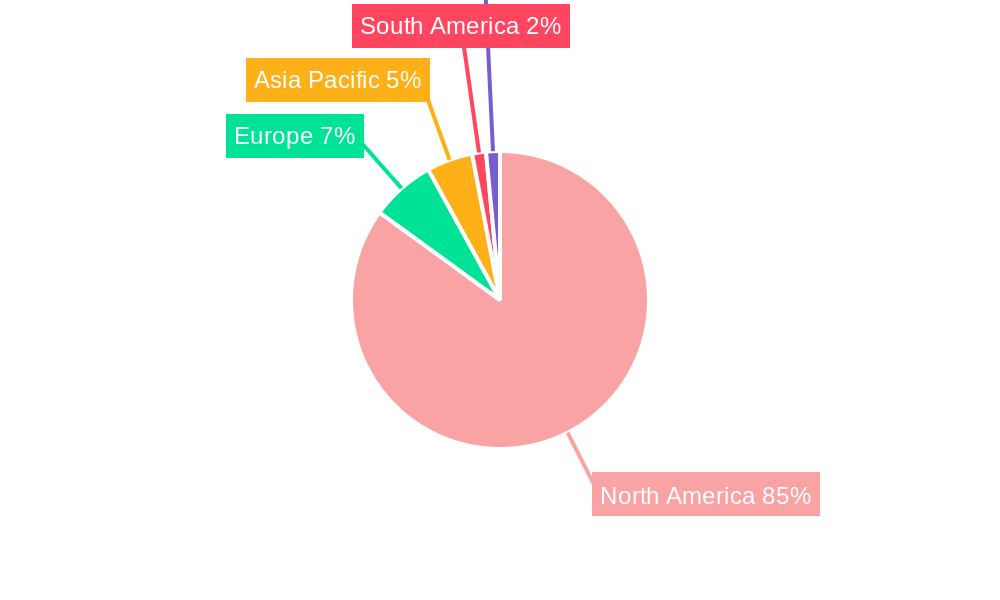

Ornamental Horticulture Market in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ornamental Horticulture Market in Canada Regional Market Share

Geographic Coverage of Ornamental Horticulture Market in Canada

Ornamental Horticulture Market in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Export Drives the Ornamental Horticulture Category in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Floriculture

- 5.1.1.1. Greenhouse Flowers

- 5.1.1.1.1. Bedding plants

- 5.1.1.1.2. Cuttings

- 5.1.1.1.2.1. Chrysanthemums

- 5.1.1.1.2.2. Geraniums

- 5.1.1.1.2.3. Impatiens

- 5.1.1.1.2.4. Poinsettias

- 5.1.1.1.2.5. Other cuttings

- 5.1.1.1.3. Cut Flowers

- 5.1.1.1.3.1. Tulips

- 5.1.1.1.3.2. Gerberas

- 5.1.1.1.3.3. Snapdragons

- 5.1.1.1.3.4. Lilies

- 5.1.1.1.3.5. Alstroemerias

- 5.1.1.1.3.6. Freesias

- 5.1.1.1.3.7. Lisianthus

- 5.1.1.1.3.8. Roses

- 5.1.1.1.3.9. Daffodils

- 5.1.1.1.3.10. Irises

- 5.1.1.1.3.11. Other cut flowers

- 5.1.1.2. Potted Plants

- 5.1.1.2.1. Tropical foliage and green plants

- 5.1.1.2.2. Fine herb plants

- 5.1.1.2.3. Outdoor hanging pots

- 5.1.1.2.4. Vegetable plants

- 5.1.1.2.5. Miniature roses

- 5.1.1.2.6. Kalanchoes

- 5.1.1.2.7. Herbaceous flowering perennials

- 5.1.1.2.8. Begonias

- 5.1.1.2.9. Petunias

- 5.1.1.2.10. African violets

- 5.1.1.2.11. Hawker's balsams

- 5.1.1.2.12. Orchids

- 5.1.1.2.13. Calibrachoas

- 5.1.1.2.14. Cyclamens

- 5.1.1.2.15. Other Potted Plants

- 5.1.1.1. Greenhouse Flowers

- 5.1.2. Nursery

- 5.1.1. Floriculture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flower Chain Stores

- 5.2.2. Domestic Wholesalers

- 5.2.3. Retail Outlet

- 5.2.4. Retail Florists

- 5.2.5. Garden Centres

- 5.2.6. Landscape Contractors

- 5.2.7. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Floriculture

- 5.3.1.1. Greenhouse Flowers

- 5.3.1.1.1. Bedding plants

- 5.3.1.1.2. Cuttings

- 5.3.1.1.2.1. Chrysanthemums

- 5.3.1.1.2.2. Geraniums

- 5.3.1.1.2.3. Impatiens

- 5.3.1.1.2.4. Poinsettias

- 5.3.1.1.2.5. Other cuttings

- 5.3.1.1.3. Cut Flowers

- 5.3.1.1.3.1. Tulips

- 5.3.1.1.3.2. Gerberas

- 5.3.1.1.3.3. Snapdragons

- 5.3.1.1.3.4. Lilies

- 5.3.1.1.3.5. Alstroemerias

- 5.3.1.1.3.6. Freesias

- 5.3.1.1.3.7. Lisianthus

- 5.3.1.1.3.8. Roses

- 5.3.1.1.3.9. Daffodils

- 5.3.1.1.3.10. Irises

- 5.3.1.1.3.11. Other cut flowers

- 5.3.1.2. Potted Plants

- 5.3.1.2.1. Tropical foliage and green plants

- 5.3.1.2.2. Fine herb plants

- 5.3.1.2.3. Outdoor hanging pots

- 5.3.1.2.4. Vegetable plants

- 5.3.1.2.5. Miniature roses

- 5.3.1.2.6. Kalanchoes

- 5.3.1.2.7. Herbaceous flowering perennials

- 5.3.1.2.8. Begonias

- 5.3.1.2.9. Petunias

- 5.3.1.2.10. African violets

- 5.3.1.2.11. Hawker's balsams

- 5.3.1.2.12. Orchids

- 5.3.1.2.13. Calibrachoas

- 5.3.1.2.14. Cyclamens

- 5.3.1.2.15. Other Potted Plants

- 5.3.1.1. Greenhouse Flowers

- 5.3.2. Nursery

- 5.3.1. Floriculture

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Flower Chain Stores

- 5.4.2. Domestic Wholesalers

- 5.4.3. Retail Outlet

- 5.4.4. Retail Florists

- 5.4.5. Garden Centres

- 5.4.6. Landscape Contractors

- 5.4.7. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Floriculture

- 6.1.1.1. Greenhouse Flowers

- 6.1.1.1.1. Bedding plants

- 6.1.1.1.2. Cuttings

- 6.1.1.1.2.1. Chrysanthemums

- 6.1.1.1.2.2. Geraniums

- 6.1.1.1.2.3. Impatiens

- 6.1.1.1.2.4. Poinsettias

- 6.1.1.1.2.5. Other cuttings

- 6.1.1.1.3. Cut Flowers

- 6.1.1.1.3.1. Tulips

- 6.1.1.1.3.2. Gerberas

- 6.1.1.1.3.3. Snapdragons

- 6.1.1.1.3.4. Lilies

- 6.1.1.1.3.5. Alstroemerias

- 6.1.1.1.3.6. Freesias

- 6.1.1.1.3.7. Lisianthus

- 6.1.1.1.3.8. Roses

- 6.1.1.1.3.9. Daffodils

- 6.1.1.1.3.10. Irises

- 6.1.1.1.3.11. Other cut flowers

- 6.1.1.2. Potted Plants

- 6.1.1.2.1. Tropical foliage and green plants

- 6.1.1.2.2. Fine herb plants

- 6.1.1.2.3. Outdoor hanging pots

- 6.1.1.2.4. Vegetable plants

- 6.1.1.2.5. Miniature roses

- 6.1.1.2.6. Kalanchoes

- 6.1.1.2.7. Herbaceous flowering perennials

- 6.1.1.2.8. Begonias

- 6.1.1.2.9. Petunias

- 6.1.1.2.10. African violets

- 6.1.1.2.11. Hawker's balsams

- 6.1.1.2.12. Orchids

- 6.1.1.2.13. Calibrachoas

- 6.1.1.2.14. Cyclamens

- 6.1.1.2.15. Other Potted Plants

- 6.1.1.1. Greenhouse Flowers

- 6.1.2. Nursery

- 6.1.1. Floriculture

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Flower Chain Stores

- 6.2.2. Domestic Wholesalers

- 6.2.3. Retail Outlet

- 6.2.4. Retail Florists

- 6.2.5. Garden Centres

- 6.2.6. Landscape Contractors

- 6.2.7. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Floriculture

- 6.3.1.1. Greenhouse Flowers

- 6.3.1.1.1. Bedding plants

- 6.3.1.1.2. Cuttings

- 6.3.1.1.2.1. Chrysanthemums

- 6.3.1.1.2.2. Geraniums

- 6.3.1.1.2.3. Impatiens

- 6.3.1.1.2.4. Poinsettias

- 6.3.1.1.2.5. Other cuttings

- 6.3.1.1.3. Cut Flowers

- 6.3.1.1.3.1. Tulips

- 6.3.1.1.3.2. Gerberas

- 6.3.1.1.3.3. Snapdragons

- 6.3.1.1.3.4. Lilies

- 6.3.1.1.3.5. Alstroemerias

- 6.3.1.1.3.6. Freesias

- 6.3.1.1.3.7. Lisianthus

- 6.3.1.1.3.8. Roses

- 6.3.1.1.3.9. Daffodils

- 6.3.1.1.3.10. Irises

- 6.3.1.1.3.11. Other cut flowers

- 6.3.1.2. Potted Plants

- 6.3.1.2.1. Tropical foliage and green plants

- 6.3.1.2.2. Fine herb plants

- 6.3.1.2.3. Outdoor hanging pots

- 6.3.1.2.4. Vegetable plants

- 6.3.1.2.5. Miniature roses

- 6.3.1.2.6. Kalanchoes

- 6.3.1.2.7. Herbaceous flowering perennials

- 6.3.1.2.8. Begonias

- 6.3.1.2.9. Petunias

- 6.3.1.2.10. African violets

- 6.3.1.2.11. Hawker's balsams

- 6.3.1.2.12. Orchids

- 6.3.1.2.13. Calibrachoas

- 6.3.1.2.14. Cyclamens

- 6.3.1.2.15. Other Potted Plants

- 6.3.1.1. Greenhouse Flowers

- 6.3.2. Nursery

- 6.3.1. Floriculture

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Flower Chain Stores

- 6.4.2. Domestic Wholesalers

- 6.4.3. Retail Outlet

- 6.4.4. Retail Florists

- 6.4.5. Garden Centres

- 6.4.6. Landscape Contractors

- 6.4.7. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Floriculture

- 7.1.1.1. Greenhouse Flowers

- 7.1.1.1.1. Bedding plants

- 7.1.1.1.2. Cuttings

- 7.1.1.1.2.1. Chrysanthemums

- 7.1.1.1.2.2. Geraniums

- 7.1.1.1.2.3. Impatiens

- 7.1.1.1.2.4. Poinsettias

- 7.1.1.1.2.5. Other cuttings

- 7.1.1.1.3. Cut Flowers

- 7.1.1.1.3.1. Tulips

- 7.1.1.1.3.2. Gerberas

- 7.1.1.1.3.3. Snapdragons

- 7.1.1.1.3.4. Lilies

- 7.1.1.1.3.5. Alstroemerias

- 7.1.1.1.3.6. Freesias

- 7.1.1.1.3.7. Lisianthus

- 7.1.1.1.3.8. Roses

- 7.1.1.1.3.9. Daffodils

- 7.1.1.1.3.10. Irises

- 7.1.1.1.3.11. Other cut flowers

- 7.1.1.2. Potted Plants

- 7.1.1.2.1. Tropical foliage and green plants

- 7.1.1.2.2. Fine herb plants

- 7.1.1.2.3. Outdoor hanging pots

- 7.1.1.2.4. Vegetable plants

- 7.1.1.2.5. Miniature roses

- 7.1.1.2.6. Kalanchoes

- 7.1.1.2.7. Herbaceous flowering perennials

- 7.1.1.2.8. Begonias

- 7.1.1.2.9. Petunias

- 7.1.1.2.10. African violets

- 7.1.1.2.11. Hawker's balsams

- 7.1.1.2.12. Orchids

- 7.1.1.2.13. Calibrachoas

- 7.1.1.2.14. Cyclamens

- 7.1.1.2.15. Other Potted Plants

- 7.1.1.1. Greenhouse Flowers

- 7.1.2. Nursery

- 7.1.1. Floriculture

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Flower Chain Stores

- 7.2.2. Domestic Wholesalers

- 7.2.3. Retail Outlet

- 7.2.4. Retail Florists

- 7.2.5. Garden Centres

- 7.2.6. Landscape Contractors

- 7.2.7. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Floriculture

- 7.3.1.1. Greenhouse Flowers

- 7.3.1.1.1. Bedding plants

- 7.3.1.1.2. Cuttings

- 7.3.1.1.2.1. Chrysanthemums

- 7.3.1.1.2.2. Geraniums

- 7.3.1.1.2.3. Impatiens

- 7.3.1.1.2.4. Poinsettias

- 7.3.1.1.2.5. Other cuttings

- 7.3.1.1.3. Cut Flowers

- 7.3.1.1.3.1. Tulips

- 7.3.1.1.3.2. Gerberas

- 7.3.1.1.3.3. Snapdragons

- 7.3.1.1.3.4. Lilies

- 7.3.1.1.3.5. Alstroemerias

- 7.3.1.1.3.6. Freesias

- 7.3.1.1.3.7. Lisianthus

- 7.3.1.1.3.8. Roses

- 7.3.1.1.3.9. Daffodils

- 7.3.1.1.3.10. Irises

- 7.3.1.1.3.11. Other cut flowers

- 7.3.1.2. Potted Plants

- 7.3.1.2.1. Tropical foliage and green plants

- 7.3.1.2.2. Fine herb plants

- 7.3.1.2.3. Outdoor hanging pots

- 7.3.1.2.4. Vegetable plants

- 7.3.1.2.5. Miniature roses

- 7.3.1.2.6. Kalanchoes

- 7.3.1.2.7. Herbaceous flowering perennials

- 7.3.1.2.8. Begonias

- 7.3.1.2.9. Petunias

- 7.3.1.2.10. African violets

- 7.3.1.2.11. Hawker's balsams

- 7.3.1.2.12. Orchids

- 7.3.1.2.13. Calibrachoas

- 7.3.1.2.14. Cyclamens

- 7.3.1.2.15. Other Potted Plants

- 7.3.1.1. Greenhouse Flowers

- 7.3.2. Nursery

- 7.3.1. Floriculture

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Flower Chain Stores

- 7.4.2. Domestic Wholesalers

- 7.4.3. Retail Outlet

- 7.4.4. Retail Florists

- 7.4.5. Garden Centres

- 7.4.6. Landscape Contractors

- 7.4.7. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Floriculture

- 8.1.1.1. Greenhouse Flowers

- 8.1.1.1.1. Bedding plants

- 8.1.1.1.2. Cuttings

- 8.1.1.1.2.1. Chrysanthemums

- 8.1.1.1.2.2. Geraniums

- 8.1.1.1.2.3. Impatiens

- 8.1.1.1.2.4. Poinsettias

- 8.1.1.1.2.5. Other cuttings

- 8.1.1.1.3. Cut Flowers

- 8.1.1.1.3.1. Tulips

- 8.1.1.1.3.2. Gerberas

- 8.1.1.1.3.3. Snapdragons

- 8.1.1.1.3.4. Lilies

- 8.1.1.1.3.5. Alstroemerias

- 8.1.1.1.3.6. Freesias

- 8.1.1.1.3.7. Lisianthus

- 8.1.1.1.3.8. Roses

- 8.1.1.1.3.9. Daffodils

- 8.1.1.1.3.10. Irises

- 8.1.1.1.3.11. Other cut flowers

- 8.1.1.2. Potted Plants

- 8.1.1.2.1. Tropical foliage and green plants

- 8.1.1.2.2. Fine herb plants

- 8.1.1.2.3. Outdoor hanging pots

- 8.1.1.2.4. Vegetable plants

- 8.1.1.2.5. Miniature roses

- 8.1.1.2.6. Kalanchoes

- 8.1.1.2.7. Herbaceous flowering perennials

- 8.1.1.2.8. Begonias

- 8.1.1.2.9. Petunias

- 8.1.1.2.10. African violets

- 8.1.1.2.11. Hawker's balsams

- 8.1.1.2.12. Orchids

- 8.1.1.2.13. Calibrachoas

- 8.1.1.2.14. Cyclamens

- 8.1.1.2.15. Other Potted Plants

- 8.1.1.1. Greenhouse Flowers

- 8.1.2. Nursery

- 8.1.1. Floriculture

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Flower Chain Stores

- 8.2.2. Domestic Wholesalers

- 8.2.3. Retail Outlet

- 8.2.4. Retail Florists

- 8.2.5. Garden Centres

- 8.2.6. Landscape Contractors

- 8.2.7. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Floriculture

- 8.3.1.1. Greenhouse Flowers

- 8.3.1.1.1. Bedding plants

- 8.3.1.1.2. Cuttings

- 8.3.1.1.2.1. Chrysanthemums

- 8.3.1.1.2.2. Geraniums

- 8.3.1.1.2.3. Impatiens

- 8.3.1.1.2.4. Poinsettias

- 8.3.1.1.2.5. Other cuttings

- 8.3.1.1.3. Cut Flowers

- 8.3.1.1.3.1. Tulips

- 8.3.1.1.3.2. Gerberas

- 8.3.1.1.3.3. Snapdragons

- 8.3.1.1.3.4. Lilies

- 8.3.1.1.3.5. Alstroemerias

- 8.3.1.1.3.6. Freesias

- 8.3.1.1.3.7. Lisianthus

- 8.3.1.1.3.8. Roses

- 8.3.1.1.3.9. Daffodils

- 8.3.1.1.3.10. Irises

- 8.3.1.1.3.11. Other cut flowers

- 8.3.1.2. Potted Plants

- 8.3.1.2.1. Tropical foliage and green plants

- 8.3.1.2.2. Fine herb plants

- 8.3.1.2.3. Outdoor hanging pots

- 8.3.1.2.4. Vegetable plants

- 8.3.1.2.5. Miniature roses

- 8.3.1.2.6. Kalanchoes

- 8.3.1.2.7. Herbaceous flowering perennials

- 8.3.1.2.8. Begonias

- 8.3.1.2.9. Petunias

- 8.3.1.2.10. African violets

- 8.3.1.2.11. Hawker's balsams

- 8.3.1.2.12. Orchids

- 8.3.1.2.13. Calibrachoas

- 8.3.1.2.14. Cyclamens

- 8.3.1.2.15. Other Potted Plants

- 8.3.1.1. Greenhouse Flowers

- 8.3.2. Nursery

- 8.3.1. Floriculture

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Flower Chain Stores

- 8.4.2. Domestic Wholesalers

- 8.4.3. Retail Outlet

- 8.4.4. Retail Florists

- 8.4.5. Garden Centres

- 8.4.6. Landscape Contractors

- 8.4.7. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Floriculture

- 9.1.1.1. Greenhouse Flowers

- 9.1.1.1.1. Bedding plants

- 9.1.1.1.2. Cuttings

- 9.1.1.1.2.1. Chrysanthemums

- 9.1.1.1.2.2. Geraniums

- 9.1.1.1.2.3. Impatiens

- 9.1.1.1.2.4. Poinsettias

- 9.1.1.1.2.5. Other cuttings

- 9.1.1.1.3. Cut Flowers

- 9.1.1.1.3.1. Tulips

- 9.1.1.1.3.2. Gerberas

- 9.1.1.1.3.3. Snapdragons

- 9.1.1.1.3.4. Lilies

- 9.1.1.1.3.5. Alstroemerias

- 9.1.1.1.3.6. Freesias

- 9.1.1.1.3.7. Lisianthus

- 9.1.1.1.3.8. Roses

- 9.1.1.1.3.9. Daffodils

- 9.1.1.1.3.10. Irises

- 9.1.1.1.3.11. Other cut flowers

- 9.1.1.2. Potted Plants

- 9.1.1.2.1. Tropical foliage and green plants

- 9.1.1.2.2. Fine herb plants

- 9.1.1.2.3. Outdoor hanging pots

- 9.1.1.2.4. Vegetable plants

- 9.1.1.2.5. Miniature roses

- 9.1.1.2.6. Kalanchoes

- 9.1.1.2.7. Herbaceous flowering perennials

- 9.1.1.2.8. Begonias

- 9.1.1.2.9. Petunias

- 9.1.1.2.10. African violets

- 9.1.1.2.11. Hawker's balsams

- 9.1.1.2.12. Orchids

- 9.1.1.2.13. Calibrachoas

- 9.1.1.2.14. Cyclamens

- 9.1.1.2.15. Other Potted Plants

- 9.1.1.1. Greenhouse Flowers

- 9.1.2. Nursery

- 9.1.1. Floriculture

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Flower Chain Stores

- 9.2.2. Domestic Wholesalers

- 9.2.3. Retail Outlet

- 9.2.4. Retail Florists

- 9.2.5. Garden Centres

- 9.2.6. Landscape Contractors

- 9.2.7. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Floriculture

- 9.3.1.1. Greenhouse Flowers

- 9.3.1.1.1. Bedding plants

- 9.3.1.1.2. Cuttings

- 9.3.1.1.2.1. Chrysanthemums

- 9.3.1.1.2.2. Geraniums

- 9.3.1.1.2.3. Impatiens

- 9.3.1.1.2.4. Poinsettias

- 9.3.1.1.2.5. Other cuttings

- 9.3.1.1.3. Cut Flowers

- 9.3.1.1.3.1. Tulips

- 9.3.1.1.3.2. Gerberas

- 9.3.1.1.3.3. Snapdragons

- 9.3.1.1.3.4. Lilies

- 9.3.1.1.3.5. Alstroemerias

- 9.3.1.1.3.6. Freesias

- 9.3.1.1.3.7. Lisianthus

- 9.3.1.1.3.8. Roses

- 9.3.1.1.3.9. Daffodils

- 9.3.1.1.3.10. Irises

- 9.3.1.1.3.11. Other cut flowers

- 9.3.1.2. Potted Plants

- 9.3.1.2.1. Tropical foliage and green plants

- 9.3.1.2.2. Fine herb plants

- 9.3.1.2.3. Outdoor hanging pots

- 9.3.1.2.4. Vegetable plants

- 9.3.1.2.5. Miniature roses

- 9.3.1.2.6. Kalanchoes

- 9.3.1.2.7. Herbaceous flowering perennials

- 9.3.1.2.8. Begonias

- 9.3.1.2.9. Petunias

- 9.3.1.2.10. African violets

- 9.3.1.2.11. Hawker's balsams

- 9.3.1.2.12. Orchids

- 9.3.1.2.13. Calibrachoas

- 9.3.1.2.14. Cyclamens

- 9.3.1.2.15. Other Potted Plants

- 9.3.1.1. Greenhouse Flowers

- 9.3.2. Nursery

- 9.3.1. Floriculture

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Flower Chain Stores

- 9.4.2. Domestic Wholesalers

- 9.4.3. Retail Outlet

- 9.4.4. Retail Florists

- 9.4.5. Garden Centres

- 9.4.6. Landscape Contractors

- 9.4.7. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Ornamental Horticulture Market in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Floriculture

- 10.1.1.1. Greenhouse Flowers

- 10.1.1.1.1. Bedding plants

- 10.1.1.1.2. Cuttings

- 10.1.1.1.2.1. Chrysanthemums

- 10.1.1.1.2.2. Geraniums

- 10.1.1.1.2.3. Impatiens

- 10.1.1.1.2.4. Poinsettias

- 10.1.1.1.2.5. Other cuttings

- 10.1.1.1.3. Cut Flowers

- 10.1.1.1.3.1. Tulips

- 10.1.1.1.3.2. Gerberas

- 10.1.1.1.3.3. Snapdragons

- 10.1.1.1.3.4. Lilies

- 10.1.1.1.3.5. Alstroemerias

- 10.1.1.1.3.6. Freesias

- 10.1.1.1.3.7. Lisianthus

- 10.1.1.1.3.8. Roses

- 10.1.1.1.3.9. Daffodils

- 10.1.1.1.3.10. Irises

- 10.1.1.1.3.11. Other cut flowers

- 10.1.1.2. Potted Plants

- 10.1.1.2.1. Tropical foliage and green plants

- 10.1.1.2.2. Fine herb plants

- 10.1.1.2.3. Outdoor hanging pots

- 10.1.1.2.4. Vegetable plants

- 10.1.1.2.5. Miniature roses

- 10.1.1.2.6. Kalanchoes

- 10.1.1.2.7. Herbaceous flowering perennials

- 10.1.1.2.8. Begonias

- 10.1.1.2.9. Petunias

- 10.1.1.2.10. African violets

- 10.1.1.2.11. Hawker's balsams

- 10.1.1.2.12. Orchids

- 10.1.1.2.13. Calibrachoas

- 10.1.1.2.14. Cyclamens

- 10.1.1.2.15. Other Potted Plants

- 10.1.1.1. Greenhouse Flowers

- 10.1.2. Nursery

- 10.1.1. Floriculture

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Flower Chain Stores

- 10.2.2. Domestic Wholesalers

- 10.2.3. Retail Outlet

- 10.2.4. Retail Florists

- 10.2.5. Garden Centres

- 10.2.6. Landscape Contractors

- 10.2.7. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Floriculture

- 10.3.1.1. Greenhouse Flowers

- 10.3.1.1.1. Bedding plants

- 10.3.1.1.2. Cuttings

- 10.3.1.1.2.1. Chrysanthemums

- 10.3.1.1.2.2. Geraniums

- 10.3.1.1.2.3. Impatiens

- 10.3.1.1.2.4. Poinsettias

- 10.3.1.1.2.5. Other cuttings

- 10.3.1.1.3. Cut Flowers

- 10.3.1.1.3.1. Tulips

- 10.3.1.1.3.2. Gerberas

- 10.3.1.1.3.3. Snapdragons

- 10.3.1.1.3.4. Lilies

- 10.3.1.1.3.5. Alstroemerias

- 10.3.1.1.3.6. Freesias

- 10.3.1.1.3.7. Lisianthus

- 10.3.1.1.3.8. Roses

- 10.3.1.1.3.9. Daffodils

- 10.3.1.1.3.10. Irises

- 10.3.1.1.3.11. Other cut flowers

- 10.3.1.2. Potted Plants

- 10.3.1.2.1. Tropical foliage and green plants

- 10.3.1.2.2. Fine herb plants

- 10.3.1.2.3. Outdoor hanging pots

- 10.3.1.2.4. Vegetable plants

- 10.3.1.2.5. Miniature roses

- 10.3.1.2.6. Kalanchoes

- 10.3.1.2.7. Herbaceous flowering perennials

- 10.3.1.2.8. Begonias

- 10.3.1.2.9. Petunias

- 10.3.1.2.10. African violets

- 10.3.1.2.11. Hawker's balsams

- 10.3.1.2.12. Orchids

- 10.3.1.2.13. Calibrachoas

- 10.3.1.2.14. Cyclamens

- 10.3.1.2.15. Other Potted Plants

- 10.3.1.1. Greenhouse Flowers

- 10.3.2. Nursery

- 10.3.1. Floriculture

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Flower Chain Stores

- 10.4.2. Domestic Wholesalers

- 10.4.3. Retail Outlet

- 10.4.4. Retail Florists

- 10.4.5. Garden Centres

- 10.4.6. Landscape Contractors

- 10.4.7. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hort Americas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SunSelect Produce Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stonehouse Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mastronardi Produce

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PlantHaven International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Hort Americas

List of Figures

- Figure 1: Global Ornamental Horticulture Market in Canada Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 7: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 9: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 13: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 17: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 19: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: South America Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 23: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 25: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 27: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 33: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 37: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 43: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Type 2025 & 2033

- Figure 47: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 48: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 49: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific Ornamental Horticulture Market in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 37: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 48: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Ornamental Horticulture Market in Canada Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Ornamental Horticulture Market in Canada Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ornamental Horticulture Market in Canada?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Ornamental Horticulture Market in Canada?

Key companies in the market include Hort Americas, SunSelect Produce Ltd. , Stonehouse Group , Mastronardi Produce , PlantHaven International .

3. What are the main segments of the Ornamental Horticulture Market in Canada?

The market segments include Type, Distribution Channel, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Export Drives the Ornamental Horticulture Category in the Country.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

March 2022: The Ministry of Agriculture and Agri-Food has invested USD 1.5 million for two projects with the Canadian Nursery Landscape Association (CNLA) to help capture new opportunities for market growth and boost exports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ornamental Horticulture Market in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ornamental Horticulture Market in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ornamental Horticulture Market in Canada?

To stay informed about further developments, trends, and reports in the Ornamental Horticulture Market in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence