Key Insights

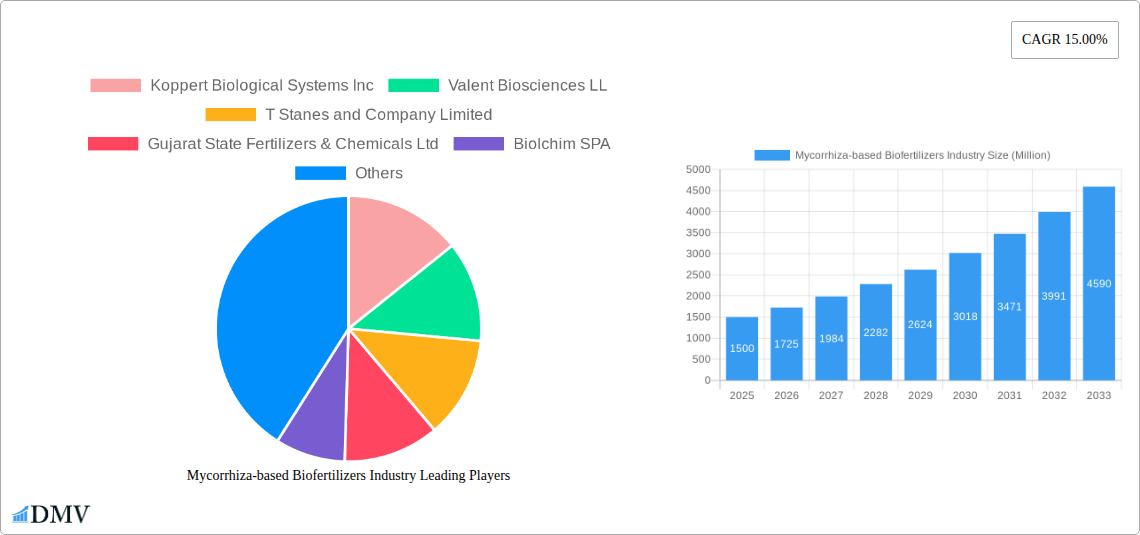

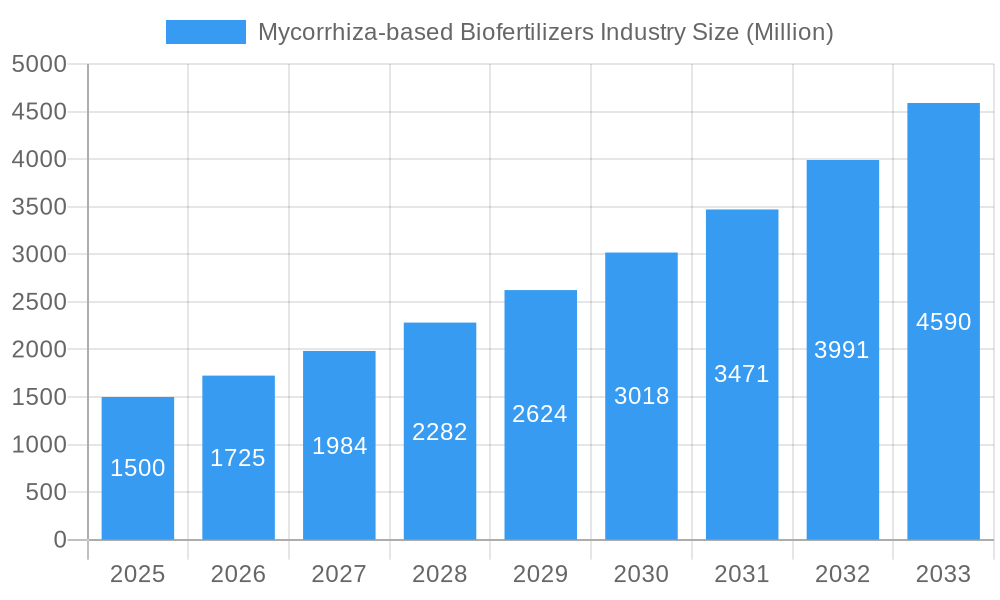

The global Mycorrhiza-based Biofertilizers market is poised for significant expansion, projected to reach a substantial market size of approximately USD 1500 million by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 15.00% through 2033. This robust growth is underpinned by several critical factors. Growing environmental consciousness among consumers and stringent regulations against synthetic fertilizer use are accelerating the adoption of sustainable agricultural practices. Farmers are increasingly recognizing the benefits of mycorrhizal fungi, which enhance nutrient uptake, improve soil health, and boost crop resilience against stress, leading to higher yields and better quality produce. This has consequently spurred substantial investment in research and development for innovative mycorrhiza-based biofertilizer formulations. The market is also benefiting from government initiatives promoting organic farming and sustainable agriculture, further incentivizing the transition away from conventional chemical inputs.

Mycorrhiza-based Biofertilizers Industry Market Size (In Billion)

The market is segmented across production analysis, consumption analysis, import/export dynamics, and price trends, all contributing to a dynamic landscape. Production analysis reveals a concentrated effort towards scaling up manufacturing capabilities to meet burgeoning demand. Consumption analysis highlights a strong uptake in key agricultural regions, driven by the desire for improved crop performance and reduced environmental impact. The import and export markets are active, reflecting global trade in these specialized biofertilizers, with value and volume considerations playing a crucial role in regional market dynamics. Price trend analysis indicates a generally stable to slightly increasing price trajectory, influenced by the cost of raw materials, production complexities, and the premium value proposition these biofertilizers offer. Key players like Koppert Biological Systems Inc. and Valent Biosciences LLC are at the forefront, investing in product innovation and expanding their market reach. Emerging economies, particularly in Asia Pacific, are demonstrating significant growth potential due to increasing agricultural modernization and a rising awareness of sustainable farming.

Mycorrhiza-based Biofertilizers Industry Company Market Share

Mycorrhiza-based Biofertilizers Industry Market Composition & Trends

The global mycorrhiza-based biofertilizers market, valued at an estimated XXX Million in the base year 2025, is characterized by moderate concentration and significant innovation. Key players like Koppert Biological Systems Inc. and Valent Biosciences LLC are driving advancements, contributing to a dynamic landscape. Regulatory frameworks are increasingly supportive of sustainable agriculture practices, acting as a crucial catalyst for market growth. While conventional fertilizers remain a substitute, the superior performance and environmental benefits of mycorrhizal inoculants are steadily eroding their market share. End-users, primarily farmers and agricultural cooperatives, are seeking enhanced crop yields, improved soil health, and reduced chemical inputs. Merger and acquisition (M&A) activities are anticipated to shape market consolidation, with recent deals indicating strategic expansions and portfolio diversification. For instance, the estimated M&A deal value is projected to reach XXX Million by 2033.

- Market Share Distribution: Dominant players hold a combined XXX% of the market, with smaller, specialized firms focusing on niche applications.

- Innovation Catalysts: Research & Development in microbial strain optimization and formulation technologies.

- Regulatory Landscape: Government incentives for organic farming and stringent regulations on synthetic fertilizer use.

- Substitute Products: Conventional chemical fertilizers, organic composts.

- End-User Profiles: Large-scale commercial farms, organic farms, horticulture, and landscape management.

- M&A Activities: Strategic acquisitions for expanding product portfolios and geographic reach.

Mycorrhiza-based Biofertilizers Industry Industry Evolution

The mycorrhiza-based biofertilizers industry has witnessed a remarkable evolution, transitioning from a niche agricultural input to a mainstream solution for sustainable crop production. Over the historical period (2019–2024), the market demonstrated a consistent upward trajectory, fueled by growing environmental consciousness and the imperative for enhanced agricultural productivity. The base year 2025 marks a significant point with an estimated market value of XXX Million, poised for substantial expansion throughout the forecast period (2025–2033). This growth is underpinned by continuous technological advancements in microbial cultivation, formulation, and application methods. Researchers are focusing on identifying and isolating novel mycorrhizal strains with superior plant growth promotion capabilities, increased stress tolerance, and enhanced nutrient solubilization. The development of advanced delivery systems, such as liquid formulations and encapsulated spores, has significantly improved ease of application and efficacy in diverse agricultural settings.

Furthermore, shifting consumer demands towards organically grown produce and a greater awareness of the detrimental effects of synthetic fertilizers have created a fertile ground for biofertilizers. Governments worldwide are implementing policies and providing subsidies to encourage the adoption of sustainable agricultural practices, directly benefiting the mycorrhiza-based biofertilizers market. The integration of mycorrhizal inoculants into integrated nutrient management (INM) programs is becoming standard practice, as farmers recognize their synergistic effects with other organic and inorganic inputs. This evolution signifies a paradigm shift in agricultural input management, moving towards eco-friendly and yield-enhancing solutions. The adoption rate of mycorrhiza-based biofertilizers has seen a Compound Annual Growth Rate (CAGR) of approximately XX% between 2019 and 2024, with projections indicating a sustained growth of XX% from 2025 to 2033. This robust growth reflects the increasing recognition of mycorrhizae's pivotal role in modern, sustainable agriculture, driving significant investments and innovations across the value chain.

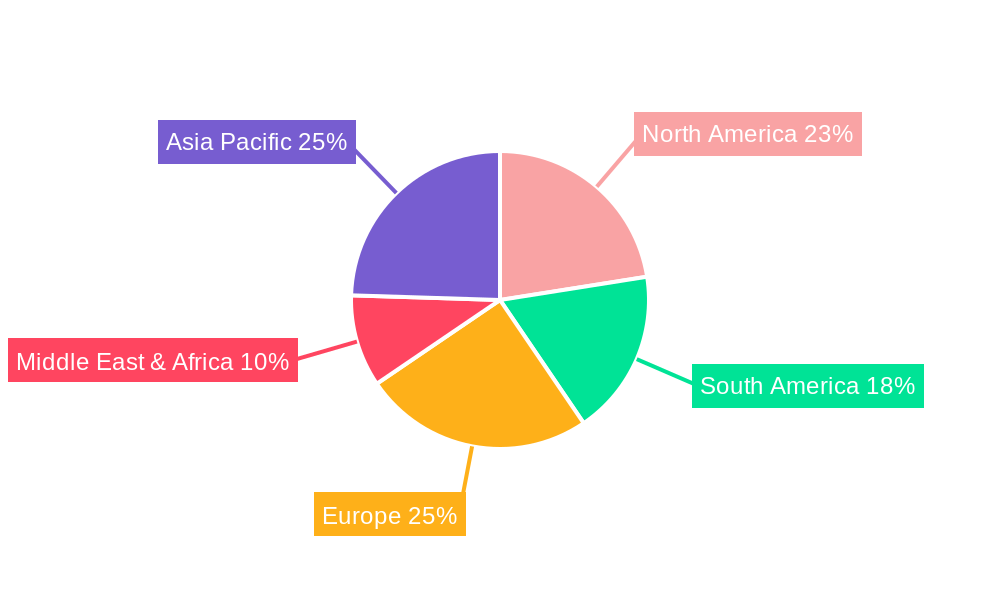

Leading Regions, Countries, or Segments in Mycorrhiza-based Biofertilizers Industry

North America and Europe currently dominate the mycorrhiza-based biofertilizers market, driven by robust R&D investments, stringent environmental regulations, and a well-established organic farming sector. Production analysis reveals a strong manufacturing base in these regions, with companies strategically located to cater to large agricultural economies. Consumption analysis also points to high adoption rates due to government support for sustainable agriculture and increasing farmer awareness of the benefits. For instance, the US and Canada contribute significantly to the North American market, while Germany and the UK lead in Europe.

The import market analysis indicates a substantial flow of mycorrhiza-based biofertilizers into regions with high agricultural output and growing demand for organic produce, such as parts of Asia and Latin America. The value of imports in North America alone is estimated to reach XXX Million by 2033. Conversely, export market analysis shows that leading manufacturers in North America and Europe are major exporters, supplying specialized microbial products globally. The export volume is projected to increase by XX% annually from 2025 to 2033. Price trend analysis suggests a steady increase in pricing due to rising raw material costs and product innovation, with an average price rise of XX% expected over the forecast period.

Key Drivers for North America's Dominance:

- Investment Trends: Significant R&D expenditure by leading companies like Valent Biosciences LLC and Koppert Biological Systems Inc.

- Regulatory Support: Government incentives for adopting sustainable agricultural practices and subsidies for biofertilizer use.

- Farmer Adoption: High awareness and adoption rates among farmers due to demonstrated yield improvements and soil health benefits.

- Large Agricultural Sector: Extensive arable land and a strong demand for high-value crops.

Key Drivers for Europe's Dominance:

- Environmental Policies: Strict regulations on synthetic fertilizer use and a strong push towards organic farming initiatives.

- Technological Advancements: Leading research institutions and companies focused on microbial innovation.

- Consumer Demand: Growing consumer preference for organic and sustainably produced food.

- EU Initiatives: Programs like the European Green Deal promoting sustainable agriculture and bio-based products.

Mycorrhiza-based Biofertilizers Industry Product Innovations

Product innovations in the mycorrhiza-based biofertilizers industry are centered on enhancing efficacy, improving shelf-life, and broadening application versatility. Novel formulations are being developed, including liquid suspensions, granulated products, and seed coatings, offering farmers greater convenience and precision in application. Research into synergistic combinations of different mycorrhizal species and beneficial bacteria aims to create multi-functional biofertilizers that not only improve nutrient uptake but also enhance plant defense mechanisms against pests and diseases. Performance metrics are being rigorously evaluated, with new products demonstrating significant improvements in root development, nutrient utilization efficiency (e.g., phosphorus and zinc), and tolerance to abiotic stresses like drought and salinity, leading to average yield increases of XX% in key crops.

Propelling Factors for Mycorrhiza-based Biofertilizers Industry Growth

The mycorrhiza-based biofertilizers industry is propelled by a confluence of powerful factors. Growing global demand for sustainable and organic food production is a primary driver, pushing farmers to adopt eco-friendly alternatives to synthetic fertilizers. Increasing environmental awareness and stricter regulations on chemical inputs further bolster this trend. Technological advancements in microbial cultivation and formulation techniques have led to more effective and user-friendly mycorrhizal products. Government initiatives and subsidies promoting sustainable agriculture and bio-inputs play a crucial role in encouraging adoption. Furthermore, the recognized benefits of mycorrhizae in improving soil health, enhancing nutrient uptake, and increasing crop resilience to environmental stresses are significant economic incentives for farmers.

Obstacles in the Mycorrhiza-based Biofertilizers Industry Market

Despite robust growth, the mycorrhiza-based biofertilizers industry faces several obstacles. A significant barrier is the lack of widespread farmer awareness and education regarding the benefits and proper application of these products, leading to skepticism and slow adoption in some regions. The perceived higher initial cost compared to conventional fertilizers can also be a deterrent. Supply chain complexities and the need for specific storage and handling conditions to maintain microbial viability present logistical challenges. Furthermore, the regulatory landscape, while increasingly supportive, can still be fragmented and vary across different countries, creating hurdles for market entry and product registration. Competition from established synthetic fertilizer markets and potential product standardization issues also pose challenges.

Future Opportunities in Mycorrhiza-based Biofertilizers Industry

Emerging opportunities for the mycorrhiza-based biofertilizers industry are abundant and span across new markets, technological frontiers, and evolving consumer preferences. Expansion into developing economies with a growing agricultural sector and increasing focus on food security presents a significant growth avenue. The development of tailored mycorrhizal formulations for specific crops and diverse soil types will cater to niche market demands. Advancements in precision agriculture and smart farming technologies offer opportunities for integrated application of biofertilizers, enhancing their efficiency and effectiveness. Consumer demand for traceable and sustainably produced food will continue to drive the adoption of mycorrhiza-based solutions. Moreover, research into symbiotic relationships with other beneficial microorganisms can lead to the development of next-generation bio-inputs with enhanced functionalities.

Major Players in the Mycorrhiza-based Biofertilizers Industry Ecosystem

- Koppert Biological Systems Inc.

- Valent Biosciences LLC

- T Stanes and Company Limited

- Gujarat State Fertilizers & Chemicals Ltd

- Biolchim SPA

- Suståne Natural Fertilizer Inc.

- Symborg Inc.

- Atlántica Agrícola

- Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- Biostadt India Limited

Key Developments in Mycorrhiza-based Biofertilizers Industry Industry

- June 2022: Valent BioSciences LLC confirmed its approval for a substantial expansion of its biorational manufacturing facility in Osage, Iowa, aimed at meeting the surging demand for its biorational products and accommodating new product introductions requiring increased capacity.

- March 2021: Symborg inaugurated a new hydrolysis plant in Spain, representing a total investment of USD 28.0 million. This facility is engineered for the production of sustainable agricultural solutions, including mycorrhiza-based biofertilizer solutions destined for the US market.

- February 2021: Koppert introduced VICI MYCO D, a biofertilizer product formulated with microorganisms that actively support root initiation and development immediately after crop planting, facilitating mineral resource exploitation and enhancing tolerance to abiotic stresses.

Strategic Mycorrhiza-based Biofertilizers Industry Market Forecast

The strategic outlook for the mycorrhiza-based biofertilizers industry is exceptionally positive, driven by a confluence of sustainable agriculture imperatives and technological advancements. The forecast period (2025–2033) is anticipated to witness sustained high growth rates, exceeding XX% annually. Key growth catalysts include the increasing global emphasis on food security coupled with environmental protection, leading to a paradigm shift in agricultural practices. Government support, through subsidies and favorable policies, will continue to be a significant driver for adoption. Innovations in product formulation and application technologies will enhance user convenience and efficacy, expanding market reach. The growing consumer preference for organic and sustainably produced food will further bolster demand, creating a robust market for mycorrhiza-based biofertilizers as an integral component of modern, eco-conscious agriculture.

Mycorrhiza-based Biofertilizers Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Mycorrhiza-based Biofertilizers Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mycorrhiza-based Biofertilizers Industry Regional Market Share

Geographic Coverage of Mycorrhiza-based Biofertilizers Industry

Mycorrhiza-based Biofertilizers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Row Crops is the largest Crop Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Mycorrhiza-based Biofertilizers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Koppert Biological Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Valent Biosciences LL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 T Stanes and Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gujarat State Fertilizers & Chemicals Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biolchim SPA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Suståne Natural Fertilizer Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Symborg Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlántica Agrícola

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biostadt India Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Global Mycorrhiza-based Biofertilizers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Mycorrhiza-based Biofertilizers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Mycorrhiza-based Biofertilizers Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mycorrhiza-based Biofertilizers Industry?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Mycorrhiza-based Biofertilizers Industry?

Key companies in the market include Koppert Biological Systems Inc, Valent Biosciences LL, T Stanes and Company Limited, Gujarat State Fertilizers & Chemicals Ltd, Biolchim SPA, Suståne Natural Fertilizer Inc, Symborg Inc, Atlántica Agrícola, Indogulf BioAg LLC (Biotech Division of Indogulf Company), Biostadt India Limited.

3. What are the main segments of the Mycorrhiza-based Biofertilizers Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Row Crops is the largest Crop Type.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

June 2022: Valent BioSciences LLC confirmed that it approved a big expansion of its biorational manufacturing facility in Osage, Iowa, to meet the rising demand for its biorational products and introduce new products that will necessitate more capacity.March 2021: Symborg opened a new hydrolysis plant in Spain, with a total investment of USD 28.0 million. The plant is designed for the manufacturing of sustainable products for agriculture, such as biofertilizer (mycorrhiza-based) solutions that are imported to the US market.February 2021: Koppert developed a biofertilizer product called VICI MYCO D, which is based on microorganisms and contributes to the start and development of the roots of plants as soon as crops are planted. It helps in exploiting mineral resources and improves tolerance to abiotic stresses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mycorrhiza-based Biofertilizers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mycorrhiza-based Biofertilizers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mycorrhiza-based Biofertilizers Industry?

To stay informed about further developments, trends, and reports in the Mycorrhiza-based Biofertilizers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence