Key Insights

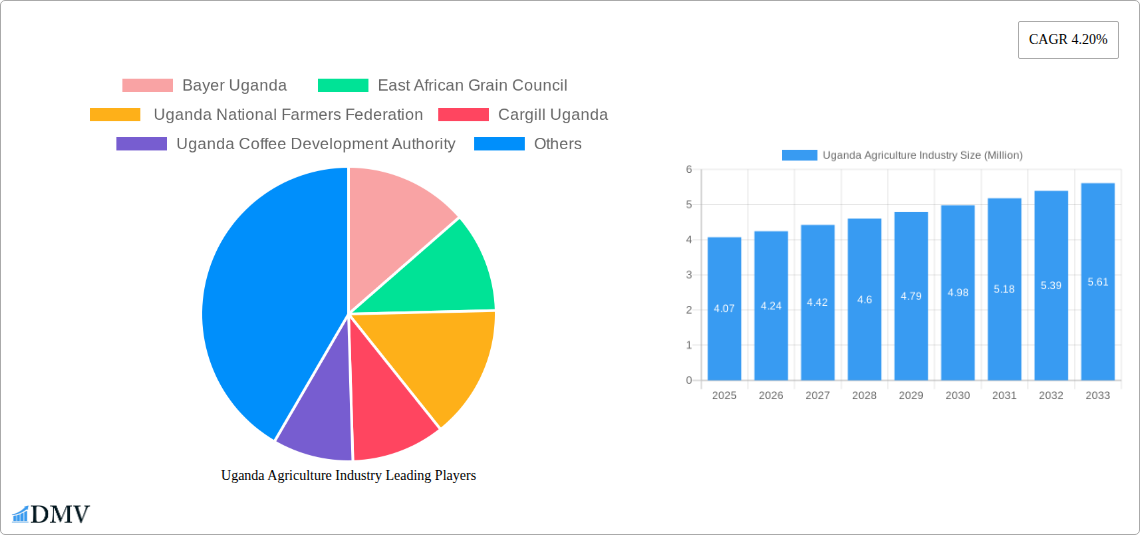

The Uganda agriculture industry is poised for significant growth, with an estimated market size of 4.07 million USD in 2025, driven by a projected Compound Annual Growth Rate (CAGR) of 4.20%. This expansion is underpinned by robust demand for key agricultural commodities, including cereals and grains, oilseeds and pulses, and fruits and vegetables. Favorable government policies aimed at boosting agricultural productivity, coupled with increasing investment in modern farming techniques and infrastructure development, are acting as crucial growth drivers. Furthermore, a growing export market for Ugandan agricultural products, particularly to neighboring East African nations, is contributing to the overall market buoyancy. The sector is also benefiting from advancements in agricultural technology, including improved seed varieties and better pest management solutions, which are enhancing yields and product quality.

Uganda Agriculture Industry Market Size (In Million)

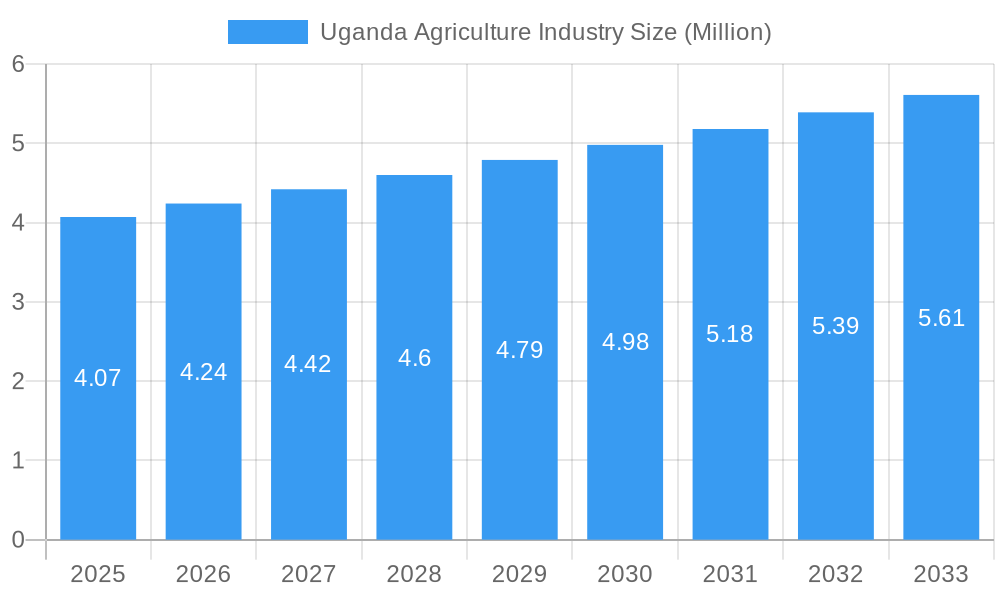

Despite the positive outlook, the Uganda agriculture industry faces certain restraining factors that could temper its growth trajectory. These include challenges related to access to affordable financing for smallholder farmers, fluctuations in global commodity prices, and the impact of climate change on agricultural productivity. Infrastructure gaps, particularly in rural areas, such as inadequate storage facilities and transportation networks, also present significant hurdles to efficient market access and reduced post-harvest losses. Nevertheless, ongoing initiatives by organizations like the Uganda National Farmers Federation and the East African Grain Council, along with the involvement of major players such as Bayer Uganda and Cargill Uganda, are actively working to address these constraints and foster a more resilient and productive agricultural ecosystem. The Uganda Coffee Development Authority's efforts in promoting high-value coffee production also represent a significant sub-sectoral driver.

Uganda Agriculture Industry Company Market Share

Uganda Agriculture Industry Market Composition & Trends

This comprehensive report delves into the dynamic Uganda agriculture industry, offering a deep dive into market composition, key trends, and future projections. We analyze market concentration, identifying key players and their influence on the landscape, alongside innovation catalysts driving advancements in cultivation, processing, and distribution. The report scrutinizes the regulatory landscape, highlighting government policies and initiatives that shape the sector. Understanding substitute products and their impact on traditional agricultural outputs is crucial, and this report provides an in-depth evaluation. End-user profiles are meticulously detailed, segmenting demand across various consumer groups and export markets. Mergers and acquisitions (M&A) activities are tracked, with estimated deal values to gauge market consolidation and strategic partnerships. Our analysis covers the study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

- Market Share Distribution: Insight into the current market share held by major agricultural sub-sectors, providing a snapshot of economic dominance.

- M&A Deal Values: Quantified estimations of recent and projected M&A transactions, indicating investor confidence and strategic realignments.

- Innovation Ecosystem: An overview of the key drivers of innovation, from governmental research grants to private sector investments in agri-tech.

Uganda Agriculture Industry Industry Evolution

The Uganda agriculture industry is undergoing a profound transformation, driven by a confluence of technological advancements, evolving consumer demands, and strategic governmental initiatives. This report meticulously analyzes the market growth trajectories, charting the expansion of key sub-sectors such as Cereals and Grains, Oilseeds and Pulses, and Fruits and Vegetables. We explore the adoption of cutting-edge technologies, including precision agriculture, improved seed varieties, and advanced irrigation systems, which are instrumental in boosting productivity and sustainability. Shifting consumer preferences, both domestically and internationally, towards organic produce, value-added products, and ethically sourced commodities are also examined, influencing production strategies and market entry. The government's commitment to modernizing the sector, evident in policy reforms and infrastructure development, further shapes its evolution. Over the study period (2019–2033), with a base year of 2025 and a forecast period from 2025–2033, we project significant growth fueled by these dynamic forces. Historical data from 2019–2024 provides a foundational understanding of the industry's past performance and the emergence of these transformative trends. We anticipate an average annual growth rate of XX% for the overall sector, with specific segments like Fruits and Vegetables exhibiting even higher expansion rates due to increased export demand and value addition. The adoption of climate-smart agricultural practices is projected to reach XX% by 2030, enhancing resilience and reducing environmental impact. Investment in agricultural research and development is estimated to increase by XX million USD annually, fostering innovation and driving efficiency gains across the value chain.

Leading Regions, Countries, or Segments in Uganda Agriculture Industry

This report highlights the dominant segments within the Uganda agriculture industry, with a particular focus on Cereals and Grains, Oilseeds and Pulses, and Fruits and Vegetables. These segments are not only pillars of Uganda's food security but also significant contributors to its export earnings. The dominance of these segments is underpinned by a combination of favorable agro-climatic conditions, government support, and increasing market demand.

Cereals and Grains: This segment, including staples like maize, rice, and sorghum, commands a significant portion of agricultural land and production. Its dominance is driven by consistent domestic demand and its role as a crucial raw material for various food processing industries. Government initiatives aimed at improving seed quality and promoting modern farming techniques have further bolstered its position. Investment trends in this segment are characterized by a focus on mechanization and post-harvest management to reduce losses.

- Key Drivers:

- Government Support: Policies promoting food security and the development of value chains for staple crops.

- Investment Trends: Increasing private sector investment in large-scale grain farming and processing facilities, estimated at over XX million USD in the past two years.

- Market Demand: Stable domestic consumption and growing regional export opportunities.

- Technological Adoption: Gradual adoption of improved farming techniques and pest management solutions.

Oilseeds and Pulses: This segment, encompassing crops like soybeans, groundnuts, and beans, is gaining prominence due to its nutritional value and its role in the edible oil and animal feed industries. The increasing demand for plant-based proteins and the diversification of agricultural production contribute to its growth. Regulatory support for oilseed cultivation and processing has also played a crucial role in its expansion.

- Key Drivers:

- Market Demand: Rising demand for edible oils and plant-based proteins, both domestically and internationally.

- Crop Diversification: Government promotion of oilseeds and pulses as part of broader agricultural diversification strategies.

- Value Addition: Growing interest in processing oilseeds into oils, meal, and other by-products, attracting significant investment.

- Export Potential: Increasing opportunities for exporting oilseeds and pulses to neighboring countries and beyond.

Fruits and Vegetables: While often more susceptible to market fluctuations, the Fruits and Vegetables segment is a dynamic and rapidly growing area, particularly for export markets. Uganda's diverse climate allows for the cultivation of a wide variety of high-value fruits and vegetables, including avocados, mangoes, passion fruits, and horticultural crops. The formation of farmer associations like Hortifresh signifies a strategic move towards professionalizing this sector and enhancing its competitiveness. Investment in this segment is largely driven by export-oriented enterprises focusing on quality, certifications, and cold chain logistics.

- Key Drivers:

- Export Markets: Strong demand from international markets, particularly in Europe and the Middle East, driving export revenue growth projected to reach XX million USD by 2030.

- Farmer Cooperatives: The emergence of organized farmer groups like Hortifresh, enhancing collective bargaining power and market access.

- Value Addition & Processing: Increasing investment in processing facilities for juices, dried fruits, and frozen vegetables.

- Technological Advancements: Adoption of modern greenhouse technologies and advanced post-harvest handling to meet international quality standards.

The dominance of these segments is further reinforced by ongoing research and development efforts aimed at improving yields, disease resistance, and product quality. Government policies that provide subsidies for inputs, facilitate access to credit, and invest in irrigation infrastructure are critical in sustaining and enhancing the competitive edge of these key agricultural sub-sectors in Uganda.

Uganda Agriculture Industry Product Innovations

Product innovations in the Uganda agriculture industry are increasingly focused on enhancing yields, improving resilience, and adding value. This includes the development and dissemination of high-yielding, disease-resistant seed varieties tailored for specific Ugandan agro-climatic zones, leading to an estimated XX% increase in crop productivity. The introduction of biological control agents, such as those for the Mango mealybug, represents a significant stride in sustainable pest management, reducing reliance on chemical pesticides by an estimated XX%. Furthermore, advancements in post-harvest technologies, including improved storage solutions and processing techniques for fruits and vegetables, are crucial for reducing spoilage and extending shelf life, thereby unlocking greater market potential.

Propelling Factors for Uganda Agriculture Industry Growth

Several key factors are propelling the growth of Uganda's agriculture industry. Government support and policy reforms are paramount, with initiatives focused on modernizing farming practices and improving market access. Technological advancements, including the adoption of improved seed varieties, precision agriculture techniques, and mechanization, are significantly boosting productivity and efficiency. Increasing domestic and international demand for agricultural products, driven by a growing population and a rising global appetite for diverse food products, provides a strong market impetus. Furthermore, investment in infrastructure, such as irrigation systems and improved transportation networks, is crucial for enhancing agricultural output and reducing post-harvest losses. The establishment of farmer cooperatives and associations also plays a vital role by empowering farmers and facilitating better access to resources and markets.

Obstacles in the Uganda Agriculture Industry Market

Despite its potential, the Uganda agriculture industry faces several significant obstacles. Regulatory challenges, including complex land tenure systems and inconsistent policy enforcement, can hinder investment and operational efficiency. Supply chain disruptions, exacerbated by inadequate infrastructure, poor road networks, and limited cold chain facilities, lead to substantial post-harvest losses, estimated at over XX% for perishable goods. Limited access to affordable finance and credit restricts farmers' ability to invest in modern technologies and inputs. Climate change impacts, such as unpredictable rainfall patterns and increased pest infestations, pose a constant threat to crop yields. Finally, competition from imports and fluctuating global commodity prices can impact the profitability of local producers.

Future Opportunities in Uganda Agriculture Industry

The future of Uganda's agriculture industry is ripe with opportunities. Value addition and agro-processing present a significant avenue for growth, transforming raw agricultural products into higher-value goods for both domestic and export markets, with potential to increase export revenue by XX%. Expansion into new export markets, particularly for high-value horticultural products and niche commodities, offers substantial revenue potential. Adoption of climate-smart agriculture and sustainable practices will not only enhance resilience but also meet the growing global demand for ethically produced food. Technological innovation, including the widespread use of digital platforms for market information, precision farming tools, and improved logistics, can further optimize operations. Emerging trends in organic farming and specialty crops also present lucrative opportunities for farmers to diversify and tap into premium markets.

Major Players in the Uganda Agriculture Industry Ecosystem

- Bayer Uganda

- East African Grain Council

- Uganda National Farmers Federation

- Cargill Uganda

- Uganda Coffee Development Authority

Key Developments in Uganda Agriculture Industry Industry

- November 2022: The Government of Uganda, through the Ministry of Agriculture, Animal Industries, and Fisheries (MAAIF), together with development partners, launched and released biological control agents for the Mango mealybug (Rastococcus invaders), significantly impacting pest management strategies.

- August 2022: The government of Uganda unveiled an ambitious plan to increase its current coffee production from 402,000 tons to 1.2 million tons annually by 2025, a move poised to substantially boost the coffee sector's output and economic contribution.

- November 2021: Hortifresh, an association of farmers dedicated to fostering a conducive environment for the long-term cultivation of Uganda's fresh fruits and vegetables, was formed, aiming to significantly benefit Ugandan farmers in this sector.

Strategic Uganda Agriculture Industry Market Forecast

The strategic forecast for the Uganda agriculture industry highlights a trajectory of robust growth, underpinned by continued government commitment and increasing private sector investment. The focus on value addition, particularly in the fruits and vegetables and coffee sectors, is expected to drive significant export revenue increases, projected to reach over $XXX million by 2030. The adoption of climate-smart agricultural practices will be crucial in mitigating risks and ensuring sustainable yields. Furthermore, the expansion of digital technologies in agriculture promises to enhance efficiency and market access for farmers. Emerging opportunities in organic produce and specialty crops will cater to niche global markets, further diversifying Uganda's agricultural export portfolio and solidifying its position as a key player in the regional and international agricultural landscape.

Uganda Agriculture Industry Segmentation

-

1. Type (Pr

- 1.1. Cereals and Grains

- 1.2. Oilseeds and Pulses

- 1.3. Fruits and Vegetables

-

2. Type (Pr

- 2.1. Cereals and Grains

- 2.2. Oilseeds and Pulses

- 2.3. Fruits and Vegetables

Uganda Agriculture Industry Segmentation By Geography

- 1. Uganda

Uganda Agriculture Industry Regional Market Share

Geographic Coverage of Uganda Agriculture Industry

Uganda Agriculture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Agriculture Contributes Highly to Uganda’s GDP

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uganda Agriculture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Cereals and Grains

- 5.1.2. Oilseeds and Pulses

- 5.1.3. Fruits and Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Cereals and Grains

- 5.2.2. Oilseeds and Pulses

- 5.2.3. Fruits and Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uganda

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer Uganda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 East African Grain Council

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uganda National Farmers Federation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cargill Uganda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uganda Coffee Development Authority

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Bayer Uganda

List of Figures

- Figure 1: Uganda Agriculture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Uganda Agriculture Industry Share (%) by Company 2025

List of Tables

- Table 1: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 2: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 3: Uganda Agriculture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 5: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 6: Uganda Agriculture Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uganda Agriculture Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Uganda Agriculture Industry?

Key companies in the market include Bayer Uganda , East African Grain Council , Uganda National Farmers Federation, Cargill Uganda, Uganda Coffee Development Authority .

3. What are the main segments of the Uganda Agriculture Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Agriculture Contributes Highly to Uganda’s GDP.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

November 2022: The Government of Uganda, through the Ministry of Agriculture, Animal Industries, and Fisheries (MAAIF), together with development partners, launched and released biological control agents for the Mango mealybug (Rastococcus invaders).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uganda Agriculture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uganda Agriculture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uganda Agriculture Industry?

To stay informed about further developments, trends, and reports in the Uganda Agriculture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence