Key Insights

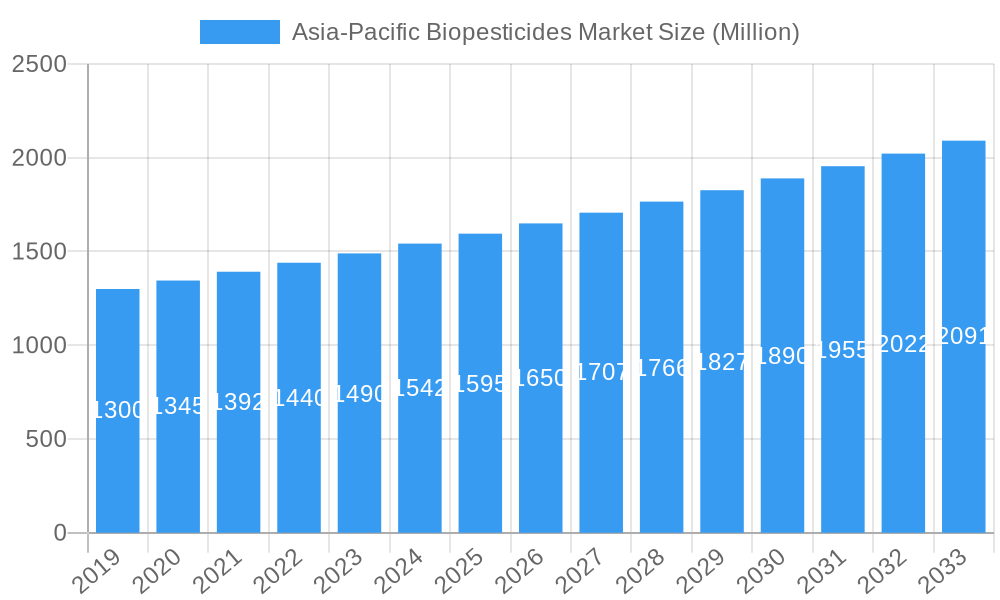

The Asia-Pacific Biopesticides Market is poised for substantial growth, projected to reach approximately USD 1.7 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 3.50% through 2033. This expansion is primarily fueled by an increasing global demand for sustainable agricultural practices and a growing awareness of the environmental and health risks associated with conventional chemical pesticides. Key drivers include stringent government regulations promoting organic farming, rising consumer preference for residue-free produce, and the inherent advantages of biopesticides such as reduced toxicity, biodegradability, and improved soil health. The market’s trajectory is further bolstered by significant investments in research and development by leading players, leading to the introduction of more effective and diversified biopesticide formulations. Farmers across the region are increasingly recognizing the long-term economic benefits of biopesticides, including enhanced crop yields, improved quality, and reduced costs associated with managing pesticide resistance and environmental remediation.

Asia-Pacific Biopesticides Market Market Size (In Billion)

The biopesticides landscape in Asia-Pacific is characterized by distinct segments catering to diverse agricultural needs. Production analysis indicates a steady rise in the manufacturing capabilities of microbial and botanical biopesticides, driven by both established chemical companies and specialized biopesticide manufacturers. Consumption is witnessing robust growth across key agricultural nations like China and India, where a large agrarian base is adopting these eco-friendly solutions. Import and export markets are also dynamic, with countries actively engaging in trade to meet domestic demand and leverage export opportunities. Price trends, while subject to initial higher production costs compared to synthetic alternatives, are stabilizing as economies of scale improve and technological advancements streamline manufacturing processes. Emerging trends such as the integration of biopesticides with integrated pest management (IPM) strategies and the development of novel bio-insecticides and bio-fungicides are expected to shape market dynamics, further solidifying the region's position as a pivotal hub for sustainable agriculture.

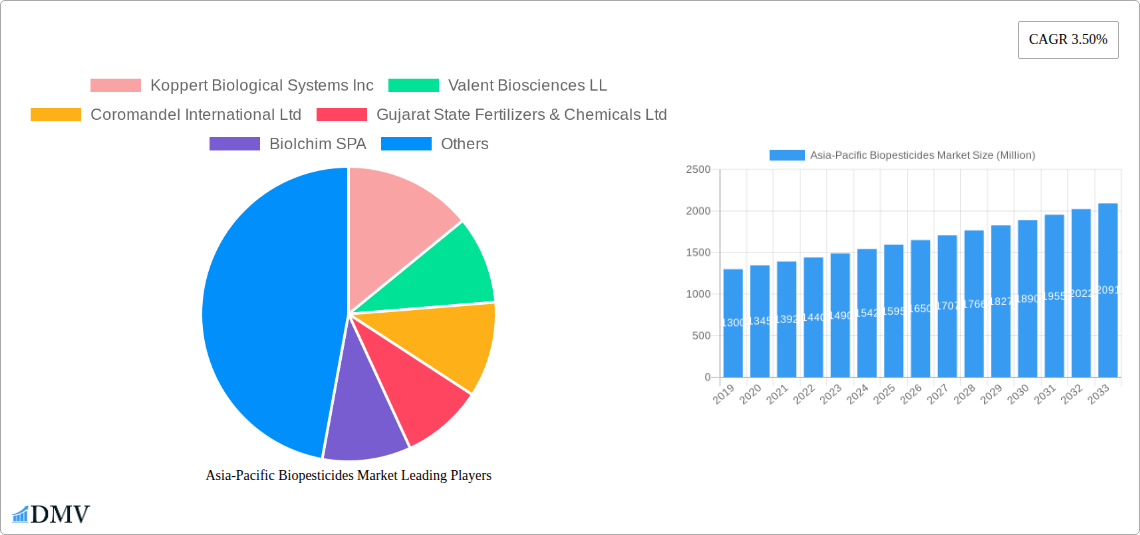

Asia-Pacific Biopesticides Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Biopesticides Market, providing critical insights for stakeholders. Spanning the historical period of 2019–2024 and forecasting growth through 2033, with a base and estimated year of 2025, this report delves into market composition, industry evolution, regional dynamics, product innovations, growth drivers, obstacles, and future opportunities. With a focus on Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, this report equips you with the data necessary for strategic decision-making in this rapidly expanding sector. The report covers key companies such as Koppert Biological Systems Inc, Valent Biosciences LL, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Biolchim SPA, IPL Biologicals Limited, T Stanes and Company Limited, Biobest Group NV, Henan Jiyuan Baiyun Industry Co Ltd, and Andermatt Group AG.

Asia-Pacific Biopesticides Market Market Composition & Trends

The Asia-Pacific Biopesticides Market is characterized by a moderately concentrated landscape, driven by increasing awareness of sustainable agriculture and stringent government regulations against synthetic pesticides. Innovation catalysts include ongoing research and development in microbial and botanical biopesticides, alongside advancements in formulation technologies. The regulatory landscape varies significantly across the region, with countries like China and India actively promoting biopesticide adoption through subsidies and favorable policies. Substitute products, primarily conventional chemical pesticides, still hold a significant market share but are facing increasing scrutiny due to environmental and health concerns. End-user profiles range from large-scale agricultural enterprises seeking to meet export market demands for residue-free produce to smallholder farmers adopting cost-effective and eco-friendly solutions. Mergers and acquisitions are becoming a key strategy for market expansion and portfolio enhancement. For instance, the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) in April 2021, effective April 01, 2021, is expected to bolster Coromandel International Ltd's biopesticide offerings. Similarly, Andermatt Group AG's merger with Andermatt Biocontrol AG in January 2022 streamlined its operations and enhanced management effectiveness. The market share distribution is influenced by the dominance of key players and the growing number of local manufacturers. M&A deal values in the sector are projected to escalate as companies seek to consolidate their market positions and acquire innovative technologies.

Asia-Pacific Biopesticides Market Industry Evolution

The Asia-Pacific Biopesticides Market has witnessed a dynamic evolutionary trajectory, marked by a significant shift towards sustainable agricultural practices driven by growing environmental concerns and consumer demand for organic and residue-free produce. Over the historical period of 2019–2024, the market experienced a compound annual growth rate (CAGR) of approximately 15%, fueled by supportive government initiatives and increased R&D investments by leading biopesticide manufacturers. Technological advancements have been pivotal in this evolution, with the development of more stable and efficacious microbial biopesticides, including advanced formulations of Bacillus thuringiensis (Bt) and Beauveria bassiana. Botanical biopesticides, derived from plant extracts like neem and pyrethrum, have also gained traction due to their broad-spectrum activity and lower environmental impact. Shifting consumer demands, particularly in developed economies within the Asia-Pacific region, have played a crucial role, pushing agricultural producers towards integrated pest management (IPM) strategies that heavily incorporate biopesticides. For example, the adoption metrics for biopesticides in countries like Japan and South Korea have seen a notable increase, with an estimated penetration of over 20% in their overall pesticide market by 2024. The market's growth trajectory is further solidified by increasing farmer awareness programs and educational initiatives that highlight the long-term benefits of biopesticides, including soil health improvement and reduced resistance development in pests. This evolution signifies a fundamental paradigm shift from chemical-centric pest control to a more holistic and sustainable approach in agriculture across the Asia-Pacific region.

Leading Regions, Countries, or Segments in Asia-Pacific Biopesticides Market

The Asia-Pacific Biopesticides Market exhibits distinct regional dominance and segment preferences, with China emerging as a frontrunner in Production Analysis and Consumption Analysis, followed closely by India.

Production Analysis: China leads in the production volume of biopesticides, leveraging its extensive manufacturing base and government support for agricultural inputs. India is also a significant producer, with numerous domestic companies contributing to the supply chain.

- Key Drivers: Strong government subsidies for biopesticide manufacturing, availability of raw materials, and established chemical pesticide infrastructure adaptable to biopesticide production.

- Dominance Factors: Large-scale fermentation facilities, lower production costs, and a vast domestic agricultural market drive China's production supremacy. India's strength lies in its diverse range of botanical biopesticides and growing R&D capabilities.

Consumption Analysis: China and India represent the largest consumer markets due to their vast agricultural landscapes and increasing adoption of sustainable farming practices. Southeast Asian nations like Vietnam and Thailand are also showing robust growth in consumption.

- Key Drivers: Growing demand for organic produce, stringent regulations on chemical pesticide residues, and government incentives for farmers to adopt bio-based solutions.

- Dominance Factors: Large arable land area, high pest pressure, and increasing farmer awareness of biopesticide benefits contribute to the substantial consumption in these key countries.

Import Market Analysis (Value & Volume): Japan and South Korea, despite smaller agricultural areas, exhibit significant import value due to their demand for high-quality, specialized biopesticides and a strong consumer preference for premium organic products. Australia also represents a notable import market.

- Key Drivers: High disposable incomes, advanced agricultural technologies, and strict food safety standards necessitate imports of specialized biopesticides.

- Dominance Factors: Focus on high-value crops, demand for certified organic inputs, and limited domestic production of certain advanced biopesticide formulations drive import activity.

Export Market Analysis (Value & Volume): China and India are key exporters, supplying biopesticides to other Asian countries and some international markets. Their competitive pricing and large production capacities enable significant export volumes.

- Key Drivers: Cost-effectiveness of production, expanding manufacturing capabilities, and increasing global demand for affordable biopesticide solutions.

- Dominance Factors: Economies of scale, efficient supply chain management, and a diverse product portfolio cater to the export market's needs.

Price Trend Analysis: The price trend analysis indicates a gradual increase in biopesticide prices, driven by rising raw material costs, advanced formulation techniques, and increasing R&D investments. However, competition from domestic manufacturers in China and India helps maintain price competitiveness.

- Key Drivers: Volatility in raw material prices (e.g., microbial strains, botanical extracts), investment in research and development for novel biopesticides, and the need for more sophisticated delivery systems.

- Dominance Factors: Premium pricing for patented formulations and specialized biopesticides, balanced by competitive pricing for generic microbial products, influences the overall price trends.

Asia-Pacific Biopesticides Market Product Innovations

Product innovations in the Asia-Pacific Biopesticides Market are centered on enhancing efficacy, stability, and ease of application. Microbial biopesticides are seeing advancements in strain selection and fermentation techniques to improve shelf-life and potency against specific pests. Botanical biopesticides are benefiting from advanced extraction methods that preserve active compounds and create synergistic blends for broader pest control. Formulation technologies are crucial, with the development of microencapsulated and nano-formulations improving delivery and reducing environmental degradation. These innovations are leading to products with faster action, longer residual effects, and broader compatibility with integrated pest management (IPM) programs, offering farmers more sustainable and effective pest management solutions.

Propelling Factors for Asia-Pacific Biopesticides Market Growth

The Asia-Pacific Biopesticides Market is propelled by several key factors.

- Technological Advancements: Continuous R&D leading to more potent and stable biopesticide formulations.

- Regulatory Support: Increasingly stringent regulations on chemical pesticides and government incentives promoting bio-based alternatives.

- Growing Consumer Demand: Rising consumer preference for organic and residue-free produce drives farmers towards sustainable pest management.

- Environmental Concerns: Heightened awareness of the detrimental effects of chemical pesticides on ecosystems and human health.

- Cost-Effectiveness: Development of economical biopesticide production methods making them more accessible to farmers.

Obstacles in the Asia-Pacific Biopesticides Market Market

Despite its growth, the Asia-Pacific Biopesticides Market faces several obstacles.

- Regulatory Hurdles: Inconsistent and lengthy registration processes for biopesticides across different countries can hinder market entry.

- Limited Farmer Awareness: A lack of adequate knowledge and training among farmers regarding the effective use and benefits of biopesticides.

- Perceived Lower Efficacy: Some farmers still perceive biopesticides as less effective or slower-acting compared to conventional chemical pesticides, especially for severe infestations.

- Storage and Shelf-Life Challenges: Certain biopesticides require specific storage conditions, and their shelf-life can be shorter than chemical alternatives.

- Supply Chain Complexities: Ensuring the consistent availability and quality of microbial strains and raw materials can be challenging.

Future Opportunities in Asia-Pacific Biopesticides Market

Emerging opportunities in the Asia-Pacific Biopesticides Market are abundant.

- Expansion into New Crop Segments: Developing and marketing biopesticides for niche crops and high-value horticultural products.

- Technological Integration: Leveraging digital tools like precision agriculture and AI for better application and monitoring of biopesticides.

- Emerging Economies: Untapped potential in developing nations within Southeast Asia and the Pacific seeking sustainable agricultural solutions.

- Biostimulants and Biofertilizers: Growing market convergence with biopesticides, offering integrated crop health solutions.

- Strategic Partnerships: Collaborations between research institutions, manufacturers, and distributors to accelerate product development and market penetration.

Major Players in the Asia-Pacific Biopesticides Market Ecosystem

- Koppert Biological Systems Inc

- Valent Biosciences LL

- Coromandel International Ltd

- Gujarat State Fertilizers & Chemicals Ltd

- Biolchim SPA

- IPL Biologicals Limited

- T Stanes and Company Limited

- Biobest Group NV

- Henan Jiyuan Baiyun Industry Co Ltd

- Andermatt Group AG

Key Developments in Asia-Pacific Biopesticides Market Industry

- April 2022: Coromandel International Ltd approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 01, 2021. This merger is anticipated to expand the company's product portfolio, including its biopesticides, in the long run.

- January 2022: Andermatt Group AG announced the merger of Andermatt Biocontrol AG with Andermatt Group AG. After the merger, all companies report directly to Andermatt Group AG, increasing the effectiveness of the management and simplifying the company's structure.

Strategic Asia-Pacific Biopesticides Market Market Forecast

The strategic forecast for the Asia-Pacific Biopesticides Market anticipates sustained robust growth driven by a confluence of factors. Increasing environmental consciousness, coupled with supportive government policies mandating reduced chemical pesticide usage, will continue to be significant growth catalysts. Advancements in biotechnology are expected to yield more targeted and efficacious biopesticide formulations, addressing specific pest challenges across a wider range of crops. The growing demand for organic and sustainably produced food will further fuel market expansion, particularly in developed economies within the region. Strategic investments in R&D, capacity expansion by key players, and the exploration of new market segments present substantial opportunities for future market potential.

Asia-Pacific Biopesticides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Biopesticides Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

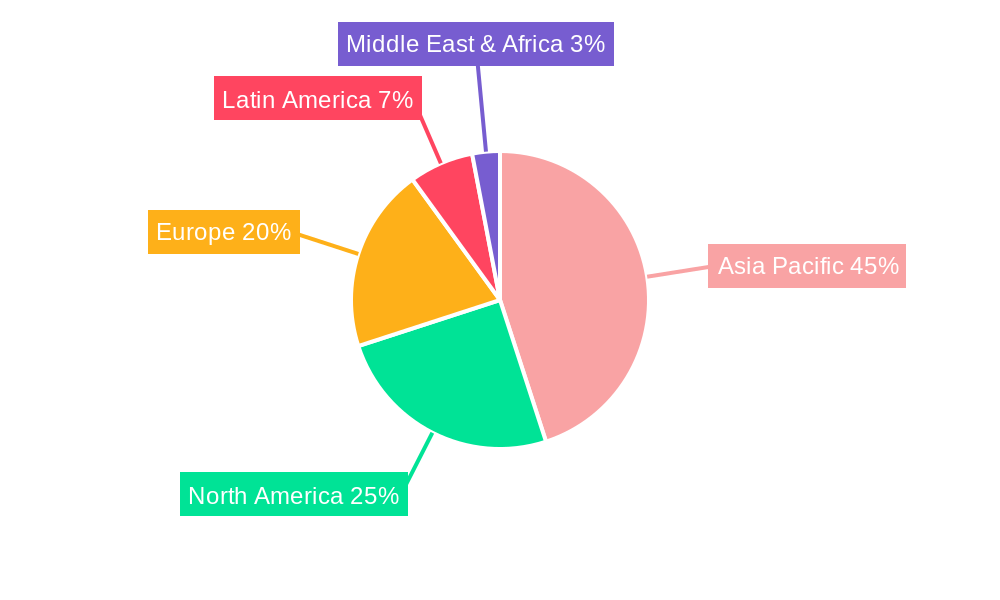

Asia-Pacific Biopesticides Market Regional Market Share

Geographic Coverage of Asia-Pacific Biopesticides Market

Asia-Pacific Biopesticides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Biofungicides is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Biopesticides Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koppert Biological Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valent Biosciences LL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coromandel International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat State Fertilizers & Chemicals Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Biolchim SPA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IPL Biologicals Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 T Stanes and Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biobest Group NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henan Jiyuan Baiyun Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Andermatt Group AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Asia-Pacific Biopesticides Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Biopesticides Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Biopesticides Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Biopesticides Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Biopesticides Market?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Asia-Pacific Biopesticides Market?

Key companies in the market include Koppert Biological Systems Inc, Valent Biosciences LL, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Biolchim SPA, IPL Biologicals Limited, T Stanes and Company Limited, Biobest Group NV, Henan Jiyuan Baiyun Industry Co Ltd, Andermatt Group AG.

3. What are the main segments of the Asia-Pacific Biopesticides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Biofungicides is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2022: The company approved the merger between Liberty Pesticides and Fertilizers Limited (LPFL) and Coromandel SQM (India) Private Limited (CSQM) (wholly-owned subsidiaries), which came into effect on April 01, 2021. This merger is anticipated to expand the company's product portfolio, including its biopesticides, in the long run.January 2022: The company announced the merger of Andermatt Biocontrol AG with Andermatt Group AG. After the merger, all companies report directly to Andermatt Group AG, increasing the effectiveness of the management and simplifying the company's structure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Biopesticides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Biopesticides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Biopesticides Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Biopesticides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence