Key Insights

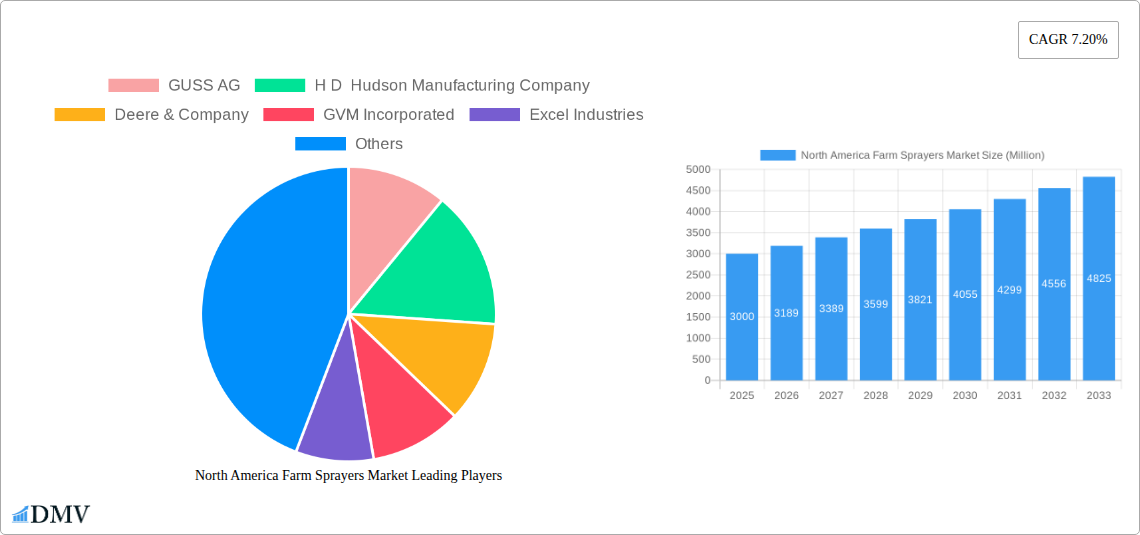

The North America Farm Sprayers Market is poised for significant expansion, projected to reach an estimated USD 3 billion in 2025 and grow at a robust CAGR of 6.2% through 2033. This growth trajectory is primarily fueled by the increasing adoption of precision agriculture technologies, driven by the need for enhanced crop yields, reduced input costs, and improved environmental sustainability. Farmers are increasingly investing in advanced sprayers that offer features like GPS guidance, variable rate application, and drone integration, enabling more efficient and targeted application of fertilizers, pesticides, and herbicides. Furthermore, government initiatives promoting sustainable farming practices and encouraging the adoption of modern agricultural equipment are acting as strong catalysts for market expansion. The demand for automated and intelligent spraying solutions is on the rise, as they help mitigate labor shortages and optimize resource utilization in the face of evolving agricultural challenges.

North America Farm Sprayers Market Market Size (In Billion)

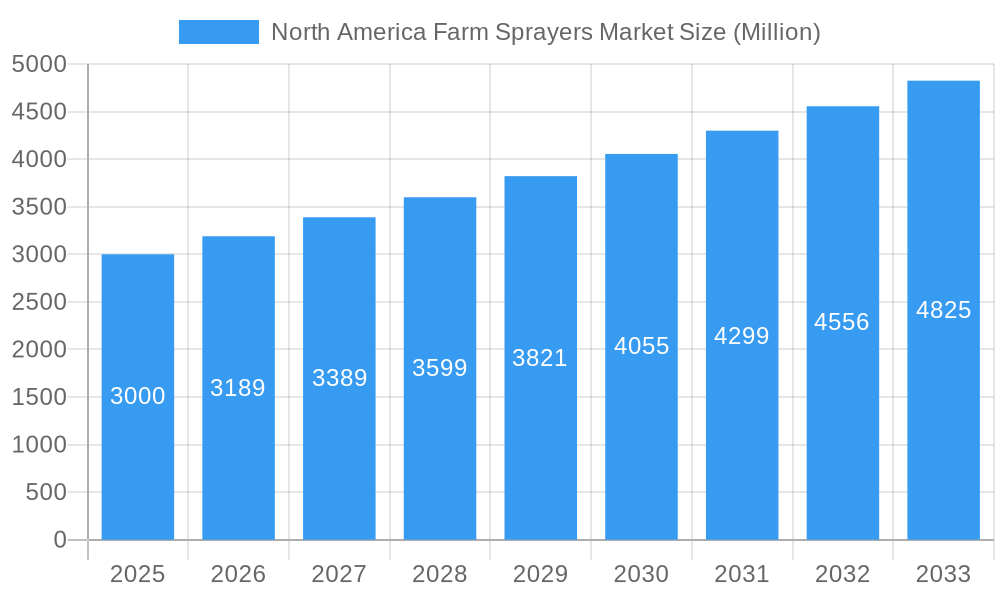

The market is characterized by a dynamic competitive landscape with key players like Deere & Company, AGCO Corporation, and GUSS AG investing heavily in research and development to introduce innovative products. Key trends include the growing popularity of self-propelled sprayers due to their efficiency and capacity, alongside a rising interest in towed and mounted sprayers for smaller-scale operations. Despite the optimistic outlook, the market faces certain restraints, including the high initial cost of advanced spraying equipment, which can be a barrier for some farmers, and stringent regulatory frameworks surrounding the use of certain agricultural chemicals. However, the continuous technological advancements and the escalating need for efficient crop protection and yield enhancement are expected to largely overshadow these challenges, ensuring a healthy growth trajectory for the North America Farm Sprayers Market in the coming years.

North America Farm Sprayers Market Company Market Share

This in-depth report provides a comprehensive analysis of the North America farm sprayers market, offering valuable insights for stakeholders including manufacturers, suppliers, distributors, and investors. The study encompasses a detailed examination of market composition, industry evolution, regional dynamics, product innovations, growth drivers, challenges, and future opportunities. With a robust methodology covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this report equips you with the data and strategic foresight to navigate the evolving landscape of agricultural spraying technology.

North America Farm Sprayers Market Market Composition & Trends

The North America farm sprayers market is characterized by a dynamic interplay of established players and emerging innovators, with a moderate to high level of market concentration. Innovation catalysts, primarily driven by the demand for precision agriculture and sustainable farming practices, are reshaping product development. Regulatory landscapes, focusing on environmental protection and worker safety, also play a crucial role in shaping market trends and product mandates. Substitute products, such as drones and manual application methods, present a competitive challenge, though farm sprayers continue to dominate for large-scale applications. End-user profiles are diverse, ranging from large commercial farms to smaller agricultural operations, each with specific needs and purchasing power. Merger and acquisition (M&A) activities are observed as companies seek to expand their product portfolios, technological capabilities, and market reach. Expected M&A deal values are estimated to be in the hundreds of millions of dollars. Market share distribution is influenced by factors such as product innovation, distribution networks, and brand reputation. The market is continuously adapting to evolving agricultural practices and technological advancements.

North America Farm Sprayers Market Industry Evolution

The North America farm sprayers market has witnessed a significant evolution, driven by a persistent demand for increased agricultural productivity and efficiency. Over the historical period (2019-2024), the market demonstrated a steady growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5.5%. This growth was fueled by the increasing adoption of advanced farming techniques, such as precision agriculture, which necessitates sophisticated spraying equipment for targeted application of fertilizers, pesticides, and herbicides. Technological advancements have been a cornerstone of this evolution. The introduction of smart sprayers, equipped with GPS, sensors, and variable rate technology (VRT), has revolutionized application methods, enabling farmers to optimize resource utilization and reduce environmental impact. These advancements have led to a significant improvement in application accuracy, with variable rate application adoption increasing by an estimated 15% annually during the historical period. Shifting consumer demands towards sustainably produced food and a growing awareness of the environmental impact of agricultural practices have further propelled the market. Farmers are increasingly seeking solutions that minimize chemical runoff and reduce the overall ecological footprint. The integration of IoT and AI in farm sprayers is also on the rise, offering real-time data analytics and predictive maintenance capabilities, thereby enhancing operational efficiency and reducing downtime. This technological integration has contributed to an estimated 10% improvement in operational efficiency for farms utilizing such advanced equipment.

Leading Regions, Countries, or Segments in North America Farm Sprayers Market

The North America farm sprayers market's dominance is largely attributed to the United States, driven by its vast agricultural landmass and the widespread adoption of modern farming technologies.

- Production Analysis: The United States leads in the production of farm sprayers, accounting for an estimated 60% of the total North American output. Key production hubs are concentrated in agricultural heartlands, benefiting from proximity to raw material suppliers and a skilled manufacturing workforce.

- Consumption Analysis: Similarly, the United States exhibits the highest consumption of farm sprayers, representing approximately 55% of the market. The large scale of commercial agriculture, coupled with governmental support for farm modernization, fuels this demand.

- Import Market Analysis (Value & Volume): The import market in North America, particularly for specialized or technologically advanced sprayers, is significant. Canada and Mexico collectively account for an estimated 25% of farm sprayer imports by value, often sourcing from the United States or European manufacturers. The total import market value for farm sprayers in North America is projected to reach over $1.5 billion in 2025.

- Export Market Analysis (Value & Volume): The United States is a major exporter of farm sprayers to other regions, contributing an estimated 40% to the global export market for these products. The total export market value for North American farm sprayers is anticipated to exceed $2.0 billion in 2025.

- Price Trend Analysis: Price trends in the North America farm sprayers market are influenced by several factors. The average price of a standard farm sprayer is currently estimated to be around $20,000, while advanced, GPS-enabled models can range from $50,000 to over $100,000. Fluctuations in raw material costs, such as steel and plastics, and advancements in technology, leading to higher-value products, contribute to these trends. The market is expected to see a steady increase in the average selling price due to the growing demand for smart and automated spraying solutions.

North America Farm Sprayers Market Product Innovations

Product innovations in the North America farm sprayers market are primarily focused on enhancing precision, efficiency, and sustainability. Technologies such as AI-powered weed detection and targeted spraying systems are revolutionizing application, minimizing chemical usage by an estimated 20-30% per application. Advanced sensor technologies and real-time data analytics enable farmers to optimize spray patterns, ensuring uniform coverage and reducing waste. Autonomous and robotic sprayers are emerging as significant advancements, offering reduced labor costs and improved operator safety. These innovations boast unique selling propositions like reduced operational costs, enhanced crop yields, and a smaller environmental footprint, making them highly attractive to modern agricultural enterprises.

Propelling Factors for North America Farm Sprayers Market Growth

The North America farm sprayers market growth is propelled by several key factors. The increasing adoption of precision agriculture techniques, driven by the need for enhanced crop yields and reduced input costs, is a major catalyst. Technological advancements, including the development of smart and autonomous spraying systems, are enhancing operational efficiency and sustainability. Furthermore, supportive government policies and subsidies encouraging agricultural modernization and sustainable farming practices are playing a crucial role. The growing global demand for food also necessitates increased agricultural productivity, directly impacting the demand for advanced farm spraying equipment.

Obstacles in the North America Farm Sprayers Market Market

Despite robust growth, the North America farm sprayers market faces several obstacles. Stringent environmental regulations concerning chemical usage and runoff can increase compliance costs for manufacturers and farmers. Supply chain disruptions, exacerbated by global events, can impact the availability of raw materials and components, leading to production delays and increased costs. The high initial investment cost of advanced and smart spraying technologies can be a barrier for small to medium-sized farms, limiting widespread adoption. Intense competition among market players also puts pressure on profit margins.

Future Opportunities in North America Farm Sprayers Market

Emerging opportunities in the North America farm sprayers market lie in the continued development and adoption of autonomous and robotic spraying solutions, promising significant cost savings and labor efficiency. The growing demand for sustainable and organic farming practices will drive the market for specialized sprayers designed for natural inputs. Expansion into niche crop segments and the development of customized solutions for specific agricultural needs present lucrative avenues. Furthermore, advancements in AI and IoT integration will create opportunities for predictive maintenance and data-driven farm management services, adding value beyond the core spraying function.

Major Players in the North America Farm Sprayers Market Ecosystem

- GUSS AG

- H D Hudson Manufacturing Company

- Deere & Company

- GVM Incorporated

- Excel Industries

- EQUIPMENT TECHNOLOGIES INC

- Jacto Inc

- AGCO Corporation

Key Developments in North America Farm Sprayers Market Industry

- 2023: GUSS AG launches its latest autonomous vineyard sprayer, enhancing precision application in viticulture.

- 2023: Deere & Company announces significant upgrades to its smart sprayer technology, integrating enhanced AI for weed identification.

- 2024: AGCO Corporation expands its portfolio with the acquisition of a leading precision spraying technology company, strengthening its offerings.

- 2024: H D Hudson Manufacturing Company introduces a new line of eco-friendly sprayers designed for reduced chemical drift.

- 2025: Jacto Inc. unveils a prototype of a drone-integrated spraying system for highly targeted crop treatments.

Strategic North America Farm Sprayers Market Market Forecast

The North America farm sprayers market is poised for continued robust growth, driven by the relentless pursuit of agricultural efficiency and sustainability. The increasing integration of smart technologies, including AI and IoT, will redefine spraying operations, leading to significant reductions in input costs and environmental impact. The forecast period anticipates a sustained rise in the adoption of autonomous and semi-autonomous spraying solutions, catering to the evolving needs of modern farming. Furthermore, governmental initiatives promoting precision agriculture and sustainable practices will act as significant growth catalysts, ensuring a vibrant and expanding market for innovative farm spraying technologies.

North America Farm Sprayers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Farm Sprayers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Farm Sprayers Market Regional Market Share

Geographic Coverage of North America Farm Sprayers Market

North America Farm Sprayers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Favorable Government Subsidies is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Farm Sprayers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GUSS AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 H D Hudson Manufacturing Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GVM Incorporated

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Excel Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EQUIPMENT TECHNOLOGIES IN

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jacto Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGCO Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 GUSS AG

List of Figures

- Figure 1: North America Farm Sprayers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Farm Sprayers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Farm Sprayers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Farm Sprayers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Farm Sprayers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Farm Sprayers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Farm Sprayers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Farm Sprayers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: North America Farm Sprayers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Farm Sprayers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Farm Sprayers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Farm Sprayers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Farm Sprayers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Farm Sprayers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Farm Sprayers Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Farm Sprayers Market?

Key companies in the market include GUSS AG, H D Hudson Manufacturing Company, Deere & Company, GVM Incorporated, Excel Industries, EQUIPMENT TECHNOLOGIES IN, Jacto Inc, AGCO Corporation.

3. What are the main segments of the North America Farm Sprayers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Favorable Government Subsidies is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Farm Sprayers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Farm Sprayers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Farm Sprayers Market?

To stay informed about further developments, trends, and reports in the North America Farm Sprayers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence