Key Insights

The Indonesian fungicide market is projected to reach USD 3.7 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.7%. This growth is propelled by escalating demand for high-yield crops and the critical need to safeguard agricultural produce from fungal diseases. Supportive government initiatives promoting modern agricultural practices and advanced crop protection solutions are also significant market drivers. The adoption of fungicides is increasing across diverse crop segments, including commercial crops, fruits, vegetables, grains, and cereals, as farmers prioritize disease management for enhanced food security and profitability. Growing awareness of integrated pest management (IPM) strategies, which incorporate responsible fungicide use, further contributes to market expansion.

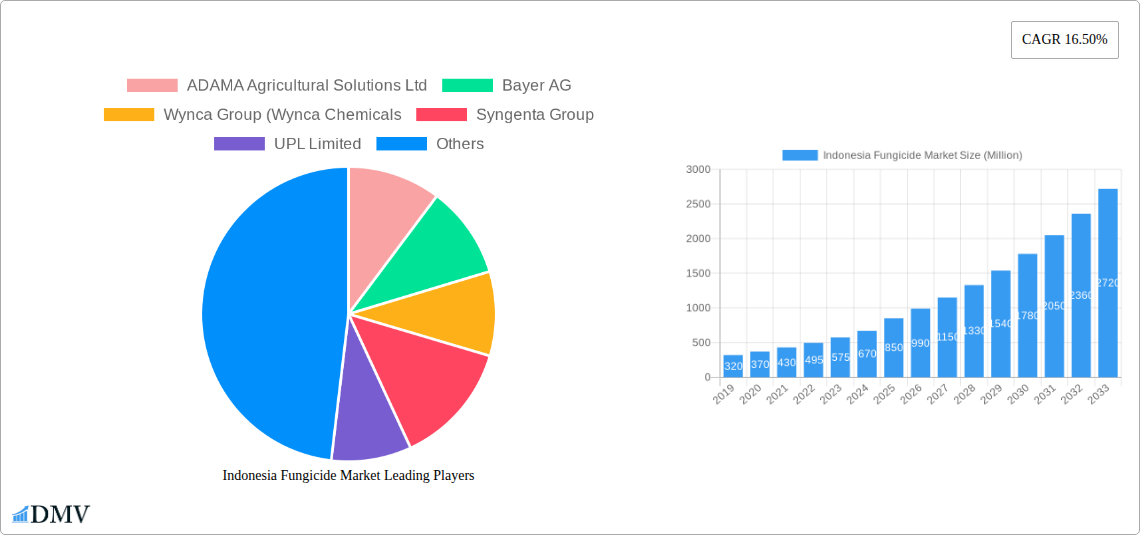

Indonesia Fungicide Market Market Size (In Billion)

Key application modes poised for substantial adoption include chemigation for efficient delivery, foliar applications for direct crop protection, and seed treatments for early-stage infection defense. Fumigation and soil treatments are also gaining traction for specialized and long-term disease prevention. Leading industry players like Bayer AG, Syngenta Group, and BASF SE are investing in R&D to introduce innovative and sustainable fungicide formulations. The Indonesian government's commitment to boosting agricultural productivity and ensuring food self-sufficiency, supported by favorable agrochemical industry policies, will continue to stimulate market growth. However, navigating stringent regulatory frameworks and addressing potential fungicide resistance require continuous innovation and responsible product stewardship for sustained market health and agricultural sustainability.

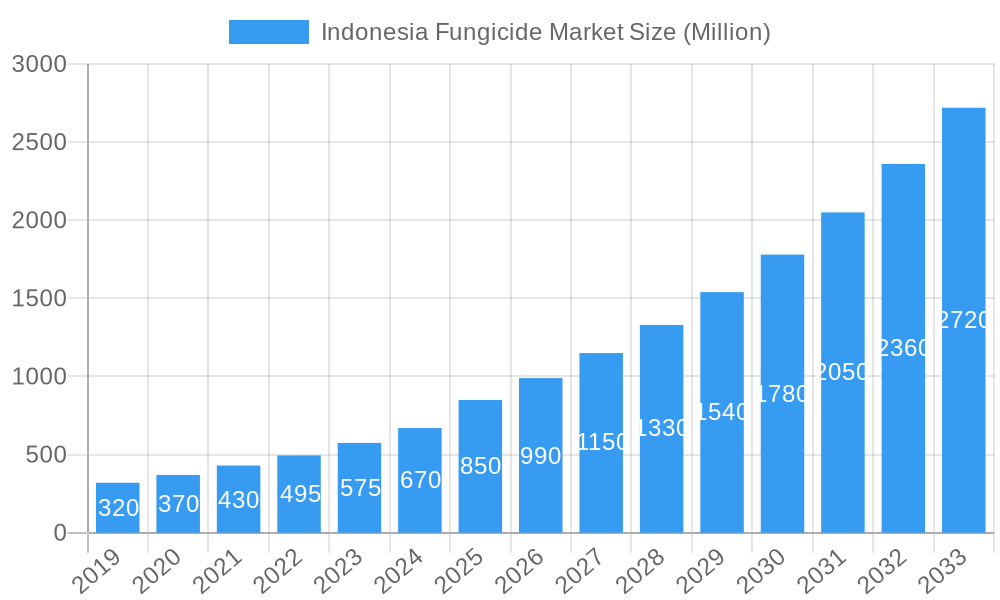

Indonesia Fungicide Market Company Market Share

Gain comprehensive insights into Indonesia's dynamic fungicide market. This report details critical trends, innovations, and growth drivers across key agricultural sectors, providing strategic intelligence for stakeholders aiming to capitalize on opportunities within this vital Southeast Asian economy.

Indonesia Fungicide Market Market Composition & Trends

The Indonesia fungicide market is characterized by a moderate to high degree of concentration, with major global players like Bayer AG, Syngenta Group, and BASF SE holding significant market share. Innovation remains a key catalyst, driven by the increasing demand for sustainable agricultural practices and higher crop yields. The regulatory landscape, while evolving, plays a crucial role in shaping market entry and product approvals. Substitute products, including biological fungicides and integrated pest management (IPM) strategies, are gaining traction but currently represent a smaller segment. End-user profiles vary across crop types, with commercial crops and fruits & vegetables demanding the most advanced and effective fungicide solutions. Mergers and acquisitions (M&A) activity, while not as pronounced as in other global markets, are strategically aimed at expanding product portfolios and geographical reach. The total market value is projected to reach XX Million by 2025, with M&A deal values currently at XX Million. Key market share distribution reveals a dominance of XX% held by the top three players.

Indonesia Fungicide Market Industry Evolution

The Indonesia fungicide market has witnessed robust growth and significant evolution over the historical period (2019-2024) and is poised for continued expansion through the forecast period (2025-2033). Driven by the nation's strong agricultural base and increasing focus on food security, the demand for effective crop protection solutions has surged. Technological advancements have been a cornerstone of this evolution, with a discernible shift towards more targeted, efficient, and environmentally conscious fungicide formulations. The adoption of advanced application modes like chemigation and seed treatment has accelerated, particularly in commercial crop cultivation, leading to improved efficacy and reduced environmental impact. Shifting consumer demands, influenced by a growing awareness of food safety and sustainability, have further propelled the market towards fungicides that offer minimal residue and enhanced crop quality.

- Market Growth Trajectories: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated value of XX Million in 2033. This growth is underpinned by increasing arable land, government initiatives supporting agricultural modernization, and rising farmer incomes.

- Technological Advancements: The introduction of novel active ingredients and sophisticated delivery systems has enhanced the efficacy of fungicides against a wider spectrum of plant diseases. Precision agriculture technologies are also influencing fungicide application, optimizing their use and minimizing waste.

- Shifting Consumer Demands: Consumers are increasingly prioritizing health and safety, leading to a higher demand for fungicides that are organic or have low toxicity profiles. This trend is pushing manufacturers to invest in research and development for more sustainable and eco-friendly products. The adoption rate of eco-friendly fungicides has seen a XX% increase year-on-year.

Leading Regions, Countries, or Segments in Indonesia Fungicide Market

Within the Indonesian fungicide market, the Commercial Crops segment stands out as the most dominant, driven by the significant economic contribution of crops like palm oil, rubber, and coffee to the national economy. These crops are susceptible to various fungal diseases that can decimate yields and impact export revenues, thus necessitating extensive and effective fungicide applications. The application mode of Foliar application is also highly prevalent within this segment due to the broad canopy of many commercial crops, allowing for widespread and efficient disease control. Indonesia's geographical diversity and varied agro-climatic zones also contribute to the prevalence of specific crop types and, consequently, the demand for specialized fungicides.

Dominant Crop Type: Commercial Crops:

- Economic Importance: Palm oil, rubber, and coffee cultivation forms a substantial portion of Indonesia's agricultural GDP and export earnings, making their disease management a high priority.

- Disease Pressure: These crops face persistent threats from fungal pathogens such as Ganoderma, Phytophthora, and Coffee Leaf Rust, requiring continuous and robust fungicide intervention.

- Investment Trends: Significant investments are channeled into research and development for fungicides tailored to the specific needs of these large-scale plantations.

- Regulatory Support: Government policies often support the use of approved fungicides to safeguard the economic stability derived from these key agricultural commodities.

Dominant Application Mode: Foliar Application:

- Efficacy: Foliar application allows for direct contact with plant surfaces, providing immediate protection against airborne and splash-borne fungal spores.

- Versatility: It is effective across a wide range of crops and disease types, making it a go-to method for broad-spectrum disease control.

- Technological Integration: Advancements in spray technologies and drone application are further enhancing the efficiency and reach of foliar fungicide treatments.

Beyond commercial crops, Fruits & Vegetables also represent a significant and growing segment, driven by domestic consumption and increasing export opportunities. Diseases like anthracnose, powdery mildew, and downy mildew pose substantial threats to the quality and shelf-life of these produce, leading to a strong demand for fungicides, particularly for foliar and seed treatment applications. The Grains & Cereals segment, while important for food security, typically sees a higher reliance on seed treatments and soil applications due to the nature of cultivation. Pulses & Oilseeds and Turf & Ornamental represent niche but developing segments, with specific fungicide needs dictated by their respective cultivation practices and market demands.

Indonesia Fungicide Market Product Innovations

Product innovation in the Indonesia fungicide market is characterized by the development of broad-spectrum fungicides, systemic and contact action formulations, and eco-friendly alternatives. Companies are focusing on products that offer enhanced efficacy against key fungal pathogens, improved crop safety, and reduced environmental impact. Recent innovations include fungicides with novel modes of action that combat resistance development and those formulated for better adhesion and rainfastness. Performance metrics are often measured by disease control efficacy, yield enhancement, and residue levels, all critical for gaining market acceptance and regulatory approval.

Propelling Factors for Indonesia Fungicide Market Growth

Several key factors are propelling the growth of the Indonesia fungicide market. The nation's vast agricultural landmass and its critical role in global food supply chains necessitate robust disease management. Increasing farmer awareness regarding the economic losses caused by fungal diseases, coupled with a growing adoption of modern farming techniques, is driving demand. Government initiatives aimed at boosting agricultural productivity and ensuring food security, along with supportive regulatory frameworks for crop protection products, further stimulate market expansion. The continuous introduction of innovative and effective fungicide solutions by leading agrochemical companies also plays a pivotal role in sustaining market growth.

Obstacles in the Indonesia Fungicide Market Market

Despite the promising growth trajectory, the Indonesia fungicide market faces certain obstacles. Stringent and evolving regulatory requirements for product registration can lead to lengthy approval processes and increased costs for manufacturers. The presence of counterfeit and substandard fungicides in the market erodes farmer trust and can lead to resistance development in pathogens. Supply chain disruptions, exacerbated by logistical challenges and fluctuating raw material prices, can impact product availability and cost-effectiveness. Furthermore, a growing demand for organic produce and increasing environmental concerns are putting pressure on the market to adopt more sustainable and biologically-derived solutions, which are still in their nascent stages of widespread adoption.

Future Opportunities in Indonesia Fungicide Market

The Indonesia fungicide market presents numerous future opportunities. The increasing adoption of precision agriculture technologies offers a significant avenue for developing targeted and efficient fungicide application systems. The burgeoning demand for organic and sustainable agricultural practices is creating a market for bio-fungicides and integrated pest management solutions, representing a substantial growth area. Furthermore, the continuous need to develop fungicides effective against evolving and resistant fungal strains will drive innovation and create opportunities for companies with advanced research and development capabilities. Expansion into under-served regions and the development of crop-specific fungicide solutions tailored to local agricultural practices also hold significant potential.

Major Players in the Indonesia Fungicide Market Ecosystem

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- PT Biotis Agrindo

- BASF SE

- FMC Corporation

- Corteva Agriscience

- Nufarm Ltd

Key Developments in Indonesia Fungicide Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions. This collaboration is expected to lead to the development of novel fungicides with reduced environmental impact.

- January 2023: Quintect 105 SC, a new fungicide from FMC, was introduced for Indonesian farmers, aiming to provide enhanced protection and secure crop quality and quantity. This launch addresses specific disease challenges faced by Indonesian agriculture.

- July 2022: FMC launched the fungicide Flint Pro 64.8 WG, specifically targeting diseases like Alternaria dry spot on potatoes and leaf spot and stem rot in watermelons. This product innovation caters to critical disease management needs in important horticultural crops.

Strategic Indonesia Fungicide Market Market Forecast

The strategic forecast for the Indonesia fungicide market indicates sustained and robust growth, driven by a confluence of factors including rising food demand, increasing farmer sophistication, and ongoing technological advancements. The market will be significantly shaped by the imperative for sustainable agriculture, leading to greater adoption of integrated pest management strategies and bio-fungicides alongside conventional chemical solutions. Government support for agricultural modernization, coupled with foreign direct investment in the agrochemical sector, will further fuel market expansion. The focus on higher-value crops like fruits and vegetables, along with the continuous need for effective disease control in staple crops, ensures a strong and enduring demand for fungicides, positioning Indonesia as a key market in the global agrochemical landscape. The market is anticipated to reach XX Million by 2033.

Indonesia Fungicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Indonesia Fungicide Market Segmentation By Geography

- 1. Indonesia

Indonesia Fungicide Market Regional Market Share

Geographic Coverage of Indonesia Fungicide Market

Indonesia Fungicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1 Growing fungal diseases damages major crops

- 3.4.2 like palm oil

- 3.4.3 coffee

- 3.4.4 rice

- 3.4.5 and maize

- 3.4.6 increasing the fungicide adoption rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Fungicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADAMA Agricultural Solutions Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wynca Group (Wynca Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Biotis Agrindo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FMC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nufarm Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADAMA Agricultural Solutions Ltd

List of Figures

- Figure 1: Indonesia Fungicide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Fungicide Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Fungicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 2: Indonesia Fungicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 3: Indonesia Fungicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 4: Indonesia Fungicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 5: Indonesia Fungicide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Indonesia Fungicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 7: Indonesia Fungicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 8: Indonesia Fungicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 9: Indonesia Fungicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 10: Indonesia Fungicide Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Fungicide Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Indonesia Fungicide Market?

Key companies in the market include ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, PT Biotis Agrindo, BASF SE, FMC Corporation, Corteva Agriscience, Nufarm Ltd.

3. What are the main segments of the Indonesia Fungicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Growing fungal diseases damages major crops. like palm oil. coffee. rice. and maize. increasing the fungicide adoption rate.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.January 2023: Quintect 105 SC is a fungicide introduced by FMC for Indonesian farmers to provide protection and secure the quality and quantity of their crops.July 2022: FMC launched the fungicide Flint Pro 64.8 WG, which controls diseases including Alternaria dry spot on potato plants as well as leaf spot disease and stem rot in watermelon plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Fungicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Fungicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Fungicide Market?

To stay informed about further developments, trends, and reports in the Indonesia Fungicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence