Key Insights

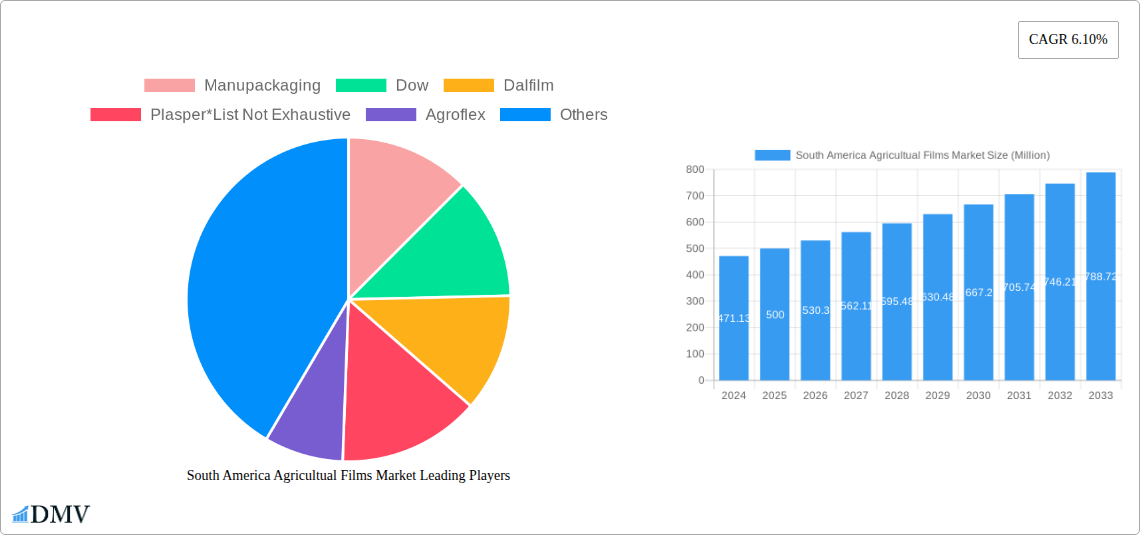

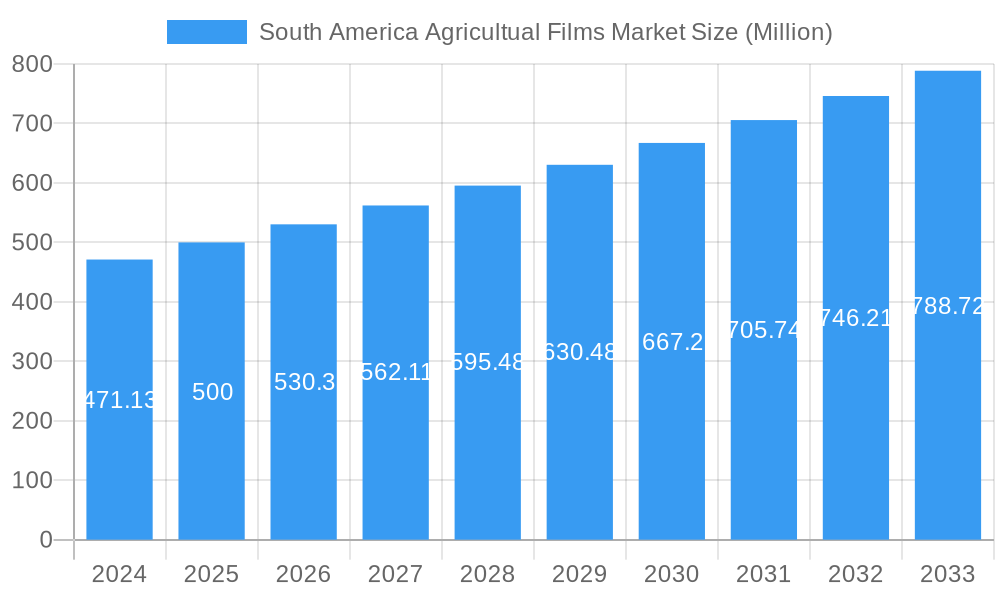

The South American agricultural films market is poised for robust expansion, projected to reach a market size of approximately $500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.10% expected to drive the sector through 2033. This growth is primarily fueled by an increasing demand for enhanced crop yields and protection against adverse weather conditions, a critical concern for the region's agricultural backbone. Key drivers include the adoption of advanced farming techniques, such as greenhouse cultivation and mulching, which significantly improve resource efficiency and output. Furthermore, government initiatives promoting sustainable agriculture and modern farming practices are providing a substantial impetus to the market. The rising awareness among farmers regarding the benefits of agricultural films, including moisture retention, weed suppression, and pest control, is also a significant contributing factor to market penetration across countries like Brazil, Argentina, and Chile.

South America Agricultual Films Market Market Size (In Million)

The market is witnessing a dynamic shift with several key trends emerging. Innovations in material science are leading to the development of more durable, UV-resistant, and biodegradable agricultural films, addressing environmental concerns and enhancing product longevity. The adoption of specialized films tailored for specific crops and climates, such as those offering thermal insulation or increased light transmission, is gaining traction. However, the market faces certain restraints, including the initial capital investment required for advanced agricultural film application systems and fluctuating raw material prices, which can impact profitability. Nevertheless, the overarching positive growth trajectory, driven by the imperative to boost food production and resilience in a changing climate, coupled with the increasing sophistication of agricultural practices, firmly positions the South American agricultural films market for sustained and significant expansion.

South America Agricultual Films Market Company Market Share

South America Agricultural Films Market: Unlocking Growth Potential for Enhanced Crop Yields & Sustainability

This comprehensive South America Agricultural Films Market report delivers an in-depth analysis of the agricultural films market in South America, covering a critical study period from 2019 to 2033, with a base year of 2025. Gain unparalleled insights into production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), price trend analysis, and key industry developments. Explore market dynamics, identify growth drivers, and navigate potential obstacles to capitalize on the burgeoning opportunities within this vital sector. This report is meticulously crafted for stakeholders seeking to understand market composition, trends, and future forecasts.

South America Agricultural Films Market Market Composition & Trends

The South America agricultural films market exhibits a moderately concentrated landscape, driven by a blend of established global players and regional specialists. Innovation catalysts include the growing demand for enhanced crop yields, improved soil health, and reduced water usage, all critical for the region's expanding agricultural output. Regulatory landscapes, while varied across countries, are increasingly focusing on sustainable agricultural practices, indirectly favoring the adoption of advanced agricultural films. Substitute products, such as traditional mulching methods, are gradually being phased out as farmers recognize the superior benefits of specialized films. End-user profiles range from large-scale commercial farms cultivating staple crops like soybeans and corn to smaller operations focused on high-value produce. Mergers and acquisitions (M&A) activities, though not at their peak, are expected to gain momentum as companies seek to expand their market reach and technological capabilities. Current market share distribution sees leading players like Dow and Manupackaging holding significant portions, with Dalfilm, Agroflex, and Polifilm also carving out substantial presence. M&A deal values, while confidential, are projected to increase as consolidation becomes a strategic imperative for sustained growth and competitive advantage in this dynamic market. The market is characterized by a continuous pursuit of films with improved UV resistance, higher light transmission/reflection capabilities, and enhanced biodegradability, directly influencing market share distribution and competitive strategies.

South America Agricultural Films Market Industry Evolution

The South America agricultural films market has undergone a significant transformation over the historical period (2019–2024), driven by a confluence of factors propelling its evolution. Early in this period, the market was largely characterized by basic polyethylene films used for simple greenhouse coverings and mulching. However, as the agricultural sector in South America matured and faced increasing pressures from climate change, pest infestations, and the global demand for higher quality produce, the need for sophisticated agricultural solutions became paramount. This led to a discernible shift towards more advanced film technologies.

Technological advancements have been a primary engine of this evolution. The development of co-extruded films offering multi-layered protection against UV degradation, thermal insulation, and pest deterrence has revolutionized greenhouse cultivation. Furthermore, the introduction of specialized films for soil solarization and fumigation has significantly improved pest and disease management, leading to healthier crops and reduced reliance on chemical treatments. The adoption of light-diffusing films, for instance, has been observed to increase by an estimated 15% year-on-year during the latter half of the historical period, leading to more uniform crop growth within greenhouses.

Shifting consumer demands, both domestically and internationally, have also played a crucial role. Consumers are increasingly aware of and demanding sustainably grown produce, free from harmful pesticides. This has spurred the demand for agricultural films that contribute to organic farming practices and reduce the overall environmental footprint of agriculture. The rise of precision agriculture has further amplified this trend, with farmers seeking films that can optimize water usage and nutrient delivery, thereby enhancing crop efficiency and quality. For example, the adoption of drip irrigation systems integrated with specialized mulching films has seen a growth rate of approximately 12% annually in countries like Brazil and Argentina, reflecting a clear trend towards resource-efficient farming.

The base year, 2025, marks a critical juncture where these evolutionary trends are expected to solidify, with an anticipated compound annual growth rate (CAGR) of approximately 6.5% projected for the forecast period (2025–2033). This robust growth is underpinned by continuous investment in R&D by key players like Dow and Manupackaging, focused on developing biodegradable and recyclable film solutions to meet stringent environmental regulations and consumer preferences. The increasing focus on protected agriculture, especially in regions with unpredictable weather patterns, will continue to drive the demand for high-performance greenhouse films, while advanced mulching films will remain crucial for optimizing water conservation and weed control in open-field cultivation. The industry's trajectory is thus characterized by a move towards higher value-added, environmentally conscious, and technologically advanced agricultural film solutions.

Leading Regions, Countries, or Segments in South America Agricultural Films Market

The South America agricultural films market is characterized by distinct regional dominance and segment strengths, driven by unique agricultural practices, economic conditions, and regulatory frameworks.

Production Analysis:

- Dominant Region: Brazil stands out as the leading region in the production of agricultural films, primarily due to its vast agricultural landmass, significant investment in agricultural technology, and a strong domestic manufacturing base.

- Key Drivers:

- Government Incentives: Supportive government policies and subsidies for agricultural modernization in Brazil encourage local production and adoption of advanced farming inputs.

- Raw Material Availability: Proximity to petrochemical industries provides access to essential raw materials for film manufacturing.

- Technological Investments: Significant investments by local and international companies in advanced extrusion and co-extrusion technologies are enhancing production capabilities.

- Growing Domestic Demand: The sheer scale of Brazilian agriculture, encompassing crops like soybeans, corn, sugarcane, and fruits, fuels a substantial demand for various types of agricultural films.

Consumption Analysis:

- Dominant Country: Brazil again emerges as the largest consumer of agricultural films, followed closely by Argentina and Chile. The diversified agricultural sectors in these countries, catering to both domestic and international markets, necessitate a wide array of agricultural film solutions.

- Key Drivers:

- Protected Agriculture Expansion: Increasing adoption of greenhouses and polytunnels in countries like Peru and Ecuador to cultivate high-value crops such as berries, avocados, and flowers for export.

- Water Scarcity & Soil Management: Growing awareness and adoption of mulching films for water conservation, weed suppression, and soil temperature regulation, especially in arid and semi-arid regions.

- Crop Yield Enhancement: The constant drive to increase agricultural productivity and quality underpins the demand for films that optimize growing conditions.

- Pest and Disease Control: The use of specialized films for soil solarization and fumigation to manage soil-borne pests and diseases is a significant consumption driver.

Import Market Analysis (Value & Volume):

- Dominant Segment: High-performance, specialized films such as UV-stabilized greenhouse films, multi-layered mulch films, and biodegradable films represent the highest value segments within the import market.

- Key Drivers:

- Technological Gap: Reliance on imports for advanced film technologies and specialized formulations not yet extensively manufactured locally.

- Quality and Performance Demands: Exporters of premium agricultural produce often demand films that meet stringent international quality standards.

- Specific Crop Requirements: Imports catering to niche crops with unique cultivation needs that require specialized film properties.

- Value of Imports: Estimated at USD 550 Million in 2025, with a projected CAGR of 7.2% during the forecast period, indicating a strong demand for high-value imported films.

- Volume of Imports: Estimated at 180,000 Metric Tons in 2025, with a projected CAGR of 6.8%.

Export Market Analysis (Value & Volume):

- Dominant Segment: While the region is a net importer of advanced films, there is a growing export market for basic and intermediate-grade agricultural films produced by local manufacturers, primarily to neighboring South American countries.

- Key Drivers:

- Cost Competitiveness: Local production of polyethylene films offers competitive pricing for neighboring markets.

- Regional Trade Agreements: Favorable trade agreements within South America facilitate easier cross-border movement of goods.

- Value of Exports: Estimated at USD 150 Million in 2025, with a projected CAGR of 4.5%.

- Volume of Exports: Estimated at 60,000 Metric Tons in 2025, with a projected CAGR of 4.2%.

Price Trend Analysis:

- Dominant Factor: Fluctuations in polyethylene resin prices, driven by crude oil prices and global supply-demand dynamics, are the primary determinants of agricultural film pricing.

- Key Drivers:

- Raw Material Costs: Volatility in crude oil prices directly impacts the cost of polyethylene, the main raw material for agricultural films.

- Technological Advancements: Introduction of higher-performance, multi-layered films commands premium pricing.

- Supply Chain Disruptions: Global and regional supply chain issues can lead to price spikes.

- Inflationary Pressures: General economic inflation across the region also contributes to increased film prices.

- Price Index: Average prices for standard greenhouse films are estimated to be around USD 2.8 per kg in 2025, with a projected annual increase of 3.5% due to raw material costs and innovation.

South America Agricultural Films Market Product Innovations

The South America agricultural films market is witnessing a surge in product innovations aimed at enhancing crop productivity, resource efficiency, and environmental sustainability. Key advancements include the development of multi-layered co-extruded films offering superior UV resistance and extended lifespan, crucial for prolonged use in harsh South American climates. Innovations in light management are leading to films that diffuse sunlight, preventing scorching and promoting uniform growth, while others are designed to reflect specific light spectrums, optimizing photosynthesis for different crops. Furthermore, a significant focus is placed on biodegradable and compostable agricultural films, addressing growing environmental concerns and regulatory pressures. These advanced films offer unique selling propositions by reducing plastic waste, improving soil health after use, and minimizing the labor-intensive task of film removal. Technological advancements are also enabling the integration of anti-fog and anti-drip properties, crucial for preventing disease spread in humid greenhouse environments, and the development of films with enhanced mechanical strength to withstand adverse weather conditions.

Propelling Factors for South America Agricultural Films Market Growth

The South America agricultural films market is propelled by several powerful growth catalysts. Technological advancements in film extrusion and material science are leading to more durable, efficient, and specialized products. The growing global and regional demand for food security and higher crop yields is a significant economic driver, pushing farmers to adopt modern farming techniques that include advanced agricultural films. Furthermore, increasing awareness and stringent regulations concerning environmental sustainability are fostering the adoption of biodegradable and recyclable films, while also promoting practices like water conservation that rely heavily on mulching films. Government initiatives aimed at modernizing agriculture and supporting farmers in adopting new technologies also play a crucial role. For instance, the push for efficient water management in countries like Chile and parts of Brazil directly fuels the demand for advanced mulching films. The expansion of protected agriculture, including greenhouses and polytunnels, to mitigate climate change impacts and improve crop quality for export markets, is another vital factor.

Obstacles in the South America Agricultural Films Market Market

Despite its growth potential, the South America agricultural films market faces several obstacles. High initial investment costs for advanced films and associated infrastructure can be a deterrent for smallholder farmers, limiting widespread adoption. Limited awareness and technical expertise among a segment of the farming community regarding the benefits and proper application of specialized films can hinder market penetration. Fluctuations in raw material prices, particularly polyethylene, directly tied to volatile global oil prices, can lead to unpredictable pricing and impact profitability for manufacturers and affordability for farmers. Inadequate recycling infrastructure and collection systems in many regions pose a challenge for the disposal and management of conventional plastic films, potentially leading to environmental concerns and regulatory backlash. Supply chain disruptions, exacerbated by logistical challenges and geopolitical factors, can also impede the timely availability of raw materials and finished products.

Future Opportunities in South America Agricultural Films Market

The South America agricultural films market is ripe with future opportunities. The growing demand for organic and sustainably produced food presents a significant opportunity for manufacturers of biodegradable and compostable agricultural films. As climate change impacts become more pronounced, the adoption of greenhouse and polytunnel films for protected agriculture is expected to surge, especially for high-value crops destined for export. The increasing adoption of precision agriculture will drive demand for specialized films integrated with irrigation and fertilization systems for optimized resource management. Furthermore, the untapped potential in certain countries within the region, coupled with ongoing investments in agricultural modernization, offers scope for market expansion. Innovations in smart films with embedded sensors for monitoring soil conditions and crop health represent a frontier for future growth, offering enhanced data-driven agricultural practices.

Major Players in the South America Agricultural Films Market Ecosystem

- Manupackaging

- Dow

- Dalfilm

- Plasper

- Agroflex

- Industrial Development Company sal

- Polifilm

- BioBag Americas Inc

Key Developments in South America Agricultural Films Market Industry

- 2023: Dow launches a new line of advanced agricultural films with enhanced UV stabilization, offering extended durability for greenhouse applications in South America.

- 2023: Manupackaging expands its production capacity for mulching films in Brazil to meet rising domestic demand driven by water conservation initiatives.

- 2024: Agroflex introduces a range of biodegradable mulch films designed for key South American crops, aligning with growing sustainability trends.

- 2024: Dalfilm announces strategic partnerships with agricultural cooperatives in Argentina to promote the adoption of advanced greenhouse films for horticultural producers.

- 2024: Polifilm invests in new co-extrusion technology to enhance its offering of high-performance, multi-layered agricultural films for the Chilean market.

Strategic South America Agricultural Films Market Market Forecast

The South America agricultural films market is poised for robust growth, projected to expand at a significant CAGR of approximately 6.5% between 2025 and 2033. This expansion will be fueled by the escalating need for enhanced crop yields and improved agricultural efficiency across the region. Key growth catalysts include the increasing adoption of protected agriculture, driven by the desire to mitigate climate variability and meet global food demand. Furthermore, the rising consumer preference for sustainably grown produce is a strong impetus for the development and uptake of biodegradable and recyclable film alternatives. Investments in technological innovation, particularly in multi-layered films offering superior UV protection and light management properties, will continue to drive market value. Strategic market forecasts indicate sustained demand for both greenhouse and mulching films, with emerging opportunities in specialized films for precision agriculture and smart farming applications, solidifying the market's bright future.

South America Agricultual Films Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Agricultual Films Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Agricultual Films Market Regional Market Share

Geographic Coverage of South America Agricultual Films Market

South America Agricultual Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Horticulture Industry and Green house farming Drives the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultual Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manupackaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dow

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dalfilm

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plasper*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agroflex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Industrial Development Company sal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Polifilm

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BioBag Americas Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Manupackaging

List of Figures

- Figure 1: South America Agricultual Films Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Agricultual Films Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultual Films Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Agricultual Films Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Agricultual Films Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Agricultual Films Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Agricultual Films Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Agricultual Films Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Agricultual Films Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Agricultual Films Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Agricultual Films Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Agricultual Films Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Agricultual Films Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Agricultual Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Agricultual Films Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultual Films Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the South America Agricultual Films Market?

Key companies in the market include Manupackaging, Dow, Dalfilm, Plasper*List Not Exhaustive, Agroflex, Industrial Development Company sal, Polifilm, BioBag Americas Inc.

3. What are the main segments of the South America Agricultual Films Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Horticulture Industry and Green house farming Drives the market.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultual Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultual Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultual Films Market?

To stay informed about further developments, trends, and reports in the South America Agricultual Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence