Key Insights

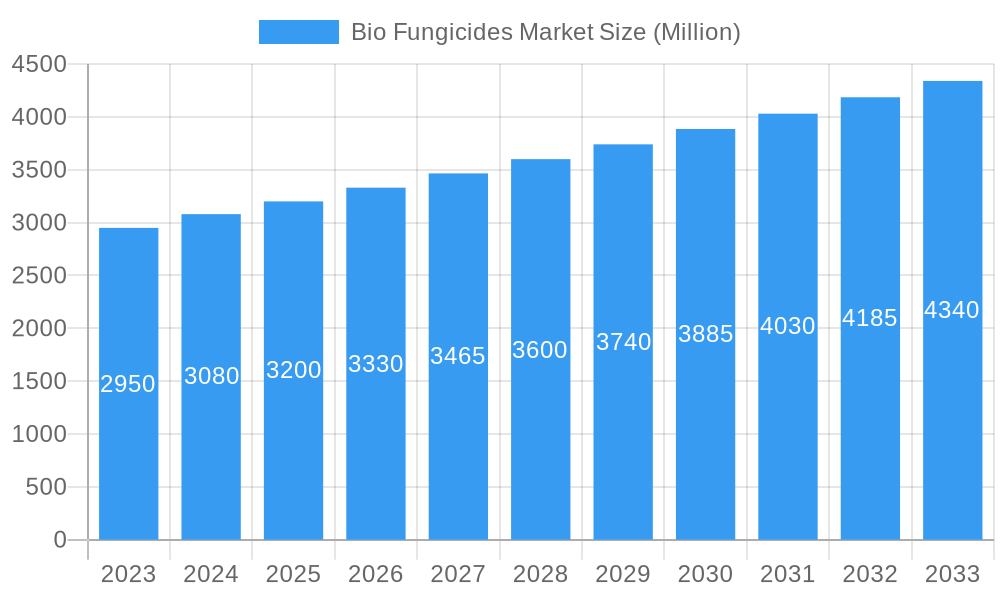

The global biofungicides market is poised for substantial growth, projected to reach approximately $3.2 billion by 2025 and expand to over $4.5 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 3.50%. This upward trajectory is largely propelled by an increasing global demand for sustainable agricultural practices and a growing consumer preference for organically produced food. Farmers are increasingly adopting biofungicides as a safer and more environmentally friendly alternative to conventional chemical fungicides, which often pose risks to human health and ecosystems. The heightened awareness of soil health, biodiversity, and the detrimental effects of chemical residues on produce further amplifies the adoption of biological solutions. Regulatory bodies worldwide are also favoring greener agricultural inputs, creating a more conducive environment for the expansion of the biofungicides market. Key applications of biofungicides span a wide range of crops, including fruits, vegetables, cereals, and ornamentals, addressing prevalent fungal diseases that can significantly impact yield and quality.

Bio Fungicides Market Market Size (In Billion)

The market's expansion is further bolstered by ongoing innovations in microbial fermentation technologies and the development of novel bio-based active ingredients. Companies are investing significantly in research and development to enhance the efficacy, shelf-life, and application methods of biofungicides, making them more competitive with traditional options. However, certain factors may temper this growth. The relatively higher cost of biofungicides compared to their chemical counterparts, coupled with a lack of widespread farmer awareness and the need for specialized application knowledge, represent significant restraints. Additionally, the variability in efficacy due to environmental conditions and the longer lead times for some biological products can pose challenges. Nevertheless, the inherent benefits of biofungicides, including reduced environmental impact, improved food safety, and the development of disease resistance in crops, are expected to outweigh these challenges, ensuring a robust and promising future for the biofungicides industry. The market is segmented across production, consumption, import/export analyses, and price trends, offering a comprehensive view of market dynamics.

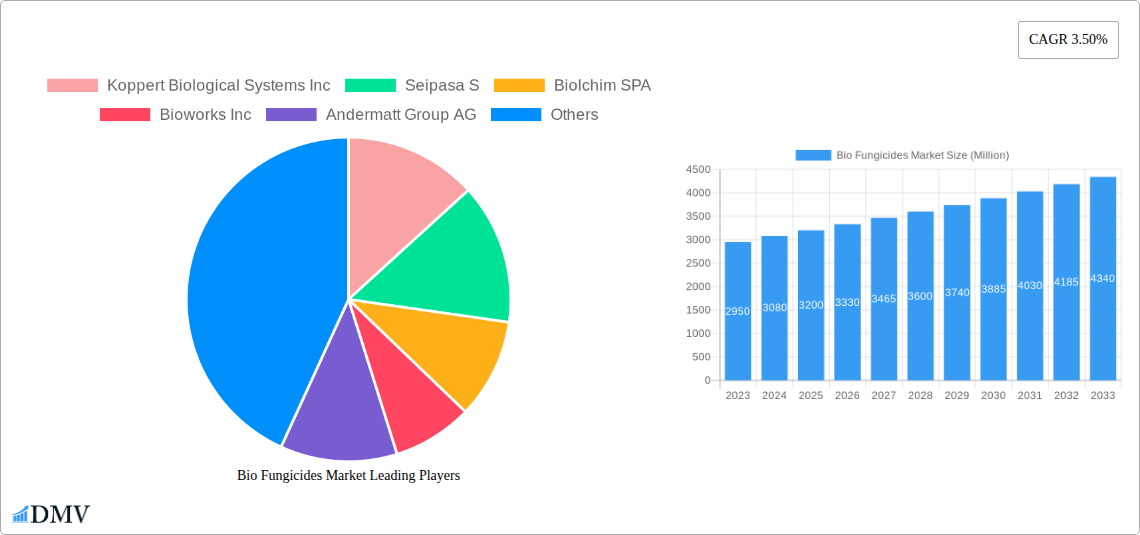

Bio Fungicides Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Bio Fungicides Market, providing critical insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, challenges, and future opportunities. Covering the historical period from 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning agricultural biologicals sector. We delve into production and consumption analysis, import/export dynamics, and intricate price trends, underpinned by expert analysis of key industry developments and strategic initiatives by leading companies.

Bio Fungicides Market Market Composition & Trends

The Bio Fungicides Market is characterized by a dynamic interplay of established agricultural giants and innovative biological startups, fostering an environment of continuous innovation. Market concentration is moderately high, with key players actively investing in research and development to introduce novel, sustainable solutions. Regulatory landscapes are evolving, with increasing government support for biological products promoting market expansion. Substitute products, primarily conventional chemical fungicides, are facing growing scrutiny due to environmental and health concerns, paving the way for bio-based alternatives. End-user profiles encompass a broad spectrum, from large-scale commercial farms to smallholder farmers seeking eco-friendly pest and disease management. Mergers, acquisitions, and strategic partnerships are prevalent, reflecting the industry's drive towards consolidation and portfolio expansion. For instance, M&A deal values are projected to reach several hundred million dollars as companies aim to secure proprietary technologies and expand their market reach.

- Market Concentration: Moderate, with strategic consolidation driven by R&D and market access needs.

- Innovation Catalysts: Growing demand for sustainable agriculture, regulatory pressures, and technological advancements in microbial fermentation and formulation.

- Regulatory Landscapes: Favorable shifts towards bio-based solutions in key agricultural economies.

- Substitute Products: Conventional chemical fungicides facing increasing resistance due to environmental and health concerns.

- End-User Profiles: Commercial farms, organic producers, and integrated pest management (IPM) practitioners.

- M&A Activities: Significant, with an estimated total deal value exceeding $800 Million between 2023-2025.

Bio Fungicides Market Industry Evolution

The Bio Fungicides Market has witnessed a remarkable transformation over the historical period, driven by a confluence of factors that are reshaping agricultural practices worldwide. From 2019 to 2024, the market experienced a steady upward trajectory, fueled by increasing farmer awareness regarding the environmental and health benefits associated with biological fungicides. This period saw a significant acceleration in research and development, leading to the introduction of more efficacious and stable bio-fungicidal formulations. Technological advancements in areas such as microbial strain selection, fermentation optimization, and advanced delivery systems have been pivotal in enhancing the performance and broadening the applicability of bio fungicides. Furthermore, shifting consumer demands towards sustainably produced food, coupled with stringent regulations on chemical pesticide residues, have created a fertile ground for the growth of the bio fungicides sector. The adoption rate of bio fungicides has steadily increased, with projections indicating a compound annual growth rate (CAGR) of approximately 12% from 2025 to 2033. This growth is further substantiated by increased investments from venture capitalists and agricultural conglomerates seeking to diversify their portfolios and tap into the sustainable agriculture market. The integration of bio fungicides into broader Integrated Pest Management (IPM) strategies is becoming a norm, underscoring their growing importance in modern agriculture. The market evolution is marked by a continuous quest for product diversification, targeting a wider range of fungal pathogens and crop types, and enhancing shelf-life and ease of application.

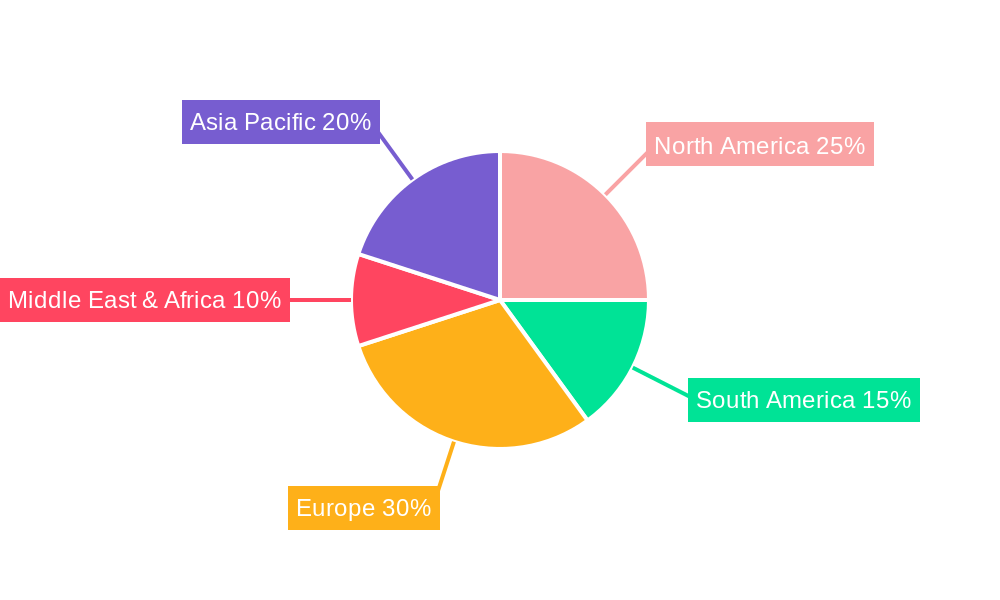

Leading Regions, Countries, or Segments in Bio Fungicides Market

The Bio Fungicides Market exhibits distinct regional dominance and segment performance, driven by a complex interplay of economic, regulatory, and agricultural factors. North America, particularly the United States, and Europe, spearheaded by countries like Germany and France, consistently emerge as frontrunners in both Production Analysis and Consumption Analysis. This leadership is largely attributable to robust governmental support for sustainable agriculture, stringent regulations on chemical pesticides, and a high adoption rate of advanced farming technologies. The Import Market Analysis (Value & Volume) reveals significant trade flows into these regions, indicating a strong demand for innovative bio fungicidal solutions. Conversely, countries in Asia Pacific, such as China and India, are witnessing rapid growth in production and consumption, driven by their vast agricultural economies and increasing focus on food security and sustainable farming practices.

Dominant Region (Production & Consumption): North America and Europe

- Key Drivers: Stringent environmental regulations, government subsidies for biological inputs, high adoption of precision agriculture, and well-established R&D infrastructure.

- In-depth Analysis: North America, led by the US, benefits from a mature market for biologicals and significant R&D investments. Europe's dominance is bolstered by the EU's Green Deal and Farm to Fork strategy, promoting organic farming and reduced pesticide use. Production capacity in these regions is expanding, with a focus on microbial strain development and advanced fermentation techniques. Consumption is driven by the need for effective disease management in high-value crops and a growing organic farming sector.

Rapidly Growing Region (Production & Consumption): Asia Pacific

- Key Drivers: Large agricultural base, increasing government initiatives for sustainable farming, rising farmer awareness, and the need to address food security challenges.

- In-depth Analysis: Countries like China and India are transforming their agricultural landscapes. Increased investment in local R&D and manufacturing facilities is boosting production. Consumption is escalating due to the growing demand for healthier food options and the implementation of policies to curb chemical pesticide usage.

Import Market Analysis (Value & Volume):

- Dominant Importers: North America, Europe.

- Key Drivers: Demand for specialized bio fungicides for niche crops, advanced formulations not yet produced domestically, and a preference for established global brands.

- In-depth Analysis: Significant imports are driven by the need to fill specific disease control gaps and access cutting-edge biological solutions. The value of imports is often higher due to the inclusion of premium, highly effective products.

Export Market Analysis (Value & Volume):

- Dominant Exporters: North America, Europe, and increasingly, select Asian countries with strong manufacturing capabilities.

- Key Drivers: Competitive pricing, established distribution networks, and the availability of cost-effective production.

- In-depth Analysis: Developed economies often export higher-value, proprietary bio fungicidal products, while emerging economies focus on volume exports of established bio-fungicide categories.

Price Trend Analysis:

- Trend: Generally stable to moderately increasing, with fluctuations based on raw material availability, production costs, and market demand.

- In-depth Analysis: While initial investment in R&D can lead to higher prices for novel products, economies of scale and increased competition are driving down prices for established bio fungicides, making them more accessible.

Bio Fungicides Market Product Innovations

Product innovation in the Bio Fungicides Market is a relentless pursuit of enhanced efficacy, broader spectrum control, and improved user-friendliness. Companies are actively developing novel formulations that utilize beneficial microbes like Trichoderma, Bacillus, and Pseudomonas species to combat a wide array of fungal pathogens. These innovations focus on improving shelf-life, enhancing compatibility with existing agricultural practices, and developing targeted delivery mechanisms for maximum impact. Unique selling propositions often lie in the specific mode of action, such as competitive exclusion, mycoparasitism, or induced systemic resistance in plants, offering a sustainable alternative to chemical fungicides. Advanced research into microbial consortia and genetically modified strains promises even more potent and specific bio fungicidal solutions for the future.

Propelling Factors for Bio Fungicides Market Growth

The Bio Fungicides Market is propelled by a robust ecosystem of growth drivers, fundamentally transforming the agricultural landscape. Growing consumer demand for organic and residue-free produce is a primary catalyst, pushing farmers to adopt sustainable pest and disease management solutions. Increasingly stringent government regulations on conventional chemical pesticides, driven by environmental and health concerns, further incentivize the adoption of bio fungicides. Technological advancements in microbial fermentation, strain selection, and formulation technologies have led to more effective and stable bio-fungicidal products, enhancing their appeal to farmers. Economic factors, including the long-term cost-effectiveness of bio fungicides through reduced resistance development and improved soil health, also play a crucial role.

- Increasing Demand for Organic & Sustainable Produce: Direct consumer preference driving farmer adoption.

- Stringent Regulatory Frameworks: Bans and restrictions on chemical pesticides create market opportunities.

- Technological Advancements: Improved efficacy, stability, and application methods of bio fungicides.

- Economic Viability: Long-term cost savings and improved crop quality.

- Awareness & Education: Growing farmer understanding of the benefits of biologicals.

Obstacles in the Bio Fungicides Market Market

Despite its promising growth trajectory, the Bio Fungicides Market faces several significant obstacles that can impede its widespread adoption. Regulatory hurdles remain a concern, with varying registration processes and timelines across different regions, often leading to delayed market entry. Supply chain disruptions, particularly related to the consistent availability of viable microbial strains and the maintenance of cold chains for certain products, can impact product quality and accessibility. Furthermore, the perceived higher initial cost compared to some conventional chemical fungicides can be a barrier for price-sensitive farmers, despite the potential for long-term economic benefits. Limited farmer awareness and the need for specialized knowledge in application techniques can also slow down adoption rates.

- Regulatory Hurdles: Complex and lengthy registration processes in various countries.

- Supply Chain Complexities: Ensuring the viability and consistent availability of microbial strains.

- Perceived Higher Initial Cost: Compared to some conventional chemical alternatives.

- Farmer Education & Adoption: Need for increased awareness and training on application methods.

- Shelf-Life Limitations: Certain bio fungicides require specific storage conditions.

Future Opportunities in Bio Fungicides Market

The future of the Bio Fungicides Market is ripe with opportunities for innovation and expansion. The development of precision bio fungicides, tailored to specific crops and pathogens, presents a significant growth avenue. Emerging markets in Africa and South America, with their vast agricultural potential and growing focus on sustainable practices, offer untapped potential for market penetration. Advances in biotechnology, including genetic engineering and synthetic biology, are expected to yield even more potent and resilient bio fungicidal agents. The integration of bio fungicides with digital farming technologies, such as AI-driven crop monitoring and customized application systems, will further enhance their efficacy and appeal.

- Precision Bio Fungicides: Targeted solutions for specific crops and diseases.

- Emerging Market Penetration: Significant untapped potential in Africa and South America.

- Advancements in Biotechnology: Development of novel microbial strains and delivery systems.

- Digital Agriculture Integration: Synergistic solutions with AI and smart farming technologies.

- Combination Products: Synergistic formulations with biostimulants and other biologicals.

Major Players in the Bio Fungicides Market Ecosystem

- Koppert Biological Systems Inc

- Seipasa S

- Biolchim SPA

- Bioworks Inc

- Andermatt Group AG

- Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- Corteva Agriscience

- Marrone Bio Innovations Inc

- Lallemand Inc

- Certis USA LLC

Key Developments in Bio Fungicides Market Industry

- October 2022: Seipasa launched its new advanced bio fungicidal product, "Fungisei," in Portugal after getting registered Phytosaniritarily by the European Commission. This expansion signifies growing market access and product availability in key European markets.

- September 2022: Corteva Agriscience signed an agreement to acquire a biologicals-based company Symborg as a part of its strategy to expand its biologicals portfolio. This strategic move signals a significant consolidation trend and Corteva's commitment to becoming a global leader in the agricultural biological market.

- June 2022: Certis Biologicals and Novozymes collaborated to develop new technologies for highly effective fungal disease control. This partnership highlights the industry's focus on innovation through cross-company research and development, aiming to provide novel solutions for row crop growers.

Strategic Bio Fungicides Market Market Forecast

The Bio Fungicides Market is poised for sustained and robust growth in the coming years, driven by a confluence of intensifying demand for sustainable agricultural practices and a favorable regulatory environment. Projections indicate a significant expansion, with market value expected to reach approximately $3,500 Million by 2033. This growth will be fueled by ongoing innovation in product development, leading to more efficacious and user-friendly bio fungicidal solutions. The increasing adoption of integrated pest management (IPM) strategies and a heightened global awareness of environmental sustainability will further accelerate market penetration. Strategic investments in research and development, coupled with the expansion of production capacities by major players, will ensure the availability of diverse and competitive bio fungicidal options, solidifying their role as indispensable tools in modern agriculture.

Bio Fungicides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Bio Fungicides Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bio Fungicides Market Regional Market Share

Geographic Coverage of Bio Fungicides Market

Bio Fungicides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Bio Fungicides Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Koppert Biological Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seipasa S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biolchim SPA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bioworks Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Andermatt Group AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Corteva Agriscience

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marrone Bio Innovations Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lallemand Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Certis USA LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Global Bio Fungicides Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Bio Fungicides Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Bio Fungicides Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Bio Fungicides Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Bio Fungicides Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Bio Fungicides Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Bio Fungicides Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Bio Fungicides Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Bio Fungicides Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Bio Fungicides Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Bio Fungicides Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Bio Fungicides Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Bio Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Bio Fungicides Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Bio Fungicides Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Bio Fungicides Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Bio Fungicides Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Bio Fungicides Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Bio Fungicides Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Bio Fungicides Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Bio Fungicides Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Bio Fungicides Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Bio Fungicides Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Bio Fungicides Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Bio Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Bio Fungicides Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Bio Fungicides Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Bio Fungicides Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Bio Fungicides Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Bio Fungicides Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Bio Fungicides Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Bio Fungicides Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Bio Fungicides Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Bio Fungicides Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Bio Fungicides Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Bio Fungicides Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Bio Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Bio Fungicides Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Bio Fungicides Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Bio Fungicides Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Bio Fungicides Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Bio Fungicides Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Bio Fungicides Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Bio Fungicides Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Bio Fungicides Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Bio Fungicides Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Bio Fungicides Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Bio Fungicides Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Bio Fungicides Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Bio Fungicides Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Bio Fungicides Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Bio Fungicides Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Bio Fungicides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Bio Fungicides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Bio Fungicides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Bio Fungicides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Bio Fungicides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Bio Fungicides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Bio Fungicides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Bio Fungicides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Bio Fungicides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Bio Fungicides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Bio Fungicides Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio Fungicides Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the Bio Fungicides Market?

Key companies in the market include Koppert Biological Systems Inc, Seipasa S, Biolchim SPA, Bioworks Inc, Andermatt Group AG, Indogulf BioAg LLC (Biotech Division of Indogulf Company), Corteva Agriscience, Marrone Bio Innovations Inc, Lallemand Inc, Certis USA LLC.

3. What are the main segments of the Bio Fungicides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

October 2022: Seipasa launched its new advanced bio fungicidal product, "Fungisei," in Portugal after getting registered Phytosaniritarily by the European Commission.September 2022: Corteva Agriscience signed an agreement to acquire a biologicals-based company Symborg as a part of its strategy to expand its biologicals portfolio. This move would help Corteva Agriscience achieve its goal of becoming a global leader in the agricultural biological market.June 2022: Certis Biologicals and Novozymes, two leading agricultural biotechnology companies, collaborated to develop new technologies for highly effective fungal disease control. This collaboration will provide new solutions to row crop growers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio Fungicides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio Fungicides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio Fungicides Market?

To stay informed about further developments, trends, and reports in the Bio Fungicides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence