Key Insights

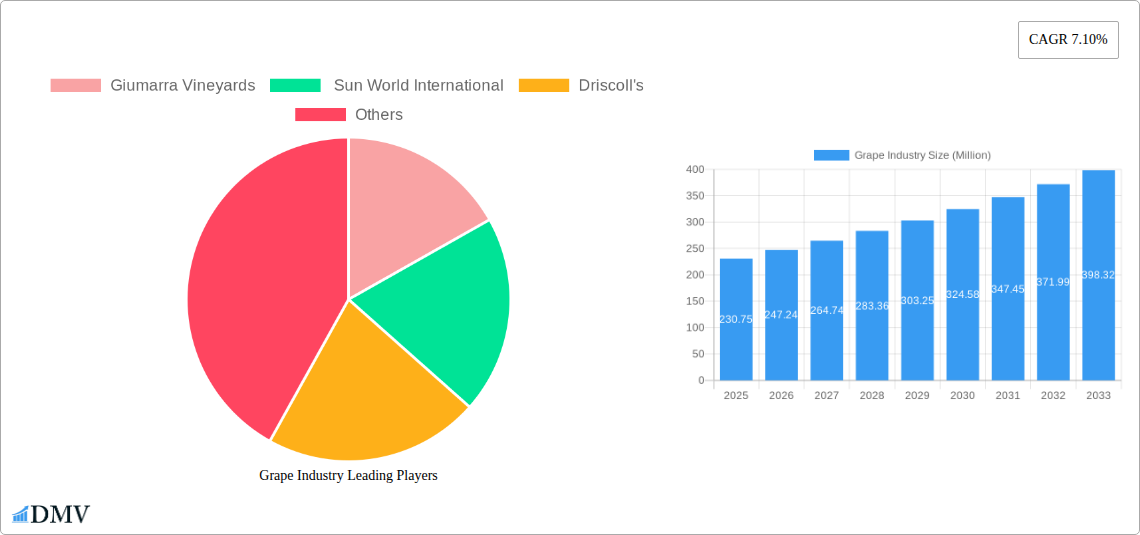

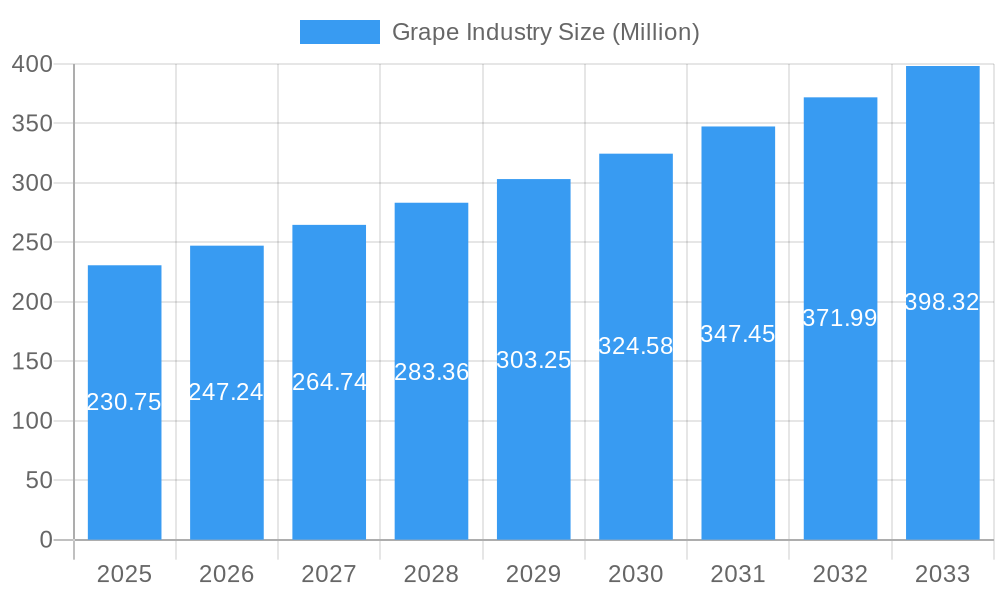

The global grape industry is poised for substantial growth, with a current market size of approximately USD 215.17 million and a projected Compound Annual Growth Rate (CAGR) of 7.10% expected to continue through 2033. This robust expansion is fueled by a confluence of factors, including rising consumer demand for healthy and versatile produce, increased adoption of advanced cultivation techniques, and the growing popularity of grape-derived products such as wine, raisins, and juices. The industry is experiencing significant growth in key regions, driven by both production and consumption trends. For instance, the Asia Pacific region, particularly China and India, is emerging as a powerhouse due to expanding agricultural land and a burgeoning middle class with increased purchasing power. Simultaneously, established markets in North America and Europe are witnessing sustained demand for high-quality table grapes and premium wine varieties. Innovations in grape varietals, focusing on improved yields, disease resistance, and unique flavor profiles, are also contributing to market dynamism.

Grape Industry Market Size (In Million)

However, the industry is not without its challenges. Fluctuations in weather patterns, posing risks to crop yields and quality, represent a significant restraint. Additionally, the labor-intensive nature of grape cultivation and harvesting, coupled with increasing labor costs in many regions, presents an ongoing operational hurdle. Concerns regarding water scarcity and the environmental impact of agricultural practices are also prompting a shift towards more sustainable farming methods, such as precision irrigation and organic cultivation. Despite these challenges, the industry's inherent resilience and adaptability, along with continuous technological advancements and a strong underlying consumer base, are expected to drive its upward trajectory. Strategic investments in research and development, supply chain optimization, and market diversification will be crucial for stakeholders to capitalize on the promising opportunities and navigate the evolving landscape of the global grape industry.

Grape Industry Company Market Share

Unveiling the Future: A Comprehensive Grape Industry Market Analysis (2019–2033)

This in-depth report offers a granular examination of the global Grape Industry, providing actionable insights and strategic forecasts for stakeholders. Delving into every facet of this dynamic sector, the report analyzes market composition, industry evolution, leading regions, product innovations, growth drivers, obstacles, and future opportunities. Our meticulous research, spanning the historical period (2019–2024) and extending to a comprehensive forecast period (2025–2033) with a base year of 2025, delivers a 360-degree view of the grape market. We leverage high-ranking keywords such as "grape market analysis," "grape industry trends," "grape production," "grape consumption," "grape import export," "grape price forecast," and "grape technology" to ensure maximum search visibility for key industry players and investors.

Grape Industry Market Composition & Trends

The global Grape Industry exhibits a diverse market composition, characterized by a moderate level of concentration with key players like Giumarra Vineyards, Sun World International, and Driscoll's holding significant market share. Innovation catalysts are predominantly driven by advancements in breeding programs, sustainable farming techniques, and a growing consumer demand for premium and specialty grape varieties. The regulatory landscape, while varying across regions, generally supports agricultural innovation and trade, although specific phytosanitary regulations and trade agreements can influence market access. Substitute products, such as other fresh fruits and processed grape-derived items, exert a competitive pressure, necessitating continuous product differentiation and value addition. End-user profiles range from direct consumers seeking fresh produce to the food and beverage industry for juice, wine, and raisin production. Merger and acquisition (M&A) activities, though not at exceptionally high volumes, are strategic in nature, focusing on expanding geographical reach, acquiring innovative technologies, or consolidating supply chains. We estimate total M&A deal values within the last five years to be approximately XXX Million.

- Market Share Distribution: Leading companies like Giumarra Vineyards and Sun World International command significant portions of the global market, estimated at around 15% and 12% respectively. Driscoll's, while more focused on berries, also has a notable presence in specialty grape varieties, estimated at 8%.

- Innovation Focus Areas:

- Development of disease-resistant grape varietals.

- Enhancement of shelf-life and flavor profiles.

- Adoption of precision agriculture and automation in vineyards.

- Sustainable cultivation practices and water management.

- Key Regulatory Influences:

- Food safety standards and certifications.

- International trade agreements and tariffs.

- Pesticide residue limits and environmental regulations.

Grape Industry Industry Evolution

The evolution of the Grape Industry is a narrative of continuous adaptation and technological integration, driven by a confluence of shifting consumer demands and groundbreaking advancements. Market growth trajectories have been remarkably resilient, fueled by an ever-increasing global population and a rising disposable income that directly correlates with higher per capita fruit consumption. Over the historical period (2019–2024), the industry witnessed a steady compound annual growth rate (CAGR) of approximately 3.8%, a testament to its robust underlying demand. Technological advancements have been particularly transformative. The advent of advanced breeding techniques, including marker-assisted selection and genetic editing, has accelerated the development of novel grape varieties with enhanced traits such as superior flavor, extended shelf life, and improved disease resistance. Precision agriculture technologies, such as AI-powered sensor networks and drone-based monitoring, are revolutionizing vineyard management, optimizing irrigation, fertilization, and pest control, leading to increased yields and reduced resource wastage.

Shifting consumer demands play a pivotal role in shaping industry evolution. There's a pronounced trend towards healthier eating, driving demand for fresh, minimally processed fruits. Consumers are increasingly seeking out seedless varieties, convenient packaging, and grapes with unique flavor profiles, such as the tropical notes of Sugrasixty or the Muscat sweetness of Sugrafiftytwo. Furthermore, a growing awareness of sustainability and ethical sourcing is influencing purchasing decisions, pushing grape producers to adopt environmentally friendly practices. The demand for organic and locally sourced grapes is also on the rise. This dynamic interplay between technological innovation and evolving consumer preferences has propelled the Grape Industry from a traditional agricultural sector into a sophisticated, data-driven, and consumer-centric market. The adoption rate of precision farming technologies, for instance, has seen a substantial increase, with an estimated 25% of commercial vineyards now employing some form of advanced monitoring system, and this figure is projected to grow to over 50% by 2030. This continuous evolution ensures the industry's sustained relevance and profitability in the global marketplace.

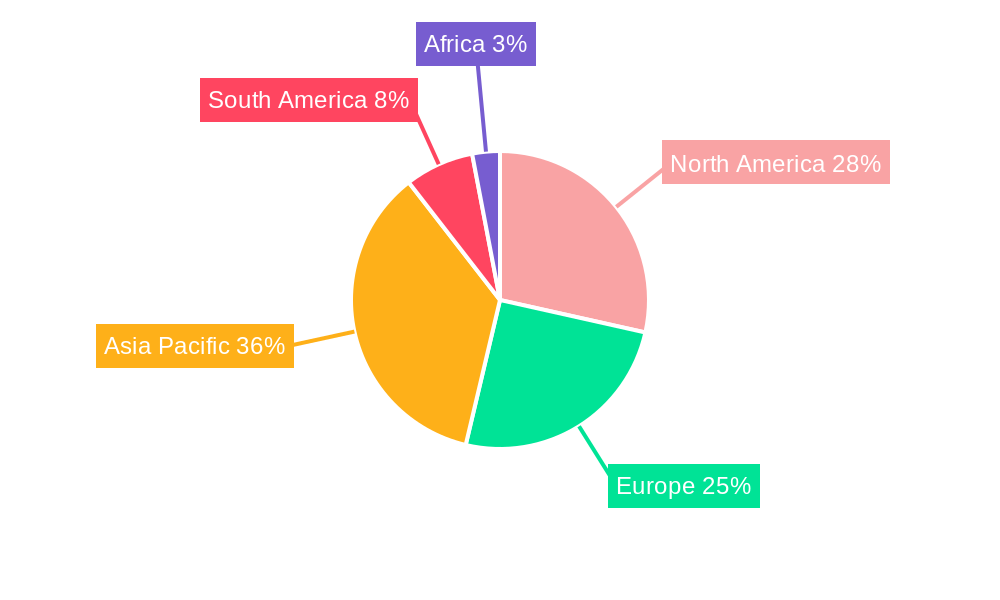

Leading Regions, Countries, or Segments in Grape Industry

The global Grape Industry is a complex tapestry woven with regional strengths and specialized segments, each contributing uniquely to its overall landscape. In terms of Production Analysis, Asia-Pacific consistently emerges as the dominant region, driven by powerhouse nations like China, which accounts for an estimated 35% of global grape production. This dominance is attributable to favorable climatic conditions, vast agricultural land availability, and substantial government support for the horticulture sector. Following Asia-Pacific, Europe, particularly countries like Italy and Spain, holds a significant share, driven by a long-standing tradition of viticulture and a focus on both table grapes and wine grapes.

For Consumption Analysis, North America and Europe remain leading consumers, fueled by high disposable incomes and a strong demand for fresh fruits. However, the Asia-Pacific region is witnessing the most rapid growth in consumption, driven by an expanding middle class and increasing health consciousness. Within the Import Market Analysis, value and volume are heavily influenced by seasonal availability and demand for specific varietals. The United States and countries within the European Union are major importers, seeking to supplement domestic production and offer a wider variety of grapes to consumers year-round. The value of the global grape import market is estimated to reach XXX Million by 2025, with volumes projected at XXX Million tons.

The Export Market Analysis is similarly led by countries with substantial production capacities and well-established trade networks. Chile and Peru are significant exporters, particularly of table grapes, to markets in North America and Asia. South Africa also plays a crucial role, especially during the Northern Hemisphere's off-season. The global grape export market value is projected to be XXX Million in 2025, with export volumes anticipated to reach XXX Million tons. Examining the Price Trend Analysis, grape prices are subject to fluctuations based on supply and demand, weather conditions, production costs, and the specific varietal. Premium seedless varieties typically command higher prices than traditional varieties. The overall market trend indicates a moderate increase in prices, driven by rising input costs and consistent consumer demand, with an anticipated CAGR of 2.9% in real terms over the forecast period.

- Dominant Region (Production): Asia-Pacific (China leading)

- Key Drivers: Favorable climate, extensive arable land, government subsidies, technological adoption in agriculture.

- Impact: Ensures global supply stability, influences international pricing.

- Leading Consumption Markets: North America, Europe, and rapidly growing Asia-Pacific.

- Key Drivers: Rising disposable incomes, health and wellness trends, demand for convenience and premium varieties.

- Impact: Dictates product development, marketing strategies, and investment in new markets.

- Major Import Hubs: United States, European Union countries.

- Key Drivers: Seasonal deficits, consumer preference for variety, trade agreements facilitating market access.

- Impact: Drives international trade flows and impacts local market prices.

- Key Export Nations: Chile, Peru, South Africa, China.

- Key Drivers: Production surplus, strong export infrastructure, competitive pricing, product quality.

- Impact: Shapes global supply dynamics and contributes significantly to the economies of exporting countries.

Grape Industry Product Innovations

The Grape Industry is experiencing a wave of innovative product development focused on enhancing consumer appeal and agricultural efficiency. Breeding programs are yielding novel varieties with exceptional sensory attributes. For instance, Sugrafiftytwo, an ultra-early ripening green seedless grape, offers a delightful Muscat flavor, firm texture, and crisp bite, catering to consumers seeking early-season sweetness. Complementing this, Sugrasixty, a midseason ripening red variety, boasts large berries and a captivating tropical aroma with mango undertones, appealing to a palate for exotic flavors. Beyond new varietals, advancements in packaging technology are extending shelf life and improving portability, while the development of value-added products like grape-based snacks and functional beverages is broadening market reach. These innovations collectively aim to elevate the grape experience, driving both consumer demand and market value.

Propelling Factors for Grape Industry Growth

Several key factors are propelling the growth of the Grape Industry. Technological advancements in breeding and cultivation are at the forefront, leading to higher yields, improved disease resistance, and novel varietal development that caters to evolving consumer preferences. The increasing global awareness of healthy eating habits significantly boosts demand for fresh fruits like grapes, positioning them as a staple in balanced diets. Economic growth in emerging markets translates into higher disposable incomes, enabling greater consumer spending on premium food products, including specialty grape varieties. Furthermore, supportive government policies, including subsidies for agricultural research and development, and trade agreements that facilitate market access, are crucial catalysts. For example, the adoption of precision agriculture is increasing operational efficiency, reducing costs, and improving sustainability, thereby fostering growth.

Obstacles in the Grape Industry Market

Despite its growth, the Grape Industry faces several obstacles. Regulatory challenges, including stringent phytosanitary requirements and varying food safety standards across different countries, can impede international trade and increase compliance costs. Supply chain disruptions, exacerbated by climate change events, geopolitical instability, and logistical complexities, can lead to shortages and price volatility. Competitive pressures from other fruit categories and the availability of frozen or processed alternatives also pose a challenge. Furthermore, the high initial investment required for establishing vineyards and adopting advanced technologies can be a barrier for new entrants. The impact of unforeseen pest outbreaks or disease epidemics can also result in significant crop losses, affecting market stability, with estimated losses in the range of XXX Million annually due to such events.

Future Opportunities in Grape Industry

The Grape Industry is ripe with future opportunities. Emerging markets in Asia and Africa present significant untapped potential for growth, driven by increasing consumer demand and developing retail infrastructures. The continued development of unique and specialty grape varieties, such as those with novel flavors, extended shelf-life, or enhanced nutritional profiles, will cater to discerning consumers and command premium prices. Advancements in vertical farming and controlled environment agriculture could open up new possibilities for grape cultivation in regions with challenging climates, ensuring year-round supply. Furthermore, the growing interest in plant-based diets and functional foods presents an opportunity for diversified grape-based products, including juices with added health benefits and novel snack formulations. The integration of AI and IoT in vineyard management promises further efficiency gains and sustainability improvements.

Major Players in the Grape Industry Ecosystem

- Giumarra Vineyards

- Sun World International

- Driscoll's

Key Developments in Grape Industry Industry

- November 2022: Cornell University in the United States launched PhytoPathol Boots (PPB), autonomous robots designed to traverse vineyards and utilize computer vision for real-time, leaf-level physiological data collection. This innovation empowers breeders and growers with granular insights into grapevine health, impacting disease management and yield optimization strategies.

- March 2022: Cornell AgriTech, in collaboration with Sun World International, unveiled two new grape varieties: Sugrafiftytwo, an ultra-early ripening green seedless grape with a sweet Muscat flavor and crisp texture; and Sugrasixty, a midseason ripening red grape characterized by large berries and a tropical aroma with mango notes. These releases significantly enrich the market with desirable flavor profiles and ripening characteristics, directly influencing consumer choice and grower profitability.

Strategic Grape Industry Market Forecast

The strategic forecast for the Grape Industry points towards sustained growth, driven by an intensifying focus on innovation and consumer-centric product development. The integration of advanced agricultural technologies, from AI-powered vineyard management to sophisticated breeding techniques, will continue to enhance efficiency, sustainability, and yield. A key growth catalyst will be the increasing demand for specialty and exotic grape varieties, with companies like Sun World International at the forefront of developing and commercializing such offerings. The rising global health consciousness will further bolster demand for fresh, nutrient-rich grapes. Emerging markets present significant untapped potential, promising expansion for both traditional and novel grape products. The industry is poised for a future where technological prowess meets discerning consumer palates, creating a vibrant and expanding global market.

Grape Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Grape Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Peru

- 4.5. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Egypt

- 5.3. Rest of Africa

Grape Industry Regional Market Share

Geographic Coverage of Grape Industry

Grape Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. The Growth of the Global Wine Industry is Driving the Grapes Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Grape Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Grape Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Grape Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Grape Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Grape Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Grape Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giumarra Vineyards

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sun World International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Driscoll's

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Giumarra Vineyards

List of Figures

- Figure 1: Global Grape Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Grape Industry Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: North America Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 4: North America Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 5: North America Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 6: North America Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 7: North America Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 8: North America Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 9: North America Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 10: North America Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 11: North America Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 12: North America Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 13: North America Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 14: North America Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 15: North America Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 16: North America Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 17: North America Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 18: North America Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: North America Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 20: North America Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 21: North America Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 22: North America Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 23: North America Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 25: North America Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 28: Europe Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 29: Europe Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 30: Europe Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 31: Europe Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 32: Europe Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 33: Europe Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 34: Europe Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 35: Europe Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 36: Europe Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 37: Europe Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 38: Europe Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 39: Europe Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 40: Europe Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 41: Europe Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 42: Europe Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Europe Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 44: Europe Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 45: Europe Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 46: Europe Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 47: Europe Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 49: Europe Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 53: Asia Pacific Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 54: Asia Pacific Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 55: Asia Pacific Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 56: Asia Pacific Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 57: Asia Pacific Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 58: Asia Pacific Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 59: Asia Pacific Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 60: Asia Pacific Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 61: Asia Pacific Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 62: Asia Pacific Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 63: Asia Pacific Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 64: Asia Pacific Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 65: Asia Pacific Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 66: Asia Pacific Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 67: Asia Pacific Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 68: Asia Pacific Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 69: Asia Pacific Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 70: Asia Pacific Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 71: Asia Pacific Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Asia Pacific Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 73: Asia Pacific Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Pacific Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: South America Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 76: South America Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 77: South America Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 78: South America Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 79: South America Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 80: South America Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 81: South America Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 82: South America Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 83: South America Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 84: South America Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 85: South America Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 86: South America Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 87: South America Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 88: South America Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 89: South America Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 90: South America Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 91: South America Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 92: South America Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 93: South America Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 94: South America Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 95: South America Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: South America Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 97: South America Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: South America Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Africa Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 100: Africa Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 101: Africa Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 102: Africa Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 103: Africa Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 104: Africa Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 105: Africa Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 106: Africa Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 107: Africa Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 108: Africa Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 109: Africa Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 110: Africa Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 111: Africa Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 112: Africa Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 113: Africa Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 114: Africa Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 115: Africa Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 116: Africa Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 117: Africa Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 118: Africa Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 119: Africa Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 120: Africa Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 121: Africa Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Africa Grape Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Global Grape Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Global Grape Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: United States Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United States Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Canada Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Canada Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Mexico Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Rest of North America Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of North America Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 34: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 35: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 36: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 37: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 40: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 41: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 42: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 43: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 45: Germany Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Germany Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: United Kingdom Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: United Kingdom Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 49: France Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 51: Italy Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 55: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 56: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 57: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 58: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 59: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 60: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 61: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 62: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 63: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 64: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 65: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 67: China Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 69: India Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 71: Australia Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Australia Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 73: Japan Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Japan Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 75: Rest of Asia Pacific Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 77: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 78: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 79: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 80: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 81: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 82: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 83: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 84: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 85: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 86: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 87: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 89: Brazil Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Brazil Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 91: Argentina Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Argentina Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 93: Chile Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Chile Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 95: Peru Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Peru Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 97: Rest of South America Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Rest of South America Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 99: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 100: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 101: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 102: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 103: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 104: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 105: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 106: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 107: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 108: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 109: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 110: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 111: South Africa Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: South Africa Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 113: Egypt Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Egypt Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 115: Rest of Africa Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 116: Rest of Africa Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Grape Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Grape Industry?

Key companies in the market include Giumarra Vineyards, Sun World International, Driscoll's .

3. What are the main segments of the Grape Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 215.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

The Growth of the Global Wine Industry is Driving the Grapes Market.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

November 2022: Cornell University in the United States rolled out its PhytoPathol Boots (PPB), which will be deployed to four grape breeding programs across the U.S. These autonomous robots will roll through vineyards, using computer vision to gather data on the physiological state of each grapevine, allowing breeders and growers to evaluate their vineyards leaf by leaf, in real-time, down to the chemical level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Grape Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Grape Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Grape Industry?

To stay informed about further developments, trends, and reports in the Grape Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence