Key Insights

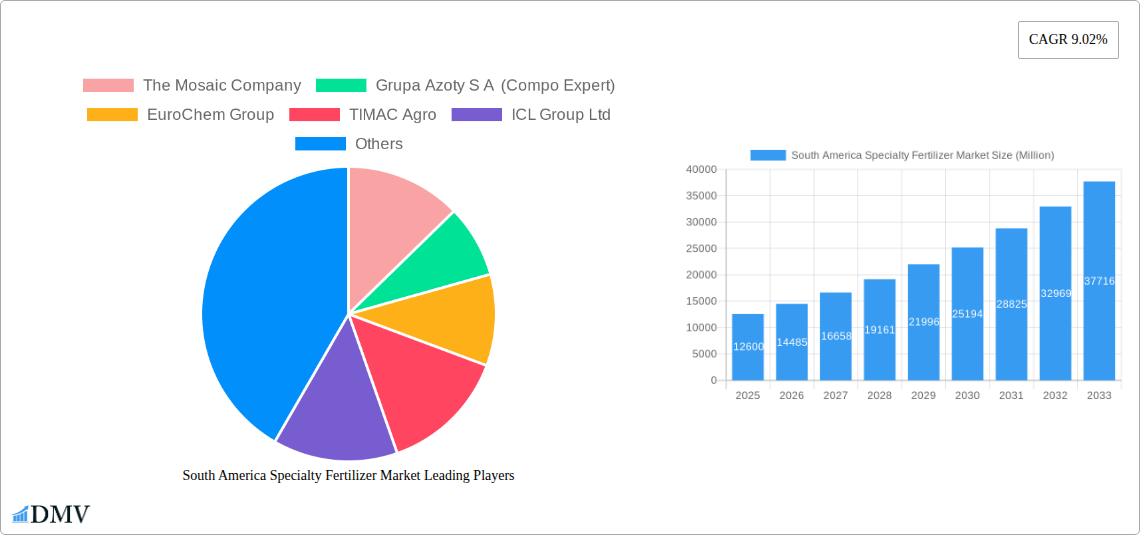

The South America Specialty Fertilizer Market is poised for significant expansion, projected to reach an impressive USD 12.6 billion by 2025. This robust growth is fueled by a compelling compound annual growth rate (CAGR) of 14.94%, indicating a dynamic and thriving sector. Key drivers propelling this market include the increasing demand for enhanced crop yields and quality to meet the rising global food requirements, coupled with a growing awareness among South American farmers about the benefits of specialty fertilizers over conventional options. These advanced formulations offer precise nutrient delivery, improved soil health, and reduced environmental impact, aligning with sustainable agricultural practices gaining traction across the region. Furthermore, government initiatives promoting modern farming techniques and investments in agricultural research and development are creating a fertile ground for specialty fertilizers.

South America Specialty Fertilizer Market Market Size (In Billion)

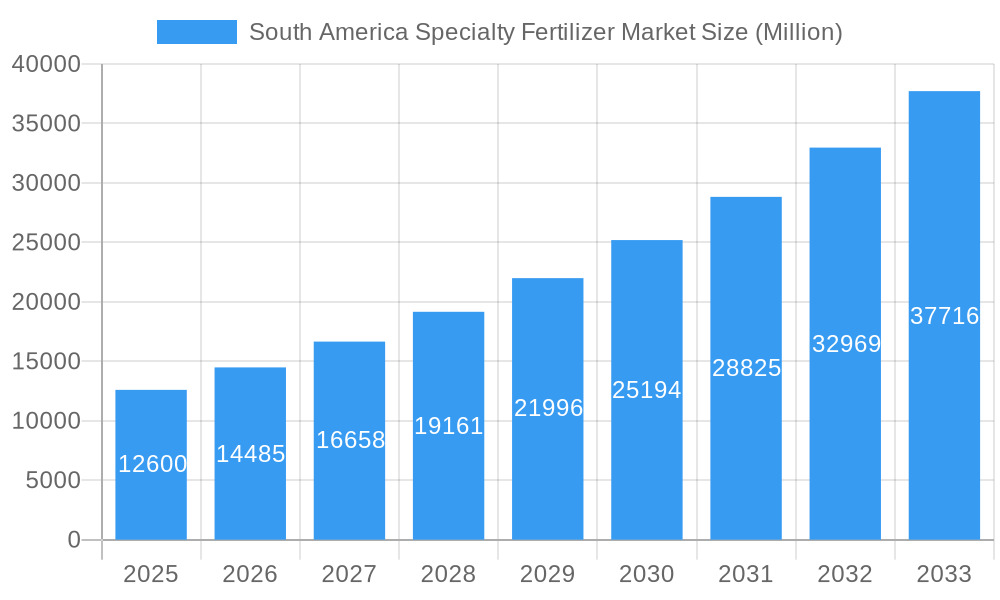

The market's trajectory is further shaped by several key trends. The rising adoption of water-soluble fertilizers, controlled-release fertilizers, and micronutrient-enriched formulations is evident as farmers seek to optimize nutrient use efficiency and minimize waste. The expansion of specialty fertilizer applications beyond staple crops into high-value produce like fruits, vegetables, and ornamental plants is also a significant trend. While the market is characterized by strong growth, certain restraints exist. High initial costs associated with some specialty fertilizer products can pose a barrier for smaller-scale farmers. However, the long-term economic benefits in terms of increased yields and reduced input wastage often outweigh these initial investments. The competitive landscape features prominent global players such as The Mosaic Company, Yara International AS, and EuroChem Group, alongside regional specialists, all vying for market share through product innovation and strategic partnerships. Brazil, with its vast agricultural land and significant contribution to global food production, is expected to be a dominant force within the South American specialty fertilizer market.

South America Specialty Fertilizer Market Company Market Share

South America Specialty Fertilizer Market: Comprehensive Analysis and Future Outlook (2019–2033)

Unlock the immense potential of the South American specialty fertilizer market with our in-depth report. This comprehensive study delves into market dynamics, growth drivers, emerging trends, and strategic opportunities shaping the industry from 2019 to 2033. We provide granular insights into production, consumption, import/export analysis, price trends, and key industry developments, empowering stakeholders with actionable intelligence for informed decision-making. Navigate the evolving landscape of advanced plant nutrition and capitalize on the burgeoning demand for sustainable agricultural solutions across Latin America.

South America Specialty Fertilizer Market Market Composition & Trends

The South America Specialty Fertilizer Market is characterized by a moderately concentrated landscape, with key players strategically vying for market dominance. Innovation remains a significant catalyst, driven by the increasing adoption of precision agriculture and the demand for crop-specific nutritional solutions. Regulatory frameworks, while evolving, are increasingly focused on promoting sustainable farming practices and the responsible use of fertilizers, influencing product development and market entry strategies. Substitute products, though present, often fall short of the targeted efficacy and efficiency offered by specialty fertilizers, particularly in optimizing yields and resource utilization. End-user profiles are diversifying, encompassing large-scale commercial farms, smallholder farmers seeking enhanced productivity, and the burgeoning organic agriculture sector. Mergers and acquisitions (M&A) are a prominent feature, with companies actively consolidating their market positions and expanding their product portfolios. M&A deal values are projected to reach several hundred million US dollars as companies aim to enhance their technological capabilities and geographical reach. Key trends include the rising adoption of slow-release and controlled-release fertilizers, the growing demand for micronutrient-enriched formulations, and the increasing focus on bio-based and water-soluble fertilizers. The market share distribution is influenced by the presence of multinational corporations and strong regional players, with a significant portion attributed to established leaders and their strategic investments in research and development.

South America Specialty Fertilizer Market Industry Evolution

The South America Specialty Fertilizer Market has witnessed a transformative evolution over the historical period (2019-2024), driven by a confluence of factors including advancements in agricultural technology, a growing awareness of sustainable farming practices, and the increasing need to boost food production in response to a growing population. This evolution is marked by a sustained upward trajectory in market growth, with a compound annual growth rate (CAGR) projected to exceed XX% over the forecast period (2025–2033). Technological advancements have been instrumental, with the introduction of sophisticated formulations such as controlled-release fertilizers (CRF), slow-release fertilizers (SRF), water-soluble fertilizers (WSF), and liquid fertilizers revolutionizing crop nutrition. These innovations enable precise nutrient delivery, minimizing waste and environmental impact, and maximizing crop yield and quality. Adoption metrics for these advanced fertilizers have surged, particularly among large-scale commercial agricultural operations, who are increasingly recognizing the economic and environmental benefits. Consumer demand has also played a pivotal role, with a growing emphasis on food security, higher crop yields, and the cultivation of nutrient-dense produce. This has led to a paradigm shift from conventional fertilizers to specialty solutions that offer tailored nutrition for specific crops and soil conditions. The market has also seen a rise in the adoption of bio-stimulants and bio-fertilizers, further underscoring the commitment towards sustainable agriculture and environmentally friendly farming practices. The competitive landscape has intensified, with both established global players and emerging regional manufacturers investing heavily in research and development to bring innovative and effective solutions to the market. The expansion of agricultural land, coupled with the continuous drive to improve crop productivity in diverse agro-climatic zones across South America, further fuels the demand for these advanced nutritional inputs. The industry's evolution is thus a dynamic interplay of technological innovation, shifting consumer preferences, and the overarching imperative to achieve sustainable agricultural intensification.

Leading Regions, Countries, or Segments in South America Specialty Fertilizer Market

The South America Specialty Fertilizer Market is dominated by Brazil, a powerhouse in agricultural production and consumption, driving significant demand across all segments. Its expansive agricultural sector, encompassing major crops like soybeans, corn, sugarcane, and coffee, necessitates advanced fertilization strategies to optimize yields and maintain soil health.

Production Analysis: Brazil leads in the production of various specialty fertilizers, leveraging its robust chemical industry and access to raw materials. Investment trends show a consistent increase in manufacturing capacities, driven by both domestic demand and export opportunities. Regulatory support for domestic production, including incentives for adopting advanced manufacturing technologies, further bolsters its position.

Consumption Analysis: Brazil's consumption of specialty fertilizers is unparalleled, fueled by its vast arable land and the intensive farming practices employed in its key agricultural regions. The adoption of high-efficiency fertilizers is significantly higher here compared to other South American nations. Investment in precision agriculture technologies further amplifies this consumption.

Import Market Analysis (Value & Volume): Brazil is also the largest importer of specialty fertilizers, particularly high-value, specialized formulations not readily produced domestically. The value of imports is projected to reach several hundred million US dollars annually, with volumes steadily increasing. Key drivers include the need for advanced micronutrients, controlled-release formulations for specific crop cycles, and bio-fertilizers.

Export Market Analysis (Value & Volume): While Brazil is a net importer of many specialty fertilizers, it also demonstrates growing export capabilities, particularly for certain bio-fertilizers and customized formulations. Argentina and Colombia also represent significant export markets for niche specialty fertilizer products originating from other South American countries. Investment in regional trade agreements aims to further enhance these export flows.

Price Trend Analysis: Price trends in Brazil are influenced by global commodity prices, currency fluctuations, and domestic supply-demand dynamics. However, the premium pricing of advanced specialty fertilizers is increasingly accepted due to their demonstrable return on investment through improved yields and reduced input costs.

Industry Developments: The dominance of Brazil is further solidified by strategic industry developments. For instance, the acquisition of Fertilaquas by ICL Group Ltd in January 2021 significantly bolstered ICL's presence and sales of controlled-released fertilizers and organic fertilizers within Brazil, underscoring the market's attractiveness.

South America Specialty Fertilizer Market Product Innovations

Product innovation in the South America Specialty Fertilizer Market is centered on enhancing nutrient use efficiency and crop performance. Leading companies are developing advanced formulations such as coated micronutrients, like those introduced by Haifa Group with their Multicote™ technology, enabling all-season complete nutrition and controlled release benefits. Water-soluble fertilizers tailored for drip irrigation systems and foliar applications are gaining traction, offering rapid nutrient uptake. Furthermore, the integration of bio-stimulants with specialty fertilizers is a significant innovation, promoting root development, stress tolerance, and overall plant health. These products offer unique selling propositions by addressing specific crop deficiencies, improving soil microbial activity, and contributing to sustainable agricultural practices, leading to superior yields and crop quality.

Propelling Factors for South America Specialty Fertilizer Market Growth

Several key factors are propelling the growth of the South America Specialty Fertilizer Market. Firstly, the increasing global demand for food security necessitates higher agricultural productivity, driving the adoption of advanced fertilization techniques. Secondly, a growing awareness among farmers regarding the environmental benefits and economic advantages of specialty fertilizers, such as reduced nutrient leaching and improved crop yields, is a significant driver. Technological advancements, including the development of precision agriculture tools and sophisticated fertilizer formulations like controlled-release and water-soluble types, are enhancing application efficiency and crop-specific nutrient delivery. Furthermore, government initiatives promoting sustainable agriculture and providing subsidies for advanced farming inputs are playing a crucial role. The expanding middle class in South America also contributes to increased demand for higher quality and more abundant food produce.

Obstacles in the South America Specialty Fertilizer Market Market

Despite the robust growth, the South America Specialty Fertilizer Market faces several obstacles. Regulatory challenges, including complex registration processes and varying standards across different countries, can hinder market entry and product diffusion. Supply chain disruptions, exacerbated by logistical complexities in vast regions and occasional political instability, can impact the timely availability of fertilizers. High upfront costs associated with certain advanced specialty fertilizers can be a barrier for smallholder farmers with limited capital. Moreover, a lack of widespread technical knowledge and training among some farming communities regarding the optimal use of these specialized products can limit their adoption and effectiveness. Intense competition from conventional fertilizers, which are often perceived as cheaper, also presents a restraint.

Future Opportunities in South America Specialty Fertilizer Market

The South America Specialty Fertilizer Market presents a wealth of future opportunities. The expanding organic farming sector across the region offers a significant avenue for bio-fertilizers and organic nutrient solutions. The growing adoption of precision agriculture technologies will drive demand for highly customized and data-driven fertilizer applications. Emerging markets within South America, beyond the established agricultural powerhouses, represent untapped potential for specialty fertilizer penetration. Furthermore, the development of innovative, environmentally friendly formulations, such as slow-release fertilizers derived from sustainable sources and bio-stimulants, aligns with the global shift towards sustainable agriculture and presents substantial growth prospects. Partnerships and collaborations between fertilizer manufacturers and agricultural technology providers can unlock new market segments and enhance product offerings.

Major Players in the South America Specialty Fertilizer Market Ecosystem

- The Mosaic Company

- Grupa Azoty S A (Compo Expert)

- EuroChem Group

- TIMAC Agro

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

- Haifa Group

- K+S Aktiengesellschaft

- Yara International AS

Key Developments in South America Specialty Fertilizer Market Industry

- March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin American market and strengthen its position as a global superbrand in advanced plant nutrition.

- January 2021: ICL Group Ltd acquired Fertilaqua, one of Brazil's leading specialty plant nutrition companies to increase the sales of its controlled-released fertilizers, organic fertilizers, and other specialty plant nutrition products.

- July 2018: Haifa Group introduced a novel range of coated micronutrients, enabling an all-season complete nutrition. Based on Multicote™ technology, the coated micronutrients provide your crops with all the benefits of controlled-release nutrition.

Strategic South America Specialty Fertilizer Market Market Forecast

The strategic South America Specialty Fertilizer Market forecast indicates continued robust growth, driven by the region's significant agricultural output and the increasing adoption of sustainable farming practices. The market is projected to reach a value of billions of US dollars by 2033. Key growth catalysts include the escalating demand for high-efficiency fertilizers that optimize crop yields and minimize environmental impact, supported by technological advancements in precision agriculture and innovative product formulations. Furthermore, supportive government policies aimed at enhancing food security and promoting sustainable agricultural development will play a crucial role. The ongoing consolidation through mergers and acquisitions, as evidenced by recent strategic deals, will further shape the competitive landscape and drive market expansion. Opportunities in emerging markets and the growing popularity of bio-fertilizers will also contribute to the market's upward trajectory.

South America Specialty Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Specialty Fertilizer Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Specialty Fertilizer Market Regional Market Share

Geographic Coverage of South America Specialty Fertilizer Market

South America Specialty Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Specialty Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Mosaic Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupa Azoty S A (Compo Expert)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EuroChem Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TIMAC Agro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICL Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sociedad Quimica y Minera de Chile SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haifa Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 K+S Aktiengesellschaft

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yara International AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 The Mosaic Company

List of Figures

- Figure 1: South America Specialty Fertilizer Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Specialty Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: South America Specialty Fertilizer Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Specialty Fertilizer Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Specialty Fertilizer Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Specialty Fertilizer Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Specialty Fertilizer Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Specialty Fertilizer Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: South America Specialty Fertilizer Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Specialty Fertilizer Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Specialty Fertilizer Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Specialty Fertilizer Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Specialty Fertilizer Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Specialty Fertilizer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Specialty Fertilizer Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Specialty Fertilizer Market?

The projected CAGR is approximately 14.94%.

2. Which companies are prominent players in the South America Specialty Fertilizer Market?

Key companies in the market include The Mosaic Company, Grupa Azoty S A (Compo Expert), EuroChem Group, TIMAC Agro, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA, Haifa Group, K+S Aktiengesellschaft, Yara International AS.

3. What are the main segments of the South America Specialty Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

March 2022: The Haifa Group entered a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the Latin American market and strengthen its position as a global superbrand in advanced plant nutrition.January 2021: ICL Group Ltd acquired Fertilaqua, one of Brazil's leading specialty plant nutrition companies to increase the sales of its controlled-released fertilizers, organic fertilizers, and other specialty plant nutrition products.July 2018: Haifa Group introduced a novel range of coated micronutrients, enabling an all-season complete nutrition. Based on Multicote™ technology, the coated micronutrients provide your crops with all the benefits of controlled-release nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Specialty Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Specialty Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Specialty Fertilizer Market?

To stay informed about further developments, trends, and reports in the South America Specialty Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence