Key Insights

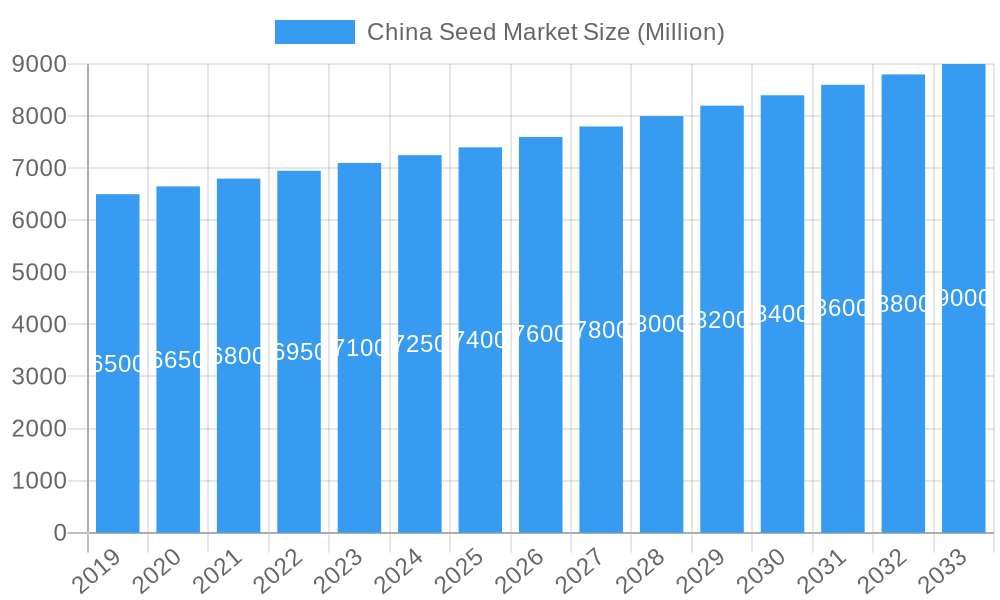

The China Seed Market is projected to reach a market size of USD 12.26 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.85% during the forecast period of 2025-2033. This growth is propelled by the escalating demand for high-yield, disease-resistant crop varieties to bolster food security for China's substantial population. Key drivers include government-led agricultural modernization initiatives and advancements in seed breeding technologies like genetic modification and marker-assisted selection. Growing farmer awareness of the economic benefits associated with improved seed technologies is also fostering increased adoption rates. Furthermore, rising consumer demand for diverse and premium agricultural produce fuels continuous innovation in seed development to meet evolving dietary preferences and quality standards.

China Seed Market Market Size (In Billion)

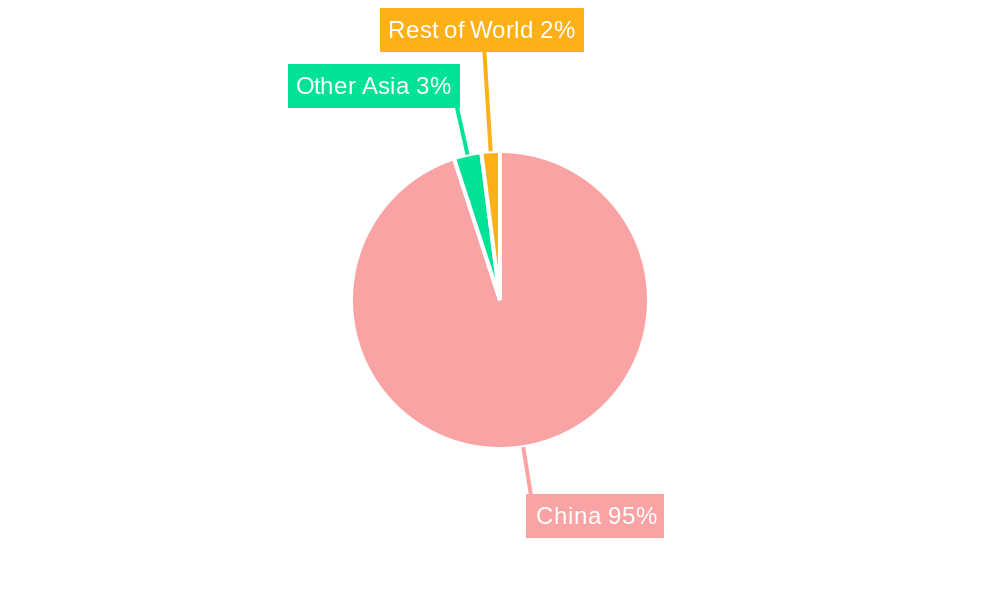

The market is marked by significant competition from both domestic and international entities, including Sakata Seeds Corporation, Syngenta Group, and Yuan Longping High-Tech Agriculture Co Ltd. Production focuses on expanding arable land and optimizing farming practices. Consumption patterns indicate a strong preference for seeds offering enhanced nutritional content, faster growth cycles, and greater resilience to adverse climatic conditions. While imports remain crucial for specialized hybrid seeds, China's domestic seed industry is increasingly meeting internal demand, with notable export potential in specific segments. Price trends are anticipated to remain stable, influenced by efficiency-driving technological advancements in seed production, alongside fluctuations in raw material costs and global agricultural commodity prices. Market expansion is supported by policy reforms and extension services addressing restraints such as stringent regulatory approvals for genetically modified seeds and the need for enhanced farmer education on advanced seed technologies.

China Seed Market Company Market Share

This comprehensive report offers an authoritative and actionable analysis of the China Seed Market, a vital sector for agricultural productivity and food security. It details production trends, consumption patterns, import-export dynamics, and price fluctuations from 2019 to 2033, with a focus on the Base Year 2025 and a Forecast Period of 2025-2033. The report examines market composition, the evolving industry landscape, leading regional players, and groundbreaking product innovations. We dissect the Chinese agricultural seed industry, highlighting key growth drivers, emerging challenges, and strategic future opportunities. This research is essential for agribusiness leaders, investors, policymakers, and researchers seeking a definitive understanding of this dynamic market.

China Seed Market Market Composition & Trends

The China Seed Market exhibits a dynamic composition, characterized by increasing consolidation and a strong emphasis on technological innovation. Market concentration is influenced by government policies promoting modern agriculture and the strategic expansion of major players. Innovation catalysts include advancements in genetic engineering, biotechnology, and precision agriculture, driving the development of high-yielding, disease-resistant, and climate-resilient seed varieties. The regulatory landscape plays a crucial role, with evolving intellectual property rights and biosafety regulations shaping market entry and product development. Substitute products, while present in traditional seed varieties, are increasingly being outcompeted by genetically modified and hybrid seeds offering superior performance. End-user profiles are diverse, ranging from large-scale commercial farms seeking efficiency gains to smallholder farmers benefiting from improved crop yields. Merger and acquisition (M&A) activities are a significant trend, with companies strategically acquiring smaller entities to expand their product portfolios, geographic reach, and technological capabilities. For instance, recent acquisitions by global giants aim to secure a stronger foothold in the vast Chinese market, driving seed market growth. The market share distribution is increasingly tilting towards companies with robust R&D capabilities and integrated supply chains. M&A deal values are projected to escalate as companies vie for leadership in this burgeoning sector. The China vegetable seed market and China grain seed market are particularly dynamic segments.

China Seed Market Industry Evolution

The China Seed Market has undergone a remarkable transformation, evolving from a fragmented sector reliant on traditional varieties to a sophisticated ecosystem driven by scientific advancements and strategic foreign investment. Over the Historical Period (2019-2024), we've witnessed a steady upward trajectory in market growth, fueled by government initiatives aimed at enhancing agricultural self-sufficiency and modernizing farming practices. This evolution is deeply intertwined with technological advancements, particularly in the realm of biotechnology and genetic modification. The adoption of hybrid seeds and, more recently, genetically modified (GM) crops has significantly boosted crop yields and improved resistance to pests and diseases, contributing to an average annual growth rate of approximately 6.5% during this period. Shifting consumer demands, including a growing preference for higher quality and safer food products, have also propelled the need for superior seed varieties. This has led to increased investment in research and development for seeds that offer enhanced nutritional profiles and reduced reliance on chemical inputs. The China hybrid seed market has been a major beneficiary of these trends. Furthermore, the integration of digital technologies, such as precision agriculture and data analytics, is beginning to reshape seed selection and application, promising further efficiency gains. The China corn seed market and China rice seed market are at the forefront of these technological integrations. The market is projected to continue its robust growth, with an estimated CAGR of 7.0% during the Forecast Period (2025-2033), driven by ongoing innovation and policy support. The Chinese agricultural input market as a whole is experiencing this dynamic evolution.

Leading Regions, Countries, or Segments in China Seed Market

The China Seed Market is characterized by distinct regional and segmental dominance, driven by a confluence of factors including agricultural infrastructure, government support, and market demand. In terms of Production Analysis, the Northeast region, historically known as China's breadbasket, remains a dominant force in grain seed production, particularly for corn and soybeans. This dominance is supported by vast arable land and established agricultural research institutions. For Consumption Analysis, the eastern and southern coastal regions, with their higher population density and greater demand for diverse food crops, lead in vegetable seed consumption. The Import Market Analysis (Value & Volume) is significantly influenced by the demand for specialized and high-performing vegetable seeds, as well as certain traits in field crops that are still under development domestically. While China aims for self-sufficiency, imports play a vital role in introducing advanced genetics, particularly for crops like tomatoes, peppers, and specific hybrid corn varieties. The Export Market Analysis (Value & Volume) is gradually expanding, with Chinese companies increasingly offering competitive seed varieties for certain field crops and vegetables to Southeast Asian and African markets. The Price Trend Analysis reveals that hybrid and genetically modified seeds command higher prices due to their superior yield potential and resilience, while conventional seeds maintain a more stable price point. The China soybean seed market and China vegetable seed market are key segments witnessing significant growth.

- Dominant Region (Production): Northeast China.

- Key Drivers: Extensive agricultural land, favorable climate for staple crops, strong government support for grain production, established seed breeding programs.

- Dominant Region (Consumption): Eastern and Southern Coastal China.

- Key Drivers: High population density, diverse dietary preferences, strong demand for fresh produce, advanced agricultural practices in peri-urban areas.

- Key Segment (Value Growth): Vegetable Seeds.

- Key Drivers: Increasing consumer demand for variety and quality, technological advancements in greenhouse cultivation, focus on specialty crops, and rising disposable incomes.

- Import Market Drivers: Introduction of novel traits, high-performing hybrid varieties for corn and rice, specialized vegetable seeds with improved shelf-life and disease resistance.

- Export Market Drivers: Cost-competitiveness, growing demand for certain hybrid field crop seeds in developing economies, increasing quality of Chinese seed varieties.

China Seed Market Product Innovations

Product innovations in the China Seed Market are primarily focused on enhancing crop yield, improving disease and pest resistance, and adapting to diverse environmental conditions. Companies are heavily investing in research and development to introduce high-yielding hybrid varieties of staple crops like corn, rice, and wheat, alongside specialized vegetable seeds with improved flavor, nutritional content, and shelf-life. The integration of biotechnology, including gene editing and marker-assisted selection, is accelerating the development of traits such as drought tolerance, salinity resistance, and enhanced nutrient uptake. For instance, the introduction of Enlist E3 technology in soybean seeds demonstrates a commitment to providing farmers with solutions for effective weed management and increased productivity. Performance metrics such as yield increase percentages, reduced input requirements (e.g., pesticides, fertilizers), and enhanced crop quality are key selling propositions for these innovative products. The China genetically modified seed market is poised for significant expansion with the continuous stream of R&D breakthroughs.

Propelling Factors for China Seed Market Growth

Several key factors are propelling the growth of the China Seed Market. Technologically, advancements in genetic engineering, hybrid breeding, and biotechnology are leading to the development of seeds with superior yields, enhanced resilience to climate change and pests, and improved nutritional value. Economically, China's large agricultural base, increasing demand for food security, and rising disposable incomes supporting the consumption of higher-quality produce are significant drivers. Government policies, including substantial investments in agricultural research and development, subsidies for modern farming practices, and initiatives to boost domestic seed production, are creating a favorable environment for market expansion. Furthermore, the increasing adoption of precision agriculture techniques is driving the demand for specialized seeds tailored to specific farming conditions. The China agricultural technology market is intrinsically linked to this growth.

Obstacles in the China Seed Market Market

Despite its robust growth, the China Seed Market faces several obstacles. Regulatory hurdles and the evolving intellectual property rights landscape can create complexities for both domestic and international players. Supply chain disruptions, exacerbated by logistical challenges and the impact of global events, can affect the availability and timely delivery of high-quality seeds. Intense competitive pressures from both established multinational corporations and a growing number of domestic seed companies can impact profit margins. Furthermore, the slow adoption of certain advanced seed technologies in some rural areas due to cost or lack of awareness can hinder market penetration. The China seed industry challenges include ensuring equitable access to innovation.

Future Opportunities in China Seed Market

The China Seed Market presents numerous future opportunities. The ongoing expansion of the China genetically modified seed market, with increasing government approval for new GM crops, offers significant potential for yield enhancement and resource efficiency. The growing demand for organic and sustainably produced food will drive opportunities for seeds that require fewer chemical inputs. Emerging technologies like drone-based seed deployment and AI-powered seed selection represent new frontiers for innovation and market penetration. Furthermore, the increasing focus on specialty crops and niche markets within the China vegetable seed market will create demand for tailored seed solutions. The Belt and Road Initiative also opens avenues for Chinese seed companies to expand their presence in international markets.

Major Players in the China Seed Market Ecosystem

- Sakata Seeds Corporation

- Beidahuang Kenfeng Seed Co Ltd

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- Yuan Longping High-Tech Agriculture Co Lt

- Syngenta Group

- Anhui Tsuen Yin Hi-Tech Seed Industry Co Ltd

- BASF SE

- Groupe Limagrain

- East-West Seed

- Bejo Zaden BV

Key Developments in China Seed Market Industry

- July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds, enhancing the China soybean seed market.

- April 2023: Syngenta Seeds and Ginkgo Bioworks collaborated to develop new traits for the next generation of seed technology to produce healthier and more resilient crops, impacting the China agricultural seed industry.

- April 2023: Syngenta acquired a vegetable seed-producing company in Brazil, Feltrin Seeds, which serves customers in over 40 countries. The acquisition is estimated to spread the product portfolio of Syngenta in all vegetable-producing countries in the world, bolstering the China vegetable seed market.

Strategic China Seed Market Market Forecast

The China Seed Market is strategically positioned for sustained and accelerated growth, driven by a confluence of factors that include ongoing technological advancements in breeding and biotechnology, increasing governmental support for agricultural modernization, and a rapidly expanding domestic and international demand for higher-quality and more resilient food crops. The forecast period of 2025–2033 is expected to witness a significant surge in the adoption of genetically modified and hybrid seeds, particularly in staple crops like corn and soybeans, as well as in the high-value vegetable seed segment. Continued investment in research and development by leading global and domestic players will introduce innovative solutions for climate resilience, pest resistance, and enhanced nutritional profiles, further stimulating market expansion. The increasing emphasis on food security and sustainable agricultural practices will underpin the market's upward trajectory, making the China seed industry a crucial component of global agricultural innovation.

China Seed Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Seed Market Segmentation By Geography

- 1. China

China Seed Market Regional Market Share

Geographic Coverage of China Seed Market

China Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sakata Seeds Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beidahuang Kenfeng Seed Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yuan Longping High-Tech Agriculture Co Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Syngenta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Anhui Tsuen Yin Hi-Tech Seed Industry Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Limagrain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East-West Seed

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bejo Zaden BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sakata Seeds Corporation

List of Figures

- Figure 1: China Seed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Seed Market Share (%) by Company 2025

List of Tables

- Table 1: China Seed Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Seed Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Seed Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Seed Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Seed Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Seed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: China Seed Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: China Seed Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Seed Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Seed Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Seed Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Seed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Seed Market?

The projected CAGR is approximately 2.85%.

2. Which companies are prominent players in the China Seed Market?

Key companies in the market include Sakata Seeds Corporation, Beidahuang Kenfeng Seed Co Ltd, Rijk Zwaan Zaadteelt en Zaadhandel BV, Yuan Longping High-Tech Agriculture Co Lt, Syngenta Group, Anhui Tsuen Yin Hi-Tech Seed Industry Co Ltd, BASF SE, Groupe Limagrain, East-West Seed, Bejo Zaden BV.

3. What are the main segments of the China Seed Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds.April 2023: Syngenta Seeds and Ginkgo Bioworks collaborated to develop new traits for the next generation of seed technology to produce healthier and more resilient crops.April 2023: Syngenta acquired a vegetable seed-producing company in Brazil, Feltrin Seeds, which serves customers in over 40 countries. The acquisition is estimated to spread the product portfolio of Syngenta in all vegetable-producing countries in the world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Seed Market?

To stay informed about further developments, trends, and reports in the China Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence